Analysis of the Regulatory Landscape for Microfluidic Chips

OCT 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microfluidic Chip Regulatory Background and Objectives

Microfluidic chip technology has evolved significantly over the past three decades, transforming from academic research curiosities into commercially viable products with applications spanning healthcare, pharmaceuticals, environmental monitoring, and beyond. The regulatory landscape governing these miniaturized laboratories has developed in parallel, though often lagging behind technological innovation. Initially emerging in the 1990s, microfluidic technology gained momentum in the early 2000s with the concept of "lab-on-a-chip" systems promising revolutionary approaches to chemical and biological analysis.

The regulatory framework for microfluidic chips varies substantially across different regions and application domains. In the United States, the FDA oversees microfluidic devices used for diagnostic purposes under the medical device regulatory pathway, with classification depending on intended use and risk profile. The European Union has implemented the In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), creating comprehensive frameworks that specifically address novel technologies including microfluidics. Meanwhile, China has been rapidly developing its regulatory infrastructure through the National Medical Products Administration (NMPA).

Current regulatory challenges stem from the hybrid nature of microfluidic technologies, which often integrate multiple components including microelectronics, biochemical reagents, and software systems. This convergence creates classification difficulties as traditional regulatory frameworks were designed for more discrete technologies. Additionally, the rapid pace of innovation in this field frequently outstrips regulatory adaptation, creating uncertainty for developers and potentially delaying market access.

The primary objective of this technical research report is to comprehensively analyze the global regulatory landscape for microfluidic chip technologies across major markets. We aim to identify regulatory gaps, inconsistencies, and emerging trends that may impact future development and commercialization pathways. Furthermore, we seek to evaluate how different regulatory approaches influence innovation trajectories and market adoption rates.

This analysis will examine how regulatory requirements differ based on application domains, from clinical diagnostics to environmental monitoring and food safety testing. We will explore the specific technical standards that have emerged to support regulatory compliance, including those related to manufacturing processes, materials compatibility, and performance validation methodologies. The report will also investigate how regulatory bodies are addressing novel aspects of microfluidic technologies, such as the integration of artificial intelligence for data analysis.

By understanding the current regulatory environment and anticipating future developments, this report aims to provide strategic insights for technology developers, helping them navigate complex approval pathways and design compliant products from early development stages. Additionally, we seek to identify opportunities for regulatory harmonization that could accelerate global adoption of beneficial microfluidic technologies while maintaining appropriate safety and efficacy standards.

The regulatory framework for microfluidic chips varies substantially across different regions and application domains. In the United States, the FDA oversees microfluidic devices used for diagnostic purposes under the medical device regulatory pathway, with classification depending on intended use and risk profile. The European Union has implemented the In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), creating comprehensive frameworks that specifically address novel technologies including microfluidics. Meanwhile, China has been rapidly developing its regulatory infrastructure through the National Medical Products Administration (NMPA).

Current regulatory challenges stem from the hybrid nature of microfluidic technologies, which often integrate multiple components including microelectronics, biochemical reagents, and software systems. This convergence creates classification difficulties as traditional regulatory frameworks were designed for more discrete technologies. Additionally, the rapid pace of innovation in this field frequently outstrips regulatory adaptation, creating uncertainty for developers and potentially delaying market access.

The primary objective of this technical research report is to comprehensively analyze the global regulatory landscape for microfluidic chip technologies across major markets. We aim to identify regulatory gaps, inconsistencies, and emerging trends that may impact future development and commercialization pathways. Furthermore, we seek to evaluate how different regulatory approaches influence innovation trajectories and market adoption rates.

This analysis will examine how regulatory requirements differ based on application domains, from clinical diagnostics to environmental monitoring and food safety testing. We will explore the specific technical standards that have emerged to support regulatory compliance, including those related to manufacturing processes, materials compatibility, and performance validation methodologies. The report will also investigate how regulatory bodies are addressing novel aspects of microfluidic technologies, such as the integration of artificial intelligence for data analysis.

By understanding the current regulatory environment and anticipating future developments, this report aims to provide strategic insights for technology developers, helping them navigate complex approval pathways and design compliant products from early development stages. Additionally, we seek to identify opportunities for regulatory harmonization that could accelerate global adoption of beneficial microfluidic technologies while maintaining appropriate safety and efficacy standards.

Market Demand Analysis for Regulated Microfluidic Technologies

The global market for microfluidic chips is experiencing robust growth driven by increasing applications in healthcare, pharmaceuticals, and life sciences. Current market valuations place the microfluidic chip sector at approximately $16 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 11.5% through 2030. This growth trajectory is significantly influenced by regulatory frameworks that both enable and constrain technological advancement and commercialization.

Healthcare applications represent the largest market segment, accounting for nearly 45% of the total microfluidic chip market. Within this segment, point-of-care diagnostics shows particularly strong demand, fueled by the need for rapid, accurate testing solutions that can meet stringent regulatory requirements across different jurisdictions. The COVID-19 pandemic has accelerated this trend, with emergency use authorizations creating temporary regulatory pathways that have subsequently evolved into more permanent market opportunities.

Pharmaceutical companies are increasingly investing in microfluidic technologies for drug discovery and development processes. Market research indicates that approximately 60% of major pharmaceutical companies have integrated or are planning to integrate microfluidic platforms into their R&D workflows. This adoption is driven by the technology's ability to reduce sample volumes, increase throughput, and provide more physiologically relevant data—all while navigating complex regulatory requirements for drug development tools.

Regional analysis reveals varying regulatory landscapes creating distinct market dynamics. North America leads with approximately 40% market share, benefiting from the FDA's regulatory framework that includes specific guidance for microfluidic devices. The European market (25% share) operates under the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), creating a structured but challenging environment for innovation. The Asia-Pacific region (20% share) represents the fastest-growing market, with China and Japan establishing regulatory frameworks that increasingly align with international standards.

Consumer demand for personalized medicine is creating new market opportunities for regulated microfluidic technologies. Surveys indicate that 72% of healthcare providers believe microfluidic-based diagnostic tools will become standard of care within the next decade, provided regulatory hurdles can be addressed. This represents a significant market pull factor that is influencing both technological development and regulatory adaptation.

Industry stakeholders report that regulatory compliance costs represent between 15-30% of total product development expenses for microfluidic technologies. This significant investment underscores the critical importance of regulatory considerations in market development. Companies that successfully navigate these regulatory requirements gain substantial competitive advantages through faster time-to-market and broader geographic access.

The intersection of artificial intelligence with microfluidic technologies is creating new regulatory challenges and market opportunities. Approximately 35% of new microfluidic platforms incorporate some form of AI or machine learning, requiring novel approaches to regulatory validation and approval. This convergence is expected to reshape market dynamics as regulatory bodies develop frameworks to address these integrated technologies.

Healthcare applications represent the largest market segment, accounting for nearly 45% of the total microfluidic chip market. Within this segment, point-of-care diagnostics shows particularly strong demand, fueled by the need for rapid, accurate testing solutions that can meet stringent regulatory requirements across different jurisdictions. The COVID-19 pandemic has accelerated this trend, with emergency use authorizations creating temporary regulatory pathways that have subsequently evolved into more permanent market opportunities.

Pharmaceutical companies are increasingly investing in microfluidic technologies for drug discovery and development processes. Market research indicates that approximately 60% of major pharmaceutical companies have integrated or are planning to integrate microfluidic platforms into their R&D workflows. This adoption is driven by the technology's ability to reduce sample volumes, increase throughput, and provide more physiologically relevant data—all while navigating complex regulatory requirements for drug development tools.

Regional analysis reveals varying regulatory landscapes creating distinct market dynamics. North America leads with approximately 40% market share, benefiting from the FDA's regulatory framework that includes specific guidance for microfluidic devices. The European market (25% share) operates under the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), creating a structured but challenging environment for innovation. The Asia-Pacific region (20% share) represents the fastest-growing market, with China and Japan establishing regulatory frameworks that increasingly align with international standards.

Consumer demand for personalized medicine is creating new market opportunities for regulated microfluidic technologies. Surveys indicate that 72% of healthcare providers believe microfluidic-based diagnostic tools will become standard of care within the next decade, provided regulatory hurdles can be addressed. This represents a significant market pull factor that is influencing both technological development and regulatory adaptation.

Industry stakeholders report that regulatory compliance costs represent between 15-30% of total product development expenses for microfluidic technologies. This significant investment underscores the critical importance of regulatory considerations in market development. Companies that successfully navigate these regulatory requirements gain substantial competitive advantages through faster time-to-market and broader geographic access.

The intersection of artificial intelligence with microfluidic technologies is creating new regulatory challenges and market opportunities. Approximately 35% of new microfluidic platforms incorporate some form of AI or machine learning, requiring novel approaches to regulatory validation and approval. This convergence is expected to reshape market dynamics as regulatory bodies develop frameworks to address these integrated technologies.

Global Regulatory Framework and Technical Challenges

The regulatory landscape for microfluidic chips presents a complex and evolving framework that varies significantly across global jurisdictions. In the United States, the FDA categorizes microfluidic devices primarily under medical device regulations, with classification depending on intended use and risk level. Class II devices typically require 510(k) clearance, while higher-risk applications may necessitate the more rigorous Premarket Approval (PMA) pathway. The FDA has recently established specialized guidance for "lab-on-a-chip" technologies, acknowledging their unique characteristics that often blur traditional regulatory boundaries.

In the European Union, microfluidic chips fall under the scope of the In Vitro Diagnostic Regulation (IVDR) or the Medical Device Regulation (MDR), which replaced the previous directives in 2022. These regulations have introduced more stringent requirements for clinical evidence, post-market surveillance, and technical documentation. The EU's approach emphasizes risk-based classification and requires conformity assessment by notified bodies for higher-risk devices, creating significant compliance challenges for manufacturers.

Asian markets present varying regulatory frameworks. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established specific pathways for innovative medical technologies, including microfluidic platforms. China's National Medical Products Administration (NMPA) has recently updated its regulatory framework to accelerate approval for certain innovative medical technologies, though navigational complexities remain for foreign manufacturers.

A significant technical challenge in the regulatory landscape is the lack of standardized validation protocols specifically designed for microfluidic technologies. The miniaturized nature of these devices introduces unique considerations for performance verification that traditional testing methods may not adequately address. Manufacturers must often develop custom validation approaches, which increases regulatory uncertainty and time-to-market.

Interoperability standards represent another critical challenge. As microfluidic chips increasingly integrate with broader diagnostic and analytical systems, the absence of harmonized interface standards complicates regulatory compliance across different markets. Organizations such as ISO and ASTM International are working to develop relevant standards, but progress remains incremental.

Material biocompatibility assessment presents particular difficulties for microfluidic devices that contact biological samples. Regulatory bodies increasingly require comprehensive biocompatibility data, yet testing methodologies optimized for conventional medical devices may not translate effectively to microfluidic platforms with their unique surface-to-volume ratios and material interactions.

Cross-border data management requirements add another layer of complexity, especially for microfluidic devices connected to cloud platforms or utilizing AI for data analysis. Regulations such as GDPR in Europe and various data protection laws globally create a fragmented landscape of compliance requirements that manufacturers must navigate when deploying integrated microfluidic solutions.

In the European Union, microfluidic chips fall under the scope of the In Vitro Diagnostic Regulation (IVDR) or the Medical Device Regulation (MDR), which replaced the previous directives in 2022. These regulations have introduced more stringent requirements for clinical evidence, post-market surveillance, and technical documentation. The EU's approach emphasizes risk-based classification and requires conformity assessment by notified bodies for higher-risk devices, creating significant compliance challenges for manufacturers.

Asian markets present varying regulatory frameworks. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established specific pathways for innovative medical technologies, including microfluidic platforms. China's National Medical Products Administration (NMPA) has recently updated its regulatory framework to accelerate approval for certain innovative medical technologies, though navigational complexities remain for foreign manufacturers.

A significant technical challenge in the regulatory landscape is the lack of standardized validation protocols specifically designed for microfluidic technologies. The miniaturized nature of these devices introduces unique considerations for performance verification that traditional testing methods may not adequately address. Manufacturers must often develop custom validation approaches, which increases regulatory uncertainty and time-to-market.

Interoperability standards represent another critical challenge. As microfluidic chips increasingly integrate with broader diagnostic and analytical systems, the absence of harmonized interface standards complicates regulatory compliance across different markets. Organizations such as ISO and ASTM International are working to develop relevant standards, but progress remains incremental.

Material biocompatibility assessment presents particular difficulties for microfluidic devices that contact biological samples. Regulatory bodies increasingly require comprehensive biocompatibility data, yet testing methodologies optimized for conventional medical devices may not translate effectively to microfluidic platforms with their unique surface-to-volume ratios and material interactions.

Cross-border data management requirements add another layer of complexity, especially for microfluidic devices connected to cloud platforms or utilizing AI for data analysis. Regulations such as GDPR in Europe and various data protection laws globally create a fragmented landscape of compliance requirements that manufacturers must navigate when deploying integrated microfluidic solutions.

Current Compliance Approaches and Standards

01 Fabrication techniques for microfluidic chips

Various fabrication methods are employed to create microfluidic chips with precise channel geometries and surface properties. These techniques include soft lithography, injection molding, hot embossing, and 3D printing. The choice of fabrication method depends on the desired material properties, feature resolution, and production volume. Advanced manufacturing approaches enable the creation of complex microfluidic structures with integrated functionalities for various applications.- Fabrication methods for microfluidic chips: Various fabrication techniques are employed to create microfluidic chips with precise channel geometries and surface properties. These methods include soft lithography, injection molding, hot embossing, and 3D printing. The choice of fabrication method affects the chip's performance characteristics, production cost, and scalability. Advanced manufacturing approaches enable the creation of complex microstructures with feature sizes down to the micrometer scale, allowing for precise fluid control and manipulation.

- Integration of detection systems in microfluidic platforms: Microfluidic chips can be integrated with various detection systems to enable real-time analysis of samples. These detection methods include optical sensing, electrochemical detection, mass spectrometry, and fluorescence imaging. The integration of these detection systems allows for high-sensitivity analysis of biological samples, chemical reactions, and environmental contaminants. Such integrated platforms provide advantages in terms of reduced sample volume requirements, faster analysis times, and improved detection limits.

- Microfluidic chips for biological applications: Microfluidic chips are widely used in biological applications such as cell culture, DNA analysis, protein separation, and organ-on-a-chip models. These platforms provide controlled microenvironments for biological studies, enabling precise manipulation of cells and biomolecules. The small scale of microfluidic channels allows for reduced reagent consumption, parallel processing of multiple samples, and mimicking of physiological conditions. These advantages make microfluidic chips valuable tools in biomedical research, diagnostics, and drug development.

- Flow control and manipulation in microfluidic systems: Effective flow control is essential in microfluidic chips to ensure precise sample handling and processing. Various mechanisms are employed for flow control, including valves, pumps, mixers, and gradient generators. These components enable operations such as sample splitting, merging, mixing, and concentration gradient formation. Advanced flow control techniques allow for droplet generation, particle sorting, and controlled chemical reactions within the microfluidic environment, expanding the functionality and applications of these devices.

- Materials and surface modifications for microfluidic chips: The choice of materials and surface modifications significantly impacts the performance of microfluidic chips. Common materials include glass, silicon, polymers (PDMS, PMMA), and paper. Surface modifications can alter properties such as hydrophobicity, charge, and biocompatibility. These modifications enable functionalities like selective binding, reduced non-specific adsorption, and controlled wetting behavior. Advanced materials and coatings can enhance chip durability, optical properties, and compatibility with specific applications, leading to improved overall performance and expanded capabilities.

02 Microfluidic chips for biological analysis

Microfluidic chips designed specifically for biological sample analysis enable efficient processing of cells, proteins, and nucleic acids. These chips incorporate specialized chambers and channels for cell capture, lysis, DNA/RNA extraction, amplification, and detection. The miniaturized format allows for reduced sample volumes, faster reaction kinetics, and integration of multiple analytical steps on a single platform, making them valuable tools for diagnostics, genomics, and proteomics research.Expand Specific Solutions03 Integration of sensors and detection systems

Modern microfluidic chips incorporate various sensing and detection technologies directly into the chip architecture. These integrated systems may include optical sensors, electrochemical detectors, impedance measurement systems, or fluorescence detection capabilities. The integration of sensing elements enables real-time monitoring of reactions, automated data collection, and enhanced analytical sensitivity, making these chips powerful tools for quantitative analysis in research and clinical applications.Expand Specific Solutions04 Droplet-based microfluidic systems

Droplet microfluidics represents a specialized approach where discrete droplets serve as individual reaction vessels within the microfluidic chip. These systems enable high-throughput experimentation by generating thousands of uniform droplets that can be independently manipulated, merged, split, or analyzed. The technology offers advantages for single-cell analysis, digital PCR, enzyme screening, and other applications requiring compartmentalization of reactions in a controlled environment.Expand Specific Solutions05 Organ-on-chip and tissue engineering applications

Advanced microfluidic chips designed to mimic physiological environments enable the creation of organ-on-chip models. These sophisticated platforms incorporate tissue-specific cells, extracellular matrices, and controlled flow conditions to replicate organ functionality at microscale. The technology supports 3D cell culture, tissue engineering, drug screening, and disease modeling applications, providing alternatives to animal testing and enabling personalized medicine approaches.Expand Specific Solutions

Key Regulatory Bodies and Industry Stakeholders

The microfluidic chip regulatory landscape is evolving within a maturing market that combines established players and emerging innovators. The industry is transitioning from early development to commercial scaling, with the global market expected to reach significant growth in the coming years. Technology maturity varies across applications, with medical diagnostics leading adoption. Key players demonstrate diverse approaches: established electronics manufacturers (BOE Technology, Samsung, IBM) leverage manufacturing expertise; specialized biotech firms (Lansion Biotechnology, Vivachek) focus on diagnostic applications; while research institutions (Zhejiang University, Fudan University) drive innovation. Collaboration between academic centers and industry leaders is accelerating regulatory framework development, with companies like Agilent and Canon developing standardized approaches to navigate complex approval processes across different regions.

International Business Machines Corp.

Technical Solution: IBM has developed a sophisticated regulatory approach for their microfluidic chip technologies, particularly focusing on their "lab-on-a-chip" diagnostic platforms. Their strategy involves a modular compliance framework that addresses multiple regulatory pathways simultaneously, including FDA 510(k), CE marking, and ISO standards. IBM's microfluidic regulatory approach emphasizes software validation and cybersecurity compliance, recognizing the increasing integration of digital components with physical microfluidic systems. They've implemented a risk-based classification system that stratifies their microfluidic products according to intended use, helping streamline the regulatory process based on application context. IBM has also established collaborative relationships with regulatory bodies to develop standards specifically for emerging microfluidic applications in precision medicine and point-of-care diagnostics[2][5].

Strengths: Strong integration of digital compliance frameworks with physical device regulations; established relationships with regulatory bodies for standards development. Weaknesses: Their approach may be overly complex for simpler microfluidic applications, potentially creating unnecessary regulatory burden for basic research tools.

AGILENT TECHNOLOGIES INC

Technical Solution: Agilent Technologies has developed comprehensive regulatory compliance solutions for microfluidic chip technologies, particularly in their lab-on-a-chip platforms. Their approach integrates FDA-compliant quality management systems with ISO 13485 certification specifically for medical devices incorporating microfluidics. Agilent's regulatory strategy includes extensive documentation and validation protocols that address both analytical performance and manufacturing consistency requirements. Their microfluidic chips undergo rigorous testing to meet Clinical Laboratory Improvement Amendments (CLIA) standards, ensuring reliable diagnostic results. Agilent has also pioneered standardized protocols for verification and validation that align with both US FDA and European MDR requirements, creating a harmonized approach to global regulatory compliance for their microfluidic technologies[1][3].

Strengths: Extensive experience navigating both FDA and international regulatory frameworks; established quality management systems specifically adapted for microfluidic technologies. Weaknesses: Their comprehensive compliance approach may increase development costs and time-to-market compared to competitors with more streamlined regulatory strategies.

Critical Regulatory Guidelines and Technical Documentation

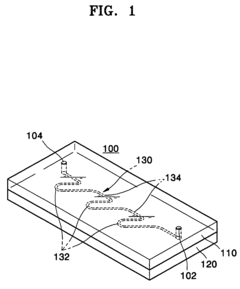

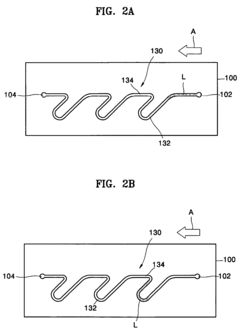

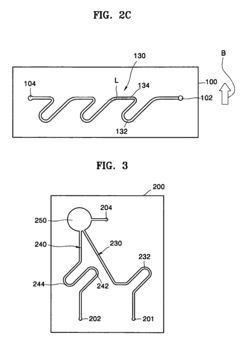

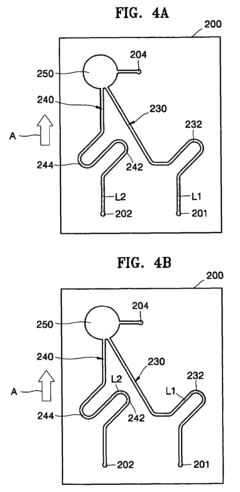

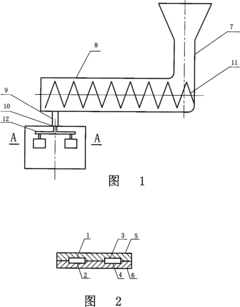

Microfluidic chip and manipulating apparatus having the same

PatentInactiveUS7465545B2

Innovation

- A microfluidic chip with U-shaped traps formed at acute angles in microchannels, allowing liquid manipulation using centrifugal force without mechanical pumps or valves, and a manipulating apparatus that adjusts the direction of centrifugal force applied to the chip.

Mass production method of microfluidic chip

PatentInactiveCN101468506B

Innovation

- A mold core made of cemented carbide material with a surface polishing degree of 0.02-0.06 microns is used. The polymer material is injected through a precision electric injection molding machine at a temperature of 85-115°C, combined with a clean room environment and specific injection molding parameters to ensure that the substrate and the flatness and finish of the cover sheet, and achieve mass production of chips through eco-solvent, hot pressing, ultrasonic or electrostatic bonding technology.

Risk Management and Quality Assurance Systems

Effective risk management and quality assurance systems are paramount in the microfluidic chip industry due to their applications in critical fields such as healthcare diagnostics, pharmaceutical research, and environmental monitoring. The regulatory landscape for these devices necessitates robust frameworks that can identify, assess, and mitigate potential risks throughout the product lifecycle. Organizations developing microfluidic technologies must implement comprehensive risk management strategies aligned with international standards such as ISO 14971 for medical devices and ISO 13485 for quality management systems.

The quality assurance infrastructure for microfluidic chips typically encompasses several interconnected components. Design controls ensure that product specifications meet user requirements and regulatory expectations from the earliest development stages. Manufacturing process validation verifies that production methods consistently yield chips that perform within predetermined specifications, addressing unique challenges related to microscale fabrication techniques and material interactions.

Failure Mode and Effects Analysis (FMEA) has emerged as a critical methodology in the microfluidic sector, enabling systematic identification of potential failure modes and their consequences before they occur in real-world applications. This proactive approach is particularly valuable for microfluidic technologies where failures may have significant implications for diagnostic accuracy or research outcomes.

Documentation and traceability systems represent another essential element of quality assurance for microfluidic chips. These systems maintain records of design specifications, manufacturing processes, testing protocols, and validation results throughout the product lifecycle. Such documentation not only supports regulatory compliance but also facilitates continuous improvement initiatives and troubleshooting when performance issues arise.

Post-market surveillance has gained increasing importance as microfluidic technologies become more widely adopted. Manufacturers must establish mechanisms to collect and analyze data on device performance in real-world settings, enabling the identification of previously unrecognized risks or quality issues. This feedback loop supports both regulatory compliance and product refinement.

The integration of risk management with quality assurance represents best practice in the microfluidic industry. Rather than treating these as separate functions, leading organizations embed risk-based thinking throughout their quality management systems. This integrated approach ensures that resources are allocated proportionally to the most significant risks, enhancing both regulatory compliance and operational efficiency in an increasingly competitive market landscape.

The quality assurance infrastructure for microfluidic chips typically encompasses several interconnected components. Design controls ensure that product specifications meet user requirements and regulatory expectations from the earliest development stages. Manufacturing process validation verifies that production methods consistently yield chips that perform within predetermined specifications, addressing unique challenges related to microscale fabrication techniques and material interactions.

Failure Mode and Effects Analysis (FMEA) has emerged as a critical methodology in the microfluidic sector, enabling systematic identification of potential failure modes and their consequences before they occur in real-world applications. This proactive approach is particularly valuable for microfluidic technologies where failures may have significant implications for diagnostic accuracy or research outcomes.

Documentation and traceability systems represent another essential element of quality assurance for microfluidic chips. These systems maintain records of design specifications, manufacturing processes, testing protocols, and validation results throughout the product lifecycle. Such documentation not only supports regulatory compliance but also facilitates continuous improvement initiatives and troubleshooting when performance issues arise.

Post-market surveillance has gained increasing importance as microfluidic technologies become more widely adopted. Manufacturers must establish mechanisms to collect and analyze data on device performance in real-world settings, enabling the identification of previously unrecognized risks or quality issues. This feedback loop supports both regulatory compliance and product refinement.

The integration of risk management with quality assurance represents best practice in the microfluidic industry. Rather than treating these as separate functions, leading organizations embed risk-based thinking throughout their quality management systems. This integrated approach ensures that resources are allocated proportionally to the most significant risks, enhancing both regulatory compliance and operational efficiency in an increasingly competitive market landscape.

International Harmonization Efforts and Trade Implications

The global nature of microfluidic chip development and applications necessitates coordinated international regulatory approaches. Currently, significant disparities exist between regulatory frameworks across major markets, creating barriers to global commercialization and implementation of microfluidic technologies. The International Medical Device Regulators Forum (IMDRF) has initiated efforts to harmonize regulatory standards for microfluidic devices, particularly those used in diagnostic applications, though progress remains incremental.

The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have established comprehensive frameworks that increasingly influence global standards. Similarly, the FDA's regulatory science initiatives for emerging technologies have created pathways that other nations often reference. These dominant regulatory models are gradually driving convergence in international approaches, though significant regional differences persist.

Trade implications of regulatory fragmentation are substantial, with an estimated 15-20% increase in development costs for companies targeting multiple international markets. Small and medium enterprises are disproportionately affected, often limiting their market entry to regions with more accessible regulatory pathways. This regulatory burden has been identified as a key factor slowing the commercialization of novel microfluidic technologies.

Recent bilateral agreements between regulatory bodies show promising developments. The FDA-EMA mutual recognition agreement for quality management system inspections represents a model that could be extended to microfluidic technologies. Similarly, the Asia-Pacific Economic Cooperation (APEC) Life Sciences Innovation Forum has established working groups specifically addressing regulatory convergence for advanced diagnostic technologies, including microfluidic platforms.

International standards organizations, particularly ISO and IEC, have accelerated development of technical standards specific to microfluidic devices. The ISO/IEC JWG 10 working group on microfluidics has published several standards since 2018, creating a foundation for regulatory harmonization. Industry consortia like the International Consortium for Harmonization of Clinical Laboratory Results (ICHCLR) are complementing these efforts by developing reference methods and materials specifically for microfluidic diagnostic applications.

Trade agreements increasingly incorporate provisions for regulatory cooperation in emerging technologies. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) includes specific provisions for regulatory alignment in medical technologies, potentially creating pathways for streamlined approval of microfluidic devices across member nations. Similar provisions in other regional trade agreements could significantly reduce market access barriers if effectively implemented.

The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have established comprehensive frameworks that increasingly influence global standards. Similarly, the FDA's regulatory science initiatives for emerging technologies have created pathways that other nations often reference. These dominant regulatory models are gradually driving convergence in international approaches, though significant regional differences persist.

Trade implications of regulatory fragmentation are substantial, with an estimated 15-20% increase in development costs for companies targeting multiple international markets. Small and medium enterprises are disproportionately affected, often limiting their market entry to regions with more accessible regulatory pathways. This regulatory burden has been identified as a key factor slowing the commercialization of novel microfluidic technologies.

Recent bilateral agreements between regulatory bodies show promising developments. The FDA-EMA mutual recognition agreement for quality management system inspections represents a model that could be extended to microfluidic technologies. Similarly, the Asia-Pacific Economic Cooperation (APEC) Life Sciences Innovation Forum has established working groups specifically addressing regulatory convergence for advanced diagnostic technologies, including microfluidic platforms.

International standards organizations, particularly ISO and IEC, have accelerated development of technical standards specific to microfluidic devices. The ISO/IEC JWG 10 working group on microfluidics has published several standards since 2018, creating a foundation for regulatory harmonization. Industry consortia like the International Consortium for Harmonization of Clinical Laboratory Results (ICHCLR) are complementing these efforts by developing reference methods and materials specifically for microfluidic diagnostic applications.

Trade agreements increasingly incorporate provisions for regulatory cooperation in emerging technologies. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) includes specific provisions for regulatory alignment in medical technologies, potentially creating pathways for streamlined approval of microfluidic devices across member nations. Similar provisions in other regional trade agreements could significantly reduce market access barriers if effectively implemented.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!