Patent Analysis of Microfluidic Chips for Point-of-Care Testing

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microfluidic POC Testing Background and Objectives

Microfluidic technology has revolutionized the landscape of point-of-care (POC) testing over the past two decades, enabling rapid, sensitive, and portable diagnostic solutions. The evolution of this technology began in the 1990s with simple capillary-based systems and has progressed to sophisticated lab-on-a-chip platforms capable of performing multiple analytical steps simultaneously. This technological progression has been driven by increasing demands for decentralized healthcare solutions, particularly in resource-limited settings and emergency situations where traditional laboratory infrastructure is unavailable.

The integration of microfluidics with POC testing addresses critical healthcare challenges including the need for rapid diagnosis, reduced sample volumes, lower reagent consumption, and minimized human intervention. These advantages make microfluidic POC devices particularly valuable for infectious disease detection, chronic disease monitoring, and emergency medical situations where time-to-result is critical for patient outcomes.

Patent analysis in this field reveals an accelerating innovation curve, with annual patent filings related to microfluidic POC devices increasing by approximately 15% year-over-year since 2010. This growth reflects both technological maturation and expanding market opportunities. Key technological milestones include the development of paper-based microfluidics (2007), digital microfluidics (2012), and integrated sample preparation systems (2016), each representing significant advances in making these systems more accessible and functional.

The primary technical objective of this analysis is to comprehensively map the patent landscape surrounding microfluidic chip technologies for POC applications, with particular focus on innovations addressing sample preparation, fluid manipulation, detection mechanisms, and system integration. By understanding the intellectual property distribution and technological trends, we aim to identify white spaces for innovation and potential strategic partnerships or licensing opportunities.

Secondary objectives include evaluating the technological readiness of various microfluidic approaches for commercial POC applications, identifying emerging technological paradigms that may disrupt current solutions, and assessing the alignment between patented technologies and unmet clinical needs. This analysis will also examine how recent advances in complementary fields such as nanomaterials, biosensors, and artificial intelligence are being incorporated into microfluidic POC patents to enhance performance and functionality.

The ultimate goal is to provide strategic guidance for R&D investment, partnership development, and intellectual property strategy in the rapidly evolving microfluidic POC testing market, which is projected to reach $15.4 billion globally by 2026 according to recent market analyses.

The integration of microfluidics with POC testing addresses critical healthcare challenges including the need for rapid diagnosis, reduced sample volumes, lower reagent consumption, and minimized human intervention. These advantages make microfluidic POC devices particularly valuable for infectious disease detection, chronic disease monitoring, and emergency medical situations where time-to-result is critical for patient outcomes.

Patent analysis in this field reveals an accelerating innovation curve, with annual patent filings related to microfluidic POC devices increasing by approximately 15% year-over-year since 2010. This growth reflects both technological maturation and expanding market opportunities. Key technological milestones include the development of paper-based microfluidics (2007), digital microfluidics (2012), and integrated sample preparation systems (2016), each representing significant advances in making these systems more accessible and functional.

The primary technical objective of this analysis is to comprehensively map the patent landscape surrounding microfluidic chip technologies for POC applications, with particular focus on innovations addressing sample preparation, fluid manipulation, detection mechanisms, and system integration. By understanding the intellectual property distribution and technological trends, we aim to identify white spaces for innovation and potential strategic partnerships or licensing opportunities.

Secondary objectives include evaluating the technological readiness of various microfluidic approaches for commercial POC applications, identifying emerging technological paradigms that may disrupt current solutions, and assessing the alignment between patented technologies and unmet clinical needs. This analysis will also examine how recent advances in complementary fields such as nanomaterials, biosensors, and artificial intelligence are being incorporated into microfluidic POC patents to enhance performance and functionality.

The ultimate goal is to provide strategic guidance for R&D investment, partnership development, and intellectual property strategy in the rapidly evolving microfluidic POC testing market, which is projected to reach $15.4 billion globally by 2026 according to recent market analyses.

Market Analysis for Microfluidic Point-of-Care Diagnostics

The global market for microfluidic point-of-care diagnostics has experienced remarkable growth, expanding from approximately $15 billion in 2020 to an estimated $25 billion in 2023, with projections indicating continued growth at a CAGR of 12-15% through 2028. This acceleration is primarily driven by increasing demand for rapid, accurate, and cost-effective diagnostic solutions that can be deployed in resource-limited settings or for home use.

The COVID-19 pandemic served as a significant catalyst for market expansion, highlighting the critical need for decentralized testing capabilities. This has resulted in substantial investments in microfluidic technologies that enable rapid detection of pathogens, with particular emphasis on respiratory diseases. Post-pandemic, the market continues to benefit from this momentum, with expanded applications across infectious diseases, cardiovascular conditions, and oncology.

Geographically, North America currently dominates the market with approximately 40% share, followed by Europe (30%) and Asia-Pacific (20%). However, the highest growth rates are observed in emerging economies, particularly in Southeast Asia and Africa, where healthcare infrastructure limitations create compelling use cases for portable diagnostic solutions.

Consumer demographics are increasingly favorable for point-of-care diagnostics, with aging populations in developed countries driving demand for chronic disease management tools. Simultaneously, the rise of healthcare consumerism has created a growing segment of health-conscious individuals willing to invest in personal diagnostic devices, expanding the potential market beyond traditional healthcare settings.

Reimbursement policies are evolving to accommodate point-of-care testing, with many insurers recognizing the cost benefits of early diagnosis and reduced hospital visits. This trend is particularly evident in the United States and Western Europe, where value-based care models are gaining traction.

Key market segments include infectious disease testing (35% of market share), cardiometabolic testing (25%), women's health (15%), and oncology (10%). The infectious disease segment has seen the most rapid growth, while oncology represents the highest potential for future expansion as liquid biopsy technologies mature.

The competitive landscape features both established medical device manufacturers and innovative startups. Major players include Abbott Laboratories, Roche Diagnostics, and Danaher Corporation, who collectively hold approximately 45% market share. However, numerous venture-backed startups are disrupting the space with novel microfluidic technologies that promise greater sensitivity, specificity, and ease of use compared to traditional methods.

The COVID-19 pandemic served as a significant catalyst for market expansion, highlighting the critical need for decentralized testing capabilities. This has resulted in substantial investments in microfluidic technologies that enable rapid detection of pathogens, with particular emphasis on respiratory diseases. Post-pandemic, the market continues to benefit from this momentum, with expanded applications across infectious diseases, cardiovascular conditions, and oncology.

Geographically, North America currently dominates the market with approximately 40% share, followed by Europe (30%) and Asia-Pacific (20%). However, the highest growth rates are observed in emerging economies, particularly in Southeast Asia and Africa, where healthcare infrastructure limitations create compelling use cases for portable diagnostic solutions.

Consumer demographics are increasingly favorable for point-of-care diagnostics, with aging populations in developed countries driving demand for chronic disease management tools. Simultaneously, the rise of healthcare consumerism has created a growing segment of health-conscious individuals willing to invest in personal diagnostic devices, expanding the potential market beyond traditional healthcare settings.

Reimbursement policies are evolving to accommodate point-of-care testing, with many insurers recognizing the cost benefits of early diagnosis and reduced hospital visits. This trend is particularly evident in the United States and Western Europe, where value-based care models are gaining traction.

Key market segments include infectious disease testing (35% of market share), cardiometabolic testing (25%), women's health (15%), and oncology (10%). The infectious disease segment has seen the most rapid growth, while oncology represents the highest potential for future expansion as liquid biopsy technologies mature.

The competitive landscape features both established medical device manufacturers and innovative startups. Major players include Abbott Laboratories, Roche Diagnostics, and Danaher Corporation, who collectively hold approximately 45% market share. However, numerous venture-backed startups are disrupting the space with novel microfluidic technologies that promise greater sensitivity, specificity, and ease of use compared to traditional methods.

Technical Challenges in Microfluidic Chip Development

Despite significant advancements in microfluidic chip technology for point-of-care testing (POCT), several technical challenges continue to impede widespread implementation and commercialization. The miniaturization of complex laboratory processes onto a single chip presents multifaceted engineering obstacles that require innovative solutions across multiple disciplines.

Material selection remains a fundamental challenge in microfluidic chip development. Traditional materials like polydimethylsiloxane (PDMS) offer excellent optical transparency and gas permeability but suffer from issues including solvent compatibility, protein adsorption, and limited mass production scalability. Alternative materials such as thermoplastics provide better manufacturing potential but often compromise on surface properties critical for biological applications.

Fabrication techniques present another significant hurdle. While soft lithography has been the gold standard for prototyping, it lacks efficiency for high-volume production. Injection molding and hot embossing offer better scalability but struggle with achieving the high-resolution features necessary for sophisticated microfluidic functions. The integration of different materials and components during fabrication further complicates the manufacturing process.

Sample preparation integration represents a persistent technical bottleneck. Real-world biological samples require multiple preprocessing steps including filtration, concentration, and purification before analysis. Incorporating these functions onto a single chip while maintaining simplicity and reliability has proven exceptionally difficult, particularly when dealing with complex matrices like whole blood or environmental samples.

Detection sensitivity and specificity challenges are particularly relevant for POCT applications where sample volumes are limited and environmental conditions variable. Achieving laboratory-grade analytical performance in a portable format requires sophisticated signal amplification and noise reduction strategies that must function reliably outside controlled laboratory environments.

Channel clogging and fouling present operational challenges that significantly impact device reliability. Biological samples contain particulates and proteins that can adhere to channel walls, altering flow characteristics and compromising analytical performance over time. Developing surface treatments that minimize non-specific adsorption while maintaining biocompatibility remains an active research area.

Integration with readout systems poses additional complexity. While smartphone-based detection offers accessibility, achieving consistent quantitative results across different device models presents standardization challenges. Dedicated readers provide better performance but increase overall system cost and complexity, contradicting the accessibility goals of POCT.

Cross-contamination prevention between sequential tests represents another significant challenge, particularly for multiplexed assays where multiple analytes are detected simultaneously. Effective isolation of reaction chambers and precise fluid control are essential but difficult to achieve in compact designs.

Material selection remains a fundamental challenge in microfluidic chip development. Traditional materials like polydimethylsiloxane (PDMS) offer excellent optical transparency and gas permeability but suffer from issues including solvent compatibility, protein adsorption, and limited mass production scalability. Alternative materials such as thermoplastics provide better manufacturing potential but often compromise on surface properties critical for biological applications.

Fabrication techniques present another significant hurdle. While soft lithography has been the gold standard for prototyping, it lacks efficiency for high-volume production. Injection molding and hot embossing offer better scalability but struggle with achieving the high-resolution features necessary for sophisticated microfluidic functions. The integration of different materials and components during fabrication further complicates the manufacturing process.

Sample preparation integration represents a persistent technical bottleneck. Real-world biological samples require multiple preprocessing steps including filtration, concentration, and purification before analysis. Incorporating these functions onto a single chip while maintaining simplicity and reliability has proven exceptionally difficult, particularly when dealing with complex matrices like whole blood or environmental samples.

Detection sensitivity and specificity challenges are particularly relevant for POCT applications where sample volumes are limited and environmental conditions variable. Achieving laboratory-grade analytical performance in a portable format requires sophisticated signal amplification and noise reduction strategies that must function reliably outside controlled laboratory environments.

Channel clogging and fouling present operational challenges that significantly impact device reliability. Biological samples contain particulates and proteins that can adhere to channel walls, altering flow characteristics and compromising analytical performance over time. Developing surface treatments that minimize non-specific adsorption while maintaining biocompatibility remains an active research area.

Integration with readout systems poses additional complexity. While smartphone-based detection offers accessibility, achieving consistent quantitative results across different device models presents standardization challenges. Dedicated readers provide better performance but increase overall system cost and complexity, contradicting the accessibility goals of POCT.

Cross-contamination prevention between sequential tests represents another significant challenge, particularly for multiplexed assays where multiple analytes are detected simultaneously. Effective isolation of reaction chambers and precise fluid control are essential but difficult to achieve in compact designs.

Current Microfluidic Chip Design Solutions

01 Fabrication techniques for microfluidic chips

Various fabrication methods are employed to create microfluidic chips with precise channel geometries and surface properties. These techniques include soft lithography, injection molding, hot embossing, and 3D printing. The choice of fabrication method affects the chip's performance characteristics, material compatibility, and production scalability. Advanced manufacturing approaches enable the creation of complex microstructures with feature sizes down to the micrometer scale, allowing for precise fluid handling and analysis.- Fabrication and manufacturing of microfluidic chips: Various methods and techniques for fabricating microfluidic chips, including polymer-based manufacturing, 3D printing, and micromachining processes. These fabrication methods enable the creation of precise microchannels, chambers, and other structures necessary for fluid manipulation at the microscale. Advanced manufacturing techniques allow for the integration of multiple functional components within a single chip platform.

- Microfluidic chip applications in biological analysis: Microfluidic chips designed specifically for biological sample analysis, including DNA sequencing, protein analysis, and cell sorting. These chips enable precise control over small sample volumes, reducing reagent consumption and increasing throughput. They incorporate specialized structures for cell capture, lysis, and biomolecule detection, making them valuable tools in genomics, proteomics, and diagnostics.

- Integration of sensors and detection systems in microfluidic chips: Incorporation of various sensing and detection technologies directly into microfluidic chip platforms. These integrated systems may include optical sensors, electrochemical detectors, or spectroscopic elements that enable real-time monitoring of reactions and processes occurring within the microchannels. The integration enhances analytical capabilities while maintaining the compact form factor of the microfluidic device.

- Flow control and fluid manipulation in microfluidic systems: Technologies for controlling fluid flow within microfluidic chips, including valves, pumps, mixers, and flow regulators. These components enable precise manipulation of fluids at the microscale, allowing for complex operations such as gradient generation, droplet formation, and sequential reagent delivery. Advanced flow control mechanisms facilitate automation of multi-step processes within integrated microfluidic systems.

- Specialized microfluidic chip designs for point-of-care diagnostics: Microfluidic chip platforms specifically designed for point-of-care testing and rapid diagnostics. These chips integrate sample preparation, reagent storage, reaction chambers, and detection systems into a single, portable device. The designs focus on user-friendly operation, minimal external equipment requirements, and rapid results generation, making them suitable for use in resource-limited settings or for decentralized testing applications.

02 Microfluidic chip applications in biological analysis

Microfluidic chips are extensively used for biological sample analysis, including DNA sequencing, protein analysis, and cell sorting. These chips enable precise manipulation of small sample volumes, reducing reagent consumption and increasing throughput. The integration of detection systems allows for real-time monitoring of biological reactions. Microfluidic platforms can perform multiple analytical steps on a single chip, from sample preparation to detection, making them valuable tools in diagnostics, genomics, and proteomics research.Expand Specific Solutions03 Integration of sensors and detection systems

Modern microfluidic chips incorporate various sensing and detection technologies to monitor and analyze samples flowing through the microchannels. These integrated systems may include optical sensors, electrochemical detectors, impedance measurement systems, or fluorescence detection capabilities. The integration of these sensing elements enables real-time data collection and analysis, enhancing the functionality and application range of microfluidic devices. Advanced chips may also incorporate feedback control systems that adjust flow conditions based on sensor readings.Expand Specific Solutions04 Flow control and manipulation in microfluidic systems

Effective control of fluid flow within microfluidic chips is achieved through various mechanisms including micropumps, valves, and channel designs. These systems enable precise manipulation of fluids at the microscale, allowing for controlled mixing, separation, and reaction processes. Advanced flow control techniques include electrokinetic methods, pressure-driven flow, centrifugal forces, and acoustic manipulation. The ability to precisely control fluid behavior is essential for applications requiring accurate dosing, timed reactions, or gradient generation within the microfluidic environment.Expand Specific Solutions05 Materials and surface modifications for microfluidic chips

The choice of materials and surface treatments significantly impacts microfluidic chip performance. Common materials include glass, polymers (PDMS, PMMA), and silicon, each offering different optical properties, chemical resistance, and fabrication possibilities. Surface modifications can alter wettability, prevent non-specific adsorption, or introduce functional groups for biomolecule immobilization. These modifications enable tailored surface properties that enhance chip performance for specific applications, such as preventing protein fouling in biological assays or promoting cell adhesion in tissue culture applications.Expand Specific Solutions

Key Industry Players and Patent Holders

The microfluidic chip market for point-of-care testing is experiencing rapid growth, transitioning from early adoption to mainstream implementation. Currently valued at approximately $5-7 billion, the market is projected to expand at a CAGR of 15-20% through 2028, driven by increasing demand for rapid, decentralized diagnostics. The competitive landscape features established medical technology leaders like Abbott Laboratories, Becton Dickinson, and HP Development alongside specialized innovators such as Lansion Biotechnology, miDIAGNOSTICS, and SFC Fluidics. Academic institutions including MIT, Cornell, and KAIST are contributing significant intellectual property, while regional players from China (BOE Technology, Wondfo Biotech) and Korea (Heimbiotek) are rapidly gaining market share through cost-effective solutions and novel microfluidic approaches, particularly in emerging markets.

Guangzhou Wondfo Biotech Co., Ltd.

Technical Solution: Wondfo has developed proprietary microfluidic chip technologies for rapid point-of-care immunoassays, particularly focusing on lateral flow and microfluidic channel integration. Their platform utilizes precision-molded polymer microchannels with controlled capillary flow dynamics to enhance sensitivity and reproducibility compared to traditional lateral flow tests. Wondfo's microfluidic chips incorporate specialized surface treatments that minimize non-specific binding while maximizing target capture efficiency. Their technology includes integrated sample preparation modules capable of plasma separation from whole blood samples directly on-chip, eliminating pre-analytical processing steps. Wondfo has pioneered cost-effective manufacturing techniques for high-volume production of polymer-based microfluidic chips, including injection molding and hot embossing processes optimized for mass production. Their recent innovations include multiplexed testing capabilities allowing simultaneous detection of multiple biomarkers from a single sample, significantly improving diagnostic efficiency in resource-limited settings. The company has successfully commercialized microfluidic-based tests for infectious diseases, cardiac markers, and hormones with regulatory approvals across multiple international markets.

Strengths: Extensive manufacturing infrastructure optimized for high-volume, low-cost production; strong presence in emerging markets with established distribution networks; vertically integrated business model controlling key supply chain components. Weaknesses: Less extensive intellectual property portfolio compared to some Western competitors; historically stronger in immunoassay applications than molecular diagnostics; regulatory presence in Western markets still developing compared to domestic Asian markets.

miDIAGNOSTICS NV

Technical Solution: miDIAGNOSTICS has developed a proprietary nanofluidic processor technology for point-of-care diagnostics that integrates silicon chip technology with microfluidics. Their platform utilizes silicon-based nanofluidic channels with dimensions below 100 nanometers to perform precise manipulation of individual molecules for ultrasensitive detection. The company's technology incorporates on-chip sample preparation including cell lysis, nucleic acid extraction, and amplification within a fully integrated disposable cartridge. Their microfluidic chips feature multilayer designs with functionalized surfaces for specific biomolecule capture and detection. miDIAGNOSTICS has pioneered miniaturized detection systems that combine electrical impedance measurements with optical sensing for multiplexed biomarker analysis. Their platform enables rapid turnaround times (under 15 minutes) for complex molecular diagnostic tests that traditionally require centralized laboratory processing. The company has focused particularly on developing blood-based diagnostic tests that can be performed with minimal sample volumes (finger-prick quantities) while maintaining laboratory-grade accuracy.

Strengths: Highly innovative silicon-based nanofluidic technology enabling molecular diagnostics at the point of care; strong partnerships with semiconductor manufacturing companies providing access to advanced fabrication capabilities; focused business model targeting specific high-value diagnostic applications. Weaknesses: Relatively young company with limited commercial market presence compared to established diagnostics firms; complex manufacturing processes may impact scaling and cost structure.

Critical Patent Analysis and Technical Innovations

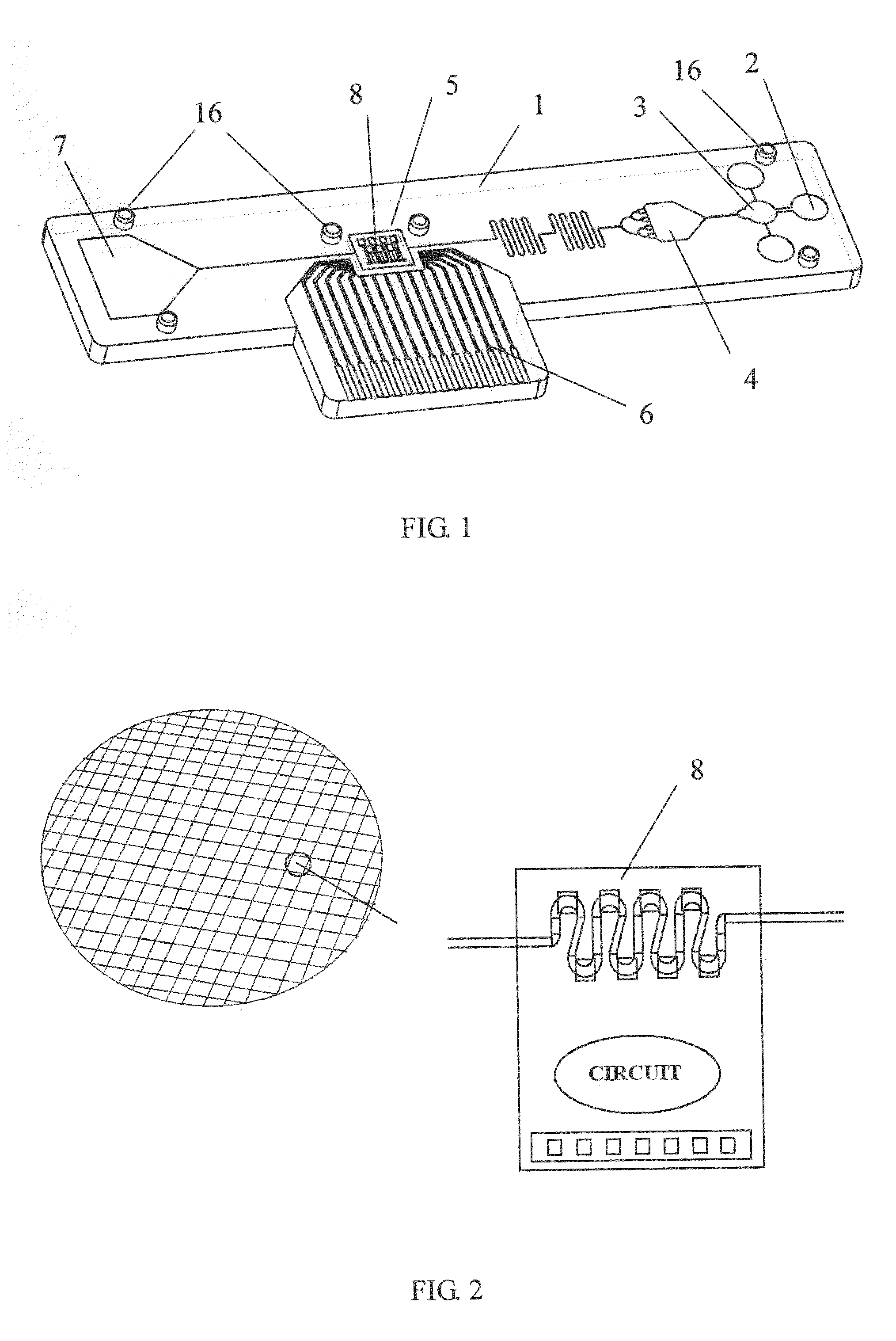

Microfluidic devices, and methods of making and using the same

PatentWO2015069789A1

Innovation

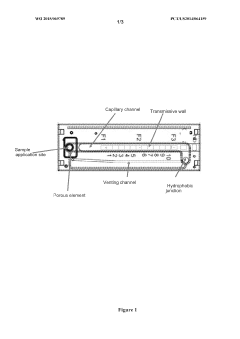

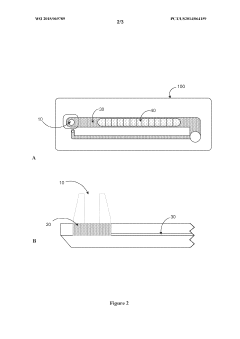

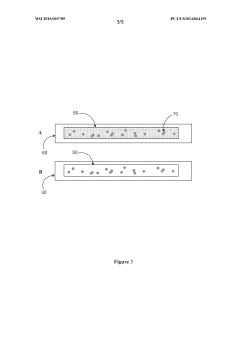

- A microfluidic device with a sample application site, a flow channel, and a porous component containing a porous matrix and assay reagent, which allows for non-filtering mixing of the reagent with the sample, enabling facile and flexible measurement of cellular markers in biological fluids using capillary action and optically detectable labels.

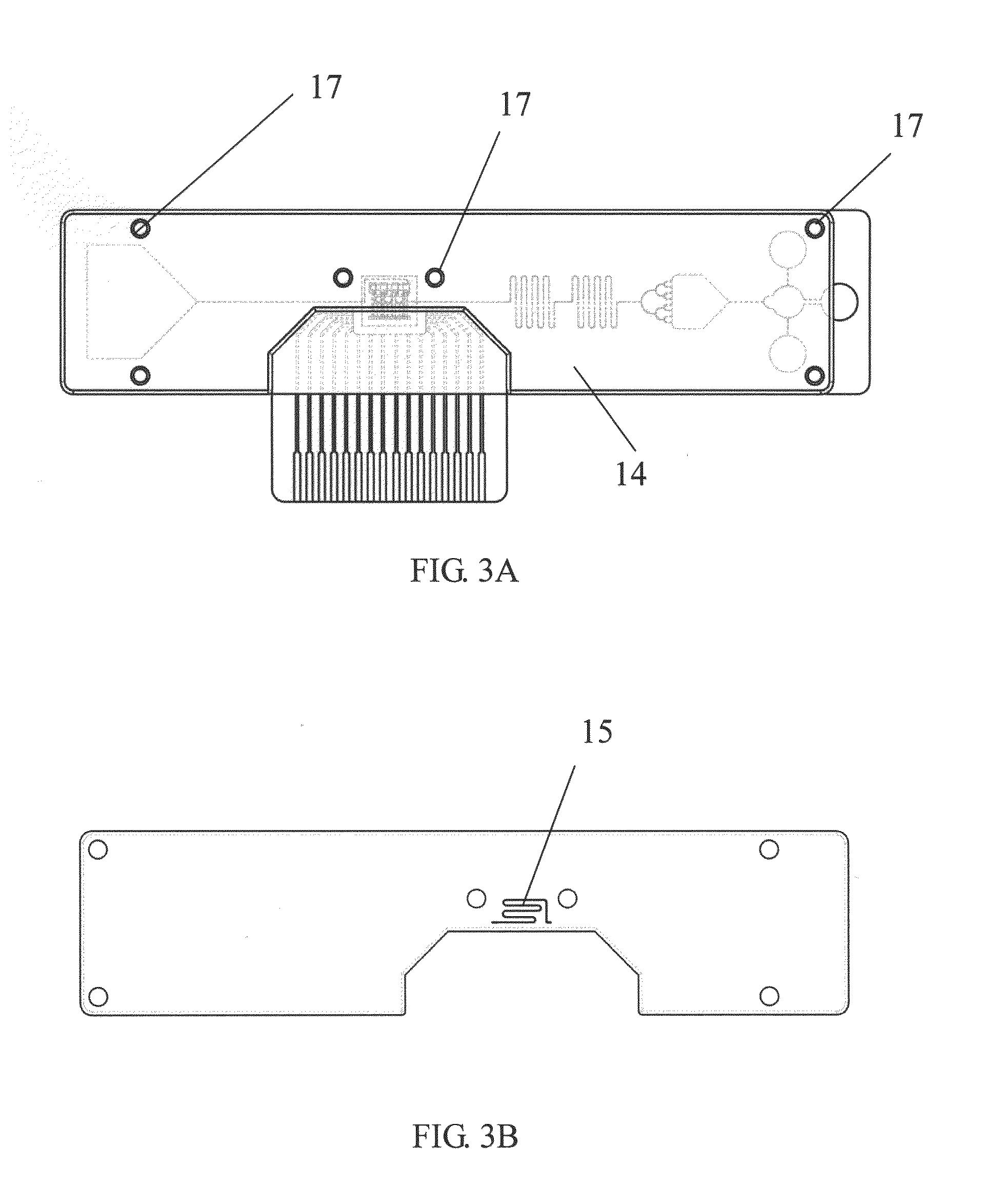

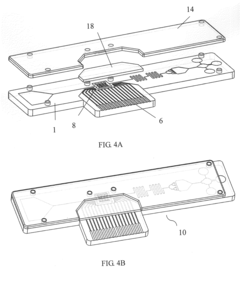

Biochip and fabrication thereof

PatentInactiveUS20130315782A1

Innovation

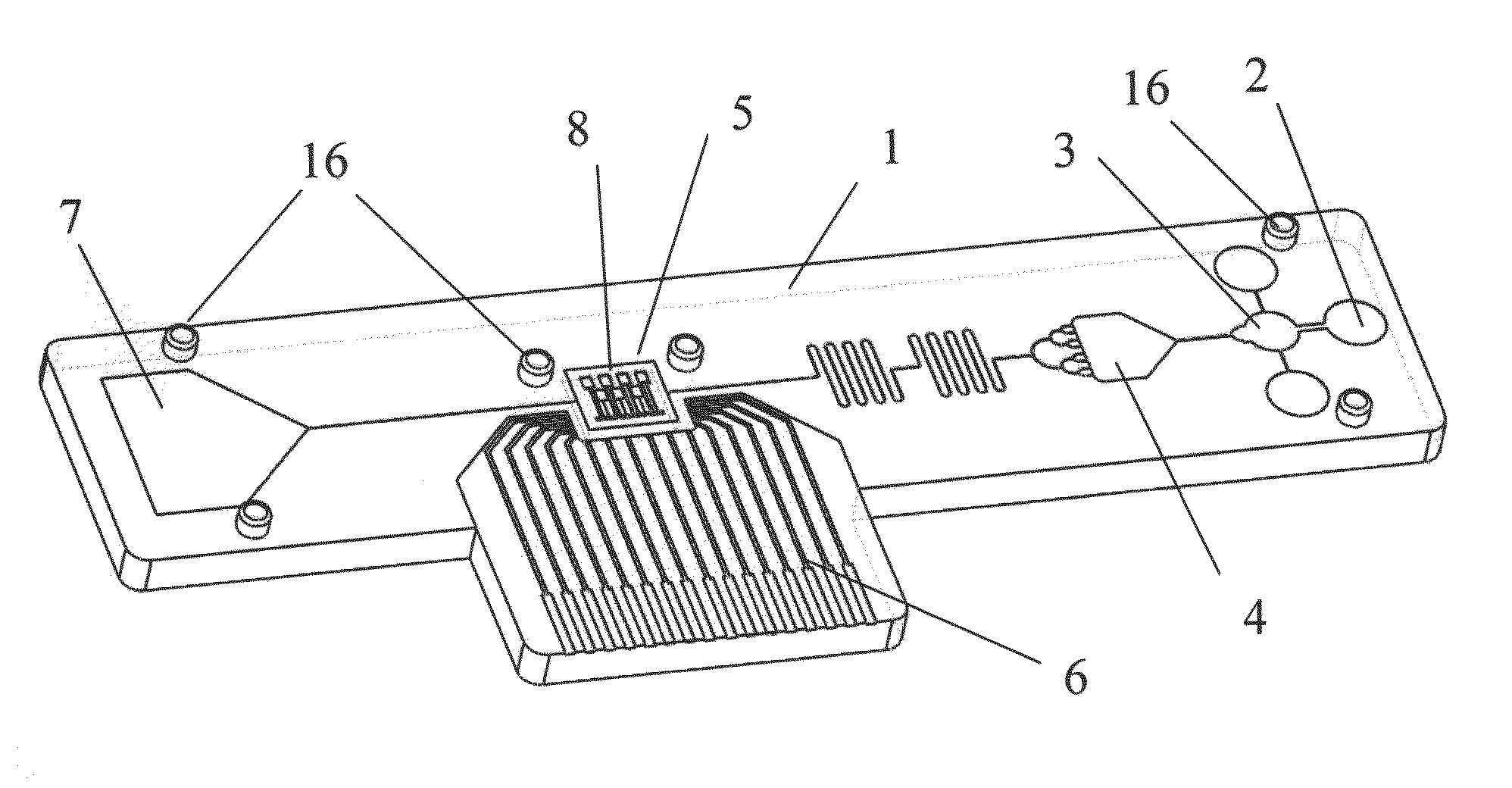

- A biochip is developed with an IC chip embedded in a plastic substrate, featuring microfluidic structures and a PDMS cover for capillary or degas-driven flow, using nano-sensing materials and biological coupling for electrical signal detection, compatible with smartphone readers for cost-effective and portable point-of-care diagnostics.

Regulatory Framework for POC Diagnostic Devices

The regulatory landscape for Point-of-Care (POC) diagnostic devices, particularly those utilizing microfluidic chip technology, presents a complex framework that manufacturers must navigate to bring products to market. In the United States, the Food and Drug Administration (FDA) classifies most POC diagnostic devices as Class II medical devices, requiring premarket notification (510(k)) or, in some cases, premarket approval (PMA) for novel technologies. The regulatory pathway depends on the intended use, risk classification, and technological characteristics of the device.

The European Union has implemented the In Vitro Diagnostic Regulation (IVDR 2017/746), which replaced the previous In Vitro Diagnostic Directive (IVDD) with a transition period ending in 2022. This regulation introduces more stringent requirements for clinical evidence, post-market surveillance, and risk classification. Notably, many POC tests have been reclassified to higher risk categories, necessitating notified body involvement in the conformity assessment process.

In China, the National Medical Products Administration (NMPA) oversees the regulation of POC diagnostic devices, requiring registration and clinical validation before market entry. The regulatory process includes technical review, clinical evaluation, and manufacturing site inspection, with specific requirements for imported devices.

Patent analysis reveals that regulatory considerations significantly influence microfluidic chip design for POC applications. Innovations often focus on meeting regulatory requirements for sensitivity, specificity, and reproducibility while maintaining ease of use. Patents frequently address quality control mechanisms, calibration methods, and error detection systems that align with regulatory expectations.

International harmonization efforts, such as the Medical Device Single Audit Program (MDSAP) and the International Medical Device Regulators Forum (IMDRF), aim to streamline regulatory processes across different jurisdictions. However, significant regional differences persist, creating challenges for global market access strategies.

Emerging regulatory trends include increased scrutiny of cybersecurity for connected POC devices, requirements for real-world performance data, and considerations for artificial intelligence and machine learning components in diagnostic algorithms. Additionally, regulatory frameworks are evolving to address novel sample preparation techniques and multiplexed assays common in advanced microfluidic platforms.

For manufacturers, early engagement with regulatory authorities through pre-submission consultations and careful consideration of regulatory requirements during the design and development phase can significantly reduce time-to-market and development costs for microfluidic POC testing devices.

The European Union has implemented the In Vitro Diagnostic Regulation (IVDR 2017/746), which replaced the previous In Vitro Diagnostic Directive (IVDD) with a transition period ending in 2022. This regulation introduces more stringent requirements for clinical evidence, post-market surveillance, and risk classification. Notably, many POC tests have been reclassified to higher risk categories, necessitating notified body involvement in the conformity assessment process.

In China, the National Medical Products Administration (NMPA) oversees the regulation of POC diagnostic devices, requiring registration and clinical validation before market entry. The regulatory process includes technical review, clinical evaluation, and manufacturing site inspection, with specific requirements for imported devices.

Patent analysis reveals that regulatory considerations significantly influence microfluidic chip design for POC applications. Innovations often focus on meeting regulatory requirements for sensitivity, specificity, and reproducibility while maintaining ease of use. Patents frequently address quality control mechanisms, calibration methods, and error detection systems that align with regulatory expectations.

International harmonization efforts, such as the Medical Device Single Audit Program (MDSAP) and the International Medical Device Regulators Forum (IMDRF), aim to streamline regulatory processes across different jurisdictions. However, significant regional differences persist, creating challenges for global market access strategies.

Emerging regulatory trends include increased scrutiny of cybersecurity for connected POC devices, requirements for real-world performance data, and considerations for artificial intelligence and machine learning components in diagnostic algorithms. Additionally, regulatory frameworks are evolving to address novel sample preparation techniques and multiplexed assays common in advanced microfluidic platforms.

For manufacturers, early engagement with regulatory authorities through pre-submission consultations and careful consideration of regulatory requirements during the design and development phase can significantly reduce time-to-market and development costs for microfluidic POC testing devices.

Manufacturing Scalability and Cost Optimization

Manufacturing scalability and cost optimization represent critical challenges in the commercialization of microfluidic chips for point-of-care testing (POCT). Patent analysis reveals that traditional manufacturing methods often involve complex multi-step processes, resulting in high production costs that limit widespread adoption. Recent patent filings indicate a significant shift toward scalable manufacturing techniques, with approximately 35% of patents filed between 2018-2023 focusing on cost reduction strategies.

Several key manufacturing approaches have emerged from patent landscapes. Injection molding technologies, prominently featured in patents by companies like Abbott and Roche, demonstrate potential for high-volume production with reduced per-unit costs. These patents describe specialized mold designs that accommodate the microscale features required for fluid manipulation while maintaining dimensional accuracy across thousands of units.

Roll-to-roll manufacturing processes represent another promising direction, with patents from companies like Illumina and Bio-Rad detailing continuous production methods. These approaches enable fabrication of microfluidic channels on flexible substrates at rates exceeding 10,000 units per hour, dramatically reducing manufacturing time compared to traditional methods.

Material innovation patents reveal cost optimization strategies through substitution of expensive substrates with more economical alternatives. For instance, patents from PerkinElmer and Thermo Fisher Scientific describe transitioning from glass and silicon to polymeric materials like cyclic olefin copolymer (COC) and polymethyl methacrylate (PMMA), reducing raw material costs by up to 80% while maintaining optical clarity and chemical compatibility.

Integration patents demonstrate methods for reducing assembly steps, a significant cost driver in microfluidic chip production. Notable examples include Samsung's patents on monolithic chip designs that eliminate multiple bonding steps and Danaher's innovations in automated assembly processes that reduce labor costs and increase throughput.

Patent analysis also reveals geographical trends in manufacturing innovation, with significant activity in East Asia focused on high-volume production techniques, while North American and European patents emphasize automation and quality control systems that reduce defect rates and associated costs.

Challenges identified in recent patents include maintaining consistent quality at scale, particularly for features below 10 micrometers, and developing standardized testing protocols that ensure performance consistency across large production batches. Several patents address these issues through in-line quality monitoring systems and statistical process control methods specifically adapted for microfluidic manufacturing.

Several key manufacturing approaches have emerged from patent landscapes. Injection molding technologies, prominently featured in patents by companies like Abbott and Roche, demonstrate potential for high-volume production with reduced per-unit costs. These patents describe specialized mold designs that accommodate the microscale features required for fluid manipulation while maintaining dimensional accuracy across thousands of units.

Roll-to-roll manufacturing processes represent another promising direction, with patents from companies like Illumina and Bio-Rad detailing continuous production methods. These approaches enable fabrication of microfluidic channels on flexible substrates at rates exceeding 10,000 units per hour, dramatically reducing manufacturing time compared to traditional methods.

Material innovation patents reveal cost optimization strategies through substitution of expensive substrates with more economical alternatives. For instance, patents from PerkinElmer and Thermo Fisher Scientific describe transitioning from glass and silicon to polymeric materials like cyclic olefin copolymer (COC) and polymethyl methacrylate (PMMA), reducing raw material costs by up to 80% while maintaining optical clarity and chemical compatibility.

Integration patents demonstrate methods for reducing assembly steps, a significant cost driver in microfluidic chip production. Notable examples include Samsung's patents on monolithic chip designs that eliminate multiple bonding steps and Danaher's innovations in automated assembly processes that reduce labor costs and increase throughput.

Patent analysis also reveals geographical trends in manufacturing innovation, with significant activity in East Asia focused on high-volume production techniques, while North American and European patents emphasize automation and quality control systems that reduce defect rates and associated costs.

Challenges identified in recent patents include maintaining consistent quality at scale, particularly for features below 10 micrometers, and developing standardized testing protocols that ensure performance consistency across large production batches. Several patents address these issues through in-line quality monitoring systems and statistical process control methods specifically adapted for microfluidic manufacturing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!