Role of Microfluidic Chips in the Development of Portable Diagnostics

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microfluidic Chip Technology Evolution and Objectives

Microfluidic technology has evolved significantly since its inception in the early 1990s, transforming from a laboratory curiosity to a cornerstone of modern portable diagnostic systems. The initial development phase focused primarily on proof-of-concept demonstrations, with rudimentary channel designs etched into glass or silicon substrates. These early systems established the fundamental principles of fluid manipulation at the microscale but lacked practical application potential due to their complexity and cost.

The late 1990s marked a pivotal shift with the introduction of soft lithography techniques using polydimethylsiloxane (PDMS), dramatically reducing fabrication costs and complexity. This democratization of microfluidic technology expanded research capabilities and accelerated innovation across multiple disciplines. By the early 2000s, researchers began exploring integration with various detection modalities, including optical, electrochemical, and mechanical sensing mechanisms, laying groundwork for diagnostic applications.

The period from 2005 to 2015 witnessed significant advancements in microfluidic chip functionality, with the development of increasingly sophisticated components such as micropumps, valves, mixers, and separators. These innovations enabled more complex sample processing workflows to be miniaturized onto single chips, a critical requirement for portable diagnostic applications. Concurrently, paper-based microfluidics emerged as a low-cost alternative for resource-limited settings, exemplified by lateral flow assays.

Recent technological evolution has focused on system integration and automation, with emphasis on sample-to-answer capabilities that minimize user intervention. Digital microfluidics, employing electrowetting principles for droplet manipulation, has emerged as a promising approach for highly reconfigurable diagnostic platforms. Additionally, 3D printing technologies have revolutionized prototyping processes, accelerating the design-build-test cycle for new microfluidic architectures.

The primary objective of microfluidic technology in portable diagnostics is to deliver laboratory-quality analytical performance in compact, user-friendly formats suitable for point-of-care implementation. This encompasses several specific goals: achieving high analytical sensitivity and specificity comparable to central laboratory methods; enabling rapid testing with results available in minutes rather than hours; minimizing sample volume requirements to improve patient comfort and accessibility; and reducing overall system costs to enable widespread adoption in diverse healthcare settings.

Looking forward, the field aims to develop fully integrated microfluidic platforms capable of multiplexed detection of various biomarkers from complex biological samples with minimal user intervention. Additional objectives include improving manufacturing scalability to support mass production, enhancing system robustness for field deployment in challenging environments, and developing standardized interfaces to facilitate interoperability with existing healthcare infrastructure and electronic medical record systems.

The late 1990s marked a pivotal shift with the introduction of soft lithography techniques using polydimethylsiloxane (PDMS), dramatically reducing fabrication costs and complexity. This democratization of microfluidic technology expanded research capabilities and accelerated innovation across multiple disciplines. By the early 2000s, researchers began exploring integration with various detection modalities, including optical, electrochemical, and mechanical sensing mechanisms, laying groundwork for diagnostic applications.

The period from 2005 to 2015 witnessed significant advancements in microfluidic chip functionality, with the development of increasingly sophisticated components such as micropumps, valves, mixers, and separators. These innovations enabled more complex sample processing workflows to be miniaturized onto single chips, a critical requirement for portable diagnostic applications. Concurrently, paper-based microfluidics emerged as a low-cost alternative for resource-limited settings, exemplified by lateral flow assays.

Recent technological evolution has focused on system integration and automation, with emphasis on sample-to-answer capabilities that minimize user intervention. Digital microfluidics, employing electrowetting principles for droplet manipulation, has emerged as a promising approach for highly reconfigurable diagnostic platforms. Additionally, 3D printing technologies have revolutionized prototyping processes, accelerating the design-build-test cycle for new microfluidic architectures.

The primary objective of microfluidic technology in portable diagnostics is to deliver laboratory-quality analytical performance in compact, user-friendly formats suitable for point-of-care implementation. This encompasses several specific goals: achieving high analytical sensitivity and specificity comparable to central laboratory methods; enabling rapid testing with results available in minutes rather than hours; minimizing sample volume requirements to improve patient comfort and accessibility; and reducing overall system costs to enable widespread adoption in diverse healthcare settings.

Looking forward, the field aims to develop fully integrated microfluidic platforms capable of multiplexed detection of various biomarkers from complex biological samples with minimal user intervention. Additional objectives include improving manufacturing scalability to support mass production, enhancing system robustness for field deployment in challenging environments, and developing standardized interfaces to facilitate interoperability with existing healthcare infrastructure and electronic medical record systems.

Market Analysis for Portable Diagnostic Solutions

The global portable diagnostic solutions market is experiencing robust growth, driven by increasing demand for point-of-care testing and decentralized healthcare services. Currently valued at approximately 29.7 billion USD in 2023, the market is projected to reach 50.6 billion USD by 2028, representing a compound annual growth rate (CAGR) of 11.2%. This significant expansion reflects the growing preference for rapid, accessible diagnostic tools across various healthcare settings.

Microfluidic chip-based portable diagnostics represent one of the fastest-growing segments within this market, with an estimated CAGR of 13.8% through 2028. This accelerated growth is attributed to their unique capabilities in handling small sample volumes, reducing reagent consumption, and enabling multiplexed testing on a single platform.

Geographically, North America dominates the portable diagnostics market with approximately 38% market share, followed by Europe (27%) and Asia-Pacific (24%). However, the Asia-Pacific region is expected to witness the highest growth rate at 14.5% annually, driven by improving healthcare infrastructure, increasing healthcare expenditure, and growing awareness about early disease detection in countries like China and India.

By application segment, infectious disease testing currently holds the largest market share at 32%, followed by cardiac markers (18%) and hematology testing (15%). The COVID-19 pandemic significantly accelerated market adoption, with over 60% of healthcare facilities reporting increased utilization of portable diagnostic solutions since 2020.

End-user analysis reveals hospitals and clinics as the primary consumers (45%), followed by home care settings (25%) and diagnostic laboratories (20%). However, the home care segment is growing at the fastest rate of 16.2% annually, indicating a strong shift toward self-testing and remote monitoring solutions.

Consumer preference studies indicate that 78% of patients prefer diagnostic solutions that deliver results in under 30 minutes, while 65% prioritize ease of use. Healthcare providers cite cost-effectiveness (82%), accuracy (95%), and integration with electronic health records (76%) as critical factors influencing adoption decisions.

Reimbursement policies significantly impact market penetration, with regions having favorable coverage showing 2.3 times higher adoption rates. The average price point for microfluidic-based portable diagnostic devices ranges from $1,500 to $8,000 for professional use systems, while consumer-oriented solutions typically range from $50 to $300 per device, with test cartridges averaging $15-45 per test depending on complexity.

Microfluidic chip-based portable diagnostics represent one of the fastest-growing segments within this market, with an estimated CAGR of 13.8% through 2028. This accelerated growth is attributed to their unique capabilities in handling small sample volumes, reducing reagent consumption, and enabling multiplexed testing on a single platform.

Geographically, North America dominates the portable diagnostics market with approximately 38% market share, followed by Europe (27%) and Asia-Pacific (24%). However, the Asia-Pacific region is expected to witness the highest growth rate at 14.5% annually, driven by improving healthcare infrastructure, increasing healthcare expenditure, and growing awareness about early disease detection in countries like China and India.

By application segment, infectious disease testing currently holds the largest market share at 32%, followed by cardiac markers (18%) and hematology testing (15%). The COVID-19 pandemic significantly accelerated market adoption, with over 60% of healthcare facilities reporting increased utilization of portable diagnostic solutions since 2020.

End-user analysis reveals hospitals and clinics as the primary consumers (45%), followed by home care settings (25%) and diagnostic laboratories (20%). However, the home care segment is growing at the fastest rate of 16.2% annually, indicating a strong shift toward self-testing and remote monitoring solutions.

Consumer preference studies indicate that 78% of patients prefer diagnostic solutions that deliver results in under 30 minutes, while 65% prioritize ease of use. Healthcare providers cite cost-effectiveness (82%), accuracy (95%), and integration with electronic health records (76%) as critical factors influencing adoption decisions.

Reimbursement policies significantly impact market penetration, with regions having favorable coverage showing 2.3 times higher adoption rates. The average price point for microfluidic-based portable diagnostic devices ranges from $1,500 to $8,000 for professional use systems, while consumer-oriented solutions typically range from $50 to $300 per device, with test cartridges averaging $15-45 per test depending on complexity.

Current Microfluidic Technologies and Barriers

Microfluidic technology has evolved significantly over the past two decades, with current platforms broadly categorized into continuous-flow and digital microfluidics. Continuous-flow systems utilize microchannel networks to manipulate fluid samples through pressure differentials or electrokinetic mechanisms, enabling precise control over sample processing. Digital microfluidics, conversely, employs electrowetting principles to manipulate discrete droplets on hydrophobic surfaces, offering flexibility in reconfigurable diagnostic protocols without requiring complex channel designs.

Paper-based microfluidics represents a cost-effective alternative gaining traction in resource-limited settings. These platforms leverage capillary action in patterned paper substrates to drive fluid movement without external power sources, exemplified by lateral flow assays widely used in pregnancy and COVID-19 rapid tests. Their simplicity and affordability make them particularly valuable for point-of-care applications in developing regions.

Despite significant advancements, microfluidic technologies face substantial barriers to widespread adoption in portable diagnostics. Fabrication challenges persist, particularly in transitioning from laboratory prototypes to mass-produced devices. Traditional photolithography techniques require specialized equipment and clean room facilities, limiting accessibility. Alternative approaches like 3D printing offer promising solutions but currently lack the resolution necessary for complex microfluidic architectures.

Sample preparation remains a critical bottleneck in microfluidic diagnostic systems. Real-world biological samples often require multiple preprocessing steps including filtration, concentration, and purification before analysis. Integrating these functions into compact portable devices presents significant engineering challenges, particularly when dealing with complex matrices like whole blood or environmental samples.

Integration with detection systems poses another significant barrier. While microfluidic chips excel at sample handling and preparation, they must interface with detection technologies ranging from optical and electrochemical to mass spectrometric systems. Miniaturizing these detection platforms while maintaining sensitivity and specificity represents a substantial technical hurdle, often requiring compromises between portability and analytical performance.

Standardization issues further complicate widespread adoption. The field currently lacks unified design standards and validation protocols, resulting in fragmented development approaches across academic and industrial sectors. This hampers interoperability between different microfluidic platforms and slows regulatory approval processes, particularly for clinical applications requiring rigorous validation.

Commercial viability concerns also persist, with manufacturing scalability and cost-effectiveness representing significant challenges. Many microfluidic technologies rely on specialized materials and precision manufacturing processes that prove difficult to scale economically. Additionally, the business model for portable diagnostics must balance device cost with performance to create sustainable market opportunities, particularly in resource-limited settings where need is greatest but purchasing power is limited.

Paper-based microfluidics represents a cost-effective alternative gaining traction in resource-limited settings. These platforms leverage capillary action in patterned paper substrates to drive fluid movement without external power sources, exemplified by lateral flow assays widely used in pregnancy and COVID-19 rapid tests. Their simplicity and affordability make them particularly valuable for point-of-care applications in developing regions.

Despite significant advancements, microfluidic technologies face substantial barriers to widespread adoption in portable diagnostics. Fabrication challenges persist, particularly in transitioning from laboratory prototypes to mass-produced devices. Traditional photolithography techniques require specialized equipment and clean room facilities, limiting accessibility. Alternative approaches like 3D printing offer promising solutions but currently lack the resolution necessary for complex microfluidic architectures.

Sample preparation remains a critical bottleneck in microfluidic diagnostic systems. Real-world biological samples often require multiple preprocessing steps including filtration, concentration, and purification before analysis. Integrating these functions into compact portable devices presents significant engineering challenges, particularly when dealing with complex matrices like whole blood or environmental samples.

Integration with detection systems poses another significant barrier. While microfluidic chips excel at sample handling and preparation, they must interface with detection technologies ranging from optical and electrochemical to mass spectrometric systems. Miniaturizing these detection platforms while maintaining sensitivity and specificity represents a substantial technical hurdle, often requiring compromises between portability and analytical performance.

Standardization issues further complicate widespread adoption. The field currently lacks unified design standards and validation protocols, resulting in fragmented development approaches across academic and industrial sectors. This hampers interoperability between different microfluidic platforms and slows regulatory approval processes, particularly for clinical applications requiring rigorous validation.

Commercial viability concerns also persist, with manufacturing scalability and cost-effectiveness representing significant challenges. Many microfluidic technologies rely on specialized materials and precision manufacturing processes that prove difficult to scale economically. Additionally, the business model for portable diagnostics must balance device cost with performance to create sustainable market opportunities, particularly in resource-limited settings where need is greatest but purchasing power is limited.

Current Microfluidic Solutions for Portable Diagnostics

01 Fabrication methods for microfluidic chips

Various techniques are employed in the fabrication of microfluidic chips, including soft lithography, injection molding, and 3D printing. These methods allow for precise control over channel dimensions and geometries, which is crucial for applications requiring specific flow characteristics. Advanced manufacturing approaches enable the creation of complex microstructures with features at the microscale, facilitating the development of integrated lab-on-a-chip devices with enhanced functionality.- Fabrication techniques for microfluidic chips: Various fabrication methods are employed to create microfluidic chips with precise channel geometries and surface properties. These techniques include soft lithography, injection molding, hot embossing, and 3D printing. The choice of fabrication method depends on the desired features, material properties, and production scale. Advanced manufacturing approaches enable the creation of complex microstructures with high precision, which is crucial for applications requiring controlled fluid flow and mixing.

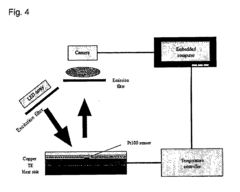

- Integration of sensing and detection systems: Microfluidic chips can be integrated with various sensing and detection systems to enable real-time monitoring and analysis. These systems include optical sensors, electrochemical detectors, and spectroscopic tools that can be miniaturized and incorporated directly into the chip architecture. The integration allows for rapid and sensitive detection of analytes, making these chips valuable for diagnostic applications, environmental monitoring, and chemical analysis.

- Applications in biological and medical research: Microfluidic chips have revolutionized biological and medical research by providing platforms for cell culture, drug screening, and disease modeling. These chips can mimic physiological conditions and create organ-on-chip systems that replicate the function of human organs. They enable high-throughput screening of drug candidates, personalized medicine approaches, and studies of cellular responses under controlled conditions, significantly reducing the need for animal testing and accelerating the drug development process.

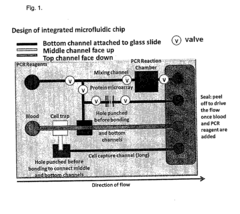

- Flow control and manipulation techniques: Advanced techniques for controlling and manipulating fluid flow within microfluidic chips are essential for their functionality. These include passive methods like capillary forces and geometric designs, as well as active methods such as electrokinetic control, pneumatic valves, and acoustic manipulation. Precise flow control enables complex operations like droplet generation, particle sorting, and gradient formation, expanding the capabilities of microfluidic systems for various applications.

- Materials and surface modifications: The choice of materials and surface modifications significantly impacts the performance of microfluidic chips. Common materials include glass, polymers (PDMS, PMMA), and silicon, each offering different optical, mechanical, and chemical properties. Surface modifications can alter wettability, prevent non-specific adsorption, and enable specific molecular interactions. These modifications are crucial for applications requiring biocompatibility, chemical resistance, or specific surface functionalities to control fluid behavior and molecular interactions within the microchannels.

02 Microfluidic chips for biological analysis

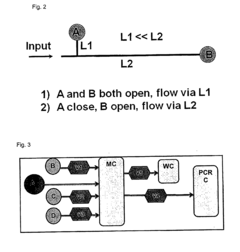

Microfluidic chips designed for biological analysis enable precise manipulation of small sample volumes for applications such as DNA sequencing, protein analysis, and cell sorting. These chips incorporate specialized chambers and channels for sample preparation, reaction, and detection steps. By miniaturizing laboratory processes, these devices reduce reagent consumption, accelerate analysis times, and improve sensitivity compared to conventional methods, making them valuable tools in diagnostics and research.Expand Specific Solutions03 Integration of sensors in microfluidic platforms

Microfluidic chips can be integrated with various sensing technologies to enable real-time monitoring and analysis of samples. These sensors may include optical, electrochemical, or mechanical detection systems that are directly incorporated into the chip architecture. The integration of sensing elements allows for automated detection of analytes, continuous monitoring of reactions, and feedback-controlled processes, enhancing the capabilities of microfluidic systems for applications in healthcare, environmental monitoring, and chemical synthesis.Expand Specific Solutions04 Droplet-based microfluidic systems

Droplet-based microfluidic systems utilize discrete droplets as microreactors for various applications. These systems enable the generation, manipulation, and analysis of individual droplets containing reagents or samples. By compartmentalizing reactions into droplets, these platforms offer advantages such as reduced cross-contamination, high-throughput capabilities, and precise control over reaction conditions. Applications include single-cell analysis, digital PCR, and high-throughput screening for drug discovery.Expand Specific Solutions05 Microfluidic organ-on-chip devices

Microfluidic organ-on-chip devices recreate the physiological microenvironment of human organs on a chip platform. These devices incorporate living cells within microchannels designed to mimic tissue architecture and function. By providing controlled fluid flow and mechanical stimuli, these systems can replicate key aspects of organ physiology. These biomimetic platforms serve as alternatives to animal testing for drug development, enable personalized medicine approaches, and provide insights into disease mechanisms under physiologically relevant conditions.Expand Specific Solutions

Leading Companies in Microfluidic Diagnostic Industry

The microfluidic chip market for portable diagnostics is experiencing rapid growth in an early-to-mid maturity phase, with the global market expected to reach $25-30 billion by 2027. Technical maturity varies across applications, with companies demonstrating different specialization levels. Industry leaders like Koninklijke Philips and HP Development are leveraging their manufacturing expertise to scale production, while innovative startups such as Pattern Bioscience and Loop Medical are driving technological breakthroughs in rapid diagnostics. Academic institutions including Northwestern University and Tsinghua Shenzhen International Graduate School are advancing fundamental research, while companies like Lansion Biotechnology and EFA Engineering are developing novel point-of-care solutions that promise to democratize access to diagnostic technologies in resource-limited settings.

Koninklijke Philips NV

Technical Solution: Philips has developed advanced microfluidic lab-on-chip platforms for portable diagnostics that integrate sample preparation, amplification, and detection in a single device. Their technology utilizes digital microfluidics to manipulate discrete droplets through electrowetting principles, enabling precise control of small fluid volumes. Philips' microfluidic solutions incorporate multiplexed immunoassays and molecular diagnostics capabilities, allowing for simultaneous detection of multiple biomarkers from a single sample. Their platforms feature integrated microheaters, sensors, and optical detection systems that enable rapid analysis of clinical samples at the point-of-care. Philips has particularly focused on developing solutions for infectious disease detection, cardiac biomarker analysis, and oncology applications, with systems designed for use in decentralized healthcare settings.

Strengths: Strong integration of electronics with microfluidics, established global distribution networks, and extensive clinical validation capabilities. Weaknesses: Higher cost compared to simpler solutions, requiring specialized manufacturing facilities and relatively complex user interfaces that may limit adoption in resource-limited settings.

HP Development Co. LP

Technical Solution: HP has leveraged its expertise in inkjet printing technology to develop microfluidic platforms for portable diagnostics. Their approach utilizes precision fluid handling techniques originally developed for printing to create cost-effective, disposable microfluidic chips. HP's technology employs thermal inkjet principles to precisely dispense reagents and samples in picoliter volumes, enabling highly controlled biochemical reactions. Their microfluidic solutions incorporate digital microfluidics for sample preparation and analysis, with integrated sensors for real-time monitoring. HP has developed specialized coatings and surface treatments to control fluid behavior within microchannels, reducing non-specific binding and improving diagnostic sensitivity. Their manufacturing approach allows for mass production of complex microfluidic structures at significantly lower costs than traditional methods, making portable diagnostics more accessible.

Strengths: Unparalleled manufacturing scale and precision, leveraging existing production infrastructure for cost-effective solutions. Weaknesses: Relatively newer entrant to the diagnostic field with less clinical validation experience compared to established medical device companies, and potential challenges in navigating regulatory pathways for medical applications.

Key Innovations in Microfluidic Chip Design

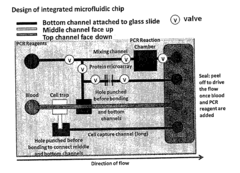

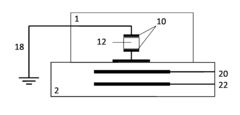

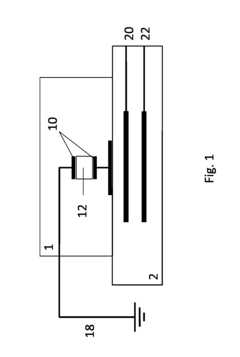

Microfluidic based integrated sample analysis system

PatentActiveUS20170001196A1

Innovation

- A portable microfluidic platform integrating a microfluidic chip with on-chip sample separation, PCR, protein, and cell analysis capabilities, utilizing a thermoelectric semiconductor, LED array, and control unit for simultaneous genetic, protein, and cell detection from a small sample volume, allowing for precise temperature control and fluorescence detection.

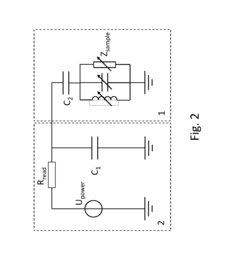

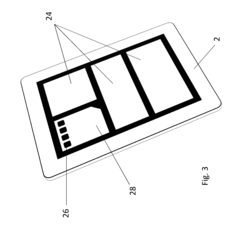

Micro-fluidic device for the analysis of a fluid sample

PatentInactiveUS20140186820A1

Innovation

- A programmable device with a capacitive touch screen is used as an interface and computing unit for micro-fluidic devices, combining detection, analysis, and display functions, reducing development costs and increasing modularity and flexibility by leveraging existing affordable and powerful capacitive touch technology.

Regulatory Framework for Point-of-Care Diagnostics

The regulatory landscape for point-of-care diagnostics incorporating microfluidic chip technology presents a complex framework that varies significantly across global markets. In the United States, the Food and Drug Administration (FDA) classifies these devices primarily under the Clinical Laboratory Improvement Amendments (CLIA) framework, with different regulatory pathways depending on the intended use and risk classification. Microfluidic-based diagnostic devices typically undergo either 510(k) clearance or Premarket Approval (PMA), with the latter being more stringent for novel technologies.

European markets operate under the In Vitro Diagnostic Regulation (IVDR), which replaced the previous IVDD in 2022, introducing more rigorous requirements for clinical evidence, post-market surveillance, and risk classification. This transition has particularly impacted microfluidic diagnostic developers by requiring more comprehensive technical documentation and performance evaluation data.

In emerging markets, regulatory frameworks are evolving rapidly but often lack standardization specific to microfluidic technologies. China's National Medical Products Administration (NMPA) has recently strengthened its oversight of innovative diagnostic technologies, while India's Central Drugs Standard Control Organization (CDSCO) is developing more specific guidelines for point-of-care testing devices.

International standards organizations play a crucial role in harmonizing requirements across borders. ISO 13485 for quality management systems and IEC 62304 for medical device software are particularly relevant for microfluidic chip-based diagnostics. The International Medical Device Regulators Forum (IMDRF) has been working toward global convergence of regulatory approaches for novel diagnostic technologies.

Regulatory challenges specific to microfluidic-based portable diagnostics include validation of miniaturized sample preparation, demonstration of clinical equivalence to laboratory methods, and ensuring reliability across diverse environmental conditions. The integration of digital components in these systems introduces additional regulatory considerations regarding cybersecurity, data privacy, and interoperability standards.

Recent regulatory trends show increasing acceptance of real-world evidence and adaptive regulatory pathways for innovative diagnostic technologies. The COVID-19 pandemic has accelerated regulatory innovations, including Emergency Use Authorizations (EUAs) and expedited review processes, which may permanently influence how novel microfluidic diagnostic technologies reach market approval.

For developers of microfluidic chip-based portable diagnostics, early engagement with regulatory bodies through pre-submission consultations has proven valuable in navigating these complex frameworks and establishing appropriate validation protocols that address the unique characteristics of these technologies.

European markets operate under the In Vitro Diagnostic Regulation (IVDR), which replaced the previous IVDD in 2022, introducing more rigorous requirements for clinical evidence, post-market surveillance, and risk classification. This transition has particularly impacted microfluidic diagnostic developers by requiring more comprehensive technical documentation and performance evaluation data.

In emerging markets, regulatory frameworks are evolving rapidly but often lack standardization specific to microfluidic technologies. China's National Medical Products Administration (NMPA) has recently strengthened its oversight of innovative diagnostic technologies, while India's Central Drugs Standard Control Organization (CDSCO) is developing more specific guidelines for point-of-care testing devices.

International standards organizations play a crucial role in harmonizing requirements across borders. ISO 13485 for quality management systems and IEC 62304 for medical device software are particularly relevant for microfluidic chip-based diagnostics. The International Medical Device Regulators Forum (IMDRF) has been working toward global convergence of regulatory approaches for novel diagnostic technologies.

Regulatory challenges specific to microfluidic-based portable diagnostics include validation of miniaturized sample preparation, demonstration of clinical equivalence to laboratory methods, and ensuring reliability across diverse environmental conditions. The integration of digital components in these systems introduces additional regulatory considerations regarding cybersecurity, data privacy, and interoperability standards.

Recent regulatory trends show increasing acceptance of real-world evidence and adaptive regulatory pathways for innovative diagnostic technologies. The COVID-19 pandemic has accelerated regulatory innovations, including Emergency Use Authorizations (EUAs) and expedited review processes, which may permanently influence how novel microfluidic diagnostic technologies reach market approval.

For developers of microfluidic chip-based portable diagnostics, early engagement with regulatory bodies through pre-submission consultations has proven valuable in navigating these complex frameworks and establishing appropriate validation protocols that address the unique characteristics of these technologies.

Manufacturing Scalability Challenges

The scalability of microfluidic chip manufacturing represents a significant bottleneck in the widespread adoption of portable diagnostic technologies. Traditional fabrication methods such as soft lithography using polydimethylsiloxane (PDMS) offer excellent prototyping capabilities but present substantial challenges when transitioning to mass production. The labor-intensive nature of these processes, coupled with the requirement for cleanroom facilities, creates prohibitive cost structures that impede commercial viability. Current manufacturing approaches struggle to maintain consistent quality across large production volumes, with defect rates increasing dramatically beyond laboratory-scale production.

Material selection further complicates scalability efforts. While PDMS remains popular for research applications, its gas permeability and absorption properties make it suboptimal for many diagnostic applications. Alternative materials like thermoplastics offer better mass-production compatibility through injection molding but require significant initial investment in tooling and equipment. The industry faces a critical materials science challenge in identifying substrates that balance biological compatibility, optical transparency, and manufacturability at scale.

Integration of functional components presents another dimension of manufacturing complexity. Modern portable diagnostic devices require seamless incorporation of electrodes, sensors, and surface modifications within microfluidic channels. Current manufacturing processes struggle to integrate these elements efficiently at scale while maintaining precise alignment and functionality. The miniaturization requirements of portable diagnostics further exacerbate these challenges, as manufacturing tolerances become increasingly critical at smaller dimensions.

Supply chain considerations also impact scalability, with specialized materials and components often sourced from limited suppliers. This dependency creates vulnerability to supply disruptions and price fluctuations. Additionally, quality control processes for microfluidic devices require sophisticated inspection technologies that can detect microscopic defects without damaging delicate structures. The development of automated, high-throughput inspection systems remains an active area of research but has not yet reached the maturity needed for truly scalable production.

Regulatory compliance adds another layer of manufacturing complexity. As diagnostic devices, microfluidic chips must meet stringent quality standards across jurisdictions. Establishing validated manufacturing processes that consistently meet these requirements demands significant investment in process development and validation studies. The documentation and traceability requirements further increase production overhead, particularly challenging for startups and smaller companies attempting to enter the portable diagnostics market.

Material selection further complicates scalability efforts. While PDMS remains popular for research applications, its gas permeability and absorption properties make it suboptimal for many diagnostic applications. Alternative materials like thermoplastics offer better mass-production compatibility through injection molding but require significant initial investment in tooling and equipment. The industry faces a critical materials science challenge in identifying substrates that balance biological compatibility, optical transparency, and manufacturability at scale.

Integration of functional components presents another dimension of manufacturing complexity. Modern portable diagnostic devices require seamless incorporation of electrodes, sensors, and surface modifications within microfluidic channels. Current manufacturing processes struggle to integrate these elements efficiently at scale while maintaining precise alignment and functionality. The miniaturization requirements of portable diagnostics further exacerbate these challenges, as manufacturing tolerances become increasingly critical at smaller dimensions.

Supply chain considerations also impact scalability, with specialized materials and components often sourced from limited suppliers. This dependency creates vulnerability to supply disruptions and price fluctuations. Additionally, quality control processes for microfluidic devices require sophisticated inspection technologies that can detect microscopic defects without damaging delicate structures. The development of automated, high-throughput inspection systems remains an active area of research but has not yet reached the maturity needed for truly scalable production.

Regulatory compliance adds another layer of manufacturing complexity. As diagnostic devices, microfluidic chips must meet stringent quality standards across jurisdictions. Establishing validated manufacturing processes that consistently meet these requirements demands significant investment in process development and validation studies. The documentation and traceability requirements further increase production overhead, particularly challenging for startups and smaller companies attempting to enter the portable diagnostics market.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!