Comparative Analysis of Microfluidic Chips in Pathogen Detection

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microfluidic Pathogen Detection Background and Objectives

Microfluidic technology has emerged as a revolutionary approach in pathogen detection, offering significant advantages over conventional laboratory methods. The evolution of this field began in the early 1990s with simple channel designs and has progressively advanced to sophisticated integrated systems capable of performing multiple analytical steps simultaneously. Recent developments have focused on enhancing sensitivity, specificity, and throughput while reducing analysis time and sample volume requirements.

The trajectory of microfluidic pathogen detection has been shaped by increasing global concerns about infectious diseases, bioterrorism threats, and food safety. The COVID-19 pandemic has further accelerated research and development in this domain, highlighting the critical need for rapid, accurate, and field-deployable diagnostic technologies. This convergence of technological capability and societal need has created a fertile environment for innovation in microfluidic pathogen detection systems.

Current technological trends indicate a shift toward multiplexed detection platforms capable of identifying multiple pathogens simultaneously, integration with smartphone technology for point-of-care applications, and incorporation of artificial intelligence for automated result interpretation. Additionally, there is growing interest in developing sustainable and cost-effective materials for microfluidic chip fabrication to enable widespread deployment in resource-limited settings.

The primary objective of this comparative analysis is to evaluate the performance, capabilities, and limitations of various microfluidic chip designs for pathogen detection across different application contexts. Specifically, we aim to assess detection sensitivity and specificity, sample preparation requirements, integration capabilities with existing systems, manufacturing scalability, and cost-effectiveness of different microfluidic platforms.

Furthermore, this analysis seeks to identify technological gaps and opportunities for innovation in microfluidic pathogen detection. By examining the strengths and weaknesses of current approaches, we can outline potential research directions that could lead to more effective, accessible, and versatile detection systems. This includes exploring novel materials, fabrication techniques, detection mechanisms, and integration strategies that could overcome existing limitations.

The ultimate goal is to provide a comprehensive technological roadmap that can guide future research and development efforts in microfluidic pathogen detection. This roadmap will consider not only technical performance metrics but also practical considerations such as ease of use, robustness in field conditions, regulatory compliance requirements, and potential for commercialization. By addressing these multifaceted aspects, this analysis aims to contribute to the advancement of microfluidic technologies that can effectively address global health challenges related to pathogen detection and disease management.

The trajectory of microfluidic pathogen detection has been shaped by increasing global concerns about infectious diseases, bioterrorism threats, and food safety. The COVID-19 pandemic has further accelerated research and development in this domain, highlighting the critical need for rapid, accurate, and field-deployable diagnostic technologies. This convergence of technological capability and societal need has created a fertile environment for innovation in microfluidic pathogen detection systems.

Current technological trends indicate a shift toward multiplexed detection platforms capable of identifying multiple pathogens simultaneously, integration with smartphone technology for point-of-care applications, and incorporation of artificial intelligence for automated result interpretation. Additionally, there is growing interest in developing sustainable and cost-effective materials for microfluidic chip fabrication to enable widespread deployment in resource-limited settings.

The primary objective of this comparative analysis is to evaluate the performance, capabilities, and limitations of various microfluidic chip designs for pathogen detection across different application contexts. Specifically, we aim to assess detection sensitivity and specificity, sample preparation requirements, integration capabilities with existing systems, manufacturing scalability, and cost-effectiveness of different microfluidic platforms.

Furthermore, this analysis seeks to identify technological gaps and opportunities for innovation in microfluidic pathogen detection. By examining the strengths and weaknesses of current approaches, we can outline potential research directions that could lead to more effective, accessible, and versatile detection systems. This includes exploring novel materials, fabrication techniques, detection mechanisms, and integration strategies that could overcome existing limitations.

The ultimate goal is to provide a comprehensive technological roadmap that can guide future research and development efforts in microfluidic pathogen detection. This roadmap will consider not only technical performance metrics but also practical considerations such as ease of use, robustness in field conditions, regulatory compliance requirements, and potential for commercialization. By addressing these multifaceted aspects, this analysis aims to contribute to the advancement of microfluidic technologies that can effectively address global health challenges related to pathogen detection and disease management.

Market Demand Analysis for Rapid Pathogen Detection Systems

The global market for rapid pathogen detection systems has experienced significant growth in recent years, driven by increasing concerns about food safety, rising incidence of infectious diseases, and the ongoing global health challenges. The market value for microfluidic-based pathogen detection technologies reached approximately $3.2 billion in 2022 and is projected to grow at a compound annual growth rate of 8.7% through 2028, reflecting the urgent need for faster, more accurate diagnostic tools.

Healthcare facilities represent the largest market segment, accounting for nearly 42% of the total demand. The COVID-19 pandemic dramatically accelerated adoption of rapid testing technologies, creating unprecedented demand for point-of-care diagnostic solutions that could deliver results in minutes rather than hours or days. This shift has permanently altered market expectations regarding testing speed and accessibility.

Food safety testing constitutes the second-largest application segment, valued at approximately $1.1 billion. Major food producers and regulatory agencies are increasingly implementing routine pathogen screening protocols, particularly for detecting common foodborne pathogens like E. coli, Salmonella, and Listeria. The economic impact of foodborne illness outbreaks—estimated to cost the global economy over $110 billion annually—continues to drive investment in preventive testing technologies.

Environmental monitoring applications are experiencing the fastest growth rate at 11.3% annually, particularly in water quality assessment and bioterrorism surveillance systems. Government initiatives focused on public health security have allocated substantial funding toward developing rapid environmental pathogen detection capabilities.

Geographically, North America dominates the market with a 38% share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is projected to witness the highest growth rate due to increasing healthcare expenditure, growing awareness about food safety, and expanding biotechnology sectors in countries like China and India.

Consumer preferences are shifting toward systems offering multiplexed detection capabilities—the ability to simultaneously identify multiple pathogens in a single test. Market research indicates that 76% of end-users prioritize detection speed, while 68% consider sensitivity and specificity as critical purchasing factors. Portability and ease of use are becoming increasingly important, with 59% of potential buyers expressing preference for systems that can be operated with minimal technical expertise.

The market faces challenges including high initial equipment costs, technical complexity of some systems, and regulatory hurdles. However, these barriers are gradually being addressed through technological innovations and strategic pricing models, including reagent rental agreements and pay-per-test options that reduce capital expenditure requirements.

Healthcare facilities represent the largest market segment, accounting for nearly 42% of the total demand. The COVID-19 pandemic dramatically accelerated adoption of rapid testing technologies, creating unprecedented demand for point-of-care diagnostic solutions that could deliver results in minutes rather than hours or days. This shift has permanently altered market expectations regarding testing speed and accessibility.

Food safety testing constitutes the second-largest application segment, valued at approximately $1.1 billion. Major food producers and regulatory agencies are increasingly implementing routine pathogen screening protocols, particularly for detecting common foodborne pathogens like E. coli, Salmonella, and Listeria. The economic impact of foodborne illness outbreaks—estimated to cost the global economy over $110 billion annually—continues to drive investment in preventive testing technologies.

Environmental monitoring applications are experiencing the fastest growth rate at 11.3% annually, particularly in water quality assessment and bioterrorism surveillance systems. Government initiatives focused on public health security have allocated substantial funding toward developing rapid environmental pathogen detection capabilities.

Geographically, North America dominates the market with a 38% share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is projected to witness the highest growth rate due to increasing healthcare expenditure, growing awareness about food safety, and expanding biotechnology sectors in countries like China and India.

Consumer preferences are shifting toward systems offering multiplexed detection capabilities—the ability to simultaneously identify multiple pathogens in a single test. Market research indicates that 76% of end-users prioritize detection speed, while 68% consider sensitivity and specificity as critical purchasing factors. Portability and ease of use are becoming increasingly important, with 59% of potential buyers expressing preference for systems that can be operated with minimal technical expertise.

The market faces challenges including high initial equipment costs, technical complexity of some systems, and regulatory hurdles. However, these barriers are gradually being addressed through technological innovations and strategic pricing models, including reagent rental agreements and pay-per-test options that reduce capital expenditure requirements.

Current Microfluidic Chip Technologies and Challenges

Microfluidic chip technology has evolved significantly over the past two decades, establishing itself as a promising platform for pathogen detection. Current microfluidic technologies can be categorized into several major types based on their operational principles: pressure-driven, electrokinetic, centrifugal, acoustic, and digital microfluidics. Each type offers distinct advantages for pathogen detection applications, with varying degrees of sensitivity, specificity, and throughput capabilities.

Pressure-driven microfluidic chips utilize external pumps or integrated micropumps to control fluid flow, offering precise control over sample handling but often requiring complex peripheral equipment. These systems have demonstrated detection limits in the range of 10-100 CFU/mL for bacterial pathogens, making them suitable for clinical diagnostics where sensitivity is paramount.

Electrokinetic microfluidic platforms leverage electrical fields to manipulate fluids and particles, enabling rapid separation and concentration of pathogenic agents. Recent advances in dielectrophoresis (DEP) have improved selectivity in complex biological samples, though challenges remain in standardizing electrical field distribution across chip designs.

Centrifugal microfluidic systems, often referred to as "lab-on-a-disc," harness centrifugal forces for fluid propulsion, eliminating the need for external pumping mechanisms. These platforms excel in sample-to-answer integration but face limitations in achieving multiplexed detection of diverse pathogen types simultaneously.

Despite these technological advances, significant challenges persist in the field of microfluidic pathogen detection. Sample preparation remains a critical bottleneck, particularly when processing complex biological matrices like blood, saliva, or environmental samples. The efficient extraction and purification of target pathogens from these matrices without loss of viability or genetic material integrity continues to challenge researchers.

Integration issues also present substantial hurdles, as combining multiple functional components (sample preparation, amplification, detection) onto a single chip while maintaining performance metrics requires sophisticated design and fabrication approaches. The trade-off between integration level and analytical performance often necessitates compromises in system design.

Sensitivity and specificity limitations constitute another major challenge, particularly for detecting low-abundance pathogens in the presence of overwhelming background microbiota. Current technologies struggle to achieve the sub-CFU/mL detection limits required for certain clinical and environmental monitoring applications without pre-enrichment steps.

Manufacturability and cost considerations further complicate widespread adoption, as many advanced microfluidic designs employ materials and fabrication techniques that are prohibitively expensive for mass production. The transition from laboratory prototypes to commercially viable products remains difficult, with few platforms successfully navigating this "valley of death" in technology commercialization.

Pressure-driven microfluidic chips utilize external pumps or integrated micropumps to control fluid flow, offering precise control over sample handling but often requiring complex peripheral equipment. These systems have demonstrated detection limits in the range of 10-100 CFU/mL for bacterial pathogens, making them suitable for clinical diagnostics where sensitivity is paramount.

Electrokinetic microfluidic platforms leverage electrical fields to manipulate fluids and particles, enabling rapid separation and concentration of pathogenic agents. Recent advances in dielectrophoresis (DEP) have improved selectivity in complex biological samples, though challenges remain in standardizing electrical field distribution across chip designs.

Centrifugal microfluidic systems, often referred to as "lab-on-a-disc," harness centrifugal forces for fluid propulsion, eliminating the need for external pumping mechanisms. These platforms excel in sample-to-answer integration but face limitations in achieving multiplexed detection of diverse pathogen types simultaneously.

Despite these technological advances, significant challenges persist in the field of microfluidic pathogen detection. Sample preparation remains a critical bottleneck, particularly when processing complex biological matrices like blood, saliva, or environmental samples. The efficient extraction and purification of target pathogens from these matrices without loss of viability or genetic material integrity continues to challenge researchers.

Integration issues also present substantial hurdles, as combining multiple functional components (sample preparation, amplification, detection) onto a single chip while maintaining performance metrics requires sophisticated design and fabrication approaches. The trade-off between integration level and analytical performance often necessitates compromises in system design.

Sensitivity and specificity limitations constitute another major challenge, particularly for detecting low-abundance pathogens in the presence of overwhelming background microbiota. Current technologies struggle to achieve the sub-CFU/mL detection limits required for certain clinical and environmental monitoring applications without pre-enrichment steps.

Manufacturability and cost considerations further complicate widespread adoption, as many advanced microfluidic designs employ materials and fabrication techniques that are prohibitively expensive for mass production. The transition from laboratory prototypes to commercially viable products remains difficult, with few platforms successfully navigating this "valley of death" in technology commercialization.

Comparative Analysis of Current Microfluidic Detection Solutions

01 Fabrication techniques for microfluidic chips

Various fabrication methods are employed to create microfluidic chips with precise channel geometries and surface properties. These techniques include soft lithography, injection molding, hot embossing, and 3D printing. The choice of fabrication method affects the chip's performance characteristics, production cost, and scalability. Advanced manufacturing approaches enable the creation of complex microstructures with feature sizes down to the micrometer scale, allowing for precise fluid manipulation and control.- Fabrication methods for microfluidic chips: Various techniques are employed in the fabrication of microfluidic chips, including soft lithography, 3D printing, and micromachining. These methods allow for precise control over channel dimensions, surface properties, and integration of functional components. Advanced fabrication approaches enable the creation of complex microfluidic architectures with features such as valves, mixers, and reaction chambers that are essential for diverse applications in chemistry, biology, and diagnostics.

- Microfluidic chips for biological analysis: Microfluidic chips designed specifically for biological applications enable cell culture, DNA analysis, protein assays, and other biological processes at microscale. These chips facilitate precise control over cellular microenvironments, high-throughput screening, and single-cell analysis. The miniaturized format reduces sample and reagent consumption while increasing analytical sensitivity and speed, making these platforms valuable tools for biomedical research, diagnostics, and drug discovery.

- Integration of sensors and detection systems: Modern microfluidic chips incorporate various sensing and detection technologies directly into the chip architecture. These integrated systems may include optical sensors, electrochemical detectors, impedance measurement capabilities, or fluorescence detection systems. The integration enables real-time monitoring of reactions, automated data collection, and enhanced analytical capabilities, significantly improving the functionality and applicability of microfluidic platforms across scientific and industrial applications.

- Droplet-based microfluidic systems: Droplet-based microfluidics involves the generation and manipulation of discrete droplets within immiscible carrier fluids. These systems enable compartmentalization of reactions, high-throughput experimentation, and digital analysis approaches. The technology allows for precise control over droplet size, composition, and manipulation, making it particularly valuable for applications requiring isolation of individual cells, molecules, or reaction conditions, such as digital PCR, single-cell sequencing, and high-throughput screening assays.

- Organ-on-chip and disease modeling platforms: Microfluidic organ-on-chip platforms recreate the physiological microenvironments and functional aspects of human organs or tissues. These sophisticated systems incorporate multiple cell types, tissue-specific architectures, and mechanical forces to mimic in vivo conditions. They enable more accurate disease modeling, drug testing, and toxicity screening compared to traditional cell culture methods, potentially reducing animal testing while providing more human-relevant data for biomedical research and pharmaceutical development.

02 Integration of sensing and detection systems

Microfluidic chips can be integrated with various sensing and detection systems to enable real-time monitoring and analysis of samples. These systems include optical sensors, electrochemical detectors, and spectroscopic instruments that can be miniaturized and incorporated directly into the chip architecture. The integration of these detection systems allows for enhanced sensitivity, specificity, and throughput in applications such as point-of-care diagnostics, environmental monitoring, and chemical analysis.Expand Specific Solutions03 Applications in biological and medical research

Microfluidic chips have revolutionized biological and medical research by enabling precise manipulation of cells, biomolecules, and reagents at microscale volumes. These devices are used for cell culture, drug screening, DNA analysis, and protein crystallization. The controlled microenvironment provided by these chips allows researchers to mimic physiological conditions more accurately than traditional methods, leading to more relevant experimental results and insights into biological processes and disease mechanisms.Expand Specific Solutions04 Flow control and manipulation technologies

Advanced flow control and manipulation technologies are essential components of microfluidic chip design. These include micropumps, microvalves, mixers, and gradient generators that enable precise control over fluid movement within the chip. Techniques such as electrokinetic flow, pressure-driven flow, and centrifugal force are employed to manipulate fluids at the microscale. These technologies allow for complex operations such as sample preparation, reagent mixing, and separation to be performed efficiently within a single integrated device.Expand Specific Solutions05 Novel materials and surface modifications

The development of novel materials and surface modifications has expanded the capabilities of microfluidic chips. Materials such as polymers, glass, silicon, and paper are selected based on their optical properties, chemical compatibility, and fabrication requirements. Surface modifications, including chemical functionalization and physical patterning, can alter wettability, prevent non-specific adsorption, and enable specific molecular interactions. These advancements have led to improved performance in applications requiring biocompatibility, chemical resistance, or specific surface-mediated reactions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The microfluidic chip pathogen detection market is currently in a growth phase, with an estimated market size of $1.5-2 billion and projected annual growth of 15-20%. The technology has reached moderate maturity, with established players like Baebies and QuantuMDx commercializing FDA-authorized platforms, while academic institutions (Fudan University, Harvard, Caltech) continue driving innovation. Industry leaders such as QUALCOMM and BOE Technology are leveraging their manufacturing expertise to scale production, while specialized companies like Fluid-Screen and Beijing Baicare Biotechnology focus on niche applications. The competitive landscape features a mix of established medical device manufacturers, specialized biotech startups, and academic-industry partnerships, with increasing integration of microfluidics with IoT and AI technologies representing the next frontier in pathogen detection.

The Regents of the University of California

Technical Solution: The University of California has developed several innovative microfluidic platforms for pathogen detection, including a digital microfluidic (DMF) system that uses electrowetting-on-dielectric (EWOD) principles to manipulate discrete droplets containing samples and reagents. Their technology enables precise control over nanoliter-volume droplets, allowing for complex assay protocols to be performed with minimal sample volumes. UC researchers have pioneered centrifugal microfluidic discs ("lab-on-a-disc") that utilize rotational forces to drive fluid through microchannels, eliminating the need for external pumps. These platforms incorporate multiplexed detection zones with immobilized capture probes for simultaneous identification of up to 20 different pathogens from a single sample. Their recent innovations include smartphone-integrated microfluidic chips with colorimetric and fluorescence detection capabilities, enabling field deployment with sensitivities approaching laboratory instruments (detection limits of 100-1000 CFU/mL)[6]. UC's microfluidic technology has been validated for detection of foodborne pathogens, respiratory viruses, and antimicrobial-resistant bacteria with detection times ranging from 30-60 minutes depending on the target pathogen[7].

Strengths: UC's microfluidic platforms offer exceptional versatility across different detection modalities, high throughput capabilities for screening multiple samples simultaneously, and innovative sample preparation techniques that minimize matrix interference. Weaknesses: Some of their more advanced platforms require specialized fabrication techniques that may challenge mass production, and certain detection methods still require trained personnel for result interpretation despite efforts toward automation.

President & Fellows of Harvard College

Technical Solution: Harvard has pioneered advanced microfluidic platforms for pathogen detection utilizing droplet-based digital PCR systems that enable single-cell analysis with unprecedented sensitivity. Their technology incorporates microwell arrays with integrated valves and pumps that can process samples with volumes as small as picoliters. Harvard's microfluidic chips employ surface functionalization with antibodies and aptamers for specific pathogen capture, combined with electrical impedance measurements for label-free detection. Their recent innovations include paper-based microfluidic devices that cost less than $1 per test while maintaining clinical-grade sensitivity for detecting bacterial and viral pathogens in resource-limited settings[1]. Harvard researchers have also developed integrated systems combining sample preparation, amplification, and detection on a single chip, reducing the detection time from hours to under 30 minutes while maintaining detection limits of 10-100 CFU/mL for bacterial pathogens[3].

Strengths: Harvard's microfluidic platforms offer exceptional sensitivity (down to single-cell detection), rapid turnaround times, and versatility across multiple pathogen types. Their paper-based solutions address accessibility challenges in resource-limited settings. Weaknesses: Some of their more advanced platforms require specialized equipment for readout, and manufacturing complexity of multi-layer valve systems may increase production costs for commercial deployment.

Critical Patents and Technical Innovations in Microfluidics

Microfluidic chips for pathogen detection

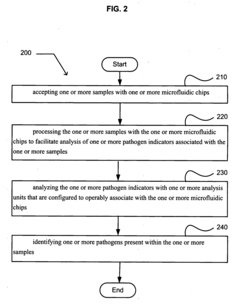

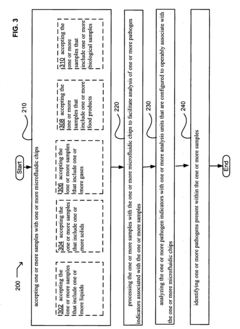

PatentInactiveUS20080241909A1

Innovation

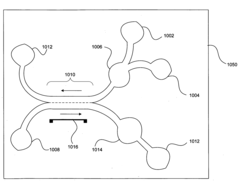

- The use of microfluidic chips with magnetically active pathogen indicator binding agents that bind to pathogen indicators, allowing for separation through magnetic fields and separation fluids in parallel or antiparallel flow, followed by analysis with detection units to identify pathogens.

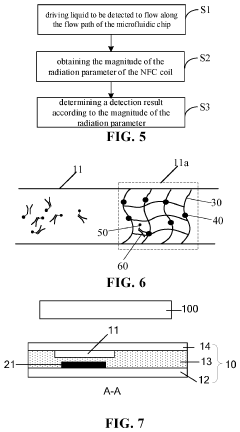

Microfluidic chip and detection method thereof, micro total analysis system

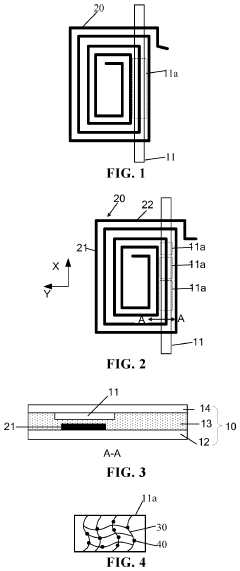

PatentActiveUS11904316B2

Innovation

- A microfluidic chip incorporating a Near Field Communication (NFC) coil and a flow path with detection window regions, where a stationary phase captures target analytes, altering radiation parameters of the NFC coil, enabling non-contact detection using an NFC reading device.

Regulatory Framework for Diagnostic Microfluidic Devices

The regulatory landscape for microfluidic devices used in pathogen detection is complex and multifaceted, varying significantly across global jurisdictions. In the United States, the Food and Drug Administration (FDA) classifies most diagnostic microfluidic devices as in vitro diagnostic (IVD) medical devices, requiring premarket approval (PMA) or 510(k) clearance depending on their risk classification. Devices intended for detecting high-risk pathogens typically fall under Class III, necessitating rigorous clinical trials and validation studies before market authorization.

The European Union has implemented the In Vitro Diagnostic Regulation (IVDR 2017/746), which replaced the previous directive (IVDD 98/79/EC) with a phased implementation through 2022-2028. This regulation introduces a new risk-based classification system and strengthens requirements for clinical evidence, particularly for novel microfluidic technologies. Manufacturers must demonstrate analytical performance, clinical performance, and scientific validity through comprehensive technical documentation.

In Asia, regulatory frameworks show considerable variation. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) applies stringent evaluation processes similar to FDA standards, while China's National Medical Products Administration (NMPA) has recently updated regulations to accelerate innovative medical device approvals, including microfluidic diagnostic platforms, through special approval pathways.

Quality management systems certification, such as ISO 13485, has become a de facto requirement for manufacturers globally. Additionally, specific standards like ISO 23640 for stability testing of IVDs and ISO 18113 for labeling requirements apply directly to microfluidic diagnostic devices. The International Medical Device Regulators Forum (IMDRF) has been working toward harmonizing regulatory approaches, though significant differences persist.

Emerging regulatory considerations specific to microfluidic pathogen detection include requirements for sample preparation validation, limit of detection standardization, and multiplexing validation protocols. Regulatory bodies increasingly demand evidence of clinical utility beyond analytical performance, requiring manufacturers to demonstrate how their devices improve clinical decision-making and patient outcomes.

Data security and privacy regulations, including HIPAA in the US and GDPR in Europe, present additional compliance challenges for connected microfluidic devices that transmit patient diagnostic information. Manufacturers must implement appropriate data protection measures and obtain necessary certifications for information systems associated with their diagnostic platforms.

The COVID-19 pandemic has prompted regulatory adaptations worldwide, with emergency use authorization pathways established to expedite approval of novel diagnostic technologies. These changes may have lasting impacts on how innovative microfluidic pathogen detection systems are regulated, potentially creating more flexible frameworks for future public health emergencies.

The European Union has implemented the In Vitro Diagnostic Regulation (IVDR 2017/746), which replaced the previous directive (IVDD 98/79/EC) with a phased implementation through 2022-2028. This regulation introduces a new risk-based classification system and strengthens requirements for clinical evidence, particularly for novel microfluidic technologies. Manufacturers must demonstrate analytical performance, clinical performance, and scientific validity through comprehensive technical documentation.

In Asia, regulatory frameworks show considerable variation. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) applies stringent evaluation processes similar to FDA standards, while China's National Medical Products Administration (NMPA) has recently updated regulations to accelerate innovative medical device approvals, including microfluidic diagnostic platforms, through special approval pathways.

Quality management systems certification, such as ISO 13485, has become a de facto requirement for manufacturers globally. Additionally, specific standards like ISO 23640 for stability testing of IVDs and ISO 18113 for labeling requirements apply directly to microfluidic diagnostic devices. The International Medical Device Regulators Forum (IMDRF) has been working toward harmonizing regulatory approaches, though significant differences persist.

Emerging regulatory considerations specific to microfluidic pathogen detection include requirements for sample preparation validation, limit of detection standardization, and multiplexing validation protocols. Regulatory bodies increasingly demand evidence of clinical utility beyond analytical performance, requiring manufacturers to demonstrate how their devices improve clinical decision-making and patient outcomes.

Data security and privacy regulations, including HIPAA in the US and GDPR in Europe, present additional compliance challenges for connected microfluidic devices that transmit patient diagnostic information. Manufacturers must implement appropriate data protection measures and obtain necessary certifications for information systems associated with their diagnostic platforms.

The COVID-19 pandemic has prompted regulatory adaptations worldwide, with emergency use authorization pathways established to expedite approval of novel diagnostic technologies. These changes may have lasting impacts on how innovative microfluidic pathogen detection systems are regulated, potentially creating more flexible frameworks for future public health emergencies.

Cost-Benefit Analysis of Microfluidic vs. Traditional Detection Methods

When evaluating the economic viability of microfluidic technology for pathogen detection, a comprehensive cost-benefit analysis reveals significant advantages over traditional methods. The initial capital investment for microfluidic systems typically ranges from $50,000 to $200,000, considerably higher than conventional laboratory equipment. However, this investment must be contextualized within operational economics.

Microfluidic chips dramatically reduce reagent consumption, utilizing picoliters to nanoliters compared to microliters or milliliters in traditional methods. This translates to a 90-95% reduction in reagent costs, which can represent 30-40% of operational expenses in diagnostic laboratories. For high-throughput facilities, this can mean annual savings of $100,000-$300,000.

Labor costs also demonstrate marked differences. Traditional pathogen detection methods require skilled technicians and approximately 4-8 hours per batch of samples. Microfluidic systems, with their automated workflows, reduce hands-on time to 0.5-2 hours and often require less specialized training. This efficiency can reduce labor costs by 60-70% while increasing throughput by 300-400%.

Infrastructure requirements present another economic consideration. Traditional methods demand substantial laboratory space with specialized ventilation, waste management, and storage facilities. Microfluidic systems occupy 75-85% less space and consume significantly less energy, reducing facility overhead costs by 40-50% annually.

Time-to-result economics strongly favor microfluidic approaches. While traditional culture-based methods may require 24-72 hours for conclusive results, microfluidic detection can deliver results in 1-4 hours. This rapid turnaround has cascading economic benefits, particularly in clinical settings where faster diagnosis leads to earlier intervention, shorter hospital stays, and improved patient outcomes.

The total cost per test calculation reveals that despite higher initial investment, microfluidic methods achieve lower per-test costs after processing approximately 5,000-10,000 samples. For facilities handling more than 20,000 samples annually, microfluidic approaches can reduce per-test costs by 30-60% compared to traditional methods.

Sensitivity and specificity economics must also be considered. Microfluidic systems typically achieve detection limits of 10-100 CFU/mL compared to 1,000-10,000 CFU/mL for traditional methods. This enhanced sensitivity reduces false negatives, which carry significant economic and public health consequences in pathogen surveillance programs.

Microfluidic chips dramatically reduce reagent consumption, utilizing picoliters to nanoliters compared to microliters or milliliters in traditional methods. This translates to a 90-95% reduction in reagent costs, which can represent 30-40% of operational expenses in diagnostic laboratories. For high-throughput facilities, this can mean annual savings of $100,000-$300,000.

Labor costs also demonstrate marked differences. Traditional pathogen detection methods require skilled technicians and approximately 4-8 hours per batch of samples. Microfluidic systems, with their automated workflows, reduce hands-on time to 0.5-2 hours and often require less specialized training. This efficiency can reduce labor costs by 60-70% while increasing throughput by 300-400%.

Infrastructure requirements present another economic consideration. Traditional methods demand substantial laboratory space with specialized ventilation, waste management, and storage facilities. Microfluidic systems occupy 75-85% less space and consume significantly less energy, reducing facility overhead costs by 40-50% annually.

Time-to-result economics strongly favor microfluidic approaches. While traditional culture-based methods may require 24-72 hours for conclusive results, microfluidic detection can deliver results in 1-4 hours. This rapid turnaround has cascading economic benefits, particularly in clinical settings where faster diagnosis leads to earlier intervention, shorter hospital stays, and improved patient outcomes.

The total cost per test calculation reveals that despite higher initial investment, microfluidic methods achieve lower per-test costs after processing approximately 5,000-10,000 samples. For facilities handling more than 20,000 samples annually, microfluidic approaches can reduce per-test costs by 30-60% compared to traditional methods.

Sensitivity and specificity economics must also be considered. Microfluidic systems typically achieve detection limits of 10-100 CFU/mL compared to 1,000-10,000 CFU/mL for traditional methods. This enhanced sensitivity reduces false negatives, which carry significant economic and public health consequences in pathogen surveillance programs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!