Assessing the Impacts of Regulation Changes on Ammonia Fuel Markets

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Technology Background and Objectives

Ammonia has emerged as a promising carbon-free energy carrier in the global transition toward sustainable energy systems. Historically, ammonia has primarily served as a feedstock for fertilizer production, with over 180 million tons produced annually worldwide. However, its potential as a fuel has gained significant attention in recent years due to its high energy density, established production infrastructure, and zero-carbon combustion characteristics when produced from renewable sources.

The evolution of ammonia fuel technology can be traced back to the early 20th century, with sporadic applications in internal combustion engines. Modern interest resurged in the early 2000s as concerns about climate change intensified. The technical trajectory has accelerated dramatically since 2015, with major research initiatives launched across Europe, Asia, and North America focusing on ammonia's role in decarbonizing hard-to-abate sectors like maritime shipping, heavy industry, and long-duration energy storage.

Current technological development focuses on three primary pathways: direct ammonia combustion in modified engines and turbines, ammonia fuel cells, and ammonia as a hydrogen carrier. Each pathway presents unique advantages and technical challenges, with varying technology readiness levels. Direct combustion approaches have advanced significantly, with several major engine manufacturers demonstrating viable prototypes for maritime applications.

The regulatory landscape surrounding ammonia fuel is rapidly evolving. The International Maritime Organization's (IMO) increasingly stringent emissions targets have created strong incentives for alternative fuels, positioning ammonia as a leading candidate for deep-sea shipping decarbonization. Similarly, national hydrogen strategies in Japan, Australia, and the European Union explicitly include ammonia within their scope, recognizing its complementary role in hydrogen economies.

The primary objectives of this technical assessment are to evaluate how recent and anticipated regulatory changes across global markets will impact the commercial viability of ammonia fuel technologies. Specifically, we aim to quantify the effects of carbon pricing mechanisms, emissions standards, renewable fuel mandates, and safety regulations on ammonia fuel adoption trajectories across different sectors. Additionally, we seek to identify critical technology gaps that must be addressed to meet regulatory requirements and accelerate market penetration.

This assessment will also examine the interplay between technology development timelines and regulatory implementation schedules, highlighting potential misalignments that could create market uncertainties or opportunities for early adopters of ammonia fuel technologies.

The evolution of ammonia fuel technology can be traced back to the early 20th century, with sporadic applications in internal combustion engines. Modern interest resurged in the early 2000s as concerns about climate change intensified. The technical trajectory has accelerated dramatically since 2015, with major research initiatives launched across Europe, Asia, and North America focusing on ammonia's role in decarbonizing hard-to-abate sectors like maritime shipping, heavy industry, and long-duration energy storage.

Current technological development focuses on three primary pathways: direct ammonia combustion in modified engines and turbines, ammonia fuel cells, and ammonia as a hydrogen carrier. Each pathway presents unique advantages and technical challenges, with varying technology readiness levels. Direct combustion approaches have advanced significantly, with several major engine manufacturers demonstrating viable prototypes for maritime applications.

The regulatory landscape surrounding ammonia fuel is rapidly evolving. The International Maritime Organization's (IMO) increasingly stringent emissions targets have created strong incentives for alternative fuels, positioning ammonia as a leading candidate for deep-sea shipping decarbonization. Similarly, national hydrogen strategies in Japan, Australia, and the European Union explicitly include ammonia within their scope, recognizing its complementary role in hydrogen economies.

The primary objectives of this technical assessment are to evaluate how recent and anticipated regulatory changes across global markets will impact the commercial viability of ammonia fuel technologies. Specifically, we aim to quantify the effects of carbon pricing mechanisms, emissions standards, renewable fuel mandates, and safety regulations on ammonia fuel adoption trajectories across different sectors. Additionally, we seek to identify critical technology gaps that must be addressed to meet regulatory requirements and accelerate market penetration.

This assessment will also examine the interplay between technology development timelines and regulatory implementation schedules, highlighting potential misalignments that could create market uncertainties or opportunities for early adopters of ammonia fuel technologies.

Market Demand Analysis for Ammonia as Alternative Fuel

The global market for ammonia as an alternative fuel is experiencing significant growth driven by the increasing focus on decarbonization and sustainable energy solutions. Current market assessments indicate that ammonia fuel demand could reach substantial volumes by 2030, with maritime shipping representing the most promising initial market. The International Maritime Organization's regulations targeting 40% reduction in carbon intensity by 2030 have positioned ammonia as a leading zero-carbon fuel candidate for the shipping industry.

Market research shows that ammonia's potential extends beyond maritime applications to stationary power generation and potentially heavy-duty transportation. The Asia-Pacific region, particularly Japan and South Korea, demonstrates the strongest early adoption trends, with government-backed initiatives supporting ammonia co-firing in coal power plants and development of ammonia-fueled vessels.

Economic analysis reveals that ammonia fuel currently faces a significant cost premium compared to conventional fuels. Production costs for green ammonia range from $600-1,200 per ton depending on renewable electricity prices and electrolyzer costs, compared to $200-400 per ton for conventional ammonia. However, this gap is projected to narrow as carbon pricing mechanisms expand globally and renewable electricity costs continue to decline.

Demand forecasts suggest a potential market of 7-10 million tons of ammonia as fuel by 2030, growing to 30-40 million tons by 2040 if regulatory support continues to strengthen. This represents a substantial growth opportunity considering the current global ammonia production of approximately 180 million tons is primarily directed toward fertilizer applications.

Consumer acceptance analysis indicates that end-users in regulated industries are increasingly willing to adopt ammonia fuel solutions when regulatory compliance requirements align with available technology options. The maritime sector shows particular readiness as major shipping companies have already announced ammonia-powered vessel orders for delivery in the mid-2020s.

Infrastructure development remains a critical factor influencing market growth. Current ammonia infrastructure is concentrated around agricultural hubs rather than transportation corridors, creating a significant barrier to widespread adoption. Investment in specialized storage, handling, and bunkering facilities at major ports will be essential to support market expansion.

Competitive analysis against other alternative fuels shows that ammonia offers advantages in energy density compared to hydrogen and batteries, while providing better scalability than biofuels. However, it faces competition from LNG as a transitional fuel and from methanol in certain applications where toxicity concerns and infrastructure compatibility favor the latter.

Market research shows that ammonia's potential extends beyond maritime applications to stationary power generation and potentially heavy-duty transportation. The Asia-Pacific region, particularly Japan and South Korea, demonstrates the strongest early adoption trends, with government-backed initiatives supporting ammonia co-firing in coal power plants and development of ammonia-fueled vessels.

Economic analysis reveals that ammonia fuel currently faces a significant cost premium compared to conventional fuels. Production costs for green ammonia range from $600-1,200 per ton depending on renewable electricity prices and electrolyzer costs, compared to $200-400 per ton for conventional ammonia. However, this gap is projected to narrow as carbon pricing mechanisms expand globally and renewable electricity costs continue to decline.

Demand forecasts suggest a potential market of 7-10 million tons of ammonia as fuel by 2030, growing to 30-40 million tons by 2040 if regulatory support continues to strengthen. This represents a substantial growth opportunity considering the current global ammonia production of approximately 180 million tons is primarily directed toward fertilizer applications.

Consumer acceptance analysis indicates that end-users in regulated industries are increasingly willing to adopt ammonia fuel solutions when regulatory compliance requirements align with available technology options. The maritime sector shows particular readiness as major shipping companies have already announced ammonia-powered vessel orders for delivery in the mid-2020s.

Infrastructure development remains a critical factor influencing market growth. Current ammonia infrastructure is concentrated around agricultural hubs rather than transportation corridors, creating a significant barrier to widespread adoption. Investment in specialized storage, handling, and bunkering facilities at major ports will be essential to support market expansion.

Competitive analysis against other alternative fuels shows that ammonia offers advantages in energy density compared to hydrogen and batteries, while providing better scalability than biofuels. However, it faces competition from LNG as a transitional fuel and from methanol in certain applications where toxicity concerns and infrastructure compatibility favor the latter.

Current Technical Challenges in Ammonia Fuel Implementation

Despite the promising potential of ammonia as a carbon-free fuel, significant technical challenges remain in its widespread implementation. The storage and transportation of ammonia present substantial hurdles due to its corrosive nature and toxicity. Current infrastructure requires specialized materials resistant to ammonia's corrosive properties, significantly increasing implementation costs. Additionally, existing pipelines and storage facilities designed for conventional fuels cannot be readily repurposed without extensive modifications.

Ammonia's energy density, while superior to hydrogen, remains lower than traditional hydrocarbon fuels, necessitating larger storage volumes for equivalent energy content. This creates design challenges for vehicles and vessels attempting to incorporate ammonia fuel systems without compromising cargo or passenger space. The volumetric efficiency issue becomes particularly pronounced in transportation applications where space optimization is critical.

Combustion efficiency represents another major technical barrier. Direct ammonia combustion exhibits slow flame speeds and narrow flammability limits, resulting in combustion instability and reduced power output in conventional engines. Current solutions often involve dual-fuel approaches or catalytic decomposition to hydrogen before combustion, adding complexity and cost to engine systems.

Safety concerns constitute perhaps the most significant implementation challenge. Ammonia's toxicity requires robust detection systems, specialized handling protocols, and comprehensive safety training. The development of failsafe systems that can prevent or mitigate accidental releases remains technically challenging, particularly in consumer-facing applications where operator expertise cannot be guaranteed.

Catalyst development for efficient ammonia cracking (decomposition to hydrogen) at lower temperatures represents an ongoing research challenge. Current catalysts require high temperatures, reducing overall system efficiency and increasing complexity. Similarly, direct ammonia fuel cells show promise but face limitations in power density and durability compared to hydrogen fuel cells.

NOx emissions during ammonia combustion present a regulatory compliance challenge. While ammonia itself contains no carbon, its nitrogen content can lead to NOx formation during combustion, potentially offsetting some environmental benefits. Advanced combustion control systems and post-treatment technologies are under development but have not reached commercial maturity.

The integration of ammonia fuel systems with existing power generation and propulsion technologies requires significant engineering adaptations. Material compatibility issues, control system modifications, and performance optimization across varying operational conditions all present substantial technical hurdles that must be overcome before widespread adoption becomes feasible.

Ammonia's energy density, while superior to hydrogen, remains lower than traditional hydrocarbon fuels, necessitating larger storage volumes for equivalent energy content. This creates design challenges for vehicles and vessels attempting to incorporate ammonia fuel systems without compromising cargo or passenger space. The volumetric efficiency issue becomes particularly pronounced in transportation applications where space optimization is critical.

Combustion efficiency represents another major technical barrier. Direct ammonia combustion exhibits slow flame speeds and narrow flammability limits, resulting in combustion instability and reduced power output in conventional engines. Current solutions often involve dual-fuel approaches or catalytic decomposition to hydrogen before combustion, adding complexity and cost to engine systems.

Safety concerns constitute perhaps the most significant implementation challenge. Ammonia's toxicity requires robust detection systems, specialized handling protocols, and comprehensive safety training. The development of failsafe systems that can prevent or mitigate accidental releases remains technically challenging, particularly in consumer-facing applications where operator expertise cannot be guaranteed.

Catalyst development for efficient ammonia cracking (decomposition to hydrogen) at lower temperatures represents an ongoing research challenge. Current catalysts require high temperatures, reducing overall system efficiency and increasing complexity. Similarly, direct ammonia fuel cells show promise but face limitations in power density and durability compared to hydrogen fuel cells.

NOx emissions during ammonia combustion present a regulatory compliance challenge. While ammonia itself contains no carbon, its nitrogen content can lead to NOx formation during combustion, potentially offsetting some environmental benefits. Advanced combustion control systems and post-treatment technologies are under development but have not reached commercial maturity.

The integration of ammonia fuel systems with existing power generation and propulsion technologies requires significant engineering adaptations. Material compatibility issues, control system modifications, and performance optimization across varying operational conditions all present substantial technical hurdles that must be overcome before widespread adoption becomes feasible.

Current Ammonia Fuel Production and Utilization Solutions

01 Emission regulations and compliance for ammonia fuel

Regulatory frameworks governing emissions from ammonia fuel systems focus on reducing harmful pollutants like NOx. These regulations impact the design and implementation of ammonia combustion systems, requiring specific emission control technologies. Compliance with these regulations involves monitoring systems, catalytic reduction methods, and reporting mechanisms to ensure ammonia fuel usage meets environmental standards across different jurisdictions.- Emission regulations and compliance for ammonia fuel systems: Regulatory frameworks governing ammonia as a fuel focus on emission standards and compliance mechanisms. These regulations address the potential environmental impacts of ammonia combustion, including NOx emissions and ammonia slip. Technologies and systems are being developed to ensure ammonia fuel systems meet increasingly stringent emission standards across different jurisdictions, with particular attention to monitoring and control systems that can demonstrate regulatory compliance.

- Safety regulations for ammonia fuel storage and handling: Safety regulations specifically address the unique hazards associated with ammonia as a fuel, including its toxicity and potential for leakage. These regulations cover storage requirements, handling protocols, and safety systems necessary for ammonia fuel infrastructure. Standards for containment systems, detection equipment, and emergency response procedures are being developed to mitigate risks while enabling the practical use of ammonia as an alternative fuel in various applications.

- Maritime regulations for ammonia as marine fuel: The maritime sector faces specific regulatory challenges when adopting ammonia as a fuel for vessels. International Maritime Organization (IMO) regulations and regional shipping authorities are developing frameworks for ammonia-fueled ships, addressing bunkering procedures, crew training requirements, and emission control areas. These regulations aim to balance the potential of ammonia to reduce carbon emissions from shipping while ensuring safe operation in the marine environment.

- Infrastructure and certification regulations: Regulatory frameworks are emerging to govern the infrastructure required for ammonia fuel adoption, including production facilities, distribution networks, and fueling stations. These regulations establish certification processes for equipment, facilities, and personnel involved in the ammonia fuel value chain. Standards for material compatibility, equipment specifications, and operational procedures are being developed to ensure consistent safety and performance across the ammonia fuel ecosystem.

- Carbon reduction incentives and regulatory support: Governments are implementing regulatory incentives to promote ammonia as a low-carbon fuel alternative. These include carbon pricing mechanisms, subsidies for ammonia fuel technologies, and regulatory pathways that recognize ammonia's potential contribution to decarbonization goals. Policy frameworks are being developed to support the transition to ammonia fuel through research funding, demonstration projects, and market-based instruments that improve the economic competitiveness of ammonia against conventional fuels.

02 Safety regulations for ammonia fuel storage and handling

Safety regulations for ammonia as a fuel address its toxic and corrosive properties, mandating specific storage container designs, pressure relief systems, and leak detection mechanisms. These regulations impact infrastructure development by requiring specialized materials resistant to ammonia corrosion, proper ventilation systems, and emergency response protocols. Compliance necessitates regular inspection regimes and certification of storage facilities to prevent hazardous incidents.Expand Specific Solutions03 Transportation and distribution regulatory framework

Regulations governing the transportation of ammonia fuel cover pipeline standards, vehicle requirements, and shipping protocols. These frameworks impact infrastructure development by specifying material compatibility, pressure ratings, and safety systems for ammonia transport. Cross-border transportation faces varying regulatory requirements, necessitating harmonization efforts and specialized training for personnel handling ammonia during distribution phases.Expand Specific Solutions04 Production standards and certification requirements

Regulatory frameworks for ammonia fuel production establish purity standards, production process requirements, and certification protocols. These regulations impact manufacturing facilities by mandating specific equipment specifications, quality control measures, and documentation procedures. Green ammonia production faces additional regulatory considerations regarding renewable energy sourcing, carbon intensity metrics, and sustainability certification to qualify for incentives or market access.Expand Specific Solutions05 Market incentives and policy support mechanisms

Regulatory frameworks include various incentive structures to promote ammonia fuel adoption, such as tax credits, subsidies, and carbon pricing mechanisms. These policies impact market development by influencing investment decisions, technology deployment timelines, and competitive positioning against conventional fuels. Regional variations in support mechanisms create different market conditions across jurisdictions, affecting global ammonia fuel supply chains and technology transfer.Expand Specific Solutions

Key Industry Players in Ammonia Fuel Ecosystem

The ammonia fuel market is evolving rapidly as regulatory changes reshape the competitive landscape. Currently in an early growth phase, the market is experiencing increasing momentum due to decarbonization policies, with projections indicating substantial expansion in the coming decade. Key players represent diverse sectors: energy giants like TotalEnergies and Toyota are investing in infrastructure; specialized chemical companies such as Haldor Topsøe and Ammonia Casale are advancing production technologies; while research institutions including Tianjin University and University of Strathclyde are driving innovation. Equipment manufacturers like IHI Corp. and Samsung Heavy Industries are developing ammonia-compatible systems. The technology remains in development with varying maturity levels across the value chain, with companies like NuScale Power exploring nuclear-powered ammonia production and Pani Clean focusing on green ammonia solutions.

Haldor Topsøe A/S

Technical Solution: Haldor Topsøe has developed comprehensive ammonia synthesis technologies that are being adapted for green ammonia production using renewable energy sources. Their SynCOR Ammonia™ process represents a significant advancement in ammonia production efficiency, achieving up to 15% lower energy consumption compared to conventional methods. The company has invested heavily in developing catalysts specifically optimized for ammonia synthesis from green hydrogen, addressing a critical component of the ammonia fuel value chain. Their technology roadmap includes solutions for both centralized large-scale production facilities and distributed smaller-scale units that can be deployed closer to renewable energy sources. Haldor Topsøe has also established partnerships with energy companies to develop integrated solutions that address the full lifecycle emissions of ammonia as a fuel, positioning themselves to adapt quickly to evolving regulatory frameworks across different markets.

Strengths: Industry-leading expertise in catalysis technology specifically for ammonia production; established commercial-scale solutions that can be rapidly deployed; strong R&D capabilities for continuous improvement of ammonia synthesis efficiency. Weaknesses: Higher capital costs compared to conventional ammonia production methods; technology still requires significant renewable electricity input, making it vulnerable to renewable energy policy changes.

Toyota Motor Corp.

Technical Solution: Toyota has developed a comprehensive strategy for ammonia as an alternative fuel, particularly focusing on maritime applications and power generation. Their approach includes direct ammonia combustion technologies for internal combustion engines, with modifications to address NOx emissions that are typically 30-40% higher than conventional fuels without proper controls. Toyota has invested in ammonia fuel cell technology that can directly utilize ammonia without first converting it to hydrogen, potentially improving overall system efficiency by 15-20%. The company has established partnerships with shipping industry stakeholders to develop ammonia-powered vessels that comply with International Maritime Organization (IMO) regulations, including the 2050 decarbonization targets. Toyota's research extends to ammonia co-firing in gas turbines, achieving up to 70% ammonia substitution rates while maintaining operational stability. Their regulatory engagement strategy includes active participation in standards development for ammonia fuel handling, storage, and utilization across multiple jurisdictions.

Strengths: Extensive experience in alternative fuel systems integration; global presence allows for adaptation to various regulatory environments; strong financial resources to support long-term technology development. Weaknesses: Core business remains in traditional automotive sector, potentially limiting full commitment to ammonia technologies; competing internal priorities with hydrogen and battery electric technologies.

Critical Patents and Innovations in Ammonia Fuel Technology

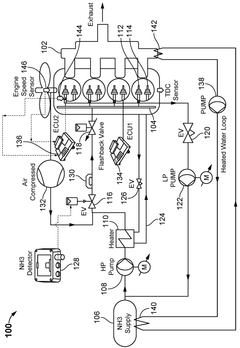

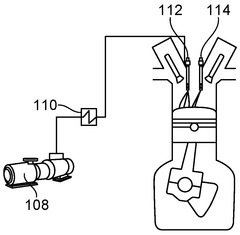

System and method for supplying ammonia to a diesel engine

PatentWO2025119942A1

Innovation

- A system and method for supplying ammonia directly into the engine cylinders of a diesel engine, utilizing a first fluid circuit with an ammonia source, high-pressure pump, and heater to maintain ammonia in the liquid phase, along with a fuel rail system featuring ammonia and diesel injectors, and engine control units to manage injection parameters.

Regulatory Framework Impact Assessment on Ammonia Fuel Adoption

Regulatory frameworks significantly influence the trajectory of ammonia fuel adoption across global markets. Current regulations governing ammonia primarily focus on its traditional applications as a fertilizer and industrial chemical, with limited provisions specifically addressing its use as an energy carrier. This regulatory gap creates uncertainty for stakeholders considering investments in ammonia fuel infrastructure and technology development.

The International Maritime Organization's (IMO) ambitious targets to reduce greenhouse gas emissions from shipping by at least 50% by 2050 have positioned ammonia as a promising alternative marine fuel. However, the absence of standardized safety protocols and operational guidelines specifically for ammonia as a fuel creates significant barriers to widespread adoption in the maritime sector.

National and regional variations in regulatory approaches further complicate the ammonia fuel landscape. The European Union's Green Deal and associated hydrogen strategy implicitly support ammonia as a hydrogen carrier, while Japan has explicitly included ammonia in its strategic energy roadmap. In contrast, regulatory frameworks in developing economies often lack provisions for alternative fuels entirely, creating an uneven global playing field.

Safety regulations represent a critical component of the regulatory framework affecting ammonia fuel adoption. The toxic nature of ammonia necessitates stringent handling protocols, which vary considerably across jurisdictions. This regulatory fragmentation increases compliance costs for multinational operators and slows technology transfer between regions.

Carbon pricing mechanisms and emissions trading schemes also significantly impact the economic viability of ammonia as a fuel. In regions with robust carbon pricing, ammonia produced from renewable energy sources ("green ammonia") gains competitive advantage over conventional fuels. However, the absence of globally harmonized carbon pricing creates market distortions and investment uncertainty.

Regulatory stability and predictability emerge as key factors influencing investment decisions in ammonia fuel infrastructure. The long-term nature of such investments requires confidence in the regulatory landscape over decades, yet many jurisdictions lack clear policy roadmaps for alternative fuel adoption. This regulatory uncertainty increases perceived investment risk and potentially delays market development.

Addressing these regulatory challenges requires coordinated international efforts to develop harmonized standards, safety protocols, and incentive structures specifically tailored to ammonia's role as an energy carrier. The effectiveness of such regulatory frameworks will significantly determine the pace and scale of ammonia fuel adoption across global markets.

The International Maritime Organization's (IMO) ambitious targets to reduce greenhouse gas emissions from shipping by at least 50% by 2050 have positioned ammonia as a promising alternative marine fuel. However, the absence of standardized safety protocols and operational guidelines specifically for ammonia as a fuel creates significant barriers to widespread adoption in the maritime sector.

National and regional variations in regulatory approaches further complicate the ammonia fuel landscape. The European Union's Green Deal and associated hydrogen strategy implicitly support ammonia as a hydrogen carrier, while Japan has explicitly included ammonia in its strategic energy roadmap. In contrast, regulatory frameworks in developing economies often lack provisions for alternative fuels entirely, creating an uneven global playing field.

Safety regulations represent a critical component of the regulatory framework affecting ammonia fuel adoption. The toxic nature of ammonia necessitates stringent handling protocols, which vary considerably across jurisdictions. This regulatory fragmentation increases compliance costs for multinational operators and slows technology transfer between regions.

Carbon pricing mechanisms and emissions trading schemes also significantly impact the economic viability of ammonia as a fuel. In regions with robust carbon pricing, ammonia produced from renewable energy sources ("green ammonia") gains competitive advantage over conventional fuels. However, the absence of globally harmonized carbon pricing creates market distortions and investment uncertainty.

Regulatory stability and predictability emerge as key factors influencing investment decisions in ammonia fuel infrastructure. The long-term nature of such investments requires confidence in the regulatory landscape over decades, yet many jurisdictions lack clear policy roadmaps for alternative fuel adoption. This regulatory uncertainty increases perceived investment risk and potentially delays market development.

Addressing these regulatory challenges requires coordinated international efforts to develop harmonized standards, safety protocols, and incentive structures specifically tailored to ammonia's role as an energy carrier. The effectiveness of such regulatory frameworks will significantly determine the pace and scale of ammonia fuel adoption across global markets.

Environmental and Safety Considerations for Ammonia Fuel Markets

The environmental and safety aspects of ammonia as a fuel source present significant challenges that must be addressed through comprehensive regulatory frameworks. Ammonia (NH3) is both toxic and corrosive, posing immediate health risks through inhalation, skin contact, and ingestion. Exposure to high concentrations can cause severe respiratory issues, chemical burns, and in extreme cases, death. These inherent hazards necessitate stringent safety protocols throughout the entire supply chain, from production to end-use applications.

Current regulatory frameworks for ammonia primarily focus on its industrial applications rather than its use as a fuel. As market adoption increases, regulatory bodies worldwide are developing specialized standards addressing the unique challenges of ammonia fuel systems. These include specifications for storage infrastructure, transportation protocols, handling procedures, and emissions monitoring. The International Maritime Organization (IMO) has been particularly active in developing guidelines for ammonia as a marine fuel, recognizing its potential role in decarbonizing the shipping industry.

Environmental considerations extend beyond safety to include ammonia's potential ecological impacts. While ammonia fuel systems produce zero carbon emissions during combustion, nitrogen oxide (NOx) emissions remain a significant concern. Advanced combustion technologies and selective catalytic reduction systems are being developed to mitigate these emissions, but their effectiveness must be validated through rigorous testing before widespread implementation.

Ammonia leakage presents another environmental challenge, as it can lead to water eutrophication and soil acidification. Regulatory frameworks increasingly require leak detection systems, containment measures, and emergency response protocols to minimize environmental damage from accidental releases. The development of standardized risk assessment methodologies specific to ammonia fuel applications is currently underway in several jurisdictions.

Public perception and community acceptance represent additional challenges for ammonia fuel markets. Effective risk communication strategies and transparent safety records will be essential for building public trust. Regulations increasingly mandate community engagement processes and public disclosure requirements for ammonia fuel infrastructure projects, recognizing that social license to operate is as crucial as technical compliance.

Training and certification requirements for personnel working with ammonia fuel systems are becoming more comprehensive. Regulatory bodies are establishing specialized training programs addressing the unique hazards of ammonia as a fuel, ensuring that workers throughout the supply chain possess the necessary skills to handle this substance safely. These programs typically cover emergency response procedures, personal protective equipment usage, and system-specific safety protocols.

Current regulatory frameworks for ammonia primarily focus on its industrial applications rather than its use as a fuel. As market adoption increases, regulatory bodies worldwide are developing specialized standards addressing the unique challenges of ammonia fuel systems. These include specifications for storage infrastructure, transportation protocols, handling procedures, and emissions monitoring. The International Maritime Organization (IMO) has been particularly active in developing guidelines for ammonia as a marine fuel, recognizing its potential role in decarbonizing the shipping industry.

Environmental considerations extend beyond safety to include ammonia's potential ecological impacts. While ammonia fuel systems produce zero carbon emissions during combustion, nitrogen oxide (NOx) emissions remain a significant concern. Advanced combustion technologies and selective catalytic reduction systems are being developed to mitigate these emissions, but their effectiveness must be validated through rigorous testing before widespread implementation.

Ammonia leakage presents another environmental challenge, as it can lead to water eutrophication and soil acidification. Regulatory frameworks increasingly require leak detection systems, containment measures, and emergency response protocols to minimize environmental damage from accidental releases. The development of standardized risk assessment methodologies specific to ammonia fuel applications is currently underway in several jurisdictions.

Public perception and community acceptance represent additional challenges for ammonia fuel markets. Effective risk communication strategies and transparent safety records will be essential for building public trust. Regulations increasingly mandate community engagement processes and public disclosure requirements for ammonia fuel infrastructure projects, recognizing that social license to operate is as crucial as technical compliance.

Training and certification requirements for personnel working with ammonia fuel systems are becoming more comprehensive. Regulatory bodies are establishing specialized training programs addressing the unique hazards of ammonia as a fuel, ensuring that workers throughout the supply chain possess the necessary skills to handle this substance safely. These programs typically cover emergency response procedures, personal protective equipment usage, and system-specific safety protocols.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!