CO₂ Capture Sorbent Contributions to Carbon Neutrality Goals

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

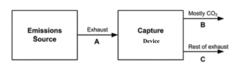

CO₂ Capture Technology Background and Neutrality Objectives

Carbon dioxide capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in various industrial settings. The development trajectory began in the 1970s with basic absorption techniques and has since expanded to include advanced sorbent materials, membrane technologies, and innovative capture processes. This evolution has been driven by increasing global awareness of climate change impacts and the urgent need to reduce greenhouse gas emissions.

The current technological landscape for CO₂ capture encompasses several methodologies, including post-combustion capture, pre-combustion capture, and oxy-fuel combustion. Among these, sorbent-based capture systems have emerged as particularly promising due to their potential for energy efficiency, cost-effectiveness, and adaptability across different industrial applications.

Recent advancements in material science have accelerated the development of novel sorbents with enhanced CO₂ selectivity, capacity, and regeneration characteristics. These include metal-organic frameworks (MOFs), zeolites, activated carbons, and amine-functionalized materials, each offering unique advantages for specific capture scenarios. The integration of these materials into existing industrial processes represents a critical pathway toward achieving meaningful carbon emission reductions.

The global commitment to carbon neutrality, formalized through agreements such as the Paris Climate Accord, has established ambitious targets for greenhouse gas reduction. Many nations have pledged to achieve net-zero emissions by mid-century, creating an urgent timeline for the deployment of effective carbon capture technologies. Within this context, CO₂ capture sorbents play a pivotal role in the broader strategy of carbon management.

The technical objectives for sorbent development focus on several key parameters: increasing CO₂ selectivity in mixed gas streams, enhancing adsorption capacity under realistic operating conditions, improving regeneration efficiency to reduce energy penalties, extending operational lifespan to minimize replacement costs, and ensuring compatibility with existing industrial infrastructure. These objectives are guided by the overarching goal of developing economically viable solutions that can be deployed at scale.

The trajectory of sorbent technology is increasingly aligned with circular economy principles, where captured carbon is viewed not merely as waste to be sequestered but as a potential feedstock for various industrial processes. This perspective is driving research toward capture systems that facilitate the conversion of CO₂ into valuable products, thereby creating economic incentives for widespread adoption of carbon capture technologies.

The current technological landscape for CO₂ capture encompasses several methodologies, including post-combustion capture, pre-combustion capture, and oxy-fuel combustion. Among these, sorbent-based capture systems have emerged as particularly promising due to their potential for energy efficiency, cost-effectiveness, and adaptability across different industrial applications.

Recent advancements in material science have accelerated the development of novel sorbents with enhanced CO₂ selectivity, capacity, and regeneration characteristics. These include metal-organic frameworks (MOFs), zeolites, activated carbons, and amine-functionalized materials, each offering unique advantages for specific capture scenarios. The integration of these materials into existing industrial processes represents a critical pathway toward achieving meaningful carbon emission reductions.

The global commitment to carbon neutrality, formalized through agreements such as the Paris Climate Accord, has established ambitious targets for greenhouse gas reduction. Many nations have pledged to achieve net-zero emissions by mid-century, creating an urgent timeline for the deployment of effective carbon capture technologies. Within this context, CO₂ capture sorbents play a pivotal role in the broader strategy of carbon management.

The technical objectives for sorbent development focus on several key parameters: increasing CO₂ selectivity in mixed gas streams, enhancing adsorption capacity under realistic operating conditions, improving regeneration efficiency to reduce energy penalties, extending operational lifespan to minimize replacement costs, and ensuring compatibility with existing industrial infrastructure. These objectives are guided by the overarching goal of developing economically viable solutions that can be deployed at scale.

The trajectory of sorbent technology is increasingly aligned with circular economy principles, where captured carbon is viewed not merely as waste to be sequestered but as a potential feedstock for various industrial processes. This perspective is driving research toward capture systems that facilitate the conversion of CO₂ into valuable products, thereby creating economic incentives for widespread adoption of carbon capture technologies.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing governmental commitments to carbon neutrality targets and the urgent need to address climate change. As of 2023, the market was valued at approximately $2.9 billion, with projections indicating a compound annual growth rate (CAGR) of 19.2% through 2030, potentially reaching $8.6 billion by the end of the decade. This remarkable growth trajectory is primarily fueled by stringent carbon emission regulations across major economies and substantial investments in carbon capture technologies.

North America currently dominates the market share, accounting for roughly 40% of global carbon capture deployments, followed by Europe at 30% and Asia-Pacific at 20%. The remaining 10% is distributed across other regions. This regional distribution reflects varying levels of policy support, technological readiness, and industrial concentration across different geographies.

The market segmentation reveals distinct categories based on technology types. Physical sorbents, including activated carbon and zeolites, hold approximately 35% of the market. Chemical sorbents, particularly amine-based solutions, represent about 30%. Membrane-based technologies account for 20%, while emerging technologies such as metal-organic frameworks (MOFs) and direct air capture solutions comprise the remaining 15%.

From an end-user perspective, the power generation sector represents the largest market segment at 45%, followed by oil and gas operations at 25%, cement manufacturing at 15%, and other industrial applications at 15%. This distribution highlights the critical role of carbon capture technologies in decarbonizing energy-intensive industries that are essential to global economic activity.

Key market drivers include increasingly ambitious national carbon reduction targets, with over 70 countries now committed to net-zero emissions by mid-century. Carbon pricing mechanisms, implemented in various forms across more than 40 countries, are creating economic incentives for carbon capture adoption. Additionally, corporate sustainability commitments are driving private sector investment, with over 300 major corporations pledging carbon neutrality by 2050.

Market barriers remain significant, however. The high capital expenditure required for carbon capture installations—typically ranging from $40-$120 per ton of CO₂ captured—presents a substantial financial hurdle. Technological limitations in capture efficiency and energy requirements continue to constrain widespread adoption. Furthermore, the underdeveloped infrastructure for CO₂ transportation and storage creates logistical challenges for scaling carbon capture solutions.

North America currently dominates the market share, accounting for roughly 40% of global carbon capture deployments, followed by Europe at 30% and Asia-Pacific at 20%. The remaining 10% is distributed across other regions. This regional distribution reflects varying levels of policy support, technological readiness, and industrial concentration across different geographies.

The market segmentation reveals distinct categories based on technology types. Physical sorbents, including activated carbon and zeolites, hold approximately 35% of the market. Chemical sorbents, particularly amine-based solutions, represent about 30%. Membrane-based technologies account for 20%, while emerging technologies such as metal-organic frameworks (MOFs) and direct air capture solutions comprise the remaining 15%.

From an end-user perspective, the power generation sector represents the largest market segment at 45%, followed by oil and gas operations at 25%, cement manufacturing at 15%, and other industrial applications at 15%. This distribution highlights the critical role of carbon capture technologies in decarbonizing energy-intensive industries that are essential to global economic activity.

Key market drivers include increasingly ambitious national carbon reduction targets, with over 70 countries now committed to net-zero emissions by mid-century. Carbon pricing mechanisms, implemented in various forms across more than 40 countries, are creating economic incentives for carbon capture adoption. Additionally, corporate sustainability commitments are driving private sector investment, with over 300 major corporations pledging carbon neutrality by 2050.

Market barriers remain significant, however. The high capital expenditure required for carbon capture installations—typically ranging from $40-$120 per ton of CO₂ captured—presents a substantial financial hurdle. Technological limitations in capture efficiency and energy requirements continue to constrain widespread adoption. Furthermore, the underdeveloped infrastructure for CO₂ transportation and storage creates logistical challenges for scaling carbon capture solutions.

Global Status and Technical Challenges in CO₂ Sorbent Development

The global landscape of CO₂ sorbent development has witnessed significant advancements in recent years, driven by the urgent need to address climate change. Currently, several countries lead this technological frontier, with the United States, European Union, China, and Japan demonstrating substantial research output and patent filings. Research institutions and industrial players in these regions have established robust ecosystems for sorbent development, creating centers of excellence that combine fundamental research with application-oriented development.

Despite these advancements, the field faces considerable technical challenges. One primary obstacle is the development of sorbents with simultaneously high CO₂ selectivity, capacity, and stability under real-world conditions. Most existing materials exhibit a trade-off between these properties, limiting their practical application. For instance, while amine-functionalized materials show excellent selectivity, they often suffer from degradation during regeneration cycles, reducing their operational lifespan.

Energy requirements for sorbent regeneration represent another significant hurdle. Current technologies typically demand substantial energy inputs for the desorption phase, which can offset the environmental benefits of carbon capture. Research indicates that regeneration energy accounts for approximately 70-80% of the total operational costs in most capture systems, highlighting the economic implications of this technical challenge.

Scalability issues further complicate widespread implementation. Laboratory-scale successes often encounter difficulties when transitioning to industrial applications due to mass transfer limitations, pressure drop concerns, and mechanical stability under continuous operation. The gap between theoretical performance and practical application remains substantial, with many promising materials failing to maintain their efficiency at scale.

Water vapor interference presents an additional challenge, as most flue gas streams contain significant moisture that can compete with CO₂ for adsorption sites. This competition can reduce capture efficiency by 20-40% under humid conditions, necessitating either moisture-resistant sorbents or additional process steps for water management.

Geographically, technical approaches show regional variations. North American research emphasizes innovative materials like metal-organic frameworks (MOFs) and porous polymers, while European efforts focus more on process integration and system optimization. Asian research, particularly in China, demonstrates strength in low-cost, scalable solutions suitable for retrofit applications in existing power plants.

The economic viability of sorbent technologies remains a critical concern, with current cost estimates for CO₂ capture ranging from $40-100 per ton, significantly higher than the target of $20-30 per ton considered necessary for widespread adoption. This economic barrier, coupled with the technical challenges, underscores the need for continued innovation and international collaboration in sorbent development.

Despite these advancements, the field faces considerable technical challenges. One primary obstacle is the development of sorbents with simultaneously high CO₂ selectivity, capacity, and stability under real-world conditions. Most existing materials exhibit a trade-off between these properties, limiting their practical application. For instance, while amine-functionalized materials show excellent selectivity, they often suffer from degradation during regeneration cycles, reducing their operational lifespan.

Energy requirements for sorbent regeneration represent another significant hurdle. Current technologies typically demand substantial energy inputs for the desorption phase, which can offset the environmental benefits of carbon capture. Research indicates that regeneration energy accounts for approximately 70-80% of the total operational costs in most capture systems, highlighting the economic implications of this technical challenge.

Scalability issues further complicate widespread implementation. Laboratory-scale successes often encounter difficulties when transitioning to industrial applications due to mass transfer limitations, pressure drop concerns, and mechanical stability under continuous operation. The gap between theoretical performance and practical application remains substantial, with many promising materials failing to maintain their efficiency at scale.

Water vapor interference presents an additional challenge, as most flue gas streams contain significant moisture that can compete with CO₂ for adsorption sites. This competition can reduce capture efficiency by 20-40% under humid conditions, necessitating either moisture-resistant sorbents or additional process steps for water management.

Geographically, technical approaches show regional variations. North American research emphasizes innovative materials like metal-organic frameworks (MOFs) and porous polymers, while European efforts focus more on process integration and system optimization. Asian research, particularly in China, demonstrates strength in low-cost, scalable solutions suitable for retrofit applications in existing power plants.

The economic viability of sorbent technologies remains a critical concern, with current cost estimates for CO₂ capture ranging from $40-100 per ton, significantly higher than the target of $20-30 per ton considered necessary for widespread adoption. This economic barrier, coupled with the technical challenges, underscores the need for continued innovation and international collaboration in sorbent development.

Current Sorbent Materials and Capture Methodologies

01 Metal-organic frameworks (MOFs) for CO₂ capture

Metal-organic frameworks are advanced porous materials with high surface area and tunable pore structures that can effectively capture CO₂ from various gas streams. These materials can be designed with specific metal centers and organic linkers to enhance CO₂ selectivity and adsorption capacity. MOFs can operate under different conditions and can be regenerated with minimal energy input, making them promising candidates for carbon neutrality applications.- Metal-organic frameworks (MOFs) for CO₂ capture: Metal-organic frameworks are advanced porous materials with high surface area and tunable pore structures that can effectively capture CO₂ from various gas streams. These materials can be designed with specific metal centers and organic linkers to enhance CO₂ selectivity and adsorption capacity. MOFs can operate under different conditions and can be regenerated with minimal energy input, making them promising candidates for carbon neutrality applications.

- Amine-functionalized sorbents for CO₂ capture: Amine-functionalized materials represent a significant class of CO₂ capture sorbents that operate through chemical adsorption mechanisms. These materials incorporate various amine groups onto support structures like silica, polymers, or porous carbons to create strong binding sites for CO₂. The amine functionality enables high selectivity even at low CO₂ concentrations, making these sorbents suitable for direct air capture applications that contribute to carbon neutrality goals.

- Zeolite-based CO₂ capture systems: Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can be utilized for CO₂ capture. These materials offer advantages such as high thermal stability, resistance to contaminants, and tunable adsorption properties. Modified zeolites with specific cation exchanges can enhance CO₂ selectivity and capacity. Zeolite-based systems can be integrated into carbon capture processes to help achieve carbon neutrality in industrial applications.

- Carbon-based sorbents for CO₂ sequestration: Carbon-based materials, including activated carbons, carbon nanotubes, and graphene derivatives, serve as effective CO₂ capture sorbents. These materials can be produced from renewable or waste resources, contributing to circular economy principles. Their high surface area, tunable pore structure, and surface chemistry can be optimized for CO₂ adsorption. Carbon-based sorbents offer advantages in terms of cost, stability, and regeneration efficiency for carbon neutrality applications.

- Integrated CO₂ capture systems for carbon neutrality: Integrated systems combine multiple technologies and processes to achieve efficient CO₂ capture as part of carbon neutrality strategies. These systems may incorporate temperature swing adsorption, pressure swing adsorption, or hybrid approaches with various sorbent materials. Integration with renewable energy sources for sorbent regeneration and coupling with CO₂ utilization technologies creates comprehensive carbon management solutions. Such integrated approaches maximize efficiency and minimize the overall carbon footprint of capture operations.

02 Amine-functionalized sorbents for enhanced CO₂ adsorption

Amine-functionalized materials represent a significant advancement in CO₂ capture technology. These sorbents contain nitrogen-based functional groups that chemically bind with CO₂ molecules, resulting in higher capture efficiency even at low CO₂ concentrations. The amine groups can be incorporated into various support materials such as silica, polymers, or porous carbon to create effective carbon capture systems that contribute to carbon neutrality goals.Expand Specific Solutions03 Regenerable solid sorbents for carbon capture systems

Regenerable solid sorbents offer a sustainable approach to CO₂ capture by allowing multiple adsorption-desorption cycles without significant loss of capacity. These materials can be designed to release captured CO₂ under specific conditions such as temperature or pressure swing, enabling efficient sorbent reuse. The regeneration process typically requires less energy compared to liquid absorption methods, making these sorbents economically viable for large-scale carbon neutrality applications.Expand Specific Solutions04 Biomass-derived carbon sorbents for sustainable CO₂ capture

Carbon sorbents derived from biomass sources provide an environmentally friendly approach to CO₂ capture. These materials are produced from renewable resources such as agricultural waste, wood, or algae through processes like pyrolysis or activation. The resulting porous carbon materials can be further modified to enhance their CO₂ adsorption properties. Biomass-derived sorbents contribute to carbon neutrality by both capturing CO₂ and utilizing sustainable raw materials in their production.Expand Specific Solutions05 Integrated systems for CO₂ capture and utilization

Integrated systems combine CO₂ capture with utilization pathways to achieve carbon neutrality. These systems capture CO₂ using specialized sorbents and then convert the captured CO₂ into valuable products such as fuels, chemicals, or building materials. By closing the carbon loop, these integrated approaches not only reduce atmospheric CO₂ but also create economic value from what would otherwise be considered a waste product. Such systems often incorporate novel catalysts and process designs to maximize efficiency and minimize energy requirements.Expand Specific Solutions

Leading Companies and Research Institutions in CO₂ Capture

The CO₂ capture sorbent market is in a growth phase, driven by increasing carbon neutrality commitments worldwide. The market is projected to expand significantly as governments and industries invest in decarbonization technologies. Currently, the competitive landscape features established energy giants (ExxonMobil, Sinopec, BASF) alongside specialized players like Climeworks AG, which has pioneered direct air capture technology with commercial installations. Academic-industry partnerships are accelerating innovation, with institutions like MIT, University of Nottingham, and China Petroleum University collaborating with corporations. Technology maturity varies across capture methods, with post-combustion approaches being more developed than direct air capture solutions. Regional innovation hubs are emerging in Europe, North America, and East Asia, with Korean entities (KEPCO and affiliates) making notable advancements in integration with power generation infrastructure.

Climeworks AG

Technical Solution: Climeworks has developed a Direct Air Capture (DAC) technology that uses solid sorbent materials to capture CO₂ directly from ambient air. Their modular collectors draw air through a filter where proprietary amine-functionalized sorbents selectively bind with CO₂ molecules. Once saturated, the collectors are heated to approximately 100°C using low-grade waste heat, releasing concentrated CO₂ that can be permanently stored underground through mineralization in basaltic rock formations or utilized in various applications. Climeworks operates the world's largest DAC plant, "Orca" in Iceland, with a capacity to remove 4,000 tons of CO₂ annually, and is developing "Mammoth," which will scale to 36,000 tons per year[1][2]. Their technology achieves capture costs currently estimated at $600-800 per ton, with projections to reduce this to $100-200 per ton by 2030 through economies of scale and technological improvements.

Strengths: Modular, scalable design allows for flexible deployment; integration with geothermal energy in Iceland provides renewable energy source for operation; permanent storage solution through mineralization offers verified carbon removal. Weaknesses: Current high cost per ton of CO₂ captured compared to point-source capture; significant energy requirements for the thermal swing regeneration process; limited total capture capacity compared to global emissions.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced amine-based solvent systems for CO₂ capture from flue gases at industrial facilities and power plants. Their technology employs modified MEA (monoethanolamine) and MDEA (methyldiethanolamine) solvents with proprietary additives that reduce energy consumption during the regeneration process by approximately 15-20% compared to conventional amine systems[3]. Sinopec has implemented large-scale carbon capture facilities at several of their refineries and petrochemical plants, including the Sinopec Qilu Petrochemical CCS project, which captures over 1 million tons of CO₂ annually for enhanced oil recovery applications. The company has also pioneered integrated CCUS (Carbon Capture, Utilization and Storage) systems that combine capture technology with CO₂ transportation infrastructure and utilization pathways, particularly for EOR operations in mature oil fields. Their research focuses on developing more stable sorbents with higher CO₂ loading capacity and faster kinetics to further reduce operational costs[4][5].

Strengths: Extensive industrial implementation experience; integration with existing oil and gas infrastructure; proven technology at commercial scale with significant capture volumes. Weaknesses: Still primarily focused on point-source capture rather than direct air capture; technology remains energy-intensive despite improvements; utilization for enhanced oil recovery may offset some climate benefits by enabling additional fossil fuel production.

Key Patents and Innovations in CO₂ Capture Sorbents

Sorbents for carbon dioxide capture

PatentActiveUS20140286844A1

Innovation

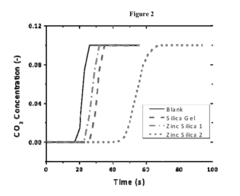

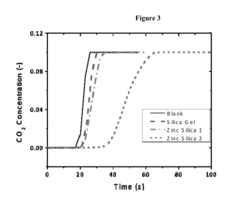

- A mesoporous structure with functionalizing moieties, including zinc atoms or amines, is used for CO2 sorption, employing chemisorption and physisorption mechanisms to enhance CO2 capture selectivity and capacity, while maintaining low diffusional resistance and energy efficiency.

Direct capture of co2 from air and point sources

PatentPendingUS20240058743A1

Innovation

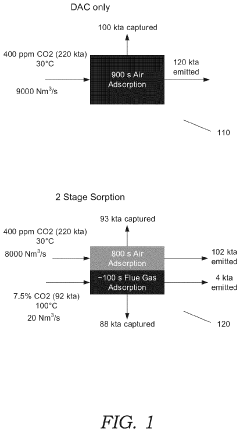

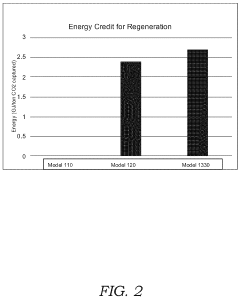

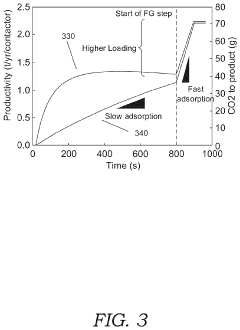

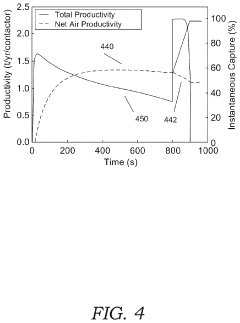

- A two-step sorption process where air is first captured at ambient conditions, followed by exposure to a CO2-rich flue gas stream for additional sorption, allowing for increased CO2 loading without prior heating and minimizing sorbent degradation, using amine sorbents and managing temperature and oxygen levels.

Economic Viability and Cost Reduction Strategies

The economic viability of CO₂ capture sorbent technologies remains a critical factor in their widespread adoption and contribution to carbon neutrality goals. Current cost estimates for carbon capture using advanced sorbents range from $40-100 per ton of CO₂, significantly higher than the carbon pricing in many markets. This cost gap represents one of the primary barriers to commercial deployment at scale.

Material costs constitute a substantial portion of the overall expense, with high-performance sorbents like metal-organic frameworks (MOFs) and amine-functionalized materials requiring specialized production processes. The synthesis of these materials often involves expensive precursors and energy-intensive manufacturing steps, driving up the total cost of ownership for capture systems.

Energy requirements for sorbent regeneration present another major economic challenge. Most physical and chemical sorbents require significant thermal or electrical energy inputs to release captured CO₂, creating operational expenses that can undermine the environmental benefits of the technology. Innovations in low-temperature regeneration processes and waste heat utilization show promise for reducing these operational costs by 15-30%.

Scale-up and manufacturing optimization offer substantial cost reduction potential. Laboratory-scale production methods typically yield sorbent materials at costs 5-10 times higher than what would be economically viable for industrial implementation. Transitioning to continuous flow synthesis, automated production lines, and standardized quality control processes could reduce material costs by up to 60% according to recent industry analyses.

Lifecycle extension strategies represent another avenue for improving economic viability. Current sorbent materials often experience performance degradation after multiple capture-regeneration cycles, necessitating frequent replacement. Research into stabilizing additives, protective coatings, and regeneration protocol optimization has demonstrated potential to extend sorbent lifetimes by 2-3 times, significantly reducing the amortized cost per ton of CO₂ captured.

Policy mechanisms and carbon markets will play a crucial role in bridging the remaining cost gap. Carbon pricing mechanisms, tax incentives for carbon capture technologies, and regulatory frameworks that recognize carbon removal credits can effectively reduce the net cost to operators. Analysis suggests that a carbon price of approximately $50-70 per ton would make many advanced sorbent technologies economically competitive with conventional emission reduction approaches.

Integration with value-added applications for captured CO₂ presents additional economic opportunities. Converting captured carbon into commercial products such as building materials, synthetic fuels, or chemical feedstocks can generate revenue streams that offset capture costs. Recent pilot projects have demonstrated potential revenue recovery of 15-40% through such utilization pathways.

Material costs constitute a substantial portion of the overall expense, with high-performance sorbents like metal-organic frameworks (MOFs) and amine-functionalized materials requiring specialized production processes. The synthesis of these materials often involves expensive precursors and energy-intensive manufacturing steps, driving up the total cost of ownership for capture systems.

Energy requirements for sorbent regeneration present another major economic challenge. Most physical and chemical sorbents require significant thermal or electrical energy inputs to release captured CO₂, creating operational expenses that can undermine the environmental benefits of the technology. Innovations in low-temperature regeneration processes and waste heat utilization show promise for reducing these operational costs by 15-30%.

Scale-up and manufacturing optimization offer substantial cost reduction potential. Laboratory-scale production methods typically yield sorbent materials at costs 5-10 times higher than what would be economically viable for industrial implementation. Transitioning to continuous flow synthesis, automated production lines, and standardized quality control processes could reduce material costs by up to 60% according to recent industry analyses.

Lifecycle extension strategies represent another avenue for improving economic viability. Current sorbent materials often experience performance degradation after multiple capture-regeneration cycles, necessitating frequent replacement. Research into stabilizing additives, protective coatings, and regeneration protocol optimization has demonstrated potential to extend sorbent lifetimes by 2-3 times, significantly reducing the amortized cost per ton of CO₂ captured.

Policy mechanisms and carbon markets will play a crucial role in bridging the remaining cost gap. Carbon pricing mechanisms, tax incentives for carbon capture technologies, and regulatory frameworks that recognize carbon removal credits can effectively reduce the net cost to operators. Analysis suggests that a carbon price of approximately $50-70 per ton would make many advanced sorbent technologies economically competitive with conventional emission reduction approaches.

Integration with value-added applications for captured CO₂ presents additional economic opportunities. Converting captured carbon into commercial products such as building materials, synthetic fuels, or chemical feedstocks can generate revenue streams that offset capture costs. Recent pilot projects have demonstrated potential revenue recovery of 15-40% through such utilization pathways.

Policy Frameworks Supporting Carbon Capture Implementation

The global policy landscape for carbon capture technologies has evolved significantly in recent years, reflecting the growing recognition of their importance in achieving carbon neutrality goals. Leading this evolution is the Paris Agreement, which established a framework for nations to commit to emissions reduction targets, indirectly stimulating investment in carbon capture technologies. Countries have subsequently developed specific policy instruments to accelerate CO₂ capture sorbent development and deployment.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO₂ permanently sequestered. This financial incentive has catalyzed private sector investment in sorbent technologies and carbon capture projects. The Inflation Reduction Act of 2022 further enhanced these incentives, increasing credit values and lowering capture thresholds, making projects more economically viable across various industrial sectors.

The European Union has implemented the Innovation Fund, allocating substantial resources to innovative low-carbon technologies including advanced sorbent development. Additionally, the EU Emissions Trading System (ETS) creates a market-based incentive for carbon capture by establishing a price on carbon emissions. The European Green Deal further strengthens this framework by setting ambitious climate neutrality targets and directing funding toward green technologies.

In Asia, China has incorporated carbon capture into its Five-Year Plans and established regional carbon trading markets, while Japan's Green Innovation Fund allocates significant resources to next-generation carbon capture technologies. These policy frameworks demonstrate regional adaptations to common climate goals, with varying emphasis on regulatory mandates versus market-based incentives.

International collaboration mechanisms such as the Carbon Sequestration Leadership Forum and Mission Innovation provide platforms for knowledge sharing and coordinated research efforts on sorbent technologies. These initiatives help harmonize standards and accelerate technology transfer across borders, particularly beneficial for developing economies seeking to implement carbon capture solutions.

Emerging policy trends include the development of carbon border adjustment mechanisms, which may indirectly incentivize carbon capture technologies by imposing costs on carbon-intensive imports. Additionally, sustainable finance taxonomies increasingly recognize carbon capture as a transition technology, potentially unlocking new funding streams for sorbent research and deployment.

The effectiveness of these policy frameworks ultimately depends on their stability, predictability, and alignment with broader climate and energy policies. Long-term policy certainty is particularly crucial for carbon capture technologies given their capital-intensive nature and extended project development timelines.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO₂ permanently sequestered. This financial incentive has catalyzed private sector investment in sorbent technologies and carbon capture projects. The Inflation Reduction Act of 2022 further enhanced these incentives, increasing credit values and lowering capture thresholds, making projects more economically viable across various industrial sectors.

The European Union has implemented the Innovation Fund, allocating substantial resources to innovative low-carbon technologies including advanced sorbent development. Additionally, the EU Emissions Trading System (ETS) creates a market-based incentive for carbon capture by establishing a price on carbon emissions. The European Green Deal further strengthens this framework by setting ambitious climate neutrality targets and directing funding toward green technologies.

In Asia, China has incorporated carbon capture into its Five-Year Plans and established regional carbon trading markets, while Japan's Green Innovation Fund allocates significant resources to next-generation carbon capture technologies. These policy frameworks demonstrate regional adaptations to common climate goals, with varying emphasis on regulatory mandates versus market-based incentives.

International collaboration mechanisms such as the Carbon Sequestration Leadership Forum and Mission Innovation provide platforms for knowledge sharing and coordinated research efforts on sorbent technologies. These initiatives help harmonize standards and accelerate technology transfer across borders, particularly beneficial for developing economies seeking to implement carbon capture solutions.

Emerging policy trends include the development of carbon border adjustment mechanisms, which may indirectly incentivize carbon capture technologies by imposing costs on carbon-intensive imports. Additionally, sustainable finance taxonomies increasingly recognize carbon capture as a transition technology, potentially unlocking new funding streams for sorbent research and deployment.

The effectiveness of these policy frameworks ultimately depends on their stability, predictability, and alignment with broader climate and energy policies. Long-term policy certainty is particularly crucial for carbon capture technologies given their capital-intensive nature and extended project development timelines.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!