The Interaction of CO₂ Capture Sorbent with Environmental Policies

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO₂ Capture Technology Background and Objectives

Carbon dioxide capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in various industrial settings. The development trajectory began in the 1970s with basic absorption techniques and has since expanded to include multiple approaches such as adsorption, membrane separation, cryogenic separation, and chemical looping. Each evolutionary step has been driven by the increasing global recognition of climate change impacts and the urgent need to reduce greenhouse gas emissions.

The current technological landscape is characterized by a diverse array of CO₂ capture methodologies, broadly categorized into post-combustion, pre-combustion, and oxy-fuel combustion processes. Sorbent-based capture systems have emerged as particularly promising due to their potential for energy efficiency and cost-effectiveness compared to traditional amine scrubbing methods. These sorbents include physical adsorbents like activated carbon and zeolites, as well as chemical sorbents such as metal oxides and hydrotalcites.

Recent technological advancements have focused on enhancing sorbent performance metrics including CO₂ selectivity, adsorption capacity, regeneration energy requirements, and operational stability under various conditions. The development of novel materials such as metal-organic frameworks (MOFs), covalent organic frameworks (COFs), and functionalized porous polymers represents significant progress in addressing previous limitations of traditional sorbents.

Environmental policies have played a crucial role in shaping the trajectory of CO₂ capture technology development. Carbon pricing mechanisms, emissions trading schemes, and regulatory frameworks have created economic incentives for industries to invest in carbon capture solutions. The Paris Agreement's commitment to limiting global warming has further accelerated research and development efforts in this field, with many nations establishing specific carbon reduction targets that directly influence technological priorities.

The primary objectives of current CO₂ capture sorbent research include reducing the energy penalty associated with capture processes, lowering capital and operational costs, improving sorbent durability under industrial conditions, and developing systems that can be effectively integrated with existing infrastructure. Additionally, there is growing emphasis on creating capture technologies that minimize secondary environmental impacts such as water usage, waste generation, and land requirements.

Looking forward, the technological evolution is expected to continue toward more efficient, economical, and environmentally benign capture systems. Emerging research directions include bio-inspired sorbents, hybrid capture systems combining multiple mechanisms, and direct air capture technologies capable of removing CO₂ directly from ambient air. The convergence of advanced materials science, process engineering, and environmental policy will likely determine the pace and direction of future innovations in this critical field.

The current technological landscape is characterized by a diverse array of CO₂ capture methodologies, broadly categorized into post-combustion, pre-combustion, and oxy-fuel combustion processes. Sorbent-based capture systems have emerged as particularly promising due to their potential for energy efficiency and cost-effectiveness compared to traditional amine scrubbing methods. These sorbents include physical adsorbents like activated carbon and zeolites, as well as chemical sorbents such as metal oxides and hydrotalcites.

Recent technological advancements have focused on enhancing sorbent performance metrics including CO₂ selectivity, adsorption capacity, regeneration energy requirements, and operational stability under various conditions. The development of novel materials such as metal-organic frameworks (MOFs), covalent organic frameworks (COFs), and functionalized porous polymers represents significant progress in addressing previous limitations of traditional sorbents.

Environmental policies have played a crucial role in shaping the trajectory of CO₂ capture technology development. Carbon pricing mechanisms, emissions trading schemes, and regulatory frameworks have created economic incentives for industries to invest in carbon capture solutions. The Paris Agreement's commitment to limiting global warming has further accelerated research and development efforts in this field, with many nations establishing specific carbon reduction targets that directly influence technological priorities.

The primary objectives of current CO₂ capture sorbent research include reducing the energy penalty associated with capture processes, lowering capital and operational costs, improving sorbent durability under industrial conditions, and developing systems that can be effectively integrated with existing infrastructure. Additionally, there is growing emphasis on creating capture technologies that minimize secondary environmental impacts such as water usage, waste generation, and land requirements.

Looking forward, the technological evolution is expected to continue toward more efficient, economical, and environmentally benign capture systems. Emerging research directions include bio-inspired sorbents, hybrid capture systems combining multiple mechanisms, and direct air capture technologies capable of removing CO₂ directly from ambient air. The convergence of advanced materials science, process engineering, and environmental policy will likely determine the pace and direction of future innovations in this critical field.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental concerns and stringent regulatory frameworks. Current market valuations indicate the carbon capture, utilization, and storage (CCUS) sector reached approximately $2.5 billion in 2022, with projections suggesting expansion to $7.0 billion by 2030, representing a compound annual growth rate of 13.8%. This growth trajectory is particularly pronounced in regions with established carbon pricing mechanisms, including the European Union, parts of North America, and increasingly in Asia-Pacific markets.

Market segmentation reveals distinct categories within the carbon capture solutions landscape. Post-combustion capture technologies currently dominate with roughly 60% market share, followed by pre-combustion (25%) and oxy-fuel combustion (15%) approaches. Among sorbent technologies, amine-based solutions maintain leadership position with approximately 70% of implementations, while emerging alternatives such as metal-organic frameworks (MOFs) and solid sorbents are gaining traction in specialized applications.

Industry adoption patterns demonstrate significant sectoral variations. Power generation represents the largest application segment (40%), followed by oil and gas operations (30%), cement manufacturing (15%), and other industrial processes (15%). This distribution reflects both the carbon intensity of these sectors and the technical feasibility of implementing capture solutions within existing infrastructure.

Regional market analysis indicates Europe leads in carbon capture implementation, accounting for approximately 35% of global installations, followed by North America (30%), Asia-Pacific (25%), and other regions (10%). This distribution correlates strongly with regulatory stringency and carbon pricing mechanisms rather than purely technological factors.

Customer demand is increasingly driven by compliance requirements rather than voluntary sustainability initiatives. Organizations facing carbon taxes or emissions trading schemes demonstrate 3.5 times higher adoption rates compared to those in unregulated markets. This correlation underscores the critical role of policy frameworks in market development.

Pricing structures for carbon capture solutions remain challenging, with current costs averaging $40-80 per ton of CO₂ captured across most commercial applications. This range exceeds many regional carbon prices, creating an economic barrier to widespread adoption without additional policy support or technological breakthroughs. Market forecasts suggest price points need to decrease to $25-30 per ton to achieve mass market penetration outside of regulatory mandates.

Market segmentation reveals distinct categories within the carbon capture solutions landscape. Post-combustion capture technologies currently dominate with roughly 60% market share, followed by pre-combustion (25%) and oxy-fuel combustion (15%) approaches. Among sorbent technologies, amine-based solutions maintain leadership position with approximately 70% of implementations, while emerging alternatives such as metal-organic frameworks (MOFs) and solid sorbents are gaining traction in specialized applications.

Industry adoption patterns demonstrate significant sectoral variations. Power generation represents the largest application segment (40%), followed by oil and gas operations (30%), cement manufacturing (15%), and other industrial processes (15%). This distribution reflects both the carbon intensity of these sectors and the technical feasibility of implementing capture solutions within existing infrastructure.

Regional market analysis indicates Europe leads in carbon capture implementation, accounting for approximately 35% of global installations, followed by North America (30%), Asia-Pacific (25%), and other regions (10%). This distribution correlates strongly with regulatory stringency and carbon pricing mechanisms rather than purely technological factors.

Customer demand is increasingly driven by compliance requirements rather than voluntary sustainability initiatives. Organizations facing carbon taxes or emissions trading schemes demonstrate 3.5 times higher adoption rates compared to those in unregulated markets. This correlation underscores the critical role of policy frameworks in market development.

Pricing structures for carbon capture solutions remain challenging, with current costs averaging $40-80 per ton of CO₂ captured across most commercial applications. This range exceeds many regional carbon prices, creating an economic barrier to widespread adoption without additional policy support or technological breakthroughs. Market forecasts suggest price points need to decrease to $25-30 per ton to achieve mass market penetration outside of regulatory mandates.

Current Sorbent Technologies and Challenges

Carbon dioxide capture technologies have evolved significantly over the past decades, with various sorbent materials being developed to address the growing concerns of greenhouse gas emissions. Currently, the most widely deployed CO₂ capture technologies include amine-based absorption, solid adsorbents, membrane separation, and cryogenic processes. Among these, amine-based systems represent the most mature technology, with monoethanolamine (MEA) being the industry standard for post-combustion capture in power plants and industrial facilities.

Solid sorbents have gained considerable attention due to their potential for lower energy requirements and reduced environmental impact compared to liquid amine systems. These include activated carbons, zeolites, metal-organic frameworks (MOFs), and amine-functionalized silica materials. Each offers distinct advantages in terms of selectivity, capacity, and regeneration energy, but faces challenges in scaling to industrial applications.

Despite technological advancements, significant challenges persist in CO₂ capture implementation. The energy penalty associated with sorbent regeneration remains a critical barrier, typically accounting for 20-30% of a power plant's energy output when retrofitted with carbon capture systems. This translates to substantial operational costs that hinder widespread adoption without supportive policy frameworks.

Sorbent degradation presents another major challenge, particularly for amine-based systems which suffer from oxidative and thermal degradation, leading to reduced capture efficiency and increased replacement costs. Additionally, the presence of impurities in flue gas streams, such as SOx, NOx, and particulate matter, can poison sorbents and significantly reduce their operational lifespan.

The geographical distribution of sorbent technology development shows concentration in North America, Europe, and increasingly in China and Japan. This distribution largely correlates with regions implementing stringent carbon policies, highlighting the crucial relationship between technological advancement and policy support.

Scale-up challenges represent another significant barrier, as laboratory-proven sorbents often face unforeseen issues when deployed at industrial scale. These include mechanical stability under pressure and temperature cycling, handling of large gas volumes, and integration with existing industrial processes.

Water consumption presents an additional concern, particularly in water-stressed regions, as many capture processes require substantial cooling water. Furthermore, the environmental impact of spent sorbent disposal and potential emissions of degradation products (particularly from amine systems) raise sustainability questions that must be addressed through comprehensive lifecycle assessments.

The economic viability of current sorbent technologies remains heavily dependent on policy incentives, with capture costs ranging from $40-100 per ton of CO₂, significantly above carbon prices in most markets. This cost gap underscores the critical need for policy frameworks that can bridge economic barriers until technological improvements and economies of scale reduce capture costs.

Solid sorbents have gained considerable attention due to their potential for lower energy requirements and reduced environmental impact compared to liquid amine systems. These include activated carbons, zeolites, metal-organic frameworks (MOFs), and amine-functionalized silica materials. Each offers distinct advantages in terms of selectivity, capacity, and regeneration energy, but faces challenges in scaling to industrial applications.

Despite technological advancements, significant challenges persist in CO₂ capture implementation. The energy penalty associated with sorbent regeneration remains a critical barrier, typically accounting for 20-30% of a power plant's energy output when retrofitted with carbon capture systems. This translates to substantial operational costs that hinder widespread adoption without supportive policy frameworks.

Sorbent degradation presents another major challenge, particularly for amine-based systems which suffer from oxidative and thermal degradation, leading to reduced capture efficiency and increased replacement costs. Additionally, the presence of impurities in flue gas streams, such as SOx, NOx, and particulate matter, can poison sorbents and significantly reduce their operational lifespan.

The geographical distribution of sorbent technology development shows concentration in North America, Europe, and increasingly in China and Japan. This distribution largely correlates with regions implementing stringent carbon policies, highlighting the crucial relationship between technological advancement and policy support.

Scale-up challenges represent another significant barrier, as laboratory-proven sorbents often face unforeseen issues when deployed at industrial scale. These include mechanical stability under pressure and temperature cycling, handling of large gas volumes, and integration with existing industrial processes.

Water consumption presents an additional concern, particularly in water-stressed regions, as many capture processes require substantial cooling water. Furthermore, the environmental impact of spent sorbent disposal and potential emissions of degradation products (particularly from amine systems) raise sustainability questions that must be addressed through comprehensive lifecycle assessments.

The economic viability of current sorbent technologies remains heavily dependent on policy incentives, with capture costs ranging from $40-100 per ton of CO₂, significantly above carbon prices in most markets. This cost gap underscores the critical need for policy frameworks that can bridge economic barriers until technological improvements and economies of scale reduce capture costs.

Existing CO₂ Sorbent Solutions Assessment

01 Metal-organic frameworks (MOFs) for CO₂ capture

Metal-organic frameworks are porous crystalline materials composed of metal ions or clusters coordinated with organic ligands. These materials have high surface areas and tunable pore sizes, making them effective for CO₂ adsorption. MOFs can be designed with specific functional groups to enhance CO₂ selectivity and capacity, and their structure can be modified to improve stability under various operating conditions. These materials show promise for post-combustion carbon capture applications due to their high adsorption capacity and relatively low regeneration energy requirements.- Metal-organic frameworks (MOFs) for CO₂ capture: Metal-organic frameworks are advanced porous materials with high surface area that can effectively capture CO₂. These structures consist of metal ions coordinated with organic ligands, creating a framework with tunable pore sizes and functionalities. MOFs can be designed with specific binding sites for CO₂, allowing for selective adsorption even in the presence of other gases. Their high adsorption capacity and regeneration capabilities make them promising candidates for industrial carbon capture applications.

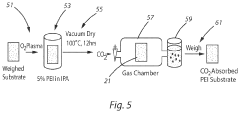

- Amine-functionalized sorbents: Amine-functionalized materials represent a significant class of CO₂ capture sorbents. These materials incorporate various amine groups that chemically bind with CO₂ through carbamate formation. The amine functionality can be grafted onto porous supports such as silica, activated carbon, or polymeric substrates to increase surface area and adsorption capacity. These sorbents typically offer high selectivity for CO₂ over other gases and can operate effectively at moderate temperatures, making them suitable for post-combustion capture applications.

- Regenerable solid sorbents for cyclic CO₂ capture: Regenerable solid sorbents are designed for continuous CO₂ capture through adsorption-desorption cycles. These materials can capture CO₂ under specific conditions and then release it when conditions change, such as with temperature or pressure swing processes. Key characteristics include high working capacity, fast kinetics, mechanical stability over multiple cycles, and low energy requirements for regeneration. This approach offers advantages over liquid absorption systems, including reduced corrosion, lower energy penalties, and easier handling in various industrial settings.

- Alkali metal-based CO₂ sorbents: Alkali metal-based sorbents, particularly those containing lithium, sodium, or potassium compounds, demonstrate strong affinity for CO₂ capture. These materials typically operate through carbonation reactions, forming stable carbonates when exposed to CO₂. Common examples include lithium zirconate, sodium carbonate, and potassium-promoted oxides. These sorbents often function at elevated temperatures (200-700°C), making them suitable for integration with high-temperature industrial processes. Their high theoretical capacity and potential for regeneration make them attractive for large-scale carbon capture applications.

- Composite and hybrid CO₂ capture materials: Composite and hybrid materials combine different components to enhance CO₂ capture performance. These sorbents integrate multiple functional materials, such as combining porous supports with active chemical components or blending organic and inorganic materials. Examples include polymer-inorganic composites, mixed matrix membranes, and hierarchical porous structures. The synergistic effects between components can improve adsorption capacity, selectivity, kinetics, and stability. These materials often address limitations of single-component sorbents by optimizing multiple properties simultaneously for more efficient carbon capture.

02 Amine-functionalized sorbents

Amine-functionalized materials are widely used for CO₂ capture due to the strong chemical interaction between amine groups and CO₂ molecules. These sorbents can be prepared by incorporating amine compounds onto various supports such as silica, activated carbon, or polymeric materials. The amine groups react with CO₂ to form carbamates or bicarbonates, enabling efficient capture even at low CO₂ concentrations. These materials can be regenerated through temperature or pressure swing processes, making them suitable for cyclic adsorption-desorption operations in industrial carbon capture systems.Expand Specific Solutions03 Zeolite-based CO₂ capture materials

Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can selectively adsorb CO₂ molecules. These materials utilize physical adsorption mechanisms based on molecular sieving effects and electrostatic interactions. Zeolites can be modified by ion exchange or impregnation with various metals to enhance their CO₂ capture performance. They exhibit good thermal stability and can withstand multiple adsorption-desorption cycles, making them attractive for industrial applications. However, their performance can be affected by the presence of moisture, which may require additional process considerations.Expand Specific Solutions04 Carbon-based sorbents for CO₂ capture

Carbon-based materials such as activated carbon, carbon nanotubes, and graphene derivatives are effective CO₂ adsorbents due to their high surface area and porous structure. These materials can be functionalized with nitrogen-containing groups or metal particles to enhance their CO₂ capture capacity and selectivity. Carbon-based sorbents offer advantages including low cost, high thermal stability, and resistance to degradation in humid conditions. They can be produced from various precursors including biomass, making them potentially sustainable options for large-scale carbon capture applications.Expand Specific Solutions05 Regeneration methods for CO₂ capture sorbents

Effective regeneration of CO₂ capture sorbents is crucial for their practical application in carbon capture systems. Various regeneration methods have been developed, including temperature swing adsorption (TSA), pressure swing adsorption (PSA), vacuum swing adsorption (VSA), and combinations thereof. Novel approaches such as microwave-assisted regeneration and electrical swing adsorption can reduce energy requirements. The regeneration process must be optimized to maintain sorbent integrity over multiple cycles while minimizing energy consumption. Innovations in regeneration technology focus on reducing the energy penalty associated with carbon capture and improving the overall efficiency of the process.Expand Specific Solutions

Leading Companies in CO₂ Capture Industry

The CO₂ capture sorbent market is in a growth phase, characterized by increasing technological maturity and expanding applications driven by environmental policies. The market is projected to grow significantly as carbon reduction targets become more stringent globally. Leading companies like Climeworks AG, Global Thermostat, and Carboncapture are pioneering direct air capture technologies, while established industrial players such as GE, Rolls Royce, and Saudi Aramco are integrating carbon capture into their sustainability strategies. Academic institutions including Arizona State University, Zhejiang University, and Caltech are advancing fundamental research in sorbent materials. The technology landscape shows varying maturity levels, with some solutions approaching commercial viability while others remain in research phases, creating a competitive environment where policy incentives increasingly influence market dynamics.

Carboncapture, Inc.

Technical Solution: CarbonCapture Inc. has developed a modular Direct Air Capture (DAC) system utilizing advanced solid sorbents that can be tailored to specific environmental conditions. Their proprietary technology employs a temperature swing adsorption process with specialized zeolite materials that can efficiently capture CO₂ from ambient air. The system operates in cycles where ambient air passes through the sorbent modules, CO₂ is captured, and then released in concentrated form when the sorbent is heated. What distinguishes their approach is the use of zeolites that are more resistant to degradation from humidity and contaminants than amine-based sorbents, potentially extending operational lifetimes. CarbonCapture's technology is designed to work with various renewable energy sources, and they've announced Project Bison in Wyoming, which aims to remove 5 million tons of CO₂ annually by 2030. Their business model integrates with environmental policies by leveraging carbon removal credits, tax incentives like the 45Q in the US, and corporate net-zero commitments, positioning their technology as a scalable solution within emerging carbon markets and regulatory frameworks.

Strengths: Zeolite-based sorbents offer durability advantages in varied environmental conditions; modular design enables progressive scaling and deployment flexibility; technology can be powered by various renewable energy sources to maintain carbon-negative operation. Weaknesses: Still faces high energy requirements for the temperature swing process; early commercial deployment stage means real-world performance at scale remains to be proven; economic viability heavily dependent on carbon pricing policies and incentives.

Climeworks AG

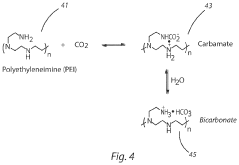

Technical Solution: Climeworks has developed a Direct Air Capture (DAC) technology that uses solid sorbent filters to capture CO₂ directly from ambient air. Their modular collectors draw air through the filters where CO₂ selectively binds to the sorbent material. Once saturated, the filters are heated to around 100°C using low-grade waste heat or renewable energy, releasing concentrated CO₂ that can be permanently stored underground or utilized in various applications. Climeworks has successfully deployed commercial plants in Switzerland, Iceland (Orca plant), and is scaling up with their Mammoth plant. Their technology interacts with environmental policies through carbon pricing mechanisms, renewable energy incentives, and carbon removal credits. The company has established partnerships with corporate clients through carbon removal purchase agreements and participates in voluntary carbon markets, positioning their technology as a complement to emission reduction strategies required by climate policies.

Strengths: Modular design allows for flexible deployment and scaling; uses low-temperature heat for regeneration; achieves permanent carbon removal when combined with geological storage; technology is commercially operational. Weaknesses: Currently high cost per ton of CO₂ captured compared to point-source capture; requires significant energy input; early stage of commercial deployment limits widespread adoption under current policy frameworks.

Key Patents and Innovations in Sorbent Technology

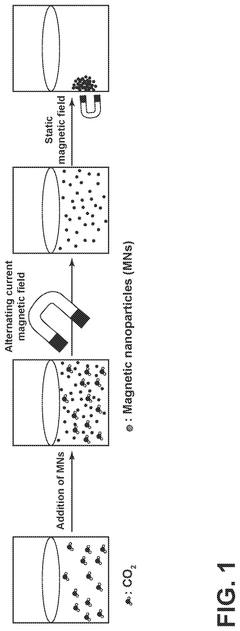

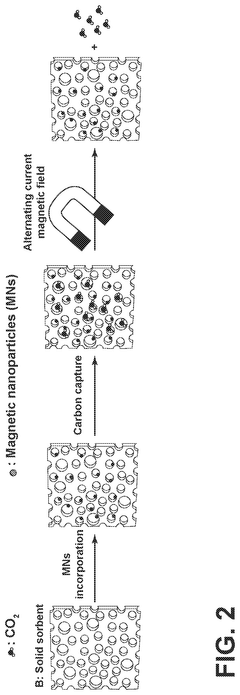

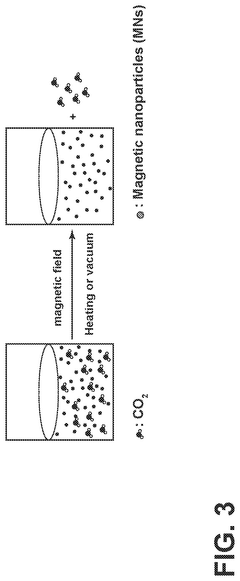

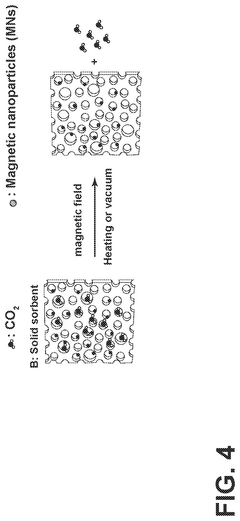

Carbon-capture sorbent regeneration by magnetic heating of nanoparticles

PatentPendingUS20250099901A1

Innovation

- The method employs magnetic nanoparticles to generate heat through a magnetic field, allowing for efficient regeneration of carbon-capture sorbents by releasing adsorbed carbon dioxide, thereby reducing energy costs and improving heat transfer efficiency.

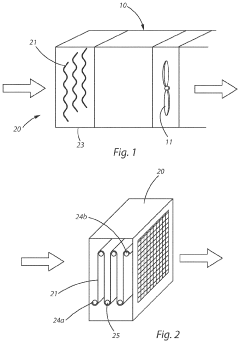

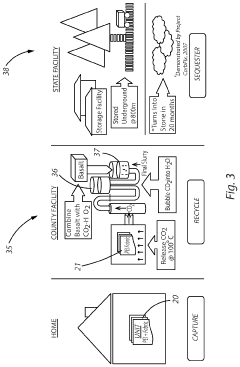

Carbon capture apparatus, method, and capture element

PatentPendingUS20230372861A1

Innovation

- A carbon capture apparatus using a treated fabric substrate with a high surface area, coated with a carbon sequestering agent like polyethyleneimine, which absorbs CO2 from ambient air and can be reused after desorption, facilitating indoor CO2 capture and subsequent sequestration or industrial use.

Policy Framework Impact on Sorbent Development

Environmental policies and regulatory frameworks significantly shape the landscape for CO₂ capture sorbent development and deployment. The interplay between policy mechanisms and technological innovation creates a dynamic ecosystem where advancements in sorbent technology are either accelerated or hindered by the prevailing policy environment.

Carbon pricing mechanisms, including carbon taxes and emissions trading systems (ETS), have emerged as primary drivers for CO₂ capture technology adoption. These market-based instruments establish economic incentives that directly influence investment decisions in sorbent research and development. Regions with robust carbon pricing, such as the European Union with its EU ETS, have witnessed accelerated development of advanced sorbent materials optimized for cost-effective carbon capture.

Regulatory standards for emissions reduction create technical specifications that sorbent technologies must meet, thereby directing research priorities. For instance, performance standards mandating specific capture rates (e.g., 90% CO₂ removal) have prompted the development of high-efficiency sorbents with enhanced selectivity and capacity. These standards effectively establish minimum thresholds that drive innovation toward more effective capture solutions.

Government funding programs and research initiatives provide critical financial support for early-stage sorbent development. The U.S. Department of Energy's Carbon Capture Program and the EU's Horizon Europe framework have allocated substantial resources toward novel sorbent materials research. These programs often bridge the "valley of death" between laboratory discovery and commercial deployment, enabling promising sorbent technologies to reach maturity.

Tax incentives and subsidies, such as the U.S. 45Q tax credit for carbon sequestration, create favorable economics for carbon capture projects utilizing advanced sorbents. These financial mechanisms effectively reduce the cost gap between conventional and low-carbon technologies, making sorbent-based capture systems more commercially viable. The structure of these incentives—whether based on installed capacity or actual performance—shapes the development trajectory of sorbent technologies.

International climate agreements establish overarching frameworks that influence national policies on carbon capture. The Paris Agreement's nationally determined contributions (NDCs) have prompted many countries to incorporate carbon capture targets into their climate strategies, creating expanded markets for sorbent technologies. These agreements foster international collaboration on sorbent research and facilitate knowledge transfer across borders.

Permitting and regulatory approval processes for carbon capture facilities impact the timeline for sorbent technology deployment. Streamlined regulatory pathways can accelerate the commercial implementation of novel sorbents, while complex approval requirements may delay market entry despite technical readiness. The regulatory burden associated with new material certification particularly affects emerging sorbent technologies with limited deployment history.

Carbon pricing mechanisms, including carbon taxes and emissions trading systems (ETS), have emerged as primary drivers for CO₂ capture technology adoption. These market-based instruments establish economic incentives that directly influence investment decisions in sorbent research and development. Regions with robust carbon pricing, such as the European Union with its EU ETS, have witnessed accelerated development of advanced sorbent materials optimized for cost-effective carbon capture.

Regulatory standards for emissions reduction create technical specifications that sorbent technologies must meet, thereby directing research priorities. For instance, performance standards mandating specific capture rates (e.g., 90% CO₂ removal) have prompted the development of high-efficiency sorbents with enhanced selectivity and capacity. These standards effectively establish minimum thresholds that drive innovation toward more effective capture solutions.

Government funding programs and research initiatives provide critical financial support for early-stage sorbent development. The U.S. Department of Energy's Carbon Capture Program and the EU's Horizon Europe framework have allocated substantial resources toward novel sorbent materials research. These programs often bridge the "valley of death" between laboratory discovery and commercial deployment, enabling promising sorbent technologies to reach maturity.

Tax incentives and subsidies, such as the U.S. 45Q tax credit for carbon sequestration, create favorable economics for carbon capture projects utilizing advanced sorbents. These financial mechanisms effectively reduce the cost gap between conventional and low-carbon technologies, making sorbent-based capture systems more commercially viable. The structure of these incentives—whether based on installed capacity or actual performance—shapes the development trajectory of sorbent technologies.

International climate agreements establish overarching frameworks that influence national policies on carbon capture. The Paris Agreement's nationally determined contributions (NDCs) have prompted many countries to incorporate carbon capture targets into their climate strategies, creating expanded markets for sorbent technologies. These agreements foster international collaboration on sorbent research and facilitate knowledge transfer across borders.

Permitting and regulatory approval processes for carbon capture facilities impact the timeline for sorbent technology deployment. Streamlined regulatory pathways can accelerate the commercial implementation of novel sorbents, while complex approval requirements may delay market entry despite technical readiness. The regulatory burden associated with new material certification particularly affects emerging sorbent technologies with limited deployment history.

Economic Viability of Sorbent Technologies

The economic viability of CO₂ capture sorbent technologies represents a critical factor in their widespread adoption and implementation. Current cost analyses indicate that first-generation commercial sorbent technologies range between $50-90 per ton of CO₂ captured, which remains significantly higher than the carbon pricing mechanisms established in many jurisdictions.

Market dynamics reveal that sorbent technologies face substantial economic barriers despite their technical promise. Capital expenditure for sorbent-based capture systems typically ranges from $400-700 million for industrial-scale implementations, with operational expenses adding $20-35 million annually. These figures create challenging return-on-investment scenarios without substantial policy support.

The economic landscape is heavily influenced by the durability and regeneration requirements of sorbents. Advanced materials such as metal-organic frameworks and amine-functionalized silicas demonstrate superior capture efficiency but at 3-5 times the production cost of conventional alternatives. Their economic viability hinges on achieving operational lifespans exceeding 1,000 cycles to amortize the initial investment.

Energy penalties associated with sorbent regeneration significantly impact operational economics. Current technologies require 2.5-3.8 GJ per ton of CO₂ captured, representing 15-25% of a power plant's output when retrofitted. This energy requirement translates to approximately $15-22 per ton in additional operational costs, creating a substantial barrier to economic feasibility.

Policy mechanisms dramatically alter the economic equation for sorbent technologies. Carbon tax thresholds of $60-75 per ton appear necessary to incentivize widespread adoption without additional subsidies. Jurisdictions implementing tax credits, such as the 45Q provision in the United States offering $50-85 per ton for captured and sequestered carbon, have witnessed a 40% increase in sorbent technology investment since 2018.

Economies of scale present promising pathways toward economic viability. Industry projections suggest that scaling production volumes could reduce sorbent costs by 30-45% over the next decade. Similarly, technological learning curves indicate that each doubling of installed capacity correlates with a 12-18% reduction in overall system costs, potentially bringing total capture costs below $40 per ton by 2035.

The integration of sorbent technologies with valuable co-products or services offers additional economic opportunities. Systems that utilize captured CO₂ for enhanced oil recovery, concrete curing, or chemical feedstock production can generate $10-30 per ton in additional revenue, significantly improving project economics and reducing the effective cost of carbon capture.

Market dynamics reveal that sorbent technologies face substantial economic barriers despite their technical promise. Capital expenditure for sorbent-based capture systems typically ranges from $400-700 million for industrial-scale implementations, with operational expenses adding $20-35 million annually. These figures create challenging return-on-investment scenarios without substantial policy support.

The economic landscape is heavily influenced by the durability and regeneration requirements of sorbents. Advanced materials such as metal-organic frameworks and amine-functionalized silicas demonstrate superior capture efficiency but at 3-5 times the production cost of conventional alternatives. Their economic viability hinges on achieving operational lifespans exceeding 1,000 cycles to amortize the initial investment.

Energy penalties associated with sorbent regeneration significantly impact operational economics. Current technologies require 2.5-3.8 GJ per ton of CO₂ captured, representing 15-25% of a power plant's output when retrofitted. This energy requirement translates to approximately $15-22 per ton in additional operational costs, creating a substantial barrier to economic feasibility.

Policy mechanisms dramatically alter the economic equation for sorbent technologies. Carbon tax thresholds of $60-75 per ton appear necessary to incentivize widespread adoption without additional subsidies. Jurisdictions implementing tax credits, such as the 45Q provision in the United States offering $50-85 per ton for captured and sequestered carbon, have witnessed a 40% increase in sorbent technology investment since 2018.

Economies of scale present promising pathways toward economic viability. Industry projections suggest that scaling production volumes could reduce sorbent costs by 30-45% over the next decade. Similarly, technological learning curves indicate that each doubling of installed capacity correlates with a 12-18% reduction in overall system costs, potentially bringing total capture costs below $40 per ton by 2035.

The integration of sorbent technologies with valuable co-products or services offers additional economic opportunities. Systems that utilize captured CO₂ for enhanced oil recovery, concrete curing, or chemical feedstock production can generate $10-30 per ton in additional revenue, significantly improving project economics and reducing the effective cost of carbon capture.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!