How CO₂ Capture Sorbent Shapes Green Manufacturing Standards

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Background and Objectives

Carbon dioxide capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in various industrial settings. The journey began in the 1970s with early experiments in carbon sequestration, primarily motivated by enhanced oil recovery rather than environmental concerns. By the 1990s, as climate change awareness grew, CO₂ capture technologies started gaining attention as potential solutions for reducing greenhouse gas emissions from industrial processes.

The evolution of sorbent materials represents a critical advancement in this field. Initial carbon capture systems relied heavily on liquid amine solutions, which, while effective, presented challenges related to energy consumption, corrosion, and degradation. The development of solid sorbents marked a significant technological leap, offering improved efficiency, reduced energy penalties, and greater operational flexibility across various temperature and pressure conditions.

Current technological objectives focus on developing advanced sorbent materials that can revolutionize green manufacturing standards. These objectives include creating sorbents with higher CO₂ selectivity, faster adsorption-desorption kinetics, and greater stability over multiple cycles. Additionally, researchers aim to design materials that can function effectively under the varied conditions present in different industrial processes, from power generation to cement production and chemical manufacturing.

The integration of CO₂ capture sorbents into manufacturing processes represents a paradigm shift in industrial sustainability. By enabling the capture of carbon emissions at their source, these technologies offer pathways to significantly reduce the carbon footprint of essential industrial activities without necessitating their complete redesign or replacement. This approach aligns with the concept of transitional technologies that can bridge current manufacturing methods with future zero-emission systems.

Looking forward, the technological roadmap emphasizes several key objectives: reducing the energy penalty associated with carbon capture to below 10% of total process energy, developing sorbents capable of maintaining performance over thousands of cycles, and creating materials that can be manufactured at scale using environmentally friendly processes. These objectives reflect the dual challenges of technical performance and practical implementation that must be addressed for widespread adoption.

The ultimate goal extends beyond mere carbon capture to establishing new green manufacturing standards where carbon management becomes an integral part of industrial design rather than an end-of-pipe solution. This vision requires sorbent technologies that are not only effective at capturing CO₂ but also compatible with circular economy principles, utilizing sustainable raw materials and offering pathways for regeneration or environmentally sound disposal at end-of-life.

The evolution of sorbent materials represents a critical advancement in this field. Initial carbon capture systems relied heavily on liquid amine solutions, which, while effective, presented challenges related to energy consumption, corrosion, and degradation. The development of solid sorbents marked a significant technological leap, offering improved efficiency, reduced energy penalties, and greater operational flexibility across various temperature and pressure conditions.

Current technological objectives focus on developing advanced sorbent materials that can revolutionize green manufacturing standards. These objectives include creating sorbents with higher CO₂ selectivity, faster adsorption-desorption kinetics, and greater stability over multiple cycles. Additionally, researchers aim to design materials that can function effectively under the varied conditions present in different industrial processes, from power generation to cement production and chemical manufacturing.

The integration of CO₂ capture sorbents into manufacturing processes represents a paradigm shift in industrial sustainability. By enabling the capture of carbon emissions at their source, these technologies offer pathways to significantly reduce the carbon footprint of essential industrial activities without necessitating their complete redesign or replacement. This approach aligns with the concept of transitional technologies that can bridge current manufacturing methods with future zero-emission systems.

Looking forward, the technological roadmap emphasizes several key objectives: reducing the energy penalty associated with carbon capture to below 10% of total process energy, developing sorbents capable of maintaining performance over thousands of cycles, and creating materials that can be manufactured at scale using environmentally friendly processes. These objectives reflect the dual challenges of technical performance and practical implementation that must be addressed for widespread adoption.

The ultimate goal extends beyond mere carbon capture to establishing new green manufacturing standards where carbon management becomes an integral part of industrial design rather than an end-of-pipe solution. This vision requires sorbent technologies that are not only effective at capturing CO₂ but also compatible with circular economy principles, utilizing sustainable raw materials and offering pathways for regeneration or environmentally sound disposal at end-of-life.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. Current market valuations place the carbon capture, utilization, and storage (CCUS) sector at approximately $2.5 billion in 2023, with projections indicating expansion to reach $7.0 billion by 2030, representing a compound annual growth rate of 15.8%. This growth trajectory is supported by substantial government investments, with the United States allocating $12 billion for CCUS development through the Infrastructure Investment and Jobs Act.

The market segmentation reveals distinct categories based on capture technology types, with post-combustion capture currently dominating market share at 58%, followed by pre-combustion (27%) and oxy-fuel combustion (15%) technologies. Sorbent-based solutions, particularly those utilizing advanced materials like metal-organic frameworks (MOFs) and amine-functionalized adsorbents, are gaining traction due to their improved efficiency and reduced energy penalties compared to traditional solvent-based approaches.

Regional analysis indicates North America leads the market with 42% share, followed by Europe (31%) and Asia-Pacific (21%). The fastest growth is anticipated in the Asia-Pacific region, particularly in China and India, where rapid industrialization coupled with emerging climate policies is creating favorable market conditions for carbon capture technologies.

Key demand drivers include stringent emission regulations, carbon pricing mechanisms, and corporate net-zero commitments. The European Union's Emissions Trading System (ETS) carbon price has reached record levels above €90 per tonne, creating economic incentives for industrial emitters to adopt capture technologies. Similarly, the enhanced 45Q tax credits in the United States now offer up to $85 per tonne for permanent CO₂ storage, significantly improving project economics.

Customer segmentation shows power generation and industrial manufacturing as the largest adopter segments, collectively accounting for 73% of the market. Cement production, steel manufacturing, and chemical processing industries represent particularly promising growth sectors due to their hard-to-abate emissions profiles and limited alternative decarbonization pathways.

Market barriers include high capital expenditure requirements, with typical industrial-scale installations costing between $400-800 million, and operational expenses ranging from $40-120 per tonne of CO₂ captured. Additional challenges include infrastructure limitations for CO₂ transport and storage, regulatory uncertainties, and competition from alternative decarbonization strategies.

The competitive landscape features established industrial gas companies like Air Liquide and Linde, specialized carbon capture technology providers such as Carbon Engineering and Climeworks, and major energy corporations including Shell and ExxonMobil that are increasingly investing in this space. Recent market consolidation through strategic acquisitions indicates growing recognition of the sector's long-term value proposition.

The market segmentation reveals distinct categories based on capture technology types, with post-combustion capture currently dominating market share at 58%, followed by pre-combustion (27%) and oxy-fuel combustion (15%) technologies. Sorbent-based solutions, particularly those utilizing advanced materials like metal-organic frameworks (MOFs) and amine-functionalized adsorbents, are gaining traction due to their improved efficiency and reduced energy penalties compared to traditional solvent-based approaches.

Regional analysis indicates North America leads the market with 42% share, followed by Europe (31%) and Asia-Pacific (21%). The fastest growth is anticipated in the Asia-Pacific region, particularly in China and India, where rapid industrialization coupled with emerging climate policies is creating favorable market conditions for carbon capture technologies.

Key demand drivers include stringent emission regulations, carbon pricing mechanisms, and corporate net-zero commitments. The European Union's Emissions Trading System (ETS) carbon price has reached record levels above €90 per tonne, creating economic incentives for industrial emitters to adopt capture technologies. Similarly, the enhanced 45Q tax credits in the United States now offer up to $85 per tonne for permanent CO₂ storage, significantly improving project economics.

Customer segmentation shows power generation and industrial manufacturing as the largest adopter segments, collectively accounting for 73% of the market. Cement production, steel manufacturing, and chemical processing industries represent particularly promising growth sectors due to their hard-to-abate emissions profiles and limited alternative decarbonization pathways.

Market barriers include high capital expenditure requirements, with typical industrial-scale installations costing between $400-800 million, and operational expenses ranging from $40-120 per tonne of CO₂ captured. Additional challenges include infrastructure limitations for CO₂ transport and storage, regulatory uncertainties, and competition from alternative decarbonization strategies.

The competitive landscape features established industrial gas companies like Air Liquide and Linde, specialized carbon capture technology providers such as Carbon Engineering and Climeworks, and major energy corporations including Shell and ExxonMobil that are increasingly investing in this space. Recent market consolidation through strategic acquisitions indicates growing recognition of the sector's long-term value proposition.

Global Sorbent Technology Landscape and Barriers

The global landscape of CO₂ capture sorbent technologies presents a complex mosaic of advancements and limitations across different regions. Currently, North America and Europe lead in research and development of advanced sorbent materials, with significant investments in both academic institutions and industrial applications. The United States Department of Energy has allocated substantial funding toward carbon capture technologies, with particular emphasis on developing high-performance, cost-effective sorbents that can operate in industrial settings.

In Asia, China has emerged as a rapidly growing player in sorbent technology development, driven by its dual needs to address severe air pollution issues and meet international climate commitments. Japanese and South Korean research institutions have made notable progress in developing novel metal-organic frameworks (MOFs) and amine-functionalized materials with exceptional CO₂ selectivity properties.

Despite these advancements, several critical barriers impede widespread adoption of CO₂ capture sorbents in manufacturing processes. The foremost challenge remains economic viability – current sorbent technologies typically increase production costs by 40-80% when integrated into manufacturing processes, creating significant market resistance. This cost barrier is particularly pronounced in energy-intensive industries such as cement, steel, and chemical production.

Technical limitations present another significant obstacle. Many promising sorbents demonstrate excellent performance in laboratory conditions but suffer from rapid degradation when exposed to industrial flue gas contaminants. The presence of SOx, NOx, and moisture significantly reduces sorbent capacity and lifetime, necessitating frequent replacement and increasing operational costs. Additionally, the energy requirements for sorbent regeneration remain prohibitively high, often negating a portion of the environmental benefits gained through carbon capture.

Scalability represents another major challenge. Laboratory-developed sorbents often face manufacturing barriers when scaled to industrial quantities, with inconsistent performance and quality control issues emerging during mass production. The physical infrastructure required for large-scale implementation – including massive contacting vessels, regeneration systems, and CO₂ compression equipment – demands substantial capital investment and physical space that many existing manufacturing facilities cannot accommodate without significant redesign.

Regulatory uncertainty further complicates the technology landscape. The absence of standardized carbon pricing mechanisms in many regions creates an uneven playing field for green manufacturing adoption. Without clear economic incentives or regulatory mandates, manufacturers remain hesitant to invest in sorbent technologies despite their potential environmental benefits.

In Asia, China has emerged as a rapidly growing player in sorbent technology development, driven by its dual needs to address severe air pollution issues and meet international climate commitments. Japanese and South Korean research institutions have made notable progress in developing novel metal-organic frameworks (MOFs) and amine-functionalized materials with exceptional CO₂ selectivity properties.

Despite these advancements, several critical barriers impede widespread adoption of CO₂ capture sorbents in manufacturing processes. The foremost challenge remains economic viability – current sorbent technologies typically increase production costs by 40-80% when integrated into manufacturing processes, creating significant market resistance. This cost barrier is particularly pronounced in energy-intensive industries such as cement, steel, and chemical production.

Technical limitations present another significant obstacle. Many promising sorbents demonstrate excellent performance in laboratory conditions but suffer from rapid degradation when exposed to industrial flue gas contaminants. The presence of SOx, NOx, and moisture significantly reduces sorbent capacity and lifetime, necessitating frequent replacement and increasing operational costs. Additionally, the energy requirements for sorbent regeneration remain prohibitively high, often negating a portion of the environmental benefits gained through carbon capture.

Scalability represents another major challenge. Laboratory-developed sorbents often face manufacturing barriers when scaled to industrial quantities, with inconsistent performance and quality control issues emerging during mass production. The physical infrastructure required for large-scale implementation – including massive contacting vessels, regeneration systems, and CO₂ compression equipment – demands substantial capital investment and physical space that many existing manufacturing facilities cannot accommodate without significant redesign.

Regulatory uncertainty further complicates the technology landscape. The absence of standardized carbon pricing mechanisms in many regions creates an uneven playing field for green manufacturing adoption. Without clear economic incentives or regulatory mandates, manufacturers remain hesitant to invest in sorbent technologies despite their potential environmental benefits.

Current Sorbent Materials and Implementation Methods

01 Eco-friendly sorbent materials for CO₂ capture

Various environmentally friendly materials can be used as sorbents for CO₂ capture. These include modified natural materials, sustainable synthetic compounds, and regenerable adsorbents that minimize waste generation. These green sorbents are designed to have high CO₂ selectivity and capacity while being produced through sustainable manufacturing processes that reduce environmental impact.- Eco-friendly sorbent materials for CO₂ capture: Various environmentally friendly materials can be used as sorbents for CO₂ capture. These include naturally derived materials, modified natural compounds, and synthetically produced substances with reduced environmental impact. These green sorbents are designed to effectively capture carbon dioxide while minimizing the ecological footprint of the manufacturing process and final product disposal.

- Energy-efficient manufacturing processes for CO₂ sorbents: Manufacturing standards for CO₂ capture sorbents emphasize energy efficiency throughout the production process. These standards include optimized synthesis routes, reduced temperature requirements, and improved reaction kinetics that minimize energy consumption. Energy recovery systems and renewable energy integration in manufacturing facilities further enhance the sustainability profile of sorbent production.

- Waste reduction and circular economy approaches in sorbent production: Green manufacturing standards for CO₂ capture sorbents incorporate waste minimization strategies and circular economy principles. These include using industrial by-products as raw materials, implementing closed-loop production systems, and designing sorbents that can be regenerated multiple times. Manufacturing processes are designed to reduce waste generation and enable the recycling of spent sorbents.

- Water conservation and pollution prevention in sorbent manufacturing: Sustainable manufacturing standards for CO₂ capture sorbents address water usage and pollution prevention. These include water-efficient production methods, wastewater treatment and recycling systems, and processes that minimize the release of harmful chemicals. Solvent-free or aqueous-based synthesis routes are preferred over those requiring organic solvents to reduce environmental contamination.

- Life cycle assessment and sustainability metrics for CO₂ sorbents: Green manufacturing standards incorporate comprehensive life cycle assessment methodologies to evaluate the environmental impact of CO₂ capture sorbents. These assessments consider raw material extraction, manufacturing processes, use phase performance, and end-of-life management. Standardized sustainability metrics help quantify carbon footprint, energy consumption, resource depletion, and other environmental indicators to guide continuous improvement in sorbent development.

02 Energy-efficient manufacturing processes for CO₂ sorbents

Energy-efficient manufacturing processes for CO₂ capture sorbents focus on reducing the carbon footprint of production. These processes include low-temperature synthesis methods, solvent-free preparation techniques, and energy recovery systems. By optimizing reaction conditions and utilizing renewable energy sources during manufacturing, these methods significantly decrease the overall environmental impact of sorbent production.Expand Specific Solutions03 Waste reduction and circular economy approaches in sorbent production

Circular economy principles are applied to CO₂ sorbent manufacturing through waste reduction strategies, recycling of production byproducts, and designing sorbents for regeneration and reuse. These approaches include using industrial waste as raw materials, implementing closed-loop production systems, and developing sorbents with extended lifecycle. Such methods minimize resource consumption and waste generation while maintaining sorbent performance.Expand Specific Solutions04 Water conservation and pollution prevention in sorbent manufacturing

Water conservation and pollution prevention are critical aspects of green manufacturing standards for CO₂ capture sorbents. These include water-efficient synthesis methods, wastewater treatment and recycling systems, and techniques to minimize the release of harmful chemicals. By implementing these practices, manufacturers can reduce water consumption and prevent contamination of water bodies during sorbent production.Expand Specific Solutions05 Standardization and certification of green manufacturing for CO₂ sorbents

Standardization and certification frameworks ensure consistent environmental performance in CO₂ sorbent manufacturing. These include life cycle assessment methodologies, environmental impact metrics, and third-party verification systems. Such standards help quantify carbon footprint, resource efficiency, and overall sustainability of production processes, enabling manufacturers to demonstrate compliance with green manufacturing principles and facilitating market adoption of environmentally superior products.Expand Specific Solutions

Leading Companies in CO2 Capture Sorbent Development

The CO₂ capture sorbent market is currently in a growth phase, with increasing global focus on carbon reduction technologies driving expansion. Market size is projected to reach significant scale as green manufacturing standards evolve, particularly in energy and industrial sectors. Technology maturity varies across applications, with companies demonstrating different levels of advancement. Leading players include Climeworks AG with its direct air capture technology, Saudi Aramco focusing on industrial-scale solutions, and Corning developing specialized materials. Korean power companies (KEPCO and subsidiaries) are investing heavily in integration with existing infrastructure, while academic institutions like Caltech, ETH Zurich, and Zhejiang University are advancing fundamental research. GE and Shell represent established industrial players adapting their expertise to this emerging field.

Climeworks AG

Technical Solution: Climeworks has developed a Direct Air Capture (DAC) technology that uses solid sorbent materials to selectively capture CO₂ directly from ambient air. Their modular collectors contain patented filter materials that bind CO₂ molecules. Once saturated, the filters are heated to approximately 100°C, releasing concentrated CO₂ that can be permanently stored underground or utilized in various applications. Climeworks' commercial plants (like Orca in Iceland) combine this capture technology with geothermal energy sources for low-carbon operation. Their sorbent technology features a cyclic adsorption-desorption process, with specially engineered porous materials that maximize surface area for CO₂ binding while minimizing energy requirements for regeneration. The company has continuously improved sorbent durability and capacity through multiple technology generations, achieving significant reductions in energy consumption per ton of CO₂ captured.

Strengths: Modular, scalable design allows for flexible deployment; integration with renewable energy sources minimizes carbon footprint; proven commercial implementation with operational plants. Weaknesses: Higher cost per ton of CO₂ captured compared to point-source capture; requires significant energy for sorbent regeneration; current scale insufficient to make meaningful climate impact without massive expansion.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed advanced carbon capture technologies focusing on post-combustion capture using specialized amine-based sorbents optimized for high CO₂ selectivity and stability under industrial conditions. Their proprietary sorbent formulations feature modified molecular structures that enhance CO₂ binding capacity while reducing regeneration energy requirements by approximately 25% compared to conventional materials. The company has implemented these technologies at large-scale facilities, including their Hawiyah NGL Recovery Plant, which captures up to 500,000 tons of CO₂ annually. Aramco's approach integrates capture systems directly into existing industrial infrastructure, minimizing retrofit costs while maximizing capture efficiency. Their sorbent materials are engineered to withstand contaminants present in industrial gas streams, extending operational lifetime and reducing replacement frequency. The captured CO₂ is subsequently utilized for enhanced oil recovery operations, creating a circular carbon economy model that improves oil production while reducing net emissions.

Strengths: Extensive industrial-scale implementation experience; integration with existing energy infrastructure; proven durability in harsh industrial environments; closed-loop utilization pathway for captured CO₂. Weaknesses: Primary utilization pathway (enhanced oil recovery) ultimately contributes to fossil fuel production; technology optimization focused on economic rather than environmental metrics; limited transparency regarding full lifecycle emissions impact.

Key Patents and Innovations in CO2 Capture Technology

Highly attrition resistant and dry regenerable sorbents for carbon dioxide capture

PatentInactiveUS20080119356A1

Innovation

- A dry regenerable sorbent is developed using a composition of active components, supports, and inorganic binders, formed through a spray drying process, which enhances mechanical strength, reactivity, and attrition resistance, allowing for efficient CO2 capture and regeneration at lower temperatures.

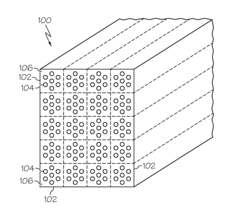

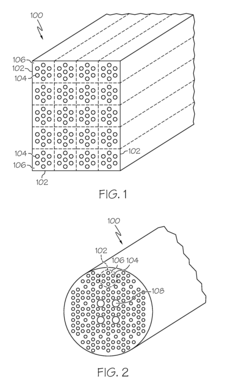

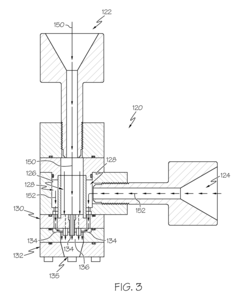

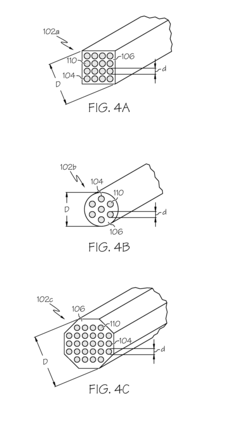

Sorbent substrates for CO<sub>2 </sub>capture and methods for forming the same

PatentInactiveUS8901030B2

Innovation

- A sorbent substrate is formed by co-extruding sorbent filaments with through-channels using a matrix of sorbent material and a support material, which are then stacked and bonded to create a substrate with high porosity and parallel channels for efficient CO2 adsorption and desorption, allowing for effective CO2 capture with improved thermal management.

Regulatory Framework and Emission Standards

The global regulatory landscape for carbon dioxide emissions has evolved significantly in response to climate change concerns, creating a complex framework that directly impacts CO₂ capture technologies. The Paris Agreement established the international foundation for emission reduction commitments, with signatory nations pledging to limit global warming to well below 2°C above pre-industrial levels. This agreement has catalyzed the development of more stringent national and regional regulatory frameworks specifically targeting industrial emissions.

In the European Union, the Emissions Trading System (ETS) represents one of the most sophisticated carbon pricing mechanisms globally, creating economic incentives for CO₂ capture implementation. The EU's recent Green Deal further strengthens these regulations, targeting carbon neutrality by 2050 and establishing interim emission reduction targets. These frameworks directly influence the development and adoption of sorbent technologies by creating market demand for effective carbon capture solutions.

The United States has implemented a regulatory approach combining federal standards with state-level initiatives. The Clean Air Act provides the EPA with authority to regulate greenhouse gas emissions, while the 45Q tax credit specifically incentivizes carbon capture, utilization, and storage (CCUS) projects. This credit structure has been instrumental in driving commercial-scale deployment of advanced sorbent technologies in manufacturing facilities.

China, as the world's largest carbon emitter, has introduced its national emissions trading scheme focused initially on the power sector with plans to expand to manufacturing industries. This represents a significant shift in policy for a major industrial economy and creates substantial market potential for CO₂ capture sorbents.

Industry-specific standards have emerged alongside these broader frameworks. The cement industry, responsible for approximately 8% of global CO₂ emissions, has developed voluntary standards through organizations like the Global Cement and Concrete Association, committing to carbon neutrality by 2050. Similar initiatives exist in steel manufacturing and chemical processing sectors.

Performance standards for CO₂ capture technologies are increasingly being incorporated into regulatory frameworks. These standards typically specify minimum capture efficiency rates, energy penalties, and lifecycle environmental impacts. The development of these technical specifications has been crucial in driving innovation in sorbent design, particularly regarding selectivity, capacity, and regeneration efficiency.

Emerging regulatory trends indicate a shift toward lifecycle assessment approaches that consider the environmental footprint of both the manufacturing process and the carbon capture technology itself. This holistic perspective is reshaping how sorbent technologies are evaluated, with increasing emphasis on sustainable material sourcing, energy consumption during regeneration, and end-of-life considerations for spent sorbents.

In the European Union, the Emissions Trading System (ETS) represents one of the most sophisticated carbon pricing mechanisms globally, creating economic incentives for CO₂ capture implementation. The EU's recent Green Deal further strengthens these regulations, targeting carbon neutrality by 2050 and establishing interim emission reduction targets. These frameworks directly influence the development and adoption of sorbent technologies by creating market demand for effective carbon capture solutions.

The United States has implemented a regulatory approach combining federal standards with state-level initiatives. The Clean Air Act provides the EPA with authority to regulate greenhouse gas emissions, while the 45Q tax credit specifically incentivizes carbon capture, utilization, and storage (CCUS) projects. This credit structure has been instrumental in driving commercial-scale deployment of advanced sorbent technologies in manufacturing facilities.

China, as the world's largest carbon emitter, has introduced its national emissions trading scheme focused initially on the power sector with plans to expand to manufacturing industries. This represents a significant shift in policy for a major industrial economy and creates substantial market potential for CO₂ capture sorbents.

Industry-specific standards have emerged alongside these broader frameworks. The cement industry, responsible for approximately 8% of global CO₂ emissions, has developed voluntary standards through organizations like the Global Cement and Concrete Association, committing to carbon neutrality by 2050. Similar initiatives exist in steel manufacturing and chemical processing sectors.

Performance standards for CO₂ capture technologies are increasingly being incorporated into regulatory frameworks. These standards typically specify minimum capture efficiency rates, energy penalties, and lifecycle environmental impacts. The development of these technical specifications has been crucial in driving innovation in sorbent design, particularly regarding selectivity, capacity, and regeneration efficiency.

Emerging regulatory trends indicate a shift toward lifecycle assessment approaches that consider the environmental footprint of both the manufacturing process and the carbon capture technology itself. This holistic perspective is reshaping how sorbent technologies are evaluated, with increasing emphasis on sustainable material sourcing, energy consumption during regeneration, and end-of-life considerations for spent sorbents.

Economic Viability and Cost-Benefit Analysis

The economic viability of CO₂ capture sorbent technologies represents a critical factor in their widespread adoption across manufacturing sectors. Current cost analyses indicate that implementing advanced sorbent technologies requires significant initial capital investment, ranging from $40-120 million for medium-scale industrial facilities. However, these investments must be evaluated against long-term operational savings and environmental compliance benefits.

When examining operational economics, CO₂ capture sorbents demonstrate varying cost-efficiency profiles depending on their composition and application context. Amine-based sorbents typically show operational costs of $50-70 per ton of CO₂ captured, while newer metal-organic frameworks (MOFs) and engineered porous materials are approaching more competitive rates of $35-55 per ton. These figures represent substantial improvements from earlier generation technologies, reflecting the rapid innovation in this field.

The cost-benefit equation is further complicated by regulatory frameworks that increasingly monetize carbon emissions. In regions with established carbon pricing mechanisms, manufacturers can offset implementation costs through avoided carbon taxes or through participation in emissions trading schemes. For instance, in the European Union where carbon prices have reached €80-90 per ton, the economic case for sorbent technologies strengthens considerably.

Return on investment timelines vary significantly across industrial sectors. Energy-intensive industries such as cement and steel production typically see ROI periods of 5-7 years, while less carbon-intensive manufacturing operations may experience longer payback periods of 8-12 years without additional incentives. These calculations are highly sensitive to energy prices, as regeneration of many sorbent materials remains energy-intensive.

Scaling considerations reveal important economic thresholds. Analysis of implementation data suggests that economies of scale become significant at capture capacities above 100,000 tons of CO₂ annually, with unit costs decreasing by approximately 15-25% compared to smaller installations. This creates particular challenges for small and medium enterprises seeking to adopt green manufacturing standards.

The economic landscape is also shaped by emerging financing mechanisms specifically designed for climate technologies. Green bonds, sustainability-linked loans, and climate tech venture capital have created new pathways for financing sorbent technology implementation, potentially reducing the capital burden on manufacturers. Several case studies indicate that blended finance approaches can reduce effective implementation costs by 20-30% through favorable interest rates and extended repayment terms.

When examining operational economics, CO₂ capture sorbents demonstrate varying cost-efficiency profiles depending on their composition and application context. Amine-based sorbents typically show operational costs of $50-70 per ton of CO₂ captured, while newer metal-organic frameworks (MOFs) and engineered porous materials are approaching more competitive rates of $35-55 per ton. These figures represent substantial improvements from earlier generation technologies, reflecting the rapid innovation in this field.

The cost-benefit equation is further complicated by regulatory frameworks that increasingly monetize carbon emissions. In regions with established carbon pricing mechanisms, manufacturers can offset implementation costs through avoided carbon taxes or through participation in emissions trading schemes. For instance, in the European Union where carbon prices have reached €80-90 per ton, the economic case for sorbent technologies strengthens considerably.

Return on investment timelines vary significantly across industrial sectors. Energy-intensive industries such as cement and steel production typically see ROI periods of 5-7 years, while less carbon-intensive manufacturing operations may experience longer payback periods of 8-12 years without additional incentives. These calculations are highly sensitive to energy prices, as regeneration of many sorbent materials remains energy-intensive.

Scaling considerations reveal important economic thresholds. Analysis of implementation data suggests that economies of scale become significant at capture capacities above 100,000 tons of CO₂ annually, with unit costs decreasing by approximately 15-25% compared to smaller installations. This creates particular challenges for small and medium enterprises seeking to adopt green manufacturing standards.

The economic landscape is also shaped by emerging financing mechanisms specifically designed for climate technologies. Green bonds, sustainability-linked loans, and climate tech venture capital have created new pathways for financing sorbent technology implementation, potentially reducing the capital burden on manufacturers. Several case studies indicate that blended finance approaches can reduce effective implementation costs by 20-30% through favorable interest rates and extended repayment terms.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!