Why CO₂ Capture Sorbent is Crucial for Sustainable Manufacturing

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Background and Objectives

Carbon dioxide (CO₂) capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in various industrial settings. The development trajectory began in the 1970s with basic absorption techniques and has since expanded to include a diverse array of capture methodologies including absorption, adsorption, membrane separation, and cryogenic processes. This evolution has been driven by the growing recognition of climate change impacts and the urgent need to reduce greenhouse gas emissions across manufacturing sectors.

The global manufacturing industry currently accounts for approximately 24% of total CO₂ emissions worldwide, making it a critical focus area for carbon reduction strategies. Traditional manufacturing processes, particularly in cement, steel, and chemical production, are inherently carbon-intensive due to both energy requirements and process-related emissions. Without significant intervention, these emissions are projected to increase by 25% by 2050 as global manufacturing output expands.

CO₂ capture sorbents represent a promising technological pathway for emissions reduction in manufacturing contexts. These materials, which can selectively capture CO₂ from industrial exhaust streams, have seen remarkable improvements in capacity, selectivity, and regeneration efficiency. Early sorbents suffered from limited capture capacity and high energy requirements for regeneration, but modern advanced materials such as metal-organic frameworks (MOFs), amine-functionalized silicas, and novel carbon-based sorbents demonstrate significantly enhanced performance metrics.

The primary technical objective in this field is to develop sorbent materials that combine high CO₂ selectivity, rapid adsorption kinetics, and low regeneration energy requirements while maintaining structural stability over thousands of adsorption-desorption cycles. Additionally, these materials must be cost-effective and environmentally benign to enable widespread industrial adoption. Current research aims to achieve capture costs below $40 per ton of CO₂, representing a critical threshold for economic viability.

Beyond technical performance, the strategic objectives of CO₂ capture sorbent development include enabling manufacturing industries to meet increasingly stringent emissions regulations while maintaining economic competitiveness. This technology pathway offers the potential for retrofitting existing manufacturing facilities rather than requiring complete process redesigns, providing a pragmatic transition strategy toward carbon-neutral manufacturing.

The convergence of climate policy pressures, technological advancements in materials science, and industrial sustainability imperatives has created unprecedented momentum in this field. The development of next-generation CO₂ capture sorbents stands as a critical enabling technology for sustainable manufacturing, potentially allowing continued industrial growth while dramatically reducing environmental impact.

The global manufacturing industry currently accounts for approximately 24% of total CO₂ emissions worldwide, making it a critical focus area for carbon reduction strategies. Traditional manufacturing processes, particularly in cement, steel, and chemical production, are inherently carbon-intensive due to both energy requirements and process-related emissions. Without significant intervention, these emissions are projected to increase by 25% by 2050 as global manufacturing output expands.

CO₂ capture sorbents represent a promising technological pathway for emissions reduction in manufacturing contexts. These materials, which can selectively capture CO₂ from industrial exhaust streams, have seen remarkable improvements in capacity, selectivity, and regeneration efficiency. Early sorbents suffered from limited capture capacity and high energy requirements for regeneration, but modern advanced materials such as metal-organic frameworks (MOFs), amine-functionalized silicas, and novel carbon-based sorbents demonstrate significantly enhanced performance metrics.

The primary technical objective in this field is to develop sorbent materials that combine high CO₂ selectivity, rapid adsorption kinetics, and low regeneration energy requirements while maintaining structural stability over thousands of adsorption-desorption cycles. Additionally, these materials must be cost-effective and environmentally benign to enable widespread industrial adoption. Current research aims to achieve capture costs below $40 per ton of CO₂, representing a critical threshold for economic viability.

Beyond technical performance, the strategic objectives of CO₂ capture sorbent development include enabling manufacturing industries to meet increasingly stringent emissions regulations while maintaining economic competitiveness. This technology pathway offers the potential for retrofitting existing manufacturing facilities rather than requiring complete process redesigns, providing a pragmatic transition strategy toward carbon-neutral manufacturing.

The convergence of climate policy pressures, technological advancements in materials science, and industrial sustainability imperatives has created unprecedented momentum in this field. The development of next-generation CO₂ capture sorbents stands as a critical enabling technology for sustainable manufacturing, potentially allowing continued industrial growth while dramatically reducing environmental impact.

Market Demand Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing unprecedented growth, driven by increasing environmental regulations and corporate sustainability commitments. Current market valuations place the carbon capture industry at approximately 2 billion USD in 2023, with projections indicating a compound annual growth rate of 15-20% over the next decade. This rapid expansion reflects the urgent need for effective CO₂ mitigation technologies across manufacturing sectors.

Manufacturing industries, particularly cement, steel, and chemical production, contribute nearly 30% of global carbon emissions. These hard-to-abate sectors face mounting pressure from regulatory frameworks like the EU Emissions Trading System and similar carbon pricing mechanisms emerging in North America and Asia. The implementation of carbon border adjustment mechanisms further intensifies market demand for effective capture solutions.

Consumer preferences are also reshaping market dynamics, with 73% of global consumers expressing willingness to pay premium prices for products manufactured with lower carbon footprints. This consumer-driven demand has created new market segments for "green" manufactured goods, incentivizing industries to adopt carbon capture technologies throughout their production processes.

Sorbent-based carbon capture solutions specifically address a critical market need for cost-effective, energy-efficient carbon management. Traditional carbon capture methods like amine scrubbing impose significant energy penalties of 25-40% on manufacturing processes. Advanced sorbents can potentially reduce this penalty to 15-20%, representing substantial operational savings while meeting emissions targets.

Regional market analysis reveals varying adoption rates, with Europe leading implementation due to stringent regulatory frameworks, followed by North America and rapidly growing interest in Asia-Pacific markets. China's recent five-year plan emphasizes carbon neutrality targets, creating the fastest-growing market for capture technologies with projected investments exceeding 60 billion USD by 2030.

Investment patterns further validate market demand, with venture capital funding for carbon capture startups reaching record levels of 1.9 billion USD in 2022, a 50% increase from the previous year. Corporate strategic investments from manufacturing conglomerates have similarly increased, with major players establishing dedicated carbon management divisions and partnership ecosystems.

The market for CO₂ utilization products represents an additional demand driver, with captured carbon increasingly valued as a feedstock for synthetic fuels, building materials, and chemical precursors. This circular economy approach is creating new value chains and revenue streams that further strengthen the business case for sorbent-based capture technologies in manufacturing settings.

Manufacturing industries, particularly cement, steel, and chemical production, contribute nearly 30% of global carbon emissions. These hard-to-abate sectors face mounting pressure from regulatory frameworks like the EU Emissions Trading System and similar carbon pricing mechanisms emerging in North America and Asia. The implementation of carbon border adjustment mechanisms further intensifies market demand for effective capture solutions.

Consumer preferences are also reshaping market dynamics, with 73% of global consumers expressing willingness to pay premium prices for products manufactured with lower carbon footprints. This consumer-driven demand has created new market segments for "green" manufactured goods, incentivizing industries to adopt carbon capture technologies throughout their production processes.

Sorbent-based carbon capture solutions specifically address a critical market need for cost-effective, energy-efficient carbon management. Traditional carbon capture methods like amine scrubbing impose significant energy penalties of 25-40% on manufacturing processes. Advanced sorbents can potentially reduce this penalty to 15-20%, representing substantial operational savings while meeting emissions targets.

Regional market analysis reveals varying adoption rates, with Europe leading implementation due to stringent regulatory frameworks, followed by North America and rapidly growing interest in Asia-Pacific markets. China's recent five-year plan emphasizes carbon neutrality targets, creating the fastest-growing market for capture technologies with projected investments exceeding 60 billion USD by 2030.

Investment patterns further validate market demand, with venture capital funding for carbon capture startups reaching record levels of 1.9 billion USD in 2022, a 50% increase from the previous year. Corporate strategic investments from manufacturing conglomerates have similarly increased, with major players establishing dedicated carbon management divisions and partnership ecosystems.

The market for CO₂ utilization products represents an additional demand driver, with captured carbon increasingly valued as a feedstock for synthetic fuels, building materials, and chemical precursors. This circular economy approach is creating new value chains and revenue streams that further strengthen the business case for sorbent-based capture technologies in manufacturing settings.

Current State and Challenges in CO2 Sorbent Technology

The global landscape of CO₂ capture sorbent technology has evolved significantly over the past decade, with notable advancements in both developed and emerging economies. Currently, the field encompasses several mature technologies alongside promising experimental approaches. Commercially available sorbents include amine-based solutions, metal-organic frameworks (MOFs), zeolites, and activated carbon materials, each with varying degrees of market penetration and technological readiness.

In the United States and Europe, research institutions and industrial partners have achieved significant breakthroughs in amine-functionalized sorbents, demonstrating capture efficiencies exceeding 90% under controlled conditions. Meanwhile, China has emerged as a leader in scaled implementation, with several large-scale carbon capture facilities utilizing advanced sorbent technologies integrated with manufacturing processes.

Despite these advances, the sector faces substantial technical challenges that impede widespread adoption. Primary among these is the energy penalty associated with sorbent regeneration, which typically consumes 20-30% of a plant's energy output, significantly impacting operational economics. Sorbent degradation remains another critical issue, with most materials showing performance deterioration after multiple capture-release cycles, necessitating frequent replacement and increasing operational costs.

Selectivity limitations present additional complications, particularly in industrial settings where flue gas contains multiple components beyond CO₂. Current sorbents often exhibit reduced efficiency when exposed to contaminants such as SOx and NOx, requiring extensive pre-treatment systems that add complexity and cost to implementation.

Scalability represents perhaps the most formidable barrier to widespread adoption. Laboratory-scale successes frequently encounter difficulties when transitioning to industrial applications, with issues including channeling, pressure drop, and uneven gas distribution compromising performance in large-scale systems.

The geographic distribution of CO₂ sorbent technology development shows concentration in specific innovation hubs. North America leads in fundamental research and patent generation, while East Asia dominates in manufacturing capacity and implementation scale. European entities excel in systems integration and regulatory framework development, creating a complementary but geographically dispersed innovation ecosystem.

Water stability remains an underaddressed challenge, with humidity significantly affecting the performance of many promising sorbent materials. This is particularly problematic for manufacturing facilities in humid regions, where additional dehumidification systems may be required, further increasing complexity and operational costs.

In the United States and Europe, research institutions and industrial partners have achieved significant breakthroughs in amine-functionalized sorbents, demonstrating capture efficiencies exceeding 90% under controlled conditions. Meanwhile, China has emerged as a leader in scaled implementation, with several large-scale carbon capture facilities utilizing advanced sorbent technologies integrated with manufacturing processes.

Despite these advances, the sector faces substantial technical challenges that impede widespread adoption. Primary among these is the energy penalty associated with sorbent regeneration, which typically consumes 20-30% of a plant's energy output, significantly impacting operational economics. Sorbent degradation remains another critical issue, with most materials showing performance deterioration after multiple capture-release cycles, necessitating frequent replacement and increasing operational costs.

Selectivity limitations present additional complications, particularly in industrial settings where flue gas contains multiple components beyond CO₂. Current sorbents often exhibit reduced efficiency when exposed to contaminants such as SOx and NOx, requiring extensive pre-treatment systems that add complexity and cost to implementation.

Scalability represents perhaps the most formidable barrier to widespread adoption. Laboratory-scale successes frequently encounter difficulties when transitioning to industrial applications, with issues including channeling, pressure drop, and uneven gas distribution compromising performance in large-scale systems.

The geographic distribution of CO₂ sorbent technology development shows concentration in specific innovation hubs. North America leads in fundamental research and patent generation, while East Asia dominates in manufacturing capacity and implementation scale. European entities excel in systems integration and regulatory framework development, creating a complementary but geographically dispersed innovation ecosystem.

Water stability remains an underaddressed challenge, with humidity significantly affecting the performance of many promising sorbent materials. This is particularly problematic for manufacturing facilities in humid regions, where additional dehumidification systems may be required, further increasing complexity and operational costs.

Current Sorbent Solutions for Industrial CO2 Capture

01 Metal-organic frameworks (MOFs) for CO₂ capture

Metal-organic frameworks are porous crystalline materials composed of metal ions or clusters coordinated with organic ligands. These materials have high surface areas and tunable pore sizes, making them effective for CO₂ adsorption. MOFs can be designed with specific functional groups to enhance CO₂ selectivity and capacity, and their structure can be modified to improve stability under various operating conditions. These materials show promise for post-combustion carbon capture applications due to their high adsorption capacity and potential for regeneration.- Metal-organic frameworks (MOFs) for CO₂ capture: Metal-organic frameworks are advanced porous materials that can be engineered for selective CO₂ adsorption. These crystalline structures combine metal ions with organic linkers to create highly tunable materials with exceptional surface areas and pore volumes. MOFs can be modified with functional groups to enhance CO₂ binding affinity and selectivity. Their regeneration typically requires less energy compared to traditional sorbents, making them promising candidates for industrial carbon capture applications.

- Amine-functionalized sorbents: Amine-functionalized materials represent a significant class of CO₂ capture sorbents that operate through chemical adsorption mechanisms. These sorbents incorporate various amine groups onto support materials such as silica, polymers, or porous carbons. The amine groups form carbamates or bicarbonates when reacting with CO₂, enabling efficient capture even at low CO₂ concentrations. These materials can be designed with different amine types (primary, secondary, tertiary) to optimize capacity, kinetics, and regeneration energy requirements for specific capture conditions.

- Alkaline earth metal-based CO₂ sorbents: Alkaline earth metal compounds, particularly calcium and magnesium oxides, serve as effective high-temperature CO₂ sorbents. These materials capture CO₂ through carbonation reactions, forming stable carbonates. The process is reversible at elevated temperatures, allowing for sorbent regeneration. These materials are particularly suitable for pre-combustion capture or direct air capture applications. Research focuses on enhancing their cyclic stability, preventing sintering, and improving mechanical properties through various synthesis methods and structural modifications.

- Carbon-based and composite sorbents: Carbon-based materials including activated carbons, carbon nanotubes, and graphene derivatives offer promising CO₂ capture capabilities. These materials can be functionalized or combined with other components to create composite sorbents with enhanced properties. Their high surface area, tunable pore structure, and surface chemistry make them versatile platforms for CO₂ adsorption. Composites may incorporate metal oxides, polymers, or other functional materials to improve selectivity and capacity while maintaining good mechanical and thermal stability for practical applications.

- Regeneration and process integration technologies: Advanced regeneration methods and process integration technologies are critical for practical CO₂ capture systems. These include temperature swing adsorption (TSA), pressure swing adsorption (PSA), vacuum swing adsorption (VSA), and hybrid approaches. Novel heating methods such as microwave, electrical, or steam regeneration can reduce energy penalties. Process intensification strategies integrate capture with other industrial processes to improve overall efficiency. These technologies focus on minimizing energy requirements, reducing equipment footprint, and enabling continuous operation for industrial-scale carbon capture applications.

02 Amine-functionalized sorbents

Amine-functionalized materials are widely used for CO₂ capture due to the strong chemical interaction between amine groups and CO₂ molecules. These sorbents can be prepared by incorporating amine compounds onto various supports such as silica, activated carbon, or polymeric materials. The amine groups react with CO₂ to form carbamates or bicarbonates, enabling efficient capture even at low CO₂ concentrations. These materials can be regenerated through temperature or pressure swing processes, making them suitable for cyclic adsorption-desorption operations in carbon capture systems.Expand Specific Solutions03 Zeolite-based CO₂ capture materials

Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can selectively adsorb CO₂. These materials utilize physical adsorption mechanisms based on molecular sieving effects and electrostatic interactions. Zeolites can be modified by ion exchange or impregnation with various metals to enhance their CO₂ capture performance. They exhibit good thermal stability and can withstand multiple adsorption-desorption cycles, making them attractive for industrial carbon capture applications. Their relatively low cost and established manufacturing processes also contribute to their practical implementation.Expand Specific Solutions04 Calcium-based CO₂ sorbents

Calcium-based materials, particularly calcium oxide (CaO), can capture CO₂ through carbonation reactions to form calcium carbonate (CaCO₃). These sorbents are typically derived from limestone or dolomite and can be regenerated through calcination at high temperatures. Calcium-based sorbents are attractive due to their high theoretical CO₂ capacity, abundance, and low cost. However, they face challenges related to sintering and capacity degradation over multiple cycles. Various approaches to stabilize these materials include doping with metal oxides, creating synthetic supports, or developing novel preparation methods to enhance their cyclic stability and mechanical strength.Expand Specific Solutions05 Novel composite and hybrid CO₂ sorbents

Composite and hybrid sorbents combine different materials to achieve enhanced CO₂ capture performance. These materials integrate the advantages of multiple components, such as the high capacity of amines with the stability of inorganic supports, or the selectivity of MOFs with the mechanical strength of polymers. Hybrid sorbents can be designed to operate effectively under specific conditions, such as high humidity, elevated temperatures, or in the presence of contaminants. These materials often exhibit improved regenerability, selectivity, and stability compared to single-component sorbents, making them promising candidates for next-generation carbon capture technologies.Expand Specific Solutions

Key Industry Players in CO2 Capture Technology

CO₂ capture sorbent technology is emerging as a critical component in sustainable manufacturing, currently in the early growth phase with an estimated market size of $2-3 billion and projected annual growth of 15-20%. The competitive landscape features established energy corporations like Korea Electric Power Corp. and its subsidiaries alongside innovative specialized players such as Climeworks AG and Global Thermostat. Academic institutions including MIT, USC, and Technical University of Denmark are driving fundamental research, while industrial giants like Shell, Rolls-Royce, and Robert Bosch are integrating these technologies into their sustainability strategies. The technology is approaching commercial viability with several demonstration projects operational, though cost-effectiveness at scale remains a challenge for widespread industrial adoption.

Global Thermostat Operations LLC

Technical Solution: Global Thermostat has developed a proprietary Direct Air Capture (DAC) technology that uses low-cost heat as energy input to capture CO₂ directly from the atmosphere. Their system employs novel amine-based sorbents attached to porous honeycomb structures that maximize surface area for CO₂ adsorption. The technology operates in a temperature swing process where ambient air flows through the structures, CO₂ binds to the sorbents, and then low-grade heat (85-100°C) releases the concentrated CO₂ for collection. This approach allows for modular, scalable units that can be deployed at various industrial facilities, utilizing waste heat from manufacturing processes to power the carbon capture system[1][3]. Global Thermostat's technology can capture CO₂ at concentrations ranging from atmospheric levels (400ppm) to higher concentrations in industrial exhaust streams, making it versatile for different manufacturing environments.

Strengths: Ability to utilize low-grade waste heat from industrial processes, reducing operational costs; modular design allows for flexible deployment and scaling; can capture CO₂ from both ambient air and concentrated sources. Weaknesses: Still requires significant energy input despite waste heat utilization; sorbent degradation over time may necessitate replacement; capital costs remain high compared to conventional manufacturing without carbon capture.

Climeworks AG

Technical Solution: Climeworks has pioneered a commercial Direct Air Capture (DAC) technology using a solid sorbent approach specifically designed for sustainable manufacturing integration. Their system employs specialized filters containing a proprietary amine-based sorbent material that selectively captures CO₂ when air passes through collectors. The process operates in cycles where ambient air is drawn through the collectors using fans, CO₂ binds to the sorbent surface, and then heat (around 100°C) is applied to release concentrated CO₂ for collection or utilization. Climeworks' modular "CO₂ collectors" can be stacked and scaled to meet various industrial requirements, with each collector capable of capturing approximately 50 tons of CO₂ annually[2]. The company has demonstrated integration with manufacturing facilities where the captured CO₂ is used as feedstock for synthetic fuels, carbonated beverages, and building materials, creating circular economy opportunities within industrial processes.

Strengths: Highly modular design allows for flexible implementation across different manufacturing scales; proven commercial deployment with multiple operational plants; can utilize renewable energy or waste heat from manufacturing processes. Weaknesses: Energy requirements remain significant at approximately 2000 kWh of heat and 650 kWh of electricity per ton of CO₂ captured; higher operational costs compared to point-source capture technologies; current scale remains limited relative to global manufacturing emissions.

Critical Patents and Research in CO2 Sorbent Development

sorbent

PatentPendingUS20250281904A1

Innovation

- Development of a solid sorbent comprising a silica support with covalently attached secondary amines confined inside its pores, optimized through controlled grafting and polymerization, achieving high amine density and stability.

Carbon capture sorbents with moisture control additives

PatentWO2025165762A1

Innovation

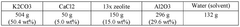

- Sorbent compositions incorporating moisture control additives and a support material, produced via mixing, drying, crushing, and sieving, enable stable carbon capture in humid conditions using a modified temperature swing adsorption process with reduced energy consumption.

Regulatory Framework and Carbon Pricing Mechanisms

The global regulatory landscape for carbon emissions has evolved significantly in recent decades, creating a complex framework that directly impacts CO₂ capture technologies and sustainable manufacturing. The Paris Agreement of 2015 represents a watershed moment, establishing internationally recognized targets for greenhouse gas reduction and creating a foundation for national-level regulatory approaches. Currently, over 70 countries have implemented or scheduled carbon pricing mechanisms, covering approximately 22% of global emissions.

Carbon pricing mechanisms fall into two primary categories: carbon taxes and emissions trading systems (ETS). Carbon taxes directly set a price on carbon emissions, providing a clear cost signal to industries. The European Union's Carbon Border Adjustment Mechanism (CBAM) exemplifies how carbon taxes are evolving to address carbon leakage concerns. Meanwhile, cap-and-trade systems like the EU ETS establish emission allowances that decrease over time, creating market-driven incentives for emission reductions.

These regulatory frameworks significantly influence the economic viability of CO₂ capture sorbent technologies. As carbon prices increase—with projections suggesting prices of $50-100 per ton CO₂ by 2030 in advanced economies—the return on investment for implementing capture technologies improves dramatically. This economic reality transforms CO₂ capture from a purely environmental consideration to a financial imperative for manufacturing operations.

Regional variations in regulatory approaches create a complex landscape for multinational manufacturers. While the EU maintains stringent emissions standards with prices reaching €80-90 per ton, other regions show considerable variation. China's national ETS, launched in 2021, initially focused on the power sector but is expanding to include manufacturing industries. The United States presents a fragmented approach with state-level initiatives like California's cap-and-trade program operating alongside federal tax incentives such as the 45Q tax credit.

Compliance mechanisms and reporting requirements add another layer of complexity. Manufacturers must navigate increasingly sophisticated monitoring, reporting, and verification (MRV) protocols. These systems ensure accountability but also create administrative burdens that CO₂ capture technologies must accommodate through integration with digital monitoring systems.

Looking forward, regulatory frameworks are trending toward greater stringency and broader coverage. The EU's Fit for 55 package aims to reduce emissions by 55% by 2030, while similar ambitious targets are emerging in other jurisdictions. This regulatory trajectory creates both urgency and opportunity for CO₂ capture sorbent technologies, positioning them as essential components in sustainable manufacturing strategies rather than optional additions.

Carbon pricing mechanisms fall into two primary categories: carbon taxes and emissions trading systems (ETS). Carbon taxes directly set a price on carbon emissions, providing a clear cost signal to industries. The European Union's Carbon Border Adjustment Mechanism (CBAM) exemplifies how carbon taxes are evolving to address carbon leakage concerns. Meanwhile, cap-and-trade systems like the EU ETS establish emission allowances that decrease over time, creating market-driven incentives for emission reductions.

These regulatory frameworks significantly influence the economic viability of CO₂ capture sorbent technologies. As carbon prices increase—with projections suggesting prices of $50-100 per ton CO₂ by 2030 in advanced economies—the return on investment for implementing capture technologies improves dramatically. This economic reality transforms CO₂ capture from a purely environmental consideration to a financial imperative for manufacturing operations.

Regional variations in regulatory approaches create a complex landscape for multinational manufacturers. While the EU maintains stringent emissions standards with prices reaching €80-90 per ton, other regions show considerable variation. China's national ETS, launched in 2021, initially focused on the power sector but is expanding to include manufacturing industries. The United States presents a fragmented approach with state-level initiatives like California's cap-and-trade program operating alongside federal tax incentives such as the 45Q tax credit.

Compliance mechanisms and reporting requirements add another layer of complexity. Manufacturers must navigate increasingly sophisticated monitoring, reporting, and verification (MRV) protocols. These systems ensure accountability but also create administrative burdens that CO₂ capture technologies must accommodate through integration with digital monitoring systems.

Looking forward, regulatory frameworks are trending toward greater stringency and broader coverage. The EU's Fit for 55 package aims to reduce emissions by 55% by 2030, while similar ambitious targets are emerging in other jurisdictions. This regulatory trajectory creates both urgency and opportunity for CO₂ capture sorbent technologies, positioning them as essential components in sustainable manufacturing strategies rather than optional additions.

Economic Feasibility and ROI Analysis for Implementation

The implementation of CO₂ capture sorbent technologies in manufacturing settings requires thorough economic analysis to justify investment. Initial capital expenditure for CO₂ capture systems varies significantly based on scale and technology choice, typically ranging from $500,000 for small-scale implementations to over $10 million for large industrial facilities. These systems generally represent 15-25% of total plant modernization costs when integrated into existing manufacturing operations.

Operational expenses must be carefully considered, including sorbent replacement cycles, energy requirements for regeneration processes, and maintenance costs. Current generation sorbent materials demonstrate replacement requirements every 2-3 years, with costs ranging from $200-600 per ton depending on material composition and performance characteristics. Energy consumption for sorbent regeneration typically adds 10-15% to facility energy costs, though this can be partially offset through heat integration strategies.

Return on investment calculations reveal promising economic scenarios, particularly when considering carbon pricing mechanisms. In regions with established carbon markets, manufacturers can achieve ROI periods of 4-7 years at current carbon prices of $40-80 per ton. This timeline shortens considerably in jurisdictions with higher carbon prices or more aggressive regulatory frameworks. Additionally, tax incentives and green manufacturing subsidies available in many industrialized nations can reduce payback periods by 15-30%.

Life cycle cost analysis demonstrates that while initial implementation costs remain significant, the total cost of ownership decreases as technologies mature and economies of scale develop. Current projections indicate a 5-8% annual reduction in implementation costs over the next decade as manufacturing volumes increase and technical innovations improve sorbent performance and durability.

Sensitivity analysis reveals that ROI is most heavily influenced by three factors: carbon price trajectories, energy costs for regeneration, and sorbent longevity. Manufacturers can optimize economic outcomes by selecting sorbent technologies aligned with their specific energy profile and operational patterns. Companies with access to low-cost renewable energy or waste heat streams can significantly improve the economic case for implementation through integrated system design.

Comparative financial modeling against alternative compliance strategies (such as carbon offsets or emissions allowance purchases) increasingly favors direct capture technologies, particularly for facilities with long-term operational horizons exceeding 15 years. This advantage becomes more pronounced under projected regulatory scenarios that anticipate rising carbon prices and tightening emissions standards through 2040.

Operational expenses must be carefully considered, including sorbent replacement cycles, energy requirements for regeneration processes, and maintenance costs. Current generation sorbent materials demonstrate replacement requirements every 2-3 years, with costs ranging from $200-600 per ton depending on material composition and performance characteristics. Energy consumption for sorbent regeneration typically adds 10-15% to facility energy costs, though this can be partially offset through heat integration strategies.

Return on investment calculations reveal promising economic scenarios, particularly when considering carbon pricing mechanisms. In regions with established carbon markets, manufacturers can achieve ROI periods of 4-7 years at current carbon prices of $40-80 per ton. This timeline shortens considerably in jurisdictions with higher carbon prices or more aggressive regulatory frameworks. Additionally, tax incentives and green manufacturing subsidies available in many industrialized nations can reduce payback periods by 15-30%.

Life cycle cost analysis demonstrates that while initial implementation costs remain significant, the total cost of ownership decreases as technologies mature and economies of scale develop. Current projections indicate a 5-8% annual reduction in implementation costs over the next decade as manufacturing volumes increase and technical innovations improve sorbent performance and durability.

Sensitivity analysis reveals that ROI is most heavily influenced by three factors: carbon price trajectories, energy costs for regeneration, and sorbent longevity. Manufacturers can optimize economic outcomes by selecting sorbent technologies aligned with their specific energy profile and operational patterns. Companies with access to low-cost renewable energy or waste heat streams can significantly improve the economic case for implementation through integrated system design.

Comparative financial modeling against alternative compliance strategies (such as carbon offsets or emissions allowance purchases) increasingly favors direct capture technologies, particularly for facilities with long-term operational horizons exceeding 15 years. This advantage becomes more pronounced under projected regulatory scenarios that anticipate rising carbon prices and tightening emissions standards through 2040.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!