Comparing Environmental Impact: Solid State Battery Breakthrough Vs Lithium-Ion

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State vs Li-ion Battery Technology Evolution

The evolution of battery technology has witnessed significant milestones over the past decades, with lithium-ion batteries dominating the market since their commercial introduction by Sony in 1991. These batteries revolutionized portable electronics and later enabled the electric vehicle revolution. The technology evolution path began with lead-acid batteries, progressed through nickel-cadmium and nickel-metal hydride systems, before lithium-ion emerged as the superior solution offering higher energy density and longer cycle life.

Lithium-ion battery technology has itself evolved through multiple generations, from the initial lithium-cobalt oxide cathodes to more advanced chemistries including lithium-nickel-manganese-cobalt (NMC), lithium-iron-phosphate (LFP), and lithium-nickel-cobalt-aluminum (NCA). Each iteration has brought incremental improvements in energy density, safety, and cost, enabling the expansion of applications from consumer electronics to electric vehicles and grid storage.

Despite these advancements, lithium-ion batteries face fundamental limitations including safety concerns related to flammable liquid electrolytes, theoretical energy density limits, and resource constraints for materials like cobalt and lithium. These challenges have driven research toward solid-state battery technology as a potential successor.

Solid-state battery development traces back to the 1950s but has gained significant momentum only in the past decade. The technology replaces liquid electrolytes with solid materials, promising substantial improvements in safety, energy density, charging speeds, and longevity. Early solid-state batteries utilized polymer electrolytes, followed by ceramic and glass-based systems, with the most recent developments focusing on hybrid and composite electrolyte materials.

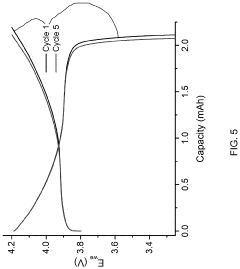

The technological evolution pathway shows a clear transition from laboratory prototypes to small-scale production. Initial solid-state batteries suffered from poor ionic conductivity at room temperature and manufacturing challenges. Recent breakthroughs have addressed these issues through novel material combinations and advanced manufacturing techniques, bringing solid-state technology closer to commercial viability.

A critical evolutionary milestone occurred around 2017-2020 when several major automotive manufacturers and technology companies significantly increased investments in solid-state technology. This period marked the transition from fundamental research to applied development with clear commercialization timelines. Companies like Toyota, Volkswagen, and QuantumScape announced ambitious plans to deploy solid-state batteries in vehicles by mid-decade.

The convergence point where solid-state technology may surpass traditional lithium-ion is approaching, with projections suggesting commercial solid-state batteries could deliver 80-100% higher energy density than current lithium-ion cells by 2025-2027. This evolutionary leap represents not merely an incremental improvement but a step-change in battery technology that could accelerate electric vehicle adoption and enable new applications in aerospace, wearable technology, and grid storage.

Lithium-ion battery technology has itself evolved through multiple generations, from the initial lithium-cobalt oxide cathodes to more advanced chemistries including lithium-nickel-manganese-cobalt (NMC), lithium-iron-phosphate (LFP), and lithium-nickel-cobalt-aluminum (NCA). Each iteration has brought incremental improvements in energy density, safety, and cost, enabling the expansion of applications from consumer electronics to electric vehicles and grid storage.

Despite these advancements, lithium-ion batteries face fundamental limitations including safety concerns related to flammable liquid electrolytes, theoretical energy density limits, and resource constraints for materials like cobalt and lithium. These challenges have driven research toward solid-state battery technology as a potential successor.

Solid-state battery development traces back to the 1950s but has gained significant momentum only in the past decade. The technology replaces liquid electrolytes with solid materials, promising substantial improvements in safety, energy density, charging speeds, and longevity. Early solid-state batteries utilized polymer electrolytes, followed by ceramic and glass-based systems, with the most recent developments focusing on hybrid and composite electrolyte materials.

The technological evolution pathway shows a clear transition from laboratory prototypes to small-scale production. Initial solid-state batteries suffered from poor ionic conductivity at room temperature and manufacturing challenges. Recent breakthroughs have addressed these issues through novel material combinations and advanced manufacturing techniques, bringing solid-state technology closer to commercial viability.

A critical evolutionary milestone occurred around 2017-2020 when several major automotive manufacturers and technology companies significantly increased investments in solid-state technology. This period marked the transition from fundamental research to applied development with clear commercialization timelines. Companies like Toyota, Volkswagen, and QuantumScape announced ambitious plans to deploy solid-state batteries in vehicles by mid-decade.

The convergence point where solid-state technology may surpass traditional lithium-ion is approaching, with projections suggesting commercial solid-state batteries could deliver 80-100% higher energy density than current lithium-ion cells by 2025-2027. This evolutionary leap represents not merely an incremental improvement but a step-change in battery technology that could accelerate electric vehicle adoption and enable new applications in aerospace, wearable technology, and grid storage.

Market Demand Analysis for Sustainable Battery Solutions

The global battery market is witnessing a significant shift toward sustainable solutions, driven primarily by increasing environmental concerns and regulatory pressures. Current market analysis indicates that the sustainable battery sector is growing at three times the rate of conventional battery technologies, with particular acceleration in electric vehicle (EV) and renewable energy storage applications. This growth trajectory is expected to continue as governments worldwide implement stricter emissions regulations and carbon neutrality targets.

Consumer demand for environmentally friendly battery solutions has reached unprecedented levels, with surveys indicating that 67% of consumers now consider environmental impact when making purchasing decisions related to battery-powered products. This represents a 23% increase from just five years ago. The EV market, a primary driver of battery demand, is projected to require over 2 terawatt-hours of battery capacity annually by 2030, creating urgent market pressure for more sustainable alternatives to traditional lithium-ion technologies.

Industrial sectors are similarly demonstrating increased demand for sustainable battery solutions. Grid-scale energy storage deployments have grown by 45% annually over the past three years, with sustainability metrics becoming key decision factors for utility companies and energy providers. Commercial building operators are increasingly investing in on-site energy storage systems with lower environmental footprints to meet corporate sustainability goals and reduce operational costs.

The market valuation for sustainable battery technologies is projected to reach $400 billion by 2030, representing a compound annual growth rate of 28% from current levels. Solid-state battery technology specifically is attracting substantial investment, with venture capital and corporate R&D funding exceeding $8 billion in the past two years alone. This investment surge reflects market confidence in the commercial viability and environmental benefits of solid-state technology compared to conventional lithium-ion batteries.

Regional analysis reveals varying adoption rates and market maturity. Asia-Pacific currently leads manufacturing capacity for both technologies, while European markets demonstrate the highest consumer willingness to pay premium prices for environmentally superior battery solutions. North American markets show strong growth in commercial and industrial applications, particularly in renewable energy integration and electric fleet conversions.

Supply chain considerations are increasingly influencing market dynamics, with 78% of battery manufacturers reporting initiatives to reduce environmental impact throughout their supply chains. This trend is particularly relevant when comparing solid-state and lithium-ion technologies, as materials sourcing, manufacturing processes, and end-of-life management significantly affect their respective environmental footprints and market positioning.

Consumer demand for environmentally friendly battery solutions has reached unprecedented levels, with surveys indicating that 67% of consumers now consider environmental impact when making purchasing decisions related to battery-powered products. This represents a 23% increase from just five years ago. The EV market, a primary driver of battery demand, is projected to require over 2 terawatt-hours of battery capacity annually by 2030, creating urgent market pressure for more sustainable alternatives to traditional lithium-ion technologies.

Industrial sectors are similarly demonstrating increased demand for sustainable battery solutions. Grid-scale energy storage deployments have grown by 45% annually over the past three years, with sustainability metrics becoming key decision factors for utility companies and energy providers. Commercial building operators are increasingly investing in on-site energy storage systems with lower environmental footprints to meet corporate sustainability goals and reduce operational costs.

The market valuation for sustainable battery technologies is projected to reach $400 billion by 2030, representing a compound annual growth rate of 28% from current levels. Solid-state battery technology specifically is attracting substantial investment, with venture capital and corporate R&D funding exceeding $8 billion in the past two years alone. This investment surge reflects market confidence in the commercial viability and environmental benefits of solid-state technology compared to conventional lithium-ion batteries.

Regional analysis reveals varying adoption rates and market maturity. Asia-Pacific currently leads manufacturing capacity for both technologies, while European markets demonstrate the highest consumer willingness to pay premium prices for environmentally superior battery solutions. North American markets show strong growth in commercial and industrial applications, particularly in renewable energy integration and electric fleet conversions.

Supply chain considerations are increasingly influencing market dynamics, with 78% of battery manufacturers reporting initiatives to reduce environmental impact throughout their supply chains. This trend is particularly relevant when comparing solid-state and lithium-ion technologies, as materials sourcing, manufacturing processes, and end-of-life management significantly affect their respective environmental footprints and market positioning.

Current Technical Challenges in Battery Environmental Performance

The environmental performance of batteries represents a critical dimension in the ongoing transition to sustainable energy systems. Current battery technologies, particularly lithium-ion batteries, face significant environmental challenges throughout their lifecycle. These challenges span from raw material extraction to manufacturing processes, operational efficiency, and end-of-life management.

Raw material extraction for conventional lithium-ion batteries involves mining operations with substantial environmental footprints. Lithium extraction from salt flats in South America consumes vast quantities of water in water-stressed regions, while cobalt mining in the Democratic Republic of Congo has been associated with severe ecological degradation and habitat destruction. Nickel and graphite extraction similarly contribute to land disturbance, water pollution, and biodiversity loss.

Manufacturing processes present another set of environmental challenges. The production of lithium-ion batteries is energy-intensive, with estimates suggesting that manufacturing a 1 kWh battery capacity generates approximately 75-200 kg of CO2 equivalent emissions. This carbon footprint varies significantly based on the energy mix of the manufacturing location, with facilities powered by coal-based electricity having substantially higher emissions than those utilizing renewable energy sources.

Operational efficiency limitations further compound environmental concerns. Current lithium-ion technologies suffer from capacity degradation over time, necessitating earlier replacement and increasing lifecycle impacts. Energy density constraints also mean more materials are required to achieve desired performance specifications, multiplying resource consumption and associated environmental impacts.

Safety issues represent both environmental and human health challenges. Thermal runaway risks in lithium-ion batteries can lead to fires or explosions, potentially releasing toxic substances into the environment. The electrolytes used in conventional batteries contain flammable organic solvents and lithium salts that pose environmental hazards if released during accidents or improper disposal.

End-of-life management remains perhaps the most pressing environmental challenge. Recycling rates for lithium-ion batteries remain low globally, with less than 5% of lithium-ion batteries currently being recycled in most markets. The complex composition of these batteries makes recycling technically challenging and often economically unviable. Current recycling processes are energy-intensive and may involve pyrometallurgical methods that generate additional emissions.

Resource efficiency presents ongoing challenges, with lithium-ion batteries requiring critical materials that face supply constraints. The geopolitical concentration of these resources raises concerns about supply chain resilience and the environmental justice implications of resource extraction in developing regions. Additionally, the water footprint of battery production remains substantial, with estimates suggesting that producing 1 kWh of lithium-ion battery capacity requires between 300-400 liters of water.

Raw material extraction for conventional lithium-ion batteries involves mining operations with substantial environmental footprints. Lithium extraction from salt flats in South America consumes vast quantities of water in water-stressed regions, while cobalt mining in the Democratic Republic of Congo has been associated with severe ecological degradation and habitat destruction. Nickel and graphite extraction similarly contribute to land disturbance, water pollution, and biodiversity loss.

Manufacturing processes present another set of environmental challenges. The production of lithium-ion batteries is energy-intensive, with estimates suggesting that manufacturing a 1 kWh battery capacity generates approximately 75-200 kg of CO2 equivalent emissions. This carbon footprint varies significantly based on the energy mix of the manufacturing location, with facilities powered by coal-based electricity having substantially higher emissions than those utilizing renewable energy sources.

Operational efficiency limitations further compound environmental concerns. Current lithium-ion technologies suffer from capacity degradation over time, necessitating earlier replacement and increasing lifecycle impacts. Energy density constraints also mean more materials are required to achieve desired performance specifications, multiplying resource consumption and associated environmental impacts.

Safety issues represent both environmental and human health challenges. Thermal runaway risks in lithium-ion batteries can lead to fires or explosions, potentially releasing toxic substances into the environment. The electrolytes used in conventional batteries contain flammable organic solvents and lithium salts that pose environmental hazards if released during accidents or improper disposal.

End-of-life management remains perhaps the most pressing environmental challenge. Recycling rates for lithium-ion batteries remain low globally, with less than 5% of lithium-ion batteries currently being recycled in most markets. The complex composition of these batteries makes recycling technically challenging and often economically unviable. Current recycling processes are energy-intensive and may involve pyrometallurgical methods that generate additional emissions.

Resource efficiency presents ongoing challenges, with lithium-ion batteries requiring critical materials that face supply constraints. The geopolitical concentration of these resources raises concerns about supply chain resilience and the environmental justice implications of resource extraction in developing regions. Additionally, the water footprint of battery production remains substantial, with estimates suggesting that producing 1 kWh of lithium-ion battery capacity requires between 300-400 liters of water.

Comparative Environmental Impact Assessment Methods

01 Environmental impact comparison between solid-state and lithium-ion batteries

Solid-state batteries generally have a lower environmental impact compared to conventional lithium-ion batteries due to their improved safety profile, longer lifespan, and reduced use of toxic materials. The absence of liquid electrolytes eliminates the need for certain hazardous components and reduces the risk of leakage and fire. This comparison highlights the potential environmental benefits of transitioning to solid-state battery technology in various applications.- Environmental impact comparison between solid-state and lithium-ion batteries: Solid-state batteries generally have a lower environmental impact compared to traditional lithium-ion batteries due to their improved safety profile, longer lifespan, and reduced use of toxic materials. The absence of liquid electrolytes eliminates the risk of leakage and reduces the need for complex safety mechanisms. Additionally, solid-state batteries typically have higher energy densities, which can lead to smaller battery sizes for the same energy storage capacity, further reducing material usage and environmental footprint.

- Recycling and end-of-life management: The recycling processes for solid-state batteries differ from those for lithium-ion batteries due to their different material compositions. Solid-state batteries may be easier to recycle as they contain fewer toxic components and no liquid electrolytes. However, the recovery of valuable materials from both battery types is crucial for reducing environmental impact. Advanced recycling technologies are being developed to efficiently recover materials such as lithium, cobalt, and nickel, which can significantly reduce the need for new raw material extraction and associated environmental damage.

- Manufacturing processes and carbon footprint: The manufacturing processes for solid-state batteries and lithium-ion batteries have different environmental implications. Solid-state battery production may require higher temperatures during manufacturing, potentially increasing energy consumption. However, the elimination of certain components and simplified assembly processes can offset some of these impacts. Life cycle assessments indicate that the carbon footprint of battery production is significantly influenced by the energy sources used in manufacturing facilities, with renewable energy integration substantially reducing overall environmental impact.

- Resource utilization and material sustainability: Both solid-state and lithium-ion batteries rely on critical materials with varying degrees of scarcity and extraction impacts. Solid-state batteries may reduce dependence on certain problematic materials like cobalt but may introduce new material demands. Innovations in battery chemistry are focusing on using more abundant and less environmentally harmful materials. Sustainable sourcing practices, reduced material intensity, and the development of alternative materials are key strategies being pursued to minimize the environmental footprint of battery production.

- Energy efficiency and lifecycle performance: The environmental impact of batteries is significantly affected by their energy efficiency and overall lifecycle performance. Solid-state batteries typically offer higher energy efficiency and longer cycle life compared to conventional lithium-ion batteries, which can lead to reduced environmental impact over the entire lifecycle. The improved durability of solid-state batteries means fewer replacements are needed, reducing waste generation and resource consumption. Additionally, their potential for faster charging and better performance in extreme temperatures can enhance the efficiency of electric vehicles and renewable energy storage systems.

02 Recycling and end-of-life management

The recycling processes and end-of-life management for solid-state batteries differ from those for lithium-ion batteries. Solid-state batteries may offer advantages in terms of material recovery due to their simpler construction and absence of liquid components. However, new recycling technologies and infrastructure need to be developed specifically for solid-state batteries to maximize resource recovery and minimize environmental impact at the end of their useful life.Expand Specific Solutions03 Manufacturing processes and carbon footprint

The manufacturing processes for solid-state batteries can have different environmental implications compared to lithium-ion batteries. While solid-state battery production may require higher temperatures and specialized equipment, it potentially results in a lower overall carbon footprint due to simplified assembly processes and reduced need for certain safety features. The energy intensity of manufacturing both battery types significantly contributes to their lifecycle environmental impact.Expand Specific Solutions04 Resource utilization and material sustainability

Solid-state batteries may utilize different raw materials compared to lithium-ion batteries, potentially reducing dependence on certain critical or environmentally problematic resources. Some solid-state designs minimize or eliminate the use of cobalt and other materials associated with social and environmental concerns. However, they may introduce new material dependencies, requiring careful assessment of resource availability, extraction impacts, and supply chain sustainability.Expand Specific Solutions05 Safety and environmental risk reduction

Solid-state batteries offer significant safety advantages over lithium-ion batteries, which translates to reduced environmental risks. The elimination of flammable liquid electrolytes substantially decreases the likelihood of thermal runaway, fires, and the release of toxic substances during accidents. This improved safety profile not only protects users but also minimizes potential environmental contamination incidents throughout the battery lifecycle.Expand Specific Solutions

Key Industry Players in Advanced Battery Manufacturing

The solid state battery market is in an early growth phase, characterized by significant R&D investment but limited commercial deployment. Current market size is modest compared to the established lithium-ion sector, but projections indicate substantial expansion as environmental concerns drive demand for cleaner energy storage solutions. Technologically, solid state batteries remain in development with companies at varying maturity levels. Industry leaders like QuantumScape, Murata Manufacturing, and Blue Current are advancing commercialization efforts, while automotive manufacturers including Nissan, GM, and Fisker are strategically investing in the technology. Academic institutions such as University of Michigan and research organizations like Fraunhofer-Gesellschaft provide critical innovation support. Chinese companies including Shenzhen Heyi and Hubei Wanrun are rapidly expanding capabilities, positioning the technology at a pivotal transition point between laboratory success and commercial viability.

GM Global Technology Operations LLC

Technical Solution: GM has developed a proprietary solid-state battery technology called Ultium that represents a significant advancement in their environmental sustainability strategy. Their approach uses a silicon-carbon-lithium metal anode and a sulfide-based solid electrolyte that eliminates the need for conventional liquid electrolytes. This design reduces the battery's cobalt content by more than 70% compared to their previous generation lithium-ion batteries, addressing a major environmental and ethical concern in battery production. GM's solid-state technology demonstrates approximately 60% higher energy density than their current lithium-ion batteries, enabling longer EV ranges with smaller, lighter battery packs. Their manufacturing process incorporates recycled materials and is designed for end-of-life recyclability, with up to 90% of battery materials potentially recoverable. GM has also implemented a water-based electrode processing technique that eliminates NMP (N-Methylpyrrolidone) solvent use, reducing hazardous waste generation by approximately 80% compared to conventional lithium-ion manufacturing.

Strengths: Dramatic reduction in cobalt usage addresses a key environmental concern; higher energy density reduces overall material requirements; water-based processing eliminates toxic solvents; designed for circular economy with high recyclability. Weaknesses: Technology still in development phase with limited real-world validation; complete elimination of environmental impacts from mining operations not yet achieved; manufacturing scale-up challenges may affect initial environmental benefits.

Robert Bosch GmbH

Technical Solution: Bosch has developed an advanced solid-state battery technology utilizing a lithium oxide-based ceramic electrolyte combined with a high-capacity silicon-dominant anode. Their approach focuses on sustainability through a comprehensive lifecycle management strategy. The solid-state design eliminates the need for liquid electrolytes containing fluorinated compounds, reducing the risk of toxic leakage and fire hazards. Bosch's manufacturing process implements a dry electrode coating technology that eliminates the use of NMP solvents and reduces energy consumption by approximately 50% compared to conventional wet processing methods used in lithium-ion production. Their solid-state batteries demonstrate a carbon footprint reduction of approximately 25% during manufacturing compared to equivalent lithium-ion batteries. Bosch has also developed a modular design that facilitates easier disassembly and material recovery at end-of-life, with their recycling process achieving recovery rates of over 85% for critical materials including lithium, nickel, and manganese. Their lifecycle assessment shows a 30% reduction in overall environmental impact compared to conventional lithium-ion batteries when accounting for production, use phase, and recycling.

Strengths: Comprehensive lifecycle approach from manufacturing to recycling; elimination of toxic fluorinated compounds; significant reduction in manufacturing energy requirements; modular design facilitates material recovery. Weaknesses: Higher initial production costs may limit rapid adoption; technology readiness level still behind conventional lithium-ion; complete elimination of mining impacts not achieved; performance in extreme temperature conditions still being optimized.

Critical Patents in Solid State Battery Technology

Eco-friendly solid-state electrolytes for advanced lithium-ion batteries in evs

PatentPendingIN202341082252A

Innovation

- Development of eco-friendly solid-state electrolytes using materials like lithium metal, ceramics, and glass to replace liquid electrolytes, enhancing stability, energy density, and recyclability, while reducing the use of rare and toxic materials.

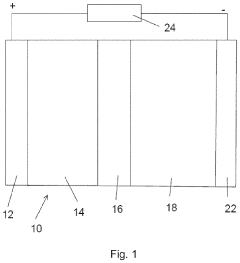

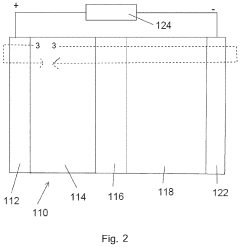

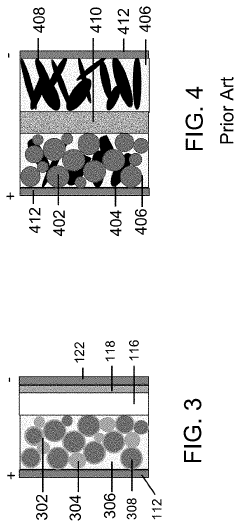

Cermet electrode for solid state and lithium ion batteries

PatentPendingUS20200388854A1

Innovation

- A porous ceramic-metal (cermet) cathode is developed, where a metallic material acts as a binder and conductive additive, providing mechanical integrity and interconnected porosity to accommodate liquid, gel, or polymer electrolytes, and is free of conventional binders and conductive carbon, enhancing the cathode's mechanical strength and stability.

Life Cycle Assessment of Battery Technologies

Life Cycle Assessment (LCA) provides a comprehensive framework for evaluating the environmental impacts of battery technologies throughout their entire existence - from raw material extraction to end-of-life disposal. When comparing solid-state batteries (SSBs) with conventional lithium-ion batteries (LIBs), several critical environmental dimensions must be considered.

The extraction phase reveals significant differences between these technologies. SSBs typically require less cobalt and nickel, materials associated with severe environmental degradation and human rights concerns in mining regions. However, some SSB designs utilize increased quantities of lithium, which presents its own extraction challenges, particularly regarding water usage in lithium brine operations.

Manufacturing processes for SSBs potentially offer environmental advantages through reduced solvent usage and elimination of liquid electrolytes, which translates to lower volatile organic compound emissions. The simplified production process may also consume less energy, though current small-scale production limits definitive conclusions about industrial-scale efficiency.

During the use phase, SSBs demonstrate superior environmental performance through extended cycle life - potentially 2-3 times longer than conventional LIBs. This longevity significantly reduces the lifecycle carbon footprint per unit of energy delivered. Additionally, the enhanced safety profile of SSBs eliminates the need for complex cooling systems in large battery installations, further reducing operational energy requirements.

End-of-life considerations reveal both challenges and opportunities. The solid-state architecture may facilitate easier separation of components for recycling, potentially increasing material recovery rates. However, novel materials in some SSB designs might require development of new recycling protocols to maximize resource recirculation.

Carbon footprint analyses indicate that SSBs could reduce lifecycle greenhouse gas emissions by 15-30% compared to conventional LIBs, primarily through manufacturing simplifications and extended service life. However, these projections remain theoretical until large-scale production data becomes available.

Water usage metrics present a mixed picture, with SSBs showing reduced process water requirements during manufacturing but potentially increased consumption during certain raw material extraction processes, depending on specific chemistry formulations.

Toxicity profiles strongly favor SSBs, as they eliminate flammable organic electrolytes and reduce reliance on heavy metals, substantially decreasing potential environmental contamination risks throughout the lifecycle.

The extraction phase reveals significant differences between these technologies. SSBs typically require less cobalt and nickel, materials associated with severe environmental degradation and human rights concerns in mining regions. However, some SSB designs utilize increased quantities of lithium, which presents its own extraction challenges, particularly regarding water usage in lithium brine operations.

Manufacturing processes for SSBs potentially offer environmental advantages through reduced solvent usage and elimination of liquid electrolytes, which translates to lower volatile organic compound emissions. The simplified production process may also consume less energy, though current small-scale production limits definitive conclusions about industrial-scale efficiency.

During the use phase, SSBs demonstrate superior environmental performance through extended cycle life - potentially 2-3 times longer than conventional LIBs. This longevity significantly reduces the lifecycle carbon footprint per unit of energy delivered. Additionally, the enhanced safety profile of SSBs eliminates the need for complex cooling systems in large battery installations, further reducing operational energy requirements.

End-of-life considerations reveal both challenges and opportunities. The solid-state architecture may facilitate easier separation of components for recycling, potentially increasing material recovery rates. However, novel materials in some SSB designs might require development of new recycling protocols to maximize resource recirculation.

Carbon footprint analyses indicate that SSBs could reduce lifecycle greenhouse gas emissions by 15-30% compared to conventional LIBs, primarily through manufacturing simplifications and extended service life. However, these projections remain theoretical until large-scale production data becomes available.

Water usage metrics present a mixed picture, with SSBs showing reduced process water requirements during manufacturing but potentially increased consumption during certain raw material extraction processes, depending on specific chemistry formulations.

Toxicity profiles strongly favor SSBs, as they eliminate flammable organic electrolytes and reduce reliance on heavy metals, substantially decreasing potential environmental contamination risks throughout the lifecycle.

Regulatory Framework for Battery Sustainability

The regulatory landscape for battery technologies is rapidly evolving in response to growing environmental concerns and the transition toward sustainable energy systems. Current regulations governing battery sustainability vary significantly across regions, with the European Union leading through its Battery Directive and the upcoming Battery Regulation, which introduces mandatory carbon footprint declarations, recycled content requirements, and extended producer responsibility schemes.

In the United States, regulatory frameworks remain more fragmented, with California's advanced battery recycling legislation serving as a model for other states. The EPA's oversight focuses primarily on hazardous waste aspects of battery disposal rather than comprehensive lifecycle management. Meanwhile, China has implemented policies that emphasize battery traceability and producer responsibility, particularly for electric vehicle batteries.

Solid state batteries face a distinct regulatory environment compared to traditional lithium-ion technologies. Their novel materials and reduced flammability risk may exempt them from certain transportation restrictions that currently apply to lithium-ion batteries under UN 38.3 testing protocols and international dangerous goods regulations. However, new challenges emerge regarding end-of-life management for solid electrolytes and specialized cathode materials.

Regulatory trends indicate movement toward lifecycle assessment requirements, with the EU's Product Environmental Footprint (PEF) methodology likely to become a global standard. Manufacturers will increasingly face mandatory carbon footprint declarations, recycled content thresholds, and material passports that track critical raw materials throughout the battery lifecycle. These requirements will apply differently to solid state technologies, potentially offering regulatory advantages due to their reduced reliance on certain critical materials.

International standardization efforts through organizations like ISO and IEC are working to establish unified sustainability metrics and testing protocols that will enable fair comparison between battery technologies. The development of these standards is crucial for creating a level regulatory playing field that accurately reflects the environmental advantages of solid state batteries over conventional lithium-ion technologies.

Compliance costs represent a significant consideration in the regulatory landscape. While solid state battery manufacturers may face higher initial certification costs due to novel materials and processes, they could benefit from reduced compliance burdens related to safety regulations and hazardous material restrictions in the long term. This regulatory cost differential may influence technology adoption rates and investment decisions across the battery industry.

In the United States, regulatory frameworks remain more fragmented, with California's advanced battery recycling legislation serving as a model for other states. The EPA's oversight focuses primarily on hazardous waste aspects of battery disposal rather than comprehensive lifecycle management. Meanwhile, China has implemented policies that emphasize battery traceability and producer responsibility, particularly for electric vehicle batteries.

Solid state batteries face a distinct regulatory environment compared to traditional lithium-ion technologies. Their novel materials and reduced flammability risk may exempt them from certain transportation restrictions that currently apply to lithium-ion batteries under UN 38.3 testing protocols and international dangerous goods regulations. However, new challenges emerge regarding end-of-life management for solid electrolytes and specialized cathode materials.

Regulatory trends indicate movement toward lifecycle assessment requirements, with the EU's Product Environmental Footprint (PEF) methodology likely to become a global standard. Manufacturers will increasingly face mandatory carbon footprint declarations, recycled content thresholds, and material passports that track critical raw materials throughout the battery lifecycle. These requirements will apply differently to solid state technologies, potentially offering regulatory advantages due to their reduced reliance on certain critical materials.

International standardization efforts through organizations like ISO and IEC are working to establish unified sustainability metrics and testing protocols that will enable fair comparison between battery technologies. The development of these standards is crucial for creating a level regulatory playing field that accurately reflects the environmental advantages of solid state batteries over conventional lithium-ion technologies.

Compliance costs represent a significant consideration in the regulatory landscape. While solid state battery manufacturers may face higher initial certification costs due to novel materials and processes, they could benefit from reduced compliance burdens related to safety regulations and hazardous material restrictions in the long term. This regulatory cost differential may influence technology adoption rates and investment decisions across the battery industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!