Solid State Battery Breakthrough: Applications and Strategic Insights

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Evolution and Objectives

Solid state batteries represent a revolutionary advancement in energy storage technology, evolving from traditional lithium-ion batteries that use liquid electrolytes. The development trajectory began in the 1970s with initial research into solid electrolytes, but significant progress has only materialized in the past decade due to breakthroughs in material science and manufacturing techniques.

The evolution of solid state battery technology has been driven by increasing demands for higher energy density, improved safety, and longer lifespan in energy storage solutions. Early iterations faced substantial challenges in ion conductivity and interface stability, limiting their practical applications. However, recent advancements in ceramic and polymer-based solid electrolytes have dramatically improved performance metrics, bringing this technology closer to commercial viability.

Current technological trends indicate a convergence toward hybrid solid electrolyte systems that combine the advantages of different materials to optimize overall battery performance. The integration of nanomaterials and advanced manufacturing processes has further accelerated development, enabling thinner electrolyte layers and more efficient ion transport mechanisms.

The primary technical objectives for solid state battery development include achieving energy densities exceeding 500 Wh/kg, extending cycle life beyond 1,000 full charge-discharge cycles, and reducing charging times to under 15 minutes. Additionally, there is a focused effort to develop manufacturing processes that can scale economically to meet projected market demand, particularly in the automotive and consumer electronics sectors.

Safety enhancement represents another critical objective, with solid state technology promising to eliminate the thermal runaway risks associated with conventional lithium-ion batteries. This aspect has gained particular importance as energy storage requirements increase across various applications, from electric vehicles to grid-scale storage systems.

Temperature stability constitutes a significant technical goal, with researchers aiming to develop solid state batteries that maintain consistent performance across a wider operating temperature range (-20°C to 80°C) than current technologies permit. This would substantially expand the application potential in extreme environments and diverse geographical regions.

The roadmap for solid state battery evolution also includes sustainability objectives, focusing on reducing dependence on rare earth materials and developing recycling-friendly designs. These environmental considerations align with global trends toward greener technologies and circular economy principles in manufacturing.

As the technology continues to mature, the ultimate objective is to establish solid state batteries as the dominant energy storage solution across multiple industries, displacing conventional lithium-ion technology through superior performance, safety, and longevity characteristics.

The evolution of solid state battery technology has been driven by increasing demands for higher energy density, improved safety, and longer lifespan in energy storage solutions. Early iterations faced substantial challenges in ion conductivity and interface stability, limiting their practical applications. However, recent advancements in ceramic and polymer-based solid electrolytes have dramatically improved performance metrics, bringing this technology closer to commercial viability.

Current technological trends indicate a convergence toward hybrid solid electrolyte systems that combine the advantages of different materials to optimize overall battery performance. The integration of nanomaterials and advanced manufacturing processes has further accelerated development, enabling thinner electrolyte layers and more efficient ion transport mechanisms.

The primary technical objectives for solid state battery development include achieving energy densities exceeding 500 Wh/kg, extending cycle life beyond 1,000 full charge-discharge cycles, and reducing charging times to under 15 minutes. Additionally, there is a focused effort to develop manufacturing processes that can scale economically to meet projected market demand, particularly in the automotive and consumer electronics sectors.

Safety enhancement represents another critical objective, with solid state technology promising to eliminate the thermal runaway risks associated with conventional lithium-ion batteries. This aspect has gained particular importance as energy storage requirements increase across various applications, from electric vehicles to grid-scale storage systems.

Temperature stability constitutes a significant technical goal, with researchers aiming to develop solid state batteries that maintain consistent performance across a wider operating temperature range (-20°C to 80°C) than current technologies permit. This would substantially expand the application potential in extreme environments and diverse geographical regions.

The roadmap for solid state battery evolution also includes sustainability objectives, focusing on reducing dependence on rare earth materials and developing recycling-friendly designs. These environmental considerations align with global trends toward greener technologies and circular economy principles in manufacturing.

As the technology continues to mature, the ultimate objective is to establish solid state batteries as the dominant energy storage solution across multiple industries, displacing conventional lithium-ion technology through superior performance, safety, and longevity characteristics.

Market Demand Analysis for Solid State Batteries

The global market for solid-state batteries is experiencing unprecedented growth, driven by increasing demand for safer, higher-capacity energy storage solutions across multiple industries. Current market projections indicate that the solid-state battery market will expand at a compound annual growth rate of 34.2% from 2023 to 2030, potentially reaching a market value of $14.9 billion by 2030. This remarkable growth trajectory reflects the substantial market pull for advanced battery technologies that overcome the limitations of conventional lithium-ion batteries.

The electric vehicle (EV) sector represents the primary demand driver, accounting for approximately 60% of the projected market for solid-state batteries. Major automotive manufacturers including Toyota, Volkswagen, and BMW have announced significant investments in solid-state battery technology, recognizing its potential to address range anxiety and safety concerns that currently limit EV adoption. Consumer surveys indicate that 78% of potential EV buyers cite battery range as their top concern, while 65% express safety worries related to conventional lithium-ion batteries.

Consumer electronics constitutes the second-largest market segment, with manufacturers seeking batteries that offer higher energy density, faster charging capabilities, and improved safety profiles. The demand for longer-lasting, more compact power sources in smartphones, laptops, and wearable devices continues to grow as consumers increasingly rely on portable technology in daily life.

The aerospace and defense sectors are emerging as significant market drivers, particularly for applications requiring extreme temperature tolerance and enhanced safety. Military and space applications demand batteries that can perform reliably under harsh conditions while minimizing risk of thermal runaway or combustion.

Grid-scale energy storage represents another expanding market opportunity, with utility companies seeking advanced battery solutions to complement renewable energy installations. The intermittent nature of solar and wind power generation necessitates efficient, large-scale energy storage systems, creating substantial demand for next-generation battery technologies.

Regional analysis reveals that Asia-Pacific currently leads in market demand, with Japan and South Korea at the forefront of solid-state battery development and commercialization. North America and Europe follow closely, with significant research initiatives and strategic investments aimed at establishing domestic supply chains for advanced battery technologies.

Market research indicates that consumers and industrial buyers are willing to pay a premium of 15-25% for solid-state batteries compared to conventional lithium-ion alternatives, provided they deliver on promises of improved safety, longer lifespan, and enhanced performance. This price tolerance is expected to improve as manufacturing scales and production costs decrease, further accelerating market adoption across multiple sectors.

The electric vehicle (EV) sector represents the primary demand driver, accounting for approximately 60% of the projected market for solid-state batteries. Major automotive manufacturers including Toyota, Volkswagen, and BMW have announced significant investments in solid-state battery technology, recognizing its potential to address range anxiety and safety concerns that currently limit EV adoption. Consumer surveys indicate that 78% of potential EV buyers cite battery range as their top concern, while 65% express safety worries related to conventional lithium-ion batteries.

Consumer electronics constitutes the second-largest market segment, with manufacturers seeking batteries that offer higher energy density, faster charging capabilities, and improved safety profiles. The demand for longer-lasting, more compact power sources in smartphones, laptops, and wearable devices continues to grow as consumers increasingly rely on portable technology in daily life.

The aerospace and defense sectors are emerging as significant market drivers, particularly for applications requiring extreme temperature tolerance and enhanced safety. Military and space applications demand batteries that can perform reliably under harsh conditions while minimizing risk of thermal runaway or combustion.

Grid-scale energy storage represents another expanding market opportunity, with utility companies seeking advanced battery solutions to complement renewable energy installations. The intermittent nature of solar and wind power generation necessitates efficient, large-scale energy storage systems, creating substantial demand for next-generation battery technologies.

Regional analysis reveals that Asia-Pacific currently leads in market demand, with Japan and South Korea at the forefront of solid-state battery development and commercialization. North America and Europe follow closely, with significant research initiatives and strategic investments aimed at establishing domestic supply chains for advanced battery technologies.

Market research indicates that consumers and industrial buyers are willing to pay a premium of 15-25% for solid-state batteries compared to conventional lithium-ion alternatives, provided they deliver on promises of improved safety, longer lifespan, and enhanced performance. This price tolerance is expected to improve as manufacturing scales and production costs decrease, further accelerating market adoption across multiple sectors.

Technical Challenges and Global Development Status

Solid-state batteries represent a significant leap forward in energy storage technology, yet their widespread commercialization faces substantial technical hurdles. The primary challenge remains the solid electrolyte interface, where issues of ionic conductivity and mechanical stability persist. Current solid electrolytes demonstrate conductivity values between 10^-4 and 10^-2 S/cm at room temperature, still below the performance of liquid electrolytes used in conventional lithium-ion batteries. This conductivity gap necessitates operation at elevated temperatures to achieve practical energy densities.

Manufacturing scalability presents another formidable obstacle. The precise fabrication techniques required for solid-state batteries demand tight tolerances and specialized equipment, resulting in production costs estimated at 5-8 times higher than conventional lithium-ion batteries. The interface between solid electrolytes and electrodes creates additional complications, with dendrite formation remaining a critical failure mechanism despite the solid architecture.

Globally, solid-state battery development exhibits distinct regional characteristics. Japan leads in patent filings with approximately 31% of global patents, followed by the United States (24%) and South Korea (15%). Japanese companies like Toyota and Panasonic have established robust research programs focused on sulfide-based electrolytes, while U.S. efforts, led by QuantumScape and Solid Power, concentrate on oxide-based systems.

European development centers around Germany and France, with automotive manufacturers driving significant investment. The EU's Battery 2030+ initiative has allocated €925 million specifically for advanced battery technologies, including solid-state systems. China has rapidly accelerated its research efforts, with CATL and BYD making substantial progress in ceramic-based electrolytes and hybrid systems.

Recent technological breakthroughs have emerged across multiple fronts. Researchers at Stanford University demonstrated a novel polymer-ceramic composite electrolyte achieving conductivity of 1.2×10^-3 S/cm at room temperature while maintaining mechanical stability. Meanwhile, Toyota announced a sulfide-based system capable of 500+ cycles with minimal capacity degradation, though commercialization remains targeted for 2027-2028.

The technology readiness level (TRL) for solid-state batteries currently ranges from 4-6, depending on the specific chemistry and architecture. Small-scale prototypes have been demonstrated successfully, but mass production capabilities remain limited to specialized pilot lines with capacities under 100 MWh annually. Industry consensus suggests full commercialization timelines extending to 2025-2030, with initial applications in premium electric vehicles and specialized electronics before broader market penetration becomes feasible.

Manufacturing scalability presents another formidable obstacle. The precise fabrication techniques required for solid-state batteries demand tight tolerances and specialized equipment, resulting in production costs estimated at 5-8 times higher than conventional lithium-ion batteries. The interface between solid electrolytes and electrodes creates additional complications, with dendrite formation remaining a critical failure mechanism despite the solid architecture.

Globally, solid-state battery development exhibits distinct regional characteristics. Japan leads in patent filings with approximately 31% of global patents, followed by the United States (24%) and South Korea (15%). Japanese companies like Toyota and Panasonic have established robust research programs focused on sulfide-based electrolytes, while U.S. efforts, led by QuantumScape and Solid Power, concentrate on oxide-based systems.

European development centers around Germany and France, with automotive manufacturers driving significant investment. The EU's Battery 2030+ initiative has allocated €925 million specifically for advanced battery technologies, including solid-state systems. China has rapidly accelerated its research efforts, with CATL and BYD making substantial progress in ceramic-based electrolytes and hybrid systems.

Recent technological breakthroughs have emerged across multiple fronts. Researchers at Stanford University demonstrated a novel polymer-ceramic composite electrolyte achieving conductivity of 1.2×10^-3 S/cm at room temperature while maintaining mechanical stability. Meanwhile, Toyota announced a sulfide-based system capable of 500+ cycles with minimal capacity degradation, though commercialization remains targeted for 2027-2028.

The technology readiness level (TRL) for solid-state batteries currently ranges from 4-6, depending on the specific chemistry and architecture. Small-scale prototypes have been demonstrated successfully, but mass production capabilities remain limited to specialized pilot lines with capacities under 100 MWh annually. Industry consensus suggests full commercialization timelines extending to 2025-2030, with initial applications in premium electric vehicles and specialized electronics before broader market penetration becomes feasible.

Current Solid State Battery Solutions

01 Solid-state electrolyte compositions

Solid-state batteries utilize specialized electrolyte compositions that enable ion transport without liquid components. These electrolytes typically include ceramic materials, polymer matrices, or composite structures that provide high ionic conductivity while maintaining mechanical stability. Advanced formulations may incorporate sulfide-based, oxide-based, or phosphate-based materials that enhance lithium-ion transport while preventing dendrite formation, which is crucial for battery safety and longevity.- Solid-state electrolyte materials and compositions: Various materials and compositions are used as solid-state electrolytes in batteries to replace traditional liquid electrolytes. These include ceramic materials, polymer electrolytes, and composite materials that offer improved safety and stability. The solid electrolytes enable ion transport between electrodes while preventing dendrite formation and reducing fire hazards associated with liquid electrolytes. These materials are engineered to have high ionic conductivity at operating temperatures while maintaining mechanical integrity.

- Electrode design and interface engineering: Specialized electrode designs and interface engineering techniques are crucial for solid-state batteries to ensure good contact between the solid electrolyte and electrodes. This includes developing composite electrodes, buffer layers, and interface modifications to reduce resistance at the solid-solid interfaces. Various coating methods and surface treatments are employed to improve the electrochemical stability of the interfaces and enhance overall battery performance by facilitating efficient ion transfer across boundaries.

- Manufacturing processes and assembly techniques: Advanced manufacturing processes and assembly techniques are developed specifically for solid-state batteries to address challenges in production scaling. These include novel deposition methods, sintering techniques, and layer-by-layer assembly approaches to create uniform, defect-free components. Specialized equipment and controlled environments are used to ensure proper integration of the solid components while maintaining precise dimensions and preventing contamination that could affect battery performance.

- Battery architecture and cell design: Innovative battery architectures and cell designs are created to optimize the performance of solid-state batteries. These include various form factors such as pouch, prismatic, and cylindrical designs adapted for solid components. Multi-layer stacking approaches, pressure application systems, and thermal management solutions are incorporated to maintain proper contact between components and manage expansion/contraction during cycling. The designs aim to maximize energy density while ensuring mechanical stability throughout the battery's operational life.

- Performance enhancement and stability solutions: Various approaches are developed to enhance the performance and stability of solid-state batteries. These include additives and dopants to improve ionic conductivity, protective coatings to prevent side reactions, and composite structures to enhance mechanical properties. Temperature management systems, pressure regulation mechanisms, and cycling protocols are designed to extend battery lifespan and maintain capacity over numerous charge-discharge cycles. These solutions address challenges related to dendrite formation, volume changes, and degradation mechanisms specific to solid-state systems.

02 Electrode-electrolyte interface engineering

The interface between electrodes and solid electrolytes represents a critical challenge in solid-state battery development. Engineering approaches focus on reducing interfacial resistance through surface modifications, interlayers, or gradient compositions. These techniques aim to improve contact between components, enhance ion transfer across boundaries, and maintain interface stability during cycling, ultimately leading to better battery performance and cycle life.Expand Specific Solutions03 Manufacturing processes for solid-state batteries

Specialized manufacturing techniques are essential for producing effective solid-state batteries. These include dry processing methods, hot pressing, tape casting, and advanced deposition techniques that enable the creation of thin, uniform layers with good interfacial contact. Novel approaches to assembly and integration help overcome challenges related to mechanical stress, thermal expansion differences, and maintaining component integrity during battery fabrication.Expand Specific Solutions04 Cathode and anode materials for solid-state systems

Electrode materials for solid-state batteries require specific properties to function effectively with solid electrolytes. High-capacity cathode materials may include lithium-rich layered oxides or sulfur-based compounds, while anodes often utilize lithium metal, silicon-based materials, or specialized carbon structures. These materials are designed to minimize volume changes during cycling, maintain structural integrity, and provide efficient ion exchange with the solid electrolyte.Expand Specific Solutions05 Safety and performance enhancement technologies

Solid-state batteries incorporate various technologies to enhance safety and performance metrics. These include thermal management systems, pressure regulation mechanisms, and protective layers that prevent short circuits and dendrite growth. Advanced monitoring systems and structural designs help maintain battery integrity under various operating conditions, while specialized additives and dopants improve ionic conductivity and cycling stability without compromising the solid-state architecture.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid-state battery market is currently in an early growth phase, characterized by significant R&D investments but limited commercial deployment. Market size is projected to expand rapidly as this technology addresses critical limitations of conventional lithium-ion batteries. Leading automotive manufacturers (Honda, Hyundai, Kia, FCA) are actively pursuing this technology to enable longer-range electric vehicles. Technology maturity varies across players, with companies like Sakti3, Murata Manufacturing, and Samsung Electro-Mechanics demonstrating promising prototypes. Research institutions (University of Michigan, IIT Roorkee) are collaborating with industrial partners like IBM and Applied Materials to overcome technical challenges in manufacturing scalability and cost reduction. The competitive landscape includes both established battery manufacturers and specialized startups racing to achieve commercial viability.

Sakti3, Inc.

Technical Solution: Sakti3 has developed a proprietary solid-state battery technology based on thin-film deposition methods. Their approach involves creating solid-state lithium batteries using vacuum deposition techniques similar to those used in semiconductor manufacturing. This process allows for precise layer-by-layer construction of battery components, eliminating liquid electrolytes entirely. The company's technology employs lithium metal anodes paired with high-voltage cathode materials and a proprietary solid electrolyte composition that enables high ionic conductivity at room temperature. Sakti3's manufacturing process is designed for scalability, with potential for integration into existing production facilities with modifications to standard equipment. Their batteries have demonstrated energy densities exceeding 400 Wh/kg in laboratory settings, significantly higher than conventional lithium-ion batteries.

Strengths: Superior energy density (potentially double that of conventional lithium-ion batteries); enhanced safety due to non-flammable solid electrolyte; longer cycle life with reduced degradation mechanisms. Weaknesses: Higher manufacturing costs compared to traditional battery technologies; challenges in scaling production to commercial volumes; potential interface resistance issues between solid components.

Uchicago Argonne LLC

Technical Solution: Argonne National Laboratory has pioneered advanced solid-state battery technology through their comprehensive materials science approach. Their research focuses on developing novel solid electrolyte materials with high ionic conductivity at room temperature, addressing one of the key challenges in solid-state battery commercialization. Argonne's scientists have made significant breakthroughs in sulfide-based solid electrolytes that demonstrate conductivity values approaching those of liquid electrolytes. Their technology also incorporates innovative interface engineering techniques to minimize resistance between the solid electrolyte and electrodes, using atomic layer deposition methods to create nanoscale buffer layers that facilitate ion transport across material boundaries. Additionally, Argonne has developed computational models that predict solid electrolyte performance and stability, accelerating the discovery of new materials with optimal properties.

Strengths: World-class research facilities and multidisciplinary expertise in materials science; strong focus on fundamental understanding of ion transport mechanisms; extensive partnerships with industry for technology transfer. Weaknesses: As a research institution, faces challenges in direct commercialization; some advanced materials may present manufacturing scalability issues; longer timeline to market compared to private industry players.

Core Patents and Technical Innovations

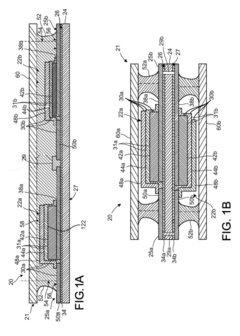

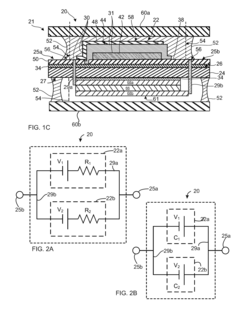

Monolithically integrated thin-film solid state lithium battery device having multiple layers of lithium electrochemical cells

PatentActiveUS20120058380A1

Innovation

- A method and device for fabricating a solid-state thin-film battery using a prismatic multilayer structure with specific layer thicknesses and materials, including a substrate, cathode and anode current collectors, electrolyte, and barrier layers, optimized through numerical techniques for enhanced energy density and stability.

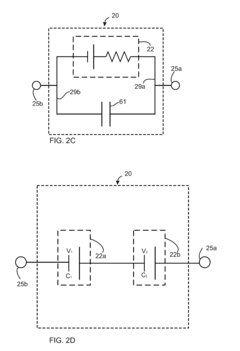

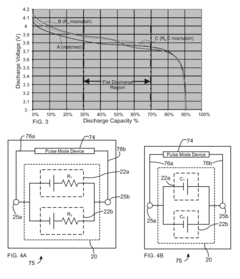

Pulsed mode apparatus with mismatched battery

PatentActiveUS20150372359A1

Innovation

- A mismatched battery configuration is introduced, where two battery cells with different internal resistances and charge capacities are connected in parallel, allowing the cell with lower resistance to power a device during the on-time and the higher resistance cell to recharge during the off-time, thereby enhancing current output.

Supply Chain Analysis and Materials Sourcing

The solid state battery supply chain represents a significant departure from traditional lithium-ion battery manufacturing networks. Current material sourcing for solid state batteries centers primarily around specialized electrolyte materials, including ceramic, glass, and polymer-based compounds. These critical components require sophisticated processing techniques and often involve rare or strategic elements such as lithium, zirconium, lanthanum, and various other ceramic precursors.

Material availability presents a substantial challenge, particularly for high-purity lithium metal anodes and specialized ceramic electrolytes. Market analysis indicates potential supply constraints for lithium metal, with current global production capacity insufficient to meet projected demand if solid state batteries achieve widespread commercial adoption. Similarly, the specialized nature of ceramic electrolyte production creates potential bottlenecks in scaling manufacturing processes.

Geographical distribution of key materials reveals significant concentration risks. Over 60% of lithium resources are located in the "Lithium Triangle" of South America, while advanced ceramic processing capabilities are predominantly concentrated in Japan, South Korea, and parts of North America. This geopolitical distribution creates strategic vulnerabilities that require careful consideration in long-term supply planning.

Vertical integration strategies are emerging among leading manufacturers. Companies like Toyota, Quantumscape, and Solid Power are actively securing upstream material sources through strategic partnerships and direct investments in mining operations. This trend indicates recognition of supply chain security as a critical competitive advantage in the evolving solid state battery landscape.

Recycling infrastructure remains underdeveloped for solid state battery components. Unlike traditional lithium-ion batteries, the recovery processes for ceramic electrolytes and composite materials are still in early development stages. This gap represents both an environmental challenge and a potential opportunity for circular economy innovations.

Cost structures for material sourcing currently exceed traditional battery supply chains by approximately 30-40%, primarily due to specialized material requirements and limited economies of scale. Industry projections suggest these premiums may persist until production volumes reach critical thresholds, estimated at approximately 10-15 GWh of annual production capacity.

Strategic diversification of supply sources will be essential for manufacturers seeking to mitigate concentration risks. Emerging alternative material pathways, including sulfide-based electrolytes and novel composite structures, may offer opportunities to reduce dependence on geographically concentrated resources while potentially improving performance characteristics.

Material availability presents a substantial challenge, particularly for high-purity lithium metal anodes and specialized ceramic electrolytes. Market analysis indicates potential supply constraints for lithium metal, with current global production capacity insufficient to meet projected demand if solid state batteries achieve widespread commercial adoption. Similarly, the specialized nature of ceramic electrolyte production creates potential bottlenecks in scaling manufacturing processes.

Geographical distribution of key materials reveals significant concentration risks. Over 60% of lithium resources are located in the "Lithium Triangle" of South America, while advanced ceramic processing capabilities are predominantly concentrated in Japan, South Korea, and parts of North America. This geopolitical distribution creates strategic vulnerabilities that require careful consideration in long-term supply planning.

Vertical integration strategies are emerging among leading manufacturers. Companies like Toyota, Quantumscape, and Solid Power are actively securing upstream material sources through strategic partnerships and direct investments in mining operations. This trend indicates recognition of supply chain security as a critical competitive advantage in the evolving solid state battery landscape.

Recycling infrastructure remains underdeveloped for solid state battery components. Unlike traditional lithium-ion batteries, the recovery processes for ceramic electrolytes and composite materials are still in early development stages. This gap represents both an environmental challenge and a potential opportunity for circular economy innovations.

Cost structures for material sourcing currently exceed traditional battery supply chains by approximately 30-40%, primarily due to specialized material requirements and limited economies of scale. Industry projections suggest these premiums may persist until production volumes reach critical thresholds, estimated at approximately 10-15 GWh of annual production capacity.

Strategic diversification of supply sources will be essential for manufacturers seeking to mitigate concentration risks. Emerging alternative material pathways, including sulfide-based electrolytes and novel composite structures, may offer opportunities to reduce dependence on geographically concentrated resources while potentially improving performance characteristics.

Environmental Impact and Sustainability Considerations

The transition to solid-state battery technology represents a significant advancement in sustainable energy storage solutions with far-reaching environmental implications. Unlike conventional lithium-ion batteries that rely on liquid electrolytes containing flammable and toxic materials, solid-state batteries utilize solid electrolytes that are inherently safer and more environmentally benign. This fundamental design difference eliminates the need for many hazardous materials currently used in battery production, potentially reducing environmental contamination risks throughout the product lifecycle.

Manufacturing processes for solid-state batteries demonstrate promising sustainability advantages. The simplified architecture requires fewer components and potentially less energy-intensive production methods. Initial lifecycle assessments suggest a reduced carbon footprint compared to conventional battery technologies, with estimates indicating up to 30% lower greenhouse gas emissions during manufacturing. As production scales and processes mature, these environmental benefits are expected to increase further.

Resource efficiency represents another critical environmental advantage of solid-state battery technology. The higher energy density achievable with solid-state designs translates to more efficient use of critical materials. Additionally, many solid-state battery architectures under development aim to reduce or eliminate dependence on scarce elements like cobalt, which is associated with significant ethical and environmental concerns in its extraction. This shift could alleviate pressure on vulnerable ecosystems and communities affected by current mining practices.

End-of-life considerations for solid-state batteries also present sustainability opportunities. The more stable chemistry and construction of these batteries may facilitate easier recycling and material recovery processes. Research indicates that valuable materials in solid-state batteries could be recovered at higher rates and with less environmental impact than current recycling methods for conventional batteries. This circular economy potential could significantly reduce the environmental burden of battery disposal.

When deployed at scale, solid-state batteries could accelerate broader environmental benefits through enabling technologies. Their superior performance characteristics may accelerate electric vehicle adoption, renewable energy storage implementation, and grid stabilization solutions. The cumulative environmental impact of these applications could substantially reduce global carbon emissions and fossil fuel dependence.

However, challenges remain in fully realizing these environmental benefits. The technology's environmental advantages must be verified through comprehensive lifecycle analyses as commercial production scales. Additionally, establishing effective recycling infrastructure specifically designed for solid-state batteries will be essential to maximize their sustainability potential. Regulatory frameworks will need to evolve to address the unique environmental considerations of this emerging technology.

Manufacturing processes for solid-state batteries demonstrate promising sustainability advantages. The simplified architecture requires fewer components and potentially less energy-intensive production methods. Initial lifecycle assessments suggest a reduced carbon footprint compared to conventional battery technologies, with estimates indicating up to 30% lower greenhouse gas emissions during manufacturing. As production scales and processes mature, these environmental benefits are expected to increase further.

Resource efficiency represents another critical environmental advantage of solid-state battery technology. The higher energy density achievable with solid-state designs translates to more efficient use of critical materials. Additionally, many solid-state battery architectures under development aim to reduce or eliminate dependence on scarce elements like cobalt, which is associated with significant ethical and environmental concerns in its extraction. This shift could alleviate pressure on vulnerable ecosystems and communities affected by current mining practices.

End-of-life considerations for solid-state batteries also present sustainability opportunities. The more stable chemistry and construction of these batteries may facilitate easier recycling and material recovery processes. Research indicates that valuable materials in solid-state batteries could be recovered at higher rates and with less environmental impact than current recycling methods for conventional batteries. This circular economy potential could significantly reduce the environmental burden of battery disposal.

When deployed at scale, solid-state batteries could accelerate broader environmental benefits through enabling technologies. Their superior performance characteristics may accelerate electric vehicle adoption, renewable energy storage implementation, and grid stabilization solutions. The cumulative environmental impact of these applications could substantially reduce global carbon emissions and fossil fuel dependence.

However, challenges remain in fully realizing these environmental benefits. The technology's environmental advantages must be verified through comprehensive lifecycle analyses as commercial production scales. Additionally, establishing effective recycling infrastructure specifically designed for solid-state batteries will be essential to maximize their sustainability potential. Regulatory frameworks will need to evolve to address the unique environmental considerations of this emerging technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!