Exploring the Solid State Battery Breakthrough Patent Landscape

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Evolution and Research Objectives

Solid state batteries represent a revolutionary advancement in energy storage technology, evolving from traditional lithium-ion batteries that use liquid electrolytes. The development trajectory began in the 1970s with the discovery of solid electrolytes, but significant progress has accelerated dramatically over the past decade. This evolution has been driven by increasing demands for higher energy density, improved safety, and longer battery life in applications ranging from consumer electronics to electric vehicles and grid storage systems.

The technological progression of solid state batteries has moved through several distinct phases. Initially, research focused on inorganic solid electrolytes such as ceramics and glass materials. This was followed by the development of polymer-based solid electrolytes, which offered improved flexibility but suffered from lower ionic conductivity. The current frontier involves composite electrolytes that combine the advantages of different material classes to overcome individual limitations.

Patent landscapes reveal a significant shift in research focus from fundamental materials science to manufacturing processes and integration techniques. Early patents predominantly covered novel electrolyte materials, while recent filings increasingly address scalable production methods, interface engineering, and system-level integration challenges. This transition indicates the technology's maturation from laboratory concept toward commercial viability.

Our research objectives in exploring the solid state battery patent landscape are multifaceted. First, we aim to identify breakthrough technologies that address key performance bottlenecks, particularly ionic conductivity at room temperature, mechanical stability during cycling, and manufacturing scalability. Second, we seek to map the competitive landscape by analyzing patent ownership concentration, geographical distribution of intellectual property, and emerging collaboration networks among industry players and research institutions.

Additionally, we intend to forecast technological trajectories by examining patent citation networks and identifying emerging clusters of innovation. This will help predict which technical approaches are gaining momentum and may become dominant in the next generation of solid state batteries. Understanding these patterns is crucial for strategic R&D investment decisions.

Finally, our analysis aims to identify white space opportunities where patenting activity is sparse relative to technical importance. These areas represent potential opportunities for differentiated innovation and strategic intellectual property development. By comprehensively analyzing the patent landscape, we can guide research priorities and inform long-term technology roadmapping for solid state battery development.

The technological progression of solid state batteries has moved through several distinct phases. Initially, research focused on inorganic solid electrolytes such as ceramics and glass materials. This was followed by the development of polymer-based solid electrolytes, which offered improved flexibility but suffered from lower ionic conductivity. The current frontier involves composite electrolytes that combine the advantages of different material classes to overcome individual limitations.

Patent landscapes reveal a significant shift in research focus from fundamental materials science to manufacturing processes and integration techniques. Early patents predominantly covered novel electrolyte materials, while recent filings increasingly address scalable production methods, interface engineering, and system-level integration challenges. This transition indicates the technology's maturation from laboratory concept toward commercial viability.

Our research objectives in exploring the solid state battery patent landscape are multifaceted. First, we aim to identify breakthrough technologies that address key performance bottlenecks, particularly ionic conductivity at room temperature, mechanical stability during cycling, and manufacturing scalability. Second, we seek to map the competitive landscape by analyzing patent ownership concentration, geographical distribution of intellectual property, and emerging collaboration networks among industry players and research institutions.

Additionally, we intend to forecast technological trajectories by examining patent citation networks and identifying emerging clusters of innovation. This will help predict which technical approaches are gaining momentum and may become dominant in the next generation of solid state batteries. Understanding these patterns is crucial for strategic R&D investment decisions.

Finally, our analysis aims to identify white space opportunities where patenting activity is sparse relative to technical importance. These areas represent potential opportunities for differentiated innovation and strategic intellectual property development. By comprehensively analyzing the patent landscape, we can guide research priorities and inform long-term technology roadmapping for solid state battery development.

Market Demand Analysis for Solid State Battery Technologies

The global market for solid-state battery technologies is experiencing unprecedented growth, driven by increasing demand for safer, higher-capacity energy storage solutions across multiple industries. Current market projections indicate that the solid-state battery market will reach approximately $8 billion by 2030, with a compound annual growth rate exceeding 34% between 2023 and 2030. This remarkable growth trajectory reflects the significant advantages these batteries offer over conventional lithium-ion technologies.

Electric vehicle manufacturers represent the primary demand driver, as they seek battery solutions that can extend range capabilities while addressing safety concerns associated with traditional lithium-ion batteries. Major automotive companies including Toyota, Volkswagen, and BMW have announced substantial investments in solid-state battery development, with commercialization targets set between 2025 and 2028. The automotive sector's push toward electrification, reinforced by stringent emissions regulations worldwide, continues to accelerate demand for advanced battery technologies.

Consumer electronics constitutes another significant market segment, with manufacturers seeking higher energy density solutions that enable longer device operation while maintaining or reducing form factors. The potential for solid-state batteries to deliver up to twice the energy density of conventional lithium-ion cells makes them particularly attractive for smartphones, wearables, and portable computing devices where space constraints are critical considerations.

Energy storage systems for grid applications and renewable energy integration represent an emerging but rapidly growing market segment. Utility companies and renewable energy providers are increasingly interested in solid-state battery technologies due to their enhanced safety profiles, longer cycle life, and improved performance in varying environmental conditions. This sector is expected to become a major demand driver as renewable energy adoption accelerates globally.

Regional analysis reveals that Asia-Pacific currently dominates solid-state battery research and development activities, with Japan and South Korea leading patent filings. However, North America and Europe are rapidly expanding their innovation ecosystems in this domain, supported by substantial government funding initiatives and corporate investments. China has also emerged as a significant player, with state-backed initiatives aimed at establishing leadership in next-generation battery technologies.

Market barriers include high manufacturing costs, scalability challenges, and technical hurdles related to interface stability and ion conductivity. Current production costs for solid-state batteries remain 5-8 times higher than conventional lithium-ion batteries, though economies of scale and manufacturing innovations are expected to reduce this gap significantly by 2028. Despite these challenges, the compelling performance advantages and safety benefits continue to drive strong market interest and investment.

Electric vehicle manufacturers represent the primary demand driver, as they seek battery solutions that can extend range capabilities while addressing safety concerns associated with traditional lithium-ion batteries. Major automotive companies including Toyota, Volkswagen, and BMW have announced substantial investments in solid-state battery development, with commercialization targets set between 2025 and 2028. The automotive sector's push toward electrification, reinforced by stringent emissions regulations worldwide, continues to accelerate demand for advanced battery technologies.

Consumer electronics constitutes another significant market segment, with manufacturers seeking higher energy density solutions that enable longer device operation while maintaining or reducing form factors. The potential for solid-state batteries to deliver up to twice the energy density of conventional lithium-ion cells makes them particularly attractive for smartphones, wearables, and portable computing devices where space constraints are critical considerations.

Energy storage systems for grid applications and renewable energy integration represent an emerging but rapidly growing market segment. Utility companies and renewable energy providers are increasingly interested in solid-state battery technologies due to their enhanced safety profiles, longer cycle life, and improved performance in varying environmental conditions. This sector is expected to become a major demand driver as renewable energy adoption accelerates globally.

Regional analysis reveals that Asia-Pacific currently dominates solid-state battery research and development activities, with Japan and South Korea leading patent filings. However, North America and Europe are rapidly expanding their innovation ecosystems in this domain, supported by substantial government funding initiatives and corporate investments. China has also emerged as a significant player, with state-backed initiatives aimed at establishing leadership in next-generation battery technologies.

Market barriers include high manufacturing costs, scalability challenges, and technical hurdles related to interface stability and ion conductivity. Current production costs for solid-state batteries remain 5-8 times higher than conventional lithium-ion batteries, though economies of scale and manufacturing innovations are expected to reduce this gap significantly by 2028. Despite these challenges, the compelling performance advantages and safety benefits continue to drive strong market interest and investment.

Global Solid State Battery Development Status and Challenges

Solid state batteries represent one of the most promising advancements in energy storage technology, offering potential solutions to the limitations of conventional lithium-ion batteries. Currently, the global development of solid state batteries faces a complex landscape of technical achievements and persistent challenges that vary significantly across regions and research institutions.

In North America, significant progress has been made by companies like QuantumScape and Solid Power, who have demonstrated prototype cells with impressive energy densities exceeding 400 Wh/kg. However, these prototypes still struggle with cycle life limitations at full depth of discharge and face manufacturing scalability issues. The region benefits from strong university-industry partnerships but faces challenges in translating laboratory success to mass production.

Asian markets, particularly Japan and South Korea, lead in solid electrolyte material development. Toyota's patent portfolio in sulfide-based solid electrolytes is particularly robust, while South Korean firms have made notable advances in composite electrolytes that balance ionic conductivity with mechanical stability. Chinese research institutions have rapidly increased their patent filings in this space, focusing on cost-effective manufacturing processes for ceramic electrolytes.

European efforts are characterized by consortium-based approaches, with initiatives like BATTERY 2030+ coordinating research across multiple countries. European researchers have made significant contributions to polymer-ceramic hybrid electrolytes and interface engineering, though commercialization timelines remain longer than their Asian counterparts.

The primary technical challenges facing solid state battery development globally include: insufficient ionic conductivity at room temperature (most solid electrolytes achieve optimal performance above 60°C); mechanical stress management during cycling; manufacturing complexity for thin, defect-free electrolyte layers; and persistent interfacial resistance issues between electrodes and electrolytes that limit power capability.

Material supply constraints represent another significant hurdle, particularly for lithium metal anodes and specialized ceramic components. The high purity requirements for solid electrolytes drive up costs, with current estimates suggesting solid state batteries remain 4-8 times more expensive per kWh than conventional lithium-ion technologies.

Despite these challenges, the patent landscape shows accelerating innovation, with annual patent filings related to solid state batteries increasing by approximately 25% year-over-year since 2018. This growth reflects both the technical promise and commercial potential of the technology, though industry consensus suggests mass-market applications remain 3-5 years from commercial viability for specialized applications and 7-10 years for widespread automotive adoption.

In North America, significant progress has been made by companies like QuantumScape and Solid Power, who have demonstrated prototype cells with impressive energy densities exceeding 400 Wh/kg. However, these prototypes still struggle with cycle life limitations at full depth of discharge and face manufacturing scalability issues. The region benefits from strong university-industry partnerships but faces challenges in translating laboratory success to mass production.

Asian markets, particularly Japan and South Korea, lead in solid electrolyte material development. Toyota's patent portfolio in sulfide-based solid electrolytes is particularly robust, while South Korean firms have made notable advances in composite electrolytes that balance ionic conductivity with mechanical stability. Chinese research institutions have rapidly increased their patent filings in this space, focusing on cost-effective manufacturing processes for ceramic electrolytes.

European efforts are characterized by consortium-based approaches, with initiatives like BATTERY 2030+ coordinating research across multiple countries. European researchers have made significant contributions to polymer-ceramic hybrid electrolytes and interface engineering, though commercialization timelines remain longer than their Asian counterparts.

The primary technical challenges facing solid state battery development globally include: insufficient ionic conductivity at room temperature (most solid electrolytes achieve optimal performance above 60°C); mechanical stress management during cycling; manufacturing complexity for thin, defect-free electrolyte layers; and persistent interfacial resistance issues between electrodes and electrolytes that limit power capability.

Material supply constraints represent another significant hurdle, particularly for lithium metal anodes and specialized ceramic components. The high purity requirements for solid electrolytes drive up costs, with current estimates suggesting solid state batteries remain 4-8 times more expensive per kWh than conventional lithium-ion technologies.

Despite these challenges, the patent landscape shows accelerating innovation, with annual patent filings related to solid state batteries increasing by approximately 25% year-over-year since 2018. This growth reflects both the technical promise and commercial potential of the technology, though industry consensus suggests mass-market applications remain 3-5 years from commercial viability for specialized applications and 7-10 years for widespread automotive adoption.

Current Technical Solutions in Solid State Battery Design

01 Solid-state electrolyte materials and compositions

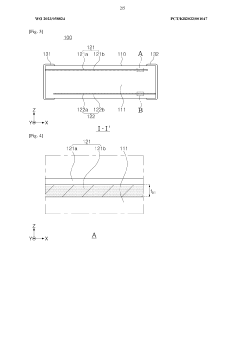

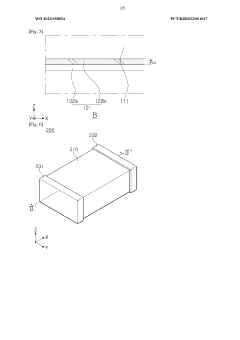

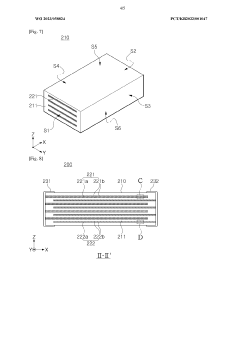

Various materials and compositions are used as solid-state electrolytes in batteries, including ceramic, polymer, and composite electrolytes. These materials offer improved safety by eliminating flammable liquid electrolytes while providing ionic conductivity necessary for battery operation. Advanced formulations incorporate specific additives to enhance ionic conductivity, mechanical properties, and electrochemical stability at the electrode-electrolyte interfaces.- Solid-state electrolyte materials and compositions: Various materials and compositions are used as solid-state electrolytes in batteries to replace traditional liquid electrolytes. These include ceramic materials, polymer electrolytes, and composite materials that offer improved safety by eliminating flammable liquid components. These solid electrolytes enable ion transport between electrodes while providing mechanical stability and preventing dendrite formation, which is crucial for battery safety and longevity.

- Electrode-electrolyte interface engineering: Engineering the interface between electrodes and solid electrolytes is critical for solid-state battery performance. This includes developing coatings, buffer layers, and interface modification techniques to reduce contact resistance and improve ion transfer across boundaries. Proper interface engineering helps mitigate issues related to mechanical stress during cycling and chemical incompatibilities between battery components.

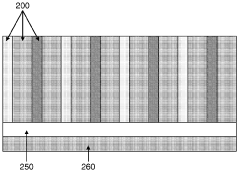

- Manufacturing processes for solid-state batteries: Specialized manufacturing techniques are developed for solid-state battery production, including dry and wet processing methods, hot pressing, tape casting, and advanced assembly techniques. These processes address challenges in creating uniform layers, ensuring good contact between components, and scaling production for commercial applications while maintaining performance and reliability.

- Composite electrode structures: Advanced electrode designs incorporate composite structures that combine active materials with solid electrolytes and conductive additives. These composite electrodes enhance ion and electron transport pathways, improve capacity utilization, and maintain structural integrity during cycling. The careful engineering of these composite structures helps overcome limitations in ionic conductivity and mechanical stability inherent to solid-state systems.

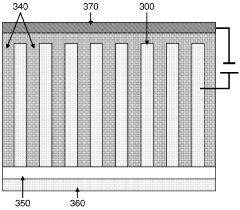

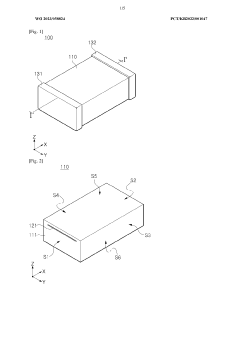

- Battery architecture and cell design: Novel cell architectures are designed specifically for solid-state batteries, including planar, bipolar, and 3D configurations. These designs address challenges related to mechanical pressure application, thermal management, and volumetric energy density. Innovative packaging solutions and structural components help maintain intimate contact between battery layers during operation and accommodate volume changes during cycling.

02 Electrode-electrolyte interface engineering

Engineering the interface between electrodes and solid electrolytes is crucial for solid-state battery performance. This includes developing coating technologies, buffer layers, and interface modification techniques to reduce interfacial resistance and improve contact. These innovations address challenges such as volume changes during cycling and chemical incompatibilities between components, resulting in enhanced cycling stability and power capability.Expand Specific Solutions03 Manufacturing processes for solid-state batteries

Novel manufacturing techniques are being developed for solid-state battery production, including advanced deposition methods, sintering processes, and assembly techniques. These processes aim to create uniform, defect-free layers and ensure good contact between components. Innovations in scalable manufacturing address challenges in mass production while maintaining performance and reducing costs.Expand Specific Solutions04 Cathode and anode materials optimization

Specialized electrode materials are being developed specifically for solid-state battery applications. These materials are designed to be compatible with solid electrolytes and maintain structural integrity during cycling. High-capacity cathode materials and lithium metal or silicon-based anodes are optimized to work within the constraints of solid-state systems while maximizing energy density and cycle life.Expand Specific Solutions05 Battery architecture and cell design

Innovative cell architectures are being developed to maximize the benefits of solid-state technology. These designs include novel stacking arrangements, pressure application systems, and thermal management solutions. The cell designs address challenges related to mechanical stress during cycling, volume changes, and uniform current distribution, while enabling higher energy density and improved safety characteristics.Expand Specific Solutions

Key Industry Players and Patent Holders Analysis

The solid-state battery market is currently in an early growth phase, characterized by significant R&D investment but limited commercial deployment. Major automotive manufacturers (Toyota, GM, Honda, Hyundai) are aggressively pursuing patents in this space, recognizing the technology's potential to revolutionize electric vehicle performance. The market is projected to reach $6-8 billion by 2030, growing at over 35% CAGR. Technology maturity varies significantly among key players: QuantumScape, Toyota, and Samsung SDI lead in patent quality, while established battery manufacturers like CATL and LG Energy Solution leverage their manufacturing expertise to accelerate commercialization. Academic-industry partnerships, particularly involving institutions like Beijing Institute of Technology and Fraunhofer-Gesellschaft, are accelerating breakthrough innovations in solid electrolyte materials and manufacturing processes.

GM Global Technology Operations LLC

Technical Solution: GM has developed a multi-layer solid-state battery architecture utilizing a proprietary lithium-rich ceramic electrolyte. Their approach focuses on addressing the critical interface challenges between solid electrolyte and electrodes through a patented gradient interlayer technology that minimizes impedance and enhances ion transport. GM's solid-state design incorporates silicon-dominant anodes rather than pure lithium metal, balancing energy density improvements with manufacturing practicality. Their solid electrolyte formulation achieves ionic conductivity of approximately 1-3 mS/cm at operating temperatures, enabling practical performance in automotive applications. GM has invested in scalable manufacturing processes that leverage aspects of existing battery production infrastructure, potentially accelerating commercialization timelines. Their patent portfolio reveals innovations in pressure management systems that maintain optimal interfacial contact throughout battery cycling, addressing a key challenge in solid-state technology. Through their Ultium platform strategy, GM is positioning to integrate solid-state technology as it matures, with targeted energy densities exceeding 500 Wh/kg for next-generation electric vehicles.

Strengths: Vertical integration capabilities from battery development through vehicle implementation, extensive automotive validation expertise, and established manufacturing scale. Weaknesses: Their silicon-dominant anode approach may not achieve the same theoretical energy density as pure lithium metal designs, and their ceramic electrolytes may present challenges in mechanical durability during vehicle operation.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered solid-state battery technology with over 1,000 patents in this field. Their approach centers on sulfide-based solid electrolytes with high ionic conductivity (2-5 mS/cm at room temperature), comparable to liquid electrolytes. Toyota's proprietary manufacturing process addresses the critical electrode-electrolyte interface challenges through a specialized coating technology that reduces contact resistance and enhances lithium ion transfer. Their solid-state design incorporates a lithium metal anode that enables theoretical energy densities exceeding 400 Wh/kg, potentially doubling current lithium-ion performance. Toyota has developed a scalable production method that adapts conventional battery manufacturing equipment, reducing capital investment requirements. Recent patents reveal innovations in pressure-regulation mechanisms within the cell structure to accommodate volume changes during cycling. Toyota has announced plans to introduce solid-state batteries in hybrid vehicles by 2025, using this as a stepping stone toward full electric vehicle implementation.

Strengths: Extensive patent portfolio, significant R&D resources, established manufacturing expertise, and integration with vehicle design capabilities. Weaknesses: Their sulfide electrolytes are moisture-sensitive requiring specialized handling, and the initial deployment in hybrids rather than full EVs suggests remaining challenges with power output or durability for high-demand applications.

Critical Patent Analysis and Technical Innovations

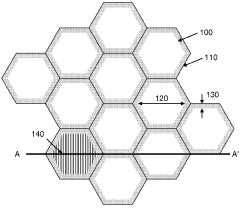

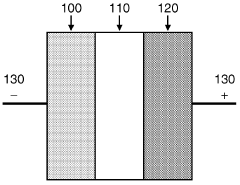

Three-dimensional solid state battery

PatentWO2010007579A1

Innovation

- A solid-state battery design featuring a substrate with a diffusion barrier layer, an anode or cathode formed by a 3D electrically conducting honeycomb structure, and a solid-state electrolyte within the containers of the 3D structure, allowing for increased surface area and mechanical stability, and using standard IC manufacturing methods.

Solid-state battery

PatentWO2023058824A1

Innovation

- A solid-state battery design incorporating a lithium aluminum germanium phosphate (LAGP) solid electrolyte and active materials like lithium cobalt phosphate (LCP), lithium germanium phosphate (LGP), and lithium tin phosphate (LSP) to achieve high operating voltage, stability, and long-term reliability.

Intellectual Property Strategy and Patent Landscape Navigation

Navigating the intellectual property landscape for solid-state battery breakthroughs requires a strategic approach to identify valuable patents, assess competitive positioning, and develop effective IP strategies. The patent landscape in this field has become increasingly complex as major battery manufacturers, automotive companies, and research institutions race to secure protection for their innovations.

Patent analysis reveals several key clusters of intellectual property in solid-state battery technology. The first cluster focuses on electrolyte materials, with patents covering ceramic, polymer, and composite electrolytes. The second cluster encompasses electrode-electrolyte interfaces, addressing the critical challenge of maintaining stable contact during battery operation. The third significant cluster involves manufacturing processes that enable commercial-scale production of solid-state batteries.

Strategic patent mapping indicates geographical concentration patterns, with Japan, South Korea, and the United States leading in patent filings. Japanese companies like Toyota and Panasonic have established strong patent portfolios focused on sulfide-based electrolytes. Korean entities such as Samsung and LG Energy Solution have concentrated on polymer-ceramic composite approaches. U.S. patents often originate from startups like QuantumScape and research universities, frequently targeting novel manufacturing methods.

Freedom-to-operate analysis reveals potential IP bottlenecks in the commercialization pathway. Key patents on certain electrolyte compositions and interface engineering techniques may necessitate licensing agreements or strategic partnerships. Companies must carefully navigate these constraints when developing their solid-state battery technologies to avoid infringement risks.

Defensive and offensive IP strategies should be considered based on a company's position in the market. Established battery manufacturers typically pursue broad patent portfolios covering multiple technical approaches, while startups often focus on securing strong protection for specific breakthrough technologies. Cross-licensing opportunities exist between companies with complementary IP portfolios, potentially accelerating commercialization timelines.

Patent quality assessment indicates that the most valuable IP assets combine novel material compositions with practical manufacturing solutions. Patents that address multiple challenges simultaneously—such as improving energy density while enhancing safety and extending cycle life—represent particularly strategic assets in this competitive landscape.

Patent analysis reveals several key clusters of intellectual property in solid-state battery technology. The first cluster focuses on electrolyte materials, with patents covering ceramic, polymer, and composite electrolytes. The second cluster encompasses electrode-electrolyte interfaces, addressing the critical challenge of maintaining stable contact during battery operation. The third significant cluster involves manufacturing processes that enable commercial-scale production of solid-state batteries.

Strategic patent mapping indicates geographical concentration patterns, with Japan, South Korea, and the United States leading in patent filings. Japanese companies like Toyota and Panasonic have established strong patent portfolios focused on sulfide-based electrolytes. Korean entities such as Samsung and LG Energy Solution have concentrated on polymer-ceramic composite approaches. U.S. patents often originate from startups like QuantumScape and research universities, frequently targeting novel manufacturing methods.

Freedom-to-operate analysis reveals potential IP bottlenecks in the commercialization pathway. Key patents on certain electrolyte compositions and interface engineering techniques may necessitate licensing agreements or strategic partnerships. Companies must carefully navigate these constraints when developing their solid-state battery technologies to avoid infringement risks.

Defensive and offensive IP strategies should be considered based on a company's position in the market. Established battery manufacturers typically pursue broad patent portfolios covering multiple technical approaches, while startups often focus on securing strong protection for specific breakthrough technologies. Cross-licensing opportunities exist between companies with complementary IP portfolios, potentially accelerating commercialization timelines.

Patent quality assessment indicates that the most valuable IP assets combine novel material compositions with practical manufacturing solutions. Patents that address multiple challenges simultaneously—such as improving energy density while enhancing safety and extending cycle life—represent particularly strategic assets in this competitive landscape.

Manufacturing Scalability and Commercialization Barriers

Despite significant advancements in solid-state battery technology, the transition from laboratory prototypes to mass production remains one of the most formidable challenges in the commercialization journey. Current manufacturing processes for solid-state batteries are predominantly manual, small-scale operations that cannot meet the volume demands of automotive or consumer electronics markets. The patent landscape reveals a critical gap between innovative material discoveries and scalable production methods.

Manufacturing solid electrolytes at scale presents unique difficulties not encountered in liquid electrolyte systems. Patents from industry leaders like Toyota, Samsung, and Quantumscape highlight various approaches to overcome these barriers, including dry and wet processing methods for ceramic electrolytes. However, these patents often protect narrow technical solutions rather than comprehensive manufacturing frameworks.

Interface stability during manufacturing represents another significant hurdle. The solid-solid interfaces between electrodes and electrolytes must maintain consistent contact during production and throughout the battery lifecycle. Recent patent filings from companies like Solid Power and ProLogium focus on innovative interface engineering techniques, but scalable solutions remain elusive.

Cost considerations further complicate commercialization efforts. Current manufacturing approaches for solid-state batteries result in production costs estimated at 5-8 times higher than conventional lithium-ion batteries. Patent analysis indicates that material costs account for approximately 65% of this differential, while specialized manufacturing equipment represents another 25%.

Equipment limitations constitute a substantial barrier, as existing battery production lines cannot be easily retrofitted for solid-state manufacturing. Patents from equipment manufacturers like Applied Materials and Wuhan Jingce reveal emerging solutions, but these technologies remain in early development stages.

Quality control and testing methodologies for mass-produced solid-state batteries present additional challenges. Unlike liquid systems, defects in solid electrolytes can be difficult to detect using conventional testing methods. Recent patents from Murata Manufacturing and LG Energy Solution describe novel inspection techniques specifically designed for solid-state systems.

The patent landscape suggests that successful commercialization will likely require vertical integration or strategic partnerships spanning the entire value chain. Companies with the most comprehensive patent portfolios covering both materials and manufacturing processes, such as Toyota and Samsung, appear best positioned to overcome these barriers.

Manufacturing solid electrolytes at scale presents unique difficulties not encountered in liquid electrolyte systems. Patents from industry leaders like Toyota, Samsung, and Quantumscape highlight various approaches to overcome these barriers, including dry and wet processing methods for ceramic electrolytes. However, these patents often protect narrow technical solutions rather than comprehensive manufacturing frameworks.

Interface stability during manufacturing represents another significant hurdle. The solid-solid interfaces between electrodes and electrolytes must maintain consistent contact during production and throughout the battery lifecycle. Recent patent filings from companies like Solid Power and ProLogium focus on innovative interface engineering techniques, but scalable solutions remain elusive.

Cost considerations further complicate commercialization efforts. Current manufacturing approaches for solid-state batteries result in production costs estimated at 5-8 times higher than conventional lithium-ion batteries. Patent analysis indicates that material costs account for approximately 65% of this differential, while specialized manufacturing equipment represents another 25%.

Equipment limitations constitute a substantial barrier, as existing battery production lines cannot be easily retrofitted for solid-state manufacturing. Patents from equipment manufacturers like Applied Materials and Wuhan Jingce reveal emerging solutions, but these technologies remain in early development stages.

Quality control and testing methodologies for mass-produced solid-state batteries present additional challenges. Unlike liquid systems, defects in solid electrolytes can be difficult to detect using conventional testing methods. Recent patents from Murata Manufacturing and LG Energy Solution describe novel inspection techniques specifically designed for solid-state systems.

The patent landscape suggests that successful commercialization will likely require vertical integration or strategic partnerships spanning the entire value chain. Companies with the most comprehensive patent portfolios covering both materials and manufacturing processes, such as Toyota and Samsung, appear best positioned to overcome these barriers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!