How Electric Vehicles Drive Solid State Battery Breakthrough Demand?

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EV Battery Evolution and Objectives

The evolution of electric vehicle (EV) battery technology represents one of the most dynamic areas of technological advancement in the transportation sector. Since the early 2000s, lithium-ion batteries have dominated the EV market, gradually improving in energy density, charging speed, and cost efficiency. However, these incremental improvements are approaching their theoretical limits, creating an urgent need for breakthrough technologies to support the accelerating global EV adoption.

Solid-state batteries have emerged as the most promising next-generation technology, offering potential solutions to the fundamental limitations of current lithium-ion systems. The primary objective in this technological transition is to develop battery systems that deliver higher energy density (exceeding 400 Wh/kg), faster charging capabilities (80% charge in under 15 minutes), longer cycle life (over 1,000 cycles), enhanced safety profiles, and reduced dependency on critical raw materials like cobalt.

The trajectory of EV battery evolution has been shaped by several key milestones. The first-generation lithium-ion batteries used in early EVs provided limited range and slow charging. Second-generation batteries introduced silicon-graphite composite anodes and higher nickel content cathodes, improving energy density by approximately 20-30%. Current third-generation systems employ advanced manufacturing techniques and optimized cell designs to further enhance performance while reducing costs.

Market pressures are accelerating the demand for solid-state technology. Consumer expectations for EVs now include range parity with internal combustion vehicles (400+ miles), charging times comparable to refueling (under 10 minutes), and price competitiveness without subsidies. These expectations cannot be met with conventional lithium-ion technology alone, creating a technological imperative for solid-state solutions.

Regulatory frameworks worldwide are also driving this evolution. The European Union's proposed 2035 ban on internal combustion engine vehicles, similar initiatives in China and California, and increasingly stringent emissions standards globally are creating a regulatory environment that necessitates rapid battery innovation. These policies aim to reduce transportation emissions by 80-95% by 2050 compared to 1990 levels.

The technical objectives for solid-state batteries include developing stable solid electrolytes with ionic conductivity exceeding 10^-3 S/cm at room temperature, creating manufacturing processes compatible with existing production infrastructure, and ensuring material sustainability through reduced reliance on scarce elements. Additionally, these batteries must maintain performance across a wider temperature range (-30°C to 60°C) than current technologies to ensure global applicability.

Solid-state batteries have emerged as the most promising next-generation technology, offering potential solutions to the fundamental limitations of current lithium-ion systems. The primary objective in this technological transition is to develop battery systems that deliver higher energy density (exceeding 400 Wh/kg), faster charging capabilities (80% charge in under 15 minutes), longer cycle life (over 1,000 cycles), enhanced safety profiles, and reduced dependency on critical raw materials like cobalt.

The trajectory of EV battery evolution has been shaped by several key milestones. The first-generation lithium-ion batteries used in early EVs provided limited range and slow charging. Second-generation batteries introduced silicon-graphite composite anodes and higher nickel content cathodes, improving energy density by approximately 20-30%. Current third-generation systems employ advanced manufacturing techniques and optimized cell designs to further enhance performance while reducing costs.

Market pressures are accelerating the demand for solid-state technology. Consumer expectations for EVs now include range parity with internal combustion vehicles (400+ miles), charging times comparable to refueling (under 10 minutes), and price competitiveness without subsidies. These expectations cannot be met with conventional lithium-ion technology alone, creating a technological imperative for solid-state solutions.

Regulatory frameworks worldwide are also driving this evolution. The European Union's proposed 2035 ban on internal combustion engine vehicles, similar initiatives in China and California, and increasingly stringent emissions standards globally are creating a regulatory environment that necessitates rapid battery innovation. These policies aim to reduce transportation emissions by 80-95% by 2050 compared to 1990 levels.

The technical objectives for solid-state batteries include developing stable solid electrolytes with ionic conductivity exceeding 10^-3 S/cm at room temperature, creating manufacturing processes compatible with existing production infrastructure, and ensuring material sustainability through reduced reliance on scarce elements. Additionally, these batteries must maintain performance across a wider temperature range (-30°C to 60°C) than current technologies to ensure global applicability.

Market Analysis for Solid State Batteries in EVs

The global market for solid-state batteries in electric vehicles is experiencing unprecedented growth, driven primarily by the increasing adoption of EVs worldwide. Current market valuations indicate that the solid-state battery market for EVs is projected to reach significant market size by 2030, with compound annual growth rates exceeding traditional lithium-ion battery technologies. This accelerated growth trajectory is directly correlated with the expanding EV market, which itself is growing at double-digit rates in major automotive markets including China, Europe, and North America.

Consumer demand patterns reveal a clear preference shift toward vehicles with longer range capabilities, faster charging times, and enhanced safety profiles - all key advantages offered by solid-state battery technology. Market research indicates that range anxiety remains the primary barrier to EV adoption among potential buyers, with approximately 70% of consumers citing driving range as their top concern when considering an electric vehicle purchase.

The premium automotive segment currently represents the most promising initial market for solid-state batteries, as higher vehicle price points can better absorb the current cost premium of this emerging technology. Luxury EV manufacturers are actively pursuing solid-state integration as a key differentiator in their product offerings, with several announcing plans to incorporate the technology in upcoming models between 2025-2028.

Regional market analysis shows varying adoption potentials, with Japan and South Korea leading in solid-state battery manufacturing capabilities, while North American and European markets demonstrate the highest consumer willingness to pay premium prices for advanced battery technologies. China remains the largest potential market by volume, with government initiatives actively supporting next-generation battery development through substantial research funding and manufacturing incentives.

Market segmentation studies indicate that commercial vehicle applications, particularly in delivery fleets and public transportation, represent a secondary but significant market opportunity for solid-state batteries. These applications particularly value the enhanced safety profile and potential for extended operational lifespans that solid-state technology promises.

Supply chain analysis reveals potential bottlenecks in critical materials required for solid-state battery production, particularly in lithium metal, specialized ceramic separators, and solid electrolyte materials. These supply constraints may impact market growth rates in the near term, though significant investment in material science research and alternative material pathways is underway to address these limitations.

Consumer willingness to pay studies suggest that EV buyers would accept a 15-20% price premium for vehicles equipped with solid-state batteries, provided they deliver on the promised performance improvements in range, charging speed, and safety. This price tolerance creates a viable entry point for manufacturers as production scales and costs decline through technological maturation and manufacturing optimization.

Consumer demand patterns reveal a clear preference shift toward vehicles with longer range capabilities, faster charging times, and enhanced safety profiles - all key advantages offered by solid-state battery technology. Market research indicates that range anxiety remains the primary barrier to EV adoption among potential buyers, with approximately 70% of consumers citing driving range as their top concern when considering an electric vehicle purchase.

The premium automotive segment currently represents the most promising initial market for solid-state batteries, as higher vehicle price points can better absorb the current cost premium of this emerging technology. Luxury EV manufacturers are actively pursuing solid-state integration as a key differentiator in their product offerings, with several announcing plans to incorporate the technology in upcoming models between 2025-2028.

Regional market analysis shows varying adoption potentials, with Japan and South Korea leading in solid-state battery manufacturing capabilities, while North American and European markets demonstrate the highest consumer willingness to pay premium prices for advanced battery technologies. China remains the largest potential market by volume, with government initiatives actively supporting next-generation battery development through substantial research funding and manufacturing incentives.

Market segmentation studies indicate that commercial vehicle applications, particularly in delivery fleets and public transportation, represent a secondary but significant market opportunity for solid-state batteries. These applications particularly value the enhanced safety profile and potential for extended operational lifespans that solid-state technology promises.

Supply chain analysis reveals potential bottlenecks in critical materials required for solid-state battery production, particularly in lithium metal, specialized ceramic separators, and solid electrolyte materials. These supply constraints may impact market growth rates in the near term, though significant investment in material science research and alternative material pathways is underway to address these limitations.

Consumer willingness to pay studies suggest that EV buyers would accept a 15-20% price premium for vehicles equipped with solid-state batteries, provided they deliver on the promised performance improvements in range, charging speed, and safety. This price tolerance creates a viable entry point for manufacturers as production scales and costs decline through technological maturation and manufacturing optimization.

Current Limitations and Technical Barriers

Despite significant advancements in electric vehicle (EV) battery technology, current lithium-ion batteries face substantial limitations that impede wider EV adoption. The most pressing constraint remains energy density, with contemporary lithium-ion cells delivering only 250-300 Wh/kg, restricting vehicle range to approximately 300-400 miles per charge. This range anxiety continues to be a primary barrier to consumer acceptance, particularly in regions with underdeveloped charging infrastructure.

Safety concerns represent another critical challenge, as conventional lithium-ion batteries utilize flammable liquid electrolytes that pose fire risks during thermal runaway events. High-profile battery fire incidents have damaged consumer confidence and necessitated complex thermal management systems that add weight, cost, and complexity to EV designs.

Charging speed limitations further hinder EV adoption, with most current battery technologies requiring 30+ minutes for 80% charging at DC fast charging stations. This duration significantly exceeds the consumer expectation benchmark of 5-10 minutes comparable to refueling conventional vehicles, creating a substantial user experience gap.

Battery longevity presents additional challenges, with current lithium-ion cells typically supporting 1,000-1,500 charge cycles before capacity degradation below 80% occurs. This translates to approximately 8-10 years of useful life, raising concerns about long-term ownership costs and vehicle resale value.

Temperature sensitivity remains problematic, with performance degradation occurring below 0°C and above 45°C. This necessitates sophisticated thermal management systems and limits EV practicality in extreme climate regions, adding complexity and cost to vehicle designs.

Manufacturing scalability faces constraints due to critical material supply limitations, particularly for cobalt and nickel. Geopolitical concentration of these resources in regions like the Democratic Republic of Congo (cobalt) and Indonesia (nickel) creates supply chain vulnerabilities and ethical sourcing concerns.

Cost barriers persist despite significant reductions, with battery packs still representing approximately 30-40% of total EV manufacturing costs. Current prices of $130-150/kWh remain above the widely accepted $100/kWh threshold required for price parity with internal combustion vehicles without subsidies.

These multifaceted challenges collectively drive the urgent demand for solid-state battery breakthroughs that promise to address these limitations through higher energy density, enhanced safety, faster charging, extended longevity, and potentially lower manufacturing costs.

Safety concerns represent another critical challenge, as conventional lithium-ion batteries utilize flammable liquid electrolytes that pose fire risks during thermal runaway events. High-profile battery fire incidents have damaged consumer confidence and necessitated complex thermal management systems that add weight, cost, and complexity to EV designs.

Charging speed limitations further hinder EV adoption, with most current battery technologies requiring 30+ minutes for 80% charging at DC fast charging stations. This duration significantly exceeds the consumer expectation benchmark of 5-10 minutes comparable to refueling conventional vehicles, creating a substantial user experience gap.

Battery longevity presents additional challenges, with current lithium-ion cells typically supporting 1,000-1,500 charge cycles before capacity degradation below 80% occurs. This translates to approximately 8-10 years of useful life, raising concerns about long-term ownership costs and vehicle resale value.

Temperature sensitivity remains problematic, with performance degradation occurring below 0°C and above 45°C. This necessitates sophisticated thermal management systems and limits EV practicality in extreme climate regions, adding complexity and cost to vehicle designs.

Manufacturing scalability faces constraints due to critical material supply limitations, particularly for cobalt and nickel. Geopolitical concentration of these resources in regions like the Democratic Republic of Congo (cobalt) and Indonesia (nickel) creates supply chain vulnerabilities and ethical sourcing concerns.

Cost barriers persist despite significant reductions, with battery packs still representing approximately 30-40% of total EV manufacturing costs. Current prices of $130-150/kWh remain above the widely accepted $100/kWh threshold required for price parity with internal combustion vehicles without subsidies.

These multifaceted challenges collectively drive the urgent demand for solid-state battery breakthroughs that promise to address these limitations through higher energy density, enhanced safety, faster charging, extended longevity, and potentially lower manufacturing costs.

Current Solid State Battery Solutions

01 Novel electrolyte materials for solid-state batteries

Advanced electrolyte materials are being developed to improve the performance of solid-state batteries. These materials include solid polymer electrolytes, ceramic electrolytes, and composite electrolytes that offer enhanced ionic conductivity and stability. The innovations focus on overcoming the challenges of traditional liquid electrolytes by providing safer alternatives with higher energy density and better thermal stability. These novel electrolytes also help address interface issues between electrodes and electrolytes in solid-state battery systems.- Novel electrolyte materials for solid-state batteries: Advanced electrolyte materials are being developed to improve ionic conductivity and stability in solid-state batteries. These materials include ceramic-polymer composites, sulfide-based solid electrolytes, and oxide-based materials that enable faster lithium-ion transport while maintaining mechanical integrity. These novel electrolytes address key challenges in solid-state battery technology by reducing interfacial resistance and enhancing electrochemical performance at room temperature.

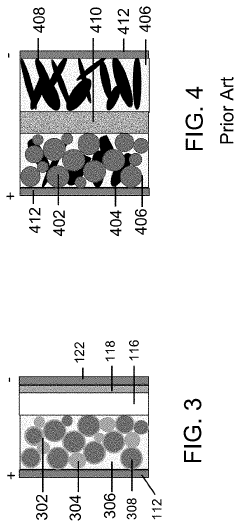

- Interface engineering for improved electrode-electrolyte contact: Breakthroughs in interface engineering focus on enhancing the contact between solid electrolytes and electrodes. Techniques include applying specialized coatings, creating gradient interfaces, and developing new bonding methods to reduce interfacial resistance. These innovations help maintain intimate contact during battery cycling, prevent delamination, and facilitate efficient ion transfer across boundaries, which are critical factors for achieving high energy density and long cycle life in solid-state batteries.

- Advanced cathode materials for high-energy density: New cathode materials are being developed specifically for solid-state battery applications, focusing on high energy density and compatibility with solid electrolytes. These include nickel-rich layered oxides, sulfur-based composites, and novel structures that accommodate volume changes during cycling. The cathode innovations enable higher voltage operation, increased capacity, and better structural stability when paired with solid electrolytes.

- Manufacturing processes for scalable solid-state battery production: Innovative manufacturing techniques are being developed to enable mass production of solid-state batteries. These include dry processing methods, advanced deposition techniques for thin film electrolytes, and new assembly processes that maintain layer integrity. These manufacturing breakthroughs address key challenges in scaling up production while maintaining quality, reducing costs, and enabling the transition from laboratory prototypes to commercial products.

- Lithium metal anode protection strategies: Protection strategies for lithium metal anodes in solid-state batteries focus on preventing dendrite formation and improving cycling stability. Approaches include artificial protective layers, nanostructured interfaces, and composite anode designs that accommodate volume changes during cycling. These innovations help harness the high energy density potential of lithium metal while addressing its reactivity and mechanical challenges when paired with solid electrolytes.

02 Electrode architecture and interface engineering

Breakthroughs in electrode design and interface engineering are critical for solid-state battery performance. These innovations include structured electrodes that maximize contact with solid electrolytes, specialized coatings that reduce interfacial resistance, and novel manufacturing techniques that ensure intimate contact between battery components. By addressing the challenges of solid-solid interfaces, these approaches help overcome power density limitations and improve cycling stability in solid-state batteries.Expand Specific Solutions03 Manufacturing processes and scalability solutions

Innovative manufacturing processes are being developed to enable commercial production of solid-state batteries. These include new deposition techniques for thin-film electrolytes, roll-to-roll processing methods, and advanced sintering approaches for ceramic components. The breakthroughs focus on addressing scalability challenges while maintaining the precise interfaces needed for optimal battery performance. These manufacturing innovations are essential for transitioning solid-state battery technology from laboratory prototypes to mass-produced commercial products.Expand Specific Solutions04 Lithium metal anode protection strategies

Protection strategies for lithium metal anodes represent a significant breakthrough in solid-state battery technology. These innovations include artificial protective layers, specialized interface materials, and novel architectures that prevent dendrite formation and lithium corrosion. By stabilizing the lithium metal anode, these approaches enable higher energy density while maintaining long cycle life. The protective strategies also address safety concerns associated with lithium metal by preventing short circuits and thermal runaway events.Expand Specific Solutions05 Composite cathode materials and structures

Advanced composite cathode materials and structures are being developed to maximize the performance of solid-state batteries. These innovations include high-capacity cathode materials, hierarchical structures that facilitate ion transport, and composite designs that maintain mechanical integrity during cycling. By addressing the challenges of ion transport within solid cathodes, these breakthroughs enable higher energy density and improved rate capability. The composite cathode designs also help mitigate volume changes during battery operation, leading to enhanced cycle life.Expand Specific Solutions

Leading Companies and Research Institutions

The electric vehicle (EV) market is driving significant demand for solid-state battery breakthroughs, currently positioned in the early growth phase of industry development. With a projected market size exceeding $8 billion by 2030, this technology represents a critical inflection point in energy storage evolution. Technical maturity varies across key players: established automotive manufacturers (Mercedes-Benz, Honda, GM) are heavily investing in research partnerships, while specialized battery developers like LG Energy Solution, TeraWatt Technology, and Ilika Technologies lead in patent development. Academic institutions (University of Michigan, University of California) contribute fundamental research, while Chinese companies (SAIC, Svolt, State Grid) are rapidly accelerating development efforts to capture market share in this transformative technology space.

LG Energy Solution Ltd.

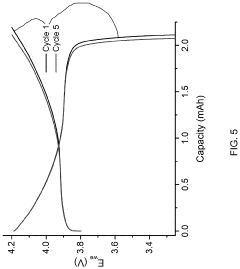

Technical Solution: LG Energy Solution has developed a proprietary solid-state battery technology utilizing sulfide-based solid electrolytes that demonstrates superior ionic conductivity compared to conventional liquid electrolytes. Their approach incorporates a composite cathode structure with optimized interfaces between active materials and the solid electrolyte, enabling faster ion transport. The company has achieved energy densities exceeding 900 Wh/L in laboratory settings, representing a significant improvement over current lithium-ion batteries. LG's manufacturing process includes a unique dry-coating technique that eliminates the need for traditional NMP solvents, reducing production costs and environmental impact. Their solid-state cells have demonstrated over 1,000 cycles with minimal capacity degradation and can operate effectively across a wider temperature range (-30°C to 60°C) than conventional batteries.

Strengths: Advanced manufacturing capabilities and established supply chain relationships with major automakers provide significant scaling advantages. Their sulfide-based technology offers higher conductivity than oxide alternatives. Weaknesses: Sulfide electrolytes are moisture-sensitive, requiring stringent manufacturing controls. Interface stability between electrodes and electrolyte remains challenging for long-term cycling.

GM Global Technology Operations LLC

Technical Solution: GM has developed a proprietary solid-state battery platform called Ultium that incorporates a silicon-rich anode and lithium metal technology. Their approach focuses on a multi-layer cell architecture with a composite solid electrolyte system that combines polymer and ceramic components to optimize both mechanical flexibility and ionic conductivity. GM's solid-state technology aims to achieve energy densities of over 1,000 Wh/L while reducing battery pack costs below $100/kWh. The company has established a dedicated battery innovation center in Warren, Michigan, where they've demonstrated prototype cells with fast-charging capabilities (80% charge in under 15 minutes) and extended cycle life. GM's solid-state battery design incorporates advanced thermal management systems that minimize temperature-related performance variations and enhance safety by eliminating flammable liquid electrolytes.

Strengths: Extensive in-house battery engineering expertise and vertical integration capabilities through partnerships with suppliers. Their hybrid electrolyte approach balances conductivity with manufacturability. Weaknesses: Still facing challenges with scaling production from laboratory to commercial volumes. The composite electrolyte system adds complexity to manufacturing processes compared to single-material approaches.

Key Patents and Scientific Breakthroughs

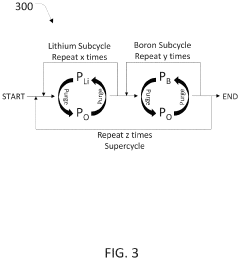

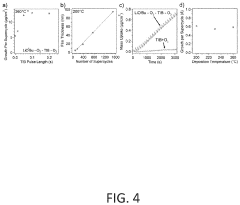

System And Method For Atomic Layer Deposition Of Solid Electrolytes

PatentPendingUS20200028208A1

Innovation

- The development of a Li3BO3—Li2CO3 (LBCO) solid electrolyte film using Atomic Layer Deposition (ALD) with a self-limiting and linear growth process, achieving higher ionic conductivity (>10−6 S/cm) and stability over a wide range of potentials, through exposure to lithium, boron, and oxygen-containing precursors, allowing for tunable structure and properties.

Cermet electrode for solid state and lithium ion batteries

PatentPendingUS20200388854A1

Innovation

- A porous ceramic-metal (cermet) cathode is developed, where a metallic material acts as a binder and conductive additive, providing mechanical integrity and interconnected porosity to accommodate liquid, gel, or polymer electrolytes, and is free of conventional binders and conductive carbon, enhancing the cathode's mechanical strength and stability.

Supply Chain Considerations

The solid state battery supply chain represents a critical factor in the widespread adoption of this technology for electric vehicles. Current lithium-ion battery production relies on established global networks for raw materials, manufacturing, and distribution. However, solid state batteries require different materials and manufacturing processes, necessitating significant supply chain restructuring.

Material sourcing presents the first major challenge. Solid state batteries typically require specialized solid electrolytes composed of ceramics, polymers, or glass materials. These may include lithium lanthanum zirconium oxide (LLZO), lithium phosphorus oxynitride (LiPON), and various sulfide-based compounds. The geographical distribution of these materials differs from traditional battery components, potentially creating new dependencies on specific regions and countries.

Manufacturing capacity represents another crucial consideration. Current battery gigafactories are designed specifically for liquid electrolyte lithium-ion cells. Transitioning to solid state technology will require substantial retooling and process redesign. Companies like Toyota, Volkswagen, and QuantumScape are investing heavily in pilot production facilities, but scaling to mass production volumes remains challenging.

Supply chain resilience must be prioritized given recent global disruptions. The COVID-19 pandemic and geopolitical tensions have highlighted vulnerabilities in complex international supply networks. Developing regional manufacturing capabilities and diversifying material sources will be essential for solid state battery production security.

Cost implications throughout the supply chain will significantly impact market adoption. While solid state batteries promise lower costs at scale due to simplified design and potentially cheaper materials, the transition period will likely see higher costs as new supply chains develop. Initial investments in specialized manufacturing equipment and processes will require amortization across production volumes.

Sustainability considerations are increasingly important in battery supply chains. Solid state technology offers potential environmental benefits through reduced use of toxic materials and improved recyclability. However, new material extraction and processing methods must be developed with environmental impact in mind to ensure the technology delivers on its green promises.

Collaboration across the automotive and battery industries will be essential to establish efficient supply chains. Joint ventures, strategic partnerships, and industry consortia are forming to share development costs and standardize approaches. These collaborative efforts will accelerate the creation of robust supply networks capable of meeting the anticipated demand surge from electric vehicle manufacturers.

Material sourcing presents the first major challenge. Solid state batteries typically require specialized solid electrolytes composed of ceramics, polymers, or glass materials. These may include lithium lanthanum zirconium oxide (LLZO), lithium phosphorus oxynitride (LiPON), and various sulfide-based compounds. The geographical distribution of these materials differs from traditional battery components, potentially creating new dependencies on specific regions and countries.

Manufacturing capacity represents another crucial consideration. Current battery gigafactories are designed specifically for liquid electrolyte lithium-ion cells. Transitioning to solid state technology will require substantial retooling and process redesign. Companies like Toyota, Volkswagen, and QuantumScape are investing heavily in pilot production facilities, but scaling to mass production volumes remains challenging.

Supply chain resilience must be prioritized given recent global disruptions. The COVID-19 pandemic and geopolitical tensions have highlighted vulnerabilities in complex international supply networks. Developing regional manufacturing capabilities and diversifying material sources will be essential for solid state battery production security.

Cost implications throughout the supply chain will significantly impact market adoption. While solid state batteries promise lower costs at scale due to simplified design and potentially cheaper materials, the transition period will likely see higher costs as new supply chains develop. Initial investments in specialized manufacturing equipment and processes will require amortization across production volumes.

Sustainability considerations are increasingly important in battery supply chains. Solid state technology offers potential environmental benefits through reduced use of toxic materials and improved recyclability. However, new material extraction and processing methods must be developed with environmental impact in mind to ensure the technology delivers on its green promises.

Collaboration across the automotive and battery industries will be essential to establish efficient supply chains. Joint ventures, strategic partnerships, and industry consortia are forming to share development costs and standardize approaches. These collaborative efforts will accelerate the creation of robust supply networks capable of meeting the anticipated demand surge from electric vehicle manufacturers.

Environmental Impact and Sustainability

The transition to electric vehicles represents a significant step toward reducing transportation-related environmental impacts. Solid-state batteries, as a next-generation energy storage solution for EVs, offer substantial sustainability advantages over conventional lithium-ion batteries. Their higher energy density translates to extended vehicle range while using fewer raw materials per kilowatt-hour of storage capacity, effectively reducing resource extraction demands and associated environmental disruption.

Manufacturing processes for solid-state batteries demonstrate promising environmental benefits. The elimination of liquid electrolytes removes the need for toxic and flammable solvents used in conventional battery production, resulting in lower volatile organic compound emissions and reduced hazardous waste generation. Early lifecycle assessments suggest solid-state battery production could achieve up to 30% lower carbon footprint compared to traditional lithium-ion manufacturing when scaled to commercial levels.

The operational phase of solid-state batteries presents additional environmental advantages. Their enhanced thermal stability eliminates the need for complex cooling systems in EV battery packs, reducing vehicle weight and energy consumption. The projected longer cycle life—potentially exceeding 2,000 complete charge cycles—significantly extends battery service life, delaying replacement needs and associated resource demands.

End-of-life considerations further highlight solid-state batteries' sustainability credentials. Their simplified construction, with fewer components and absence of liquid electrolytes, facilitates more efficient recycling processes. The higher concentration of valuable materials like lithium and the potential for direct recycling methods could increase recovery rates to over 90% for critical materials, compared to current rates of 50-60% for conventional batteries.

Regulatory frameworks worldwide increasingly recognize these environmental benefits. The European Battery Directive revision specifically incentivizes technologies with improved lifecycle impacts, while several Asian markets have introduced sustainability criteria in battery manufacturing subsidies that favor solid-state technology. These policy developments further accelerate industry investment in environmentally superior battery solutions.

The cumulative environmental benefits of solid-state batteries could substantially enhance the sustainability profile of electric vehicles. Conservative estimates suggest their adoption could reduce the lifecycle carbon footprint of EVs by an additional 15-20% beyond improvements already achieved with current battery technologies, strengthening the environmental case for transportation electrification and accelerating the transition away from fossil fuel dependence.

Manufacturing processes for solid-state batteries demonstrate promising environmental benefits. The elimination of liquid electrolytes removes the need for toxic and flammable solvents used in conventional battery production, resulting in lower volatile organic compound emissions and reduced hazardous waste generation. Early lifecycle assessments suggest solid-state battery production could achieve up to 30% lower carbon footprint compared to traditional lithium-ion manufacturing when scaled to commercial levels.

The operational phase of solid-state batteries presents additional environmental advantages. Their enhanced thermal stability eliminates the need for complex cooling systems in EV battery packs, reducing vehicle weight and energy consumption. The projected longer cycle life—potentially exceeding 2,000 complete charge cycles—significantly extends battery service life, delaying replacement needs and associated resource demands.

End-of-life considerations further highlight solid-state batteries' sustainability credentials. Their simplified construction, with fewer components and absence of liquid electrolytes, facilitates more efficient recycling processes. The higher concentration of valuable materials like lithium and the potential for direct recycling methods could increase recovery rates to over 90% for critical materials, compared to current rates of 50-60% for conventional batteries.

Regulatory frameworks worldwide increasingly recognize these environmental benefits. The European Battery Directive revision specifically incentivizes technologies with improved lifecycle impacts, while several Asian markets have introduced sustainability criteria in battery manufacturing subsidies that favor solid-state technology. These policy developments further accelerate industry investment in environmentally superior battery solutions.

The cumulative environmental benefits of solid-state batteries could substantially enhance the sustainability profile of electric vehicles. Conservative estimates suggest their adoption could reduce the lifecycle carbon footprint of EVs by an additional 15-20% beyond improvements already achieved with current battery technologies, strengthening the environmental case for transportation electrification and accelerating the transition away from fossil fuel dependence.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!