Solid State Battery Breakthrough: Regulatory and Compliance Challenges

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Evolution and Objectives

Solid state batteries represent a significant evolution in energy storage technology, emerging from decades of research into safer and more efficient alternatives to conventional lithium-ion batteries. The development trajectory began in the 1970s with the discovery of solid electrolytes, but meaningful progress accelerated only in the early 2000s as materials science advanced sufficiently to address fundamental challenges in ionic conductivity and interfacial stability.

The evolution of solid state battery technology has been characterized by three distinct phases. The initial exploratory phase (1970s-1990s) established theoretical foundations but yielded limited practical applications due to poor conductivity of early solid electrolytes. The developmental phase (2000-2015) saw significant improvements in materials, particularly with the introduction of sulfide-based and oxide-based solid electrolytes that approached the conductivity levels of liquid counterparts.

Currently, we are in the commercialization phase (2016-present), where laboratory successes are being translated into manufacturable products. This phase has been marked by substantial investments from automotive manufacturers and energy companies seeking to capitalize on the technology's potential for electric vehicles and grid storage applications.

The primary objectives driving solid state battery development include achieving enhanced safety through elimination of flammable liquid electrolytes, increasing energy density beyond the theoretical limits of conventional lithium-ion batteries (>400 Wh/kg), extending cycle life to 1,000+ cycles, and enabling faster charging capabilities. Additionally, there are objectives related to operational temperature range expansion, particularly for low-temperature performance where conventional batteries struggle.

Recent breakthroughs have centered on addressing the critical challenges of interfacial resistance between solid electrolytes and electrodes, and developing manufacturing processes suitable for mass production. Notable advancements include the development of composite electrolytes that combine the benefits of different material classes, and novel electrode architectures that accommodate volume changes during cycling.

Looking forward, the technology roadmap aims to achieve commercial viability in specialized applications by 2023-2025, with widespread adoption in consumer electronics and electric vehicles anticipated by 2025-2030. The ultimate objective is to develop solid state batteries that outperform conventional lithium-ion batteries across all performance metrics while being cost-competitive at scale.

These technological objectives must now be balanced against emerging regulatory and compliance challenges, as novel materials and manufacturing processes encounter existing regulatory frameworks that were largely designed for conventional battery technologies. The intersection of technological innovation and regulatory adaptation represents a critical factor in determining the timeline for widespread commercial deployment.

The evolution of solid state battery technology has been characterized by three distinct phases. The initial exploratory phase (1970s-1990s) established theoretical foundations but yielded limited practical applications due to poor conductivity of early solid electrolytes. The developmental phase (2000-2015) saw significant improvements in materials, particularly with the introduction of sulfide-based and oxide-based solid electrolytes that approached the conductivity levels of liquid counterparts.

Currently, we are in the commercialization phase (2016-present), where laboratory successes are being translated into manufacturable products. This phase has been marked by substantial investments from automotive manufacturers and energy companies seeking to capitalize on the technology's potential for electric vehicles and grid storage applications.

The primary objectives driving solid state battery development include achieving enhanced safety through elimination of flammable liquid electrolytes, increasing energy density beyond the theoretical limits of conventional lithium-ion batteries (>400 Wh/kg), extending cycle life to 1,000+ cycles, and enabling faster charging capabilities. Additionally, there are objectives related to operational temperature range expansion, particularly for low-temperature performance where conventional batteries struggle.

Recent breakthroughs have centered on addressing the critical challenges of interfacial resistance between solid electrolytes and electrodes, and developing manufacturing processes suitable for mass production. Notable advancements include the development of composite electrolytes that combine the benefits of different material classes, and novel electrode architectures that accommodate volume changes during cycling.

Looking forward, the technology roadmap aims to achieve commercial viability in specialized applications by 2023-2025, with widespread adoption in consumer electronics and electric vehicles anticipated by 2025-2030. The ultimate objective is to develop solid state batteries that outperform conventional lithium-ion batteries across all performance metrics while being cost-competitive at scale.

These technological objectives must now be balanced against emerging regulatory and compliance challenges, as novel materials and manufacturing processes encounter existing regulatory frameworks that were largely designed for conventional battery technologies. The intersection of technological innovation and regulatory adaptation represents a critical factor in determining the timeline for widespread commercial deployment.

Market Demand Analysis for Solid State Batteries

The global market for solid-state batteries is experiencing unprecedented growth, driven by increasing demand for safer, higher-capacity energy storage solutions across multiple industries. Current market projections indicate that the solid-state battery market will reach approximately $8 billion by 2026, with a compound annual growth rate exceeding 34% between 2021 and 2026. This remarkable growth trajectory reflects the significant advantages these batteries offer over conventional lithium-ion technologies.

Electric vehicle manufacturers represent the primary demand driver, as they seek battery technologies that can deliver greater energy density, faster charging capabilities, and enhanced safety profiles. Major automotive companies including Toyota, Volkswagen, and BMW have announced substantial investments in solid-state battery technology, recognizing its potential to overcome the range anxiety and safety concerns that currently limit EV adoption. The automotive sector alone is expected to account for over 40% of the total solid-state battery market by 2025.

Consumer electronics manufacturers constitute another significant market segment, with growing interest in solid-state batteries for smartphones, laptops, and wearable devices. The demand stems from consumer preferences for devices with longer battery life, reduced charging times, and elimination of fire risks associated with conventional batteries. Industry analysts project that this segment will grow at a rate of approximately 29% annually through 2026.

The renewable energy sector presents an emerging but rapidly expanding market for solid-state batteries. As solar and wind power generation increases globally, the need for efficient, safe, and long-lasting energy storage solutions becomes critical. Utility companies are particularly interested in solid-state technology for grid-scale storage applications, where safety and longevity are paramount concerns.

Market research indicates strong regional variations in demand patterns. Asia-Pacific currently leads in manufacturing capacity and adoption, with Japan and South Korea at the forefront of technological development. North America and Europe show accelerating demand, primarily driven by automotive and renewable energy applications. Government policies supporting clean energy and transportation electrification in these regions further stimulate market growth.

Despite strong demand signals, several market constraints exist. Current production costs remain significantly higher than conventional lithium-ion batteries, with solid-state batteries costing approximately 2-3 times more per kWh. Supply chain limitations for key materials such as solid electrolytes and specialized manufacturing equipment also restrict market expansion. These constraints are expected to ease gradually as production scales and manufacturing processes mature.

Electric vehicle manufacturers represent the primary demand driver, as they seek battery technologies that can deliver greater energy density, faster charging capabilities, and enhanced safety profiles. Major automotive companies including Toyota, Volkswagen, and BMW have announced substantial investments in solid-state battery technology, recognizing its potential to overcome the range anxiety and safety concerns that currently limit EV adoption. The automotive sector alone is expected to account for over 40% of the total solid-state battery market by 2025.

Consumer electronics manufacturers constitute another significant market segment, with growing interest in solid-state batteries for smartphones, laptops, and wearable devices. The demand stems from consumer preferences for devices with longer battery life, reduced charging times, and elimination of fire risks associated with conventional batteries. Industry analysts project that this segment will grow at a rate of approximately 29% annually through 2026.

The renewable energy sector presents an emerging but rapidly expanding market for solid-state batteries. As solar and wind power generation increases globally, the need for efficient, safe, and long-lasting energy storage solutions becomes critical. Utility companies are particularly interested in solid-state technology for grid-scale storage applications, where safety and longevity are paramount concerns.

Market research indicates strong regional variations in demand patterns. Asia-Pacific currently leads in manufacturing capacity and adoption, with Japan and South Korea at the forefront of technological development. North America and Europe show accelerating demand, primarily driven by automotive and renewable energy applications. Government policies supporting clean energy and transportation electrification in these regions further stimulate market growth.

Despite strong demand signals, several market constraints exist. Current production costs remain significantly higher than conventional lithium-ion batteries, with solid-state batteries costing approximately 2-3 times more per kWh. Supply chain limitations for key materials such as solid electrolytes and specialized manufacturing equipment also restrict market expansion. These constraints are expected to ease gradually as production scales and manufacturing processes mature.

Technical Barriers and Global Development Status

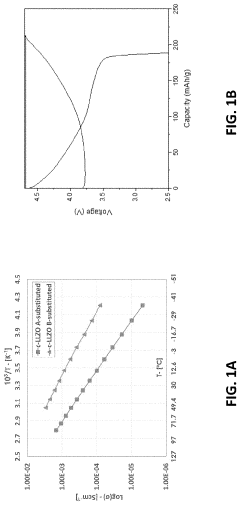

Solid-state battery technology faces significant technical barriers despite its promising potential. The primary challenge lies in the solid electrolyte interface, where issues of ion conductivity at room temperature remain substantially lower than liquid electrolytes. Current solid electrolytes struggle to achieve the 10^-3 S/cm conductivity threshold necessary for practical applications, particularly in consumer electronics and electric vehicles.

Material compatibility presents another formidable obstacle. The chemical and mechanical interactions between solid electrolytes and electrode materials often lead to interfacial resistance growth during cycling. This resistance increase results in capacity fade and shortened battery lifespan, with most prototype cells demonstrating significant performance degradation after 100-200 cycles.

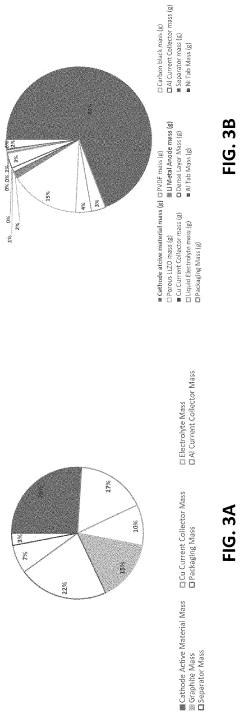

Manufacturing scalability constitutes a critical barrier to commercialization. Traditional battery production lines are optimized for liquid electrolyte systems, while solid-state batteries require fundamentally different processing techniques. The precision needed for thin-film deposition of solid electrolytes and the challenges of creating defect-free interfaces at scale have prevented mass production capabilities.

Globally, development status varies significantly by region. Japan leads in solid-state battery patents, with companies like Toyota holding over 1,000 patents in this domain. Their approach focuses primarily on sulfide-based electrolytes, with pilot production facilities already established. The European Union has invested heavily through initiatives like the Battery 2030+ program, concentrating on oxide-based systems with emphasis on safety standards integration from early development stages.

In North America, startups like QuantumScape and Solid Power have attracted significant venture capital, focusing on hybrid approaches that combine aspects of conventional lithium-ion technology with solid-state innovations. These companies have announced plans for commercial production by 2025-2026, though regulatory hurdles remain substantial.

China has rapidly accelerated its position through government-backed initiatives like the "Made in China 2025" program, which specifically targets advanced battery technologies. Chinese manufacturers have demonstrated particular strength in scaling production processes, though their intellectual property position remains less robust than Japanese counterparts.

Regulatory frameworks globally remain underdeveloped for solid-state technology, creating uncertainty for manufacturers. Safety testing protocols designed for liquid electrolyte systems do not adequately address the unique characteristics of solid-state batteries, particularly regarding thermal runaway prevention verification and long-term stability assessment under various environmental conditions.

Material compatibility presents another formidable obstacle. The chemical and mechanical interactions between solid electrolytes and electrode materials often lead to interfacial resistance growth during cycling. This resistance increase results in capacity fade and shortened battery lifespan, with most prototype cells demonstrating significant performance degradation after 100-200 cycles.

Manufacturing scalability constitutes a critical barrier to commercialization. Traditional battery production lines are optimized for liquid electrolyte systems, while solid-state batteries require fundamentally different processing techniques. The precision needed for thin-film deposition of solid electrolytes and the challenges of creating defect-free interfaces at scale have prevented mass production capabilities.

Globally, development status varies significantly by region. Japan leads in solid-state battery patents, with companies like Toyota holding over 1,000 patents in this domain. Their approach focuses primarily on sulfide-based electrolytes, with pilot production facilities already established. The European Union has invested heavily through initiatives like the Battery 2030+ program, concentrating on oxide-based systems with emphasis on safety standards integration from early development stages.

In North America, startups like QuantumScape and Solid Power have attracted significant venture capital, focusing on hybrid approaches that combine aspects of conventional lithium-ion technology with solid-state innovations. These companies have announced plans for commercial production by 2025-2026, though regulatory hurdles remain substantial.

China has rapidly accelerated its position through government-backed initiatives like the "Made in China 2025" program, which specifically targets advanced battery technologies. Chinese manufacturers have demonstrated particular strength in scaling production processes, though their intellectual property position remains less robust than Japanese counterparts.

Regulatory frameworks globally remain underdeveloped for solid-state technology, creating uncertainty for manufacturers. Safety testing protocols designed for liquid electrolyte systems do not adequately address the unique characteristics of solid-state batteries, particularly regarding thermal runaway prevention verification and long-term stability assessment under various environmental conditions.

Current Technical Solutions and Implementations

01 Safety regulations for solid state batteries

Solid state batteries must comply with various safety regulations to ensure they do not pose risks during operation, transportation, or disposal. These regulations address thermal stability, mechanical integrity, and prevention of short circuits. Manufacturers must demonstrate compliance with standards that evaluate battery performance under extreme conditions, including high temperatures, physical impact, and electrical stress. Safety certification is required before these batteries can be commercially deployed in consumer electronics, electric vehicles, or energy storage systems.- Safety standards and certification for solid state batteries: Solid state batteries must comply with various safety standards and certification requirements before they can be commercialized. These standards address thermal stability, mechanical integrity, and electrical safety aspects specific to solid electrolyte technologies. Manufacturers must conduct rigorous testing to demonstrate compliance with international safety protocols, which often include abuse testing under extreme conditions to ensure consumer safety.

- Environmental compliance and lifecycle management: Regulatory frameworks for solid state batteries include environmental compliance requirements throughout their lifecycle. This encompasses manufacturing processes, material sourcing, usage, and end-of-life disposal or recycling. Manufacturers must adhere to regulations limiting hazardous substances and implement proper waste management protocols. Environmental impact assessments are required to evaluate the ecological footprint of solid state battery production and disposal.

- Transportation and shipping regulations: Solid state batteries are subject to specific transportation and shipping regulations that differ from those for conventional lithium-ion batteries. These regulations address the unique safety characteristics of solid electrolytes during transit. Manufacturers must comply with international dangerous goods transport codes, proper packaging requirements, and labeling standards to ensure safe handling during distribution across global markets.

- Quality control and manufacturing standards: Regulatory frameworks mandate specific quality control processes and manufacturing standards for solid state battery production. These include requirements for production environment cleanliness, material purity verification, and process validation. Manufacturers must implement robust quality management systems, conduct regular audits, and maintain detailed documentation of manufacturing processes to ensure consistency and reliability of the final battery products.

- Intellectual property and patent compliance: Solid state battery development involves complex intellectual property considerations and patent compliance requirements. Companies must navigate existing patent landscapes to avoid infringement while protecting their own innovations. This includes conducting freedom-to-operate analyses, managing patent portfolios, and establishing appropriate licensing agreements. Regulatory frameworks may also include provisions for technology transfer and cross-licensing to promote innovation while respecting intellectual property rights.

02 Environmental compliance and sustainability requirements

Solid state battery manufacturers must adhere to environmental regulations governing the sourcing of raw materials, manufacturing processes, and end-of-life disposal. These requirements include restrictions on hazardous substances, responsible mining practices for critical minerals, and recyclability standards. Environmental impact assessments may be required during the development phase, and manufacturers must implement sustainable production methods to reduce carbon footprint. Compliance with circular economy principles is increasingly important as regulatory bodies emphasize battery recycling and resource recovery.Expand Specific Solutions03 Certification and testing protocols

Specific testing protocols and certification processes have been established for solid state batteries to verify their performance, safety, and reliability. These include standardized methods for evaluating energy density, cycle life, temperature tolerance, and charging characteristics. Third-party certification bodies conduct rigorous testing under controlled conditions to ensure batteries meet industry standards and regulatory requirements. Manufacturers must document test results and maintain quality control systems throughout production to maintain certification status and ensure consistent compliance with established protocols.Expand Specific Solutions04 Intellectual property and patent compliance

The solid state battery field involves complex intellectual property considerations, requiring manufacturers to navigate patent landscapes and ensure freedom to operate. Companies must conduct thorough patent searches and analyses to avoid infringement of existing technologies while protecting their own innovations. Cross-licensing agreements may be necessary in this highly competitive field where fundamental technologies are often protected by multiple overlapping patents. Regulatory frameworks for intellectual property vary by jurisdiction, requiring global manufacturers to develop comprehensive IP strategies that address regional differences in patent law.Expand Specific Solutions05 Transportation and shipping regulations

Solid state batteries are subject to specific transportation and shipping regulations that govern their movement across borders and through different modes of transport. These regulations address classification, packaging requirements, labeling, and documentation needed for compliant shipping. While solid state batteries generally present lower fire risks than liquid electrolyte batteries, they still require specialized handling procedures and may face restrictions when transported by air. International agreements like the UN Model Regulations and modal regulations such as IATA Dangerous Goods Regulations establish the framework for safe transport, with requirements varying based on battery chemistry, size, and energy content.Expand Specific Solutions

Critical Patents and Technical Literature Review

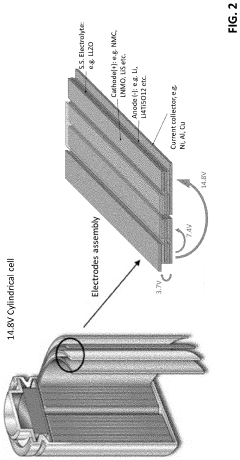

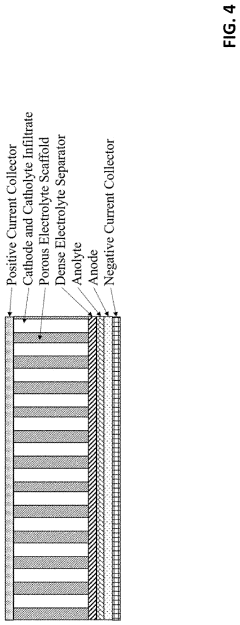

Hybrid and solid-state battery architectures with high loading and methods of manufacture thereof

PatentInactiveUS20200067128A1

Innovation

- A solid-state or hybrid battery design featuring a three-dimensional porous scaffold with enhanced ionic and electronic conductivity, incorporating a ceramic solid-state electrolyte and a dendrite-blocking separator, allowing for higher electrochemically-active material loadings and improved lithium ion and electron conductivity.

Quasi-solid-state electrolytes, electrochemical cells, and related methods

PatentWO2024091531A1

Innovation

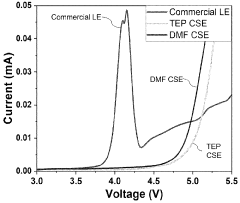

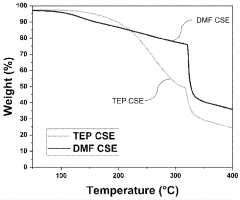

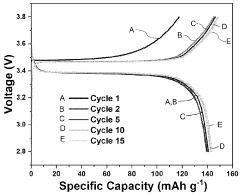

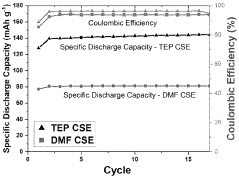

- A quasi-solid-state electrolyte is developed, comprising a mixture of a solid polymer electrolyte and a fire retardant solvent, such as triethyl phosphate, which forms a polymer matrix with lithium-ion percolation channels, enhancing ionic conductivity and stability, and is used in electrochemical cells to create a high-energy-density, safe, and reliable battery.

Regulatory Framework and Compliance Requirements

The regulatory landscape for solid-state batteries represents a complex and evolving framework that manufacturers must navigate to bring these innovative energy storage solutions to market. Current regulations governing lithium-ion batteries provide the foundation, but significant gaps exist when addressing the unique characteristics and safety profiles of solid-state technology. Regulatory bodies including the International Electrotechnical Commission (IEC), Underwriters Laboratories (UL), and various transportation authorities are actively developing or revising standards specifically for solid-state batteries.

Safety certification requirements present particular challenges due to the novel materials and architectures employed in solid-state designs. Testing protocols established for conventional batteries may not adequately assess the failure modes or thermal runaway risks specific to solid electrolytes. This necessitates the development of new testing methodologies that can accurately evaluate performance under various environmental conditions and stress scenarios.

Transportation regulations pose another significant compliance hurdle. The International Air Transport Association (IATA) and similar organizations maintain strict guidelines for battery shipment, which must be adapted to account for the different safety characteristics of solid-state batteries. While these batteries generally offer improved safety profiles compared to liquid electrolyte counterparts, regulatory frameworks have not yet fully recognized these advantages through differentiated classification or handling requirements.

Environmental compliance considerations are increasingly important as regulatory bodies worldwide implement more stringent sustainability standards. Manufacturers must address end-of-life management, recycling protocols, and potential environmental impacts of novel materials used in solid-state batteries. The European Union's Battery Directive and similar regulations in other regions are evolving to incorporate requirements specific to advanced battery technologies, including potential restrictions on certain materials and mandatory recycling targets.

Market access requirements vary significantly across global regions, creating a fragmented compliance landscape. Companies must navigate different certification processes, documentation requirements, and technical standards across North America, Europe, Asia, and emerging markets. This regulatory heterogeneity increases development costs and time-to-market for new solid-state battery technologies.

Intellectual property considerations intersect with regulatory compliance, particularly regarding patented materials and manufacturing processes. Companies must ensure their innovations not only meet regulatory requirements but also navigate the complex patent landscape to avoid infringement issues while protecting their own technological advances through strategic IP filings.

Safety certification requirements present particular challenges due to the novel materials and architectures employed in solid-state designs. Testing protocols established for conventional batteries may not adequately assess the failure modes or thermal runaway risks specific to solid electrolytes. This necessitates the development of new testing methodologies that can accurately evaluate performance under various environmental conditions and stress scenarios.

Transportation regulations pose another significant compliance hurdle. The International Air Transport Association (IATA) and similar organizations maintain strict guidelines for battery shipment, which must be adapted to account for the different safety characteristics of solid-state batteries. While these batteries generally offer improved safety profiles compared to liquid electrolyte counterparts, regulatory frameworks have not yet fully recognized these advantages through differentiated classification or handling requirements.

Environmental compliance considerations are increasingly important as regulatory bodies worldwide implement more stringent sustainability standards. Manufacturers must address end-of-life management, recycling protocols, and potential environmental impacts of novel materials used in solid-state batteries. The European Union's Battery Directive and similar regulations in other regions are evolving to incorporate requirements specific to advanced battery technologies, including potential restrictions on certain materials and mandatory recycling targets.

Market access requirements vary significantly across global regions, creating a fragmented compliance landscape. Companies must navigate different certification processes, documentation requirements, and technical standards across North America, Europe, Asia, and emerging markets. This regulatory heterogeneity increases development costs and time-to-market for new solid-state battery technologies.

Intellectual property considerations intersect with regulatory compliance, particularly regarding patented materials and manufacturing processes. Companies must ensure their innovations not only meet regulatory requirements but also navigate the complex patent landscape to avoid infringement issues while protecting their own technological advances through strategic IP filings.

Safety Standards and Certification Processes

The regulatory landscape for solid-state batteries presents a complex matrix of safety standards and certification processes that manufacturers must navigate before commercialization. Currently, most existing battery safety standards were developed for lithium-ion technologies, creating a significant gap for solid-state battery certification. Organizations such as UL (Underwriters Laboratories), IEC (International Electrotechnical Commission), and ISO (International Organization for Standardization) are actively working to adapt existing frameworks or develop new standards specifically for solid-state technologies.

The UL 1642 standard for lithium batteries and IEC 62133 for secondary cells require substantial modification to address the unique characteristics of solid-state batteries, particularly regarding thermal runaway prevention mechanisms and electrolyte safety profiles. These standards typically evaluate batteries through rigorous testing protocols including crush tests, thermal cycling, short circuit tests, and overcharge conditions - all of which may manifest differently in solid-state architectures.

Certification processes for solid-state batteries currently follow a hybrid approach, combining elements from existing lithium-ion battery protocols with additional testing specific to solid electrolyte properties. This creates regulatory uncertainty and potential delays as testing methodologies evolve alongside the technology. The UN Transportation Tests (UN 38.3) for dangerous goods shipping also requires reconsideration for solid-state batteries, as their transport classification may differ from conventional lithium-ion cells.

Regional variations in certification requirements further complicate the regulatory landscape. The European Union's Battery Directive and REACH regulations impose specific chemical safety and recycling requirements, while China's GB standards and North America's UL listings each present unique compliance challenges. Manufacturers must simultaneously satisfy these divergent regional frameworks while the technology itself continues to evolve.

Emerging certification challenges include validating long-term aging characteristics, establishing appropriate accelerated life testing protocols, and developing non-destructive testing methods suitable for solid-state architectures. The industry is increasingly advocating for performance-based rather than prescriptive standards to accommodate the rapid pace of innovation in solid-state battery chemistry and design.

Regulatory bodies and industry consortia are collaborating to establish "pre-certification" pathways that allow for iterative testing during development stages, potentially accelerating the timeline from laboratory breakthrough to market-ready products. These collaborative approaches recognize that safety standards must evolve in parallel with the technology rather than acting solely as gatekeepers.

The UL 1642 standard for lithium batteries and IEC 62133 for secondary cells require substantial modification to address the unique characteristics of solid-state batteries, particularly regarding thermal runaway prevention mechanisms and electrolyte safety profiles. These standards typically evaluate batteries through rigorous testing protocols including crush tests, thermal cycling, short circuit tests, and overcharge conditions - all of which may manifest differently in solid-state architectures.

Certification processes for solid-state batteries currently follow a hybrid approach, combining elements from existing lithium-ion battery protocols with additional testing specific to solid electrolyte properties. This creates regulatory uncertainty and potential delays as testing methodologies evolve alongside the technology. The UN Transportation Tests (UN 38.3) for dangerous goods shipping also requires reconsideration for solid-state batteries, as their transport classification may differ from conventional lithium-ion cells.

Regional variations in certification requirements further complicate the regulatory landscape. The European Union's Battery Directive and REACH regulations impose specific chemical safety and recycling requirements, while China's GB standards and North America's UL listings each present unique compliance challenges. Manufacturers must simultaneously satisfy these divergent regional frameworks while the technology itself continues to evolve.

Emerging certification challenges include validating long-term aging characteristics, establishing appropriate accelerated life testing protocols, and developing non-destructive testing methods suitable for solid-state architectures. The industry is increasingly advocating for performance-based rather than prescriptive standards to accommodate the rapid pace of innovation in solid-state battery chemistry and design.

Regulatory bodies and industry consortia are collaborating to establish "pre-certification" pathways that allow for iterative testing during development stages, potentially accelerating the timeline from laboratory breakthrough to market-ready products. These collaborative approaches recognize that safety standards must evolve in parallel with the technology rather than acting solely as gatekeepers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!