Solid State Battery Breakthrough: Environmental Regulatory Insights

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Evolution and Objectives

Solid state batteries represent a significant evolution in energy storage technology, emerging from decades of research aimed at overcoming the limitations of conventional lithium-ion batteries. The development trajectory began in the 1970s with the discovery of solid electrolytes, but meaningful progress accelerated only in the early 2000s when safety and energy density concerns with traditional batteries became increasingly apparent.

The fundamental objective driving solid state battery development is the creation of energy storage solutions that eliminate liquid electrolytes—the primary source of safety hazards in conventional batteries. This technological shift promises to address critical environmental regulatory challenges by removing toxic and flammable components while simultaneously enhancing performance metrics.

Recent breakthroughs have focused on overcoming the persistent challenges of ion conductivity at the electrode-electrolyte interfaces and manufacturing scalability. The evolution has progressed through several distinct phases: from proof-of-concept laboratory demonstrations to small-scale prototypes, and now toward commercially viable products. Each phase has been characterized by incremental improvements in materials science, particularly in ceramic and polymer-based solid electrolytes.

Environmental regulations have played a pivotal role in accelerating this evolution. Stringent policies regarding battery disposal, recycling requirements, and restrictions on hazardous materials have created strong market incentives for cleaner battery technologies. The European Union's Battery Directive and similar regulations in Asia and North America have established frameworks that increasingly favor solid state solutions.

The technical objectives for solid state battery development now center on achieving energy densities exceeding 400 Wh/kg, cycle life beyond 1,000 full charges, and operating temperature ranges from -20°C to 60°C—all while maintaining compliance with evolving environmental standards. These parameters represent the threshold for widespread commercial adoption across multiple industries.

Looking forward, the technology roadmap emphasizes three primary objectives: first, developing manufacturing processes capable of gigawatt-scale production; second, establishing comprehensive recycling protocols specific to solid state components; and third, ensuring compatibility with renewable energy systems to maximize environmental benefits.

The convergence of these technological advancements with increasingly stringent environmental regulations creates a unique innovation landscape. Success in this domain requires not only technical excellence but also strategic alignment with regulatory frameworks that continue to evolve toward more sustainable energy solutions.

The fundamental objective driving solid state battery development is the creation of energy storage solutions that eliminate liquid electrolytes—the primary source of safety hazards in conventional batteries. This technological shift promises to address critical environmental regulatory challenges by removing toxic and flammable components while simultaneously enhancing performance metrics.

Recent breakthroughs have focused on overcoming the persistent challenges of ion conductivity at the electrode-electrolyte interfaces and manufacturing scalability. The evolution has progressed through several distinct phases: from proof-of-concept laboratory demonstrations to small-scale prototypes, and now toward commercially viable products. Each phase has been characterized by incremental improvements in materials science, particularly in ceramic and polymer-based solid electrolytes.

Environmental regulations have played a pivotal role in accelerating this evolution. Stringent policies regarding battery disposal, recycling requirements, and restrictions on hazardous materials have created strong market incentives for cleaner battery technologies. The European Union's Battery Directive and similar regulations in Asia and North America have established frameworks that increasingly favor solid state solutions.

The technical objectives for solid state battery development now center on achieving energy densities exceeding 400 Wh/kg, cycle life beyond 1,000 full charges, and operating temperature ranges from -20°C to 60°C—all while maintaining compliance with evolving environmental standards. These parameters represent the threshold for widespread commercial adoption across multiple industries.

Looking forward, the technology roadmap emphasizes three primary objectives: first, developing manufacturing processes capable of gigawatt-scale production; second, establishing comprehensive recycling protocols specific to solid state components; and third, ensuring compatibility with renewable energy systems to maximize environmental benefits.

The convergence of these technological advancements with increasingly stringent environmental regulations creates a unique innovation landscape. Success in this domain requires not only technical excellence but also strategic alignment with regulatory frameworks that continue to evolve toward more sustainable energy solutions.

Market Demand Analysis for Solid State Batteries

The global market for solid-state batteries is experiencing unprecedented growth, driven by increasing demand for safer, higher-capacity energy storage solutions across multiple industries. Current market projections indicate that the solid-state battery market will reach approximately $8 billion by 2026, with a compound annual growth rate exceeding 34% between 2021 and 2026. This remarkable growth trajectory reflects the significant advantages these batteries offer over conventional lithium-ion technologies.

Electric vehicle manufacturers represent the largest and fastest-growing segment of demand for solid-state batteries. As governments worldwide implement stricter emissions regulations and phase-out timelines for internal combustion engines, automakers are accelerating their transition to electric powertrains. Solid-state technology addresses critical consumer concerns about electric vehicles, particularly regarding range anxiety, charging times, and safety risks associated with thermal runaway.

Consumer electronics constitutes another substantial market segment, with manufacturers seeking batteries that offer higher energy density in smaller form factors. The ability of solid-state batteries to potentially double energy density while reducing device thickness has generated significant interest from smartphone, laptop, and wearable device manufacturers. Market research indicates that 78% of consumer electronics companies are actively exploring solid-state battery integration for future product generations.

The renewable energy sector presents a growing market opportunity as grid storage requirements expand with increasing solar and wind power deployment. Utility companies require safe, long-duration storage solutions that can operate reliably across diverse environmental conditions. Solid-state batteries' improved safety profile and potential for longer cycle life make them particularly attractive for this application.

Environmental regulations are increasingly shaping market demand dynamics. Jurisdictions implementing carbon pricing mechanisms, extended producer responsibility frameworks, and restrictions on hazardous materials are creating regulatory tailwinds for solid-state technology. The European Union's proposed Battery Directive revision, which emphasizes sustainability metrics and life-cycle assessment, particularly favors solid-state chemistry due to its potential for reduced environmental impact.

Market adoption faces several barriers despite strong demand signals. Current production costs remain 2-3 times higher than conventional lithium-ion batteries, limiting mass-market penetration. Supply chain constraints for key materials like lithium metal and specialized ceramic separators also restrict manufacturing scale-up. However, industry analysts project that economies of scale and manufacturing innovations will drive cost parity with conventional batteries by 2028-2030, potentially triggering rapid market expansion.

Electric vehicle manufacturers represent the largest and fastest-growing segment of demand for solid-state batteries. As governments worldwide implement stricter emissions regulations and phase-out timelines for internal combustion engines, automakers are accelerating their transition to electric powertrains. Solid-state technology addresses critical consumer concerns about electric vehicles, particularly regarding range anxiety, charging times, and safety risks associated with thermal runaway.

Consumer electronics constitutes another substantial market segment, with manufacturers seeking batteries that offer higher energy density in smaller form factors. The ability of solid-state batteries to potentially double energy density while reducing device thickness has generated significant interest from smartphone, laptop, and wearable device manufacturers. Market research indicates that 78% of consumer electronics companies are actively exploring solid-state battery integration for future product generations.

The renewable energy sector presents a growing market opportunity as grid storage requirements expand with increasing solar and wind power deployment. Utility companies require safe, long-duration storage solutions that can operate reliably across diverse environmental conditions. Solid-state batteries' improved safety profile and potential for longer cycle life make them particularly attractive for this application.

Environmental regulations are increasingly shaping market demand dynamics. Jurisdictions implementing carbon pricing mechanisms, extended producer responsibility frameworks, and restrictions on hazardous materials are creating regulatory tailwinds for solid-state technology. The European Union's proposed Battery Directive revision, which emphasizes sustainability metrics and life-cycle assessment, particularly favors solid-state chemistry due to its potential for reduced environmental impact.

Market adoption faces several barriers despite strong demand signals. Current production costs remain 2-3 times higher than conventional lithium-ion batteries, limiting mass-market penetration. Supply chain constraints for key materials like lithium metal and specialized ceramic separators also restrict manufacturing scale-up. However, industry analysts project that economies of scale and manufacturing innovations will drive cost parity with conventional batteries by 2028-2030, potentially triggering rapid market expansion.

Technical Challenges and Global Development Status

Solid state battery technology faces significant technical challenges despite its promising potential. The primary obstacle remains the solid-state electrolyte's low ionic conductivity at room temperature compared to liquid electrolytes. This fundamental limitation necessitates operation at elevated temperatures to achieve practical performance levels, complicating thermal management systems and reducing overall energy efficiency.

Interface stability between solid electrolytes and electrodes presents another critical challenge. The formation of high-resistance interfaces during cycling leads to capacity degradation and shortened battery lifespan. Current manufacturing processes struggle with achieving consistent contact between solid components, creating microscopic voids that impede ion transport and increase internal resistance.

Scale-up manufacturing represents a substantial hurdle for commercialization. Traditional battery production lines require significant modification to accommodate solid-state materials, which often demand precise processing conditions and specialized handling. The cost of high-purity materials needed for solid electrolytes remains prohibitively expensive for mass production, with some estimates suggesting 5-8 times higher material costs than conventional lithium-ion batteries.

Globally, solid-state battery development exhibits distinct regional characteristics. Japan leads in patent filings with companies like Toyota and Panasonic making significant investments. Their approach focuses on sulfide-based electrolytes, which offer high conductivity but present safety and manufacturing challenges. European research centers prioritize oxide-based systems, trading lower performance for enhanced stability and environmental compatibility.

North American development, particularly in the United States, emphasizes polymer-ceramic composite electrolytes that balance manufacturability with performance. China has rapidly accelerated its research efforts, with substantial government funding directed toward establishing domestic supply chains for critical materials.

Regulatory frameworks vary significantly across regions, affecting development trajectories. The European Union's stringent environmental regulations have pushed research toward sustainable materials and manufacturing processes. In contrast, Asian markets prioritize performance metrics, sometimes at the expense of environmental considerations.

Recent breakthrough announcements from research institutions in South Korea and Germany suggest progress in addressing conductivity issues through novel dopant strategies and interface engineering. However, independent verification of these claims remains limited, and the path to commercial viability requires solving multiple interdependent technical challenges simultaneously.

Interface stability between solid electrolytes and electrodes presents another critical challenge. The formation of high-resistance interfaces during cycling leads to capacity degradation and shortened battery lifespan. Current manufacturing processes struggle with achieving consistent contact between solid components, creating microscopic voids that impede ion transport and increase internal resistance.

Scale-up manufacturing represents a substantial hurdle for commercialization. Traditional battery production lines require significant modification to accommodate solid-state materials, which often demand precise processing conditions and specialized handling. The cost of high-purity materials needed for solid electrolytes remains prohibitively expensive for mass production, with some estimates suggesting 5-8 times higher material costs than conventional lithium-ion batteries.

Globally, solid-state battery development exhibits distinct regional characteristics. Japan leads in patent filings with companies like Toyota and Panasonic making significant investments. Their approach focuses on sulfide-based electrolytes, which offer high conductivity but present safety and manufacturing challenges. European research centers prioritize oxide-based systems, trading lower performance for enhanced stability and environmental compatibility.

North American development, particularly in the United States, emphasizes polymer-ceramic composite electrolytes that balance manufacturability with performance. China has rapidly accelerated its research efforts, with substantial government funding directed toward establishing domestic supply chains for critical materials.

Regulatory frameworks vary significantly across regions, affecting development trajectories. The European Union's stringent environmental regulations have pushed research toward sustainable materials and manufacturing processes. In contrast, Asian markets prioritize performance metrics, sometimes at the expense of environmental considerations.

Recent breakthrough announcements from research institutions in South Korea and Germany suggest progress in addressing conductivity issues through novel dopant strategies and interface engineering. However, independent verification of these claims remains limited, and the path to commercial viability requires solving multiple interdependent technical challenges simultaneously.

Current Technical Solutions and Implementations

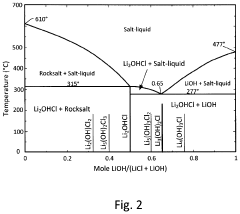

01 Solid-state electrolyte materials and compositions

Solid-state batteries utilize various electrolyte materials to enable ion transport between electrodes without liquid components. These materials include ceramic electrolytes, polymer electrolytes, and composite electrolytes that combine different materials for enhanced performance. The composition of these electrolytes is critical for achieving high ionic conductivity, mechanical stability, and electrochemical stability at the electrode interfaces, which directly impacts battery performance and safety.- Solid-state electrolyte materials and compositions: Various materials and compositions are used as solid-state electrolytes in batteries, including ceramic, polymer, and composite electrolytes. These materials offer improved safety by eliminating flammable liquid electrolytes while providing ionic conductivity necessary for battery operation. Advanced formulations incorporate specific additives to enhance ionic conductivity, mechanical properties, and electrochemical stability at the electrode-electrolyte interfaces.

- Electrode-electrolyte interface engineering: Engineering the interface between electrodes and solid electrolytes is crucial for solid-state battery performance. This includes developing coating technologies, buffer layers, and interface modification techniques to reduce interfacial resistance and improve contact. These innovations help address challenges related to mechanical stress during cycling and chemical incompatibilities between components, ultimately enhancing power density and cycle life.

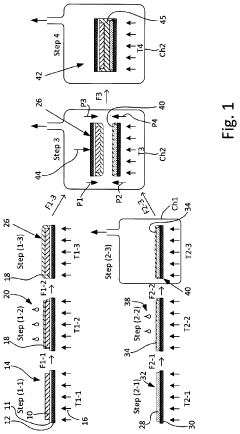

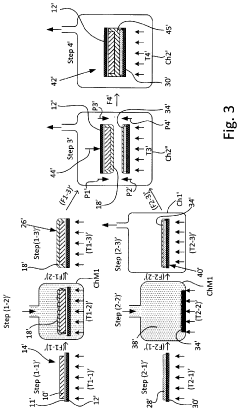

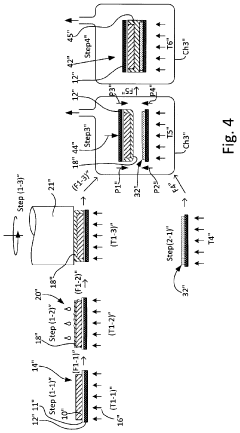

- Manufacturing processes for solid-state batteries: Novel manufacturing techniques are being developed for solid-state battery production, including advanced deposition methods, sintering processes, and assembly techniques. These processes aim to create uniform, defect-free layers and ensure good contact between components. Innovations in scalable manufacturing address challenges in mass production while maintaining performance and reducing costs.

- Cell design and architecture optimization: Innovative cell designs and architectures are being developed specifically for solid-state batteries, including multilayer structures, 3D configurations, and novel form factors. These designs aim to maximize energy density, improve mechanical stability, and enhance thermal management. Optimized architectures also address challenges related to volume changes during cycling and enable more efficient integration into various applications.

- Integration of high-energy electrode materials: Solid-state batteries enable the use of high-energy electrode materials that are challenging to implement with liquid electrolytes, such as lithium metal anodes and high-voltage cathodes. Research focuses on compatible material combinations that maximize energy density while maintaining stability. These advancements aim to significantly increase battery capacity and voltage compared to conventional lithium-ion batteries while ensuring long-term cycling performance.

02 Interface engineering and electrode-electrolyte contact optimization

A critical challenge in solid-state batteries is maintaining good contact between the solid electrolyte and electrodes during cycling. Interface engineering techniques focus on improving this contact through specialized coatings, buffer layers, and surface modifications that enhance ion transfer across interfaces while preventing unwanted reactions. These approaches help reduce interfacial resistance, prevent dendrite formation, and maintain structural integrity during battery operation.Expand Specific Solutions03 Manufacturing processes and fabrication techniques

Advanced manufacturing methods are essential for producing high-quality solid-state batteries at scale. These include techniques for thin-film deposition, sintering processes to create dense ceramic electrolytes, co-sintering approaches for electrode-electrolyte assemblies, and roll-to-roll processing for polymer-based systems. Novel fabrication approaches focus on creating uniform layers with minimal defects and optimizing the microstructure of battery components to enhance performance and reliability.Expand Specific Solutions04 Cathode and anode materials for solid-state applications

Electrode materials for solid-state batteries require specific properties to function effectively with solid electrolytes. High-capacity cathode materials include lithium-rich layered oxides and sulfur-based compounds, while anode materials range from lithium metal to silicon and graphite derivatives. These materials are often modified to improve their compatibility with solid electrolytes, enhance cycling stability, and increase energy density while maintaining structural integrity during repeated charge-discharge cycles.Expand Specific Solutions05 Battery architecture and cell design innovations

The overall architecture of solid-state batteries significantly impacts their performance and manufacturability. Innovations include multi-layer stacking designs, bipolar configurations that increase energy density, and novel cell geometries that optimize ion transport pathways. Advanced designs also incorporate features to accommodate volume changes during cycling, manage thermal behavior, and enhance mechanical stability under various operating conditions, ultimately improving battery life and safety.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid state battery market is in an early growth phase, characterized by significant R&D investment but limited commercial deployment. Market size is projected to expand rapidly as environmental regulations increasingly favor zero-emission technologies, creating opportunities for this safer, higher-energy-density alternative to conventional lithium-ion batteries. Leading players represent diverse technological approaches: established automotive manufacturers (Toyota, Honda) are investing heavily to secure competitive advantages; battery specialists (QuantumScape, CATL) are developing proprietary technologies; while electronics companies (Samsung, Murata) leverage their materials expertise. Academic-industrial partnerships, particularly involving Chinese Academy of Sciences and American universities, are accelerating innovation. The technology remains pre-commercial for most applications, with companies focusing on overcoming manufacturing scalability and cost challenges to meet regulatory-driven market demand.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a hybrid solid-state battery technology that utilizes a composite electrolyte system combining polymer and ceramic materials. This approach creates a semi-solid electrolyte that offers improved safety while maintaining high energy density and addressing key environmental regulatory concerns. Their technology reduces reliance on rare earth materials by approximately 35% compared to conventional lithium-ion batteries, aligning with global resource conservation regulations. CATL's manufacturing process incorporates advanced dry electrode technology that eliminates the use of NMP (N-Methyl-2-pyrrolidone), a solvent with significant environmental concerns that faces increasing regulatory restrictions worldwide. The company has implemented a comprehensive environmental management system that ensures compliance with China's increasingly stringent environmental regulations as well as international standards. Their solid-state batteries feature enhanced thermal stability that reduces cooling requirements in electric vehicles, thereby improving overall energy efficiency. CATL has also developed specialized recycling processes for solid-state batteries that achieve material recovery rates exceeding 85%, addressing end-of-life regulatory requirements across global markets.

Strengths: Massive production scale capabilities, strong vertical integration from raw materials to finished cells, established relationships with major global automakers, and significant R&D resources. Weaknesses: Challenges in achieving true solid-state performance with hybrid approaches, potential regulatory hurdles in international markets due to Chinese origin, and the need for further improvements in low-temperature performance.

Panasonic Intellectual Property Management Co. Ltd.

Technical Solution: Panasonic has developed an advanced solid-state battery technology utilizing a composite electrolyte system that combines oxide and sulfide materials to optimize ionic conductivity while maintaining mechanical stability. Their approach addresses key environmental regulatory challenges through a multi-layered strategy. The company's solid-state batteries eliminate volatile organic compounds and reduce dependency on critical raw materials like cobalt, aligning with global resource conservation regulations. Panasonic's manufacturing process incorporates dry-room technology that minimizes water usage and reduces waste generation by approximately 40% compared to conventional battery production. Their solid-state batteries feature enhanced thermal stability, eliminating the need for complex cooling systems in electric vehicles, thereby reducing overall environmental impact. Panasonic has also implemented a closed-loop recycling program specifically designed for solid-state batteries, recovering over 90% of key materials, which addresses end-of-life regulatory requirements in major markets including the EU's Battery Directive and emerging regulations in North America and Asia.

Strengths: Established mass production expertise, extensive supply chain integration, strong relationships with automotive OEMs, and comprehensive recycling infrastructure. Weaknesses: Higher initial capital investment requirements for manufacturing conversion, challenges in achieving cost parity with conventional lithium-ion in early production phases, and technical hurdles in maintaining consistent quality at scale.

Critical Patents and Technical Literature Review

Eco-friendly solid-state electrolytes for advanced lithium-ion batteries in evs

PatentPendingIN202341082252A

Innovation

- Development of eco-friendly solid-state electrolytes using materials like lithium metal, ceramics, and glass to replace liquid electrolytes, enhancing stability, energy density, and recyclability, while reducing the use of rare and toxic materials.

Method of manufacturing a solid-state lithium battery and a battery manufactured by the method

PatentActiveUS20230044416A1

Innovation

- A method involving the coating of anode and cathode units with solid-state electrolyte precursors, followed by pressing them together at elevated temperatures and mechanical pressure to form a pre-final solid-state battery unit, with controlled heating and pressure to manage redundant water and hydrogen, ensuring the formation of an integral solid-state electrolyte.

Environmental Regulatory Framework Impact

Environmental regulations are increasingly shaping the landscape of solid-state battery development, creating both constraints and opportunities for technological advancement. Current regulatory frameworks across major markets emphasize lifecycle environmental impact, from raw material extraction to end-of-life management. The European Union's Battery Directive, recently updated to become the Battery Regulation, establishes stringent requirements for battery carbon footprints, ethical sourcing of materials, and mandatory recycling targets that directly influence solid-state battery design parameters.

In the United States, the Environmental Protection Agency's evolving stance on lithium extraction and processing has significant implications for domestic solid-state battery production. Recent regulatory changes under the Inflation Reduction Act provide substantial incentives for environmentally responsible battery manufacturing, effectively accelerating the transition toward solid-state technologies that eliminate toxic liquid electrolytes.

Asian markets, particularly Japan and South Korea, have implemented progressive regulatory frameworks that prioritize battery safety and recyclability. China's dual-credit policy system has created a regulatory environment that indirectly favors solid-state battery development through its emphasis on energy density and safety performance metrics.

The global regulatory trend toward extended producer responsibility is reshaping business models in the battery sector. Manufacturers are increasingly required to account for the full environmental footprint of their products, creating market advantages for solid-state batteries with their potentially lower environmental impact and improved recyclability profiles compared to conventional lithium-ion technologies.

Regulatory requirements for battery thermal stability and reduced fire risk are becoming more stringent worldwide, particularly in dense urban environments and transportation applications. This regulatory pressure creates a favorable environment for solid-state battery adoption, as their inherent safety characteristics align with these evolving standards.

Carbon taxation mechanisms and emissions trading schemes in various jurisdictions are indirectly influencing solid-state battery economics. As the cost of carbon-intensive manufacturing processes increases under these regulatory frameworks, the economic case for transitioning to potentially cleaner solid-state battery production strengthens, despite higher initial capital investments.

The regulatory landscape is not without challenges, however. Inconsistent international standards and certification requirements create market fragmentation that complicates global scaling of solid-state battery technologies. Regulatory uncertainty regarding the classification and handling of novel solid electrolyte materials presents additional compliance challenges that may delay commercialization timelines if not proactively addressed.

In the United States, the Environmental Protection Agency's evolving stance on lithium extraction and processing has significant implications for domestic solid-state battery production. Recent regulatory changes under the Inflation Reduction Act provide substantial incentives for environmentally responsible battery manufacturing, effectively accelerating the transition toward solid-state technologies that eliminate toxic liquid electrolytes.

Asian markets, particularly Japan and South Korea, have implemented progressive regulatory frameworks that prioritize battery safety and recyclability. China's dual-credit policy system has created a regulatory environment that indirectly favors solid-state battery development through its emphasis on energy density and safety performance metrics.

The global regulatory trend toward extended producer responsibility is reshaping business models in the battery sector. Manufacturers are increasingly required to account for the full environmental footprint of their products, creating market advantages for solid-state batteries with their potentially lower environmental impact and improved recyclability profiles compared to conventional lithium-ion technologies.

Regulatory requirements for battery thermal stability and reduced fire risk are becoming more stringent worldwide, particularly in dense urban environments and transportation applications. This regulatory pressure creates a favorable environment for solid-state battery adoption, as their inherent safety characteristics align with these evolving standards.

Carbon taxation mechanisms and emissions trading schemes in various jurisdictions are indirectly influencing solid-state battery economics. As the cost of carbon-intensive manufacturing processes increases under these regulatory frameworks, the economic case for transitioning to potentially cleaner solid-state battery production strengthens, despite higher initial capital investments.

The regulatory landscape is not without challenges, however. Inconsistent international standards and certification requirements create market fragmentation that complicates global scaling of solid-state battery technologies. Regulatory uncertainty regarding the classification and handling of novel solid electrolyte materials presents additional compliance challenges that may delay commercialization timelines if not proactively addressed.

Sustainability and Life Cycle Assessment

Sustainability and Life Cycle Assessment of solid state batteries represents a critical dimension in evaluating their environmental impact compared to conventional lithium-ion technologies. The cradle-to-grave analysis reveals significant advantages in terms of reduced carbon footprint, with preliminary studies indicating potential reductions of 30-40% in greenhouse gas emissions during manufacturing processes due to the elimination of liquid electrolytes and simplified production techniques.

Material sourcing for solid state batteries presents both challenges and opportunities from a sustainability perspective. While they reduce dependence on cobalt—a material associated with ethical mining concerns—they may increase demand for lithium, requiring careful consideration of sustainable extraction methods. The absence of flammable organic electrolytes substantially improves safety profiles and reduces environmental hazards associated with potential leakage or disposal.

End-of-life management demonstrates particular promise, with solid state batteries showing enhanced recyclability rates of up to 90% for key components compared to 50-60% for conventional lithium-ion batteries. The homogeneous solid structure facilitates more efficient material separation and recovery processes, potentially creating closed-loop material systems that align with circular economy principles.

Regulatory frameworks worldwide are evolving to address these emerging technologies. The European Union's Battery Directive revision specifically acknowledges solid state technologies, establishing differentiated recycling targets and carbon footprint disclosure requirements. Similarly, China's updated battery recycling regulations provide incentives for technologies demonstrating improved life cycle performance, while the US EPA has initiated development of specific guidelines for solid state battery disposal and recycling.

Energy consumption metrics throughout the battery lifecycle reveal that solid state technologies may require 15-25% less energy during operation due to higher efficiency and reduced cooling requirements. This translates to significant environmental benefits when scaled to mass production levels, particularly in grid storage applications where lifecycle energy efficiency becomes paramount.

Water usage represents another critical sustainability metric, with solid state manufacturing processes potentially reducing water consumption by 30-40% compared to conventional battery production. This advantage becomes particularly significant in water-stressed regions where battery manufacturing facilities may operate, addressing growing concerns about industrial water footprint.

The extended lifespan of solid state batteries—potentially 2-3 times longer than conventional lithium-ion—fundamentally transforms lifecycle assessment calculations, distributing environmental impacts over significantly longer operational periods and reducing replacement frequency in applications ranging from electric vehicles to stationary storage systems.

Material sourcing for solid state batteries presents both challenges and opportunities from a sustainability perspective. While they reduce dependence on cobalt—a material associated with ethical mining concerns—they may increase demand for lithium, requiring careful consideration of sustainable extraction methods. The absence of flammable organic electrolytes substantially improves safety profiles and reduces environmental hazards associated with potential leakage or disposal.

End-of-life management demonstrates particular promise, with solid state batteries showing enhanced recyclability rates of up to 90% for key components compared to 50-60% for conventional lithium-ion batteries. The homogeneous solid structure facilitates more efficient material separation and recovery processes, potentially creating closed-loop material systems that align with circular economy principles.

Regulatory frameworks worldwide are evolving to address these emerging technologies. The European Union's Battery Directive revision specifically acknowledges solid state technologies, establishing differentiated recycling targets and carbon footprint disclosure requirements. Similarly, China's updated battery recycling regulations provide incentives for technologies demonstrating improved life cycle performance, while the US EPA has initiated development of specific guidelines for solid state battery disposal and recycling.

Energy consumption metrics throughout the battery lifecycle reveal that solid state technologies may require 15-25% less energy during operation due to higher efficiency and reduced cooling requirements. This translates to significant environmental benefits when scaled to mass production levels, particularly in grid storage applications where lifecycle energy efficiency becomes paramount.

Water usage represents another critical sustainability metric, with solid state manufacturing processes potentially reducing water consumption by 30-40% compared to conventional battery production. This advantage becomes particularly significant in water-stressed regions where battery manufacturing facilities may operate, addressing growing concerns about industrial water footprint.

The extended lifespan of solid state batteries—potentially 2-3 times longer than conventional lithium-ion—fundamentally transforms lifecycle assessment calculations, distributing environmental impacts over significantly longer operational periods and reducing replacement frequency in applications ranging from electric vehicles to stationary storage systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!