How Solid State Battery Breakthrough Complies with Contemporary Regulations?

OCT 24, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Evolution and Objectives

Solid state battery technology represents a significant evolution in energy storage systems, emerging from decades of research into safer and more efficient alternatives to conventional lithium-ion batteries. The development trajectory began in the 1970s with initial explorations into solid electrolytes, but substantial progress has only materialized in the last decade with breakthroughs in material science and manufacturing techniques.

The evolution of solid state batteries has been driven by persistent limitations in traditional battery technologies, particularly concerning energy density, safety, and charging speed. Early iterations faced significant challenges with ion conductivity at room temperature, making them impractical for commercial applications. However, recent advancements in ceramic and polymer-based solid electrolytes have dramatically improved performance metrics, bringing this technology closer to market viability.

A critical milestone in this evolution was the development of sulfide-based solid electrolytes around 2011, which demonstrated ionic conductivity comparable to liquid electrolytes. This was followed by innovations in electrode-electrolyte interfaces that addressed previous degradation issues. The technology has since progressed through various stages of optimization, with each generation improving upon cycle life, temperature stability, and manufacturing scalability.

The primary objective of contemporary solid state battery research is to develop commercially viable products that comply with increasingly stringent safety and environmental regulations while delivering superior performance. Specifically, researchers aim to eliminate the flammable liquid electrolytes present in conventional batteries, thereby addressing fire risks that have prompted regulatory scrutiny across multiple jurisdictions.

Another key objective is to increase energy density beyond the theoretical limits of lithium-ion technology, potentially enabling electric vehicles with ranges exceeding 500 miles on a single charge. This aligns with regulatory pushes in many regions toward electrification of transportation and reduction of carbon emissions.

Regulatory compliance objectives include developing batteries that meet or exceed UL 1642 and IEC 62133 safety standards, particularly regarding thermal runaway prevention. Additionally, researchers are working to ensure compatibility with emerging regulations on battery recyclability and sustainable material sourcing, such as the EU Battery Directive's upcoming revisions.

The technology roadmap also prioritizes manufacturing processes that can scale while maintaining compliance with workplace safety regulations and environmental protection standards. This includes developing production methods that minimize the use of toxic materials and reduce energy consumption during manufacturing, addressing both regulatory requirements and sustainability goals.

The evolution of solid state batteries has been driven by persistent limitations in traditional battery technologies, particularly concerning energy density, safety, and charging speed. Early iterations faced significant challenges with ion conductivity at room temperature, making them impractical for commercial applications. However, recent advancements in ceramic and polymer-based solid electrolytes have dramatically improved performance metrics, bringing this technology closer to market viability.

A critical milestone in this evolution was the development of sulfide-based solid electrolytes around 2011, which demonstrated ionic conductivity comparable to liquid electrolytes. This was followed by innovations in electrode-electrolyte interfaces that addressed previous degradation issues. The technology has since progressed through various stages of optimization, with each generation improving upon cycle life, temperature stability, and manufacturing scalability.

The primary objective of contemporary solid state battery research is to develop commercially viable products that comply with increasingly stringent safety and environmental regulations while delivering superior performance. Specifically, researchers aim to eliminate the flammable liquid electrolytes present in conventional batteries, thereby addressing fire risks that have prompted regulatory scrutiny across multiple jurisdictions.

Another key objective is to increase energy density beyond the theoretical limits of lithium-ion technology, potentially enabling electric vehicles with ranges exceeding 500 miles on a single charge. This aligns with regulatory pushes in many regions toward electrification of transportation and reduction of carbon emissions.

Regulatory compliance objectives include developing batteries that meet or exceed UL 1642 and IEC 62133 safety standards, particularly regarding thermal runaway prevention. Additionally, researchers are working to ensure compatibility with emerging regulations on battery recyclability and sustainable material sourcing, such as the EU Battery Directive's upcoming revisions.

The technology roadmap also prioritizes manufacturing processes that can scale while maintaining compliance with workplace safety regulations and environmental protection standards. This includes developing production methods that minimize the use of toxic materials and reduce energy consumption during manufacturing, addressing both regulatory requirements and sustainability goals.

Market Demand Analysis for Advanced Battery Technologies

The global market for advanced battery technologies is experiencing unprecedented growth, driven primarily by the rapid expansion of electric vehicles (EVs), renewable energy storage systems, and portable electronics. Current projections indicate the global advanced battery market will reach approximately $168 billion by 2030, with solid-state batteries potentially capturing a significant portion of this market within the next decade. This growth trajectory is supported by substantial investments from both private and public sectors, with governments worldwide committing billions to battery research and manufacturing infrastructure.

Consumer demand for improved battery performance is creating strong market pull for solid-state technology. Traditional lithium-ion batteries face limitations in energy density, charging speed, and safety that solid-state batteries promise to overcome. Market research indicates that EV consumers consistently rank range anxiety and charging time among their top concerns, with 78% of potential buyers citing battery performance as a decisive factor in purchasing decisions.

The regulatory landscape is increasingly favorable for advanced battery technologies, particularly those addressing safety concerns. Following several high-profile thermal runaway incidents with conventional lithium-ion batteries, regulatory bodies in North America, Europe, and Asia have implemented stricter safety standards. Solid-state batteries, with their non-flammable electrolytes, align perfectly with these evolving regulations, creating a significant market advantage.

Industrial sectors beyond automotive are also driving demand for solid-state technology. The aerospace industry requires batteries with higher energy density and improved safety profiles for electric aircraft development. Similarly, medical device manufacturers seek longer-lasting, more reliable power sources for implantable devices. These specialized applications represent high-value market segments where solid-state batteries can command premium pricing.

Regional market analysis reveals varying adoption rates and regulatory approaches. Asia-Pacific leads manufacturing capacity development, with Japan and South Korea at the forefront of solid-state battery commercialization. European markets show the strongest regulatory push toward advanced battery technologies, driven by ambitious carbon reduction targets. North American markets demonstrate the highest consumer willingness to pay premium prices for improved battery performance.

Supply chain considerations are increasingly influencing market dynamics. The reduced reliance on critical materials like cobalt in many solid-state battery designs addresses growing concerns about resource availability and ethical sourcing. This alignment with sustainable development goals enhances market appeal among environmentally conscious consumers and corporations with strong ESG commitments.

Market forecasts indicate solid-state batteries will initially enter premium market segments where performance advantages justify higher costs, gradually expanding to mass-market applications as manufacturing scales and costs decrease. This phased market penetration strategy aligns with the technology's current development status and manufacturing readiness level.

Consumer demand for improved battery performance is creating strong market pull for solid-state technology. Traditional lithium-ion batteries face limitations in energy density, charging speed, and safety that solid-state batteries promise to overcome. Market research indicates that EV consumers consistently rank range anxiety and charging time among their top concerns, with 78% of potential buyers citing battery performance as a decisive factor in purchasing decisions.

The regulatory landscape is increasingly favorable for advanced battery technologies, particularly those addressing safety concerns. Following several high-profile thermal runaway incidents with conventional lithium-ion batteries, regulatory bodies in North America, Europe, and Asia have implemented stricter safety standards. Solid-state batteries, with their non-flammable electrolytes, align perfectly with these evolving regulations, creating a significant market advantage.

Industrial sectors beyond automotive are also driving demand for solid-state technology. The aerospace industry requires batteries with higher energy density and improved safety profiles for electric aircraft development. Similarly, medical device manufacturers seek longer-lasting, more reliable power sources for implantable devices. These specialized applications represent high-value market segments where solid-state batteries can command premium pricing.

Regional market analysis reveals varying adoption rates and regulatory approaches. Asia-Pacific leads manufacturing capacity development, with Japan and South Korea at the forefront of solid-state battery commercialization. European markets show the strongest regulatory push toward advanced battery technologies, driven by ambitious carbon reduction targets. North American markets demonstrate the highest consumer willingness to pay premium prices for improved battery performance.

Supply chain considerations are increasingly influencing market dynamics. The reduced reliance on critical materials like cobalt in many solid-state battery designs addresses growing concerns about resource availability and ethical sourcing. This alignment with sustainable development goals enhances market appeal among environmentally conscious consumers and corporations with strong ESG commitments.

Market forecasts indicate solid-state batteries will initially enter premium market segments where performance advantages justify higher costs, gradually expanding to mass-market applications as manufacturing scales and costs decrease. This phased market penetration strategy aligns with the technology's current development status and manufacturing readiness level.

Current State and Technical Barriers in Solid State Batteries

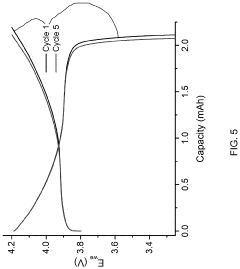

Solid state batteries (SSBs) represent a significant advancement in energy storage technology, promising higher energy density, improved safety, and longer lifespan compared to conventional lithium-ion batteries. Currently, the technology exists primarily in laboratory settings and small-scale production, with major manufacturers including Toyota, Samsung, QuantumScape, and Solid Power leading development efforts.

The global market for SSBs remains nascent but is projected to grow substantially, with estimates suggesting a market value exceeding $6 billion by 2030. Despite this potential, several critical technical barriers impede widespread commercialization. Chief among these is the challenge of solid-solid interfaces between electrodes and electrolytes, which create high impedance and limit ion transport efficiency.

Ion conductivity in solid electrolytes presents another significant hurdle. While liquid electrolytes in conventional batteries facilitate rapid ion movement, solid electrolytes typically exhibit lower ionic conductivity at room temperature. This limitation necessitates operation at elevated temperatures to achieve comparable performance, complicating practical applications in consumer electronics and electric vehicles.

Manufacturing scalability remains problematic, with current production methods being complex, costly, and difficult to scale. The precision required for creating uniform, defect-free solid electrolyte layers presents formidable engineering challenges that have yet to be fully resolved. Additionally, the high cost of materials such as lithium lanthanum zirconium oxide (LLZO) and lithium phosphorus sulfide (LPS) contributes to production expenses that exceed those of conventional lithium-ion batteries by factors of 5-10.

Mechanical stress during cycling represents another technical barrier. Volume changes in electrode materials during charge-discharge cycles can create mechanical stresses at the electrode-electrolyte interface, potentially leading to contact loss and performance degradation over time. This issue is particularly pronounced in all-solid-state configurations.

Geographically, research and development efforts are concentrated in East Asia (particularly Japan and South Korea), North America, and Europe. Japan leads in patent filings related to solid-state battery technology, with Toyota alone holding over 1,000 patents in this domain. The United States follows with significant investments from both private companies and government research initiatives through the Department of Energy.

Regulatory frameworks across different regions present additional challenges, with safety certification standards still evolving for this emerging technology. Current regulations for battery transportation, disposal, and recycling were largely developed for liquid-electrolyte systems and may require adaptation to accommodate the unique characteristics of solid-state batteries.

The global market for SSBs remains nascent but is projected to grow substantially, with estimates suggesting a market value exceeding $6 billion by 2030. Despite this potential, several critical technical barriers impede widespread commercialization. Chief among these is the challenge of solid-solid interfaces between electrodes and electrolytes, which create high impedance and limit ion transport efficiency.

Ion conductivity in solid electrolytes presents another significant hurdle. While liquid electrolytes in conventional batteries facilitate rapid ion movement, solid electrolytes typically exhibit lower ionic conductivity at room temperature. This limitation necessitates operation at elevated temperatures to achieve comparable performance, complicating practical applications in consumer electronics and electric vehicles.

Manufacturing scalability remains problematic, with current production methods being complex, costly, and difficult to scale. The precision required for creating uniform, defect-free solid electrolyte layers presents formidable engineering challenges that have yet to be fully resolved. Additionally, the high cost of materials such as lithium lanthanum zirconium oxide (LLZO) and lithium phosphorus sulfide (LPS) contributes to production expenses that exceed those of conventional lithium-ion batteries by factors of 5-10.

Mechanical stress during cycling represents another technical barrier. Volume changes in electrode materials during charge-discharge cycles can create mechanical stresses at the electrode-electrolyte interface, potentially leading to contact loss and performance degradation over time. This issue is particularly pronounced in all-solid-state configurations.

Geographically, research and development efforts are concentrated in East Asia (particularly Japan and South Korea), North America, and Europe. Japan leads in patent filings related to solid-state battery technology, with Toyota alone holding over 1,000 patents in this domain. The United States follows with significant investments from both private companies and government research initiatives through the Department of Energy.

Regulatory frameworks across different regions present additional challenges, with safety certification standards still evolving for this emerging technology. Current regulations for battery transportation, disposal, and recycling were largely developed for liquid-electrolyte systems and may require adaptation to accommodate the unique characteristics of solid-state batteries.

Current Technical Solutions for Solid State Batteries

01 Safety standards and certification for solid state batteries

Solid state batteries must comply with various safety standards and certification requirements to ensure they meet regulatory guidelines. These standards address thermal stability, electrical safety, and performance under different conditions. Manufacturers need to demonstrate compliance through testing and certification processes before their batteries can be marketed and sold. This includes meeting international standards for battery safety and performance.- Safety standards and certification for solid state batteries: Solid state batteries must comply with various safety standards and certification requirements before they can be commercialized. These regulations ensure that the batteries meet specific safety criteria related to thermal stability, mechanical integrity, and electrical safety. Manufacturers need to conduct rigorous testing to demonstrate compliance with international standards such as IEC and UL specifications, which may include tests for short circuit protection, overcharge protection, and thermal runaway prevention.

- Environmental compliance and material restrictions: Regulatory frameworks impose restrictions on materials used in solid state batteries, particularly regarding toxic or hazardous substances. Manufacturers must adhere to regulations such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) when selecting materials for electrolytes, electrodes, and other components. Additionally, end-of-life considerations including recycling requirements and proper disposal methods must be addressed to ensure environmental compliance.

- Transportation and shipping regulations: Solid state batteries are subject to specific transportation regulations that govern their shipment by air, sea, or land. These regulations typically classify batteries based on their energy density, composition, and safety features. While solid state batteries generally offer improved safety compared to liquid electrolyte batteries, they must still comply with UN transportation regulations, IATA Dangerous Goods Regulations for air transport, and other regional shipping requirements. Proper packaging, labeling, and documentation are essential for regulatory compliance during transportation.

- Manufacturing process compliance and quality control: Regulatory frameworks require manufacturers to implement standardized manufacturing processes and quality control measures for solid state batteries. This includes adherence to Good Manufacturing Practices (GMP), quality management systems such as ISO 9001, and specific industry standards for battery production. Manufacturers must establish robust testing protocols, traceability systems, and documentation procedures to demonstrate compliance with regulatory requirements throughout the production process.

- Intellectual property and regulatory data management: Managing intellectual property rights and regulatory data is crucial for solid state battery manufacturers. This includes proper documentation of patents, trade secrets, and regulatory submissions. Companies must implement systems to track regulatory changes across different jurisdictions, manage compliance documentation, and protect proprietary technology while meeting disclosure requirements. Effective data management systems help ensure ongoing compliance with evolving regulations while safeguarding valuable intellectual property.

02 Environmental regulations and disposal requirements

Regulatory frameworks govern the environmental aspects of solid state batteries, including manufacturing processes, material usage, and end-of-life disposal. These regulations aim to minimize environmental impact and ensure proper recycling or disposal of battery components. Manufacturers must adhere to restrictions on hazardous substances and implement environmentally responsible production methods. Compliance with these regulations is essential for market access in various jurisdictions.Expand Specific Solutions03 Transportation and shipping regulations

Solid state batteries are subject to specific transportation and shipping regulations due to their energy storage capabilities. These regulations govern how batteries can be packaged, labeled, and transported across different modes of transportation. Compliance with international dangerous goods regulations is necessary when shipping batteries internationally. Manufacturers must ensure their products meet all relevant transportation safety requirements to prevent incidents during shipping.Expand Specific Solutions04 Manufacturing quality control and compliance systems

Quality control systems and manufacturing standards are critical for regulatory compliance of solid state batteries. These systems ensure consistency in production and adherence to design specifications. Manufacturers must implement robust quality management systems that include documentation, testing protocols, and traceability measures. Regular audits and inspections may be required to maintain compliance with industry standards and regulatory requirements.Expand Specific Solutions05 Intellectual property and patent compliance

Navigating the intellectual property landscape is essential for solid state battery manufacturers to ensure they don't infringe on existing patents. This includes conducting freedom-to-operate analyses and securing necessary licenses for patented technologies. Companies must also protect their own innovations through appropriate patent filings. Compliance with intellectual property laws across different jurisdictions is necessary for global market access and to avoid costly litigation.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid state battery market is currently in an early growth phase, characterized by significant R&D investments but limited commercial deployment. Market size is projected to expand rapidly, reaching approximately $6-8 billion by 2030, driven by automotive electrification demands. Technologically, the field shows varying maturity levels across players. Industry leaders like QuantumScape, Samsung, and CATL are advancing toward commercialization with promising prototypes demonstrating improved energy density and safety profiles. Traditional battery manufacturers (Murata, LG Energy Solution) are leveraging existing infrastructure to accelerate development, while automotive companies like Honda are forming strategic partnerships to secure supply chains. Academic-industry collaborations involving MIT, University of Michigan, and Central South University are addressing fundamental challenges in electrolyte stability and manufacturing scalability, positioning solid state technology as the next evolutionary step in energy storage.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed an innovative solid-state battery technology called Condensed Battery that uses condensed matter electrolytes with a unique structure that allows for high ionic conductivity while maintaining mechanical stability. Their approach integrates a self-assembled artificial solid-electrolyte interphase (SEI) layer that effectively prevents lithium dendrite growth and enhances safety. CATL's solid-state batteries comply with China's GB/T 36276 standards for electric vehicle batteries and international IEC 62660 requirements. The company has implemented a comprehensive battery management system that monitors cell temperature, voltage, and internal resistance to ensure regulatory compliance with thermal runaway prevention standards. Their manufacturing processes adhere to ISO 14001 environmental management standards and EU REACH regulations regarding hazardous materials.

Strengths: Established mass production capabilities, strong supply chain integration, comprehensive safety management systems, and extensive experience with regulatory compliance across global markets. Weaknesses: Higher initial costs compared to their conventional lithium-ion offerings, and technology still in early commercialization phase with limited real-world performance data.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a composite solid electrolyte system that combines sulfide-based and oxide-based materials to optimize ionic conductivity while maintaining mechanical stability. Their solid-state battery technology incorporates a proprietary protective coating on the lithium metal anode that prevents unwanted side reactions with the electrolyte. The company's manufacturing process complies with ISO 9001 quality management standards and ISO 14001 environmental management systems. LG's solid-state batteries meet UL 1642 safety standards for lithium batteries and IEC 62133 requirements for safe operation. Their battery management system includes multiple redundant safety features including thermal fuses and pressure relief mechanisms that exceed regulatory requirements in major markets including the US, EU, and Asia. LG has also implemented a comprehensive recycling program that complies with EU Battery Directive 2006/66/EC and similar regulations worldwide.

Strengths: Extensive manufacturing infrastructure, established quality control systems, strong global distribution network, and experience navigating complex regulatory environments across multiple jurisdictions. Weaknesses: Current solid-state technology still faces challenges with production scaling and cost competitiveness compared to conventional lithium-ion batteries.

Core Patents and Innovations in Solid State Battery Technology

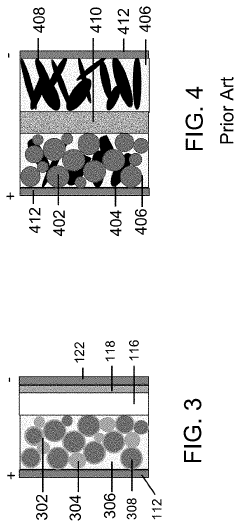

Cermet electrode for solid state and lithium ion batteries

PatentPendingUS20200388854A1

Innovation

- A porous ceramic-metal (cermet) cathode is developed, where a metallic material acts as a binder and conductive additive, providing mechanical integrity and interconnected porosity to accommodate liquid, gel, or polymer electrolytes, and is free of conventional binders and conductive carbon, enhancing the cathode's mechanical strength and stability.

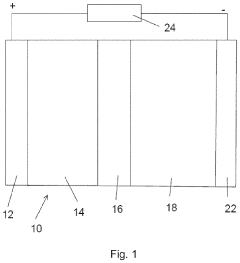

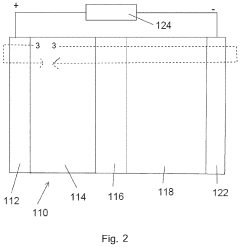

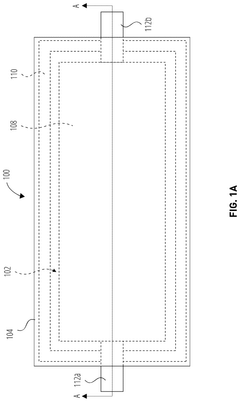

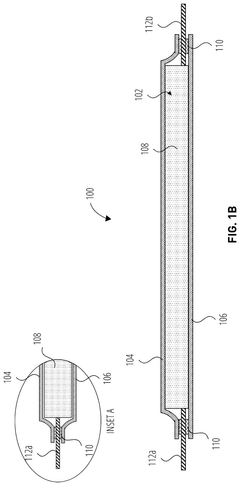

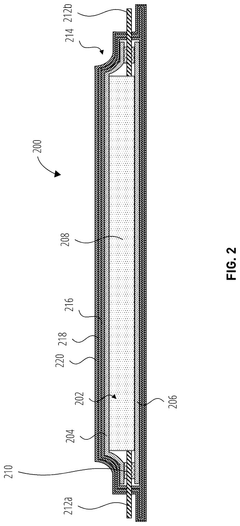

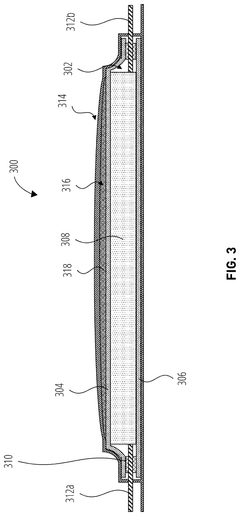

Battery cells including resilient pouches

PatentPendingUS20240363933A1

Innovation

- The use of a pouch structure with heat-resistant materials, such as polyimide polymers like Kapton, and a thermoplastic sealant, like thermoplastic urethane, to create a hermetically sealed internal volume that accommodates expansion and contraction of electrodes, along with optional supplemental layers for additional strength and safety features like fire suppressants, to enhance thermal and mechanical resilience.

Regulatory Compliance Framework for Battery Technologies

The regulatory landscape for battery technologies has evolved significantly in response to emerging innovations like solid-state batteries. Current regulatory frameworks primarily address traditional lithium-ion batteries, creating compliance challenges for solid-state technology. These frameworks span multiple jurisdictions with varying requirements, necessitating a comprehensive understanding for successful market entry.

Safety regulations form the cornerstone of battery compliance, with standards such as IEC 62133, UL 1642, and UN 38.3 establishing testing protocols for thermal stability, electrical safety, and mechanical integrity. Solid-state batteries must demonstrate compliance with these standards despite their fundamentally different architecture and materials. The absence of flammable liquid electrolytes in solid-state designs potentially simplifies certain safety compliance aspects while introducing new testing challenges for solid electrolyte integrity.

Environmental regulations present another critical dimension, with directives like the EU Battery Directive (2006/66/EC) and its upcoming revision addressing battery lifecycle management. These regulations establish requirements for collection, recycling, and disposal of batteries, with specific provisions regarding hazardous materials content. Solid-state batteries may offer advantages in this area due to their reduced reliance on toxic materials, but must still navigate complex end-of-life compliance requirements.

Transportation regulations governed by UN Model Regulations and modal regulations (IATA DGR, IMDG Code) impose strict requirements on battery shipping. Current classifications primarily address liquid-electrolyte batteries, creating uncertainty regarding appropriate classification and packaging requirements for solid-state alternatives. Industry stakeholders are actively engaging with regulatory bodies to develop appropriate transportation protocols for these novel energy storage systems.

Manufacturing standards and quality control requirements represent another regulatory consideration. ISO 9001 and industry-specific standards establish expectations for production processes, quality management systems, and traceability. Solid-state battery manufacturers must adapt these frameworks to their unique production methods while demonstrating equivalent quality assurance capabilities.

Market access regulations vary significantly by region, with certification marks like CE (Europe), UL (North America), and CCC (China) serving as prerequisites for commercialization. The novelty of solid-state technology may necessitate additional testing and documentation to satisfy regulatory authorities unfamiliar with these designs. Early engagement with certification bodies can facilitate smoother approval processes and prevent costly redesigns.

Safety regulations form the cornerstone of battery compliance, with standards such as IEC 62133, UL 1642, and UN 38.3 establishing testing protocols for thermal stability, electrical safety, and mechanical integrity. Solid-state batteries must demonstrate compliance with these standards despite their fundamentally different architecture and materials. The absence of flammable liquid electrolytes in solid-state designs potentially simplifies certain safety compliance aspects while introducing new testing challenges for solid electrolyte integrity.

Environmental regulations present another critical dimension, with directives like the EU Battery Directive (2006/66/EC) and its upcoming revision addressing battery lifecycle management. These regulations establish requirements for collection, recycling, and disposal of batteries, with specific provisions regarding hazardous materials content. Solid-state batteries may offer advantages in this area due to their reduced reliance on toxic materials, but must still navigate complex end-of-life compliance requirements.

Transportation regulations governed by UN Model Regulations and modal regulations (IATA DGR, IMDG Code) impose strict requirements on battery shipping. Current classifications primarily address liquid-electrolyte batteries, creating uncertainty regarding appropriate classification and packaging requirements for solid-state alternatives. Industry stakeholders are actively engaging with regulatory bodies to develop appropriate transportation protocols for these novel energy storage systems.

Manufacturing standards and quality control requirements represent another regulatory consideration. ISO 9001 and industry-specific standards establish expectations for production processes, quality management systems, and traceability. Solid-state battery manufacturers must adapt these frameworks to their unique production methods while demonstrating equivalent quality assurance capabilities.

Market access regulations vary significantly by region, with certification marks like CE (Europe), UL (North America), and CCC (China) serving as prerequisites for commercialization. The novelty of solid-state technology may necessitate additional testing and documentation to satisfy regulatory authorities unfamiliar with these designs. Early engagement with certification bodies can facilitate smoother approval processes and prevent costly redesigns.

Environmental Impact and Sustainability Considerations

Solid state batteries represent a significant advancement in energy storage technology with profound implications for environmental sustainability. The manufacturing processes for solid state batteries generally require fewer toxic materials compared to conventional lithium-ion batteries, particularly eliminating the need for flammable liquid electrolytes. This reduction in hazardous materials aligns with increasingly stringent environmental regulations worldwide, including the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives.

The lifecycle assessment of solid state batteries demonstrates potentially lower environmental impact across production, use, and disposal phases. Manufacturing solid state batteries typically consumes less energy and water than traditional battery production, resulting in reduced carbon emissions. This advantage positions solid state battery technology favorably under carbon taxation schemes and emissions trading systems being implemented globally.

Regarding end-of-life considerations, solid state batteries offer improved recyclability prospects. The absence of liquid components simplifies the recycling process, potentially increasing recovery rates for valuable materials like lithium, cobalt, and nickel. This characteristic supports compliance with extended producer responsibility regulations and circular economy initiatives such as the EU Battery Directive, which mandates specific collection and recycling targets.

The reduced fire risk associated with solid state batteries also addresses safety regulations concerning transportation and storage of energy storage systems. This safety profile may facilitate regulatory approval in applications where conventional lithium-ion batteries face restrictions due to thermal runaway concerns, such as in aviation or large-scale energy storage installations.

From a resource sustainability perspective, some solid state battery designs utilize more abundant materials, potentially reducing dependence on critical raw materials subject to supply chain regulations. This aspect becomes increasingly important as governments worldwide implement policies to secure strategic mineral supplies and reduce geopolitical vulnerabilities in battery supply chains.

However, novel materials used in solid state batteries may introduce new regulatory challenges. Regulatory frameworks will need to evolve to address potential unknown environmental impacts of these materials. Manufacturers must conduct thorough environmental risk assessments to ensure compliance with precautionary principles embedded in contemporary environmental legislation.

As climate change mitigation policies intensify globally, the superior energy density and longer lifespan of solid state batteries contribute positively to carbon reduction goals in transportation and renewable energy sectors. This alignment with sustainability objectives may qualify solid state battery technologies for various green incentives and subsidies, further accelerating their market adoption and technological refinement.

The lifecycle assessment of solid state batteries demonstrates potentially lower environmental impact across production, use, and disposal phases. Manufacturing solid state batteries typically consumes less energy and water than traditional battery production, resulting in reduced carbon emissions. This advantage positions solid state battery technology favorably under carbon taxation schemes and emissions trading systems being implemented globally.

Regarding end-of-life considerations, solid state batteries offer improved recyclability prospects. The absence of liquid components simplifies the recycling process, potentially increasing recovery rates for valuable materials like lithium, cobalt, and nickel. This characteristic supports compliance with extended producer responsibility regulations and circular economy initiatives such as the EU Battery Directive, which mandates specific collection and recycling targets.

The reduced fire risk associated with solid state batteries also addresses safety regulations concerning transportation and storage of energy storage systems. This safety profile may facilitate regulatory approval in applications where conventional lithium-ion batteries face restrictions due to thermal runaway concerns, such as in aviation or large-scale energy storage installations.

From a resource sustainability perspective, some solid state battery designs utilize more abundant materials, potentially reducing dependence on critical raw materials subject to supply chain regulations. This aspect becomes increasingly important as governments worldwide implement policies to secure strategic mineral supplies and reduce geopolitical vulnerabilities in battery supply chains.

However, novel materials used in solid state batteries may introduce new regulatory challenges. Regulatory frameworks will need to evolve to address potential unknown environmental impacts of these materials. Manufacturers must conduct thorough environmental risk assessments to ensure compliance with precautionary principles embedded in contemporary environmental legislation.

As climate change mitigation policies intensify globally, the superior energy density and longer lifespan of solid state batteries contribute positively to carbon reduction goals in transportation and renewable energy sectors. This alignment with sustainability objectives may qualify solid state battery technologies for various green incentives and subsidies, further accelerating their market adoption and technological refinement.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!