Solid State Battery Breakthrough: Safety Standards and Protocols

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Evolution and Objectives

Solid state batteries represent a significant evolution in energy storage technology, emerging as a promising alternative to conventional lithium-ion batteries with liquid electrolytes. The development trajectory of solid state batteries can be traced back to the 1970s, with initial research focusing on inorganic solid electrolytes. However, substantial progress has only materialized in the last decade, driven by increasing demands for safer, higher-capacity energy storage solutions across multiple industries.

The technological evolution of solid state batteries has been characterized by persistent efforts to overcome key challenges, particularly related to electrolyte conductivity, interface stability, and manufacturing scalability. Early iterations suffered from poor ionic conductivity at room temperature, limiting practical applications. Recent breakthroughs in materials science have yielded solid electrolytes with conductivity values approaching those of liquid counterparts, marking a critical inflection point in development.

Current research trends indicate accelerating innovation in composite electrolytes, electrode-electrolyte interfaces, and advanced manufacturing techniques. The integration of nanotechnology and computational materials science has enabled more precise engineering of battery components, addressing historical limitations in power density and cycle life. This convergence of multidisciplinary approaches signals a maturing technology poised for commercial viability.

The primary technical objectives for solid state battery development center on safety enhancement through elimination of flammable liquid electrolytes, which addresses a fundamental vulnerability in conventional battery designs. Additional objectives include achieving higher energy density (>400 Wh/kg), extended cycle life (>1,000 cycles), improved fast-charging capabilities, and wider operating temperature ranges (-20°C to 80°C).

Safety standards and protocols represent a critical dimension of solid state battery advancement. Unlike conventional batteries with established safety frameworks, solid state technologies require new testing methodologies and certification processes that account for their unique failure modes and performance characteristics. The development of these standards has become increasingly urgent as commercialization timelines accelerate.

Industry projections suggest that solid state batteries could achieve mass market penetration by 2025-2030, contingent upon resolving remaining technical challenges and establishing robust safety protocols. The technology roadmap indicates a phased approach, with initial deployment in premium electronic devices, followed by electric vehicles, and eventually grid-scale storage applications.

The ultimate goal extends beyond simple replacement of existing battery technologies to enabling transformative applications previously constrained by energy storage limitations, including next-generation electric mobility, advanced medical devices, and distributed renewable energy systems.

The technological evolution of solid state batteries has been characterized by persistent efforts to overcome key challenges, particularly related to electrolyte conductivity, interface stability, and manufacturing scalability. Early iterations suffered from poor ionic conductivity at room temperature, limiting practical applications. Recent breakthroughs in materials science have yielded solid electrolytes with conductivity values approaching those of liquid counterparts, marking a critical inflection point in development.

Current research trends indicate accelerating innovation in composite electrolytes, electrode-electrolyte interfaces, and advanced manufacturing techniques. The integration of nanotechnology and computational materials science has enabled more precise engineering of battery components, addressing historical limitations in power density and cycle life. This convergence of multidisciplinary approaches signals a maturing technology poised for commercial viability.

The primary technical objectives for solid state battery development center on safety enhancement through elimination of flammable liquid electrolytes, which addresses a fundamental vulnerability in conventional battery designs. Additional objectives include achieving higher energy density (>400 Wh/kg), extended cycle life (>1,000 cycles), improved fast-charging capabilities, and wider operating temperature ranges (-20°C to 80°C).

Safety standards and protocols represent a critical dimension of solid state battery advancement. Unlike conventional batteries with established safety frameworks, solid state technologies require new testing methodologies and certification processes that account for their unique failure modes and performance characteristics. The development of these standards has become increasingly urgent as commercialization timelines accelerate.

Industry projections suggest that solid state batteries could achieve mass market penetration by 2025-2030, contingent upon resolving remaining technical challenges and establishing robust safety protocols. The technology roadmap indicates a phased approach, with initial deployment in premium electronic devices, followed by electric vehicles, and eventually grid-scale storage applications.

The ultimate goal extends beyond simple replacement of existing battery technologies to enabling transformative applications previously constrained by energy storage limitations, including next-generation electric mobility, advanced medical devices, and distributed renewable energy systems.

Market Demand Analysis for Safer Energy Storage

The global energy storage market is experiencing unprecedented growth, driven by the increasing adoption of electric vehicles (EVs), renewable energy systems, and portable electronics. This growth trajectory has intensified the demand for safer energy storage solutions, particularly as incidents involving conventional lithium-ion batteries continue to make headlines. Market research indicates that the global battery market is projected to reach $310 billion by 2030, with safety concerns becoming a primary factor influencing consumer purchasing decisions and regulatory frameworks.

Consumer surveys reveal that safety ranks as the top concern among potential EV buyers, with 78% of respondents citing battery safety as a critical consideration. This concern extends beyond the automotive sector to consumer electronics, where high-profile incidents of device fires have damaged brand reputations and resulted in costly recalls. The aviation industry has implemented strict regulations on lithium battery transport following multiple incidents, creating significant logistical challenges for manufacturers and distributors.

Insurance companies have begun adjusting their policies to account for the risks associated with energy storage systems, with some introducing premium increases of up to 30% for properties with certain battery installations. This financial pressure is creating market demand for demonstrably safer alternatives like solid-state batteries, which can potentially qualify for lower insurance rates due to their reduced fire risk.

The industrial and grid-scale storage sectors are similarly prioritizing safety in their procurement decisions. Utility companies investing in large-scale battery storage systems are increasingly specifying enhanced safety requirements in their tenders, with many willing to pay premium prices for solutions that offer superior safety profiles. Market analysis shows that solutions with advanced safety features command price premiums of 15-25% compared to standard offerings.

Regulatory bodies worldwide are tightening safety standards for energy storage systems. The European Union's Battery Directive revision, China's new battery safety standards, and updated UL certifications in North America are creating a regulatory environment that favors inherently safer technologies like solid-state batteries. This regulatory pressure is accelerating market demand for compliant solutions.

The market opportunity for safer energy storage extends beyond the batteries themselves to encompass safety monitoring systems, thermal management solutions, and advanced battery management systems. This ecosystem of safety-focused products and services represents a significant adjacent market estimated at $45 billion by 2028, growing at a CAGR of 22%.

Consumer awareness of battery safety issues has increased dramatically, with online search trends showing a 300% increase in queries related to "battery safety" and "safe batteries" over the past five years. This heightened awareness is creating market pull for technologies that can credibly claim superior safety performance, positioning solid-state batteries as a compelling solution to meet this growing demand.

Consumer surveys reveal that safety ranks as the top concern among potential EV buyers, with 78% of respondents citing battery safety as a critical consideration. This concern extends beyond the automotive sector to consumer electronics, where high-profile incidents of device fires have damaged brand reputations and resulted in costly recalls. The aviation industry has implemented strict regulations on lithium battery transport following multiple incidents, creating significant logistical challenges for manufacturers and distributors.

Insurance companies have begun adjusting their policies to account for the risks associated with energy storage systems, with some introducing premium increases of up to 30% for properties with certain battery installations. This financial pressure is creating market demand for demonstrably safer alternatives like solid-state batteries, which can potentially qualify for lower insurance rates due to their reduced fire risk.

The industrial and grid-scale storage sectors are similarly prioritizing safety in their procurement decisions. Utility companies investing in large-scale battery storage systems are increasingly specifying enhanced safety requirements in their tenders, with many willing to pay premium prices for solutions that offer superior safety profiles. Market analysis shows that solutions with advanced safety features command price premiums of 15-25% compared to standard offerings.

Regulatory bodies worldwide are tightening safety standards for energy storage systems. The European Union's Battery Directive revision, China's new battery safety standards, and updated UL certifications in North America are creating a regulatory environment that favors inherently safer technologies like solid-state batteries. This regulatory pressure is accelerating market demand for compliant solutions.

The market opportunity for safer energy storage extends beyond the batteries themselves to encompass safety monitoring systems, thermal management solutions, and advanced battery management systems. This ecosystem of safety-focused products and services represents a significant adjacent market estimated at $45 billion by 2028, growing at a CAGR of 22%.

Consumer awareness of battery safety issues has increased dramatically, with online search trends showing a 300% increase in queries related to "battery safety" and "safe batteries" over the past five years. This heightened awareness is creating market pull for technologies that can credibly claim superior safety performance, positioning solid-state batteries as a compelling solution to meet this growing demand.

Technical Challenges in Solid State Battery Development

Despite significant advancements in solid-state battery technology, numerous technical challenges continue to impede widespread commercialization. The primary obstacle remains the solid electrolyte interface, where issues of ionic conductivity at room temperature significantly lag behind conventional liquid electrolytes. Most solid electrolytes demonstrate optimal performance only at elevated temperatures, creating substantial engineering challenges for everyday applications.

Material compatibility presents another formidable barrier, particularly at the cathode-electrolyte interface where chemical and mechanical instabilities occur during cycling. The volume changes during lithium insertion and extraction create mechanical stress that can lead to contact loss and increased impedance. This interface degradation accelerates capacity fade and shortens battery lifespan.

Manufacturing scalability constitutes a critical challenge for solid-state battery production. Current laboratory-scale fabrication methods often involve complex processes that are difficult to translate to mass production. The precise control required for thin-film deposition of solid electrolytes and the creation of stable interfaces demands specialized equipment and expertise that significantly increases production costs.

Dendrite formation, contrary to early assumptions, remains problematic even in solid-state configurations. Recent research has demonstrated that lithium metal can still penetrate certain solid electrolytes along grain boundaries or through microscopic defects, potentially causing internal short circuits. This phenomenon necessitates careful materials selection and interface engineering to ensure long-term safety and reliability.

Pressure requirements represent another significant hurdle. Many solid-state battery designs require substantial stack pressure to maintain intimate contact between components, particularly as the cell cycles. This necessity complicates cell design and increases packaging requirements, adding weight and complexity that offset some of the technology's inherent advantages.

Thermal management challenges also persist, as solid-state batteries exhibit different thermal behavior compared to conventional lithium-ion cells. Heat dissipation pathways differ substantially, requiring redesigned battery management systems to prevent localized heating that could compromise performance and safety.

Cost factors remain perhaps the most significant barrier to commercialization. Current solid electrolyte materials often involve expensive elements or complex synthesis procedures. The precision manufacturing requirements and specialized equipment needed for production further elevate costs, making it difficult for solid-state batteries to compete economically with established technologies without significant economies of scale.

Material compatibility presents another formidable barrier, particularly at the cathode-electrolyte interface where chemical and mechanical instabilities occur during cycling. The volume changes during lithium insertion and extraction create mechanical stress that can lead to contact loss and increased impedance. This interface degradation accelerates capacity fade and shortens battery lifespan.

Manufacturing scalability constitutes a critical challenge for solid-state battery production. Current laboratory-scale fabrication methods often involve complex processes that are difficult to translate to mass production. The precise control required for thin-film deposition of solid electrolytes and the creation of stable interfaces demands specialized equipment and expertise that significantly increases production costs.

Dendrite formation, contrary to early assumptions, remains problematic even in solid-state configurations. Recent research has demonstrated that lithium metal can still penetrate certain solid electrolytes along grain boundaries or through microscopic defects, potentially causing internal short circuits. This phenomenon necessitates careful materials selection and interface engineering to ensure long-term safety and reliability.

Pressure requirements represent another significant hurdle. Many solid-state battery designs require substantial stack pressure to maintain intimate contact between components, particularly as the cell cycles. This necessity complicates cell design and increases packaging requirements, adding weight and complexity that offset some of the technology's inherent advantages.

Thermal management challenges also persist, as solid-state batteries exhibit different thermal behavior compared to conventional lithium-ion cells. Heat dissipation pathways differ substantially, requiring redesigned battery management systems to prevent localized heating that could compromise performance and safety.

Cost factors remain perhaps the most significant barrier to commercialization. Current solid electrolyte materials often involve expensive elements or complex synthesis procedures. The precision manufacturing requirements and specialized equipment needed for production further elevate costs, making it difficult for solid-state batteries to compete economically with established technologies without significant economies of scale.

Current Safety Solutions and Standards

01 Thermal management and safety protocols

Solid state batteries require specific thermal management systems to prevent overheating and thermal runaway. Safety protocols include temperature monitoring, heat dissipation mechanisms, and thermal insulation barriers between battery components. These systems help maintain optimal operating temperatures and prevent thermal-related safety incidents by controlling heat generation and dissipation during charging and discharging cycles.- Thermal management systems for solid-state batteries: Thermal management systems are crucial for solid-state battery safety, as they help prevent thermal runaway and maintain optimal operating temperatures. These systems include cooling mechanisms, temperature monitoring sensors, and heat dissipation structures that work together to ensure the battery operates within safe temperature ranges. Advanced thermal management designs incorporate phase change materials and intelligent control algorithms to respond to temperature fluctuations and prevent overheating incidents.

- Mechanical protection and structural integrity protocols: Solid-state batteries require specific mechanical protection protocols to maintain their structural integrity during operation and in case of accidents. These include reinforced battery casings, shock absorption systems, and pressure regulation mechanisms that protect the solid electrolyte from fracturing. Standards for mechanical testing involve crush resistance, vibration tolerance, and impact resistance to ensure the battery remains safe even under extreme physical stress conditions.

- Electrical safety monitoring and control systems: Electrical safety systems for solid-state batteries include advanced monitoring circuits that detect abnormal voltage, current, and impedance changes. These systems implement protective measures such as circuit breakers, fuses, and isolation mechanisms that activate when electrical parameters exceed safe thresholds. Intelligent battery management systems continuously analyze electrical performance data to identify potential safety risks before they escalate into hazardous situations.

- Interface stability and degradation prevention standards: Standards for interface stability focus on preventing degradation at the electrode-electrolyte interfaces in solid-state batteries. These include protocols for evaluating interface resistance growth over time, detection of dendrite formation, and assessment of chemical compatibility between battery components. Safety measures involve protective coatings, buffer layers, and interface engineering techniques that maintain stable interfaces throughout the battery lifecycle, preventing internal short circuits and capacity loss.

- Testing and certification protocols for solid-state batteries: Comprehensive testing and certification protocols have been developed specifically for solid-state batteries, including accelerated aging tests, abuse testing under extreme conditions, and performance verification across various operating environments. These protocols evaluate battery response to overcharging, short-circuiting, and mechanical deformation. Certification standards require documentation of safety features, failure mode analysis, and emergency response procedures to ensure batteries meet industry safety requirements before market deployment.

02 Mechanical protection and structural integrity standards

Standards for mechanical protection focus on the structural integrity of solid state batteries under various physical stresses. This includes requirements for resistance to vibration, shock, compression, and puncture. Protective enclosures and reinforcement structures are designed to prevent physical damage to the electrolyte and electrode interfaces, which could otherwise lead to internal short circuits or electrolyte degradation.Expand Specific Solutions03 Electrolyte stability and interface management

Safety standards address the stability of solid electrolytes and their interfaces with electrodes. Protocols include testing for chemical compatibility between components, monitoring for dendrite formation, and evaluating interface degradation over time. Proper interface management prevents internal short circuits and maintains consistent ion transport pathways, which are critical for both performance and safety of solid state batteries.Expand Specific Solutions04 Testing and certification requirements

Comprehensive testing protocols have been developed specifically for solid state batteries, including accelerated aging tests, abuse testing, and performance verification under extreme conditions. Certification requirements include electrical safety testing, environmental impact assessment, and compliance with international standards. These tests evaluate battery response to overcharging, short-circuiting, and physical damage to ensure safety across the battery lifecycle.Expand Specific Solutions05 Failure detection and emergency response systems

Advanced monitoring systems for early detection of potential failures in solid state batteries include sensors for pressure changes, gas evolution, and electrical anomalies. Emergency response protocols involve isolation mechanisms, controlled discharge procedures, and containment strategies. Battery management systems incorporate predictive algorithms to identify potential failure modes before they become critical safety issues.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid-state battery safety standards market is currently in an early growth phase, characterized by significant R&D investment but limited commercial deployment. Market size is projected to expand rapidly as automotive and electronics industries increasingly prioritize safer energy storage solutions. Technologically, established players like Toyota, Samsung, and QuantumScape are leading innovation, with CATL and LG Energy Solution rapidly advancing their capabilities. Asian manufacturers including Murata Manufacturing and Taiyo Yuden bring expertise in materials engineering critical for safety protocol development. University research partnerships (Michigan, California) are accelerating standardization efforts, while newer entrants like Sila Nanotechnologies and Energy Exploration Technologies are introducing disruptive approaches to safety testing methodologies. The competitive landscape reflects a global race to establish dominant safety certification frameworks ahead of anticipated mass-market adoption.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a hybrid solid-liquid electrolyte technology called "condensed matter battery" that bridges conventional and fully solid-state approaches, offering enhanced safety while maintaining manufacturing scalability[1]. Their design incorporates a semi-solid gel polymer electrolyte with ceramic fillers that suppress dendrite growth while providing improved thermal stability compared to conventional lithium-ion batteries. CATL's safety protocols include multi-level protection systems with specialized pressure relief mechanisms designed specifically for their hybrid electrolyte chemistry. The company has established comprehensive testing standards that evaluate cell performance under mechanical deformation, thermal abuse, and electrical stress conditions[2]. Their manufacturing process includes specialized quality control steps that verify electrolyte composition uniformity and interface stability between electrodes and the semi-solid electrolyte. CATL has implemented advanced non-destructive testing methods including ultrasonic and X-ray techniques to detect microscopic defects that could compromise safety during operation. Their battery management systems include proprietary algorithms specifically calibrated for the unique characteristics of their condensed matter battery technology, providing real-time safety monitoring and predictive failure analysis[3]. CATL plans commercial production beginning in 2025, with initial focus on premium EV applications.

Strengths: Massive manufacturing scale and supply chain advantages; Hybrid approach offers easier transition from current production methods; Strong existing relationships with global automotive manufacturers. Weaknesses: Performance compromises compared to fully solid-state designs; Lower energy density than some competing solid-state technologies; Thermal management still required though less intensive than conventional batteries.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered solid-state battery technology with over 1,000 patents related to solid electrolytes and battery safety[1]. Their approach focuses on sulfide-based solid electrolytes that offer high ionic conductivity while addressing dendrite formation issues. Toyota's safety protocols include multi-layer protection systems with mechanical stress absorption layers and thermal runaway prevention mechanisms. They've developed proprietary manufacturing processes that reduce interfacial resistance between electrodes and electrolytes, enhancing both safety and performance[2]. Toyota's solid-state battery design incorporates specialized pressure-regulation systems that maintain optimal contact between components during charge-discharge cycles while preventing mechanical failures. Their safety standards exceed conventional lithium-ion requirements, with testing protocols that simulate extreme conditions including physical penetration, overcharging, and thermal shock scenarios[3]. Toyota aims to commercialize this technology by 2027-2028, with initial implementation in hybrid vehicles before expanding to full EVs.

Strengths: Extensive patent portfolio providing strong IP protection; Demonstrated safety improvements over conventional lithium-ion batteries; Integration expertise with existing vehicle platforms. Weaknesses: Higher manufacturing costs compared to conventional batteries; Production scaling challenges for mass market adoption; Temperature sensitivity issues in certain operating conditions.

Critical Patents and Innovations in Solid Electrolytes

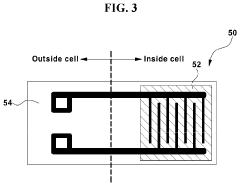

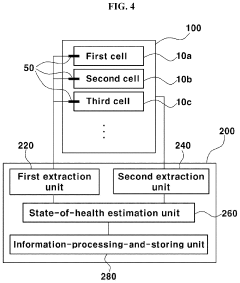

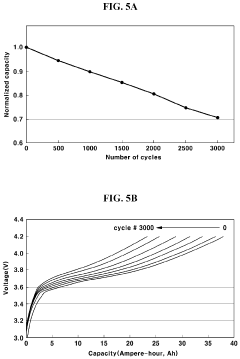

System and method for estimating state of health of all-solid-state battery

PatentActiveUS20230057912A1

Innovation

- A system and method involving hydrogen sulfide sensors to measure the amount or increase rate of hydrogen sulfide in each cell, coupled with an all-solid-state battery management system that processes this data to estimate the battery's state of health, using a combination of chemical reaction and electrochemical reaction factors to provide accurate and reliable SOH estimation.

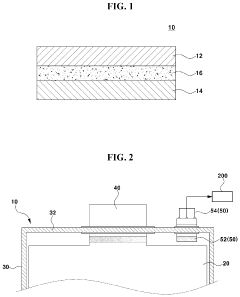

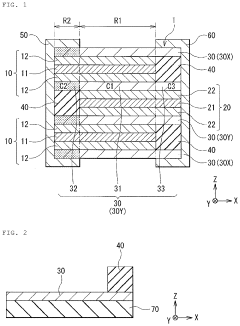

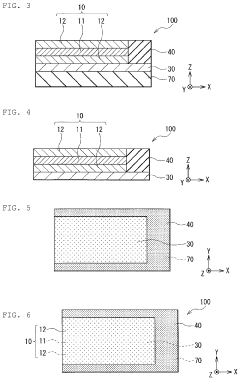

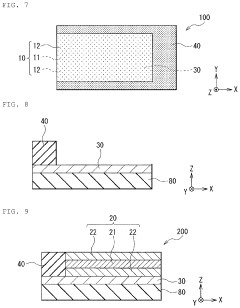

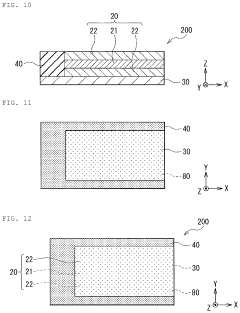

Solid-state battery, battery pack, electric motor vehicle, power storage system, electric tool, and electronic device

PatentActiveUS20200020974A1

Innovation

- A solid-state battery configuration with a solid electrolyte layer having high ion conductivity in regions where the cathode and anode layers face each other and low ion conductivity in regions where they do not, along with a cathode and anode terminal structure that ensures electrical isolation, is implemented to enhance safety.

Regulatory Framework and Compliance Requirements

The regulatory landscape for solid-state batteries represents a complex and evolving framework that manufacturers must navigate to ensure market acceptance and consumer safety. Current regulations governing lithium-ion batteries provide the foundation, but significant gaps exist when addressing the unique characteristics of solid-state technology. Regulatory bodies including the International Electrotechnical Commission (IEC), Underwriters Laboratories (UL), and various national safety organizations are actively developing specialized standards for solid-state battery certification.

The IEC 62660 series, originally designed for lithium-ion batteries in electric vehicles, requires substantial modification to address solid-state specific safety concerns such as dendrite formation prevention and interface stability under various operating conditions. Similarly, UL 1642 and UL 2054 standards for portable battery safety need expansion to incorporate solid-state battery testing protocols that account for their different failure modes and thermal characteristics.

Transportation regulations present another critical compliance area. The UN Manual of Tests and Criteria, particularly UN 38.3 for lithium battery transport, must evolve to address solid-state batteries' unique properties. Current hazardous materials classifications may require reconsideration as solid-state batteries potentially offer reduced fire risks compared to conventional lithium-ion technologies.

Regional regulatory differences further complicate compliance efforts. The European Union's Battery Directive and upcoming Battery Regulation emphasize sustainability metrics and end-of-life management, while China's GB/T standards focus on performance benchmarks. The United States relies heavily on consensus standards developed by organizations like IEEE and NFPA, creating a fragmented regulatory environment that manufacturers must reconcile.

Emerging compliance requirements increasingly focus on lifecycle assessment and material traceability. Solid-state battery manufacturers must document the environmental impact of their production processes and establish transparent supply chains for critical materials like lithium, particularly as regulations targeting conflict minerals and carbon footprints become more stringent.

Certification pathways for solid-state batteries remain under development, with regulatory bodies establishing transitional frameworks that combine existing standards with new testing protocols. These interim approaches typically require enhanced documentation of safety validation methods and more extensive abuse testing to compensate for limited field performance data. Manufacturers engaging proactively with regulatory bodies during this development phase can help shape practical compliance frameworks while accelerating their path to market.

The IEC 62660 series, originally designed for lithium-ion batteries in electric vehicles, requires substantial modification to address solid-state specific safety concerns such as dendrite formation prevention and interface stability under various operating conditions. Similarly, UL 1642 and UL 2054 standards for portable battery safety need expansion to incorporate solid-state battery testing protocols that account for their different failure modes and thermal characteristics.

Transportation regulations present another critical compliance area. The UN Manual of Tests and Criteria, particularly UN 38.3 for lithium battery transport, must evolve to address solid-state batteries' unique properties. Current hazardous materials classifications may require reconsideration as solid-state batteries potentially offer reduced fire risks compared to conventional lithium-ion technologies.

Regional regulatory differences further complicate compliance efforts. The European Union's Battery Directive and upcoming Battery Regulation emphasize sustainability metrics and end-of-life management, while China's GB/T standards focus on performance benchmarks. The United States relies heavily on consensus standards developed by organizations like IEEE and NFPA, creating a fragmented regulatory environment that manufacturers must reconcile.

Emerging compliance requirements increasingly focus on lifecycle assessment and material traceability. Solid-state battery manufacturers must document the environmental impact of their production processes and establish transparent supply chains for critical materials like lithium, particularly as regulations targeting conflict minerals and carbon footprints become more stringent.

Certification pathways for solid-state batteries remain under development, with regulatory bodies establishing transitional frameworks that combine existing standards with new testing protocols. These interim approaches typically require enhanced documentation of safety validation methods and more extensive abuse testing to compensate for limited field performance data. Manufacturers engaging proactively with regulatory bodies during this development phase can help shape practical compliance frameworks while accelerating their path to market.

Environmental Impact and Sustainability Considerations

The transition to solid-state battery technology represents a significant advancement in sustainable energy storage solutions. Unlike conventional lithium-ion batteries with liquid electrolytes, solid-state batteries eliminate the need for toxic and flammable organic solvents, substantially reducing environmental hazards associated with production, usage, and disposal. This fundamental design change minimizes the risk of leakage and contamination, offering enhanced environmental protection throughout the battery lifecycle.

Manufacturing processes for solid-state batteries demonstrate promising sustainability advantages. The simplified production methods require fewer toxic materials and generate less hazardous waste. Initial lifecycle assessments indicate potential reductions in carbon footprint by 15-30% compared to conventional lithium-ion batteries, primarily due to more energy-efficient manufacturing processes and extended operational lifespans.

Resource utilization presents both opportunities and challenges for solid-state battery sustainability. While these batteries may reduce dependence on certain critical materials like cobalt, they introduce demand for other materials such as lithium, ceramic compounds, and specialized solid electrolytes. Sustainable sourcing strategies and circular economy approaches will be essential to mitigate potential new supply chain pressures and environmental impacts from resource extraction.

End-of-life management for solid-state batteries offers significant environmental advantages. Their non-toxic, non-flammable composition simplifies recycling processes and reduces hazardous waste management requirements. The stable solid components enable more efficient material recovery, with preliminary studies suggesting recovery rates of up to 90% for key materials, compared to 50-60% for conventional batteries.

Integration of solid-state batteries into renewable energy systems further amplifies their environmental benefits. Their improved safety profile and longer cycle life make them ideal for grid storage applications supporting intermittent renewable energy sources. This capability could accelerate the transition away from fossil fuels by providing more reliable and safer energy storage solutions for solar and wind power systems.

Regulatory frameworks are evolving to address the unique environmental considerations of solid-state batteries. New standards are being developed to evaluate their full lifecycle environmental impact, including material sourcing, manufacturing emissions, operational efficiency, and end-of-life management. These frameworks will be crucial for ensuring that the environmental promises of solid-state battery technology are fully realized through responsible implementation and management.

Manufacturing processes for solid-state batteries demonstrate promising sustainability advantages. The simplified production methods require fewer toxic materials and generate less hazardous waste. Initial lifecycle assessments indicate potential reductions in carbon footprint by 15-30% compared to conventional lithium-ion batteries, primarily due to more energy-efficient manufacturing processes and extended operational lifespans.

Resource utilization presents both opportunities and challenges for solid-state battery sustainability. While these batteries may reduce dependence on certain critical materials like cobalt, they introduce demand for other materials such as lithium, ceramic compounds, and specialized solid electrolytes. Sustainable sourcing strategies and circular economy approaches will be essential to mitigate potential new supply chain pressures and environmental impacts from resource extraction.

End-of-life management for solid-state batteries offers significant environmental advantages. Their non-toxic, non-flammable composition simplifies recycling processes and reduces hazardous waste management requirements. The stable solid components enable more efficient material recovery, with preliminary studies suggesting recovery rates of up to 90% for key materials, compared to 50-60% for conventional batteries.

Integration of solid-state batteries into renewable energy systems further amplifies their environmental benefits. Their improved safety profile and longer cycle life make them ideal for grid storage applications supporting intermittent renewable energy sources. This capability could accelerate the transition away from fossil fuels by providing more reliable and safer energy storage solutions for solar and wind power systems.

Regulatory frameworks are evolving to address the unique environmental considerations of solid-state batteries. New standards are being developed to evaluate their full lifecycle environmental impact, including material sourcing, manufacturing emissions, operational efficiency, and end-of-life management. These frameworks will be crucial for ensuring that the environmental promises of solid-state battery technology are fully realized through responsible implementation and management.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!