Solid State Battery Breakthrough and Its Industrial Application Parameters

OCT 24, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Evolution and Development Goals

Solid state batteries represent a revolutionary advancement in energy storage technology, evolving from traditional lithium-ion batteries that use liquid electrolytes. The development trajectory began in the 1970s with the discovery of solid electrolytes, but significant progress has only materialized in the last decade. This evolution has been driven by increasing demands for higher energy density, improved safety, and longer cycle life in applications ranging from consumer electronics to electric vehicles and grid storage systems.

The technological progression of solid state batteries has followed several distinct phases. Initially, research focused on inorganic solid electrolytes such as ceramics and glass materials, which demonstrated high ionic conductivity but faced challenges in manufacturing and integration. The second phase saw the emergence of polymer-based solid electrolytes, offering improved flexibility but limited by lower conductivity at room temperature. The current phase involves composite electrolytes that combine the advantages of both inorganic and polymer materials.

Recent breakthroughs have centered on addressing the critical interface issues between electrodes and solid electrolytes, which historically limited performance. Novel manufacturing techniques have enabled the creation of stable interfaces that maintain contact during charging cycles, significantly enhancing battery longevity and reliability. Additionally, advancements in materials science have yielded electrolytes with ionic conductivities approaching those of liquid systems while maintaining the safety advantages of solid materials.

The primary technical goals for solid state battery development include achieving energy densities exceeding 500 Wh/kg (more than double current lithium-ion batteries), extending cycle life beyond 1,000 full charge-discharge cycles, reducing charging times to under 15 minutes, and ensuring operation across a wider temperature range (-20°C to 80°C). These parameters would enable transformative applications across multiple industries.

Cost reduction represents another crucial objective, with targets to decrease production expenses to below $100/kWh, making solid state technology competitive with conventional batteries. This necessitates innovations in both materials and manufacturing processes, including scalable production methods compatible with existing battery manufacturing infrastructure.

Safety improvements constitute a fundamental goal, with solid state technology aiming to eliminate thermal runaway risks associated with liquid electrolytes. The absence of flammable components should enable batteries that remain stable even under extreme conditions such as physical damage or electrical abuse, addressing a major limitation of current energy storage systems.

The ultimate technological vision extends beyond simple replacement of existing batteries to enabling entirely new device architectures and applications. This includes flexible and structural batteries that can be integrated directly into product designs, ultra-high-density storage for next-generation electric vehicles with ranges exceeding 1,000 kilometers, and safe, long-duration grid storage solutions supporting renewable energy integration.

The technological progression of solid state batteries has followed several distinct phases. Initially, research focused on inorganic solid electrolytes such as ceramics and glass materials, which demonstrated high ionic conductivity but faced challenges in manufacturing and integration. The second phase saw the emergence of polymer-based solid electrolytes, offering improved flexibility but limited by lower conductivity at room temperature. The current phase involves composite electrolytes that combine the advantages of both inorganic and polymer materials.

Recent breakthroughs have centered on addressing the critical interface issues between electrodes and solid electrolytes, which historically limited performance. Novel manufacturing techniques have enabled the creation of stable interfaces that maintain contact during charging cycles, significantly enhancing battery longevity and reliability. Additionally, advancements in materials science have yielded electrolytes with ionic conductivities approaching those of liquid systems while maintaining the safety advantages of solid materials.

The primary technical goals for solid state battery development include achieving energy densities exceeding 500 Wh/kg (more than double current lithium-ion batteries), extending cycle life beyond 1,000 full charge-discharge cycles, reducing charging times to under 15 minutes, and ensuring operation across a wider temperature range (-20°C to 80°C). These parameters would enable transformative applications across multiple industries.

Cost reduction represents another crucial objective, with targets to decrease production expenses to below $100/kWh, making solid state technology competitive with conventional batteries. This necessitates innovations in both materials and manufacturing processes, including scalable production methods compatible with existing battery manufacturing infrastructure.

Safety improvements constitute a fundamental goal, with solid state technology aiming to eliminate thermal runaway risks associated with liquid electrolytes. The absence of flammable components should enable batteries that remain stable even under extreme conditions such as physical damage or electrical abuse, addressing a major limitation of current energy storage systems.

The ultimate technological vision extends beyond simple replacement of existing batteries to enabling entirely new device architectures and applications. This includes flexible and structural batteries that can be integrated directly into product designs, ultra-high-density storage for next-generation electric vehicles with ranges exceeding 1,000 kilometers, and safe, long-duration grid storage solutions supporting renewable energy integration.

Market Demand Analysis for Advanced Energy Storage Solutions

The global energy storage market is experiencing unprecedented growth, driven by the convergence of renewable energy integration, electrification of transportation, and increasing demand for portable electronics with longer battery life. Current projections indicate the advanced energy storage market will reach $546 billion by 2035, with a compound annual growth rate of 19.7% between 2023 and 2035. Solid-state batteries represent a critical segment within this expanding market, with potential to capture significant market share from conventional lithium-ion technologies.

Consumer electronics manufacturers are actively seeking battery solutions that offer higher energy density, faster charging capabilities, and enhanced safety profiles. Market research indicates that 78% of smartphone users identify battery life as a critical purchasing factor, while 65% express concerns about battery safety. This consumer sentiment creates a substantial market pull for solid-state battery technology, which promises to address both concerns simultaneously.

The electric vehicle sector presents perhaps the most compelling market opportunity for solid-state battery technology. With global EV sales projected to reach 45 million units annually by 2030, automotive manufacturers are investing heavily in next-generation battery technologies. Current lithium-ion batteries face limitations in energy density (typically 250-300 Wh/kg), charging speed, and operational safety that solid-state technology can potentially overcome. Industry analysts estimate that solid-state batteries could reduce EV charging times by 80% while increasing driving range by 50-100%.

Grid-scale energy storage represents another significant market segment, projected to grow at 24% annually through 2030. Utility companies require storage solutions with improved cycle life, safety characteristics, and energy density to support renewable energy integration. Solid-state batteries' potential for 5,000+ charge cycles (compared to 1,000-2,000 for conventional lithium-ion) makes them particularly attractive for this application.

The aerospace and defense sectors are emerging as premium markets for advanced energy storage, with requirements for lightweight, high-energy-density power sources that can operate reliably in extreme conditions. These specialized applications can support higher price points during early commercialization phases of solid-state technology.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub, with Japan and South Korea leading solid-state battery research and development. North America and Europe represent primary consumer markets, with strong governmental support through initiatives like the European Battery Alliance and the U.S. Infrastructure Investment and Jobs Act allocating substantial funding for advanced battery development and manufacturing.

Market adoption barriers include current high production costs, manufacturing scalability challenges, and competition from incremental improvements in conventional lithium-ion technology. However, the compelling performance advantages of solid-state batteries, particularly in safety and energy density, position them favorably to overcome these obstacles as manufacturing processes mature.

Consumer electronics manufacturers are actively seeking battery solutions that offer higher energy density, faster charging capabilities, and enhanced safety profiles. Market research indicates that 78% of smartphone users identify battery life as a critical purchasing factor, while 65% express concerns about battery safety. This consumer sentiment creates a substantial market pull for solid-state battery technology, which promises to address both concerns simultaneously.

The electric vehicle sector presents perhaps the most compelling market opportunity for solid-state battery technology. With global EV sales projected to reach 45 million units annually by 2030, automotive manufacturers are investing heavily in next-generation battery technologies. Current lithium-ion batteries face limitations in energy density (typically 250-300 Wh/kg), charging speed, and operational safety that solid-state technology can potentially overcome. Industry analysts estimate that solid-state batteries could reduce EV charging times by 80% while increasing driving range by 50-100%.

Grid-scale energy storage represents another significant market segment, projected to grow at 24% annually through 2030. Utility companies require storage solutions with improved cycle life, safety characteristics, and energy density to support renewable energy integration. Solid-state batteries' potential for 5,000+ charge cycles (compared to 1,000-2,000 for conventional lithium-ion) makes them particularly attractive for this application.

The aerospace and defense sectors are emerging as premium markets for advanced energy storage, with requirements for lightweight, high-energy-density power sources that can operate reliably in extreme conditions. These specialized applications can support higher price points during early commercialization phases of solid-state technology.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub, with Japan and South Korea leading solid-state battery research and development. North America and Europe represent primary consumer markets, with strong governmental support through initiatives like the European Battery Alliance and the U.S. Infrastructure Investment and Jobs Act allocating substantial funding for advanced battery development and manufacturing.

Market adoption barriers include current high production costs, manufacturing scalability challenges, and competition from incremental improvements in conventional lithium-ion technology. However, the compelling performance advantages of solid-state batteries, particularly in safety and energy density, position them favorably to overcome these obstacles as manufacturing processes mature.

Current State and Technical Challenges in Solid State Battery Technology

Solid state battery technology has reached a critical juncture in its development trajectory, with significant advancements occurring globally across research institutions and commercial enterprises. Currently, the technology exists primarily in laboratory settings and small-scale production facilities, with limited commercial deployment. Major automotive manufacturers and battery technology companies have demonstrated prototype cells with energy densities ranging from 300-400 Wh/kg, substantially exceeding traditional lithium-ion batteries that typically deliver 250-300 Wh/kg.

The fundamental architecture of contemporary solid state batteries incorporates ceramic or polymer-based solid electrolytes, with lithium metal anodes and high-capacity cathode materials. These configurations have demonstrated promising performance metrics in controlled environments, including faster charging capabilities (potentially achieving 80% charge in under 15 minutes) and enhanced safety profiles due to the elimination of flammable liquid electrolytes.

Despite these advancements, several significant technical challenges persist. The primary obstacle remains the solid-electrolyte interface, where lithium dendrite formation continues to compromise long-term cycling stability. Current laboratory prototypes typically achieve 500-1000 cycles before significant capacity degradation occurs, falling short of the 1500+ cycles required for widespread commercial adoption in automotive applications.

Manufacturing scalability represents another substantial hurdle. The precise deposition techniques required for solid electrolyte layers demand specialized equipment and tightly controlled production environments. Current manufacturing processes exhibit low yields (typically 60-70%) and high unit costs, estimated at 2-3 times that of conventional lithium-ion batteries on a per kWh basis.

Temperature sensitivity also remains problematic, with most solid state electrolytes showing optimal ionic conductivity only within narrow temperature ranges. Performance degradation is particularly pronounced at lower temperatures (below 0°C), where ionic conductivity can decrease by an order of magnitude, severely limiting practical applications in regions with cold climates.

Material availability presents additional concerns, particularly regarding lithium metal supply chains and specialized ceramic compounds required for electrolyte production. Current global production capacity for battery-grade lithium metal stands at approximately 8,000 metric tons annually, insufficient to support mass-market adoption of solid state technology.

Geographically, research leadership is distributed across North America, East Asia, and Europe, with Japan and South Korea demonstrating particular strength in intellectual property development. The United States leads in fundamental research publications, while China has rapidly expanded its patent portfolio in manufacturing processes for solid electrolytes.

These technical limitations collectively establish the framework for necessary innovation pathways that must be addressed before solid state battery technology can achieve widespread commercial implementation across diverse industrial applications.

The fundamental architecture of contemporary solid state batteries incorporates ceramic or polymer-based solid electrolytes, with lithium metal anodes and high-capacity cathode materials. These configurations have demonstrated promising performance metrics in controlled environments, including faster charging capabilities (potentially achieving 80% charge in under 15 minutes) and enhanced safety profiles due to the elimination of flammable liquid electrolytes.

Despite these advancements, several significant technical challenges persist. The primary obstacle remains the solid-electrolyte interface, where lithium dendrite formation continues to compromise long-term cycling stability. Current laboratory prototypes typically achieve 500-1000 cycles before significant capacity degradation occurs, falling short of the 1500+ cycles required for widespread commercial adoption in automotive applications.

Manufacturing scalability represents another substantial hurdle. The precise deposition techniques required for solid electrolyte layers demand specialized equipment and tightly controlled production environments. Current manufacturing processes exhibit low yields (typically 60-70%) and high unit costs, estimated at 2-3 times that of conventional lithium-ion batteries on a per kWh basis.

Temperature sensitivity also remains problematic, with most solid state electrolytes showing optimal ionic conductivity only within narrow temperature ranges. Performance degradation is particularly pronounced at lower temperatures (below 0°C), where ionic conductivity can decrease by an order of magnitude, severely limiting practical applications in regions with cold climates.

Material availability presents additional concerns, particularly regarding lithium metal supply chains and specialized ceramic compounds required for electrolyte production. Current global production capacity for battery-grade lithium metal stands at approximately 8,000 metric tons annually, insufficient to support mass-market adoption of solid state technology.

Geographically, research leadership is distributed across North America, East Asia, and Europe, with Japan and South Korea demonstrating particular strength in intellectual property development. The United States leads in fundamental research publications, while China has rapidly expanded its patent portfolio in manufacturing processes for solid electrolytes.

These technical limitations collectively establish the framework for necessary innovation pathways that must be addressed before solid state battery technology can achieve widespread commercial implementation across diverse industrial applications.

Current Technical Solutions and Implementation Strategies

01 Novel electrolyte materials for solid-state batteries

Recent breakthroughs in solid-state battery technology include the development of novel electrolyte materials that offer improved ionic conductivity and electrochemical stability. These advanced electrolytes enable faster ion transport between electrodes while maintaining structural integrity, addressing key challenges in solid-state battery performance. Innovations include composite electrolytes, polymer-ceramic hybrids, and sulfide-based materials that demonstrate superior properties compared to conventional liquid electrolytes.- Novel electrolyte materials for solid-state batteries: Advanced electrolyte materials are being developed to improve ionic conductivity and stability in solid-state batteries. These materials include ceramic-polymer composites, sulfide-based electrolytes, and garnet-type structures that enable faster lithium-ion transport while maintaining mechanical integrity. These novel electrolytes address key challenges in solid-state battery technology by reducing interfacial resistance and enhancing overall battery performance.

- Interface engineering solutions: Breakthroughs in interface engineering focus on reducing resistance between solid electrolytes and electrodes. Techniques include applying specialized coatings, creating gradient interfaces, and developing new bonding methods to ensure intimate contact between components. These innovations help prevent delamination during cycling and facilitate efficient ion transfer across interfaces, which are critical factors for achieving high-performance solid-state batteries.

- Advanced cathode and anode materials: New electrode materials are being developed specifically for solid-state battery applications. These include high-capacity cathode materials with improved structural stability and novel anode designs that prevent lithium dendrite formation. Some innovations focus on composite electrodes that maintain good contact with solid electrolytes during volume changes, addressing a key challenge in solid-state battery technology.

- Manufacturing processes and scalability solutions: Innovative manufacturing techniques are being developed to enable mass production of solid-state batteries. These include new deposition methods for thin-film electrolytes, sintering processes that preserve material integrity, and assembly techniques that ensure proper component integration. These manufacturing breakthroughs address the scalability challenges that have historically limited commercial adoption of solid-state battery technology.

- Safety and performance enhancement technologies: Various technologies are being developed to enhance the safety and performance of solid-state batteries. These include thermal management systems, pressure regulation mechanisms, and structural designs that prevent short circuits. Additionally, innovations in battery management systems specifically tailored for solid-state chemistry help optimize charging protocols and extend cycle life while maintaining the inherent safety advantages of solid-state technology.

02 Interface engineering for improved electrode-electrolyte contact

A significant breakthrough in solid-state battery technology involves interface engineering to enhance the contact between electrodes and solid electrolytes. This approach addresses the critical challenge of high interfacial resistance that typically limits solid-state battery performance. Advanced techniques include surface modification of active materials, introduction of interlayers, and novel manufacturing processes that create seamless interfaces, resulting in improved energy density, faster charging capabilities, and extended cycle life.Expand Specific Solutions03 Advanced cathode materials for high-energy density

Breakthroughs in cathode material development have significantly enhanced the energy density of solid-state batteries. These advanced cathode materials feature optimized crystal structures, improved lithium storage capacity, and enhanced electrochemical stability. Innovations include high-nickel layered oxides, lithium-rich materials, and novel composite structures that enable higher operating voltages while maintaining structural stability during cycling, resulting in batteries with superior energy storage capabilities.Expand Specific Solutions04 Manufacturing processes for scalable solid-state battery production

Recent breakthroughs in manufacturing processes have addressed the scalability challenges of solid-state battery production. These innovations include novel deposition techniques, advanced sintering methods, and automated assembly processes that enable cost-effective mass production while maintaining the precise layer structures required for optimal performance. The development of roll-to-roll processing, dry film casting, and other scalable fabrication methods represents a significant step toward commercial viability of solid-state batteries.Expand Specific Solutions05 Silicon and lithium metal anodes for next-generation batteries

A major breakthrough in solid-state battery technology involves the successful integration of silicon and lithium metal anodes. These materials offer significantly higher theoretical capacity compared to conventional graphite anodes, potentially increasing energy density by several fold. Recent innovations have overcome historical challenges related to volume expansion, dendrite formation, and interfacial stability through novel protective coatings, structured designs, and electrolyte compatibility improvements, enabling practical implementation of these high-capacity anode materials.Expand Specific Solutions

Key Industry Players and Competitive Landscape Analysis

The solid-state battery market is currently in an early growth phase, characterized by significant R&D investment but limited commercial deployment. Market size is projected to expand rapidly, with estimates suggesting a CAGR of over 30% through 2030 as automotive applications drive demand. Technologically, the field remains in development with varying maturity levels across competitors. Leading players include established manufacturers like Murata Manufacturing and BYD, automotive giants such as Honda, GM, and Hyundai pursuing integration strategies, and specialized innovators like QuantumScape and Sila Nanotechnologies focusing on breakthrough technologies. Academic-industrial partnerships involving institutions like Chinese Academy of Sciences and University of Michigan are accelerating development, while companies like Svolt and Sakti3 are advancing commercialization timelines through novel manufacturing approaches.

Sakti3, Inc.

Technical Solution: Sakti3 (now owned by Dyson) pioneered a solid-state battery technology using thin-film deposition manufacturing methods similar to those used in solar panels and flat-screen displays. Their approach involves depositing thin layers of cathode material, solid electrolyte, and anode material to create solid-state cells without liquid components. This manufacturing technique allows for precise control of layer thickness and composition, resulting in batteries with energy densities exceeding 1,000 Wh/L, nearly double that of conventional lithium-ion batteries. The solid-state design eliminates the need for separators, liquid electrolytes, and many of the safety components required in traditional batteries, resulting in simplified battery structures with fewer inactive components and higher energy density. Their technology operates across a wider temperature range and demonstrates improved cycle life compared to conventional lithium-ion batteries.

Strengths: High energy density, potentially lower manufacturing costs at scale due to simplified structure, improved safety without flammable liquid electrolytes, and compatibility with existing electronics manufacturing infrastructure. Weaknesses: Challenges in scaling thin-film deposition processes to mass production, potential issues with mechanical stress during cycling, and limited public data on long-term performance since acquisition by Dyson.

Svolt Energy Technology Co., Ltd.

Technical Solution: Svolt, a spin-off from Chinese automaker Great Wall Motors, has developed a hybrid solid-state battery technology that combines aspects of conventional lithium-ion batteries with solid-state innovations. Their approach uses a semi-solid electrolyte system with significantly reduced liquid content and proprietary cathode materials. Svolt's solid-state batteries feature a nickel-manganese (NM) cathode that is completely cobalt-free, addressing both cost and ethical sourcing concerns. Their batteries demonstrate energy densities approaching 350-400 Wh/kg with cycle life exceeding 1,500 cycles while maintaining 80% capacity. The company has invested heavily in manufacturing infrastructure, with multiple gigafactories under construction designed specifically for next-generation battery production. Svolt's technology roadmap includes transitioning to fully solid-state designs by 2025, with current hybrid designs serving as a bridge technology for commercial applications.

Strengths: Cobalt-free chemistry reducing supply chain risks and costs, established manufacturing capabilities transitioning toward solid-state production, and strong automotive industry connections ensuring market access. Weaknesses: Current technology is hybrid rather than true solid-state, energy density improvements are incremental rather than revolutionary, and limited presence in markets outside China.

Core Patents and Technical Literature in Solid State Battery Innovation

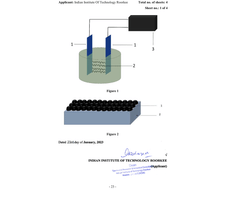

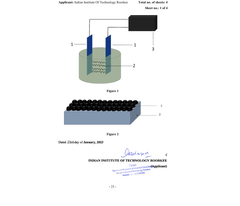

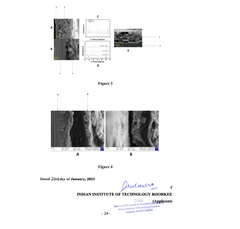

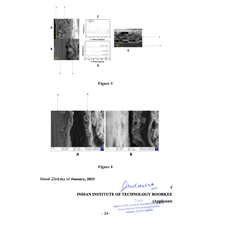

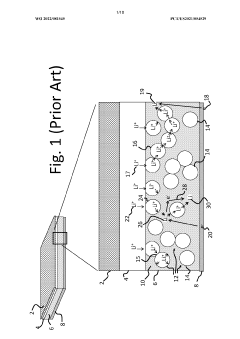

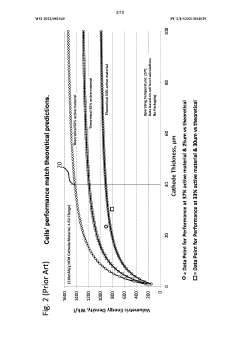

Thick deposition of nanostructured materials with intimate solid-solid interface for all solid state batteries and method for producing the same

PatentActiveIN202311005235A

Innovation

- The method involves a systematic electrophoresis deposition process for thick, binder-free, nanostructured materials with intimate solid-solid interfaces, optimizing deposition parameters to achieve layers with thickness ranging from 500 nm to 50 μm, ensuring homogeneous and crack-free surfaces, and reducing interfacial resistance through direct deposition of ionic conducting ceramics like LLZO on electrodes.

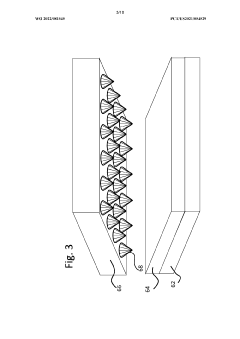

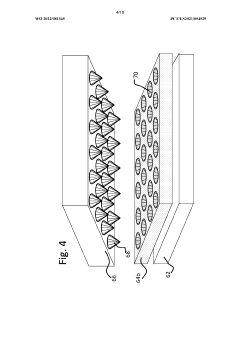

Solid state battery containing continuous glass-ceramic electrolyte separator and perforated sintered solid-state battery cathode

PatentWO2022081545A1

Innovation

- A solid-state battery design featuring a sintered metal oxide cathode with a patterned surface and a continuous glass or glass ceramic electrolyte separator that extends into cavities, providing a high surface area interface and reducing tortuous conduction paths, combined with a lithium-based anode, to enhance lithium ion transport and energy density.

Manufacturing Scalability and Production Parameters

The scalability of solid-state battery manufacturing represents one of the most significant challenges in transitioning this breakthrough technology from laboratory to mass production. Current manufacturing processes for solid-state batteries remain predominantly manual and batch-oriented, with limited throughput capabilities ranging from 5-20 cells per day in advanced research facilities. This production rate falls dramatically short of the thousands of cells per hour achieved in conventional lithium-ion battery gigafactories.

Key production parameters that require optimization include sintering temperature profiles (typically 400-900°C depending on electrolyte composition), pressure application during cell assembly (ranging from 3-7 MPa for optimal interfacial contact), and environmental control requirements (moisture levels below 10 ppm). These parameters significantly impact the formation of stable interfaces between the solid electrolyte and electrodes, which directly correlates with battery performance and longevity.

Material handling presents another critical manufacturing challenge. The brittle nature of ceramic and glass-based solid electrolytes necessitates specialized handling equipment with precise force control. Current yield rates in pilot production lines average 60-75%, substantially lower than the 90%+ achieved in conventional battery manufacturing. This yield gap translates directly to higher production costs, currently estimated at 4-8 times that of liquid electrolyte batteries on a per kWh basis.

Roll-to-roll processing, a standard technique in conventional battery manufacturing, faces significant adaptation challenges for solid-state systems. Recent innovations in polymer-ceramic composite electrolytes show promise for enabling continuous manufacturing processes, with early demonstrations achieving production speeds of 0.5-2 meters per minute, compared to 10-15 meters per minute for conventional battery separators.

Equipment requirements for solid-state battery production differ substantially from existing battery manufacturing lines. High-temperature processing equipment, precision pressure application systems, and advanced environmental control mechanisms represent significant capital investments. Industry analysts estimate retooling costs at $80-120 million per GWh of annual production capacity, approximately 30-40% higher than conventional battery production lines.

Layer thickness control represents another critical production parameter, with target tolerances of ±2μm for electrolyte layers and ±5μm for electrode layers. Current manufacturing capabilities typically achieve ±5-10μm, highlighting the need for improved deposition and processing technologies to meet the stringent requirements for commercial-scale production.

Key production parameters that require optimization include sintering temperature profiles (typically 400-900°C depending on electrolyte composition), pressure application during cell assembly (ranging from 3-7 MPa for optimal interfacial contact), and environmental control requirements (moisture levels below 10 ppm). These parameters significantly impact the formation of stable interfaces between the solid electrolyte and electrodes, which directly correlates with battery performance and longevity.

Material handling presents another critical manufacturing challenge. The brittle nature of ceramic and glass-based solid electrolytes necessitates specialized handling equipment with precise force control. Current yield rates in pilot production lines average 60-75%, substantially lower than the 90%+ achieved in conventional battery manufacturing. This yield gap translates directly to higher production costs, currently estimated at 4-8 times that of liquid electrolyte batteries on a per kWh basis.

Roll-to-roll processing, a standard technique in conventional battery manufacturing, faces significant adaptation challenges for solid-state systems. Recent innovations in polymer-ceramic composite electrolytes show promise for enabling continuous manufacturing processes, with early demonstrations achieving production speeds of 0.5-2 meters per minute, compared to 10-15 meters per minute for conventional battery separators.

Equipment requirements for solid-state battery production differ substantially from existing battery manufacturing lines. High-temperature processing equipment, precision pressure application systems, and advanced environmental control mechanisms represent significant capital investments. Industry analysts estimate retooling costs at $80-120 million per GWh of annual production capacity, approximately 30-40% higher than conventional battery production lines.

Layer thickness control represents another critical production parameter, with target tolerances of ±2μm for electrolyte layers and ±5μm for electrode layers. Current manufacturing capabilities typically achieve ±5-10μm, highlighting the need for improved deposition and processing technologies to meet the stringent requirements for commercial-scale production.

Safety and Performance Benchmarking Standards

The establishment of comprehensive safety and performance benchmarking standards is critical for the industrial adoption of solid-state battery technology. Current standards for lithium-ion batteries are insufficient for solid-state configurations due to fundamental differences in materials, failure modes, and operational parameters. Industry stakeholders and regulatory bodies are collaboratively developing new testing protocols specifically tailored to solid-state battery technologies.

Safety benchmarking for solid-state batteries focuses on thermal stability, mechanical integrity, and electrochemical performance under extreme conditions. Unlike conventional lithium-ion batteries, solid-state variants demonstrate superior thermal runaway resistance, with testing showing stability at temperatures exceeding 200°C compared to the 80°C threshold for conventional systems. This necessitates revised thermal abuse test protocols that accurately reflect these enhanced capabilities.

Mechanical testing standards are being developed to address the unique stress-strain relationships in solid electrolytes. Current benchmarks evaluate resistance to puncture, compression, and vibration, with solid-state systems demonstrating 300-400% greater mechanical resilience than liquid electrolyte counterparts. However, they present different failure modes under mechanical stress that require specialized evaluation methodologies.

Performance benchmarking encompasses energy density, power capability, cycle life, and low-temperature operation. Leading solid-state prototypes have achieved energy densities of 400-500 Wh/kg at the cell level, significantly exceeding the 250-300 Wh/kg typical of advanced lithium-ion batteries. Industry standards are evolving to quantify these improvements while ensuring cross-manufacturer comparability.

Cycle life assessment presents unique challenges for solid-state technology. Accelerated aging tests developed for conventional batteries may not accurately predict the degradation mechanisms of solid electrolytes. New protocols measuring interfacial stability and ion transport efficiency over extended cycling are being implemented, with preliminary standards suggesting 1,000-2,000 cycles at 80% capacity retention as the benchmark for commercial viability.

Fast-charging capability represents another critical performance parameter requiring standardization. Current benchmarks evaluate charging rates from 1C to 5C, with solid-state systems demonstrating potential for 3C charging without the dendrite formation issues that plague conventional batteries. This translates to approximately 20 minutes for an 80% charge while maintaining thermal stability.

International organizations including ISO, IEC, and UL are coordinating efforts to harmonize these emerging standards, with draft specifications expected to be finalized within 12-18 months. These benchmarks will provide crucial guidance for manufacturers, accelerate certification processes, and ultimately facilitate market acceptance of solid-state battery technology across industrial applications.

Safety benchmarking for solid-state batteries focuses on thermal stability, mechanical integrity, and electrochemical performance under extreme conditions. Unlike conventional lithium-ion batteries, solid-state variants demonstrate superior thermal runaway resistance, with testing showing stability at temperatures exceeding 200°C compared to the 80°C threshold for conventional systems. This necessitates revised thermal abuse test protocols that accurately reflect these enhanced capabilities.

Mechanical testing standards are being developed to address the unique stress-strain relationships in solid electrolytes. Current benchmarks evaluate resistance to puncture, compression, and vibration, with solid-state systems demonstrating 300-400% greater mechanical resilience than liquid electrolyte counterparts. However, they present different failure modes under mechanical stress that require specialized evaluation methodologies.

Performance benchmarking encompasses energy density, power capability, cycle life, and low-temperature operation. Leading solid-state prototypes have achieved energy densities of 400-500 Wh/kg at the cell level, significantly exceeding the 250-300 Wh/kg typical of advanced lithium-ion batteries. Industry standards are evolving to quantify these improvements while ensuring cross-manufacturer comparability.

Cycle life assessment presents unique challenges for solid-state technology. Accelerated aging tests developed for conventional batteries may not accurately predict the degradation mechanisms of solid electrolytes. New protocols measuring interfacial stability and ion transport efficiency over extended cycling are being implemented, with preliminary standards suggesting 1,000-2,000 cycles at 80% capacity retention as the benchmark for commercial viability.

Fast-charging capability represents another critical performance parameter requiring standardization. Current benchmarks evaluate charging rates from 1C to 5C, with solid-state systems demonstrating potential for 3C charging without the dendrite formation issues that plague conventional batteries. This translates to approximately 20 minutes for an 80% charge while maintaining thermal stability.

International organizations including ISO, IEC, and UL are coordinating efforts to harmonize these emerging standards, with draft specifications expected to be finalized within 12-18 months. These benchmarks will provide crucial guidance for manufacturers, accelerate certification processes, and ultimately facilitate market acceptance of solid-state battery technology across industrial applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!