Regulations Impacting Solid State Battery Breakthrough Technologies

OCT 24, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Regulatory Landscape and Development Goals

Solid state batteries represent a significant evolution in energy storage technology, promising higher energy density, improved safety, and longer lifespan compared to conventional lithium-ion batteries. The regulatory landscape surrounding this emerging technology is complex and multifaceted, spanning safety standards, environmental regulations, transportation requirements, and intellectual property frameworks across global markets.

Current regulatory frameworks primarily focus on lithium-ion battery technologies, creating a gap in specific regulations tailored to solid-state battery innovations. The International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) are actively developing standards specifically addressing the unique characteristics and safety considerations of solid-state batteries, with preliminary guidelines expected within the next 12-18 months.

Safety certification represents a critical regulatory hurdle for solid-state battery commercialization. Unlike conventional batteries with liquid electrolytes, solid-state batteries present different thermal runaway risks and failure modes, necessitating the development of new testing protocols. The UN Manual of Tests and Criteria for dangerous goods transportation is currently undergoing revision to incorporate specific provisions for solid-state battery technologies.

Environmental regulations significantly impact solid-state battery development, particularly regarding material sourcing and end-of-life management. The European Union's Battery Directive is being updated to include provisions for advanced battery chemistries, while the U.S. Environmental Protection Agency is developing guidelines for recycling and disposal of solid-state battery components, which differ substantially from traditional lithium-ion batteries.

Manufacturing regulations present another layer of complexity, with workplace safety standards requiring adaptation to address the unique production processes involved in solid-state battery fabrication. The Occupational Safety and Health Administration (OSHA) in the United States and similar bodies globally are evaluating potential workplace hazards associated with solid-state battery production.

The development goals for solid-state battery technology are ambitious yet achievable within a structured regulatory framework. Primary objectives include achieving energy densities exceeding 500 Wh/kg, cycle life beyond 1,000 cycles, and operating temperature ranges from -40°C to 80°C. These performance targets must be reached while maintaining compliance with evolving safety standards and environmental regulations.

Regulatory harmonization across major markets represents a critical development goal, as fragmented regulations could impede global commercialization efforts. Industry consortia and international standards organizations are working toward establishing unified testing protocols and safety requirements to facilitate market entry across North America, Europe, and Asia.

Current regulatory frameworks primarily focus on lithium-ion battery technologies, creating a gap in specific regulations tailored to solid-state battery innovations. The International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) are actively developing standards specifically addressing the unique characteristics and safety considerations of solid-state batteries, with preliminary guidelines expected within the next 12-18 months.

Safety certification represents a critical regulatory hurdle for solid-state battery commercialization. Unlike conventional batteries with liquid electrolytes, solid-state batteries present different thermal runaway risks and failure modes, necessitating the development of new testing protocols. The UN Manual of Tests and Criteria for dangerous goods transportation is currently undergoing revision to incorporate specific provisions for solid-state battery technologies.

Environmental regulations significantly impact solid-state battery development, particularly regarding material sourcing and end-of-life management. The European Union's Battery Directive is being updated to include provisions for advanced battery chemistries, while the U.S. Environmental Protection Agency is developing guidelines for recycling and disposal of solid-state battery components, which differ substantially from traditional lithium-ion batteries.

Manufacturing regulations present another layer of complexity, with workplace safety standards requiring adaptation to address the unique production processes involved in solid-state battery fabrication. The Occupational Safety and Health Administration (OSHA) in the United States and similar bodies globally are evaluating potential workplace hazards associated with solid-state battery production.

The development goals for solid-state battery technology are ambitious yet achievable within a structured regulatory framework. Primary objectives include achieving energy densities exceeding 500 Wh/kg, cycle life beyond 1,000 cycles, and operating temperature ranges from -40°C to 80°C. These performance targets must be reached while maintaining compliance with evolving safety standards and environmental regulations.

Regulatory harmonization across major markets represents a critical development goal, as fragmented regulations could impede global commercialization efforts. Industry consortia and international standards organizations are working toward establishing unified testing protocols and safety requirements to facilitate market entry across North America, Europe, and Asia.

Market Demand Analysis for Solid State Battery Technologies

The global market for solid state battery technologies is experiencing unprecedented growth, driven by increasing demand for safer, higher energy density power solutions across multiple industries. Current market projections indicate the solid state battery market will reach approximately $8-10 billion by 2030, with a compound annual growth rate exceeding 30% between 2023 and 2030. This remarkable growth trajectory is primarily fueled by the automotive sector's aggressive electrification strategies, with major manufacturers committing billions to electric vehicle development programs.

Consumer electronics represents another significant market driver, as manufacturers seek batteries with higher energy density, faster charging capabilities, and improved safety profiles. The demand for extended device runtime without increasing form factor has created substantial pull for solid state solutions that can potentially deliver 2-3 times the energy density of conventional lithium-ion batteries.

Aerospace and defense sectors are emerging as premium market segments for solid state battery adoption, willing to pay significant premiums for the weight reduction, safety improvements, and performance advantages these technologies offer. Military applications particularly value the reduced thermal signature and elimination of flammable electrolytes that solid state designs provide.

Market research indicates that safety concerns represent the primary adoption driver across all sectors, with 78% of potential industrial customers citing safety as their top consideration when evaluating next-generation battery technologies. This is followed closely by energy density improvements (65%) and extended operational lifespan (58%).

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub, with Japan and South Korea leading in intellectual property development. However, North America and Europe are rapidly accelerating their investment in both research and production capacity, driven by supply chain security concerns and governmental strategic initiatives.

Consumer willingness to pay premiums for solid state technology varies significantly by application. In the automotive sector, surveys indicate consumers would accept a 15-20% price premium for vehicles offering 30% greater range and substantially reduced charging times. Enterprise customers in industrial applications demonstrate even greater price flexibility, with willingness to pay up to 40% premiums for solutions that eliminate thermal runaway risks in sensitive environments.

The regulatory landscape is increasingly favorable toward solid state technologies, with several jurisdictions implementing stricter safety standards for energy storage that conventional lithium-ion chemistries struggle to meet. This regulatory pressure is creating additional market pull for solid state solutions, particularly in densely populated urban environments and sensitive applications like medical devices and aerospace.

Consumer electronics represents another significant market driver, as manufacturers seek batteries with higher energy density, faster charging capabilities, and improved safety profiles. The demand for extended device runtime without increasing form factor has created substantial pull for solid state solutions that can potentially deliver 2-3 times the energy density of conventional lithium-ion batteries.

Aerospace and defense sectors are emerging as premium market segments for solid state battery adoption, willing to pay significant premiums for the weight reduction, safety improvements, and performance advantages these technologies offer. Military applications particularly value the reduced thermal signature and elimination of flammable electrolytes that solid state designs provide.

Market research indicates that safety concerns represent the primary adoption driver across all sectors, with 78% of potential industrial customers citing safety as their top consideration when evaluating next-generation battery technologies. This is followed closely by energy density improvements (65%) and extended operational lifespan (58%).

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub, with Japan and South Korea leading in intellectual property development. However, North America and Europe are rapidly accelerating their investment in both research and production capacity, driven by supply chain security concerns and governmental strategic initiatives.

Consumer willingness to pay premiums for solid state technology varies significantly by application. In the automotive sector, surveys indicate consumers would accept a 15-20% price premium for vehicles offering 30% greater range and substantially reduced charging times. Enterprise customers in industrial applications demonstrate even greater price flexibility, with willingness to pay up to 40% premiums for solutions that eliminate thermal runaway risks in sensitive environments.

The regulatory landscape is increasingly favorable toward solid state technologies, with several jurisdictions implementing stricter safety standards for energy storage that conventional lithium-ion chemistries struggle to meet. This regulatory pressure is creating additional market pull for solid state solutions, particularly in densely populated urban environments and sensitive applications like medical devices and aerospace.

Current Regulatory Challenges for Solid State Battery Development

The regulatory landscape for solid state battery development presents significant challenges that impact innovation trajectories and commercialization timelines. Current regulations were largely designed for conventional lithium-ion batteries, creating a misalignment with the unique properties and safety profiles of solid state technologies. This regulatory gap creates uncertainty for manufacturers and investors, potentially slowing advancement in this promising field.

Safety certification standards represent a primary regulatory hurdle. Existing protocols for battery safety testing (UL 1642, IEC 62133) were developed for liquid electrolyte systems and fail to adequately address the different failure modes and safety characteristics of solid electrolytes. Regulatory bodies including the International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) are working to develop specific standards, but this process typically requires 3-5 years for completion.

Transportation regulations present another significant challenge. Current dangerous goods regulations (UN 38.3, IATA DGR) impose strict requirements on lithium battery shipping that may be unnecessarily stringent for solid state batteries, which demonstrate superior thermal stability and reduced fire risk. However, proving these safety advantages requires extensive testing data that emerging companies often lack resources to generate.

Manufacturing regulations also create barriers to scale-up. Environmental permits, workplace safety requirements, and materials handling regulations vary significantly across jurisdictions, creating complex compliance landscapes for companies attempting global deployment. The use of novel materials in solid state batteries further complicates regulatory compliance, as some components lack established safety profiles or environmental impact assessments.

Intellectual property protection represents a regulatory challenge of a different nature. The fragmented patent landscape for solid state battery technologies creates uncertainty regarding freedom to operate. Major players have secured broad patent portfolios covering electrolyte compositions, manufacturing processes, and cell designs, potentially restricting innovation pathways for new entrants without extensive cross-licensing agreements.

Recycling and end-of-life regulations add another layer of complexity. Extended Producer Responsibility laws in the EU, China, and increasingly in North America require manufacturers to account for the full lifecycle of batteries. However, recycling processes optimized for conventional lithium-ion batteries may be unsuitable for solid state technologies, requiring development of new recovery methods and regulatory frameworks.

Energy density and performance claims face increasing regulatory scrutiny. As solid state battery developers make ambitious claims regarding energy density improvements and charging capabilities, regulatory bodies including the FTC in the US and advertising standards authorities globally are demanding more rigorous substantiation of marketing claims, particularly for consumer applications.

Safety certification standards represent a primary regulatory hurdle. Existing protocols for battery safety testing (UL 1642, IEC 62133) were developed for liquid electrolyte systems and fail to adequately address the different failure modes and safety characteristics of solid electrolytes. Regulatory bodies including the International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) are working to develop specific standards, but this process typically requires 3-5 years for completion.

Transportation regulations present another significant challenge. Current dangerous goods regulations (UN 38.3, IATA DGR) impose strict requirements on lithium battery shipping that may be unnecessarily stringent for solid state batteries, which demonstrate superior thermal stability and reduced fire risk. However, proving these safety advantages requires extensive testing data that emerging companies often lack resources to generate.

Manufacturing regulations also create barriers to scale-up. Environmental permits, workplace safety requirements, and materials handling regulations vary significantly across jurisdictions, creating complex compliance landscapes for companies attempting global deployment. The use of novel materials in solid state batteries further complicates regulatory compliance, as some components lack established safety profiles or environmental impact assessments.

Intellectual property protection represents a regulatory challenge of a different nature. The fragmented patent landscape for solid state battery technologies creates uncertainty regarding freedom to operate. Major players have secured broad patent portfolios covering electrolyte compositions, manufacturing processes, and cell designs, potentially restricting innovation pathways for new entrants without extensive cross-licensing agreements.

Recycling and end-of-life regulations add another layer of complexity. Extended Producer Responsibility laws in the EU, China, and increasingly in North America require manufacturers to account for the full lifecycle of batteries. However, recycling processes optimized for conventional lithium-ion batteries may be unsuitable for solid state technologies, requiring development of new recovery methods and regulatory frameworks.

Energy density and performance claims face increasing regulatory scrutiny. As solid state battery developers make ambitious claims regarding energy density improvements and charging capabilities, regulatory bodies including the FTC in the US and advertising standards authorities globally are demanding more rigorous substantiation of marketing claims, particularly for consumer applications.

Current Regulatory Compliance Solutions for Solid State Batteries

01 Solid-state electrolyte materials and compositions

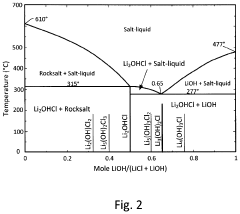

Solid-state batteries utilize various electrolyte materials to enable ion transport between electrodes without liquid components. These materials include ceramic electrolytes, polymer electrolytes, and composite electrolytes that combine different materials to optimize performance. The composition of these electrolytes is critical for achieving high ionic conductivity, mechanical stability, and electrochemical stability at the electrode interfaces, which directly impacts battery performance and safety.- Solid-state electrolyte materials and compositions: Solid-state batteries utilize various electrolyte materials to enable ion transport between electrodes without liquid components. These materials include ceramic electrolytes, polymer electrolytes, and composite electrolytes that combine different materials to optimize performance. The composition of these electrolytes is critical for achieving high ionic conductivity, mechanical stability, and electrochemical stability across a wide temperature range, which directly impacts the overall battery performance and safety.

- Interface engineering and electrode-electrolyte contact optimization: A critical challenge in solid-state batteries is managing the interface between the solid electrolyte and electrodes. Interface engineering techniques focus on improving the contact between these components to reduce resistance and enhance ion transfer. Methods include surface coatings, buffer layers, and specialized manufacturing processes that create stable interfaces while preventing unwanted chemical reactions. These approaches help minimize impedance growth during cycling and improve the overall energy density and cycle life of solid-state batteries.

- Manufacturing processes and assembly techniques: The manufacturing of solid-state batteries requires specialized processes to ensure proper component integration and performance. These include dry and wet processing methods, hot pressing, tape casting, and advanced deposition techniques. Assembly techniques focus on creating uniform layers with minimal defects while maintaining good interfacial contact between components. The manufacturing approach significantly impacts battery performance, scalability, and production costs, making it a crucial aspect of solid-state battery development.

- Cathode and anode materials for solid-state configurations: Electrode materials for solid-state batteries are specifically designed to function optimally with solid electrolytes. Cathode materials include various lithium-containing compounds modified for solid-state applications, while anode materials range from lithium metal to silicon-based composites and other alternatives that offer high energy density. These materials are often engineered with specific surface treatments or dopants to improve their compatibility with solid electrolytes and enhance electrochemical performance while maintaining structural stability during cycling.

- Safety enhancements and thermal management: Solid-state batteries offer inherent safety advantages over liquid electrolyte batteries by eliminating flammable components. Additional safety features include thermal management systems, pressure regulation mechanisms, and protective circuitry. These enhancements help prevent thermal runaway, manage heat distribution during operation, and ensure stable performance across various operating conditions. The improved safety profile makes solid-state batteries particularly attractive for applications in electric vehicles, aerospace, and consumer electronics where safety is paramount.

02 Electrode-electrolyte interface engineering

The interface between electrodes and solid electrolytes presents significant challenges in solid-state batteries. Engineering approaches focus on reducing interfacial resistance, preventing dendrite formation, and ensuring good mechanical contact. Techniques include surface coatings, buffer layers, and specialized interface materials that facilitate ion transfer while maintaining structural integrity during cycling. These innovations help overcome the high impedance issues common at solid-solid interfaces.Expand Specific Solutions03 Manufacturing processes for solid-state batteries

Advanced manufacturing techniques are essential for producing high-quality solid-state batteries at scale. These include specialized deposition methods for thin-film electrolytes, sintering processes for ceramic components, and novel assembly techniques that ensure proper layer adhesion and interface formation. Manufacturing innovations focus on reducing production costs, increasing energy density, and ensuring consistent performance across battery cells.Expand Specific Solutions04 Cathode and anode materials for solid-state applications

Electrode materials for solid-state batteries require specific properties to function effectively with solid electrolytes. High-capacity cathode materials include lithium-rich layered oxides and sulfur-based compounds, while anodes often utilize lithium metal, silicon, or specialized carbon structures. These materials are designed to minimize volume changes during cycling, maintain good contact with the electrolyte, and deliver high energy density while ensuring compatibility with the solid-state architecture.Expand Specific Solutions05 Safety and performance enhancement technologies

Solid-state batteries offer inherent safety advantages over liquid-electrolyte batteries, but require specific technologies to maximize these benefits. Innovations include thermal management systems, pressure regulation mechanisms, and protective architectures that prevent short circuits and thermal runaway. Performance enhancements focus on extending cycle life, improving rate capability, and ensuring stable operation across wide temperature ranges, making solid-state batteries viable for demanding applications like electric vehicles.Expand Specific Solutions

Key Industry Players and Regulatory Compliance Strategies

The solid state battery technology sector is currently in an early growth phase, characterized by significant R&D investments but limited commercial deployment. The global market is projected to expand rapidly, with key players positioning themselves across the value chain. Leading automotive manufacturers like Toyota, Honda, Hyundai, and Kia are actively pursuing this technology to secure competitive advantages in electric vehicle markets. Battery specialists including QuantumScape, Solid Power, Blue Current, and Sila Nanotechnologies are driving innovation alongside established battery producers like CATL, LG Energy Solution, and Murata Manufacturing. The technology remains in pre-commercialization stages, with companies focusing on overcoming challenges related to manufacturing scalability, cost reduction, and regulatory compliance before widespread adoption becomes feasible.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a comprehensive regulatory compliance strategy for their solid-state battery technology that addresses both existing and anticipated regulations. Their approach includes a dual-track development program that maintains compatibility with current lithium-ion battery regulations while preparing for future solid-state specific frameworks. The company has established dedicated regulatory affairs teams in key markets including the US, EU, China, and South Korea to monitor regulatory developments and participate in standards-setting processes. LG's solid-state technology focuses on sulfide-based solid electrolytes with enhanced safety features that potentially reduce regulatory burdens related to thermal runaway and flammability concerns. They have implemented an advanced materials compliance system that tracks regulatory requirements for all battery components across global jurisdictions, ensuring that their supply chain meets evolving chemical registration and reporting obligations such as REACH in Europe and TSCA in the United States.

Strengths: Extensive experience navigating complex regulatory environments for battery technologies; established relationships with regulatory bodies across multiple jurisdictions; integrated compliance management systems. Weaknesses: Their sulfide electrolytes face additional regulatory scrutiny due to potential hydrogen sulfide generation in certain failure conditions; regulatory approval processes may delay time-to-market compared to conventional technologies.

Toyota Motor Corp.

Technical Solution: Toyota has developed a comprehensive regulatory strategy for their solid-state battery technology that leverages their extensive experience in automotive compliance. Their approach focuses on a sulfide-based solid electrolyte system that addresses safety concerns central to battery regulations. Toyota's regulatory compliance framework includes early engagement with authorities in key markets including Japan, the US, and EU to shape emerging standards for solid-state batteries. The company has established dedicated testing facilities that simulate real-world conditions to generate data supporting regulatory approvals, particularly focusing on demonstrating enhanced safety under abuse conditions compared to conventional lithium-ion batteries. Toyota has also developed a proprietary manufacturing process designed to comply with existing chemical handling regulations while anticipating future requirements specific to solid-state battery production. Their strategy includes participation in international standards organizations like ISO and IEC to help establish testing protocols specifically adapted to solid-state technology characteristics.

Strengths: Extensive automotive regulatory experience provides advantage in transportation applications; vertical integration allows coordinated regulatory approach from materials to vehicle integration; strong government relationships in key markets. Weaknesses: Conservative approach to regulatory compliance may slow time-to-market compared to more aggressive competitors; focus on automotive applications may limit flexibility in adapting to regulations in other sectors.

Critical Patents and Regulatory Approval Pathways

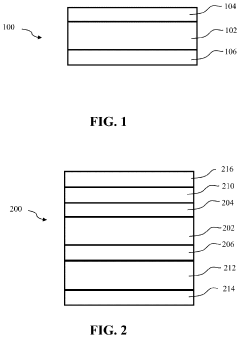

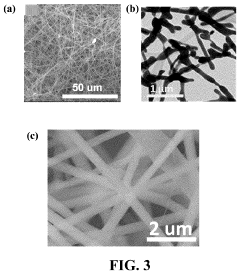

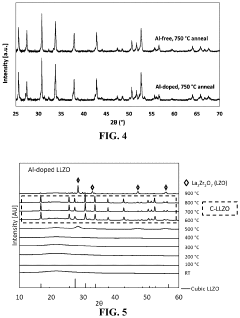

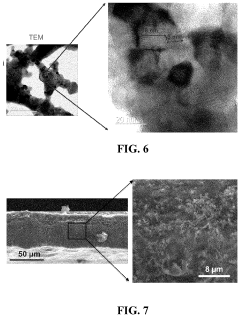

Solid-state nanofiber polymer multilayer composite electrolytes and cells

PatentActiveUS11923501B2

Innovation

- The development of ceramic lithium-conducting nanofibers integrated with polymer electrolytes, specifically using LLZO-PEO composite thin films, to enhance ionic conductivity and electrochemical stability, with nanofibers forming a three-dimensional network for improved ion transport and mechanical robustness.

Method of manufacturing a solid-state lithium battery and a battery manufactured by the method

PatentActiveUS20230044416A1

Innovation

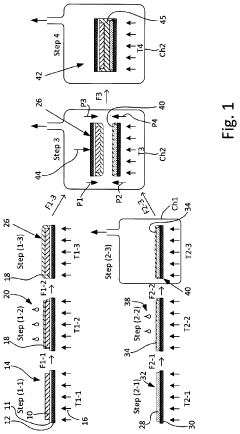

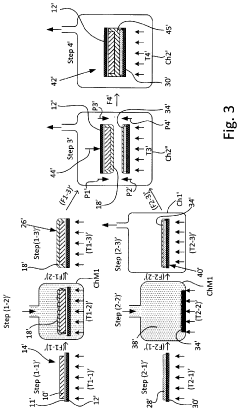

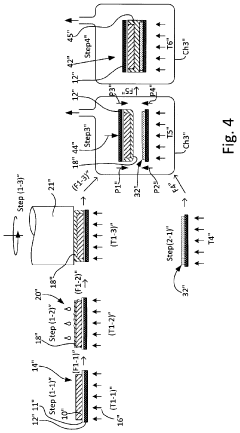

- A method involving the coating of anode and cathode units with solid-state electrolyte precursors, followed by pressing them together at elevated temperatures and mechanical pressure to form a pre-final solid-state battery unit, with controlled heating and pressure to manage redundant water and hydrogen, ensuring the formation of an integral solid-state electrolyte.

Environmental Impact Assessment and Sustainability Requirements

The regulatory landscape surrounding solid state battery technologies increasingly emphasizes environmental impact assessment and sustainability requirements. As these breakthrough technologies move from laboratory to commercial scale, manufacturers face stringent regulations designed to ensure environmental protection throughout the battery lifecycle. The European Union's Battery Directive, recently updated to address emerging technologies, now requires comprehensive life cycle assessments for new battery technologies, with solid state batteries specifically mentioned as requiring additional scrutiny due to their novel materials and manufacturing processes.

Environmental impact assessments for solid state battery production must address several critical areas. The extraction of lithium, silicon, and rare earth elements used in solid electrolytes faces intensifying regulatory oversight, with particular focus on water usage, habitat disruption, and carbon emissions. Regulations in major markets now mandate detailed reporting on resource extraction practices, with penalties for non-compliance becoming increasingly severe. The EU's proposed Carbon Border Adjustment Mechanism will likely impact the global solid state battery supply chain by imposing carbon-related import fees on materials sourced from regions with less stringent environmental regulations.

Manufacturing processes for solid state batteries must meet evolving clean air and water standards. Unlike traditional lithium-ion production, solid state manufacturing often requires higher temperature processing and specialized equipment, creating unique environmental challenges that regulators are beginning to address through technology-specific frameworks. The U.S. Environmental Protection Agency has initiated a specialized assessment program for next-generation battery manufacturing facilities, with particular attention to solid state production methods.

End-of-life regulations present perhaps the most significant regulatory hurdle for solid state battery technologies. While these batteries promise longer lifespans than conventional lithium-ion cells, regulations increasingly demand "design for recyclability" approaches. The EU's Extended Producer Responsibility framework now specifically addresses solid state technologies, requiring manufacturers to demonstrate viable recycling pathways before market approval. Several jurisdictions have implemented mandatory recycling targets that will apply to solid state batteries, despite limited commercial recycling infrastructure currently existing for these novel compositions.

Sustainability certification schemes are emerging as de facto regulatory requirements in many markets. The proposed Battery Passport system in Europe will require detailed environmental impact data throughout the supply chain, creating significant compliance challenges for solid state battery manufacturers utilizing novel material sources. Similarly, government procurement policies in major markets increasingly specify sustainability metrics that may advantage or disadvantage solid state technologies depending on their environmental performance relative to conventional batteries.

Environmental impact assessments for solid state battery production must address several critical areas. The extraction of lithium, silicon, and rare earth elements used in solid electrolytes faces intensifying regulatory oversight, with particular focus on water usage, habitat disruption, and carbon emissions. Regulations in major markets now mandate detailed reporting on resource extraction practices, with penalties for non-compliance becoming increasingly severe. The EU's proposed Carbon Border Adjustment Mechanism will likely impact the global solid state battery supply chain by imposing carbon-related import fees on materials sourced from regions with less stringent environmental regulations.

Manufacturing processes for solid state batteries must meet evolving clean air and water standards. Unlike traditional lithium-ion production, solid state manufacturing often requires higher temperature processing and specialized equipment, creating unique environmental challenges that regulators are beginning to address through technology-specific frameworks. The U.S. Environmental Protection Agency has initiated a specialized assessment program for next-generation battery manufacturing facilities, with particular attention to solid state production methods.

End-of-life regulations present perhaps the most significant regulatory hurdle for solid state battery technologies. While these batteries promise longer lifespans than conventional lithium-ion cells, regulations increasingly demand "design for recyclability" approaches. The EU's Extended Producer Responsibility framework now specifically addresses solid state technologies, requiring manufacturers to demonstrate viable recycling pathways before market approval. Several jurisdictions have implemented mandatory recycling targets that will apply to solid state batteries, despite limited commercial recycling infrastructure currently existing for these novel compositions.

Sustainability certification schemes are emerging as de facto regulatory requirements in many markets. The proposed Battery Passport system in Europe will require detailed environmental impact data throughout the supply chain, creating significant compliance challenges for solid state battery manufacturers utilizing novel material sources. Similarly, government procurement policies in major markets increasingly specify sustainability metrics that may advantage or disadvantage solid state technologies depending on their environmental performance relative to conventional batteries.

International Regulatory Harmonization Opportunities

The global regulatory landscape for solid-state battery technologies presents both challenges and opportunities for harmonization. Currently, different regions maintain varying standards for battery safety, performance testing, transportation, and disposal, creating significant barriers to market entry and technology deployment. The European Union's Battery Directive and the upcoming Battery Regulation establish comprehensive frameworks covering the entire battery lifecycle, while the United States relies on a combination of federal agencies including the Department of Energy, EPA, and NHTSA to regulate different aspects of battery technologies.

Harmonization efforts are emerging through international bodies such as the International Electrotechnical Commission (IEC) and the United Nations Economic Commission for Europe (UNECE), which are developing standardized testing protocols and safety requirements specifically addressing solid-state battery technologies. These initiatives aim to create globally recognized standards that can facilitate international trade while maintaining rigorous safety protocols.

Key opportunities for regulatory harmonization include the development of unified safety testing methodologies that account for the unique characteristics of solid-state batteries, such as their thermal stability and reduced flammability compared to conventional lithium-ion batteries. The establishment of standardized performance metrics would enable fair comparison across different solid-state technologies and accelerate market adoption.

Transportation regulations represent another critical area for harmonization. Current dangerous goods regulations were primarily designed for liquid electrolyte batteries and may impose unnecessary restrictions on solid-state batteries, which typically present lower fire risks. Creating specialized transportation classifications for solid-state technologies could significantly reduce logistical costs and accelerate global deployment.

End-of-life management presents perhaps the most promising harmonization opportunity. Developing internationally recognized recycling standards and material recovery protocols specifically for solid-state batteries could create circular economy opportunities while addressing environmental concerns. The higher value materials often used in solid-state batteries, including certain rare earth elements, make standardized recovery processes economically attractive across markets.

Intellectual property protection frameworks also require harmonization to balance innovation incentives with technology diffusion. Creating patent pools or standardized licensing frameworks for core solid-state battery technologies could accelerate commercialization while ensuring fair compensation for innovators across jurisdictions.

Successful regulatory harmonization will require multi-stakeholder engagement including industry consortia, academic institutions, and government agencies. The International Battery Materials Association (IBMA) and Global Battery Alliance are already facilitating such dialogues, potentially serving as platforms for developing consensus-based approaches to solid-state battery regulation that can be adopted across major markets.

Harmonization efforts are emerging through international bodies such as the International Electrotechnical Commission (IEC) and the United Nations Economic Commission for Europe (UNECE), which are developing standardized testing protocols and safety requirements specifically addressing solid-state battery technologies. These initiatives aim to create globally recognized standards that can facilitate international trade while maintaining rigorous safety protocols.

Key opportunities for regulatory harmonization include the development of unified safety testing methodologies that account for the unique characteristics of solid-state batteries, such as their thermal stability and reduced flammability compared to conventional lithium-ion batteries. The establishment of standardized performance metrics would enable fair comparison across different solid-state technologies and accelerate market adoption.

Transportation regulations represent another critical area for harmonization. Current dangerous goods regulations were primarily designed for liquid electrolyte batteries and may impose unnecessary restrictions on solid-state batteries, which typically present lower fire risks. Creating specialized transportation classifications for solid-state technologies could significantly reduce logistical costs and accelerate global deployment.

End-of-life management presents perhaps the most promising harmonization opportunity. Developing internationally recognized recycling standards and material recovery protocols specifically for solid-state batteries could create circular economy opportunities while addressing environmental concerns. The higher value materials often used in solid-state batteries, including certain rare earth elements, make standardized recovery processes economically attractive across markets.

Intellectual property protection frameworks also require harmonization to balance innovation incentives with technology diffusion. Creating patent pools or standardized licensing frameworks for core solid-state battery technologies could accelerate commercialization while ensuring fair compensation for innovators across jurisdictions.

Successful regulatory harmonization will require multi-stakeholder engagement including industry consortia, academic institutions, and government agencies. The International Battery Materials Association (IBMA) and Global Battery Alliance are already facilitating such dialogues, potentially serving as platforms for developing consensus-based approaches to solid-state battery regulation that can be adopted across major markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!