Comparison of Market Trends: Solid State Battery Breakthrough Vs Competitors

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Evolution and Objectives

Solid state batteries represent a significant evolution in energy storage technology, emerging from decades of research into safer, more efficient alternatives to conventional lithium-ion batteries. The journey began in the 1970s with the discovery of solid electrolytes, but meaningful progress accelerated only in the early 2000s when safety concerns about traditional batteries became more pronounced. This technological trajectory has been driven by increasing demands for higher energy density, improved safety, and longer lifespan in applications ranging from consumer electronics to electric vehicles and grid storage.

The evolution of solid state battery technology has progressed through several distinct phases. Initially, research focused on ceramic and glass-based electrolytes, which offered improved safety but suffered from poor conductivity at room temperature. The second phase saw the development of polymer-based solid electrolytes, which addressed some conductivity issues but introduced manufacturing challenges. The current phase involves hybrid approaches combining the advantages of different materials to optimize performance across multiple parameters.

Market competitors have pursued divergent technological paths. Traditional lithium-ion manufacturers have focused on incremental improvements to existing technologies, including advanced cathode materials and silicon anodes. Meanwhile, flow battery developers have targeted grid-scale applications with different value propositions centered on duration rather than energy density. Hydrogen fuel cells represent another competing technology, particularly in heavy transport applications where quick refueling is prioritized over charging infrastructure.

The primary objectives driving solid state battery development include achieving energy densities exceeding 400 Wh/kg (compared to 250-300 Wh/kg for current lithium-ion batteries), extending cycle life beyond 1,000 full charge-discharge cycles, reducing charging times to under 15 minutes for 80% capacity, and significantly improving safety by eliminating flammable liquid electrolytes. Cost reduction represents another critical objective, with targets of under $100/kWh necessary to achieve price parity with internal combustion vehicles.

Technical challenges remain substantial, particularly regarding interface stability between solid electrolytes and electrodes, manufacturing scalability, and temperature sensitivity. The industry is working toward commercialization timelines that project limited production by 2025 and mass market availability by 2028-2030, though these estimates vary significantly between market analysts and technology developers.

The evolution of this technology is increasingly influenced by regulatory frameworks promoting decarbonization, with several major automotive markets announcing future bans on internal combustion engines, creating strong incentives for breakthrough battery technologies that can enable widespread electric vehicle adoption.

The evolution of solid state battery technology has progressed through several distinct phases. Initially, research focused on ceramic and glass-based electrolytes, which offered improved safety but suffered from poor conductivity at room temperature. The second phase saw the development of polymer-based solid electrolytes, which addressed some conductivity issues but introduced manufacturing challenges. The current phase involves hybrid approaches combining the advantages of different materials to optimize performance across multiple parameters.

Market competitors have pursued divergent technological paths. Traditional lithium-ion manufacturers have focused on incremental improvements to existing technologies, including advanced cathode materials and silicon anodes. Meanwhile, flow battery developers have targeted grid-scale applications with different value propositions centered on duration rather than energy density. Hydrogen fuel cells represent another competing technology, particularly in heavy transport applications where quick refueling is prioritized over charging infrastructure.

The primary objectives driving solid state battery development include achieving energy densities exceeding 400 Wh/kg (compared to 250-300 Wh/kg for current lithium-ion batteries), extending cycle life beyond 1,000 full charge-discharge cycles, reducing charging times to under 15 minutes for 80% capacity, and significantly improving safety by eliminating flammable liquid electrolytes. Cost reduction represents another critical objective, with targets of under $100/kWh necessary to achieve price parity with internal combustion vehicles.

Technical challenges remain substantial, particularly regarding interface stability between solid electrolytes and electrodes, manufacturing scalability, and temperature sensitivity. The industry is working toward commercialization timelines that project limited production by 2025 and mass market availability by 2028-2030, though these estimates vary significantly between market analysts and technology developers.

The evolution of this technology is increasingly influenced by regulatory frameworks promoting decarbonization, with several major automotive markets announcing future bans on internal combustion engines, creating strong incentives for breakthrough battery technologies that can enable widespread electric vehicle adoption.

Market Demand Analysis for Next-Gen Battery Technologies

The global battery market is experiencing unprecedented growth, driven primarily by the rapid expansion of electric vehicles (EVs), renewable energy storage systems, and portable electronics. Current projections indicate the advanced battery market will reach $168 billion by 2030, with a compound annual growth rate exceeding 18% between 2023-2030. This remarkable growth trajectory is creating substantial demand for next-generation battery technologies that overcome the limitations of conventional lithium-ion batteries.

Solid-state batteries have emerged as the most promising next-generation technology, with market research indicating potential demand could reach $8 billion by 2026 and $44 billion by 2030. This accelerated growth is fueled by automotive manufacturers' aggressive electrification strategies, with many major OEMs announcing plans to transition significant portions of their fleets to electric by 2030-2035.

Consumer demand patterns reveal increasing concerns about battery safety, charging speed, and range anxiety. Market surveys indicate 78% of potential EV buyers consider battery performance and safety as critical purchasing factors. Solid-state technology directly addresses these concerns with its superior safety profile, faster charging capabilities, and higher energy density compared to conventional lithium-ion batteries.

The stationary energy storage sector represents another significant market driver, projected to grow at 27% CAGR through 2030. Grid-scale applications require batteries with longer cycle life, improved safety, and reduced maintenance—attributes that solid-state and other next-generation technologies can potentially deliver.

Competitive analysis reveals several parallel development paths beyond solid-state technology. Silicon anode batteries are gaining commercial traction with incremental improvements to existing lithium-ion architecture. Lithium-sulfur batteries offer theoretical energy densities up to five times greater than conventional lithium-ion but face commercialization challenges. Sodium-ion batteries are emerging as a cost-effective alternative for stationary applications where energy density is less critical.

Regional market analysis shows Asia-Pacific leading battery manufacturing capacity, with China controlling approximately 75% of global lithium-ion production. However, recent policy initiatives in North America and Europe aim to establish regional battery supply chains, creating new market opportunities for next-generation technologies.

Consumer electronics manufacturers are increasingly seeking batteries with higher energy density and faster charging capabilities, representing an early adoption market for solid-state technology before automotive-scale production becomes viable. This segment could serve as a proving ground for next-generation battery technologies, allowing manufacturers to refine production processes before scaling to larger applications.

Solid-state batteries have emerged as the most promising next-generation technology, with market research indicating potential demand could reach $8 billion by 2026 and $44 billion by 2030. This accelerated growth is fueled by automotive manufacturers' aggressive electrification strategies, with many major OEMs announcing plans to transition significant portions of their fleets to electric by 2030-2035.

Consumer demand patterns reveal increasing concerns about battery safety, charging speed, and range anxiety. Market surveys indicate 78% of potential EV buyers consider battery performance and safety as critical purchasing factors. Solid-state technology directly addresses these concerns with its superior safety profile, faster charging capabilities, and higher energy density compared to conventional lithium-ion batteries.

The stationary energy storage sector represents another significant market driver, projected to grow at 27% CAGR through 2030. Grid-scale applications require batteries with longer cycle life, improved safety, and reduced maintenance—attributes that solid-state and other next-generation technologies can potentially deliver.

Competitive analysis reveals several parallel development paths beyond solid-state technology. Silicon anode batteries are gaining commercial traction with incremental improvements to existing lithium-ion architecture. Lithium-sulfur batteries offer theoretical energy densities up to five times greater than conventional lithium-ion but face commercialization challenges. Sodium-ion batteries are emerging as a cost-effective alternative for stationary applications where energy density is less critical.

Regional market analysis shows Asia-Pacific leading battery manufacturing capacity, with China controlling approximately 75% of global lithium-ion production. However, recent policy initiatives in North America and Europe aim to establish regional battery supply chains, creating new market opportunities for next-generation technologies.

Consumer electronics manufacturers are increasingly seeking batteries with higher energy density and faster charging capabilities, representing an early adoption market for solid-state technology before automotive-scale production becomes viable. This segment could serve as a proving ground for next-generation battery technologies, allowing manufacturers to refine production processes before scaling to larger applications.

Current Landscape and Technical Barriers in Solid State Batteries

The solid state battery landscape is currently characterized by significant research momentum but limited commercial deployment. Major players including Toyota, Samsung SDI, QuantumScape, and Solid Power have made substantial investments, with Toyota alone holding over 1,000 patents in this field. Despite this activity, solid state batteries remain primarily in the research and development phase, with few products reaching market maturity. Current prototypes demonstrate energy densities of 400-500 Wh/kg, substantially higher than conventional lithium-ion batteries (250-300 Wh/kg), yet most remain confined to laboratory settings.

The primary technical barriers impeding widespread commercialization center around four critical challenges. First, interface stability between solid electrolytes and electrodes presents significant hurdles, with many solid electrolytes exhibiting poor contact with electrode materials, leading to high interfacial resistance and reduced performance. This challenge is particularly pronounced during charge-discharge cycles when volume changes in electrode materials can create physical gaps at interfaces.

Second, manufacturing scalability remains problematic. Current production methods for solid electrolytes often involve complex processes that are difficult to scale economically. Techniques such as vacuum deposition and high-temperature sintering that work in laboratory settings face significant challenges when translated to mass production environments, resulting in prohibitively high manufacturing costs.

Third, ion conductivity at room temperature continues to be a limiting factor. While some solid electrolytes demonstrate impressive conductivity at elevated temperatures, their performance at ambient conditions often falls below that of liquid electrolytes. This limitation directly impacts power density and charging capabilities, particularly in cold-weather conditions.

Fourth, mechanical stress management during cycling represents a persistent challenge. The rigid nature of solid electrolytes makes them susceptible to cracking and delamination during repeated charge-discharge cycles, significantly reducing battery lifespan. This issue is exacerbated by the volume changes in electrode materials, particularly silicon and lithium metal anodes.

Geographically, solid state battery technology development shows distinct regional patterns. Japan leads in patent filings, with Toyota and Panasonic at the forefront. The United States demonstrates strength in venture-backed innovation through companies like QuantumScape and Solid Power. South Korea maintains competitive positioning through Samsung and LG investments, while China is rapidly accelerating research efforts through government-backed initiatives and companies like CATL and BYD.

The primary technical barriers impeding widespread commercialization center around four critical challenges. First, interface stability between solid electrolytes and electrodes presents significant hurdles, with many solid electrolytes exhibiting poor contact with electrode materials, leading to high interfacial resistance and reduced performance. This challenge is particularly pronounced during charge-discharge cycles when volume changes in electrode materials can create physical gaps at interfaces.

Second, manufacturing scalability remains problematic. Current production methods for solid electrolytes often involve complex processes that are difficult to scale economically. Techniques such as vacuum deposition and high-temperature sintering that work in laboratory settings face significant challenges when translated to mass production environments, resulting in prohibitively high manufacturing costs.

Third, ion conductivity at room temperature continues to be a limiting factor. While some solid electrolytes demonstrate impressive conductivity at elevated temperatures, their performance at ambient conditions often falls below that of liquid electrolytes. This limitation directly impacts power density and charging capabilities, particularly in cold-weather conditions.

Fourth, mechanical stress management during cycling represents a persistent challenge. The rigid nature of solid electrolytes makes them susceptible to cracking and delamination during repeated charge-discharge cycles, significantly reducing battery lifespan. This issue is exacerbated by the volume changes in electrode materials, particularly silicon and lithium metal anodes.

Geographically, solid state battery technology development shows distinct regional patterns. Japan leads in patent filings, with Toyota and Panasonic at the forefront. The United States demonstrates strength in venture-backed innovation through companies like QuantumScape and Solid Power. South Korea maintains competitive positioning through Samsung and LG investments, while China is rapidly accelerating research efforts through government-backed initiatives and companies like CATL and BYD.

Leading Solid State Battery Solutions and Architectures

01 Advancements in solid electrolyte materials

Recent innovations in solid electrolyte materials are driving the solid state battery market forward. These materials offer improved ionic conductivity, better thermal stability, and enhanced safety compared to liquid electrolytes. Key developments include ceramic-based electrolytes, polymer electrolytes, and composite electrolytes that combine the advantages of different material types. These advancements are crucial for overcoming the conductivity limitations that have historically challenged solid state battery commercialization.- Technological advancements in solid-state battery materials: Recent innovations in solid-state battery materials focus on improving ionic conductivity, mechanical stability, and interface properties. These advancements include novel solid electrolytes, composite cathodes, and engineered interfaces that enhance battery performance. The development of new materials addresses key challenges such as dendrite formation and interfacial resistance, leading to batteries with higher energy density and improved safety characteristics.

- Manufacturing processes and scalability solutions: Emerging manufacturing techniques are addressing the scalability challenges of solid-state battery production. These include novel deposition methods, roll-to-roll processing, and advanced assembly techniques that enable cost-effective mass production. Innovations in manufacturing processes focus on reducing production costs, improving yield rates, and enabling the transition from laboratory-scale prototypes to commercial-scale manufacturing of solid-state batteries.

- Market applications and industry adoption trends: Solid-state batteries are gaining traction across various market segments, particularly in electric vehicles, consumer electronics, and grid storage applications. The market trends indicate increasing industry partnerships, strategic investments, and commercialization efforts aimed at bringing solid-state technology to mainstream markets. Automotive manufacturers are particularly interested in solid-state technology due to its potential for higher energy density, faster charging capabilities, and improved safety compared to conventional lithium-ion batteries.

- Safety and performance enhancements: Solid-state batteries offer significant safety advantages over traditional lithium-ion batteries, including reduced risk of thermal runaway and elimination of flammable liquid electrolytes. Recent developments focus on enhancing cycle life, rate capability, and temperature stability while maintaining these safety benefits. Innovations in this area include protective coatings, pressure-management systems, and thermal management solutions that extend battery lifespan and improve operational safety under various conditions.

- Integration and system-level innovations: System-level innovations are emerging to optimize the integration of solid-state batteries into various applications. These include advanced battery management systems, thermal regulation technologies, and modular designs that facilitate easier integration into existing products and infrastructure. The trend shows increasing focus on developing complete energy storage solutions rather than just battery cells, with emphasis on optimizing the entire power system for specific application requirements.

02 Manufacturing process innovations

Manufacturing scalability represents a significant market trend in solid state batteries. New production techniques are being developed to address challenges in mass production, including layer deposition methods, interface engineering, and assembly processes. These innovations aim to reduce production costs while maintaining quality and performance, enabling solid state batteries to compete with conventional lithium-ion batteries in the consumer market.Expand Specific Solutions03 Electric vehicle applications and market growth

The electric vehicle sector represents a primary driver for solid state battery market expansion. Automotive manufacturers are increasingly investing in solid state technology due to its potential for higher energy density, faster charging capabilities, and improved safety. This trend is reflected in strategic partnerships between battery developers and automotive companies, with projections indicating significant market growth as the technology matures and production scales up.Expand Specific Solutions04 Interface engineering and stability improvements

A critical trend in solid state battery development focuses on interface engineering between electrodes and electrolytes. Innovations in this area address challenges related to interfacial resistance, mechanical stability during cycling, and chemical compatibility between components. These improvements are essential for extending battery lifespan, enhancing performance under various operating conditions, and ensuring long-term reliability for commercial applications.Expand Specific Solutions05 Energy storage applications beyond transportation

While electric vehicles represent a major market segment, solid state batteries are increasingly being developed for diverse applications including consumer electronics, grid storage, and specialized industrial uses. This diversification trend is driving tailored battery designs with varying form factors, capacity requirements, and performance characteristics. The expansion into multiple sectors is creating new market opportunities and accelerating overall adoption of solid state battery technology.Expand Specific Solutions

Key Industry Players and Competitive Positioning

The solid state battery market is currently in an early growth phase, characterized by significant R&D investments but limited commercial deployment. Market size is projected to expand rapidly as this technology promises higher energy density and safety compared to conventional lithium-ion batteries. Among key players, QuantumScape, Toyota, and Honda are making substantial breakthroughs in solid electrolyte development, while Sila Nanotechnologies and Energy Exploration Technologies focus on innovative materials. Established electronics manufacturers like Samsung, Murata, and TDK are leveraging their manufacturing expertise to scale production. The technology remains in pre-commercialization stage for most companies, with significant challenges in manufacturing scalability and cost reduction before mass market adoption can be achieved.

QuantumScape Corp.

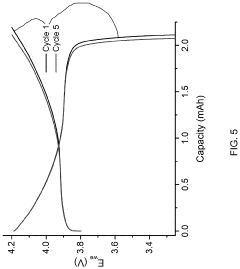

Technical Solution: QuantumScape has developed a proprietary solid-state lithium-metal battery technology that eliminates the need for conventional separators and anode host materials. Their ceramic separator technology enables a pure lithium-metal anode that forms during battery charging, offering higher energy density than traditional lithium-ion batteries. The company's solid-state design uses a solid ceramic electrolyte separator that can prevent dendrite formation while allowing lithium ions to pass during charge and discharge cycles. Their batteries have demonstrated the ability to charge to 80% capacity in just 15 minutes and maintain over 80% capacity after 800+ charging cycles. QuantumScape's technology operates at room temperature, unlike many competing solid-state approaches that require high-temperature operation. The company has secured significant backing from Volkswagen Group and plans to begin commercial production by 2024-2025.

Strengths: Superior energy density (80-100% higher than conventional lithium-ion), fast charging capabilities, improved safety with non-flammable electrolyte, and longer cycle life. Weaknesses: Manufacturing scale-up challenges, high production costs compared to established lithium-ion technology, and unproven long-term reliability in real-world automotive applications.

Sakti3, Inc.

Technical Solution: Sakti3 (acquired by Dyson in 2015) developed a solid-state battery technology based on thin-film deposition methods similar to those used in semiconductor manufacturing. Their approach uses a lithium metal anode with a proprietary solid electrolyte and high-capacity cathode materials. The manufacturing process involves vacuum deposition techniques that create ultra-thin layers of battery materials, eliminating liquid electrolytes entirely. This results in batteries with energy densities approaching 1,000 Wh/L, significantly higher than conventional lithium-ion batteries. Sakti3's technology addresses the dendrite formation issue through their solid electrolyte design, which physically prevents lithium filaments from growing between electrodes. The company's solid-state cells have demonstrated over 1,000 charge cycles while maintaining 80% capacity, suggesting excellent longevity. Despite Dyson's eventual abandonment of its electric vehicle project, the Sakti3 technology continues to be developed for other applications including consumer electronics and stationary storage.

Strengths: Innovative thin-film manufacturing approach, high energy density, potential for lower manufacturing costs at scale, and compatibility with existing electronics form factors. Weaknesses: Limited large-scale production experience, challenges in scaling thin-film deposition for automotive-scale batteries, and uncertainty following Dyson's strategic shifts.

Critical Patents and Technical Innovations Analysis

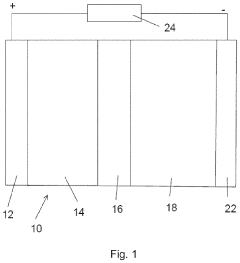

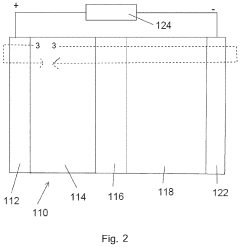

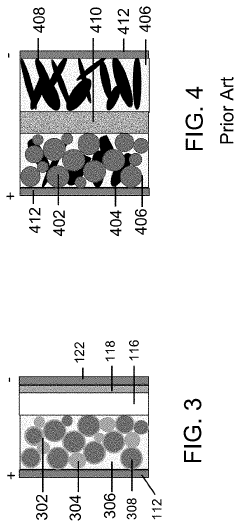

Cermet electrode for solid state and lithium ion batteries

PatentPendingUS20200388854A1

Innovation

- A porous ceramic-metal (cermet) cathode is developed, where a metallic material acts as a binder and conductive additive, providing mechanical integrity and interconnected porosity to accommodate liquid, gel, or polymer electrolytes, and is free of conventional binders and conductive carbon, enhancing the cathode's mechanical strength and stability.

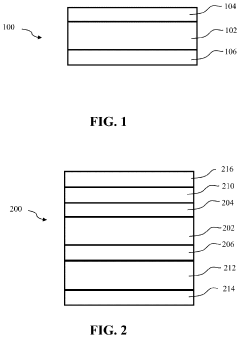

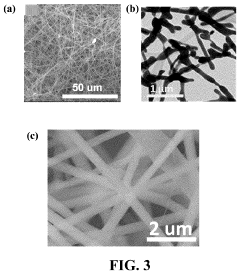

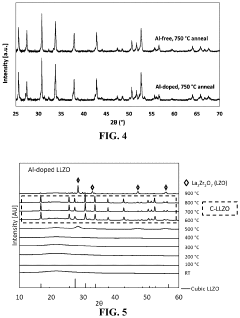

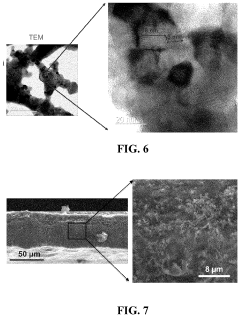

Solid-state nanofiber polymer multilayer composite electrolytes and cells

PatentActiveUS11923501B2

Innovation

- The development of ceramic lithium-conducting nanofibers integrated with polymer electrolytes, specifically using LLZO-PEO composite thin films, to enhance ionic conductivity and electrochemical stability, with nanofibers forming a three-dimensional network for improved ion transport and mechanical robustness.

Investment Landscape and Funding Trends

The solid state battery sector has witnessed unprecedented investment growth over the past five years, with global funding reaching approximately $6.5 billion in 2022, representing a 450% increase compared to 2017 levels. This surge reflects investors' confidence in solid state technology as the next frontier in energy storage solutions, particularly for electric vehicles and renewable energy applications.

Venture capital firms have emerged as primary funding sources, with notable investments from Breakthrough Energy Ventures, Kleiner Perkins, and SoftBank Vision Fund. These entities have collectively injected over $2.3 billion into solid state battery startups since 2019, focusing primarily on companies demonstrating scalable manufacturing capabilities and competitive energy densities.

Corporate investment presents another significant funding channel, with automotive manufacturers leading the charge. Toyota has committed $13.6 billion toward battery technology development through 2030, with a substantial portion allocated specifically to solid state research. Similarly, Volkswagen has invested $300 million in QuantumScape, while BMW and Ford have established strategic partnerships with Solid Power, contributing $130 million in combined funding.

Government grants and subsidies constitute the third major funding stream, with the U.S. Department of Energy allocating $209 million for advanced battery research in 2022, approximately 40% of which targets solid state technologies. The European Union's Horizon Europe program has earmarked €350 million for next-generation battery development between 2021-2027, while Japan's NEDO has committed ¥10 billion ($90 million) specifically for solid state battery commercialization efforts.

In contrast, competing battery technologies demonstrate varied investment patterns. Lithium-ion improvements continue to attract substantial funding ($4.2 billion in 2022), though growth rates have slowed to 15-20% annually. Emerging alternatives such as sodium-ion and lithium-sulfur batteries have seen accelerating investment interest, securing $780 million and $420 million respectively in 2022, representing year-over-year growth of 85% and 110%.

Regional analysis reveals Asia-Pacific dominance in solid state battery investments, capturing 48% of global funding, followed by North America (32%) and Europe (18%). This distribution largely mirrors existing battery manufacturing capabilities, though North American investment growth rates currently outpace other regions, suggesting potential shifts in the global manufacturing landscape as solid state technologies mature toward commercialization.

Venture capital firms have emerged as primary funding sources, with notable investments from Breakthrough Energy Ventures, Kleiner Perkins, and SoftBank Vision Fund. These entities have collectively injected over $2.3 billion into solid state battery startups since 2019, focusing primarily on companies demonstrating scalable manufacturing capabilities and competitive energy densities.

Corporate investment presents another significant funding channel, with automotive manufacturers leading the charge. Toyota has committed $13.6 billion toward battery technology development through 2030, with a substantial portion allocated specifically to solid state research. Similarly, Volkswagen has invested $300 million in QuantumScape, while BMW and Ford have established strategic partnerships with Solid Power, contributing $130 million in combined funding.

Government grants and subsidies constitute the third major funding stream, with the U.S. Department of Energy allocating $209 million for advanced battery research in 2022, approximately 40% of which targets solid state technologies. The European Union's Horizon Europe program has earmarked €350 million for next-generation battery development between 2021-2027, while Japan's NEDO has committed ¥10 billion ($90 million) specifically for solid state battery commercialization efforts.

In contrast, competing battery technologies demonstrate varied investment patterns. Lithium-ion improvements continue to attract substantial funding ($4.2 billion in 2022), though growth rates have slowed to 15-20% annually. Emerging alternatives such as sodium-ion and lithium-sulfur batteries have seen accelerating investment interest, securing $780 million and $420 million respectively in 2022, representing year-over-year growth of 85% and 110%.

Regional analysis reveals Asia-Pacific dominance in solid state battery investments, capturing 48% of global funding, followed by North America (32%) and Europe (18%). This distribution largely mirrors existing battery manufacturing capabilities, though North American investment growth rates currently outpace other regions, suggesting potential shifts in the global manufacturing landscape as solid state technologies mature toward commercialization.

Regulatory and Environmental Considerations

The regulatory landscape surrounding battery technologies is evolving rapidly as governments worldwide implement stricter environmental standards and safety regulations. Solid state batteries face a potentially more favorable regulatory environment compared to traditional lithium-ion batteries due to their enhanced safety profile and reduced fire risk. The absence of flammable liquid electrolytes in solid state designs significantly diminishes thermal runaway concerns, which may translate to less stringent transportation and storage regulations once these technologies mature.

Environmental considerations strongly favor solid state battery development, as these technologies typically require fewer toxic materials and present reduced end-of-life disposal challenges. While conventional lithium-ion competitors continue to face scrutiny regarding cobalt sourcing from conflict regions and environmental impacts of mining operations, solid state alternatives offer pathways to reduce or eliminate problematic materials. Several solid state designs aim to minimize or eliminate cobalt usage entirely, addressing both ethical supply chain concerns and potential future regulatory restrictions on critical materials.

Carbon footprint assessments across battery lifecycles indicate potential advantages for solid state technologies. Manufacturing processes for solid state batteries may ultimately consume less energy and produce fewer emissions than conventional battery production, though this advantage remains theoretical until large-scale manufacturing is established. The extended cycle life projected for solid state batteries—potentially 2-3 times longer than conventional lithium-ion—further enhances their environmental credentials by reducing replacement frequency and associated resource consumption.

Recycling infrastructure represents another critical regulatory consideration. Current recycling processes designed for liquid-electrolyte batteries will require adaptation for solid state technologies. Regulatory bodies in Europe, Asia, and North America are already developing frameworks for battery passport systems that track materials through the entire lifecycle. Companies pioneering solid state technologies must proactively engage with these emerging regulatory frameworks to ensure compliance and competitive advantage.

Government incentive programs increasingly favor technologies with superior environmental profiles. The European Battery Alliance, China's New Energy Vehicle policies, and the US Inflation Reduction Act all contain provisions that could accelerate solid state battery adoption through preferential treatment in subsidies, tax incentives, and procurement requirements. These policy instruments may significantly influence market dynamics by offsetting the initially higher production costs of solid state technologies.

Environmental considerations strongly favor solid state battery development, as these technologies typically require fewer toxic materials and present reduced end-of-life disposal challenges. While conventional lithium-ion competitors continue to face scrutiny regarding cobalt sourcing from conflict regions and environmental impacts of mining operations, solid state alternatives offer pathways to reduce or eliminate problematic materials. Several solid state designs aim to minimize or eliminate cobalt usage entirely, addressing both ethical supply chain concerns and potential future regulatory restrictions on critical materials.

Carbon footprint assessments across battery lifecycles indicate potential advantages for solid state technologies. Manufacturing processes for solid state batteries may ultimately consume less energy and produce fewer emissions than conventional battery production, though this advantage remains theoretical until large-scale manufacturing is established. The extended cycle life projected for solid state batteries—potentially 2-3 times longer than conventional lithium-ion—further enhances their environmental credentials by reducing replacement frequency and associated resource consumption.

Recycling infrastructure represents another critical regulatory consideration. Current recycling processes designed for liquid-electrolyte batteries will require adaptation for solid state technologies. Regulatory bodies in Europe, Asia, and North America are already developing frameworks for battery passport systems that track materials through the entire lifecycle. Companies pioneering solid state technologies must proactively engage with these emerging regulatory frameworks to ensure compliance and competitive advantage.

Government incentive programs increasingly favor technologies with superior environmental profiles. The European Battery Alliance, China's New Energy Vehicle policies, and the US Inflation Reduction Act all contain provisions that could accelerate solid state battery adoption through preferential treatment in subsidies, tax incentives, and procurement requirements. These policy instruments may significantly influence market dynamics by offsetting the initially higher production costs of solid state technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!