Impact of Government Regulations on Solid State Battery Breakthrough

OCT 24, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Regulatory Landscape and Development Goals

Solid state battery technology has evolved significantly over the past decade, transitioning from laboratory curiosities to commercially viable energy storage solutions. The regulatory landscape surrounding this technology has become increasingly complex as governments worldwide recognize both the strategic importance of advanced battery technologies and the need to ensure their safe deployment. Current regulatory frameworks primarily focus on three key areas: safety standards, environmental impact, and supply chain security.

Safety regulations represent the most immediate concern for solid state battery developers. Unlike conventional lithium-ion batteries with flammable liquid electrolytes, solid state batteries utilize non-flammable solid electrolytes, potentially offering inherent safety advantages. However, regulatory bodies including the International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) are still developing comprehensive testing protocols specifically designed for solid state technologies, creating uncertainty for manufacturers navigating certification processes.

Environmental regulations constitute another significant factor shaping the development trajectory of solid state batteries. The European Union's Battery Directive and similar regulations in North America and Asia increasingly emphasize sustainability metrics including carbon footprint, recyclability, and ethical material sourcing. These requirements are driving innovation in manufacturing processes and materials selection, with particular focus on reducing dependence on critical minerals with complex supply chains.

Supply chain security has emerged as a third regulatory priority, with governments implementing policies to reduce dependence on geographically concentrated materials. The U.S. Inflation Reduction Act and EU Critical Raw Materials Act exemplify this trend, offering incentives for domestic battery production and materials processing while imposing restrictions on components sourced from designated countries of concern.

The technical goals for solid state battery development are increasingly being shaped by these regulatory considerations. Primary objectives include achieving energy densities exceeding 400 Wh/kg (compared to 250-300 Wh/kg for current lithium-ion technologies), cycle life beyond 1,000 full charge-discharge cycles, and operating temperature ranges from -20°C to 60°C to meet automotive and grid storage requirements.

Manufacturing scalability represents another critical goal, with current solid state production methods facing challenges in transitioning from laboratory to industrial scale. Regulatory requirements for traceability, quality control, and worker safety add complexity to manufacturing processes, necessitating innovations in production technology and facility design.

Looking forward, the regulatory landscape is expected to continue evolving as solid state battery technology matures. Harmonization of international standards remains a key industry objective, with organizations like the Global Battery Alliance working to establish consistent frameworks that balance innovation with safety and sustainability requirements.

Safety regulations represent the most immediate concern for solid state battery developers. Unlike conventional lithium-ion batteries with flammable liquid electrolytes, solid state batteries utilize non-flammable solid electrolytes, potentially offering inherent safety advantages. However, regulatory bodies including the International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) are still developing comprehensive testing protocols specifically designed for solid state technologies, creating uncertainty for manufacturers navigating certification processes.

Environmental regulations constitute another significant factor shaping the development trajectory of solid state batteries. The European Union's Battery Directive and similar regulations in North America and Asia increasingly emphasize sustainability metrics including carbon footprint, recyclability, and ethical material sourcing. These requirements are driving innovation in manufacturing processes and materials selection, with particular focus on reducing dependence on critical minerals with complex supply chains.

Supply chain security has emerged as a third regulatory priority, with governments implementing policies to reduce dependence on geographically concentrated materials. The U.S. Inflation Reduction Act and EU Critical Raw Materials Act exemplify this trend, offering incentives for domestic battery production and materials processing while imposing restrictions on components sourced from designated countries of concern.

The technical goals for solid state battery development are increasingly being shaped by these regulatory considerations. Primary objectives include achieving energy densities exceeding 400 Wh/kg (compared to 250-300 Wh/kg for current lithium-ion technologies), cycle life beyond 1,000 full charge-discharge cycles, and operating temperature ranges from -20°C to 60°C to meet automotive and grid storage requirements.

Manufacturing scalability represents another critical goal, with current solid state production methods facing challenges in transitioning from laboratory to industrial scale. Regulatory requirements for traceability, quality control, and worker safety add complexity to manufacturing processes, necessitating innovations in production technology and facility design.

Looking forward, the regulatory landscape is expected to continue evolving as solid state battery technology matures. Harmonization of international standards remains a key industry objective, with organizations like the Global Battery Alliance working to establish consistent frameworks that balance innovation with safety and sustainability requirements.

Market Demand Analysis for Solid State Battery Technology

The global market for solid-state battery technology is experiencing unprecedented growth, driven by increasing demand for safer, higher-capacity energy storage solutions across multiple sectors. Current market projections indicate that the solid-state battery market could reach $8 billion by 2026, with a compound annual growth rate exceeding 34% between 2021 and 2026. This remarkable growth trajectory is primarily fueled by the automotive industry's aggressive shift toward electrification, where solid-state batteries promise to address critical limitations of conventional lithium-ion technology.

Electric vehicle manufacturers represent the largest demand segment, seeking batteries that offer greater energy density, faster charging capabilities, and enhanced safety profiles. Major automakers including Toyota, Volkswagen, and BMW have announced significant investments in solid-state technology, recognizing its potential to extend EV range beyond 500 miles while reducing charging times to under 15 minutes. This automotive push alone is expected to create demand for over 100 GWh of solid-state battery capacity by 2030.

Consumer electronics constitutes another substantial market segment, with manufacturers of smartphones, laptops, and wearable devices increasingly interested in solid-state solutions. The technology's compact form factor and reduced fire risk make it particularly attractive for these applications, potentially expanding the market by $2.5 billion by 2028. Industry analysts note that early adoption in premium electronic devices could serve as a crucial stepping stone for broader commercialization.

Grid-scale energy storage represents an emerging but rapidly growing demand sector. Utility companies are exploring solid-state batteries as alternatives to current storage technologies, attracted by their longer cycle life and improved safety characteristics. This segment is projected to grow at 41% annually through 2030, particularly in regions with aggressive renewable energy targets requiring advanced storage solutions.

Market research indicates strong regional variations in demand patterns. Asia-Pacific currently leads in manufacturing capacity development, with Japan and South Korea hosting the most advanced research facilities. North America shows the strongest demand growth rate at 38% annually, driven by both automotive and defense applications. European demand is characterized by stringent safety regulations accelerating the transition from conventional lithium-ion technologies.

The market landscape is further shaped by evolving government regulations, which simultaneously create both barriers and opportunities. Regulatory frameworks addressing battery safety, recycling requirements, and supply chain security are influencing investment decisions and technology development pathways. Countries with supportive regulatory environments that balance innovation with safety considerations are attracting disproportionate shares of research funding and manufacturing capacity.

Electric vehicle manufacturers represent the largest demand segment, seeking batteries that offer greater energy density, faster charging capabilities, and enhanced safety profiles. Major automakers including Toyota, Volkswagen, and BMW have announced significant investments in solid-state technology, recognizing its potential to extend EV range beyond 500 miles while reducing charging times to under 15 minutes. This automotive push alone is expected to create demand for over 100 GWh of solid-state battery capacity by 2030.

Consumer electronics constitutes another substantial market segment, with manufacturers of smartphones, laptops, and wearable devices increasingly interested in solid-state solutions. The technology's compact form factor and reduced fire risk make it particularly attractive for these applications, potentially expanding the market by $2.5 billion by 2028. Industry analysts note that early adoption in premium electronic devices could serve as a crucial stepping stone for broader commercialization.

Grid-scale energy storage represents an emerging but rapidly growing demand sector. Utility companies are exploring solid-state batteries as alternatives to current storage technologies, attracted by their longer cycle life and improved safety characteristics. This segment is projected to grow at 41% annually through 2030, particularly in regions with aggressive renewable energy targets requiring advanced storage solutions.

Market research indicates strong regional variations in demand patterns. Asia-Pacific currently leads in manufacturing capacity development, with Japan and South Korea hosting the most advanced research facilities. North America shows the strongest demand growth rate at 38% annually, driven by both automotive and defense applications. European demand is characterized by stringent safety regulations accelerating the transition from conventional lithium-ion technologies.

The market landscape is further shaped by evolving government regulations, which simultaneously create both barriers and opportunities. Regulatory frameworks addressing battery safety, recycling requirements, and supply chain security are influencing investment decisions and technology development pathways. Countries with supportive regulatory environments that balance innovation with safety considerations are attracting disproportionate shares of research funding and manufacturing capacity.

Current State and Regulatory Challenges in Solid State Battery Development

Solid state batteries represent a significant advancement in energy storage technology, promising higher energy density, improved safety, and longer lifespan compared to conventional lithium-ion batteries. However, their development and commercialization face complex regulatory landscapes that vary significantly across global markets. Currently, solid state battery technology remains predominantly in the research and development phase, with limited commercial deployment despite substantial investment from major automotive manufacturers and battery companies.

The regulatory framework governing solid state batteries encompasses multiple domains including safety standards, material restrictions, manufacturing protocols, and end-of-life management. In the United States, the Department of Energy and the Consumer Product Safety Commission have established preliminary guidelines for solid state battery safety testing, though comprehensive standards specific to this technology remain under development. The European Union, through its Battery Directive and REACH regulations, imposes stringent requirements on battery composition, particularly regarding hazardous materials, which impacts the selection of solid electrolytes and electrode materials.

A significant regulatory challenge lies in the certification processes for new battery technologies. Existing test protocols designed for liquid-electrolyte batteries may not adequately address the unique characteristics and failure modes of solid state systems. This regulatory gap creates uncertainty for manufacturers and potentially delays market entry. Additionally, the novel materials used in solid state batteries, such as lithium metal anodes and ceramic electrolytes, may face scrutiny under chemical registration regulations that were not designed with these applications in mind.

International harmonization of standards represents another major challenge. Divergent regulatory approaches between North America, Europe, and Asia create compliance complexities for global manufacturers. Japan's battery safety standards emphasize thermal stability testing, while China's regulatory framework focuses on production scale and domestic supply chain development. These differences necessitate market-specific design modifications that increase development costs and time-to-market.

Intellectual property protection presents both regulatory and competitive challenges. The current patent landscape for solid state battery technology is highly fragmented, with key innovations distributed across academic institutions, startups, and established manufacturers. This fragmentation creates potential for patent disputes that could impede technology transfer and commercialization efforts. Some jurisdictions have begun implementing expedited patent review processes for clean energy technologies, though these mechanisms vary in effectiveness.

Environmental regulations increasingly influence solid state battery development. Extended producer responsibility laws in Europe and parts of Asia mandate recycling and recovery of battery materials, creating additional compliance requirements. However, the recyclability of solid state batteries remains largely theoretical, as commercial-scale recycling processes for these novel structures have yet to be established. This regulatory uncertainty complicates long-term planning for manufacturers and may influence material selection decisions during the design phase.

The regulatory framework governing solid state batteries encompasses multiple domains including safety standards, material restrictions, manufacturing protocols, and end-of-life management. In the United States, the Department of Energy and the Consumer Product Safety Commission have established preliminary guidelines for solid state battery safety testing, though comprehensive standards specific to this technology remain under development. The European Union, through its Battery Directive and REACH regulations, imposes stringent requirements on battery composition, particularly regarding hazardous materials, which impacts the selection of solid electrolytes and electrode materials.

A significant regulatory challenge lies in the certification processes for new battery technologies. Existing test protocols designed for liquid-electrolyte batteries may not adequately address the unique characteristics and failure modes of solid state systems. This regulatory gap creates uncertainty for manufacturers and potentially delays market entry. Additionally, the novel materials used in solid state batteries, such as lithium metal anodes and ceramic electrolytes, may face scrutiny under chemical registration regulations that were not designed with these applications in mind.

International harmonization of standards represents another major challenge. Divergent regulatory approaches between North America, Europe, and Asia create compliance complexities for global manufacturers. Japan's battery safety standards emphasize thermal stability testing, while China's regulatory framework focuses on production scale and domestic supply chain development. These differences necessitate market-specific design modifications that increase development costs and time-to-market.

Intellectual property protection presents both regulatory and competitive challenges. The current patent landscape for solid state battery technology is highly fragmented, with key innovations distributed across academic institutions, startups, and established manufacturers. This fragmentation creates potential for patent disputes that could impede technology transfer and commercialization efforts. Some jurisdictions have begun implementing expedited patent review processes for clean energy technologies, though these mechanisms vary in effectiveness.

Environmental regulations increasingly influence solid state battery development. Extended producer responsibility laws in Europe and parts of Asia mandate recycling and recovery of battery materials, creating additional compliance requirements. However, the recyclability of solid state batteries remains largely theoretical, as commercial-scale recycling processes for these novel structures have yet to be established. This regulatory uncertainty complicates long-term planning for manufacturers and may influence material selection decisions during the design phase.

Current Technical Solutions for Regulatory Compliance

01 Solid-state electrolyte compositions

Solid-state batteries utilize specialized electrolyte compositions that enable ion transport without liquid components. These electrolytes typically include ceramic materials, polymer matrices, or composite structures that provide high ionic conductivity while maintaining mechanical stability. Advanced formulations may incorporate sulfide-based, oxide-based, or phosphate-based materials that enhance lithium-ion transport while preventing dendrite formation. These solid electrolytes are crucial for improving battery safety and energy density compared to conventional liquid electrolyte systems.- Solid-state electrolyte materials and compositions: Solid-state batteries utilize various electrolyte materials to enable ion transport between electrodes. These materials include ceramic electrolytes, polymer electrolytes, and composite electrolytes that combine different materials to optimize performance. Advanced compositions focus on improving ionic conductivity while maintaining mechanical stability and electrochemical compatibility with electrode materials. These electrolytes eliminate the need for liquid components, enhancing safety and energy density of the battery systems.

- Electrode-electrolyte interface engineering: Interface engineering between electrodes and solid electrolytes is critical for solid-state battery performance. Techniques include surface coatings, buffer layers, and specialized interface materials that reduce contact resistance and prevent unwanted chemical reactions. These approaches address challenges such as mechanical stress during cycling and formation of high-impedance interphases. Proper interface design ensures efficient ion transfer across boundaries and extends battery cycle life.

- Manufacturing processes for solid-state batteries: Advanced manufacturing techniques are essential for commercial viability of solid-state batteries. These include specialized deposition methods for thin-film electrolytes, high-pressure sintering processes for ceramic components, and novel assembly techniques that ensure proper contact between layers. Manufacturing innovations focus on scalability, cost reduction, and maintaining precise control over material interfaces. These processes aim to transition solid-state battery technology from laboratory prototypes to mass production.

- Cathode and anode materials for solid-state systems: Electrode materials for solid-state batteries require specific properties to function effectively with solid electrolytes. High-capacity cathode materials include lithium-rich layered oxides and sulfur-based compounds, while anodes often utilize lithium metal, silicon-based materials, or specialized carbon structures. These materials are engineered to minimize volume changes during cycling and maintain intimate contact with the solid electrolyte. Innovations focus on materials that enable higher energy density while remaining compatible with solid-state architectures.

- Safety and performance enhancement strategies: Solid-state batteries incorporate various design strategies to enhance safety and performance. These include thermal management systems, pressure regulation mechanisms, and protective structures that prevent dendrite formation. Advanced battery management systems monitor cell conditions to prevent degradation. Additional innovations include self-healing components and architectures that accommodate volume changes during cycling. These strategies collectively address the challenges of achieving long cycle life, fast charging capabilities, and operation across wide temperature ranges.

02 Interface engineering in solid-state batteries

Interface engineering focuses on optimizing the contact between solid electrolytes and electrodes to reduce resistance and improve ion transfer. This involves developing specialized coatings, buffer layers, or gradient structures that mitigate interfacial impedance issues. Techniques may include atomic layer deposition, surface functionalization, or the introduction of interlayers that promote adhesion and ion transport across boundaries. Effective interface engineering is essential for maximizing the performance and cycle life of solid-state battery systems.Expand Specific Solutions03 Cathode and anode materials for solid-state batteries

Specialized electrode materials are developed specifically for solid-state battery architectures. These materials must maintain intimate contact with solid electrolytes while accommodating volume changes during cycling. High-capacity cathode materials may include lithium-rich layered oxides or sulfur-based composites, while anodes often utilize lithium metal, silicon-based materials, or specialized carbon structures. The design of these electrode materials focuses on maximizing energy density while ensuring compatibility with the solid electrolyte interface to enable stable, long-term cycling performance.Expand Specific Solutions04 Manufacturing processes for solid-state batteries

Advanced manufacturing techniques are essential for producing high-performance solid-state batteries at scale. These processes include specialized methods for powder preparation, layer deposition, sintering, and cell assembly that ensure uniform interfaces and minimize defects. Techniques such as tape casting, roll-to-roll processing, or pressure-assisted sintering help overcome challenges related to material integration and densification. Manufacturing innovations focus on reducing production costs while maintaining the precise structural control needed for optimal solid-state battery performance.Expand Specific Solutions05 Thermal management and safety features

Solid-state batteries incorporate specialized thermal management systems and safety features that leverage their inherent stability advantages. These designs may include passive thermal regulation structures, active cooling systems, or protective circuitry that prevents thermal runaway. The absence of flammable liquid electrolytes significantly reduces fire risks, while engineered pressure-relief mechanisms and structural reinforcements enhance overall safety. These features enable solid-state batteries to operate reliably under extreme conditions while providing superior safety compared to conventional lithium-ion technologies.Expand Specific Solutions

Key Industry Players and Regulatory Compliance Strategies

The solid state battery market is in an early growth phase, characterized by significant R&D investments but limited commercial deployment. Current market size is estimated at $500-700 million, with projections to reach $8-10 billion by 2030. Government regulations are increasingly shaping the competitive landscape, particularly through funding initiatives and safety standards. Leading players demonstrate varying levels of technological maturity: Toyota, Panasonic, and CATL have advanced prototypes and pilot production capabilities, while newer entrants like Blue Current and Svolt are focusing on innovative materials. University collaborations (Harvard, UC Regents) and research institutions (Battelle, NASA) are contributing fundamental breakthroughs, while automotive manufacturers (GM, Honda) are strategically investing to secure future supply chains.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered solid-state battery development with over 1,000 patents related to solid-state battery technology. Their approach focuses on sulfide-based solid electrolytes that enable higher energy density and faster charging. Toyota has actively engaged with regulatory bodies across multiple jurisdictions to shape safety standards and certification processes for solid-state batteries. The company has established a regulatory affairs division specifically focused on navigating government regulations affecting battery technology deployment. Toyota collaborates with the Japanese government on the "Battery Strategy for Green Growth" initiative, which includes regulatory harmonization efforts across international markets. They've developed a compliance framework that addresses varying regulatory requirements in North America, Europe, and Asia, particularly focusing on material sourcing restrictions, recycling mandates, and transportation regulations.

Strengths: Extensive patent portfolio provides strong IP protection; established relationships with regulatory bodies across multiple markets; integrated approach to regulatory compliance across product development cycle. Weaknesses: Regulatory fragmentation across global markets increases compliance costs; stringent safety regulations may delay commercialization timeline; varying government incentive structures across regions create market uncertainties.

Panasonic Holdings Corp.

Technical Solution: Panasonic has developed a multi-layered regulatory compliance strategy for their solid-state battery technology, focusing particularly on lithium supply chain regulations. Their technical approach incorporates regulatory considerations from the design phase, with particular attention to materials selection that meets emerging environmental regulations. Panasonic's solid-state battery technology utilizes ceramic-based electrolytes that align with safety regulations while delivering performance improvements. The company has established a dedicated regulatory intelligence team that monitors evolving government policies affecting battery manufacturing and deployment across key markets. Panasonic actively participates in industry consortia that engage with regulatory bodies to develop standards for next-generation battery technologies. Their compliance framework addresses regulations spanning from raw material sourcing (particularly critical minerals regulations) to end-of-life recycling requirements.

Strengths: Strong relationships with automotive OEMs provides insights into vehicle-specific regulatory requirements; established manufacturing infrastructure facilitates regulatory compliance; experience navigating Japanese and international battery regulations. Weaknesses: Complex global supply chain increases regulatory compliance challenges; varying international standards for battery safety certification create market entry barriers; regulatory uncertainty regarding solid-state battery recycling requirements.

Critical Patents and Innovations in Regulatory-Compliant Battery Design

Solid-state electrolyte, cathode electrode, and methods of making same for sulfide-based all-solid-state-batteries

PatentPendingUS20230055896A1

Innovation

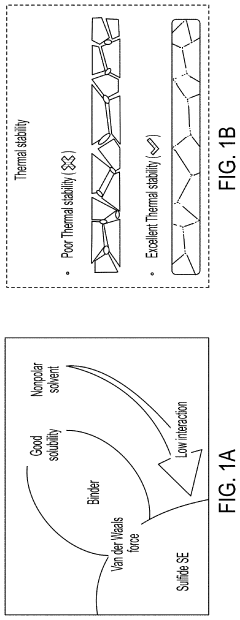

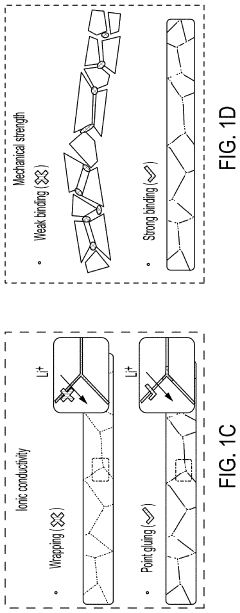

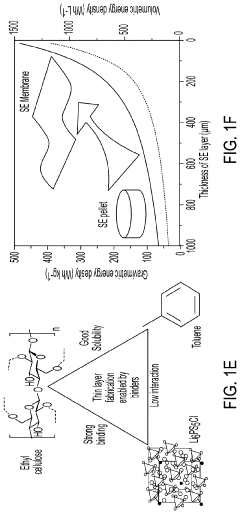

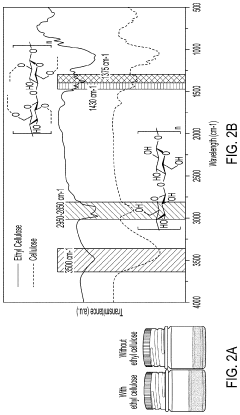

- A method involving the use of ethyl cellulose as a binder and solvent in the vacuum filtration process to create a thin, robust, and highly ion-conductive sulfide SE membrane with Li6PS5Cl, coupled with a water-mediated synthesis of Li3InCl6 for the cathode layer, to achieve a stable and efficient battery configuration.

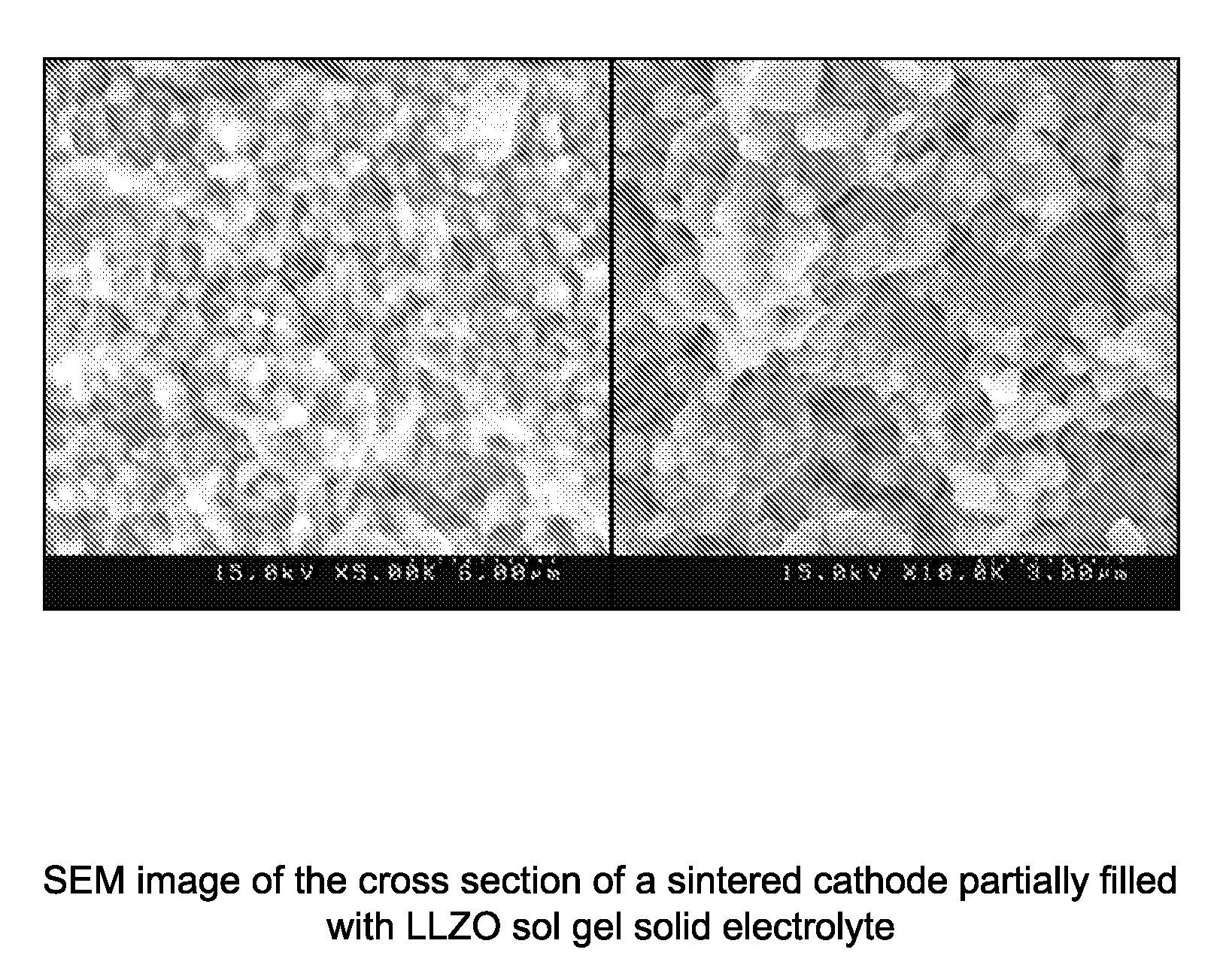

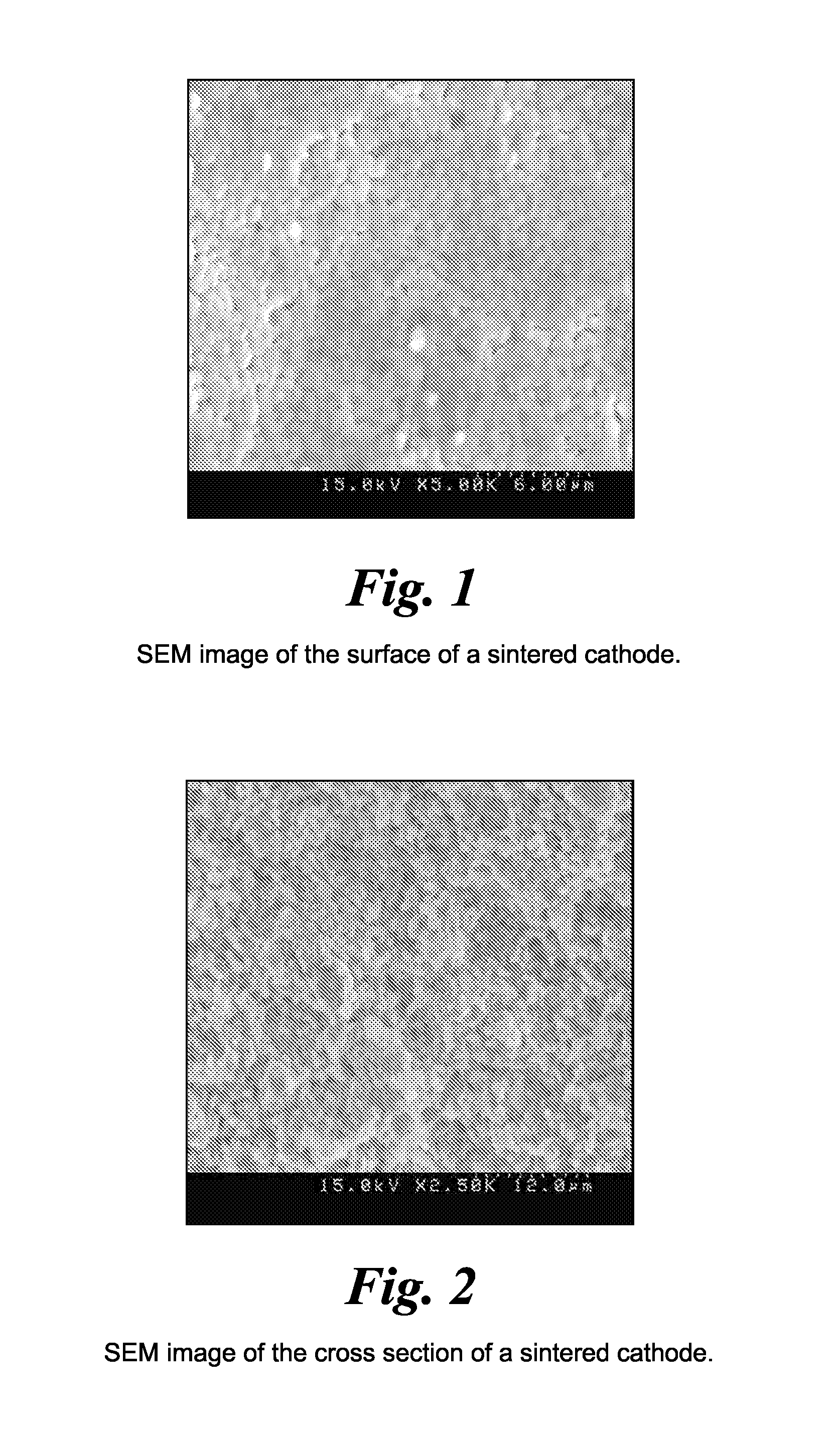

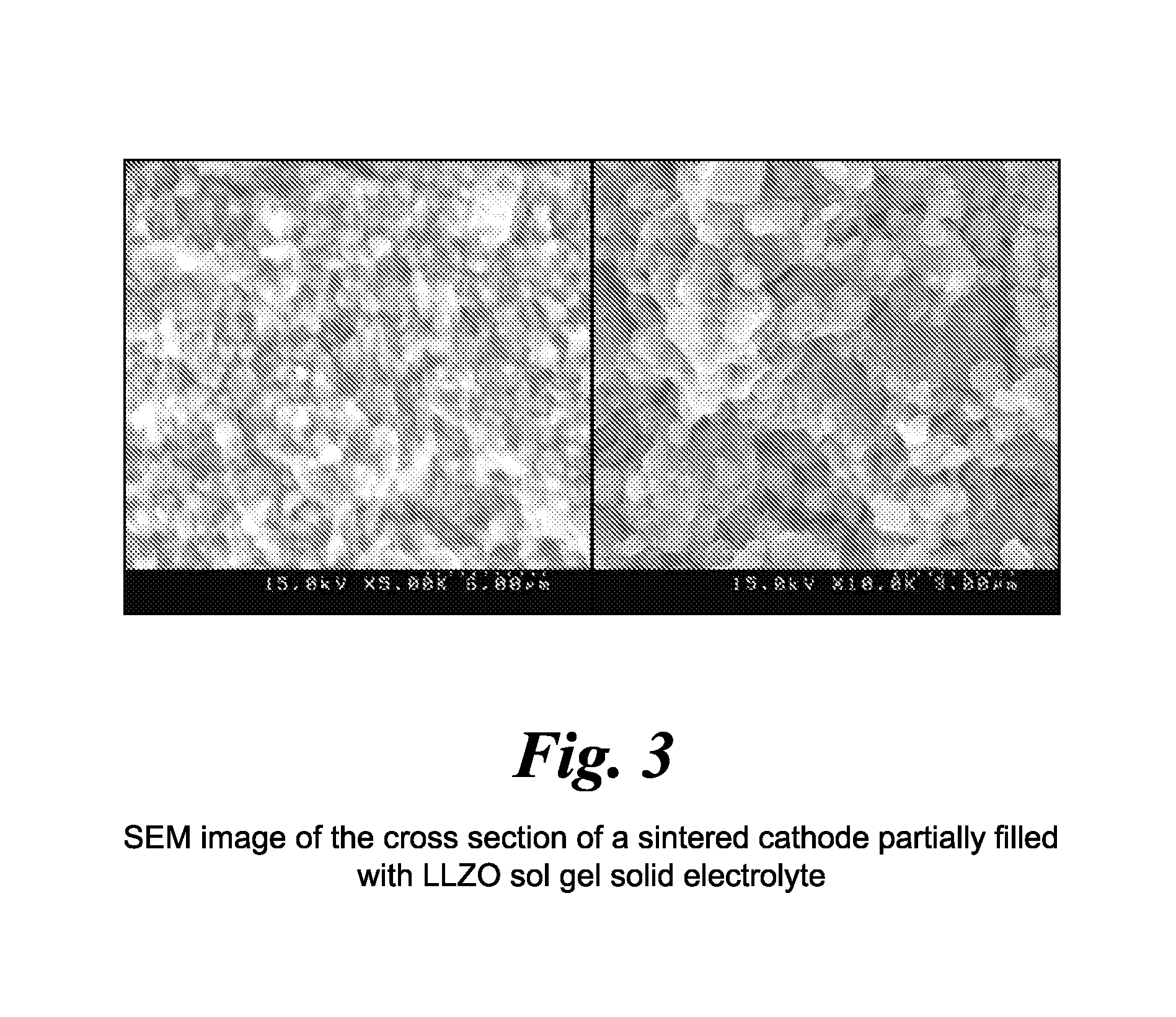

Impregnated sintered solid state composite electrode, solid state battery, and methods of preparation

PatentInactiveUS20150056520A1

Innovation

- A method involving the formation of sintered porous cathode pellets, impregnation with a liquid precursor of an inorganic amorphous ionically conductive solid electrolyte, and curing to create a composite cathode with enhanced ionic pathways, using materials like amorphous lithium lanthanum zirconium oxide (LLZO), which reduces shrinkage and improves conductivity.

International Regulatory Harmonization Efforts

The global nature of battery technology development and deployment necessitates coordinated regulatory approaches across different jurisdictions. Recent years have witnessed significant efforts toward international regulatory harmonization for solid-state battery technologies, with several key initiatives emerging as pivotal frameworks for cross-border collaboration.

The United Nations Global Technical Regulation (GTR) on Electric Vehicle Safety has become a cornerstone for harmonizing safety standards across major automotive markets. This framework specifically addresses battery safety protocols, with recent amendments incorporating provisions for solid-state battery technologies. The GTR serves as a template for national regulations, reducing compliance complexity for manufacturers operating in multiple markets.

Regional harmonization efforts have gained momentum, particularly through the EU-US-Japan Trilateral Initiative on Critical Battery Materials and Technologies. This collaboration focuses on aligning regulatory approaches to battery safety certification, recycling requirements, and material sourcing verification. The initiative has established working groups dedicated to solid-state battery standardization, aiming to develop common testing protocols and safety benchmarks.

The International Electrotechnical Commission (IEC) has expanded its Technical Committee 21 activities to develop unified standards specifically for solid-state battery technologies. These standards address performance metrics, safety testing methodologies, and interoperability requirements. Notably, the IEC 62660 series is being updated to incorporate solid-state battery specifications, providing manufacturers with globally recognized compliance pathways.

Mutual recognition agreements (MRAs) between regulatory bodies have emerged as practical tools for reducing redundant testing requirements. The China-Korea-Japan Trilateral Summit has established an MRA framework for battery certification, allowing test results from accredited laboratories in one country to be accepted by authorities in partner nations. This approach significantly reduces market entry barriers while maintaining safety oversight.

The World Trade Organization's Technical Barriers to Trade Committee has facilitated discussions on harmonizing battery regulations as emerging technical standards. These dialogues have resulted in informal agreements to notify trading partners of regulatory changes affecting solid-state battery technologies, providing opportunities for comment before implementation and reducing the risk of creating unnecessary trade barriers.

Despite progress, challenges remain in achieving full regulatory harmonization. Differences in national priorities regarding environmental protection, resource security, and industrial policy continue to create regulatory divergence. The varying pace of technological adoption across markets further complicates efforts to establish unified approaches to novel solid-state battery chemistries and architectures.

The United Nations Global Technical Regulation (GTR) on Electric Vehicle Safety has become a cornerstone for harmonizing safety standards across major automotive markets. This framework specifically addresses battery safety protocols, with recent amendments incorporating provisions for solid-state battery technologies. The GTR serves as a template for national regulations, reducing compliance complexity for manufacturers operating in multiple markets.

Regional harmonization efforts have gained momentum, particularly through the EU-US-Japan Trilateral Initiative on Critical Battery Materials and Technologies. This collaboration focuses on aligning regulatory approaches to battery safety certification, recycling requirements, and material sourcing verification. The initiative has established working groups dedicated to solid-state battery standardization, aiming to develop common testing protocols and safety benchmarks.

The International Electrotechnical Commission (IEC) has expanded its Technical Committee 21 activities to develop unified standards specifically for solid-state battery technologies. These standards address performance metrics, safety testing methodologies, and interoperability requirements. Notably, the IEC 62660 series is being updated to incorporate solid-state battery specifications, providing manufacturers with globally recognized compliance pathways.

Mutual recognition agreements (MRAs) between regulatory bodies have emerged as practical tools for reducing redundant testing requirements. The China-Korea-Japan Trilateral Summit has established an MRA framework for battery certification, allowing test results from accredited laboratories in one country to be accepted by authorities in partner nations. This approach significantly reduces market entry barriers while maintaining safety oversight.

The World Trade Organization's Technical Barriers to Trade Committee has facilitated discussions on harmonizing battery regulations as emerging technical standards. These dialogues have resulted in informal agreements to notify trading partners of regulatory changes affecting solid-state battery technologies, providing opportunities for comment before implementation and reducing the risk of creating unnecessary trade barriers.

Despite progress, challenges remain in achieving full regulatory harmonization. Differences in national priorities regarding environmental protection, resource security, and industrial policy continue to create regulatory divergence. The varying pace of technological adoption across markets further complicates efforts to establish unified approaches to novel solid-state battery chemistries and architectures.

Environmental Impact Assessment and Sustainability Compliance

The environmental impact of solid state battery development is significantly influenced by government regulations, which are increasingly focusing on sustainability throughout the entire battery lifecycle. Current regulatory frameworks in major markets like the EU, US, and China are establishing stringent requirements for battery manufacturing processes, material sourcing, and end-of-life management. These regulations aim to minimize the ecological footprint of battery production while maximizing resource efficiency.

Solid state battery technologies present distinct environmental advantages compared to conventional lithium-ion batteries, particularly in eliminating the need for toxic liquid electrolytes. This characteristic substantially reduces fire hazards and potential environmental contamination risks. However, the extraction of materials required for solid state batteries, including lithium, silicon, and various rare earth elements, continues to raise environmental concerns that regulators are actively addressing through sustainability compliance measures.

Life cycle assessment (LCA) studies indicate that solid state batteries may offer reduced carbon footprints compared to traditional batteries when considering their extended lifespan and improved energy density. Regulatory bodies are increasingly requiring manufacturers to conduct comprehensive LCAs and disclose environmental impact data, creating both challenges and opportunities for technology developers. Companies that proactively address these requirements gain competitive advantages in environmentally conscious markets.

The circular economy principles embedded in recent regulations, such as the EU Battery Directive revision, are reshaping solid state battery development by emphasizing recyclability and material recovery. These regulations mandate specific recycling efficiency rates and recovered material content, driving innovation in battery design for disassembly and material separation. Consequently, solid state battery architectures are evolving to facilitate easier recycling while maintaining performance characteristics.

Water usage and pollution control represent another critical regulatory focus area. Manufacturing processes for solid state batteries typically require significant water resources and potentially generate hazardous waste streams. Emerging regulations are establishing increasingly strict limits on water consumption, wastewater discharge quality, and hazardous waste management, compelling manufacturers to invest in advanced treatment technologies and closed-loop production systems.

Carbon footprint regulations, including carbon pricing mechanisms and emissions trading schemes, are creating financial incentives for developing low-carbon manufacturing processes for solid state batteries. Companies are responding by investing in renewable energy for production facilities and optimizing energy-intensive processes such as high-temperature sintering required for certain solid electrolyte materials.

Solid state battery technologies present distinct environmental advantages compared to conventional lithium-ion batteries, particularly in eliminating the need for toxic liquid electrolytes. This characteristic substantially reduces fire hazards and potential environmental contamination risks. However, the extraction of materials required for solid state batteries, including lithium, silicon, and various rare earth elements, continues to raise environmental concerns that regulators are actively addressing through sustainability compliance measures.

Life cycle assessment (LCA) studies indicate that solid state batteries may offer reduced carbon footprints compared to traditional batteries when considering their extended lifespan and improved energy density. Regulatory bodies are increasingly requiring manufacturers to conduct comprehensive LCAs and disclose environmental impact data, creating both challenges and opportunities for technology developers. Companies that proactively address these requirements gain competitive advantages in environmentally conscious markets.

The circular economy principles embedded in recent regulations, such as the EU Battery Directive revision, are reshaping solid state battery development by emphasizing recyclability and material recovery. These regulations mandate specific recycling efficiency rates and recovered material content, driving innovation in battery design for disassembly and material separation. Consequently, solid state battery architectures are evolving to facilitate easier recycling while maintaining performance characteristics.

Water usage and pollution control represent another critical regulatory focus area. Manufacturing processes for solid state batteries typically require significant water resources and potentially generate hazardous waste streams. Emerging regulations are establishing increasingly strict limits on water consumption, wastewater discharge quality, and hazardous waste management, compelling manufacturers to invest in advanced treatment technologies and closed-loop production systems.

Carbon footprint regulations, including carbon pricing mechanisms and emissions trading schemes, are creating financial incentives for developing low-carbon manufacturing processes for solid state batteries. Companies are responding by investing in renewable energy for production facilities and optimizing energy-intensive processes such as high-temperature sintering required for certain solid electrolyte materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!