Evaluating Ammonia Fuel Catalysts in Industrial Heat Production

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Catalyst Development Background and Objectives

Ammonia has emerged as a promising carbon-free energy carrier in the global pursuit of sustainable energy solutions. The development of ammonia fuel catalysts represents a critical technological frontier, particularly for industrial heat production applications where high-energy density fuels are required. Historically, ammonia has been primarily utilized as a fertilizer since the development of the Haber-Bosch process in the early 20th century, with its potential as an energy carrier largely unexplored until recent decades.

The evolution of ammonia fuel technology has accelerated significantly since 2010, driven by increasing pressure to decarbonize industrial processes and the recognition of ammonia's advantages as a hydrogen carrier. With a hydrogen content of 17.8% by weight and an energy density of 18.6 MJ/kg, ammonia offers substantial energy storage capabilities without the storage challenges associated with pure hydrogen.

Current technological development focuses on catalytic systems that can efficiently release hydrogen from ammonia or enable direct ammonia combustion at temperatures suitable for industrial heat applications. Traditional catalysts based on ruthenium and nickel have demonstrated effectiveness but face limitations in terms of cost, durability, and activation temperature requirements that hinder widespread industrial adoption.

The primary objective of ammonia catalyst research is to develop materials that can facilitate ammonia decomposition or combustion at lower temperatures (below 400°C) while maintaining stability under industrial operating conditions. Secondary objectives include reducing catalyst costs by minimizing or eliminating precious metal content, enhancing catalyst longevity in the presence of common industrial contaminants, and optimizing catalyst formulations for specific heat production applications.

Recent breakthroughs in nanocatalyst design, including core-shell structures and supported metal catalysts, have shown promising results in laboratory settings. These advances suggest potential pathways to overcome current limitations, particularly in reducing the activation energy required for ammonia conversion processes.

The global transition toward hydrogen economies has further elevated the importance of ammonia catalyst development, as ammonia represents one of the most practical means of hydrogen transport and storage at scale. Countries including Japan, Australia, and several European nations have initiated significant research programs specifically targeting ammonia fuel technologies for industrial applications.

The technical trajectory indicates a convergence of catalyst development with burner and heat exchanger design optimization, recognizing that effective industrial implementation requires integrated systems rather than isolated catalyst improvements. This holistic approach aims to address the complete technology readiness pathway from laboratory demonstration to commercial deployment in industrial heating applications.

The evolution of ammonia fuel technology has accelerated significantly since 2010, driven by increasing pressure to decarbonize industrial processes and the recognition of ammonia's advantages as a hydrogen carrier. With a hydrogen content of 17.8% by weight and an energy density of 18.6 MJ/kg, ammonia offers substantial energy storage capabilities without the storage challenges associated with pure hydrogen.

Current technological development focuses on catalytic systems that can efficiently release hydrogen from ammonia or enable direct ammonia combustion at temperatures suitable for industrial heat applications. Traditional catalysts based on ruthenium and nickel have demonstrated effectiveness but face limitations in terms of cost, durability, and activation temperature requirements that hinder widespread industrial adoption.

The primary objective of ammonia catalyst research is to develop materials that can facilitate ammonia decomposition or combustion at lower temperatures (below 400°C) while maintaining stability under industrial operating conditions. Secondary objectives include reducing catalyst costs by minimizing or eliminating precious metal content, enhancing catalyst longevity in the presence of common industrial contaminants, and optimizing catalyst formulations for specific heat production applications.

Recent breakthroughs in nanocatalyst design, including core-shell structures and supported metal catalysts, have shown promising results in laboratory settings. These advances suggest potential pathways to overcome current limitations, particularly in reducing the activation energy required for ammonia conversion processes.

The global transition toward hydrogen economies has further elevated the importance of ammonia catalyst development, as ammonia represents one of the most practical means of hydrogen transport and storage at scale. Countries including Japan, Australia, and several European nations have initiated significant research programs specifically targeting ammonia fuel technologies for industrial applications.

The technical trajectory indicates a convergence of catalyst development with burner and heat exchanger design optimization, recognizing that effective industrial implementation requires integrated systems rather than isolated catalyst improvements. This holistic approach aims to address the complete technology readiness pathway from laboratory demonstration to commercial deployment in industrial heating applications.

Industrial Heat Production Market Analysis

The industrial heat production market represents a significant segment of global energy consumption, accounting for approximately 20% of total energy usage worldwide. This sector is primarily dominated by fossil fuel-based solutions, with natural gas, coal, and oil serving as the predominant energy sources for generating high-temperature heat required in various industrial processes. The market size for industrial heat production was valued at around $150 billion in 2022, with projections indicating growth to $190 billion by 2030.

Manufacturing industries, particularly steel, cement, glass, and chemicals, constitute the largest consumers of industrial heat, collectively accounting for over 70% of industrial heat demand. These sectors require temperatures ranging from 400°C to 1600°C for their core processes, presenting unique challenges for decarbonization efforts. The geographical distribution of industrial heat demand correlates strongly with manufacturing hubs, with China, the United States, and the European Union being the largest markets.

Recent market trends reveal increasing pressure on industrial heat producers to reduce carbon emissions, driven by stringent environmental regulations and corporate sustainability commitments. This has accelerated interest in alternative heat production technologies, with ammonia fuel catalysts emerging as a promising solution due to ammonia's zero-carbon combustion properties and established global production infrastructure.

The economic landscape for industrial heat production is undergoing transformation as carbon pricing mechanisms gain traction globally. The European Union's Emissions Trading System has particularly impacted the cost structure of conventional heat production methods, creating economic incentives for lower-carbon alternatives. Current cost analyses indicate that while fossil fuel-based heat production remains less expensive in most regions, the gap is narrowing as carbon prices increase and renewable energy costs decline.

Customer demand patterns are evolving, with end-users increasingly willing to pay premiums for products manufactured using low-carbon processes. This market pull is complemented by regulatory push factors, including subsidies for clean energy technologies and penalties for carbon-intensive operations. The combined effect has created a favorable market environment for ammonia-based heat production systems, particularly in regions with aggressive decarbonization targets.

Market forecasts suggest that alternative heat production technologies, including ammonia-based systems, could capture up to 15% of the industrial heat market by 2030, representing a potential market opportunity of $28 billion. Early adoption is expected in industries with lower temperature requirements and those facing the most stringent emissions regulations, creating strategic entry points for ammonia catalyst technologies.

Manufacturing industries, particularly steel, cement, glass, and chemicals, constitute the largest consumers of industrial heat, collectively accounting for over 70% of industrial heat demand. These sectors require temperatures ranging from 400°C to 1600°C for their core processes, presenting unique challenges for decarbonization efforts. The geographical distribution of industrial heat demand correlates strongly with manufacturing hubs, with China, the United States, and the European Union being the largest markets.

Recent market trends reveal increasing pressure on industrial heat producers to reduce carbon emissions, driven by stringent environmental regulations and corporate sustainability commitments. This has accelerated interest in alternative heat production technologies, with ammonia fuel catalysts emerging as a promising solution due to ammonia's zero-carbon combustion properties and established global production infrastructure.

The economic landscape for industrial heat production is undergoing transformation as carbon pricing mechanisms gain traction globally. The European Union's Emissions Trading System has particularly impacted the cost structure of conventional heat production methods, creating economic incentives for lower-carbon alternatives. Current cost analyses indicate that while fossil fuel-based heat production remains less expensive in most regions, the gap is narrowing as carbon prices increase and renewable energy costs decline.

Customer demand patterns are evolving, with end-users increasingly willing to pay premiums for products manufactured using low-carbon processes. This market pull is complemented by regulatory push factors, including subsidies for clean energy technologies and penalties for carbon-intensive operations. The combined effect has created a favorable market environment for ammonia-based heat production systems, particularly in regions with aggressive decarbonization targets.

Market forecasts suggest that alternative heat production technologies, including ammonia-based systems, could capture up to 15% of the industrial heat market by 2030, representing a potential market opportunity of $28 billion. Early adoption is expected in industries with lower temperature requirements and those facing the most stringent emissions regulations, creating strategic entry points for ammonia catalyst technologies.

Current Ammonia Catalyst Technology Landscape

The ammonia catalyst landscape has evolved significantly over the past century, with the Haber-Bosch process remaining the foundation of industrial ammonia synthesis. Currently, iron-based catalysts dominate commercial applications, typically consisting of magnetite (Fe3O4) promoted with K2O, CaO, Al2O3, and MgO. These traditional catalysts operate at high temperatures (400-500°C) and pressures (100-300 bar), achieving conversion efficiencies of 10-15% per pass.

Ruthenium-based catalysts represent the most significant advancement in recent decades, offering superior activity at lower operating pressures (40-100 bar) and temperatures (350-450°C). The KAAP (Kellogg Advanced Ammonia Process) employs ruthenium catalysts supported on carbon, achieving energy savings of 20-30% compared to conventional systems. However, ruthenium's high cost and limited availability have restricted widespread adoption to specialized applications.

Nickel-based catalysts have emerged as promising alternatives, particularly for low-temperature ammonia decomposition in fuel applications. These catalysts typically incorporate promoters such as cerium, lanthanum, or molybdenum to enhance stability and activity, operating effectively in the 300-400°C range with reasonable conversion rates.

For ammonia combustion applications in industrial heat production, noble metal catalysts including platinum, palladium, and rhodium supported on ceramic substrates demonstrate superior performance. These catalysts facilitate complete ammonia oxidation at temperatures as low as 250-350°C, significantly lower than the 850°C required for thermal combustion, thereby reducing NOx formation.

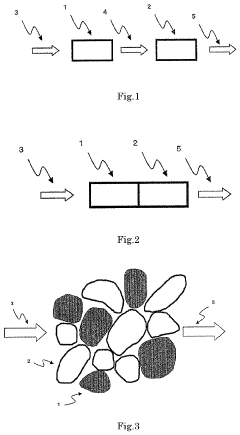

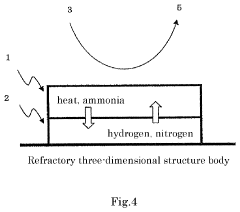

Structured catalysts, including monoliths, foams, and microreactors, represent the cutting edge of catalyst engineering. These designs optimize mass and heat transfer while minimizing pressure drop, critical factors for efficient ammonia utilization in heat production systems. Ceramic and metallic monoliths coated with active catalyst layers are increasingly deployed in industrial settings due to their mechanical durability and thermal stability.

Bimetallic and multi-component catalysts constitute another frontier, with combinations like Ni-Pt, Cu-Ru, and Fe-Co showing synergistic effects that enhance activity and selectivity while reducing precious metal content. These advanced formulations often incorporate nanoscale engineering to maximize active site exposure and catalyst lifetime.

Catalyst deactivation remains a significant challenge, particularly in ammonia combustion applications where sulfur poisoning, thermal sintering, and coking can rapidly degrade performance. Modern catalyst systems increasingly incorporate protective measures such as sulfur traps, stabilizing additives, and regeneration capabilities to extend operational lifetimes in industrial environments.

The commercial landscape features established players like Haldor Topsoe, Johnson Matthey, and Clariant dominating catalyst production, with emerging companies like Starfire Energy and Syzygy Plasmonics developing next-generation technologies focused specifically on green ammonia applications for heat and power generation.

Ruthenium-based catalysts represent the most significant advancement in recent decades, offering superior activity at lower operating pressures (40-100 bar) and temperatures (350-450°C). The KAAP (Kellogg Advanced Ammonia Process) employs ruthenium catalysts supported on carbon, achieving energy savings of 20-30% compared to conventional systems. However, ruthenium's high cost and limited availability have restricted widespread adoption to specialized applications.

Nickel-based catalysts have emerged as promising alternatives, particularly for low-temperature ammonia decomposition in fuel applications. These catalysts typically incorporate promoters such as cerium, lanthanum, or molybdenum to enhance stability and activity, operating effectively in the 300-400°C range with reasonable conversion rates.

For ammonia combustion applications in industrial heat production, noble metal catalysts including platinum, palladium, and rhodium supported on ceramic substrates demonstrate superior performance. These catalysts facilitate complete ammonia oxidation at temperatures as low as 250-350°C, significantly lower than the 850°C required for thermal combustion, thereby reducing NOx formation.

Structured catalysts, including monoliths, foams, and microreactors, represent the cutting edge of catalyst engineering. These designs optimize mass and heat transfer while minimizing pressure drop, critical factors for efficient ammonia utilization in heat production systems. Ceramic and metallic monoliths coated with active catalyst layers are increasingly deployed in industrial settings due to their mechanical durability and thermal stability.

Bimetallic and multi-component catalysts constitute another frontier, with combinations like Ni-Pt, Cu-Ru, and Fe-Co showing synergistic effects that enhance activity and selectivity while reducing precious metal content. These advanced formulations often incorporate nanoscale engineering to maximize active site exposure and catalyst lifetime.

Catalyst deactivation remains a significant challenge, particularly in ammonia combustion applications where sulfur poisoning, thermal sintering, and coking can rapidly degrade performance. Modern catalyst systems increasingly incorporate protective measures such as sulfur traps, stabilizing additives, and regeneration capabilities to extend operational lifetimes in industrial environments.

The commercial landscape features established players like Haldor Topsoe, Johnson Matthey, and Clariant dominating catalyst production, with emerging companies like Starfire Energy and Syzygy Plasmonics developing next-generation technologies focused specifically on green ammonia applications for heat and power generation.

Current Ammonia Catalyst Solutions for Heat Production

01 Catalysts for ammonia synthesis and decomposition

Various catalysts are used for the efficient synthesis and decomposition of ammonia in fuel applications. These catalysts typically include transition metals and their compounds that facilitate the breaking of nitrogen-hydrogen bonds. Advanced catalyst designs incorporate support materials to enhance stability and activity, allowing for lower operating temperatures and pressures in ammonia production and utilization systems.- Catalysts for ammonia synthesis and decomposition: Various catalysts are used for the synthesis and decomposition of ammonia in fuel applications. These catalysts typically include transition metals and their compounds that facilitate the breaking of nitrogen-hydrogen bonds. The catalysts are designed to operate efficiently at specific temperature and pressure conditions, enhancing the reaction rates and selectivity. Some catalysts incorporate support materials to increase surface area and stability during the reaction process.

- Ruthenium-based catalysts for ammonia fuel cells: Ruthenium-based catalysts play a significant role in ammonia fuel cell applications due to their high activity for ammonia oxidation. These catalysts can be modified with various promoters to enhance their performance and durability. The catalysts are often supported on carbon materials or metal oxides to increase the active surface area and improve electron transfer. Ruthenium-based catalysts operate at lower temperatures compared to traditional catalysts, making them suitable for portable and stationary fuel cell applications.

- Nickel-based catalysts for ammonia cracking: Nickel-based catalysts are widely used for ammonia cracking to produce hydrogen for fuel applications. These catalysts can be enhanced with various promoters such as cerium, lanthanum, or other rare earth elements to improve their activity and resistance to poisoning. The catalysts are typically supported on alumina, silica, or other porous materials to increase surface area and stability. Nickel-based catalysts offer a cost-effective alternative to precious metal catalysts while maintaining acceptable performance levels for hydrogen production from ammonia.

- Novel catalyst structures for ammonia fuel applications: Advanced catalyst structures are being developed to enhance the performance of ammonia as a fuel. These structures include core-shell configurations, nanostructured arrays, and hierarchical porous materials that maximize active surface area while minimizing material usage. Some designs incorporate multiple active phases to perform sequential reactions in a single catalyst bed. These novel structures aim to improve catalyst stability, reduce degradation rates, and enhance mass transfer properties, leading to more efficient ammonia conversion and utilization in various energy applications.

- Catalyst systems for direct ammonia fuel cells: Specialized catalyst systems are being developed for direct ammonia fuel cells that can utilize ammonia directly without prior decomposition to hydrogen. These systems often employ bi-functional or multi-functional catalysts that can simultaneously facilitate ammonia oxidation and oxygen reduction reactions. The catalysts typically contain noble metals like platinum, palladium, or their alloys, sometimes combined with transition metal oxides. These catalyst systems are designed to operate at intermediate temperatures and minimize the formation of nitrogen oxide byproducts, making them environmentally friendly for power generation applications.

02 Ammonia as hydrogen carrier for fuel cells

Ammonia serves as an effective hydrogen carrier for fuel cell applications, with specialized catalysts enabling the controlled release of hydrogen from ammonia. These catalytic systems allow for on-demand hydrogen generation at lower temperatures, making ammonia a practical storage medium for fuel cell vehicles and stationary power systems. The catalysts facilitate the cracking of ammonia into nitrogen and hydrogen with minimal energy input.Expand Specific Solutions03 Metal-based catalysts for ammonia combustion

Metal-based catalysts enhance the combustion efficiency of ammonia as a direct fuel. These catalysts, often containing noble metals or transition metal oxides, lower the ignition temperature of ammonia and improve flame stability. By promoting complete combustion, these catalytic systems reduce nitrogen oxide emissions while maximizing energy output, making ammonia viable as a carbon-free fuel for various combustion applications.Expand Specific Solutions04 Nanocatalysts for ammonia fuel applications

Nanocatalysts with precisely engineered structures offer superior performance in ammonia fuel applications. These nanoscale materials provide increased surface area and active sites, enhancing catalytic activity at lower temperatures. Advanced synthesis methods create tailored nanoparticles with controlled size, shape, and composition, resulting in more efficient ammonia conversion processes for energy generation with reduced catalyst loading requirements.Expand Specific Solutions05 Catalyst systems for ammonia-powered engines

Specialized catalyst systems enable the effective use of ammonia in internal combustion engines and turbines. These catalysts address the challenges of ammonia's lower flame speed and higher ignition energy by promoting efficient combustion. Dual-function catalysts can both assist with ammonia decomposition and reduce harmful emissions, allowing conventional engines to be modified for ammonia fuel use with minimal performance penalties.Expand Specific Solutions

Leading Companies in Ammonia Catalyst Development

The ammonia fuel catalyst market for industrial heat production is in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. The global market is expanding rapidly, driven by decarbonization initiatives and projected to reach significant scale as industries seek low-carbon heat solutions. Technology maturity varies across players, with companies like AMOGY, Atmonia, and Kanadevia leading innovation in catalyst development. Academic institutions (Tokyo Institute of Technology, University of Tokyo, Oxford) collaborate with industrial partners (Toyota, SABIC, Linde) to advance catalyst efficiency and durability. Research organizations like Southwest Research Institute and Dalian Institute of Chemical Physics are accelerating technology transfer, while energy majors (Saudi Aramco, TotalEnergies) are strategically positioning for the ammonia economy transition.

AMOGY, Inc.

Technical Solution: AMOGY has developed an innovative ammonia cracking technology that efficiently converts ammonia to hydrogen for industrial heat applications. Their system utilizes a proprietary ruthenium-based catalyst that operates at temperatures between 450-550°C, achieving over 99.5% ammonia conversion efficiency. The technology incorporates a compact, modular reactor design that integrates heat recovery systems to maximize thermal efficiency. AMOGY's approach includes a novel membrane separation technique that purifies the hydrogen product stream while recycling unreacted ammonia. Their catalyst formulation demonstrates exceptional stability, maintaining performance for over 5,000 operating hours without significant degradation. The system is designed to scale from 100kW to multi-MW applications, making it suitable for various industrial heating processes that currently rely on fossil fuels.

Strengths: Superior catalyst stability with minimal performance degradation over time; modular design allows for flexible deployment across different industrial scales; integrated heat recovery significantly improves overall system efficiency. Weaknesses: Ruthenium-based catalysts face cost challenges due to precious metal content; system requires precise temperature control to maintain optimal conversion efficiency.

Atmonia ehf

Technical Solution: Atmonia has pioneered a revolutionary approach to ammonia-based heat production using non-precious metal catalysts. Their technology centers on iron-molybdenum composite catalysts that achieve ammonia decomposition at temperatures as low as 400°C, significantly lower than conventional systems. The catalyst system incorporates nanoscale engineering with specific surface treatments that enhance active site density and accessibility. Atmonia's process integrates direct ammonia combustion with partial cracking, allowing for flexible operation depending on heat quality requirements. Their reactor design features a novel fluidized bed configuration that optimizes catalyst-ammonia contact while minimizing pressure drop. The system includes advanced control algorithms that adjust operating parameters based on heat demand profiles, enabling responsive load-following capabilities. Atmonia has demonstrated their technology at pilot scale (250kW thermal output), achieving thermal efficiencies exceeding 85% with NOx emissions below regulatory thresholds through proprietary combustion control techniques.

Strengths: Earth-abundant catalyst materials significantly reduce system costs compared to precious metal alternatives; lower operating temperatures reduce energy requirements and material constraints; flexible operation mode allows optimization for different industrial applications. Weaknesses: Catalyst activity still lower than precious metal alternatives, requiring larger reactor volumes; system performance more sensitive to impurities in ammonia feedstock.

Key Catalyst Innovations and Patent Analysis

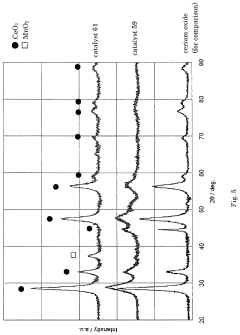

Catalyst for production of hydrogen and process for producing hydrogen using the catalyst, and catalyst for combustion of ammonia, process for producing the catalyst and process for combusting ammonia using the catalyst

PatentActiveUS10857523B2

Innovation

- A catalyst comprising a manganese-cerium oxide with additional metal elements, such as silver and copper, and a transition metal oxide, arranged in a specific configuration to utilize combustion heat for ammonia decomposition, ensuring efficient hydrogen production without external heat sources.

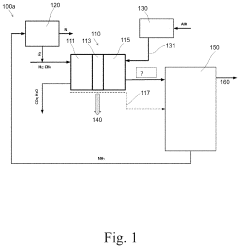

Solid oxide fuel cell arrangement generating ammonia as byproduct and utilizing ammonia as secondary fuel

PatentInactiveUS20220093950A1

Innovation

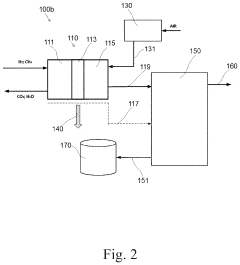

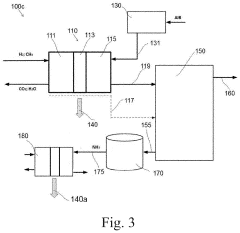

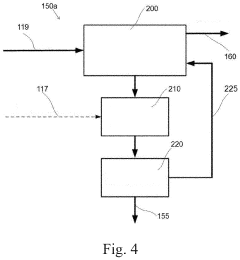

- A solid oxide fuel cell system that includes a gas separator to extract ammonia from the tail-gas stream, which can be used to fuel a secondary energy conversion device, stored, or reformed into hydrogen, utilizing heat transfer means to optimize the separation process.

Environmental Impact Assessment

The environmental impact of ammonia as a fuel for industrial heat production must be comprehensively assessed to understand its true sustainability credentials. When evaluating ammonia fuel catalysts, lifecycle emissions represent a critical metric. While ammonia combustion itself produces primarily nitrogen and water vapor without direct carbon dioxide emissions, the environmental footprint extends beyond the point of use.

Current ammonia production relies heavily on the Haber-Bosch process, which typically consumes fossil fuels and accounts for approximately 1-2% of global carbon emissions. However, catalysts being developed for ammonia combustion can significantly reduce NOx emissions—a major environmental concern with ammonia fuel. Advanced selective catalytic reduction (SCR) systems utilizing copper zeolite and vanadium-based catalysts have demonstrated up to 95% reduction in NOx formation during ammonia combustion.

Water resource impacts must also be considered, as ammonia production requires substantial water inputs. Modern catalyst systems are being engineered to minimize water consumption during both production and utilization phases. Additionally, potential ammonia leakage presents environmental risks due to its toxicity to aquatic ecosystems, necessitating robust containment systems and monitoring protocols.

Land use considerations reveal that transitioning to green ammonia production powered by renewable energy would require significant land area for solar or wind installations. However, this represents a one-time impact compared to the ongoing environmental degradation associated with fossil fuel extraction.

Comparative analysis with traditional heat production methods shows that ammonia fuel systems utilizing efficient catalysts can reduce greenhouse gas emissions by 60-90% when produced using renewable energy. The environmental payback period—the time required for emissions savings to offset the environmental cost of system implementation—ranges from 2-5 years depending on catalyst efficiency and renewable energy integration.

Regulatory compliance frameworks are evolving rapidly, with emissions standards becoming increasingly stringent. Catalyst technologies that enable ammonia combustion to meet these standards will be essential for industrial adoption. The EU's Industrial Emissions Directive and similar regulations worldwide are driving innovation in low-emission catalyst design.

Circular economy opportunities exist in catalyst recovery and recycling, particularly for precious metal catalysts used in ammonia conversion systems. Emerging technologies allow for up to 85% recovery of platinum group metals from spent catalysts, significantly reducing the environmental impact of catalyst production.

Current ammonia production relies heavily on the Haber-Bosch process, which typically consumes fossil fuels and accounts for approximately 1-2% of global carbon emissions. However, catalysts being developed for ammonia combustion can significantly reduce NOx emissions—a major environmental concern with ammonia fuel. Advanced selective catalytic reduction (SCR) systems utilizing copper zeolite and vanadium-based catalysts have demonstrated up to 95% reduction in NOx formation during ammonia combustion.

Water resource impacts must also be considered, as ammonia production requires substantial water inputs. Modern catalyst systems are being engineered to minimize water consumption during both production and utilization phases. Additionally, potential ammonia leakage presents environmental risks due to its toxicity to aquatic ecosystems, necessitating robust containment systems and monitoring protocols.

Land use considerations reveal that transitioning to green ammonia production powered by renewable energy would require significant land area for solar or wind installations. However, this represents a one-time impact compared to the ongoing environmental degradation associated with fossil fuel extraction.

Comparative analysis with traditional heat production methods shows that ammonia fuel systems utilizing efficient catalysts can reduce greenhouse gas emissions by 60-90% when produced using renewable energy. The environmental payback period—the time required for emissions savings to offset the environmental cost of system implementation—ranges from 2-5 years depending on catalyst efficiency and renewable energy integration.

Regulatory compliance frameworks are evolving rapidly, with emissions standards becoming increasingly stringent. Catalyst technologies that enable ammonia combustion to meet these standards will be essential for industrial adoption. The EU's Industrial Emissions Directive and similar regulations worldwide are driving innovation in low-emission catalyst design.

Circular economy opportunities exist in catalyst recovery and recycling, particularly for precious metal catalysts used in ammonia conversion systems. Emerging technologies allow for up to 85% recovery of platinum group metals from spent catalysts, significantly reducing the environmental impact of catalyst production.

Economic Feasibility Analysis

The economic feasibility of ammonia fuel catalysts in industrial heat production hinges on several interconnected factors that determine their commercial viability. Initial capital expenditure represents a significant consideration, with catalyst systems requiring substantial investment ranging from $500,000 to $3 million depending on scale and sophistication. These systems necessitate specialized equipment for ammonia handling, storage facilities, and safety infrastructure that further elevates implementation costs.

Operational expenses present a complex economic equation. While ammonia itself costs approximately $500-700 per ton, catalyst maintenance introduces recurring expenses of 15-20% of initial catalyst cost annually. Catalyst degradation patterns typically necessitate replacement every 2-4 years, creating predictable but substantial reinvestment cycles that must be factored into long-term financial planning.

Energy conversion efficiency emerges as a critical economic determinant. Current ammonia catalytic systems achieve 65-75% thermal efficiency compared to natural gas systems at 80-90%. This efficiency gap translates directly to higher fuel consumption rates and operational costs, though this differential is narrowing with each generation of catalyst technology.

Regulatory compliance costs vary significantly by region but generally add 5-15% to overall implementation expenses. Carbon pricing mechanisms in various markets create favorable economics for ammonia systems, with carbon taxes ranging from $20-50 per ton providing potential cost advantages of $0.5-2 million annually for large industrial operations transitioning from fossil fuels.

Return on investment calculations indicate payback periods of 4-7 years for most industrial applications, with facilities operating in regions with stringent carbon regulations achieving breakeven in as little as 3 years. Sensitivity analysis reveals that catalyst longevity improvements of just 25% could reduce payback periods by approximately 18 months.

Scale economics demonstrate significant advantages for larger implementations, with per-unit energy costs decreasing by approximately 30% when scaling from small (5MW) to large (50MW) thermal systems. This creates particular economic incentives for large industrial heat consumers such as steel mills, cement plants, and chemical manufacturing facilities.

Future economic projections suggest improving feasibility as catalyst technologies mature, with cost reductions of 30-40% anticipated over the next decade through manufacturing scale improvements and material innovations. This trajectory positions ammonia catalysts to achieve cost parity with conventional heating systems in most industrial applications by 2030-2035, particularly as carbon pricing mechanisms become more widespread.

Operational expenses present a complex economic equation. While ammonia itself costs approximately $500-700 per ton, catalyst maintenance introduces recurring expenses of 15-20% of initial catalyst cost annually. Catalyst degradation patterns typically necessitate replacement every 2-4 years, creating predictable but substantial reinvestment cycles that must be factored into long-term financial planning.

Energy conversion efficiency emerges as a critical economic determinant. Current ammonia catalytic systems achieve 65-75% thermal efficiency compared to natural gas systems at 80-90%. This efficiency gap translates directly to higher fuel consumption rates and operational costs, though this differential is narrowing with each generation of catalyst technology.

Regulatory compliance costs vary significantly by region but generally add 5-15% to overall implementation expenses. Carbon pricing mechanisms in various markets create favorable economics for ammonia systems, with carbon taxes ranging from $20-50 per ton providing potential cost advantages of $0.5-2 million annually for large industrial operations transitioning from fossil fuels.

Return on investment calculations indicate payback periods of 4-7 years for most industrial applications, with facilities operating in regions with stringent carbon regulations achieving breakeven in as little as 3 years. Sensitivity analysis reveals that catalyst longevity improvements of just 25% could reduce payback periods by approximately 18 months.

Scale economics demonstrate significant advantages for larger implementations, with per-unit energy costs decreasing by approximately 30% when scaling from small (5MW) to large (50MW) thermal systems. This creates particular economic incentives for large industrial heat consumers such as steel mills, cement plants, and chemical manufacturing facilities.

Future economic projections suggest improving feasibility as catalyst technologies mature, with cost reductions of 30-40% anticipated over the next decade through manufacturing scale improvements and material innovations. This trajectory positions ammonia catalysts to achieve cost parity with conventional heating systems in most industrial applications by 2030-2035, particularly as carbon pricing mechanisms become more widespread.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!