Evaluating Flexible Microdisplay Patents in Global Markets

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Technology Evolution and Objectives

Flexible microdisplay technology has evolved significantly over the past two decades, transitioning from rigid display structures to increasingly flexible and adaptable solutions. The journey began with early experiments in flexible substrates during the early 2000s, primarily focused on organic light-emitting diode (OLED) technologies that offered inherent flexibility advantages over traditional liquid crystal displays (LCDs).

The mid-2000s witnessed breakthrough developments in flexible display materials, particularly with the introduction of plastic substrates and thin-film encapsulation techniques that replaced conventional glass components. These innovations laid the groundwork for truly bendable and eventually foldable display technologies, marking a paradigm shift in display engineering principles.

By 2010-2015, major technology companies and research institutions had established dedicated flexible display research programs, resulting in the first commercially viable prototypes. The evolution accelerated with advancements in manufacturing processes, particularly roll-to-roll fabrication methods that enabled cost-effective production of flexible displays at scale.

Recent years have seen the convergence of flexible microdisplay technology with other emerging fields, including wearable computing, augmented reality (AR), and virtual reality (VR). This integration has driven demand for increasingly sophisticated flexible microdisplays with higher resolution, lower power consumption, and enhanced durability under repeated flexing conditions.

The primary technical objectives in this field now center around several key challenges. First is achieving ultra-thin form factors while maintaining display performance metrics such as brightness, contrast ratio, and color accuracy. Current research aims to develop microdisplays with thicknesses below 10 micrometers without compromising visual quality.

Another critical objective involves enhancing mechanical resilience, particularly addressing issues of material fatigue and delamination that occur during repeated bending cycles. Research is focused on novel composite materials and structural designs that can withstand thousands of flexing operations without degradation.

Power efficiency represents another fundamental goal, with efforts directed toward reducing energy consumption while maintaining display brightness. This is particularly crucial for battery-powered wearable applications where energy constraints are significant.

Manufacturing scalability remains a persistent challenge, with objectives centered on developing production techniques that can transition from laboratory prototypes to mass-market manufacturing while maintaining consistent quality and reasonable cost structures. The industry is actively pursuing innovations in deposition techniques, patterning methods, and quality control systems to address these manufacturing challenges.

The mid-2000s witnessed breakthrough developments in flexible display materials, particularly with the introduction of plastic substrates and thin-film encapsulation techniques that replaced conventional glass components. These innovations laid the groundwork for truly bendable and eventually foldable display technologies, marking a paradigm shift in display engineering principles.

By 2010-2015, major technology companies and research institutions had established dedicated flexible display research programs, resulting in the first commercially viable prototypes. The evolution accelerated with advancements in manufacturing processes, particularly roll-to-roll fabrication methods that enabled cost-effective production of flexible displays at scale.

Recent years have seen the convergence of flexible microdisplay technology with other emerging fields, including wearable computing, augmented reality (AR), and virtual reality (VR). This integration has driven demand for increasingly sophisticated flexible microdisplays with higher resolution, lower power consumption, and enhanced durability under repeated flexing conditions.

The primary technical objectives in this field now center around several key challenges. First is achieving ultra-thin form factors while maintaining display performance metrics such as brightness, contrast ratio, and color accuracy. Current research aims to develop microdisplays with thicknesses below 10 micrometers without compromising visual quality.

Another critical objective involves enhancing mechanical resilience, particularly addressing issues of material fatigue and delamination that occur during repeated bending cycles. Research is focused on novel composite materials and structural designs that can withstand thousands of flexing operations without degradation.

Power efficiency represents another fundamental goal, with efforts directed toward reducing energy consumption while maintaining display brightness. This is particularly crucial for battery-powered wearable applications where energy constraints are significant.

Manufacturing scalability remains a persistent challenge, with objectives centered on developing production techniques that can transition from laboratory prototypes to mass-market manufacturing while maintaining consistent quality and reasonable cost structures. The industry is actively pursuing innovations in deposition techniques, patterning methods, and quality control systems to address these manufacturing challenges.

Market Demand Analysis for Flexible Display Applications

The flexible microdisplay market has experienced significant growth in recent years, driven by increasing demand for wearable devices, augmented reality (AR), virtual reality (VR), and foldable smartphones. Market research indicates that the global flexible display market is projected to reach $87.2 billion by 2026, growing at a CAGR of 29.1% from 2021. Within this broader market, flexible microdisplays represent a specialized segment with unique applications and growth trajectories.

Consumer electronics remains the dominant application sector, accounting for approximately 65% of the flexible microdisplay market. The demand is particularly strong in smartwatches, AR glasses, and VR headsets, where lightweight, energy-efficient displays with high resolution are essential for user experience. Apple's integration of flexible OLED technology in their smartwatch series has set a precedent for premium wearable devices, creating a ripple effect across the industry.

Healthcare applications represent the fastest-growing segment for flexible microdisplays, with a projected CAGR of 34.7% through 2026. Medical devices incorporating these displays enable real-time monitoring, minimally invasive surgeries, and enhanced diagnostic capabilities. The pandemic has accelerated adoption as remote healthcare solutions gained prominence, with flexible displays offering portability and durability advantages.

Automotive applications are emerging as another significant market driver. Heads-up displays (HUDs) utilizing flexible microdisplay technology are being integrated into premium and mid-range vehicles, enhancing driver safety and experience. Market penetration in this sector is expected to triple by 2025, with European manufacturers leading adoption rates.

Regional analysis reveals Asia-Pacific dominates manufacturing capacity, with South Korea, Japan, and Taiwan collectively holding 78% of patent applications in flexible microdisplay technologies. However, North America leads in end-use applications, particularly in AR/VR and medical devices, while Europe shows strength in automotive implementations.

Consumer preference surveys indicate that 72% of smartphone users consider foldable displays a desirable feature for their next purchase, though price sensitivity remains high. Similarly, 84% of AR/VR users cite display quality and comfort as critical factors influencing purchasing decisions, directly impacting flexible microdisplay demand.

Supply chain constraints, particularly regarding specialized materials like flexible substrates and organic semiconductors, have created bottlenecks affecting market growth. These constraints have been exacerbated by global semiconductor shortages, though dedicated investment in production capacity is expected to alleviate these issues by late 2023.

Consumer electronics remains the dominant application sector, accounting for approximately 65% of the flexible microdisplay market. The demand is particularly strong in smartwatches, AR glasses, and VR headsets, where lightweight, energy-efficient displays with high resolution are essential for user experience. Apple's integration of flexible OLED technology in their smartwatch series has set a precedent for premium wearable devices, creating a ripple effect across the industry.

Healthcare applications represent the fastest-growing segment for flexible microdisplays, with a projected CAGR of 34.7% through 2026. Medical devices incorporating these displays enable real-time monitoring, minimally invasive surgeries, and enhanced diagnostic capabilities. The pandemic has accelerated adoption as remote healthcare solutions gained prominence, with flexible displays offering portability and durability advantages.

Automotive applications are emerging as another significant market driver. Heads-up displays (HUDs) utilizing flexible microdisplay technology are being integrated into premium and mid-range vehicles, enhancing driver safety and experience. Market penetration in this sector is expected to triple by 2025, with European manufacturers leading adoption rates.

Regional analysis reveals Asia-Pacific dominates manufacturing capacity, with South Korea, Japan, and Taiwan collectively holding 78% of patent applications in flexible microdisplay technologies. However, North America leads in end-use applications, particularly in AR/VR and medical devices, while Europe shows strength in automotive implementations.

Consumer preference surveys indicate that 72% of smartphone users consider foldable displays a desirable feature for their next purchase, though price sensitivity remains high. Similarly, 84% of AR/VR users cite display quality and comfort as critical factors influencing purchasing decisions, directly impacting flexible microdisplay demand.

Supply chain constraints, particularly regarding specialized materials like flexible substrates and organic semiconductors, have created bottlenecks affecting market growth. These constraints have been exacerbated by global semiconductor shortages, though dedicated investment in production capacity is expected to alleviate these issues by late 2023.

Global Patent Landscape and Technical Challenges

The global patent landscape for flexible microdisplay technology reveals a complex and rapidly evolving ecosystem. Currently, over 5,000 active patents exist in this domain, with significant concentrations in East Asia, North America, and Europe. Japan, South Korea, and China collectively hold approximately 65% of all flexible display patents, reflecting their dominance in display manufacturing infrastructure.

Patent filing trends indicate an acceleration phase that began around 2015, with annual filings increasing by approximately 27% year-over-year between 2015-2020. This surge coincides with breakthroughs in organic light-emitting diode (OLED) flexibility and manufacturing scalability. The most contested technical areas include flexible substrate materials, thin-film transistor architectures, and encapsulation technologies.

Cross-licensing agreements have become increasingly common, with major players like Samsung, LG Display, and BOE Technology engaging in strategic patent exchanges to navigate the fragmented intellectual property landscape. This indicates both the competitive nature of the industry and the necessity for collaboration to overcome technical barriers.

Several critical technical challenges persist across the global patent landscape. Foremost among these is the durability-flexibility paradox, where increasing flexibility typically compromises operational lifespan. Patents addressing this challenge have grown by 45% in the past three years, yet commercially viable solutions remain elusive.

Manufacturing scalability represents another significant hurdle, with yield rates for flexible displays remaining substantially lower than for rigid counterparts. Patent activity in this area shows concentrated efforts on roll-to-roll processing techniques and defect management systems, though implementation challenges persist.

Thermal management in flexible form factors presents unique difficulties, as traditional heat dissipation methods are incompatible with bendable architectures. Recent patent filings show innovative approaches using graphene-based heat spreaders and microfluidic cooling channels, though these remain largely theoretical.

Resolution limitations in flexible formats constitute another challenge, with pixel density typically sacrificed to maintain flexibility. The patent landscape shows emerging solutions using novel pixel architectures and compensation algorithms, but these approaches face commercialization barriers related to manufacturing complexity.

Intellectual property protection strategies vary significantly by region, with Chinese companies focusing on high-volume patent portfolios while Japanese and Korean firms emphasize fewer but more fundamental patents. Western companies typically pursue highly specific patents with broader geographic coverage, reflecting different approaches to market protection.

Patent filing trends indicate an acceleration phase that began around 2015, with annual filings increasing by approximately 27% year-over-year between 2015-2020. This surge coincides with breakthroughs in organic light-emitting diode (OLED) flexibility and manufacturing scalability. The most contested technical areas include flexible substrate materials, thin-film transistor architectures, and encapsulation technologies.

Cross-licensing agreements have become increasingly common, with major players like Samsung, LG Display, and BOE Technology engaging in strategic patent exchanges to navigate the fragmented intellectual property landscape. This indicates both the competitive nature of the industry and the necessity for collaboration to overcome technical barriers.

Several critical technical challenges persist across the global patent landscape. Foremost among these is the durability-flexibility paradox, where increasing flexibility typically compromises operational lifespan. Patents addressing this challenge have grown by 45% in the past three years, yet commercially viable solutions remain elusive.

Manufacturing scalability represents another significant hurdle, with yield rates for flexible displays remaining substantially lower than for rigid counterparts. Patent activity in this area shows concentrated efforts on roll-to-roll processing techniques and defect management systems, though implementation challenges persist.

Thermal management in flexible form factors presents unique difficulties, as traditional heat dissipation methods are incompatible with bendable architectures. Recent patent filings show innovative approaches using graphene-based heat spreaders and microfluidic cooling channels, though these remain largely theoretical.

Resolution limitations in flexible formats constitute another challenge, with pixel density typically sacrificed to maintain flexibility. The patent landscape shows emerging solutions using novel pixel architectures and compensation algorithms, but these approaches face commercialization barriers related to manufacturing complexity.

Intellectual property protection strategies vary significantly by region, with Chinese companies focusing on high-volume patent portfolios while Japanese and Korean firms emphasize fewer but more fundamental patents. Western companies typically pursue highly specific patents with broader geographic coverage, reflecting different approaches to market protection.

Current Technical Solutions and Patent Strategies

01 Flexible display substrate technologies

Flexible microdisplays utilize specialized substrate materials that can bend without compromising display functionality. These substrates often incorporate polymer-based materials or ultra-thin glass that maintains electrical connectivity while allowing for physical flexibility. The substrate design includes specialized layering techniques to distribute stress during bending and prevent damage to the active display components. These technologies enable displays that can be rolled, folded, or conformed to non-flat surfaces while maintaining image quality.- Flexible display substrate technologies: Flexible microdisplays utilize specialized substrate materials that can bend without compromising display functionality. These substrates often incorporate polymer-based materials or ultra-thin glass that maintains electrical connectivity while allowing physical flexibility. The substrate design includes specialized layering techniques to distribute stress during bending and prevent damage to the active display components, enabling applications in wearable devices and curved display surfaces.

- OLED technology for flexible displays: Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its self-emissive properties and thin-film structure. These displays eliminate the need for rigid backlighting components, allowing for ultra-thin and bendable display configurations. The technology incorporates specialized organic materials that emit light when current is applied, with modifications to ensure consistent performance when the display is flexed or bent.

- Flexible display driving circuits: Specialized driving circuits are essential for flexible microdisplays to maintain image quality during bending. These circuits incorporate stretchable or bendable conductive materials that maintain electrical performance under mechanical stress. The designs often feature distributed circuit architectures that minimize strain concentration and utilize novel interconnect technologies to ensure reliable signal transmission across flexible interfaces, enabling consistent display performance regardless of the display's physical configuration.

- Protective encapsulation for flexible displays: Flexible microdisplays require specialized encapsulation technologies to protect sensitive electronic components from environmental factors while maintaining flexibility. These encapsulation methods use thin-film barrier layers that prevent moisture and oxygen penetration while allowing the display to bend. Multi-layer approaches combine organic and inorganic materials to achieve both flexibility and protection, with self-healing properties in some advanced designs to maintain barrier integrity after repeated flexing.

- Flexible display optical systems: Optical components in flexible microdisplays are designed to maintain consistent visual performance during bending. These systems incorporate flexible light management films, adaptable lens arrays, and deformable optical elements that adjust to changes in display curvature. The technologies include specialized diffusers and polarizers that maintain their optical properties when flexed, ensuring consistent brightness, contrast, and viewing angles regardless of the display's physical configuration.

02 Flexible OLED microdisplay implementations

Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its self-emissive nature and thin-film construction. These implementations feature specialized thin-film transistor (TFT) backplanes that can bend without performance degradation. The OLED layers are engineered with elastic properties to maintain functionality during flexing, with particular attention to preventing oxygen and moisture ingress that could damage the organic materials. These displays achieve high contrast ratios and color accuracy while maintaining flexibility.Expand Specific Solutions03 Flexible display driving mechanisms

Specialized driving circuits and mechanisms are required for flexible microdisplays to maintain image quality during bending. These include compensation algorithms that adjust pixel driving based on the display's physical configuration, flexible printed circuit connections that maintain electrical integrity during flexing, and strain-resistant signal routing. The driving mechanisms often incorporate real-time sensing of display curvature to optimize image rendering and power consumption based on the current physical state of the display.Expand Specific Solutions04 Flexible display encapsulation methods

Protecting the sensitive electronic components of flexible microdisplays requires specialized encapsulation technologies. These methods include multi-layer barrier films that prevent moisture and oxygen penetration while maintaining flexibility, edge sealing techniques that accommodate bending stress, and elastic encapsulant materials that flex with the display without cracking or delaminating. The encapsulation systems are designed to withstand repeated bending cycles while providing environmental protection for the display components.Expand Specific Solutions05 Testing and reliability methods for flexible displays

Ensuring the reliability of flexible microdisplays requires specialized testing methodologies and quality control processes. These include automated optical inspection systems adapted for curved surfaces, bend-cycle testing apparatus that simulate real-world usage patterns, and stress distribution analysis to identify potential failure points. Testing protocols evaluate image quality retention during and after bending, electrical continuity throughout flexing cycles, and long-term reliability under various environmental conditions and usage scenarios.Expand Specific Solutions

Key Industry Players and Patent Holders

The flexible microdisplay patent landscape reflects a highly competitive market in its growth phase, with an estimated global value exceeding $15 billion and projected annual growth of 20%. The technology is approaching maturity but still evolving, particularly in foldable and rollable applications. Asian manufacturers dominate, with BOE Technology, LG Display, and Samsung Electronics leading patent portfolios, while Japan Display and Tianma Microelectronics are making significant advances. Western players like Apple and Intel focus on specialized applications and integration technologies. Chinese companies have rapidly expanded their patent holdings, challenging traditional Japanese and Korean dominance, with particular strength in manufacturing processes and flexible substrate technologies.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced flexible AMOLED microdisplay technology utilizing low-temperature polysilicon (LTPS) backplanes combined with organic light-emitting materials. Their patented approach incorporates ultra-thin film encapsulation (TFE) technology that enables displays with bending radii below 1mm while maintaining structural integrity. BOE's flexible microdisplays feature pixel densities exceeding 1000 PPI and utilize proprietary compensation circuits to address non-uniform brightness issues common in flexible displays. The company has implemented a unique mechanical stress distribution layer that prevents pixel damage during repeated flexing, allowing for over 200,000 bending cycles without performance degradation. Their patent portfolio covers manufacturing processes that significantly reduce production costs through innovative laser lift-off techniques and roll-to-roll processing capabilities.

Strengths: Industry-leading pixel density and ultra-thin form factor (under 0.5mm thickness) provide competitive advantage in AR/VR applications. Extensive patent protection across manufacturing processes creates strong market barriers. Weaknesses: Higher production costs compared to rigid displays and limited color gamut performance in extreme bending conditions may restrict adoption in cost-sensitive consumer markets.

LG Display Co., Ltd.

Technical Solution: LG Display has pioneered flexible microdisplay technology through their patented P-OLED (Plastic OLED) platform specifically optimized for near-eye applications. Their technical approach utilizes a polyimide substrate with specialized barrier films that provide exceptional oxygen and moisture protection while maintaining flexibility. LG's patents cover a unique pixel structure that incorporates micro-lenses to enhance light extraction efficiency by approximately 30% compared to conventional designs. Their flexible microdisplays feature proprietary thin-film encapsulation methods that enable a total thickness under 100 micrometers while supporting pixel densities above 2000 PPI for AR/VR applications. LG has developed specialized compensation algorithms that dynamically adjust pixel voltage based on the display's physical configuration, ensuring consistent image quality regardless of the bending state. Their manufacturing process incorporates patented laser patterning techniques that significantly improve production yields for complex microdisplay architectures.

Strengths: Superior color accuracy (over 110% DCI-P3) and contrast ratios exceeding 1,000,000:1 provide exceptional visual quality. Established mass production capabilities enable competitive pricing and reliable supply chain. Weaknesses: Limited flexibility compared to some competitors (minimum bending radius of approximately 2mm) and higher power consumption may restrict application in portable devices with limited battery capacity.

Critical Patent Analysis and Innovation Assessment

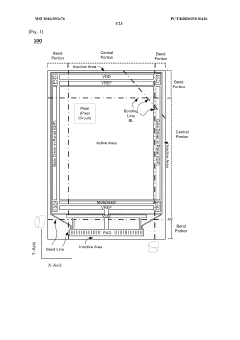

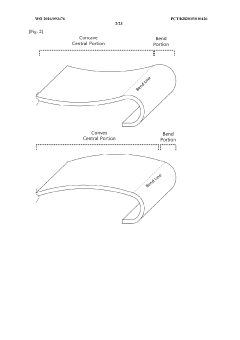

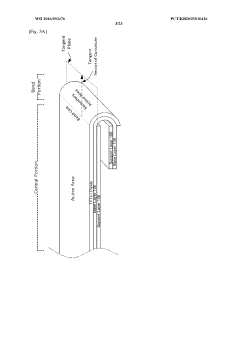

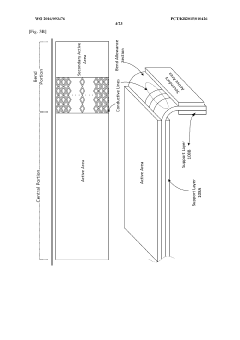

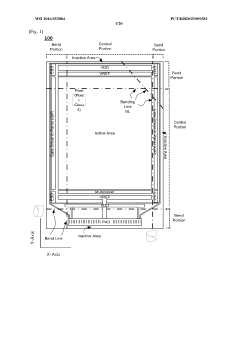

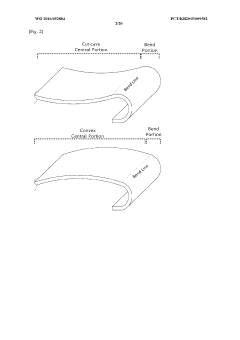

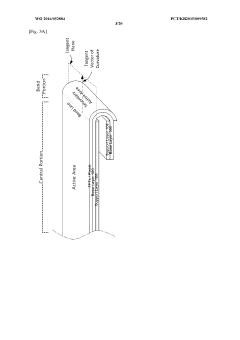

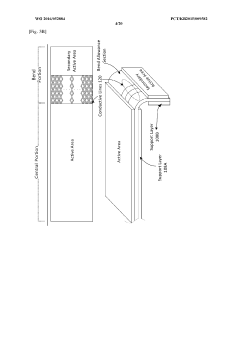

Flexible display device with multiple types of micro-coating layers

PatentWO2016093476A1

Innovation

- A flexible display apparatus with micro-coating layers over wire traces in the bend allowance section, including getter materials like silica-based particles to reduce moisture permeation and enhance adhesion, and a support member to maintain curvature, facilitating the placement of components behind the active area and reducing the need for masking.

Flexible display device

PatentWO2016052884A1

Innovation

- A flexible display configuration with wire traces designed to withstand bending stress, featuring a base layer with a bend portion, encapsulation, and micro cover layers, along with support films and adhesive layers to minimize inactive area visibility and enhance flexibility.

IP Protection Strategies Across Global Markets

Protecting intellectual property in the flexible microdisplay sector requires tailored strategies across different global markets due to varying legal frameworks and enforcement mechanisms. In North America, particularly the United States, robust patent protection exists with strong enforcement capabilities, making comprehensive utility patents essential for core technologies while design patents protect aesthetic elements. Companies should leverage the Patent Trial and Appeal Board (PTAB) for efficient dispute resolution and consider the International Trade Commission (ITC) for import restriction remedies against infringing products.

The European market presents a different landscape with the European Patent Office (EPO) offering centralized filing but requiring validation in individual countries. The Unified Patent Court (UPC) system, though not fully implemented across all EU members, provides streamlined enforcement mechanisms. Strategic considerations should include filing utility models in Germany for faster, less expensive protection of incremental innovations in flexible display technologies.

Asian markets demand particularly nuanced approaches. Japan offers strong IP protection but with stringent examination standards requiring detailed technical documentation. China, despite historical enforcement challenges, has significantly improved its IP protection framework, making it crucial to file both invention patents and utility models simultaneously. The specialized IP courts in Beijing, Shanghai, and Guangzhou have demonstrated increasing willingness to protect foreign IP rights.

For emerging markets like India and Brazil, companies should prioritize defensive filing strategies while building relationships with local manufacturing partners. These markets often have slower examination processes but growing importance in the global supply chain for flexible display technologies.

Cross-border protection mechanisms such as the Patent Cooperation Treaty (PCT) provide cost-effective pathways for international protection, allowing companies to delay national phase entries while preserving priority dates. For flexible microdisplay technologies, which often incorporate both hardware and software elements, layered protection strategies combining patents, trade secrets, and copyright are recommended.

Monitoring and enforcement programs should be tailored to regional risk profiles, with greater resources allocated to markets with higher infringement probabilities or strategic importance. Regular freedom-to-operate analyses should be conducted when entering new markets to avoid inadvertent infringement of local patents, particularly in jurisdictions with utility model systems that may not undergo substantive examination.

The European market presents a different landscape with the European Patent Office (EPO) offering centralized filing but requiring validation in individual countries. The Unified Patent Court (UPC) system, though not fully implemented across all EU members, provides streamlined enforcement mechanisms. Strategic considerations should include filing utility models in Germany for faster, less expensive protection of incremental innovations in flexible display technologies.

Asian markets demand particularly nuanced approaches. Japan offers strong IP protection but with stringent examination standards requiring detailed technical documentation. China, despite historical enforcement challenges, has significantly improved its IP protection framework, making it crucial to file both invention patents and utility models simultaneously. The specialized IP courts in Beijing, Shanghai, and Guangzhou have demonstrated increasing willingness to protect foreign IP rights.

For emerging markets like India and Brazil, companies should prioritize defensive filing strategies while building relationships with local manufacturing partners. These markets often have slower examination processes but growing importance in the global supply chain for flexible display technologies.

Cross-border protection mechanisms such as the Patent Cooperation Treaty (PCT) provide cost-effective pathways for international protection, allowing companies to delay national phase entries while preserving priority dates. For flexible microdisplay technologies, which often incorporate both hardware and software elements, layered protection strategies combining patents, trade secrets, and copyright are recommended.

Monitoring and enforcement programs should be tailored to regional risk profiles, with greater resources allocated to markets with higher infringement probabilities or strategic importance. Regular freedom-to-operate analyses should be conducted when entering new markets to avoid inadvertent infringement of local patents, particularly in jurisdictions with utility model systems that may not undergo substantive examination.

Standardization Efforts in Flexible Display Technologies

The standardization of flexible display technologies has become increasingly critical as the market for flexible microdisplays expands globally. Several international organizations have taken leading roles in establishing technical standards that facilitate interoperability, quality assurance, and market growth. The International Electrotechnical Commission (IEC) has developed the IEC 62715 series specifically addressing flexible display technologies, covering essential parameters such as mechanical durability, optical performance under bending conditions, and environmental testing methodologies.

In parallel, the Society for Information Display (SID) has established working groups focused on standardizing measurement techniques for flexible displays, particularly addressing the unique challenges of evaluating display performance during and after repeated flexing cycles. These standards are crucial for patent evaluation as they provide objective benchmarks against which innovations can be measured.

The IEEE has contributed significantly through its P2048 standards for virtual reality and augmented reality displays, which increasingly incorporate flexible microdisplay technologies. These standards address interface protocols, performance metrics, and testing methodologies that directly impact the value and applicability of flexible display patents in emerging markets.

Regional standardization bodies have also made notable contributions. In Asia, the Japan Electronics and Information Technology Industries Association (JEITA) has developed standards specifically for flexible OLED displays, while Korea's Telecommunications Technology Association (TTA) has focused on standards for foldable display interfaces. The China Electronics Standardization Institute (CESI) has recently accelerated its efforts in flexible display standardization, particularly in areas related to reliability testing.

Industry consortia have emerged as important drivers of de facto standards. The Flexible Display Alliance, comprising major display manufacturers and technology developers, has published technical guidelines that, while not formal standards, significantly influence patent development strategies and market acceptance criteria.

The fragmentation of standards across different regions presents challenges for global patent evaluation. Patents that align with standards in multiple jurisdictions typically command higher valuation and offer greater licensing potential. Consequently, standardization tracking has become an essential component of patent portfolio management for companies operating in the flexible microdisplay space.

In parallel, the Society for Information Display (SID) has established working groups focused on standardizing measurement techniques for flexible displays, particularly addressing the unique challenges of evaluating display performance during and after repeated flexing cycles. These standards are crucial for patent evaluation as they provide objective benchmarks against which innovations can be measured.

The IEEE has contributed significantly through its P2048 standards for virtual reality and augmented reality displays, which increasingly incorporate flexible microdisplay technologies. These standards address interface protocols, performance metrics, and testing methodologies that directly impact the value and applicability of flexible display patents in emerging markets.

Regional standardization bodies have also made notable contributions. In Asia, the Japan Electronics and Information Technology Industries Association (JEITA) has developed standards specifically for flexible OLED displays, while Korea's Telecommunications Technology Association (TTA) has focused on standards for foldable display interfaces. The China Electronics Standardization Institute (CESI) has recently accelerated its efforts in flexible display standardization, particularly in areas related to reliability testing.

Industry consortia have emerged as important drivers of de facto standards. The Flexible Display Alliance, comprising major display manufacturers and technology developers, has published technical guidelines that, while not formal standards, significantly influence patent development strategies and market acceptance criteria.

The fragmentation of standards across different regions presents challenges for global patent evaluation. Patents that align with standards in multiple jurisdictions typically command higher valuation and offer greater licensing potential. Consequently, standardization tracking has become an essential component of patent portfolio management for companies operating in the flexible microdisplay space.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!