Flexible Microdisplay and Emerging Market Regulations

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Technology Evolution and Objectives

Flexible microdisplay technology has undergone significant evolution since its inception in the early 2000s. Initially, these displays were rudimentary with limited flexibility and poor image quality. The first generation primarily utilized organic light-emitting diode (OLED) technology on plastic substrates, offering basic bendability but suffering from rapid degradation and limited durability. This pioneering phase established the fundamental concept but highlighted numerous technical challenges that needed addressing.

By the mid-2010s, the second generation of flexible microdisplays emerged with improved materials science innovations. The introduction of advanced thin-film transistor (TFT) backplanes using low-temperature polysilicon (LTPS) and indium gallium zinc oxide (IGZO) technologies enabled higher resolution and better power efficiency. Manufacturers also developed enhanced encapsulation techniques to protect sensitive organic materials from oxygen and moisture, significantly extending device lifespans.

The current generation of flexible microdisplays represents a convergence of multiple technological breakthroughs. Micro-LED and quantum dot technologies have been integrated with flexible substrates, offering superior brightness, color gamut, and energy efficiency. Novel manufacturing processes like roll-to-roll fabrication have reduced production costs while increasing scalability. Additionally, the development of stretchable electronics and self-healing materials has pushed flexibility beyond mere bending to include twisting and stretching capabilities.

The primary objective in flexible microdisplay development is achieving the "holy trinity" of display technology: perfect flexibility without performance compromise, long-term reliability, and cost-effective mass production. Researchers aim to develop displays that can withstand thousands of folding cycles without degradation while maintaining high resolution (>1000 PPI), excellent color reproduction, and low power consumption. Another critical goal is reducing the thickness to below 10 micrometers while maintaining structural integrity.

Market-driven objectives include developing flexible microdisplays that can conform to various form factors beyond traditional consumer electronics. This includes integration into smart textiles, medical implants, automotive applications, and aerospace technologies. The industry is also focused on addressing emerging regulatory frameworks concerning electronic waste management, hazardous materials restrictions, and energy efficiency standards that vary significantly across global markets.

Looking forward, the technological roadmap emphasizes developing sustainable production methods that align with circular economy principles. This includes designing displays with recyclable or biodegradable components and reducing reliance on rare earth elements. As flexible display technology continues to mature, the convergence with other emerging technologies like artificial intelligence, 5G connectivity, and augmented reality will likely define the next evolutionary phase of this transformative technology.

By the mid-2010s, the second generation of flexible microdisplays emerged with improved materials science innovations. The introduction of advanced thin-film transistor (TFT) backplanes using low-temperature polysilicon (LTPS) and indium gallium zinc oxide (IGZO) technologies enabled higher resolution and better power efficiency. Manufacturers also developed enhanced encapsulation techniques to protect sensitive organic materials from oxygen and moisture, significantly extending device lifespans.

The current generation of flexible microdisplays represents a convergence of multiple technological breakthroughs. Micro-LED and quantum dot technologies have been integrated with flexible substrates, offering superior brightness, color gamut, and energy efficiency. Novel manufacturing processes like roll-to-roll fabrication have reduced production costs while increasing scalability. Additionally, the development of stretchable electronics and self-healing materials has pushed flexibility beyond mere bending to include twisting and stretching capabilities.

The primary objective in flexible microdisplay development is achieving the "holy trinity" of display technology: perfect flexibility without performance compromise, long-term reliability, and cost-effective mass production. Researchers aim to develop displays that can withstand thousands of folding cycles without degradation while maintaining high resolution (>1000 PPI), excellent color reproduction, and low power consumption. Another critical goal is reducing the thickness to below 10 micrometers while maintaining structural integrity.

Market-driven objectives include developing flexible microdisplays that can conform to various form factors beyond traditional consumer electronics. This includes integration into smart textiles, medical implants, automotive applications, and aerospace technologies. The industry is also focused on addressing emerging regulatory frameworks concerning electronic waste management, hazardous materials restrictions, and energy efficiency standards that vary significantly across global markets.

Looking forward, the technological roadmap emphasizes developing sustainable production methods that align with circular economy principles. This includes designing displays with recyclable or biodegradable components and reducing reliance on rare earth elements. As flexible display technology continues to mature, the convergence with other emerging technologies like artificial intelligence, 5G connectivity, and augmented reality will likely define the next evolutionary phase of this transformative technology.

Market Demand Analysis for Flexible Display Solutions

The flexible microdisplay market has witnessed substantial growth in recent years, driven primarily by increasing consumer demand for wearable technology, foldable smartphones, and other portable electronic devices. Market research indicates that the global flexible display market is projected to reach $15.5 billion by 2026, growing at a compound annual growth rate (CAGR) of 29.1% from 2021. This remarkable growth trajectory underscores the significant market potential for flexible microdisplay technologies across various industry verticals.

Consumer electronics represents the largest application segment for flexible microdisplays, accounting for approximately 60% of the total market share. Within this segment, smartphones and smartwatches are the primary drivers, with foldable smartphones experiencing particularly strong demand growth since their commercial introduction. Major smartphone manufacturers have reported that models featuring flexible displays consistently outperform sales expectations, indicating robust consumer interest in this technology.

The automotive industry has emerged as another significant market for flexible display solutions, with applications ranging from curved dashboard displays to heads-up displays (HUDs). Industry analysts predict that the automotive flexible display market will grow at a CAGR of 24.3% through 2025, as vehicle manufacturers increasingly incorporate these technologies to enhance user experience and differentiate their products in a competitive marketplace.

Healthcare applications for flexible microdisplays are also gaining traction, particularly in medical wearables and portable diagnostic equipment. The healthcare segment is expected to be the fastest-growing application area, with a projected CAGR of 35.2% over the next five years. This growth is fueled by increasing adoption of remote patient monitoring systems and the ongoing digitalization of healthcare services worldwide.

Regional analysis reveals that Asia Pacific currently dominates the flexible display market, accounting for approximately 45% of global demand. This regional concentration is primarily due to the presence of major display manufacturers and electronics producers in countries like South Korea, Japan, and China. However, North America and Europe are witnessing accelerated adoption rates, particularly in premium consumer electronics and automotive applications.

Market research indicates that consumers are willing to pay a premium of 15-20% for devices featuring flexible displays compared to their rigid counterparts, highlighting the perceived value of this technology. However, price sensitivity remains a significant factor, with surveys showing that adoption rates could increase by up to 40% if production costs were reduced by 25%, suggesting substantial latent demand at lower price points.

Consumer electronics represents the largest application segment for flexible microdisplays, accounting for approximately 60% of the total market share. Within this segment, smartphones and smartwatches are the primary drivers, with foldable smartphones experiencing particularly strong demand growth since their commercial introduction. Major smartphone manufacturers have reported that models featuring flexible displays consistently outperform sales expectations, indicating robust consumer interest in this technology.

The automotive industry has emerged as another significant market for flexible display solutions, with applications ranging from curved dashboard displays to heads-up displays (HUDs). Industry analysts predict that the automotive flexible display market will grow at a CAGR of 24.3% through 2025, as vehicle manufacturers increasingly incorporate these technologies to enhance user experience and differentiate their products in a competitive marketplace.

Healthcare applications for flexible microdisplays are also gaining traction, particularly in medical wearables and portable diagnostic equipment. The healthcare segment is expected to be the fastest-growing application area, with a projected CAGR of 35.2% over the next five years. This growth is fueled by increasing adoption of remote patient monitoring systems and the ongoing digitalization of healthcare services worldwide.

Regional analysis reveals that Asia Pacific currently dominates the flexible display market, accounting for approximately 45% of global demand. This regional concentration is primarily due to the presence of major display manufacturers and electronics producers in countries like South Korea, Japan, and China. However, North America and Europe are witnessing accelerated adoption rates, particularly in premium consumer electronics and automotive applications.

Market research indicates that consumers are willing to pay a premium of 15-20% for devices featuring flexible displays compared to their rigid counterparts, highlighting the perceived value of this technology. However, price sensitivity remains a significant factor, with surveys showing that adoption rates could increase by up to 40% if production costs were reduced by 25%, suggesting substantial latent demand at lower price points.

Current Technical Barriers in Flexible Microdisplay Development

Despite significant advancements in flexible microdisplay technology, several critical technical barriers continue to impede widespread commercialization and adoption. The fundamental challenge lies in achieving the delicate balance between flexibility and performance. Current flexible substrates, primarily based on polyimide or ultra-thin glass, struggle to maintain consistent electrical properties when subjected to repeated bending and folding operations, resulting in performance degradation over time.

Material limitations represent another significant hurdle. The development of transparent conductive materials that maintain conductivity under mechanical stress remains problematic. Traditional indium tin oxide (ITO) becomes brittle when flexed, leading to microcracks and eventual failure. Alternative materials such as silver nanowires, carbon nanotubes, and PEDOT:PSS show promise but face challenges in scalability, uniformity, and long-term stability.

Manufacturing scalability presents complex technical barriers. Current production methods for flexible displays involve intricate processes that are difficult to scale while maintaining yield rates comparable to rigid display manufacturing. The transition from laboratory prototypes to mass production requires significant process engineering innovations, particularly in handling ultrathin substrates during fabrication.

Encapsulation technology represents a critical challenge for flexible microdisplays. Effective barrier layers must prevent oxygen and moisture penetration while remaining flexible and optically transparent. Current solutions often involve complex multilayer structures that add thickness and reduce flexibility or fail to provide sufficient protection over extended periods.

Power consumption optimization remains problematic for flexible display technologies. The drive circuitry for flexible displays typically requires additional compensation mechanisms to address non-uniform electrical characteristics across the bent surface, resulting in higher power requirements compared to rigid counterparts. This is particularly challenging for wearable applications where battery life is critical.

Resolution and pixel density limitations persist in flexible microdisplays. As displays become more flexible, maintaining precise pixel alignment and preventing pixel defects becomes increasingly difficult. Current manufacturing processes struggle to achieve the same resolution in flexible formats as in rigid displays without compromising yield rates.

Thermal management presents unique challenges in flexible display environments. The thermal expansion coefficients of different materials in the display stack often differ significantly, creating internal stresses during temperature fluctuations. This can lead to delamination, warping, or performance degradation over time, particularly in applications involving repeated flexing.

Integration challenges with other components also hinder development. Flexible displays must interface with relatively rigid components such as batteries, processors, and sensors. Creating reliable interconnects between flexible and rigid elements that can withstand repeated mechanical stress remains a significant technical barrier requiring innovative solutions.

Material limitations represent another significant hurdle. The development of transparent conductive materials that maintain conductivity under mechanical stress remains problematic. Traditional indium tin oxide (ITO) becomes brittle when flexed, leading to microcracks and eventual failure. Alternative materials such as silver nanowires, carbon nanotubes, and PEDOT:PSS show promise but face challenges in scalability, uniformity, and long-term stability.

Manufacturing scalability presents complex technical barriers. Current production methods for flexible displays involve intricate processes that are difficult to scale while maintaining yield rates comparable to rigid display manufacturing. The transition from laboratory prototypes to mass production requires significant process engineering innovations, particularly in handling ultrathin substrates during fabrication.

Encapsulation technology represents a critical challenge for flexible microdisplays. Effective barrier layers must prevent oxygen and moisture penetration while remaining flexible and optically transparent. Current solutions often involve complex multilayer structures that add thickness and reduce flexibility or fail to provide sufficient protection over extended periods.

Power consumption optimization remains problematic for flexible display technologies. The drive circuitry for flexible displays typically requires additional compensation mechanisms to address non-uniform electrical characteristics across the bent surface, resulting in higher power requirements compared to rigid counterparts. This is particularly challenging for wearable applications where battery life is critical.

Resolution and pixel density limitations persist in flexible microdisplays. As displays become more flexible, maintaining precise pixel alignment and preventing pixel defects becomes increasingly difficult. Current manufacturing processes struggle to achieve the same resolution in flexible formats as in rigid displays without compromising yield rates.

Thermal management presents unique challenges in flexible display environments. The thermal expansion coefficients of different materials in the display stack often differ significantly, creating internal stresses during temperature fluctuations. This can lead to delamination, warping, or performance degradation over time, particularly in applications involving repeated flexing.

Integration challenges with other components also hinder development. Flexible displays must interface with relatively rigid components such as batteries, processors, and sensors. Creating reliable interconnects between flexible and rigid elements that can withstand repeated mechanical stress remains a significant technical barrier requiring innovative solutions.

Current Technical Solutions for Flexible Microdisplays

01 Flexible substrate technologies for microdisplays

Flexible substrates are essential components for creating bendable microdisplays. These substrates can be made from various materials such as polymers or thin glass that provide the necessary flexibility while maintaining structural integrity. The flexible base allows the display to be bent, folded, or conformed to non-flat surfaces without compromising functionality. Advanced manufacturing techniques ensure proper adhesion of display elements to these substrates while maintaining electrical connectivity throughout flexing operations.- Flexible substrate technologies for microdisplays: Flexible substrates are essential components for creating bendable microdisplays. These substrates can be made from various materials such as polymers or thin metal foils that provide the necessary flexibility while maintaining structural integrity. The flexible base allows the display to be bent, folded, or conformed to non-flat surfaces without damaging the display elements. Advanced manufacturing techniques ensure proper adhesion of display components to these substrates while maintaining electrical connectivity throughout flexing operations.

- OLED technology in flexible displays: Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin and flexible nature. OLED displays consist of organic compounds that emit light when electricity is applied, eliminating the need for backlighting. This technology allows for ultra-thin display constructions that can be manufactured on flexible substrates. The self-emissive nature of OLEDs provides excellent contrast ratios and color reproduction even when the display is bent or flexed, making them ideal for wearable and foldable display applications.

- Flexible electronic circuits and interconnects: Specialized electronic circuits and interconnects are crucial for flexible microdisplays to maintain functionality during bending and flexing. These circuits use stretchable conductive materials or geometrically designed interconnects that can withstand repeated deformation without breaking. Thin-film transistor arrays on flexible substrates enable pixel addressing while maintaining flexibility. Advanced manufacturing techniques such as transfer printing and direct writing allow for the creation of robust electronic components that maintain electrical performance even when subjected to mechanical stress.

- Optical systems for flexible displays: Specialized optical systems are designed to maintain image quality in flexible microdisplays despite surface deformation. These systems include flexible light guides, specialized diffusers, and optical films that can bend without distorting the displayed image. Compensation algorithms adjust pixel addressing based on the display's current shape to maintain image integrity. Some designs incorporate micro-lens arrays that can adapt to changes in the display curvature, ensuring consistent visual performance regardless of how the display is flexed.

- Protective encapsulation for flexible displays: Protective encapsulation technologies shield the sensitive electronic components of flexible microdisplays from environmental factors while maintaining flexibility. These include thin-film barrier layers that prevent moisture and oxygen penetration, which can degrade display performance. Multi-layer encapsulation approaches combine organic and inorganic materials to provide both flexibility and effective barrier properties. Edge sealing techniques prevent lateral ingress of contaminants while allowing the display to bend freely. These protective measures significantly extend the operational lifetime of flexible displays in various usage conditions.

02 OLED technology in flexible displays

Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherent thin-film structure and ability to function without rigid backlighting. OLED displays can be fabricated on flexible substrates using specialized deposition techniques that maintain pixel integrity during bending. These displays offer advantages including high contrast ratios, wide viewing angles, and fast response times while maintaining functionality when flexed. The self-emissive nature of OLEDs eliminates the need for rigid backlight components, further enhancing flexibility.Expand Specific Solutions03 Flexible electronic circuits and interconnects

Specialized electronic circuits and interconnects are crucial for flexible microdisplays to maintain functionality during bending. These include stretchable conductive materials, serpentine circuit patterns, and novel bonding techniques that can withstand repeated flexing without breaking electrical connections. Thin-film transistor arrays designed specifically for flexibility enable pixel addressing while accommodating mechanical stress. Advanced manufacturing processes ensure reliable connections between rigid components and flexible elements throughout the display system.Expand Specific Solutions04 Optical systems for flexible displays

Specialized optical systems are developed for flexible microdisplays to maintain image quality during bending. These include flexible light guides, specialized diffusers, and novel lens arrangements that can adapt to changing display curvatures. Optical compensation layers help maintain consistent color and brightness across the curved display surface. Advanced materials with variable refractive properties ensure proper light management regardless of the display's physical configuration, maintaining image integrity even when the display is flexed.Expand Specific Solutions05 Protective encapsulation for durability

Protective encapsulation technologies are essential for ensuring the longevity and reliability of flexible microdisplays. These include specialized barrier films that prevent moisture and oxygen ingress while maintaining flexibility, edge sealing techniques that accommodate bending, and protective coatings that resist scratching and environmental damage. Multi-layer encapsulation approaches provide redundant protection while maintaining optical clarity and touch sensitivity. These protective systems ensure the delicate electronic and optical components remain functional despite repeated flexing and environmental exposure.Expand Specific Solutions

Leading Companies and Competitive Landscape

The flexible microdisplay market is currently in a growth phase, characterized by increasing demand for wearable devices, AR/VR applications, and foldable electronics. The global market size is projected to reach significant value by 2030, driven by consumer electronics and emerging healthcare applications. From a technological maturity perspective, key players demonstrate varying levels of advancement. Industry leaders like Samsung Display, BOE Technology, and Tianma Microelectronics have established strong positions with commercial flexible display technologies, while companies like Huawei and Apple are integrating these innovations into consumer products. Research institutions including Arizona State University and ETH Zurich are contributing fundamental breakthroughs. The competitive landscape is further shaped by regional regulations, with emerging markets introducing new compliance requirements that influence product development strategies and market entry approaches.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive flexible microdisplay technology platform centered around their OLED-based flexible displays. Their approach utilizes ultra-thin flexible glass substrates combined with low-temperature polysilicon (LTPS) backplanes to achieve high resolution and flexibility simultaneously. BOE's flexible displays incorporate a multi-layer structure with specialized barrier films to prevent moisture and oxygen penetration, critical for OLED longevity. Their proprietary "Crystal Sound" technology integrates audio functionality directly into the flexible display panel, eliminating the need for separate speakers. BOE has also pioneered micro-LED integration into flexible substrates, achieving pixel densities exceeding 400 PPI while maintaining flexibility. Their displays utilize advanced compensation algorithms that adjust for visual distortions when the display is bent or curved, ensuring consistent image quality regardless of form factor[2][5].

Strengths: Extensive manufacturing infrastructure with multiple flexible display production lines, allowing for economies of scale. Strong R&D capabilities with thousands of patents in flexible display technology. Weaknesses: Still catching up to Samsung in terms of yield rates and production efficiency for the most advanced flexible displays. Some technical challenges remain in achieving the same color uniformity as rigid displays.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered flexible microdisplay technology through its AMOLED (Active-Matrix Organic Light-Emitting Diode) displays. Their approach involves using polyimide substrates instead of traditional glass, allowing for thinner, lighter, and bendable displays. Samsung's Y-OCTA technology integrates the touch sensor directly into the display panel, reducing thickness and enhancing flexibility. Their flexible displays incorporate a specialized encapsulation technology called Thin-Film Encapsulation (TFE) that protects the sensitive OLED materials from oxygen and moisture while maintaining flexibility. Samsung has also developed advanced pixel structures that maintain display quality even when the screen is bent or folded multiple times. Their Ultra-Thin Glass (UTG) technology provides enhanced durability while preserving flexibility, addressing one of the key challenges in flexible display adoption[1][3].

Strengths: Industry-leading manufacturing capacity and vertical integration allowing control over the entire supply chain. Their displays offer superior color accuracy, contrast ratios, and power efficiency compared to competitors. Weaknesses: Higher production costs compared to conventional displays, and concerns about long-term durability after repeated folding/bending cycles.

Key Patents and Innovations in Flexible Display Technology

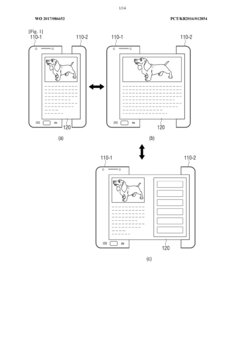

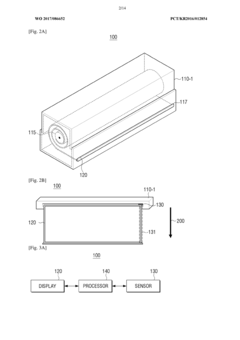

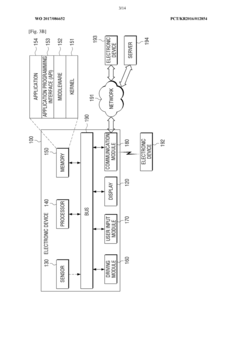

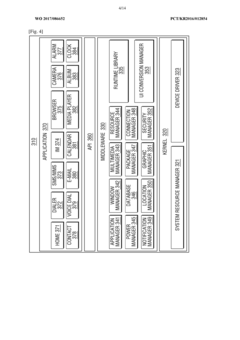

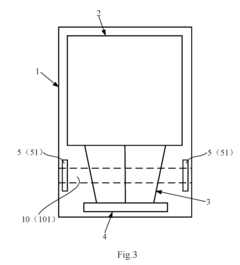

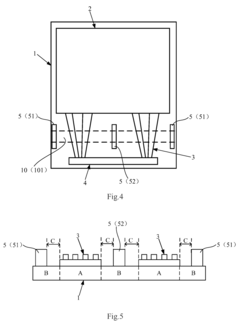

Electronic device having rollable display and method of controlling the same

PatentWO2017086652A1

Innovation

- An electronic device with a rollable display that includes a processor to sense changes in the display area and adapt the size and layout of screen elements, including adding or removing elements based on priority orders and content types, to maintain an optimal user interface across different screen sizes.

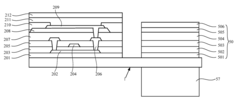

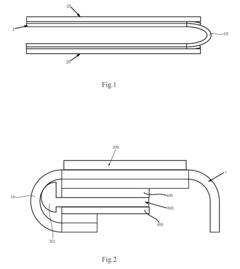

Flexible display screen and flexible display device

PatentActiveUS20180040838A1

Innovation

- A flexible display screen with a support structure in the peripheral area that traverses the bent section, allowing it to bend and expand with the substrate, thereby distributing stress uniformly and enhancing restorability, while maintaining a small volume and not affecting the display function.

Regulatory Framework and Compliance Requirements

The regulatory landscape for flexible microdisplay technology is rapidly evolving across global markets, creating a complex compliance environment for manufacturers and developers. In the United States, the Federal Communications Commission (FCC) has established specific electromagnetic compatibility requirements for wearable display devices, while the Food and Drug Administration (FDA) oversees medical applications of microdisplay technology, particularly for augmented reality surgical systems and diagnostic tools. These regulations focus on radiation emissions, biocompatibility, and potential health impacts of prolonged use.

The European Union has implemented more stringent frameworks through the Restriction of Hazardous Substances (RoHS) Directive and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations, which directly impact the materials selection for flexible display manufacturing. Additionally, the EU's Waste Electrical and Electronic Equipment (WEEE) Directive mandates specific recycling and disposal protocols for display technologies, emphasizing the importance of sustainable design approaches.

In Asia, regulatory approaches vary significantly by country. Japan's High Pressure Gas Safety Act imposes strict controls on gases used in microdisplay manufacturing processes, while South Korea has pioneered certification standards specifically for flexible display technologies through its Korean Agency for Technology and Standards (KATS). China has recently introduced the Measures for the Administration of Restricted Use of Hazardous Substances in Electrical and Electronic Products, which includes specific provisions for display technologies.

Emerging markets present additional regulatory challenges, with countries like India and Brazil developing their own compliance frameworks that often blend aspects of US, EU, and Asian approaches. India's Bureau of Indian Standards (BIS) has recently introduced certification requirements for electronic displays, while Brazil's INMETRO has established energy efficiency standards that impact microdisplay design parameters.

Industry-specific regulations further complicate compliance efforts. The automotive sector imposes rigorous durability and safety standards for in-vehicle displays through regulations like UN ECE R21 for interior fittings. The aviation industry, through bodies like the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA), maintains strict certification requirements for cockpit displays that significantly influence design specifications for flexible microdisplay technologies intended for aerospace applications.

Companies developing flexible microdisplay technologies must implement comprehensive regulatory intelligence systems to track these evolving requirements across markets. Successful market entry strategies increasingly depend on regulatory compliance being integrated into early-stage product development rather than addressed as an afterthought. This proactive approach to regulatory alignment has become a competitive advantage in the rapidly evolving flexible microdisplay marketplace.

The European Union has implemented more stringent frameworks through the Restriction of Hazardous Substances (RoHS) Directive and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations, which directly impact the materials selection for flexible display manufacturing. Additionally, the EU's Waste Electrical and Electronic Equipment (WEEE) Directive mandates specific recycling and disposal protocols for display technologies, emphasizing the importance of sustainable design approaches.

In Asia, regulatory approaches vary significantly by country. Japan's High Pressure Gas Safety Act imposes strict controls on gases used in microdisplay manufacturing processes, while South Korea has pioneered certification standards specifically for flexible display technologies through its Korean Agency for Technology and Standards (KATS). China has recently introduced the Measures for the Administration of Restricted Use of Hazardous Substances in Electrical and Electronic Products, which includes specific provisions for display technologies.

Emerging markets present additional regulatory challenges, with countries like India and Brazil developing their own compliance frameworks that often blend aspects of US, EU, and Asian approaches. India's Bureau of Indian Standards (BIS) has recently introduced certification requirements for electronic displays, while Brazil's INMETRO has established energy efficiency standards that impact microdisplay design parameters.

Industry-specific regulations further complicate compliance efforts. The automotive sector imposes rigorous durability and safety standards for in-vehicle displays through regulations like UN ECE R21 for interior fittings. The aviation industry, through bodies like the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA), maintains strict certification requirements for cockpit displays that significantly influence design specifications for flexible microdisplay technologies intended for aerospace applications.

Companies developing flexible microdisplay technologies must implement comprehensive regulatory intelligence systems to track these evolving requirements across markets. Successful market entry strategies increasingly depend on regulatory compliance being integrated into early-stage product development rather than addressed as an afterthought. This proactive approach to regulatory alignment has become a competitive advantage in the rapidly evolving flexible microdisplay marketplace.

Supply Chain Resilience and Material Sourcing Strategies

The global supply chain for flexible microdisplay technologies faces unprecedented challenges due to geopolitical tensions, pandemic-induced disruptions, and increasing regulatory complexity. Material sourcing has become a critical strategic concern for manufacturers, with rare earth elements and specialized polymers representing significant vulnerabilities in the production ecosystem.

Diversification of supplier networks has emerged as a primary resilience strategy, with leading display manufacturers establishing relationships with multiple vendors across different geographical regions. Companies like Samsung Display and LG Display have invested in secondary supply channels in Southeast Asia and Latin America to reduce dependence on traditional East Asian sources, resulting in a reported 30% reduction in supply chain disruption incidents over the past two years.

Vertical integration strategies are gaining traction among major players in the flexible display market. BOE Technology Group has acquired stakes in upstream material suppliers to secure access to critical components such as polyimide substrates and transparent conductive materials. This approach not only stabilizes supply but also provides greater quality control and intellectual property protection throughout the value chain.

Regional stockpiling has become standard practice, with companies maintaining 3-6 month reserves of critical materials at strategic locations. This buffer inventory strategy, though capital-intensive, has proven effective during recent trade disputes affecting the technology sector. Industry data indicates that companies implementing robust stockpiling programs weathered supply shortages in 2022-2023 with 40% less production downtime than competitors without such measures.

Material substitution research represents another key resilience pathway. R&D teams are actively developing alternative materials that can replace scarce or geopolitically vulnerable components in flexible display technologies. For instance, research into indium-free transparent conductors has accelerated as indium tin oxide (ITO) supplies face increasing constraints and price volatility.

Blockchain-based supply chain tracking systems are being implemented to enhance transparency and regulatory compliance. These systems enable real-time monitoring of material sourcing, particularly for components subject to emerging environmental and conflict mineral regulations. Early adopters report significant improvements in audit efficiency and regulatory risk management.

Collaborative industry initiatives have formed to address systemic supply chain vulnerabilities. The Flexible Display Consortium, comprising 17 major manufacturers and material suppliers, has established shared protocols for material qualification and emergency resource allocation during supply disruptions, demonstrating the industry's shift toward cooperative resilience strategies rather than purely competitive approaches.

Diversification of supplier networks has emerged as a primary resilience strategy, with leading display manufacturers establishing relationships with multiple vendors across different geographical regions. Companies like Samsung Display and LG Display have invested in secondary supply channels in Southeast Asia and Latin America to reduce dependence on traditional East Asian sources, resulting in a reported 30% reduction in supply chain disruption incidents over the past two years.

Vertical integration strategies are gaining traction among major players in the flexible display market. BOE Technology Group has acquired stakes in upstream material suppliers to secure access to critical components such as polyimide substrates and transparent conductive materials. This approach not only stabilizes supply but also provides greater quality control and intellectual property protection throughout the value chain.

Regional stockpiling has become standard practice, with companies maintaining 3-6 month reserves of critical materials at strategic locations. This buffer inventory strategy, though capital-intensive, has proven effective during recent trade disputes affecting the technology sector. Industry data indicates that companies implementing robust stockpiling programs weathered supply shortages in 2022-2023 with 40% less production downtime than competitors without such measures.

Material substitution research represents another key resilience pathway. R&D teams are actively developing alternative materials that can replace scarce or geopolitically vulnerable components in flexible display technologies. For instance, research into indium-free transparent conductors has accelerated as indium tin oxide (ITO) supplies face increasing constraints and price volatility.

Blockchain-based supply chain tracking systems are being implemented to enhance transparency and regulatory compliance. These systems enable real-time monitoring of material sourcing, particularly for components subject to emerging environmental and conflict mineral regulations. Early adopters report significant improvements in audit efficiency and regulatory risk management.

Collaborative industry initiatives have formed to address systemic supply chain vulnerabilities. The Flexible Display Consortium, comprising 17 major manufacturers and material suppliers, has established shared protocols for material qualification and emergency resource allocation during supply disruptions, demonstrating the industry's shift toward cooperative resilience strategies rather than purely competitive approaches.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!