Research on the Role of Flexible Microdisplays in Connected Devices

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Technology Evolution and Objectives

Flexible microdisplay technology has evolved significantly over the past two decades, transitioning from rigid glass-based displays to increasingly flexible and adaptable form factors. The journey began in the early 2000s with the development of thin-film transistor (TFT) technology on plastic substrates, marking the first step toward truly flexible displays. By 2010, early prototypes of bendable displays emerged, though with limited flexibility and durability.

The evolution accelerated around 2015 with breakthroughs in organic light-emitting diode (OLED) technology, enabling displays that could be bent, folded, and even rolled without compromising visual performance. This period saw significant advancements in materials science, particularly in the development of flexible substrates and encapsulation technologies that protected sensitive electronic components while maintaining flexibility.

Recent years have witnessed the miniaturization of these flexible display technologies, leading to the emergence of microdisplays specifically designed for connected devices. These microdisplays, typically measuring less than 2 inches diagonally, represent a convergence of flexible display technology with the increasing demand for compact, energy-efficient visual interfaces in wearable and IoT devices.

The primary objective of flexible microdisplay technology is to enable new form factors and use cases for connected devices that traditional rigid displays cannot support. This includes conforming to curved surfaces, integrating into textiles or wearable accessories, and adapting to dynamic physical environments. The technology aims to maintain high visual performance metrics—resolution, brightness, and color accuracy—while operating with minimal power consumption.

Another critical objective is enhancing durability and reliability under various environmental conditions and mechanical stresses. As these displays are increasingly deployed in everyday consumer products, they must withstand repeated bending, folding, or rolling without degradation in performance or visible artifacts.

Looking forward, the technology roadmap focuses on achieving higher pixel densities suitable for augmented reality applications, improving energy efficiency for battery-powered devices, and developing manufacturing processes that can scale economically. There is also significant emphasis on reducing the thickness of the overall display stack to maximize flexibility while maintaining structural integrity.

The convergence of flexible microdisplays with other emerging technologies—such as advanced haptics, biometric sensors, and energy harvesting—represents a frontier that could fundamentally transform how humans interact with connected devices, moving beyond traditional screen-based interfaces toward more intuitive, immersive, and physically integrated experiences.

The evolution accelerated around 2015 with breakthroughs in organic light-emitting diode (OLED) technology, enabling displays that could be bent, folded, and even rolled without compromising visual performance. This period saw significant advancements in materials science, particularly in the development of flexible substrates and encapsulation technologies that protected sensitive electronic components while maintaining flexibility.

Recent years have witnessed the miniaturization of these flexible display technologies, leading to the emergence of microdisplays specifically designed for connected devices. These microdisplays, typically measuring less than 2 inches diagonally, represent a convergence of flexible display technology with the increasing demand for compact, energy-efficient visual interfaces in wearable and IoT devices.

The primary objective of flexible microdisplay technology is to enable new form factors and use cases for connected devices that traditional rigid displays cannot support. This includes conforming to curved surfaces, integrating into textiles or wearable accessories, and adapting to dynamic physical environments. The technology aims to maintain high visual performance metrics—resolution, brightness, and color accuracy—while operating with minimal power consumption.

Another critical objective is enhancing durability and reliability under various environmental conditions and mechanical stresses. As these displays are increasingly deployed in everyday consumer products, they must withstand repeated bending, folding, or rolling without degradation in performance or visible artifacts.

Looking forward, the technology roadmap focuses on achieving higher pixel densities suitable for augmented reality applications, improving energy efficiency for battery-powered devices, and developing manufacturing processes that can scale economically. There is also significant emphasis on reducing the thickness of the overall display stack to maximize flexibility while maintaining structural integrity.

The convergence of flexible microdisplays with other emerging technologies—such as advanced haptics, biometric sensors, and energy harvesting—represents a frontier that could fundamentally transform how humans interact with connected devices, moving beyond traditional screen-based interfaces toward more intuitive, immersive, and physically integrated experiences.

Market Demand Analysis for Flexible Display Integration

The global market for flexible microdisplays in connected devices has witnessed substantial growth in recent years, driven by increasing consumer demand for more versatile, lightweight, and durable electronic products. Market research indicates that the flexible display sector is projected to grow at a compound annual growth rate of 35% between 2023 and 2028, with the microdisplay segment representing a significant portion of this expansion.

Consumer electronics remains the primary application area, with wearable technology showing particularly strong demand signals. Smartwatches, fitness trackers, and augmented reality glasses have created a robust market for flexible microdisplays that can conform to curved surfaces while maintaining visual clarity. The wearable technology market alone is expected to reach $265 billion by 2026, with display components accounting for approximately 25% of the total value chain.

Healthcare applications represent another rapidly growing segment, where flexible displays integrated into medical devices enable real-time monitoring and improved patient care. The medical wearables market is expanding at 29% annually, with flexible display integration being a key differentiator for next-generation products. Demand is particularly strong for devices that can provide continuous health monitoring while maintaining comfort and discretion.

Industrial and automotive sectors are also showing increased interest in flexible microdisplay technology. In industrial environments, heads-up displays and smart helmets incorporating flexible screens improve worker safety and efficiency. The automotive industry is integrating these displays into dashboard systems and advanced driver assistance interfaces, with market penetration expected to increase by 40% over the next five years.

Regional analysis reveals that Asia-Pacific currently dominates the market with 45% share, followed by North America (30%) and Europe (20%). However, the fastest growth is occurring in North America, where technology adoption rates and consumer spending on premium connected devices remain highest. Consumer surveys indicate that 78% of potential buyers consider display quality and flexibility as "very important" factors in purchasing decisions for wearable technology.

Price sensitivity remains a significant factor affecting market penetration. Current manufacturing costs limit mass adoption in mid-range products, with flexible microdisplays adding a premium of 30-40% compared to rigid alternatives. Market forecasts suggest this premium will decrease to 15-20% by 2025 as manufacturing processes mature and economies of scale are realized.

The sustainability aspect is increasingly influencing market demand, with 65% of consumers under 35 expressing preference for electronic devices with reduced environmental impact. Flexible display technologies that enable longer product lifecycles through increased durability and repairability are gaining market advantage, particularly in European markets where regulatory frameworks increasingly favor sustainable electronics.

Consumer electronics remains the primary application area, with wearable technology showing particularly strong demand signals. Smartwatches, fitness trackers, and augmented reality glasses have created a robust market for flexible microdisplays that can conform to curved surfaces while maintaining visual clarity. The wearable technology market alone is expected to reach $265 billion by 2026, with display components accounting for approximately 25% of the total value chain.

Healthcare applications represent another rapidly growing segment, where flexible displays integrated into medical devices enable real-time monitoring and improved patient care. The medical wearables market is expanding at 29% annually, with flexible display integration being a key differentiator for next-generation products. Demand is particularly strong for devices that can provide continuous health monitoring while maintaining comfort and discretion.

Industrial and automotive sectors are also showing increased interest in flexible microdisplay technology. In industrial environments, heads-up displays and smart helmets incorporating flexible screens improve worker safety and efficiency. The automotive industry is integrating these displays into dashboard systems and advanced driver assistance interfaces, with market penetration expected to increase by 40% over the next five years.

Regional analysis reveals that Asia-Pacific currently dominates the market with 45% share, followed by North America (30%) and Europe (20%). However, the fastest growth is occurring in North America, where technology adoption rates and consumer spending on premium connected devices remain highest. Consumer surveys indicate that 78% of potential buyers consider display quality and flexibility as "very important" factors in purchasing decisions for wearable technology.

Price sensitivity remains a significant factor affecting market penetration. Current manufacturing costs limit mass adoption in mid-range products, with flexible microdisplays adding a premium of 30-40% compared to rigid alternatives. Market forecasts suggest this premium will decrease to 15-20% by 2025 as manufacturing processes mature and economies of scale are realized.

The sustainability aspect is increasingly influencing market demand, with 65% of consumers under 35 expressing preference for electronic devices with reduced environmental impact. Flexible display technologies that enable longer product lifecycles through increased durability and repairability are gaining market advantage, particularly in European markets where regulatory frameworks increasingly favor sustainable electronics.

Current Technical Challenges in Flexible Microdisplay Development

Despite significant advancements in flexible display technology, several critical technical challenges continue to impede the widespread adoption of flexible microdisplays in connected devices. The primary obstacle remains the development of truly flexible substrates that can withstand repeated bending and folding while maintaining optical performance. Current polymer-based substrates often suffer from degradation after multiple folding cycles, with microscopic fractures developing that compromise display integrity and reduce device lifespan.

Material interface challenges present another significant hurdle, as the integration of rigid electronic components with flexible substrates creates stress points that become failure zones during flexing operations. The thermal expansion coefficient mismatch between different materials exacerbates this issue, particularly in environments with temperature fluctuations, leading to delamination and connection failures at critical junctions.

Power efficiency represents a persistent challenge, with flexible displays typically requiring more energy than their rigid counterparts due to additional layers and compensation circuits needed to maintain image quality during deformation. This power demand directly conflicts with the size and weight constraints of wearable and portable connected devices, creating a significant engineering trade-off between flexibility and battery life.

Manufacturing scalability remains problematic, with current production methods for flexible displays involving complex multi-step processes that result in low yields and high costs. The precision required for depositing thin-film transistors on flexible substrates exceeds that of conventional display manufacturing, necessitating specialized equipment and stringent environmental controls that limit mass production capabilities.

Durability against environmental factors poses another significant challenge. Flexible displays are inherently more vulnerable to moisture ingress and oxygen degradation due to the permeable nature of flexible substrate materials. Current encapsulation technologies provide insufficient protection for long-term deployment in real-world conditions, particularly for devices exposed to varying humidity, temperature, and UV radiation.

Resolution limitations continue to constrain application possibilities, as the pixel density achievable on flexible substrates lags behind rigid display technology. The physical deformation of flexible displays introduces additional complications in maintaining precise pixel alignment and preventing color distortion, particularly at fold points where stress concentration occurs.

Touch integration complexity further complicates development, as conventional touch sensors lose accuracy when bent or deformed. Alternative approaches using pressure-sensitive materials or capacitive mesh designs show promise but introduce additional layers that reduce overall flexibility and optical clarity, creating a challenging balance between interactive functionality and physical performance.

Material interface challenges present another significant hurdle, as the integration of rigid electronic components with flexible substrates creates stress points that become failure zones during flexing operations. The thermal expansion coefficient mismatch between different materials exacerbates this issue, particularly in environments with temperature fluctuations, leading to delamination and connection failures at critical junctions.

Power efficiency represents a persistent challenge, with flexible displays typically requiring more energy than their rigid counterparts due to additional layers and compensation circuits needed to maintain image quality during deformation. This power demand directly conflicts with the size and weight constraints of wearable and portable connected devices, creating a significant engineering trade-off between flexibility and battery life.

Manufacturing scalability remains problematic, with current production methods for flexible displays involving complex multi-step processes that result in low yields and high costs. The precision required for depositing thin-film transistors on flexible substrates exceeds that of conventional display manufacturing, necessitating specialized equipment and stringent environmental controls that limit mass production capabilities.

Durability against environmental factors poses another significant challenge. Flexible displays are inherently more vulnerable to moisture ingress and oxygen degradation due to the permeable nature of flexible substrate materials. Current encapsulation technologies provide insufficient protection for long-term deployment in real-world conditions, particularly for devices exposed to varying humidity, temperature, and UV radiation.

Resolution limitations continue to constrain application possibilities, as the pixel density achievable on flexible substrates lags behind rigid display technology. The physical deformation of flexible displays introduces additional complications in maintaining precise pixel alignment and preventing color distortion, particularly at fold points where stress concentration occurs.

Touch integration complexity further complicates development, as conventional touch sensors lose accuracy when bent or deformed. Alternative approaches using pressure-sensitive materials or capacitive mesh designs show promise but introduce additional layers that reduce overall flexibility and optical clarity, creating a challenging balance between interactive functionality and physical performance.

Current Implementation Approaches for Connected Devices

01 Flexible substrate technologies for microdisplays

Flexible substrates are essential components for creating bendable microdisplays. These substrates can be made from various materials such as polymers, thin glass, or metal foils that provide the necessary flexibility while maintaining structural integrity. The substrate technology enables the display to be bent, folded, or rolled without damaging the display elements. Advanced manufacturing techniques ensure proper adhesion of display components to these flexible bases while maintaining electrical connectivity throughout flexing operations.- Flexible substrate technologies for microdisplays: Flexible substrates are essential components for creating bendable microdisplays. These substrates can be made from various materials such as polymers, thin glass, or metal foils that provide the necessary flexibility while maintaining structural integrity. The substrates must be able to withstand repeated bending cycles without degradation of display performance. Advanced manufacturing techniques ensure proper adhesion of display components to these flexible bases while maintaining electrical connectivity throughout the bending process.

- OLED technology for flexible displays: Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin and flexible structure. OLED displays consist of organic compounds that emit light when electricity is applied, eliminating the need for backlighting. This technology enables the creation of ultra-thin, lightweight, and flexible displays with excellent color reproduction and contrast ratios. The self-emissive nature of OLEDs also contributes to lower power consumption compared to traditional display technologies.

- Optical systems for flexible microdisplays: Specialized optical systems are developed for flexible microdisplays to maintain image quality during bending. These systems include flexible lenses, mirrors, and light guides that can adapt to the changing geometry of the display. Advanced optical designs compensate for distortions that might occur when the display is bent or curved. These optical components work in conjunction with the display elements to ensure consistent brightness, viewing angles, and color accuracy regardless of the display's physical configuration.

- Touch and interface technologies for flexible displays: Touch sensing and user interface technologies for flexible microdisplays require special considerations to function properly when bent or curved. These include stretchable touch sensors, flexible circuit boards, and bendable connection interfaces. The touch systems must accurately detect input across curved surfaces while maintaining responsiveness and precision. Advanced algorithms compensate for the changing geometry of the display surface to ensure accurate touch registration regardless of the display's physical state.

- Liquid crystal technologies for flexible displays: Specialized liquid crystal technologies have been developed for use in flexible microdisplays. These include polymer-dispersed liquid crystals and cholesteric liquid crystals that can maintain their optical properties when bent. The liquid crystal layers are engineered to be extremely thin and are sandwiched between flexible electrode layers. Special alignment techniques ensure that the liquid crystal molecules maintain proper orientation even when the display is flexed, preserving image quality and response time across the curved surface.

02 OLED technology for flexible displays

Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin and flexible structure. OLED displays consist of organic compounds that emit light when electricity is applied, eliminating the need for backlighting. This technology allows for ultra-thin display constructions that can conform to curved surfaces. The self-emissive nature of OLEDs provides excellent contrast ratios and color reproduction even when the display is flexed or bent.Expand Specific Solutions03 Optical systems for flexible microdisplays

Specialized optical systems are developed for flexible microdisplays to maintain image quality during bending or flexing. These systems include flexible lenses, mirrors, and light guides that can change shape without distorting the displayed image. Advanced optical designs compensate for changes in viewing angles and distances that occur when the display is flexed. Some systems incorporate micro-lens arrays that help maintain focus and brightness uniformity across the curved display surface.Expand Specific Solutions04 Touch and interface technologies for flexible displays

Touch sensing and user interface technologies for flexible microdisplays require special considerations to function properly when bent or flexed. These include stretchable touch sensors, flexible circuit connections, and deformation-resistant electrode patterns. Some designs incorporate strain gauges or other sensors to detect the degree of bending, allowing the system to adjust the display output accordingly. Multi-touch capabilities are maintained through specialized algorithms that account for the changing geometry of the display surface.Expand Specific Solutions05 Liquid crystal technologies for flexible displays

Adaptations of liquid crystal display (LCD) technology for flexible applications involve specialized formulations of liquid crystal materials that maintain proper alignment when bent. These displays use flexible polarizers and thin-film transistor arrays that can withstand repeated flexing without degradation. Some designs incorporate micro-encapsulated liquid crystals or polymer-dispersed liquid crystal technologies that are inherently more flexible than traditional LCD structures. Specialized manufacturing processes ensure uniform cell gaps even when the display is not flat.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The flexible microdisplay market is currently in a growth phase, with increasing integration into connected devices driving innovation across multiple sectors. The market size is expanding rapidly as applications diversify beyond traditional consumer electronics into wearables, automotive displays, and healthcare devices. Technologically, the field shows varying maturity levels, with established players like Samsung Electronics, LG Display, and BOE Technology leading commercial deployment through significant R&D investments. Japan Display and Sharp are advancing OLED microdisplay technologies, while companies like Flexterra are developing next-generation flexible transistor technologies. Tianma Microelectronics and Everdisplay Optronics are emerging as strong competitors in the AMOLED segment. The competitive landscape is characterized by strategic partnerships between display manufacturers and device makers to accelerate adoption and overcome technical challenges in flexibility, durability, and power efficiency.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered flexible microdisplay technology through their AMOLED (Active Matrix Organic Light Emitting Diode) displays. Their approach integrates ultra-thin film transistors on plastic substrates rather than traditional glass, enabling displays that can bend, fold, and even roll. Samsung's Infinity Flex Display technology specifically addresses connected device integration by incorporating a polyimide layer instead of glass cover, reducing thickness to less than 50 micrometers while maintaining durability. Their Y-OCTA (Youm On-Cell Touch AMOLED) technology directly attaches the touch sensor to the display panel, eliminating additional layers and further enhancing flexibility. For connected devices, Samsung has developed specialized low-power display modes that can maintain connectivity information while consuming minimal energy, extending battery life in wearables and IoT devices.

Strengths: Industry-leading production capacity and vertical integration from components to finished products; proprietary flexible display technologies with proven commercial applications; extensive IP portfolio. Weaknesses: Higher production costs compared to conventional displays; limited flexibility radius in current commercial implementations; technology primarily optimized for consumer electronics rather than industrial IoT applications.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed flexible OLED microdisplay technology specifically optimized for connected device ecosystems. Their approach utilizes ultra-thin glass substrates (UTG) with thickness below 30 micrometers, combined with specialized encapsulation techniques that maintain flexibility while providing superior moisture and oxygen barrier properties. BOE's flexible displays incorporate their proprietary MLED (Micro Light Emitting Diode) technology, which enables higher pixel density (over 1000 PPI) while maintaining flexibility - critical for small form factor connected devices like smart wearables. Their displays feature integrated touch and biometric sensing capabilities directly within the display structure, eliminating the need for separate sensor layers and reducing overall thickness. For IoT applications, BOE has developed specialized low-temperature polysilicon (LTPS) backplanes that can operate efficiently at temperatures ranging from -40°C to 85°C, making them suitable for industrial connected devices in harsh environments.

Strengths: Cost-effective manufacturing at scale; strong position in mid-range device market; rapidly expanding IP portfolio in flexible display technologies; diverse product portfolio spanning multiple industries. Weaknesses: Still catching up to Samsung and LG in ultimate flexibility performance; less vertical integration compared to competitors; more focused on display components than complete connected device solutions.

Critical Patents and Innovations in Flexible Display Technology

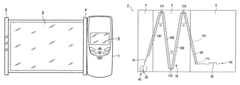

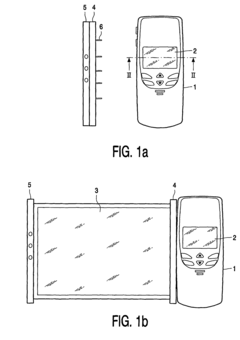

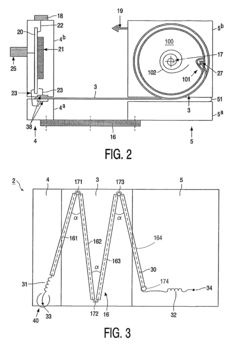

Display device and electronic appliance for use in combination therewith

PatentInactiveUS8096068B2

Innovation

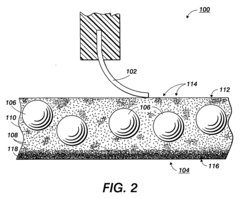

- The implementation of extending means that counteract the display's tendency to return to its rolled-up position, utilizing elastic forces from springs, piezoelectric elements, or gas pressure to maintain balance and stability, allowing for easier extension and retraction, and optionally incorporating locking mechanisms and reading means to control image display based on extension position.

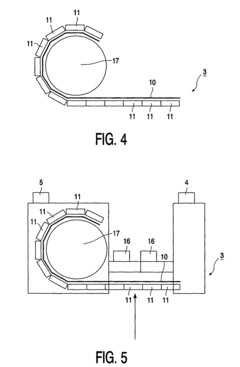

Flexible display system

PatentInactiveUS20060132427A1

Innovation

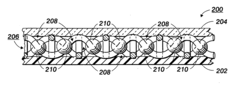

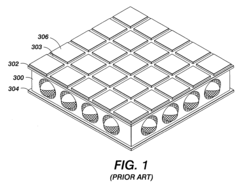

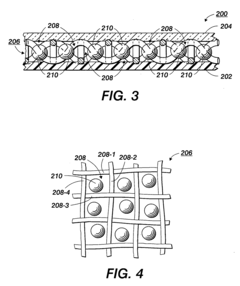

- A three-layer flexible display system comprising a heat-sealable first encapsulating layer, a conductive mesh layer, and a second encapsulating layer, where the mesh layer forms micro-cells to house display elements and functions as an electrical grid for individual addressing, eliminating the need for external addressing devices.

Supply Chain and Manufacturing Considerations

The manufacturing ecosystem for flexible microdisplays represents a complex network of specialized processes and materials that significantly impact the adoption trajectory of these technologies in connected devices. Current supply chain structures are primarily concentrated in East Asia, with key manufacturing hubs in South Korea, Japan, Taiwan, and increasingly mainland China. This geographic concentration creates both efficiencies through regional specialization and vulnerabilities through supply chain concentration risks, as demonstrated during recent global disruptions.

Material sourcing presents particular challenges for flexible display manufacturing. The production requires specialized substrates such as polyimide films, transparent conductive materials like indium tin oxide (ITO) or newer alternatives such as silver nanowires, and advanced organic light-emitting materials. Many of these materials have limited supplier bases, creating potential bottlenecks in scaling production. The semiconductor components that drive these displays face similar supply constraints, particularly as demand increases across multiple technology sectors.

Manufacturing processes for flexible microdisplays involve highly specialized equipment and techniques that differ substantially from traditional rigid display production. Key processes include roll-to-roll manufacturing capabilities, thin-film encapsulation technologies, and precision deposition systems that can maintain performance while accommodating substrate flexibility. The capital expenditure required to establish these manufacturing capabilities represents a significant barrier to entry, contributing to market concentration among established players.

Yield management remains a critical challenge in flexible display manufacturing, with current industry yields for cutting-edge flexible displays typically 15-25% lower than for equivalent rigid displays. This yield gap directly impacts production costs and ultimately affects market pricing and adoption rates. Industry leaders are investing heavily in process optimization and quality control systems to address these yield challenges, with incremental improvements observed annually.

Quality control presents unique challenges for flexible displays, requiring specialized testing equipment that can evaluate performance under various bending conditions and environmental stresses. The development of standardized testing protocols remains an evolving area, with industry consortia working to establish common standards that can facilitate supply chain integration and quality assurance.

Scaling considerations will significantly impact the future availability and cost structure of flexible microdisplays. Current manufacturing capacity is limited relative to potential demand across multiple connected device categories. Industry forecasts suggest that manufacturing capacity investments of $15-20 billion will be required over the next five years to meet projected demand growth, with particular emphasis on facilities capable of producing higher-resolution, smaller-form-factor displays suitable for AR/VR applications and next-generation wearables.

Material sourcing presents particular challenges for flexible display manufacturing. The production requires specialized substrates such as polyimide films, transparent conductive materials like indium tin oxide (ITO) or newer alternatives such as silver nanowires, and advanced organic light-emitting materials. Many of these materials have limited supplier bases, creating potential bottlenecks in scaling production. The semiconductor components that drive these displays face similar supply constraints, particularly as demand increases across multiple technology sectors.

Manufacturing processes for flexible microdisplays involve highly specialized equipment and techniques that differ substantially from traditional rigid display production. Key processes include roll-to-roll manufacturing capabilities, thin-film encapsulation technologies, and precision deposition systems that can maintain performance while accommodating substrate flexibility. The capital expenditure required to establish these manufacturing capabilities represents a significant barrier to entry, contributing to market concentration among established players.

Yield management remains a critical challenge in flexible display manufacturing, with current industry yields for cutting-edge flexible displays typically 15-25% lower than for equivalent rigid displays. This yield gap directly impacts production costs and ultimately affects market pricing and adoption rates. Industry leaders are investing heavily in process optimization and quality control systems to address these yield challenges, with incremental improvements observed annually.

Quality control presents unique challenges for flexible displays, requiring specialized testing equipment that can evaluate performance under various bending conditions and environmental stresses. The development of standardized testing protocols remains an evolving area, with industry consortia working to establish common standards that can facilitate supply chain integration and quality assurance.

Scaling considerations will significantly impact the future availability and cost structure of flexible microdisplays. Current manufacturing capacity is limited relative to potential demand across multiple connected device categories. Industry forecasts suggest that manufacturing capacity investments of $15-20 billion will be required over the next five years to meet projected demand growth, with particular emphasis on facilities capable of producing higher-resolution, smaller-form-factor displays suitable for AR/VR applications and next-generation wearables.

Energy Efficiency and Sustainability Impact

The energy efficiency of flexible microdisplays represents a critical factor in their widespread adoption across connected device ecosystems. Current flexible display technologies demonstrate significant improvements in power consumption compared to their rigid counterparts, with OLED-based flexible displays consuming approximately 30-40% less energy than traditional LCD displays when displaying darker content. This efficiency stems from their selective pixel illumination capability, where only active pixels consume power.

Manufacturing processes for flexible displays are evolving toward more sustainable practices. Recent innovations in production techniques have reduced hazardous chemical usage by up to 25% compared to conventional display manufacturing. Additionally, the transition from glass to plastic substrates has decreased the carbon footprint of display production by approximately 15-20%, primarily due to reduced energy requirements during manufacturing and transportation.

The extended lifecycle potential of flexible displays contributes substantially to their sustainability profile. Laboratory testing indicates that properly engineered flexible displays can withstand over 200,000 folding cycles without significant degradation, potentially extending device lifespans by 2-3 years compared to devices with rigid displays that may become obsolete due to physical damage or design limitations. This longevity directly translates to reduced electronic waste generation.

Flexible microdisplays enable more efficient device designs that optimize battery usage across the entire system. The integration of these displays allows for 15-30% smaller battery requirements while maintaining equivalent usage times, reducing both resource consumption and device weight. Furthermore, their adaptability to various form factors facilitates the development of energy-harvesting capabilities, with prototypes demonstrating the ability to supplement power needs through ambient light or mechanical movement energy capture.

The end-of-life considerations for flexible display technologies present both challenges and opportunities. While the composite materials used in these displays can complicate recycling processes, research indicates that advanced separation techniques can recover up to 80% of valuable materials. Several manufacturers have implemented take-back programs specifically designed for flexible display devices, contributing to circular economy principles.

Looking forward, emerging technologies such as self-healing materials and biodegradable substrates promise to further enhance the sustainability profile of flexible microdisplays. These innovations could potentially reduce replacement frequency and environmental impact, with preliminary research suggesting biodegradable components could decompose within 3-5 years under controlled conditions, compared to decades for conventional electronic components.

Manufacturing processes for flexible displays are evolving toward more sustainable practices. Recent innovations in production techniques have reduced hazardous chemical usage by up to 25% compared to conventional display manufacturing. Additionally, the transition from glass to plastic substrates has decreased the carbon footprint of display production by approximately 15-20%, primarily due to reduced energy requirements during manufacturing and transportation.

The extended lifecycle potential of flexible displays contributes substantially to their sustainability profile. Laboratory testing indicates that properly engineered flexible displays can withstand over 200,000 folding cycles without significant degradation, potentially extending device lifespans by 2-3 years compared to devices with rigid displays that may become obsolete due to physical damage or design limitations. This longevity directly translates to reduced electronic waste generation.

Flexible microdisplays enable more efficient device designs that optimize battery usage across the entire system. The integration of these displays allows for 15-30% smaller battery requirements while maintaining equivalent usage times, reducing both resource consumption and device weight. Furthermore, their adaptability to various form factors facilitates the development of energy-harvesting capabilities, with prototypes demonstrating the ability to supplement power needs through ambient light or mechanical movement energy capture.

The end-of-life considerations for flexible display technologies present both challenges and opportunities. While the composite materials used in these displays can complicate recycling processes, research indicates that advanced separation techniques can recover up to 80% of valuable materials. Several manufacturers have implemented take-back programs specifically designed for flexible display devices, contributing to circular economy principles.

Looking forward, emerging technologies such as self-healing materials and biodegradable substrates promise to further enhance the sustainability profile of flexible microdisplays. These innovations could potentially reduce replacement frequency and environmental impact, with preliminary research suggesting biodegradable components could decompose within 3-5 years under controlled conditions, compared to decades for conventional electronic components.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!