Impact of Coating Techniques on Flexible Microdisplay Durability

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Coating Evolution and Objectives

Flexible microdisplay technology has evolved significantly over the past two decades, transitioning from rigid glass-based displays to highly flexible polymer substrates. This evolution has been driven by increasing demand for wearable devices, foldable smartphones, and other applications requiring displays that can withstand repeated bending and folding without performance degradation. The coating techniques applied to these displays have played a crucial role in determining their durability and longevity.

Early coating methods for flexible displays in the early 2000s primarily focused on basic barrier films to prevent moisture ingress. These initial approaches provided minimal protection against mechanical stress and environmental factors, resulting in displays with limited flexibility and durability. The introduction of multi-layer barrier coatings around 2005-2010 marked a significant advancement, allowing for improved moisture resistance while maintaining some degree of flexibility.

The period between 2010 and 2015 saw the development of hybrid organic-inorganic coating systems that offered superior barrier properties while accommodating mechanical deformation. These coatings typically consisted of alternating layers of inorganic materials (such as silicon oxide or aluminum oxide) and organic polymers, creating a tortuous path for moisture and oxygen penetration while maintaining flexibility.

Recent advancements have focused on nanocomposite coatings that incorporate functional nanoparticles to enhance specific properties such as scratch resistance, anti-reflection, and self-healing capabilities. These advanced coating systems aim to address the multifaceted challenges faced by flexible microdisplays, including mechanical stress, environmental exposure, and daily wear and tear.

The primary objective of current coating technology research is to develop solutions that can simultaneously address multiple durability challenges while maintaining optical clarity and touch functionality. Specifically, researchers aim to create coating systems that can withstand at least 200,000 folding cycles without visible degradation, provide effective barrier properties against moisture and oxygen (water vapor transmission rate below 10^-6 g/m²/day), and resist scratches from everyday use.

Another critical objective is to develop coating techniques that are compatible with high-volume manufacturing processes, as current advanced coating methods often require specialized equipment and controlled environments that limit scalability. The industry is actively pursuing roll-to-roll compatible coating technologies that can be integrated into existing production lines without significant modifications.

Looking forward, the field aims to develop "smart" coating systems that can adapt to environmental conditions or self-repair when damaged. These ambitious objectives represent the frontier of flexible microdisplay coating technology and will likely shape research directions for the next decade as the market for flexible display devices continues to expand across consumer electronics, medical devices, and industrial applications.

Early coating methods for flexible displays in the early 2000s primarily focused on basic barrier films to prevent moisture ingress. These initial approaches provided minimal protection against mechanical stress and environmental factors, resulting in displays with limited flexibility and durability. The introduction of multi-layer barrier coatings around 2005-2010 marked a significant advancement, allowing for improved moisture resistance while maintaining some degree of flexibility.

The period between 2010 and 2015 saw the development of hybrid organic-inorganic coating systems that offered superior barrier properties while accommodating mechanical deformation. These coatings typically consisted of alternating layers of inorganic materials (such as silicon oxide or aluminum oxide) and organic polymers, creating a tortuous path for moisture and oxygen penetration while maintaining flexibility.

Recent advancements have focused on nanocomposite coatings that incorporate functional nanoparticles to enhance specific properties such as scratch resistance, anti-reflection, and self-healing capabilities. These advanced coating systems aim to address the multifaceted challenges faced by flexible microdisplays, including mechanical stress, environmental exposure, and daily wear and tear.

The primary objective of current coating technology research is to develop solutions that can simultaneously address multiple durability challenges while maintaining optical clarity and touch functionality. Specifically, researchers aim to create coating systems that can withstand at least 200,000 folding cycles without visible degradation, provide effective barrier properties against moisture and oxygen (water vapor transmission rate below 10^-6 g/m²/day), and resist scratches from everyday use.

Another critical objective is to develop coating techniques that are compatible with high-volume manufacturing processes, as current advanced coating methods often require specialized equipment and controlled environments that limit scalability. The industry is actively pursuing roll-to-roll compatible coating technologies that can be integrated into existing production lines without significant modifications.

Looking forward, the field aims to develop "smart" coating systems that can adapt to environmental conditions or self-repair when damaged. These ambitious objectives represent the frontier of flexible microdisplay coating technology and will likely shape research directions for the next decade as the market for flexible display devices continues to expand across consumer electronics, medical devices, and industrial applications.

Market Demand Analysis for Durable Flexible Displays

The flexible display market has witnessed remarkable growth in recent years, driven by increasing consumer demand for portable, lightweight, and durable electronic devices. According to industry reports, the global flexible display market is projected to reach $42 billion by 2026, with a compound annual growth rate of 28% from 2021. This substantial growth underscores the significant market potential for durable flexible microdisplays across various sectors.

Consumer electronics represents the largest application segment, with smartphones and wearable devices leading the demand. Major smartphone manufacturers have already incorporated flexible displays in their premium models, creating a ripple effect throughout the industry. The wearable technology sector, including smartwatches and fitness trackers, has emerged as another significant driver, valuing durability as a critical factor in product development.

Market research indicates that durability remains a primary concern for end-users, with 78% of consumers citing screen durability as a decisive factor in purchasing decisions. This consumer preference has intensified competition among manufacturers to develop more resilient flexible display technologies, particularly focusing on advanced coating techniques that enhance longevity while maintaining optical performance.

The automotive industry presents another expanding market for durable flexible displays, with applications in dashboard systems, heads-up displays, and entertainment consoles. Industry analysts predict that by 2025, over 60% of premium vehicles will incorporate some form of flexible display technology, creating substantial demand for highly durable solutions capable of withstanding automotive environmental conditions.

Healthcare and military sectors are emerging as high-value niche markets, where extreme durability requirements drive premium pricing strategies. Medical devices utilizing flexible displays must withstand sterilization processes and frequent cleaning, while military applications demand resistance to harsh environmental conditions, including temperature extremes and impact resistance.

Regional analysis reveals Asia-Pacific as the dominant market for flexible display technologies, accounting for approximately 45% of global demand. This regional concentration aligns with the presence of major display manufacturers and electronics production facilities. However, North America and Europe show the fastest growth rates in adopting premium durable display solutions, particularly in automotive and healthcare applications.

Market surveys consistently highlight that consumers are willing to pay a premium of 15-20% for devices with demonstrably more durable displays, creating significant revenue opportunities for manufacturers who can effectively address durability challenges through innovative coating techniques. This price elasticity underscores the commercial viability of investing in advanced coating research and development.

Consumer electronics represents the largest application segment, with smartphones and wearable devices leading the demand. Major smartphone manufacturers have already incorporated flexible displays in their premium models, creating a ripple effect throughout the industry. The wearable technology sector, including smartwatches and fitness trackers, has emerged as another significant driver, valuing durability as a critical factor in product development.

Market research indicates that durability remains a primary concern for end-users, with 78% of consumers citing screen durability as a decisive factor in purchasing decisions. This consumer preference has intensified competition among manufacturers to develop more resilient flexible display technologies, particularly focusing on advanced coating techniques that enhance longevity while maintaining optical performance.

The automotive industry presents another expanding market for durable flexible displays, with applications in dashboard systems, heads-up displays, and entertainment consoles. Industry analysts predict that by 2025, over 60% of premium vehicles will incorporate some form of flexible display technology, creating substantial demand for highly durable solutions capable of withstanding automotive environmental conditions.

Healthcare and military sectors are emerging as high-value niche markets, where extreme durability requirements drive premium pricing strategies. Medical devices utilizing flexible displays must withstand sterilization processes and frequent cleaning, while military applications demand resistance to harsh environmental conditions, including temperature extremes and impact resistance.

Regional analysis reveals Asia-Pacific as the dominant market for flexible display technologies, accounting for approximately 45% of global demand. This regional concentration aligns with the presence of major display manufacturers and electronics production facilities. However, North America and Europe show the fastest growth rates in adopting premium durable display solutions, particularly in automotive and healthcare applications.

Market surveys consistently highlight that consumers are willing to pay a premium of 15-20% for devices with demonstrably more durable displays, creating significant revenue opportunities for manufacturers who can effectively address durability challenges through innovative coating techniques. This price elasticity underscores the commercial viability of investing in advanced coating research and development.

Current Coating Technologies and Technical Barriers

The flexible microdisplay industry currently employs several advanced coating technologies, each with specific advantages and limitations. Physical Vapor Deposition (PVD) remains one of the most widely used techniques, offering excellent uniformity and precise thickness control. Within PVD, magnetron sputtering has gained prominence for barrier layers due to its ability to create dense films with good adhesion properties. However, PVD processes typically require high vacuum conditions and elevated temperatures, which can potentially damage temperature-sensitive flexible substrates.

Chemical Vapor Deposition (CVD) techniques, particularly Plasma-Enhanced CVD (PECVD), have become essential for depositing silicon nitride and silicon oxide layers that serve as effective moisture barriers. PECVD operates at lower temperatures than traditional CVD, making it more compatible with flexible substrates, though plasma damage remains a concern for sensitive organic materials used in flexible displays.

Atomic Layer Deposition (ALD) represents the cutting edge for ultra-thin barrier coatings, providing exceptional conformality and precise thickness control at the atomic scale. ALD can create highly effective moisture barriers even at thicknesses below 100 nm, but its inherently slow deposition rate significantly impacts manufacturing throughput and increases production costs.

Solution-based coating methods such as slot-die coating and inkjet printing offer advantages in scalability and cost-effectiveness. These techniques are particularly valuable for depositing organic materials and certain functional layers. However, they often struggle with achieving the uniformity and defect control necessary for critical barrier layers.

Despite these technological advances, significant barriers persist in coating technology for flexible microdisplays. The "pinhole problem" remains perhaps the most challenging technical barrier, where microscopic defects in barrier layers create pathways for moisture and oxygen penetration, dramatically reducing display lifetime. Even a single pinhole per square centimeter can compromise the entire barrier system.

The mechanical durability of coatings under repeated bending and folding represents another major challenge. Inorganic barrier layers, while excellent against moisture permeation, tend to crack under mechanical stress, creating new pathways for contaminant ingress. This has led to the development of hybrid organic-inorganic multilayer structures, though these add complexity to manufacturing processes.

Interface adhesion between dissimilar materials presents another significant barrier, particularly at the junction between rigid inorganic barriers and flexible organic substrates. Delamination during bending cycles remains a persistent failure mode that significantly impacts display durability.

Chemical Vapor Deposition (CVD) techniques, particularly Plasma-Enhanced CVD (PECVD), have become essential for depositing silicon nitride and silicon oxide layers that serve as effective moisture barriers. PECVD operates at lower temperatures than traditional CVD, making it more compatible with flexible substrates, though plasma damage remains a concern for sensitive organic materials used in flexible displays.

Atomic Layer Deposition (ALD) represents the cutting edge for ultra-thin barrier coatings, providing exceptional conformality and precise thickness control at the atomic scale. ALD can create highly effective moisture barriers even at thicknesses below 100 nm, but its inherently slow deposition rate significantly impacts manufacturing throughput and increases production costs.

Solution-based coating methods such as slot-die coating and inkjet printing offer advantages in scalability and cost-effectiveness. These techniques are particularly valuable for depositing organic materials and certain functional layers. However, they often struggle with achieving the uniformity and defect control necessary for critical barrier layers.

Despite these technological advances, significant barriers persist in coating technology for flexible microdisplays. The "pinhole problem" remains perhaps the most challenging technical barrier, where microscopic defects in barrier layers create pathways for moisture and oxygen penetration, dramatically reducing display lifetime. Even a single pinhole per square centimeter can compromise the entire barrier system.

The mechanical durability of coatings under repeated bending and folding represents another major challenge. Inorganic barrier layers, while excellent against moisture permeation, tend to crack under mechanical stress, creating new pathways for contaminant ingress. This has led to the development of hybrid organic-inorganic multilayer structures, though these add complexity to manufacturing processes.

Interface adhesion between dissimilar materials presents another significant barrier, particularly at the junction between rigid inorganic barriers and flexible organic substrates. Delamination during bending cycles remains a persistent failure mode that significantly impacts display durability.

Existing Coating Solutions for Microdisplay Protection

01 Protective coating materials for flexible displays

Various materials can be used as protective coatings for flexible microdisplays to enhance durability. These include specialized polymers, hardcoats, and composite materials that provide resistance to scratches, impacts, and environmental factors while maintaining the flexibility of the display. These coatings can be applied in thin layers to preserve the optical properties and flexibility of the underlying display while significantly improving its resistance to physical damage and wear.- Protective coating materials for flexible displays: Various materials can be used as protective coatings for flexible microdisplays to enhance durability. These include specialized polymers, hardcoats, and composite materials that provide resistance to scratches, impacts, and environmental factors while maintaining the flexibility of the display. These coatings can be formulated to offer optimal balance between protection and flexibility, ensuring the longevity of the microdisplay under various usage conditions.

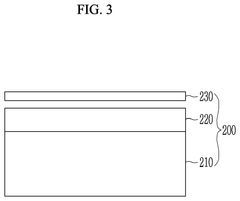

- Multi-layer coating techniques for enhanced durability: Multi-layer coating approaches can significantly improve the durability of flexible microdisplays. By applying sequential layers with different functional properties, manufacturers can create a comprehensive protection system. These layers may include adhesion promoters, barrier layers against moisture and oxygen, scratch-resistant layers, and anti-reflective coatings. The strategic combination of these layers provides superior protection while maintaining display performance and flexibility.

- Deposition techniques for uniform protective coatings: Various deposition methods can be employed to achieve uniform protective coatings on flexible microdisplays. These include physical vapor deposition, chemical vapor deposition, atomic layer deposition, and solution-based coating methods such as spin coating, dip coating, and spray coating. Each technique offers specific advantages in terms of coating uniformity, thickness control, and compatibility with different substrate materials, which are crucial for ensuring the durability of flexible displays.

- Edge sealing and encapsulation methods: Edge sealing and encapsulation techniques are critical for protecting flexible microdisplays from environmental factors such as moisture and oxygen. These methods involve creating a hermetic seal around the display components using specialized adhesives, frit glass, or laser welding techniques. Effective edge sealing prevents the ingress of contaminants that could degrade display performance and reduces mechanical stress at the edges, which are particularly vulnerable in flexible displays.

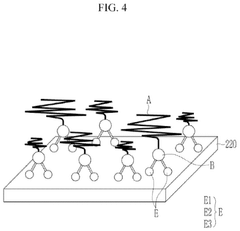

- Stress-relief structures and flexible substrate treatments: Implementing stress-relief structures and substrate treatments can significantly enhance the durability of flexible microdisplays. These include micro-patterning of substrates, incorporation of elastomeric interlayers, and specialized surface treatments that improve adhesion between layers. Such approaches help distribute mechanical stress during bending and folding operations, preventing delamination and cracking of coating layers and extending the operational lifetime of flexible displays.

02 Multi-layer coating techniques for enhanced protection

Multi-layer coating approaches involve applying several distinct functional layers to flexible microdisplays. Each layer serves a specific purpose, such as moisture barrier, scratch resistance, anti-reflection, or flexibility enhancement. The combination of these layers creates a comprehensive protection system that addresses multiple durability concerns simultaneously. The thickness and composition of each layer can be precisely controlled to optimize the balance between protection and flexibility.Expand Specific Solutions03 Vacuum deposition and sputtering techniques

Vacuum deposition and sputtering are advanced coating techniques that enable the application of extremely thin, uniform protective layers on flexible microdisplays. These methods involve depositing materials in a vacuum environment, allowing for precise control over coating thickness and composition. The resulting coatings provide excellent adhesion, optical clarity, and durability while maintaining the flexibility of the display. These techniques are particularly suitable for applying inorganic protective materials like metal oxides.Expand Specific Solutions04 Flexible encapsulation methods

Encapsulation techniques involve completely sealing the flexible display components to protect them from environmental factors such as moisture, oxygen, and contaminants. Advanced flexible encapsulation methods use thin-film barriers, edge sealing technologies, and specialized adhesives that can bend without compromising the protective seal. These methods significantly extend the lifespan of flexible displays by preventing degradation of sensitive electronic components while maintaining the display's flexibility.Expand Specific Solutions05 Self-healing coating technologies

Self-healing coatings represent an innovative approach to flexible display protection, incorporating materials that can repair minor scratches and damage automatically. These coatings contain special polymers or microcapsules that release healing agents when damaged, restoring the protective surface. This technology is particularly valuable for flexible displays that experience frequent bending and folding, as it provides ongoing protection against the accumulation of minor damage that could otherwise compromise display performance over time.Expand Specific Solutions

Leading Companies in Flexible Display Coating Industry

The flexible microdisplay coating techniques market is currently in a growth phase, with increasing demand driven by wearable technology and AR/VR applications. Market size is projected to expand significantly as consumer electronics manufacturers seek more durable display solutions. Technologically, the field remains moderately mature with ongoing innovation. Samsung Electronics and LG Display lead with advanced coating technologies for OLED flexible displays, while BOE Technology and Japan Display are rapidly advancing their capabilities. Emerging players like Tianma Microelectronics and Semiconductor Energy Laboratory are developing specialized coating solutions focusing on durability enhancement. Applied Materials provides critical manufacturing equipment, creating a competitive ecosystem where durability improvements represent a key differentiator in this evolving market.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed advanced multi-layer coating techniques specifically for flexible microdisplays that incorporate a combination of hard coating and self-healing materials. Their proprietary "Flex Shield" technology uses a multi-functional coating system with inorganic-organic hybrid materials that provides exceptional scratch resistance while maintaining flexibility. The process involves atomic layer deposition (ALD) to create ultra-thin barrier films that protect against oxygen and moisture penetration, critical for OLED longevity. Samsung's coating technique includes a specialized siloxane-based top layer that can withstand over 200,000 folding cycles without significant degradation in optical properties. Their process also incorporates nanoparticle reinforcement in the polymer matrix to enhance mechanical durability while maintaining transparency above 95%. Recent innovations include temperature-adaptive coating materials that adjust their mechanical properties based on environmental conditions to prevent cracking during extreme temperature fluctuations.

Strengths: Industry-leading folding durability with self-healing capabilities that can repair minor scratches; excellent barrier properties against environmental contaminants; maintains high transparency even after repeated folding. Weaknesses: Higher manufacturing costs compared to conventional coating methods; requires specialized equipment for precise layer deposition; slightly increased thickness that may affect overall device flexibility in ultra-thin applications.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has pioneered a unique "Flexible Armor" coating system specifically engineered for microdisplay applications in foldable and rollable devices. Their approach utilizes a gradient hardness coating structure where multiple layers with varying mechanical properties are sequentially applied to distribute stress and prevent coating failure during bending. The innermost layer features a highly elastic polymer base that bonds directly to the display substrate, while intermediate layers incorporate nano-ceramic particles for enhanced scratch resistance. BOE's proprietary vacuum deposition process creates ultra-thin (sub-micron) barrier layers that effectively block water vapor transmission to less than 10^-6 g/m²/day, significantly extending OLED lifetime in flexible applications. Their most recent innovation incorporates photocurable resins with tunable hardness that are cured using a proprietary UV patterning technique, allowing different regions of the display to have optimized mechanical properties based on expected stress distribution. This approach has demonstrated a 40% improvement in coating durability compared to uniform hardness systems when subjected to repeated folding tests.

Strengths: Gradient hardness approach effectively distributes mechanical stress during folding; excellent moisture barrier properties; regional optimization of coating properties for different functional areas of the display. Weaknesses: Complex multi-step manufacturing process increases production time; requires precise control of material interfaces to prevent delamination; slightly lower initial hardness compared to rigid display coatings.

Key Innovations in Flexible Display Coating Patents

Coating composition, display device including coating layer, and manufacturing method of display device

PatentActiveUS12104032B2

Innovation

- A coating composition comprising compounds with different molecular weights of a perfluoropolyether group, combined in specific weight ratios, is applied to form an anti-fingerprint layer that enhances wear resistance and adhesion to a hard coating layer, improving the anti-fingerprint characteristics and chemical resistance of the display device.

Display device and electronic device comprising same

PatentPendingEP4474363A1

Innovation

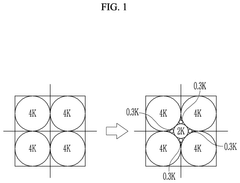

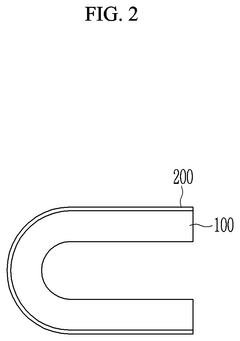

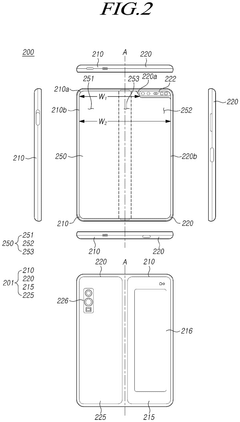

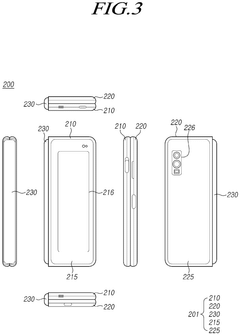

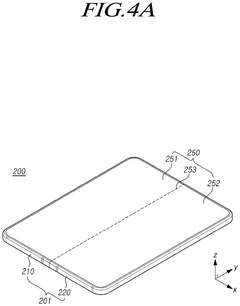

- A window configuration for flexible display devices is implemented, featuring a base layer with a first hard coating layer having coating portions of different hardnesses, where the thickness of the coating layer is greater in flat areas than in bending areas, enhancing both bending performance and impact resistance.

Environmental Impact of Coating Materials

The environmental impact of coating materials used in flexible microdisplay manufacturing represents a critical consideration in the sustainable development of this technology. Traditional coating processes often involve volatile organic compounds (VOCs) and hazardous air pollutants that pose significant environmental risks. These substances contribute to air pollution, ozone depletion, and can contaminate water systems when improperly disposed of. Recent studies indicate that approximately 30% of emissions from electronics manufacturing facilities stem from coating operations, highlighting the urgent need for environmentally responsible alternatives.

Water-based coating systems have emerged as promising alternatives, reducing VOC emissions by up to 80% compared to solvent-based counterparts. However, these systems typically require higher energy consumption during the drying process, creating a different environmental trade-off that manufacturers must carefully evaluate. The energy footprint of various coating techniques varies significantly, with vacuum deposition methods consuming 3-5 times more energy than solution-based approaches, despite their superior performance characteristics.

Life cycle assessment (LCA) studies of coating materials reveal that fluorinated compounds, while offering excellent durability and water resistance for flexible displays, persist in the environment for decades and bioaccumulate in living organisms. Silicon-based alternatives demonstrate a 40% lower environmental impact across their lifecycle, though they may not match the performance metrics of fluorinated options in all applications.

Regulatory frameworks worldwide are increasingly restricting the use of environmentally harmful coating materials. The European Union's REACH regulation has already placed limitations on several compounds commonly used in display coatings, while similar restrictions are emerging in North America and Asia. This regulatory landscape is accelerating industry transition toward greener alternatives, with compliance becoming a competitive necessity rather than an optional consideration.

Recycling and end-of-life management present particular challenges for coated flexible displays. The multi-layer nature of these devices, combined with specialized coating materials, often complicates separation processes and reduces recyclability. Innovative approaches such as designed-for-disassembly coatings and biodegradable protective layers are being explored, though these solutions currently represent less than 5% of the market.

Recent innovations in bio-based coating materials derived from renewable resources show promise for reducing environmental impact while maintaining performance requirements. These materials can reduce carbon footprint by 25-60% compared to petroleum-based alternatives, depending on processing methods and application techniques. However, scalability and cost considerations remain significant barriers to widespread adoption in commercial flexible microdisplay manufacturing.

Water-based coating systems have emerged as promising alternatives, reducing VOC emissions by up to 80% compared to solvent-based counterparts. However, these systems typically require higher energy consumption during the drying process, creating a different environmental trade-off that manufacturers must carefully evaluate. The energy footprint of various coating techniques varies significantly, with vacuum deposition methods consuming 3-5 times more energy than solution-based approaches, despite their superior performance characteristics.

Life cycle assessment (LCA) studies of coating materials reveal that fluorinated compounds, while offering excellent durability and water resistance for flexible displays, persist in the environment for decades and bioaccumulate in living organisms. Silicon-based alternatives demonstrate a 40% lower environmental impact across their lifecycle, though they may not match the performance metrics of fluorinated options in all applications.

Regulatory frameworks worldwide are increasingly restricting the use of environmentally harmful coating materials. The European Union's REACH regulation has already placed limitations on several compounds commonly used in display coatings, while similar restrictions are emerging in North America and Asia. This regulatory landscape is accelerating industry transition toward greener alternatives, with compliance becoming a competitive necessity rather than an optional consideration.

Recycling and end-of-life management present particular challenges for coated flexible displays. The multi-layer nature of these devices, combined with specialized coating materials, often complicates separation processes and reduces recyclability. Innovative approaches such as designed-for-disassembly coatings and biodegradable protective layers are being explored, though these solutions currently represent less than 5% of the market.

Recent innovations in bio-based coating materials derived from renewable resources show promise for reducing environmental impact while maintaining performance requirements. These materials can reduce carbon footprint by 25-60% compared to petroleum-based alternatives, depending on processing methods and application techniques. However, scalability and cost considerations remain significant barriers to widespread adoption in commercial flexible microdisplay manufacturing.

Manufacturing Scalability Challenges

The scaling of coating techniques for flexible microdisplays presents significant manufacturing challenges that must be addressed to achieve commercial viability. Current laboratory-scale coating processes often fail to translate effectively to mass production environments, creating bottlenecks in the manufacturing pipeline. The precision required for nanometer-thick coatings becomes increasingly difficult to maintain when production volumes increase, leading to higher defect rates and yield issues.

Equipment compatibility represents another major hurdle in scaling production. Many specialized coating techniques require custom-built equipment that lacks standardization across the industry. This incompatibility creates integration difficulties when attempting to incorporate coating processes into existing manufacturing lines, often necessitating costly retrofitting or complete production line redesigns.

Process consistency across large substrate areas remains problematic for flexible microdisplay manufacturing. Edge effects, coating thickness variations, and material distribution inconsistencies become more pronounced as substrate dimensions increase. These variations directly impact display performance metrics such as brightness uniformity and pixel response consistency, which are critical quality parameters for consumer-grade products.

The time-intensive nature of certain advanced coating techniques further complicates scalability. Multi-layer coating systems that require precise curing or treatment between layers create production bottlenecks that limit throughput. Vacuum-based coating methods, while offering excellent quality, typically have longer cycle times compared to atmospheric processes, creating additional constraints on production capacity.

Material waste management presents both economic and environmental challenges in scaled production. High-precision coating techniques often utilize expensive materials with significant overspray or excess application that cannot be easily recovered. As production volumes increase, this waste becomes increasingly costly and environmentally problematic, necessitating the development of more efficient material delivery systems or alternative coating approaches.

Quality control methodologies must also evolve to accommodate high-volume production. In-line inspection techniques capable of detecting nanoscale defects at production speeds remain underdeveloped, creating quality assurance challenges. The correlation between coating defects and long-term durability performance is not always immediately apparent, requiring sophisticated testing protocols that may not be feasible in high-throughput manufacturing environments.

Equipment compatibility represents another major hurdle in scaling production. Many specialized coating techniques require custom-built equipment that lacks standardization across the industry. This incompatibility creates integration difficulties when attempting to incorporate coating processes into existing manufacturing lines, often necessitating costly retrofitting or complete production line redesigns.

Process consistency across large substrate areas remains problematic for flexible microdisplay manufacturing. Edge effects, coating thickness variations, and material distribution inconsistencies become more pronounced as substrate dimensions increase. These variations directly impact display performance metrics such as brightness uniformity and pixel response consistency, which are critical quality parameters for consumer-grade products.

The time-intensive nature of certain advanced coating techniques further complicates scalability. Multi-layer coating systems that require precise curing or treatment between layers create production bottlenecks that limit throughput. Vacuum-based coating methods, while offering excellent quality, typically have longer cycle times compared to atmospheric processes, creating additional constraints on production capacity.

Material waste management presents both economic and environmental challenges in scaled production. High-precision coating techniques often utilize expensive materials with significant overspray or excess application that cannot be easily recovered. As production volumes increase, this waste becomes increasingly costly and environmentally problematic, necessitating the development of more efficient material delivery systems or alternative coating approaches.

Quality control methodologies must also evolve to accommodate high-volume production. In-line inspection techniques capable of detecting nanoscale defects at production speeds remain underdeveloped, creating quality assurance challenges. The correlation between coating defects and long-term durability performance is not always immediately apparent, requiring sophisticated testing protocols that may not be feasible in high-throughput manufacturing environments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!