Evaluation of Flexible Microdisplay for Multifunctional Display Applications

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Technology Evolution and Objectives

Flexible microdisplay technology has evolved significantly over the past two decades, transitioning from rigid display paradigms to malleable form factors that enable unprecedented applications. The journey began with early experiments in organic light-emitting diode (OLED) technology in the early 2000s, which demonstrated the theoretical possibility of creating displays on non-rigid substrates. This fundamental breakthrough laid the groundwork for subsequent innovations in materials science and manufacturing processes.

By the mid-2010s, significant advancements in thin-film transistor (TFT) technology enabled the development of more robust flexible display prototypes with improved resolution and durability. The introduction of low-temperature polysilicon (LTPS) and oxide TFT technologies marked a critical turning point, allowing for higher electron mobility while maintaining flexibility. Concurrently, innovations in encapsulation techniques addressed the oxygen and moisture sensitivity issues that had previously limited the commercial viability of flexible displays.

Recent years have witnessed the emergence of microLED and quantum dot technologies as promising candidates for next-generation flexible microdisplays. These technologies offer superior brightness, energy efficiency, and color gamut compared to traditional OLED displays, while maintaining the mechanical flexibility required for novel form factors. The miniaturization of these display elements to the microscale represents a significant technical achievement that enables higher pixel densities in flexible formats.

The evolution trajectory points toward increasingly seamless integration of flexible microdisplays into multifunctional applications. Current research focuses on achieving higher resolutions (exceeding 1000 PPI), reducing power consumption, enhancing durability through advanced materials, and developing manufacturing processes suitable for mass production. Additionally, efforts are underway to improve the bending radius capabilities, with targets moving from the current 1-3mm toward sub-millimeter flexibility.

The primary objectives for flexible microdisplay technology development include achieving form factors that can conform to complex three-dimensional surfaces, enabling truly wearable display solutions that integrate naturally with the human body. This includes applications in augmented reality (AR) eyewear, medical devices, automotive heads-up displays, and smart textiles. Technical goals encompass not only display performance metrics but also mechanical resilience, with targets for withstanding thousands of folding cycles without degradation.

Another critical objective is the development of self-powered flexible displays through integration with energy harvesting technologies and ultra-low-power operation modes. This would eliminate the need for bulky batteries, further enhancing the potential for seamless integration into everyday objects and environments. The ultimate vision is to create "disappearing displays" that become virtually indistinguishable from conventional materials while providing dynamic visual information when needed.

By the mid-2010s, significant advancements in thin-film transistor (TFT) technology enabled the development of more robust flexible display prototypes with improved resolution and durability. The introduction of low-temperature polysilicon (LTPS) and oxide TFT technologies marked a critical turning point, allowing for higher electron mobility while maintaining flexibility. Concurrently, innovations in encapsulation techniques addressed the oxygen and moisture sensitivity issues that had previously limited the commercial viability of flexible displays.

Recent years have witnessed the emergence of microLED and quantum dot technologies as promising candidates for next-generation flexible microdisplays. These technologies offer superior brightness, energy efficiency, and color gamut compared to traditional OLED displays, while maintaining the mechanical flexibility required for novel form factors. The miniaturization of these display elements to the microscale represents a significant technical achievement that enables higher pixel densities in flexible formats.

The evolution trajectory points toward increasingly seamless integration of flexible microdisplays into multifunctional applications. Current research focuses on achieving higher resolutions (exceeding 1000 PPI), reducing power consumption, enhancing durability through advanced materials, and developing manufacturing processes suitable for mass production. Additionally, efforts are underway to improve the bending radius capabilities, with targets moving from the current 1-3mm toward sub-millimeter flexibility.

The primary objectives for flexible microdisplay technology development include achieving form factors that can conform to complex three-dimensional surfaces, enabling truly wearable display solutions that integrate naturally with the human body. This includes applications in augmented reality (AR) eyewear, medical devices, automotive heads-up displays, and smart textiles. Technical goals encompass not only display performance metrics but also mechanical resilience, with targets for withstanding thousands of folding cycles without degradation.

Another critical objective is the development of self-powered flexible displays through integration with energy harvesting technologies and ultra-low-power operation modes. This would eliminate the need for bulky batteries, further enhancing the potential for seamless integration into everyday objects and environments. The ultimate vision is to create "disappearing displays" that become virtually indistinguishable from conventional materials while providing dynamic visual information when needed.

Market Demand Analysis for Multifunctional Display Applications

The flexible microdisplay market is experiencing significant growth driven by increasing demand for multifunctional display applications across various industries. Current market research indicates that the global flexible display market is projected to reach $15.5 billion by 2026, with a compound annual growth rate (CAGR) of 35% from 2021. This remarkable growth trajectory is primarily fueled by the expanding applications in consumer electronics, automotive interfaces, medical devices, and wearable technology.

Consumer electronics represents the largest market segment, with smartphones and tablets incorporating flexible displays to enable foldable and rollable form factors. Market penetration of foldable smartphones has increased by 300% since 2020, demonstrating strong consumer acceptance of this technology. Industry analysts predict that by 2025, approximately 30% of premium smartphones will feature some form of flexible display technology.

The wearable technology sector presents another substantial growth opportunity for flexible microdisplays. The global smartwatch market alone is expected to reach $96 billion by 2027, with flexible displays becoming a key differentiating feature. Healthcare wearables incorporating flexible microdisplays for continuous health monitoring are projected to grow at 42% CAGR through 2026, driven by increasing health consciousness and remote patient monitoring needs.

Automotive applications represent an emerging high-value market for flexible microdisplays. The trend toward vehicle digitalization has created demand for curved, conformable displays that can be integrated into non-flat surfaces within vehicle interiors. Market research indicates that the automotive display market will reach $30.8 billion by 2025, with flexible displays accounting for approximately 18% of this total.

Military and aerospace applications, though smaller in volume, offer premium pricing opportunities for flexible microdisplay technologies. These sectors demand high-reliability displays capable of withstanding extreme conditions while providing superior visual performance. The defense display market is growing at 15% annually, with flexible technologies increasingly specified for next-generation equipment.

Regional analysis reveals that Asia-Pacific currently dominates the flexible display manufacturing landscape, accounting for 65% of global production capacity. However, North America leads in research and development investment, while Europe shows the fastest adoption rate in automotive applications. This regional distribution indicates a globally distributed value chain with specialized roles across different markets.

Customer requirements analysis shows increasing demand for higher resolution (>1000 PPI), improved durability (>200,000 fold cycles), enhanced color gamut (>120% NTSC), and reduced power consumption (<1W for 2-inch displays). These technical requirements are directly driving research priorities in the flexible microdisplay industry and shaping product development roadmaps.

Consumer electronics represents the largest market segment, with smartphones and tablets incorporating flexible displays to enable foldable and rollable form factors. Market penetration of foldable smartphones has increased by 300% since 2020, demonstrating strong consumer acceptance of this technology. Industry analysts predict that by 2025, approximately 30% of premium smartphones will feature some form of flexible display technology.

The wearable technology sector presents another substantial growth opportunity for flexible microdisplays. The global smartwatch market alone is expected to reach $96 billion by 2027, with flexible displays becoming a key differentiating feature. Healthcare wearables incorporating flexible microdisplays for continuous health monitoring are projected to grow at 42% CAGR through 2026, driven by increasing health consciousness and remote patient monitoring needs.

Automotive applications represent an emerging high-value market for flexible microdisplays. The trend toward vehicle digitalization has created demand for curved, conformable displays that can be integrated into non-flat surfaces within vehicle interiors. Market research indicates that the automotive display market will reach $30.8 billion by 2025, with flexible displays accounting for approximately 18% of this total.

Military and aerospace applications, though smaller in volume, offer premium pricing opportunities for flexible microdisplay technologies. These sectors demand high-reliability displays capable of withstanding extreme conditions while providing superior visual performance. The defense display market is growing at 15% annually, with flexible technologies increasingly specified for next-generation equipment.

Regional analysis reveals that Asia-Pacific currently dominates the flexible display manufacturing landscape, accounting for 65% of global production capacity. However, North America leads in research and development investment, while Europe shows the fastest adoption rate in automotive applications. This regional distribution indicates a globally distributed value chain with specialized roles across different markets.

Customer requirements analysis shows increasing demand for higher resolution (>1000 PPI), improved durability (>200,000 fold cycles), enhanced color gamut (>120% NTSC), and reduced power consumption (<1W for 2-inch displays). These technical requirements are directly driving research priorities in the flexible microdisplay industry and shaping product development roadmaps.

Current State and Technical Challenges in Flexible Microdisplays

Flexible microdisplay technology has witnessed significant advancements in recent years, with global research institutions and companies making substantial progress. Currently, the field is dominated by several key technologies including OLED (Organic Light-Emitting Diode), AMOLED (Active-Matrix OLED), MicroLED, and E-paper displays. Each technology offers distinct advantages for flexible applications, with OLED leading in commercial deployment due to its inherent flexibility, wide color gamut, and high contrast ratios.

The current manufacturing landscape reveals that mass production capabilities for flexible microdisplays remain concentrated in East Asia, particularly in South Korea, Japan, and Taiwan, with emerging capacity in mainland China. Companies like Samsung Display, LG Display, BOE, and JDI have established advanced production lines specifically for flexible display technologies, though yield rates continue to present challenges at scale.

Despite impressive progress, significant technical challenges persist in the development and commercialization of flexible microdisplays. Durability remains a primary concern, as repeated bending and folding operations lead to mechanical stress that can compromise display integrity. Current solutions typically withstand between 100,000 to 200,000 fold cycles, which falls short of ideal performance metrics for long-term consumer applications.

Material limitations constitute another major obstacle. The development of truly flexible substrates that maintain optical clarity while providing sufficient barrier properties against oxygen and moisture remains challenging. Polyimide films currently serve as the predominant substrate material, but they present limitations in transparency and thermal stability under certain conditions.

Power efficiency presents a persistent challenge, particularly for battery-powered wearable applications. While OLED technology offers advantages in this regard, further improvements are necessary to enable all-day usage in compact form factors. Additionally, the integration of touch functionality in flexible displays introduces additional complexity, with current solutions often compromising on flexibility or adding undesirable thickness.

Manufacturing scalability represents perhaps the most significant barrier to widespread adoption. Current production processes for flexible displays involve complex deposition techniques, precise encapsulation methods, and specialized handling requirements that contribute to high production costs and limited yield rates. The industry has yet to develop truly cost-effective manufacturing approaches that maintain quality while enabling mass production.

Resolution constraints also remain problematic for microdisplay applications requiring high pixel density. Achieving resolutions above 1000 PPI (pixels per inch) while maintaining flexibility presents significant technical hurdles, particularly for applications in augmented reality and virtual reality where image quality is paramount.

The current manufacturing landscape reveals that mass production capabilities for flexible microdisplays remain concentrated in East Asia, particularly in South Korea, Japan, and Taiwan, with emerging capacity in mainland China. Companies like Samsung Display, LG Display, BOE, and JDI have established advanced production lines specifically for flexible display technologies, though yield rates continue to present challenges at scale.

Despite impressive progress, significant technical challenges persist in the development and commercialization of flexible microdisplays. Durability remains a primary concern, as repeated bending and folding operations lead to mechanical stress that can compromise display integrity. Current solutions typically withstand between 100,000 to 200,000 fold cycles, which falls short of ideal performance metrics for long-term consumer applications.

Material limitations constitute another major obstacle. The development of truly flexible substrates that maintain optical clarity while providing sufficient barrier properties against oxygen and moisture remains challenging. Polyimide films currently serve as the predominant substrate material, but they present limitations in transparency and thermal stability under certain conditions.

Power efficiency presents a persistent challenge, particularly for battery-powered wearable applications. While OLED technology offers advantages in this regard, further improvements are necessary to enable all-day usage in compact form factors. Additionally, the integration of touch functionality in flexible displays introduces additional complexity, with current solutions often compromising on flexibility or adding undesirable thickness.

Manufacturing scalability represents perhaps the most significant barrier to widespread adoption. Current production processes for flexible displays involve complex deposition techniques, precise encapsulation methods, and specialized handling requirements that contribute to high production costs and limited yield rates. The industry has yet to develop truly cost-effective manufacturing approaches that maintain quality while enabling mass production.

Resolution constraints also remain problematic for microdisplay applications requiring high pixel density. Achieving resolutions above 1000 PPI (pixels per inch) while maintaining flexibility presents significant technical hurdles, particularly for applications in augmented reality and virtual reality where image quality is paramount.

Current Technical Solutions for Flexible Microdisplays

01 Flexible substrate technologies for microdisplays

Flexible substrates are fundamental to creating bendable microdisplays. These substrates typically use materials like polyimide, thin glass, or metal foils that can withstand repeated bending while maintaining structural integrity. The flexibility of these substrates enables the development of displays that can be curved, folded, or rolled without compromising functionality. Advanced manufacturing techniques ensure proper adhesion of display components to these flexible bases while maintaining electrical connectivity during flexing operations.- Flexible substrate materials for microdisplays: Various flexible substrate materials can be used to create bendable microdisplays. These include polymer films, thin glass, and metal foils that provide the necessary mechanical flexibility while maintaining structural integrity. The substrate choice affects the overall flexibility, durability, and performance of the microdisplay. Advanced materials engineering allows for substrates that can withstand repeated bending cycles without degradation of display quality.

- Flexible electronic components and circuitry: Specialized electronic components and circuitry designed for flexibility enable bendable microdisplays. These include thin-film transistors (TFTs), flexible interconnects, and stretchable conductors that maintain electrical performance while being deformed. The integration of these components allows for the creation of display systems that can be bent, folded, or rolled without losing functionality, opening new possibilities for wearable and portable display applications.

- Display technologies for flexible microdisplays: Various display technologies have been adapted for flexible applications, including OLED, LCD, and e-paper. Each technology offers different advantages in terms of flexibility, power consumption, and visual performance. OLED technology is particularly suitable for flexible displays due to its thin profile and self-emissive nature. Innovations in these technologies focus on maintaining display quality and brightness while accommodating the mechanical stress of bending and flexing.

- Testing and reliability of flexible displays: Specialized testing methods and reliability assessments are crucial for flexible microdisplays. These include bend testing, environmental stress testing, and accelerated aging tests to evaluate the durability and performance of flexible displays under various conditions. Testing protocols measure parameters such as bending radius, cycle count, and performance degradation to ensure that flexible displays meet reliability standards for commercial applications.

- Manufacturing processes for flexible microdisplays: Novel manufacturing techniques enable the production of flexible microdisplays at scale. These include roll-to-roll processing, laser patterning, and low-temperature deposition methods that allow for the creation of electronic components on flexible substrates. Advanced encapsulation techniques protect sensitive electronic components from environmental factors while maintaining flexibility. These manufacturing innovations help overcome the challenges of producing reliable and cost-effective flexible display technologies.

02 Flexible electronic components and circuitry

Flexible electronic components are essential for microdisplay flexibility. These include thin-film transistors (TFTs), flexible interconnects, and stretchable conductors that maintain functionality when bent. Special circuit designs accommodate mechanical stress during flexing while preventing signal degradation. Techniques such as using serpentine interconnects or mesh-like circuit patterns allow for stretching and bending without breaking electrical connections, ensuring consistent display performance regardless of the display's physical configuration.Expand Specific Solutions03 Flexible display technologies and materials

Various display technologies have been adapted for flexibility, including OLED, LCD, and e-paper. These technologies use specialized materials that maintain optical properties when bent or flexed. Flexible OLEDs utilize organic compounds deposited on flexible substrates, while flexible LCDs employ specialized liquid crystal formulations and flexible polarizers. Encapsulation techniques protect sensitive display materials from oxygen and moisture while maintaining flexibility. These innovations enable displays that can conform to curved surfaces or be folded without image distortion.Expand Specific Solutions04 Testing and reliability of flexible microdisplays

Testing methodologies for flexible displays evaluate performance under various bending conditions and repeated flexing cycles. These include mechanical stress tests, optical performance measurements during bending, and accelerated aging tests to predict long-term reliability. Specialized equipment measures parameters like bend radius limitations, pixel functionality during flexing, and electrical continuity under stress. These testing protocols ensure that flexible microdisplays maintain image quality and functionality throughout their expected lifecycle despite repeated mechanical deformation.Expand Specific Solutions05 Applications and integration of flexible microdisplays

Flexible microdisplays enable innovative applications across multiple industries. In wearable technology, these displays can conform to body contours for smartwatches, fitness trackers, and medical monitoring devices. For mobile devices, they allow for foldable smartphones and rollable tablets that expand screen size while maintaining portability. Automotive applications include curved dashboard displays and heads-up displays that follow windshield contours. Integration techniques focus on connecting flexible displays with rigid components while maintaining overall system flexibility and durability.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The flexible microdisplay market is currently in a growth phase, with increasing applications in wearables, AR/VR, and smart devices. The global market size is projected to expand significantly due to rising demand for lightweight, energy-efficient display solutions. Leading players include Samsung Display and BOE Technology, who are advancing OLED flexible display technologies, while E Ink Corporation dominates the e-paper segment. LG Display and CSOT are also making significant investments in this space. Research institutions like ITRI and universities are contributing to technological advancements, while companies like Semiconductor Energy Laboratory focus on specialized semiconductor technologies for flexible displays. The technology is approaching maturity in certain applications but continues to evolve with innovations in durability, resolution, and power efficiency.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed advanced flexible AMOLED technology for multifunctional display applications. Their flexible microdisplay solution utilizes Ultra-Thin Glass (UTG) substrate technology combined with Low-Temperature Polycrystalline Oxide (LTPO) backplane technology. This combination enables variable refresh rates (1-120Hz) while maintaining high resolution and color accuracy. Samsung's Y-OCTA technology integrates the touch sensor directly into the display panel, reducing thickness and improving flexibility. Their flexible displays incorporate strain-resistant materials that can withstand over 200,000 folding cycles while maintaining structural integrity. Samsung has also implemented advanced pixel compensation algorithms to prevent image retention and burn-in issues common in flexible displays. Their latest innovations include stretchable display prototypes with up to 30% elasticity while maintaining display performance.

Strengths: Industry-leading display quality with high brightness (up to 1,500 nits) and color accuracy; mature mass production capabilities; extensive IP portfolio in flexible display technologies. Weaknesses: Higher production costs compared to conventional displays; limited supplier ecosystem for specialized components; challenges with achieving uniform brightness across bent surfaces.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has pioneered flexible OLED microdisplay technology using their proprietary Flexible Oxide Backplane (FOB) technology. Their solution incorporates ultra-thin flexible glass substrates with thickness below 30 micrometers, allowing for a bending radius under 1mm while maintaining display performance. BOE's approach utilizes a specialized encapsulation technology called Thin Film Encapsulation (TFE) that provides superior moisture and oxygen barrier properties while preserving flexibility. Their displays feature integrated touch functionality through in-cell touch technology, reducing overall thickness. BOE has developed specialized compensation circuits to address non-uniform brightness issues when displays are bent or folded. Their latest generation implements micro-LED elements within flexible substrates to achieve higher brightness (over 2000 nits) and energy efficiency for outdoor applications. BOE's flexible displays support resolutions up to 2K with pixel densities exceeding 400 PPI.

Strengths: Cost-effective manufacturing at scale; strong vertical integration from materials to finished displays; rapidly expanding IP portfolio in flexible display technologies. Weaknesses: Slightly lower color accuracy compared to Samsung displays; less mature quality control processes; more limited experience with ultra-premium display applications requiring the highest specifications.

Core Patents and Innovations in Flexible Display Technology

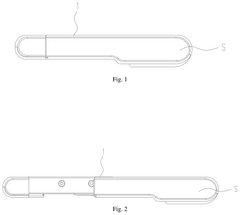

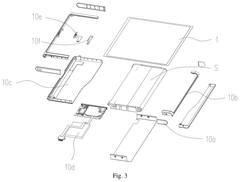

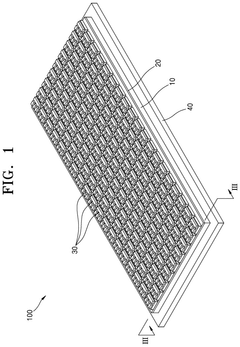

Flexible display device

PatentPendingUS20250194026A1

Innovation

- A flexible display device design that includes a fixed portion, a shaft, screen end fixing members, a flexible display screen, and elastic members. The elastic members provide balanced stretching forces to the screen ends, equilibrating with friction forces to reduce the risk of display abnormalities and improve reliability.

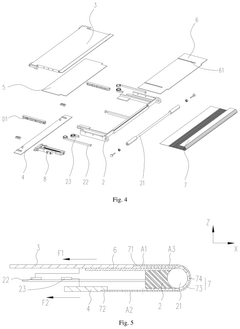

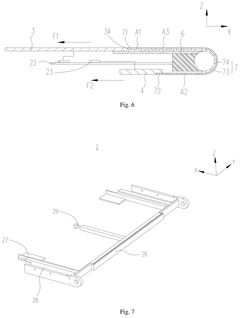

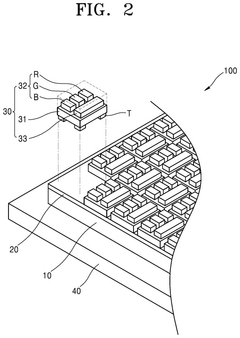

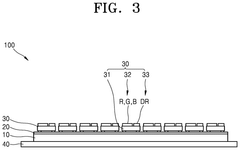

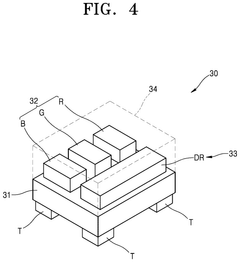

Flexible display apparatus and method of manufacturing the same

PatentPendingUS20240427378A1

Innovation

- The solution involves individually mounting a driver integrated chip (IC) within each light-emitting device package to control red, green, and blue LED chips, simplifying the manufacturing process, reducing product thickness, and minimizing the driver IC size, while using a monolayer FPCB structure and a flexible protection member to manage heat and improve image display performance.

Manufacturing Processes and Scalability Assessment

The manufacturing processes for flexible microdisplays represent a critical determinant of their commercial viability and widespread adoption. Current production methodologies primarily revolve around thin-film transistor (TFT) fabrication on flexible substrates, with organic light-emitting diode (OLED) and microLED technologies emerging as dominant display technologies for flexible applications. The manufacturing process typically involves substrate preparation, TFT array fabrication, display element deposition, encapsulation, and final integration with driving electronics.

Roll-to-roll (R2R) processing has emerged as a promising manufacturing approach, offering significant advantages in throughput and cost reduction compared to traditional batch processing methods. However, R2R processing for high-resolution microdisplays still faces challenges in maintaining precise alignment and uniformity across large areas. Several manufacturers have developed hybrid approaches that combine batch processing for critical high-resolution components with R2R techniques for less demanding process steps.

Yield management represents a significant challenge in flexible microdisplay manufacturing. Current industry benchmarks indicate yield rates between 60-85% for flexible displays, compared to 90%+ for rigid display technologies. This yield gap directly impacts production costs and scalability. Key yield-limiting factors include particle contamination, mechanical stress during handling, and defects in the thin-film layers. Advanced clean room technologies and automated handling systems have shown promise in addressing these challenges.

Material selection significantly influences both manufacturing complexity and scalability. Polyimide remains the predominant substrate material due to its thermal stability and mechanical properties, though alternatives such as polyethylene naphthalate (PEN) and ultrathin glass are gaining traction for specific applications. The industry is witnessing a transition toward solution-processable organic semiconductors and printable conductive materials that are more compatible with high-throughput manufacturing processes.

From a scalability perspective, current production capacities for flexible microdisplays remain limited compared to conventional display technologies. Major manufacturers have announced capacity expansions, with projected industry-wide production capability expected to reach approximately 15-20 million units annually by 2025. This represents a significant increase from current levels but may still be insufficient to meet projected demand across consumer electronics, automotive, and medical applications.

Cost considerations remain paramount, with current manufacturing costs for flexible microdisplays estimated at 2.5-4 times higher than comparable rigid displays. However, cost reduction trajectories suggest this gap could narrow to 1.3-1.8 times by 2026, primarily driven by yield improvements, economies of scale, and material innovations. This cost trajectory will be critical in determining market penetration across different application segments.

Roll-to-roll (R2R) processing has emerged as a promising manufacturing approach, offering significant advantages in throughput and cost reduction compared to traditional batch processing methods. However, R2R processing for high-resolution microdisplays still faces challenges in maintaining precise alignment and uniformity across large areas. Several manufacturers have developed hybrid approaches that combine batch processing for critical high-resolution components with R2R techniques for less demanding process steps.

Yield management represents a significant challenge in flexible microdisplay manufacturing. Current industry benchmarks indicate yield rates between 60-85% for flexible displays, compared to 90%+ for rigid display technologies. This yield gap directly impacts production costs and scalability. Key yield-limiting factors include particle contamination, mechanical stress during handling, and defects in the thin-film layers. Advanced clean room technologies and automated handling systems have shown promise in addressing these challenges.

Material selection significantly influences both manufacturing complexity and scalability. Polyimide remains the predominant substrate material due to its thermal stability and mechanical properties, though alternatives such as polyethylene naphthalate (PEN) and ultrathin glass are gaining traction for specific applications. The industry is witnessing a transition toward solution-processable organic semiconductors and printable conductive materials that are more compatible with high-throughput manufacturing processes.

From a scalability perspective, current production capacities for flexible microdisplays remain limited compared to conventional display technologies. Major manufacturers have announced capacity expansions, with projected industry-wide production capability expected to reach approximately 15-20 million units annually by 2025. This represents a significant increase from current levels but may still be insufficient to meet projected demand across consumer electronics, automotive, and medical applications.

Cost considerations remain paramount, with current manufacturing costs for flexible microdisplays estimated at 2.5-4 times higher than comparable rigid displays. However, cost reduction trajectories suggest this gap could narrow to 1.3-1.8 times by 2026, primarily driven by yield improvements, economies of scale, and material innovations. This cost trajectory will be critical in determining market penetration across different application segments.

Durability and Reliability Testing Methodologies

The durability and reliability of flexible microdisplays represent critical factors in their commercial viability for multifunctional display applications. Comprehensive testing methodologies must be established to evaluate these parameters under conditions that simulate real-world usage scenarios and potential failure modes.

Standard mechanical stress tests for flexible microdisplays include cyclic bending, folding, and rolling tests that measure performance degradation after repeated deformation. These tests typically involve specialized equipment capable of precisely controlling bending radius, folding angle, and applying consistent force while simultaneously monitoring electrical and optical performance. Industry standards recommend between 100,000 to 1,000,000 cycles for consumer electronics applications, with more demanding requirements for automotive or industrial implementations.

Environmental reliability testing encompasses temperature cycling (-40°C to 85°C), humidity exposure (85% RH at 85°C), and combined temperature-humidity-bias tests. These conditions accelerate potential failure mechanisms such as delamination, moisture ingress, and interface degradation. Additionally, UV exposure tests evaluate the photostability of organic materials commonly used in flexible display constructions, with standardized protocols requiring 1,000+ hours of accelerated exposure.

Impact and drop testing methodologies have been adapted specifically for flexible displays, incorporating specialized fixtures that account for the unique deformation characteristics of these devices. Unlike rigid displays, flexible microdisplays may absorb impact energy through deformation, necessitating modified test protocols that evaluate both immediate damage and latent effects that may manifest after repeated impacts.

Electrical reliability testing focuses on the unique challenges posed by flexible interconnects and thin-film transistor stability under mechanical deformation. Specialized test patterns and measurement techniques have been developed to isolate failure mechanisms at the pixel level, with particular attention to crack propagation in conductive traces and degradation of semiconductor interfaces under strain.

Lifetime prediction models have evolved significantly, incorporating multi-physics simulations that combine mechanical, thermal, and electrical stressors. These models employ Weibull statistical analysis and accelerated life testing methodologies to extrapolate expected field performance from laboratory data. Recent advances in machine learning approaches have improved prediction accuracy by identifying complex failure patterns across multiple test parameters.

Standardization efforts led by organizations such as JEDEC, IEC, and SID have begun establishing flexible display-specific test protocols, though consensus standards remain under development. Leading manufacturers have implemented proprietary testing regimes that often exceed these emerging standards, particularly for high-reliability applications in medical, automotive, and aerospace sectors.

Standard mechanical stress tests for flexible microdisplays include cyclic bending, folding, and rolling tests that measure performance degradation after repeated deformation. These tests typically involve specialized equipment capable of precisely controlling bending radius, folding angle, and applying consistent force while simultaneously monitoring electrical and optical performance. Industry standards recommend between 100,000 to 1,000,000 cycles for consumer electronics applications, with more demanding requirements for automotive or industrial implementations.

Environmental reliability testing encompasses temperature cycling (-40°C to 85°C), humidity exposure (85% RH at 85°C), and combined temperature-humidity-bias tests. These conditions accelerate potential failure mechanisms such as delamination, moisture ingress, and interface degradation. Additionally, UV exposure tests evaluate the photostability of organic materials commonly used in flexible display constructions, with standardized protocols requiring 1,000+ hours of accelerated exposure.

Impact and drop testing methodologies have been adapted specifically for flexible displays, incorporating specialized fixtures that account for the unique deformation characteristics of these devices. Unlike rigid displays, flexible microdisplays may absorb impact energy through deformation, necessitating modified test protocols that evaluate both immediate damage and latent effects that may manifest after repeated impacts.

Electrical reliability testing focuses on the unique challenges posed by flexible interconnects and thin-film transistor stability under mechanical deformation. Specialized test patterns and measurement techniques have been developed to isolate failure mechanisms at the pixel level, with particular attention to crack propagation in conductive traces and degradation of semiconductor interfaces under strain.

Lifetime prediction models have evolved significantly, incorporating multi-physics simulations that combine mechanical, thermal, and electrical stressors. These models employ Weibull statistical analysis and accelerated life testing methodologies to extrapolate expected field performance from laboratory data. Recent advances in machine learning approaches have improved prediction accuracy by identifying complex failure patterns across multiple test parameters.

Standardization efforts led by organizations such as JEDEC, IEC, and SID have begun establishing flexible display-specific test protocols, though consensus standards remain under development. Leading manufacturers have implemented proprietary testing regimes that often exceed these emerging standards, particularly for high-reliability applications in medical, automotive, and aerospace sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!