Impact of Flexible Microdisplay on Next-gen Computing Architectures

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Technology Evolution and Objectives

Flexible microdisplay technology has evolved significantly over the past two decades, transitioning from rigid display architectures to increasingly malleable form factors. The journey began with early experiments in organic light-emitting diode (OLED) technology in the early 2000s, which laid the groundwork for displays that could potentially bend without compromising visual quality or operational integrity.

By 2010, research institutions and technology companies had made substantial progress in developing prototype flexible displays, though these early versions faced significant challenges in durability, resolution, and manufacturing scalability. The period between 2010 and 2015 marked a critical transition phase where flexible display technology moved from laboratory curiosity to commercially viable products.

The evolution accelerated dramatically from 2015 onwards, with breakthroughs in materials science enabling thinner, more resilient display substrates. Innovations in transparent conductive materials, particularly metal nanowires and graphene-based compounds, replaced traditional indium tin oxide (ITO), which was too brittle for flexible applications. Simultaneously, advancements in thin-film transistor (TFT) technology allowed for the creation of backplanes that could withstand repeated flexing without performance degradation.

Current flexible microdisplay technology encompasses several competing approaches, including OLED, microLED, and electrophoretic displays, each offering distinct advantages in terms of power consumption, brightness, and flexibility parameters. The miniaturization of these technologies to microdisplay scale presents unique engineering challenges that continue to drive innovation in the field.

The primary objective of flexible microdisplay development is to enable new computing form factors that transcend the limitations of traditional rigid displays. This includes wearable computing devices that conform to the human body, foldable and rollable smartphones and tablets that expand the available screen real estate without increasing device footprint, and immersive augmented reality experiences through lightweight, comfortable headsets.

Another critical objective is achieving technological convergence between display flexibility and computational capability. As computing architectures evolve toward more distributed and heterogeneous models, flexible microdisplays must integrate seamlessly with processing units, memory systems, and sensor arrays, all while maintaining their mechanical flexibility.

Looking forward, the technology roadmap aims to achieve several ambitious milestones: sub-millimeter thickness for entire display modules, bend radii below 1mm without performance degradation, resolution exceeding 2000 PPI for near-eye applications, and power consumption profiles compatible with all-day wearable use cases. These objectives collectively point toward a future where the physical form of computing devices becomes as adaptable and dynamic as the software they run.

By 2010, research institutions and technology companies had made substantial progress in developing prototype flexible displays, though these early versions faced significant challenges in durability, resolution, and manufacturing scalability. The period between 2010 and 2015 marked a critical transition phase where flexible display technology moved from laboratory curiosity to commercially viable products.

The evolution accelerated dramatically from 2015 onwards, with breakthroughs in materials science enabling thinner, more resilient display substrates. Innovations in transparent conductive materials, particularly metal nanowires and graphene-based compounds, replaced traditional indium tin oxide (ITO), which was too brittle for flexible applications. Simultaneously, advancements in thin-film transistor (TFT) technology allowed for the creation of backplanes that could withstand repeated flexing without performance degradation.

Current flexible microdisplay technology encompasses several competing approaches, including OLED, microLED, and electrophoretic displays, each offering distinct advantages in terms of power consumption, brightness, and flexibility parameters. The miniaturization of these technologies to microdisplay scale presents unique engineering challenges that continue to drive innovation in the field.

The primary objective of flexible microdisplay development is to enable new computing form factors that transcend the limitations of traditional rigid displays. This includes wearable computing devices that conform to the human body, foldable and rollable smartphones and tablets that expand the available screen real estate without increasing device footprint, and immersive augmented reality experiences through lightweight, comfortable headsets.

Another critical objective is achieving technological convergence between display flexibility and computational capability. As computing architectures evolve toward more distributed and heterogeneous models, flexible microdisplays must integrate seamlessly with processing units, memory systems, and sensor arrays, all while maintaining their mechanical flexibility.

Looking forward, the technology roadmap aims to achieve several ambitious milestones: sub-millimeter thickness for entire display modules, bend radii below 1mm without performance degradation, resolution exceeding 2000 PPI for near-eye applications, and power consumption profiles compatible with all-day wearable use cases. These objectives collectively point toward a future where the physical form of computing devices becomes as adaptable and dynamic as the software they run.

Market Demand Analysis for Flexible Display Computing

The flexible microdisplay market is experiencing unprecedented growth driven by evolving consumer preferences and technological advancements. Current market analysis indicates that the global flexible display market is projected to reach $15.5 billion by 2026, with a compound annual growth rate exceeding 35% between 2021-2026. This remarkable expansion is primarily fueled by increasing demand for portable, lightweight computing devices that offer enhanced user experiences through novel form factors.

Consumer electronics represents the largest application segment, with smartphones and wearable devices leading adoption. Market research reveals that approximately 67% of consumers express interest in devices with flexible displays, citing improved portability and durability as key purchasing factors. The enterprise market segment is also showing significant interest, with 58% of business technology decision-makers considering flexible display technology for next-generation workplace computing solutions.

Geographically, Asia-Pacific dominates the flexible microdisplay manufacturing landscape, accounting for nearly 60% of global production capacity. However, North America and Europe lead in research and development investments, particularly in advanced computing architectures designed to leverage flexible display capabilities.

The integration of flexible microdisplays into computing architectures is creating new market categories beyond traditional device segments. Foldable laptops, rollable tablets, and wearable computing devices are emerging as high-growth product categories, with market penetration expected to increase by 45% annually through 2025.

Healthcare and automotive sectors represent rapidly expanding vertical markets, with projected five-year growth rates of 42% and 38% respectively. In healthcare, flexible displays enable advanced patient monitoring systems and portable diagnostic equipment. The automotive industry is incorporating these displays into next-generation infotainment systems and smart cockpit designs.

Market analysis indicates that supply chain constraints currently limit wider adoption, with production capacity meeting only 70% of projected demand. This supply-demand gap is expected to narrow as manufacturers scale production capabilities, potentially reaching equilibrium by 2024.

Consumer willingness to pay premium prices for flexible display computing devices remains strong, with surveys indicating acceptance of 15-25% price premiums compared to rigid display alternatives. This pricing resilience is supported by the perceived value of enhanced durability, portability, and novel user experiences enabled by flexible display technology.

Consumer electronics represents the largest application segment, with smartphones and wearable devices leading adoption. Market research reveals that approximately 67% of consumers express interest in devices with flexible displays, citing improved portability and durability as key purchasing factors. The enterprise market segment is also showing significant interest, with 58% of business technology decision-makers considering flexible display technology for next-generation workplace computing solutions.

Geographically, Asia-Pacific dominates the flexible microdisplay manufacturing landscape, accounting for nearly 60% of global production capacity. However, North America and Europe lead in research and development investments, particularly in advanced computing architectures designed to leverage flexible display capabilities.

The integration of flexible microdisplays into computing architectures is creating new market categories beyond traditional device segments. Foldable laptops, rollable tablets, and wearable computing devices are emerging as high-growth product categories, with market penetration expected to increase by 45% annually through 2025.

Healthcare and automotive sectors represent rapidly expanding vertical markets, with projected five-year growth rates of 42% and 38% respectively. In healthcare, flexible displays enable advanced patient monitoring systems and portable diagnostic equipment. The automotive industry is incorporating these displays into next-generation infotainment systems and smart cockpit designs.

Market analysis indicates that supply chain constraints currently limit wider adoption, with production capacity meeting only 70% of projected demand. This supply-demand gap is expected to narrow as manufacturers scale production capabilities, potentially reaching equilibrium by 2024.

Consumer willingness to pay premium prices for flexible display computing devices remains strong, with surveys indicating acceptance of 15-25% price premiums compared to rigid display alternatives. This pricing resilience is supported by the perceived value of enhanced durability, portability, and novel user experiences enabled by flexible display technology.

Technical Challenges and Global Development Status

Flexible microdisplay technology faces significant technical challenges despite its promising potential for next-generation computing architectures. The primary obstacle remains material science limitations, particularly in developing substrates that maintain display quality while providing sufficient flexibility and durability. Current flexible displays typically experience degradation in performance metrics after repeated bending cycles, with pixel failure rates increasing exponentially beyond 100,000 flexes in laboratory testing environments.

Manufacturing scalability presents another major hurdle. While prototype production has demonstrated feasibility, mass production techniques struggle with yield rates below 70% for high-resolution flexible displays, compared to over 90% for conventional rigid displays. This manufacturing inefficiency significantly impacts cost structures and market viability.

Power consumption optimization remains unresolved, with flexible display technologies requiring 15-30% more power than their rigid counterparts due to additional compensation circuitry needed to maintain image quality during physical deformation. This power differential creates substantial design constraints for mobile and wearable applications where battery life is critical.

Globally, development status varies significantly by region. East Asia maintains leadership with approximately 65% of flexible display patents filed in the last five years originating from South Korea, Japan, and Taiwan. These countries have established specialized manufacturing ecosystems specifically for flexible display technologies, with significant government investment supporting research initiatives.

North American companies lead in software integration and system architecture innovation, focusing on how flexible displays can transform user interfaces and computing paradigms rather than core display technology itself. European research institutions have made notable contributions in novel materials development, particularly in stretchable conductors and self-healing substrates.

The technology readiness level (TRL) for flexible microdisplays varies by application, ranging from TRL 7-8 for simple curved implementations to TRL 4-5 for advanced foldable or rollable high-resolution displays suitable for computing applications. This disparity indicates that while some commercial products exist, truly transformative implementations remain in development phases.

Standardization efforts remain fragmented, with multiple competing approaches to interface protocols, durability testing methodologies, and performance specifications. This lack of industry consensus has slowed integration into mainstream computing architectures and limited interoperability between hardware components from different manufacturers.

Manufacturing scalability presents another major hurdle. While prototype production has demonstrated feasibility, mass production techniques struggle with yield rates below 70% for high-resolution flexible displays, compared to over 90% for conventional rigid displays. This manufacturing inefficiency significantly impacts cost structures and market viability.

Power consumption optimization remains unresolved, with flexible display technologies requiring 15-30% more power than their rigid counterparts due to additional compensation circuitry needed to maintain image quality during physical deformation. This power differential creates substantial design constraints for mobile and wearable applications where battery life is critical.

Globally, development status varies significantly by region. East Asia maintains leadership with approximately 65% of flexible display patents filed in the last five years originating from South Korea, Japan, and Taiwan. These countries have established specialized manufacturing ecosystems specifically for flexible display technologies, with significant government investment supporting research initiatives.

North American companies lead in software integration and system architecture innovation, focusing on how flexible displays can transform user interfaces and computing paradigms rather than core display technology itself. European research institutions have made notable contributions in novel materials development, particularly in stretchable conductors and self-healing substrates.

The technology readiness level (TRL) for flexible microdisplays varies by application, ranging from TRL 7-8 for simple curved implementations to TRL 4-5 for advanced foldable or rollable high-resolution displays suitable for computing applications. This disparity indicates that while some commercial products exist, truly transformative implementations remain in development phases.

Standardization efforts remain fragmented, with multiple competing approaches to interface protocols, durability testing methodologies, and performance specifications. This lack of industry consensus has slowed integration into mainstream computing architectures and limited interoperability between hardware components from different manufacturers.

Current Flexible Display Integration Solutions

01 Flexible display substrate technologies

Flexible microdisplays utilize specialized substrate materials that can bend without compromising display functionality. These substrates often incorporate polymer-based materials or ultra-thin glass that provides the necessary flexibility while maintaining structural integrity. The substrate design includes specialized layers that can withstand repeated bending cycles while protecting the active display elements from mechanical stress and environmental factors.- Flexible display substrate technologies: Flexible microdisplays utilize specialized substrate materials that can bend without compromising display functionality. These substrates often incorporate polymer-based materials or ultra-thin glass that maintains electrical connectivity while allowing for physical flexibility. The substrate design includes specialized interconnects and buffer layers that accommodate mechanical stress during bending, ensuring consistent performance in various form factors.

- OLED implementation in flexible displays: Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin structure and self-emissive properties. These displays incorporate specialized organic materials that emit light when current is applied, eliminating the need for rigid backlighting systems. The OLED layers are designed to maintain performance integrity during bending, with specialized encapsulation techniques to protect the organic materials from environmental factors.

- Driving circuits for flexible displays: Specialized driving circuits are essential for flexible microdisplays to maintain image quality during bending. These circuits incorporate thin-film transistors (TFTs) on flexible substrates, often using materials like amorphous silicon or metal oxides that can withstand mechanical stress. The circuit design includes stress-relief structures and redundant pathways to ensure signal integrity even when the display is flexed or folded.

- Optical components for flexible displays: Flexible microdisplays incorporate specialized optical components that maintain performance while accommodating bending. These include flexible light guides, specialized diffusers, and micro-lens arrays that can deform without optical degradation. The optical design often includes compensation mechanisms that adjust for changes in viewing angles and light distribution that occur during flexing, ensuring consistent image quality regardless of the display's physical configuration.

- Testing and reliability methods for flexible displays: Ensuring the reliability of flexible microdisplays requires specialized testing methodologies that evaluate performance under repeated bending and environmental stresses. These methods include automated flex testing, environmental chamber testing, and accelerated aging protocols specific to flexible display technologies. Advanced imaging and electrical characterization techniques are employed to detect microscopic defects that might lead to failure under mechanical stress, ensuring long-term durability of the flexible display systems.

02 OLED technology for flexible displays

Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin and flexible structure. OLED displays can be fabricated on flexible substrates and do not require rigid backlighting components. The self-emissive nature of OLEDs allows for thinner display constructions that can bend without affecting image quality, making them ideal for wearable and foldable display applications.Expand Specific Solutions03 Flexible display driving circuits

Specialized driving circuits are essential for flexible microdisplays to maintain image quality during bending. These circuits are designed to compensate for electrical resistance changes that occur when the display is flexed. Advanced thin-film transistor (TFT) technologies are employed that can withstand mechanical deformation while maintaining stable electrical characteristics. The driving circuits may incorporate stress-compensation algorithms that adjust pixel driving parameters based on the display's physical configuration.Expand Specific Solutions04 Optical systems for flexible displays

Flexible microdisplays incorporate specialized optical systems that maintain image quality regardless of the display's curvature. These systems may include flexible light guides, specialized diffusers, and adaptive optics that compensate for changes in viewing angles when the display is bent. Some designs utilize micro-lens arrays that can adjust to maintain optimal focus and brightness across the curved display surface.Expand Specific Solutions05 Protective encapsulation for flexible displays

Effective encapsulation is critical for flexible microdisplays to protect sensitive electronic components from oxygen and moisture while maintaining flexibility. Advanced thin-film encapsulation techniques create ultra-thin barrier layers that can bend without cracking. These may include alternating organic and inorganic layers or specialized polymer materials that provide environmental protection while allowing the display to flex repeatedly without degradation.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The flexible microdisplay market is currently in a growth phase, with significant potential to transform next-generation computing architectures. The competitive landscape is dominated by established display technology leaders including Samsung Display, LG Display, BOE Technology, and Tianma Microelectronics, who possess advanced manufacturing capabilities. The market is projected to expand substantially as flexible displays enable new form factors in wearables, AR/VR, and foldable devices. While traditional display manufacturers lead in production capacity, technology companies like Google, NVIDIA, and IBM are driving innovation in integration with computing systems. The technology is approaching commercial maturity for certain applications, though truly flexible computing architectures remain in early development stages, with companies like Industrial Technology Research Institute and university partnerships advancing fundamental research.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered flexible AMOLED technology through their "Flex" display series, which enables foldable and rollable computing devices. Their technical approach involves using polyimide substrates instead of glass to achieve flexibility while maintaining display quality. Samsung's Ultra-Thin Glass (UTG) technology provides a balance between flexibility and durability, with thickness reduced to approximately 30 micrometers. Their flexible displays incorporate Y-OCTA (Youm On-Cell Touch AMOLED) technology that integrates the touch sensor directly into the display panel, reducing thickness by up to 30% compared to conventional designs. Samsung has also developed advanced TFT backplanes using LTPO (Low-Temperature Polycrystalline Oxide) technology that enables variable refresh rates (1-120Hz), significantly reducing power consumption by up to 40% in their flexible displays. Their architecture integrates specialized display drivers and power management systems optimized for folding form factors, allowing seamless transitions between display states.

Strengths: Industry-leading production capacity with established supply chain; advanced materials science expertise in flexible substrates; proven commercialization track record with multiple generations of foldable devices. Weaknesses: Higher production costs compared to rigid displays; durability concerns at fold points after extended use cycles; limited flexibility radius constrains certain architectural implementations.

LG Display Co., Ltd.

Technical Solution: LG Display has developed proprietary flexible OLED technology branded as "Plastic OLED" (POLED) that uses plastic substrates instead of traditional glass. Their technical approach focuses on rollable display architectures that can extend or retract from a compact base, as demonstrated in their rollable TV and smartphone prototypes. LG's flexible displays utilize a unique RGB subpixel structure that maintains color accuracy even when bent or rolled, with a minimum bending radius of approximately 3mm. Their displays incorporate in-cell touch technology that eliminates the need for a separate touch panel, reducing overall thickness to less than 0.6mm. LG has pioneered a specialized TFT backplane using LTPS (Low-Temperature Polysilicon) technology optimized for flexibility while maintaining electron mobility above 100 cm²/Vs. Their architecture includes proprietary compensation algorithms that adjust for electrical variations caused by mechanical stress during bending, ensuring consistent image quality across different form states. LG has also developed specialized interconnect solutions that can withstand over 200,000 fold/unfold cycles without performance degradation.

Strengths: Leading position in rollable display technology; advanced materials engineering for extreme flexibility; innovative form factors beyond folding (rolling, stretching). Weaknesses: Higher manufacturing complexity leading to lower yields; challenges in mass production scalability; thermal management issues in tightly rolled configurations.

Core Patents and Breakthroughs in Flexible Microdisplays

Electronic devices with flexible display

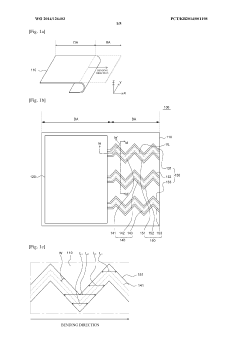

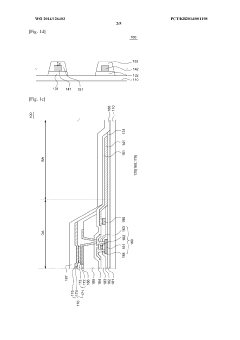

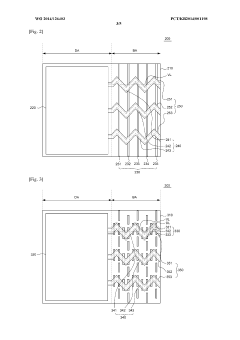

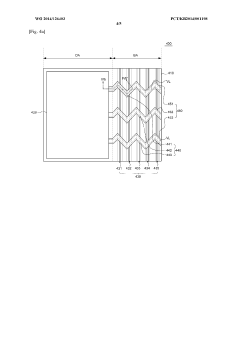

PatentWO2014126403A1

Innovation

- A flexible OLED display configuration featuring a flexible substrate with a display area and a bending area, where wires have a non-straight trace pattern and are covered by upper and lower insulating layers with matching trace patterns, reducing mechanical stress and inhibiting crack propagation by separating individual insulating patterns.

Attenuated flexible display device thickness through a triangulated contour

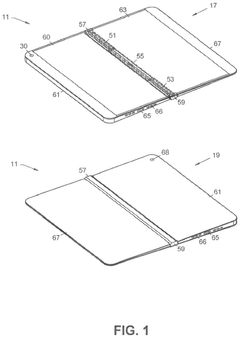

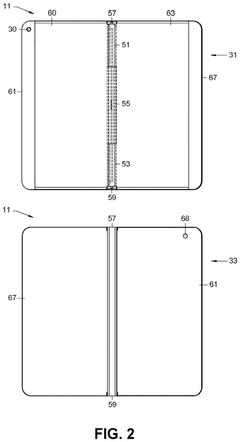

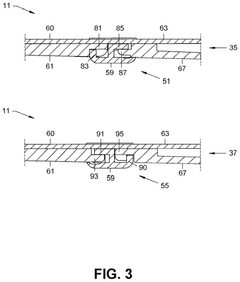

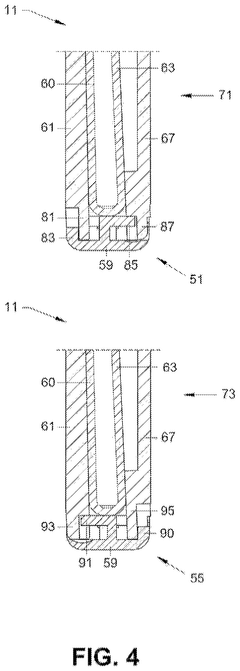

PatentActiveUS12124301B2

Innovation

- A foldable touch screen display device with a flexible display and a hinge mechanism featuring plate stops that prevent the device from folding beyond a flat open state, allowing transformation from a compact phone-sized state to an expanded tablet-sized state while maintaining structural integrity and reducing mechanical complexity.

Supply Chain Considerations for Flexible Display Technologies

The flexible microdisplay supply chain represents a complex ecosystem that significantly impacts the development and adoption of next-generation computing architectures. Material sourcing presents the first critical challenge, as flexible displays require specialized substrates such as polyimide films, ultra-thin glass, or advanced polymers that must meet stringent flexibility, durability, and optical performance requirements. These materials often come from limited suppliers, creating potential bottlenecks in production scaling.

Manufacturing processes for flexible displays involve sophisticated techniques including roll-to-roll processing, thin-film transistor deposition, and encapsulation technologies that differ substantially from traditional rigid display production. The specialized equipment and expertise required for these processes are concentrated among a small number of manufacturers, primarily in East Asia, creating regional dependencies in the supply chain.

Component integration presents another layer of complexity, as flexible displays must interface with other computing architecture elements including processors, memory, and power management systems. These components must be adapted or redesigned to accommodate the mechanical and electrical requirements of flexible form factors, necessitating close collaboration between display manufacturers and semiconductor companies.

Quality control and yield management remain persistent challenges in flexible display production. The multi-layer construction of these displays creates numerous opportunities for defects, with yield rates typically lower than conventional displays. This directly impacts production costs and ultimately affects market pricing and adoption rates for next-generation computing devices incorporating these technologies.

Logistics and inventory management for flexible displays require special consideration due to their fragility and sensitivity to environmental factors. Custom packaging, controlled transportation conditions, and specialized handling protocols add complexity and cost to the distribution network, particularly for global supply chains spanning multiple climate zones and regulatory environments.

Geopolitical factors increasingly influence the flexible display supply chain, with technology export controls, intellectual property considerations, and regional manufacturing incentives creating a shifting landscape for production decisions. Companies developing next-generation computing architectures must navigate these complexities while establishing resilient supply networks that can adapt to disruptions.

Sustainability considerations are becoming increasingly important, with manufacturers facing pressure to address the environmental impact of flexible display production, including chemical usage, energy consumption, and end-of-life recyclability. These factors will influence supply chain design and partner selection as environmental regulations continue to evolve globally.

Manufacturing processes for flexible displays involve sophisticated techniques including roll-to-roll processing, thin-film transistor deposition, and encapsulation technologies that differ substantially from traditional rigid display production. The specialized equipment and expertise required for these processes are concentrated among a small number of manufacturers, primarily in East Asia, creating regional dependencies in the supply chain.

Component integration presents another layer of complexity, as flexible displays must interface with other computing architecture elements including processors, memory, and power management systems. These components must be adapted or redesigned to accommodate the mechanical and electrical requirements of flexible form factors, necessitating close collaboration between display manufacturers and semiconductor companies.

Quality control and yield management remain persistent challenges in flexible display production. The multi-layer construction of these displays creates numerous opportunities for defects, with yield rates typically lower than conventional displays. This directly impacts production costs and ultimately affects market pricing and adoption rates for next-generation computing devices incorporating these technologies.

Logistics and inventory management for flexible displays require special consideration due to their fragility and sensitivity to environmental factors. Custom packaging, controlled transportation conditions, and specialized handling protocols add complexity and cost to the distribution network, particularly for global supply chains spanning multiple climate zones and regulatory environments.

Geopolitical factors increasingly influence the flexible display supply chain, with technology export controls, intellectual property considerations, and regional manufacturing incentives creating a shifting landscape for production decisions. Companies developing next-generation computing architectures must navigate these complexities while establishing resilient supply networks that can adapt to disruptions.

Sustainability considerations are becoming increasingly important, with manufacturers facing pressure to address the environmental impact of flexible display production, including chemical usage, energy consumption, and end-of-life recyclability. These factors will influence supply chain design and partner selection as environmental regulations continue to evolve globally.

Energy Efficiency and Sustainability Implications

Flexible microdisplay technology represents a significant advancement in display engineering with profound implications for energy consumption and sustainability in next-generation computing architectures. The inherent properties of flexible displays—including their reduced material requirements, lower power consumption, and extended lifecycle—position them as environmentally advantageous alternatives to conventional rigid displays.

The energy efficiency benefits of flexible microdisplays stem primarily from their fundamental design characteristics. Unlike traditional LCD or LED displays that require constant backlighting, many flexible display technologies such as OLED and e-paper consume power only when pixels change state. This results in power savings of up to 40-60% compared to conventional displays, particularly in applications with static content display requirements. Furthermore, the integration of these displays with low-power processors and optimized rendering algorithms can yield additional energy reductions of 15-25% across the entire computing system.

From a manufacturing perspective, flexible displays typically require fewer energy-intensive processes than their rigid counterparts. Production methods such as roll-to-roll manufacturing consume approximately 30% less energy than traditional panel fabrication techniques. Additionally, the reduced material requirements—particularly the elimination of glass substrates—decrease the embodied energy in each display unit by an estimated 25-35%, significantly lowering the carbon footprint of device production.

The sustainability advantages extend beyond energy considerations to include material efficiency and end-of-life management. Flexible displays often utilize thinner substrates and fewer rare earth elements, reducing resource extraction impacts. Their lightweight nature also contributes to transportation efficiency, with studies indicating a 10-15% reduction in shipping-related emissions compared to conventional display technologies.

When implemented in next-generation computing architectures, flexible microdisplays enable novel form factors that can optimize device longevity and repairability. Foldable and rollable designs reduce physical stress on display components, potentially extending product lifespans by 30-50% compared to rigid alternatives. This longevity directly translates to reduced electronic waste generation, addressing a critical environmental challenge in the technology sector.

The adaptability of flexible displays also supports circular economy principles through modular design approaches. By enabling easier component separation and replacement, these technologies facilitate more effective recycling and refurbishment processes. Industry analyses suggest that properly designed flexible display systems could achieve 70-80% material recovery rates, substantially higher than the 20-30% typical of conventional display technologies.

The energy efficiency benefits of flexible microdisplays stem primarily from their fundamental design characteristics. Unlike traditional LCD or LED displays that require constant backlighting, many flexible display technologies such as OLED and e-paper consume power only when pixels change state. This results in power savings of up to 40-60% compared to conventional displays, particularly in applications with static content display requirements. Furthermore, the integration of these displays with low-power processors and optimized rendering algorithms can yield additional energy reductions of 15-25% across the entire computing system.

From a manufacturing perspective, flexible displays typically require fewer energy-intensive processes than their rigid counterparts. Production methods such as roll-to-roll manufacturing consume approximately 30% less energy than traditional panel fabrication techniques. Additionally, the reduced material requirements—particularly the elimination of glass substrates—decrease the embodied energy in each display unit by an estimated 25-35%, significantly lowering the carbon footprint of device production.

The sustainability advantages extend beyond energy considerations to include material efficiency and end-of-life management. Flexible displays often utilize thinner substrates and fewer rare earth elements, reducing resource extraction impacts. Their lightweight nature also contributes to transportation efficiency, with studies indicating a 10-15% reduction in shipping-related emissions compared to conventional display technologies.

When implemented in next-generation computing architectures, flexible microdisplays enable novel form factors that can optimize device longevity and repairability. Foldable and rollable designs reduce physical stress on display components, potentially extending product lifespans by 30-50% compared to rigid alternatives. This longevity directly translates to reduced electronic waste generation, addressing a critical environmental challenge in the technology sector.

The adaptability of flexible displays also supports circular economy principles through modular design approaches. By enabling easier component separation and replacement, these technologies facilitate more effective recycling and refurbishment processes. Industry analyses suggest that properly designed flexible display systems could achieve 70-80% material recovery rates, substantially higher than the 20-30% typical of conventional display technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!