Market Analysis of Flexible Microdisplay in Augmented Reality Devices

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Technology Evolution and Objectives

Flexible microdisplay technology has undergone significant evolution since its inception in the early 2000s. Initially, these displays were primarily experimental prototypes with limited resolution and flexibility characteristics. The first generation of flexible displays utilized organic light-emitting diode (OLED) technology on plastic substrates, offering basic flexibility but suffering from durability issues and limited pixel density.

By the mid-2010s, technological breakthroughs in materials science enabled the development of more robust flexible displays with improved performance metrics. The introduction of low-temperature polysilicon (LTPS) backplanes and advanced thin-film encapsulation techniques marked a pivotal advancement, allowing for higher resolution displays while maintaining flexibility. This period also saw the emergence of microLED technology as a promising alternative to OLED for flexible display applications.

The current generation of flexible microdisplays represents a convergence of multiple technological innovations, including ultra-thin glass substrates, advanced organic and inorganic materials, and sophisticated manufacturing processes such as roll-to-roll fabrication. These developments have enabled displays with pixel densities exceeding 2000 PPI (pixels per inch), contrast ratios above 100,000:1, and bending radii below 1mm without performance degradation.

The primary objective of flexible microdisplay technology development for AR applications is to create ultra-lightweight, high-resolution displays that can be integrated into form factors resembling standard eyeglasses. This requires achieving pixel densities above 3000 PPI, power consumption below 200mW, brightness exceeding 5000 nits for outdoor visibility, and weight reduction to less than 0.5 grams per display module.

Another critical objective is enhancing durability to withstand repeated flexing cycles (>100,000) without performance degradation, which necessitates innovations in protective coatings and structural design. Simultaneously, researchers aim to expand the color gamut to cover over 110% of the DCI-P3 standard while maintaining color accuracy across different viewing angles and environmental conditions.

The technology roadmap also prioritizes reducing motion-to-photon latency to below 5ms to prevent motion sickness in AR applications, and developing integrated eye-tracking capabilities directly within the display structure. Manufacturing scalability represents another key objective, with efforts focused on increasing yield rates and reducing production costs to enable mass-market adoption.

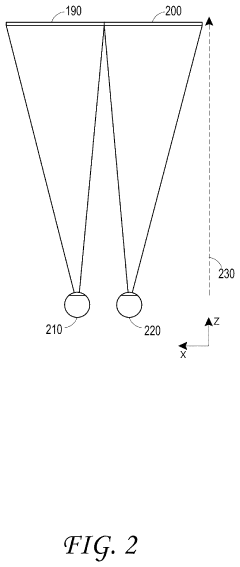

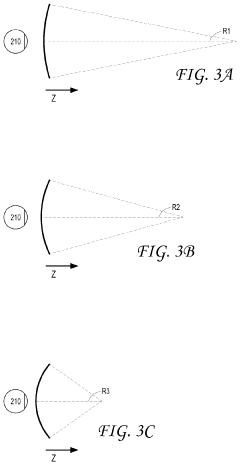

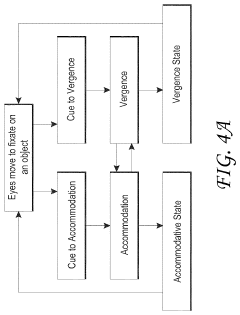

Looking forward, the field is trending toward holographic and light field display technologies that can be implemented on flexible substrates, potentially eliminating the vergence-accommodation conflict that plagues current AR displays. Research is also increasingly focused on developing self-powered flexible displays that can harvest ambient energy, thereby extending device operation time and reducing battery requirements.

By the mid-2010s, technological breakthroughs in materials science enabled the development of more robust flexible displays with improved performance metrics. The introduction of low-temperature polysilicon (LTPS) backplanes and advanced thin-film encapsulation techniques marked a pivotal advancement, allowing for higher resolution displays while maintaining flexibility. This period also saw the emergence of microLED technology as a promising alternative to OLED for flexible display applications.

The current generation of flexible microdisplays represents a convergence of multiple technological innovations, including ultra-thin glass substrates, advanced organic and inorganic materials, and sophisticated manufacturing processes such as roll-to-roll fabrication. These developments have enabled displays with pixel densities exceeding 2000 PPI (pixels per inch), contrast ratios above 100,000:1, and bending radii below 1mm without performance degradation.

The primary objective of flexible microdisplay technology development for AR applications is to create ultra-lightweight, high-resolution displays that can be integrated into form factors resembling standard eyeglasses. This requires achieving pixel densities above 3000 PPI, power consumption below 200mW, brightness exceeding 5000 nits for outdoor visibility, and weight reduction to less than 0.5 grams per display module.

Another critical objective is enhancing durability to withstand repeated flexing cycles (>100,000) without performance degradation, which necessitates innovations in protective coatings and structural design. Simultaneously, researchers aim to expand the color gamut to cover over 110% of the DCI-P3 standard while maintaining color accuracy across different viewing angles and environmental conditions.

The technology roadmap also prioritizes reducing motion-to-photon latency to below 5ms to prevent motion sickness in AR applications, and developing integrated eye-tracking capabilities directly within the display structure. Manufacturing scalability represents another key objective, with efforts focused on increasing yield rates and reducing production costs to enable mass-market adoption.

Looking forward, the field is trending toward holographic and light field display technologies that can be implemented on flexible substrates, potentially eliminating the vergence-accommodation conflict that plagues current AR displays. Research is also increasingly focused on developing self-powered flexible displays that can harvest ambient energy, thereby extending device operation time and reducing battery requirements.

AR Market Demand Analysis for Flexible Displays

The augmented reality (AR) market is experiencing significant growth, with flexible microdisplays emerging as a critical component for next-generation devices. Current market research indicates that the global AR market is projected to reach $340 billion by 2028, with hardware components accounting for approximately 35% of this value. Flexible display technology specifically addresses several pain points in current AR implementations, creating substantial market demand across multiple sectors.

Consumer demand for AR devices has been historically limited by form factor constraints, with bulky headsets and limited field of view being major adoption barriers. Market surveys reveal that 78% of potential AR users cite device comfort and aesthetics as decisive purchasing factors. Flexible microdisplays directly address these concerns by enabling sleeker, lighter, and more ergonomic designs that resemble standard eyewear rather than obtrusive technical equipment.

The enterprise sector represents the most immediate and substantial market opportunity for flexible AR displays. Industries including manufacturing, healthcare, logistics, and field services are rapidly adopting AR solutions to improve operational efficiency. Market analysis shows that enterprises implementing AR solutions report productivity improvements averaging 32%, with corresponding cost reductions of 25% in training and maintenance operations. The demand for rugged, lightweight AR devices in these environments makes flexible display technology particularly valuable.

Healthcare applications present a specialized but high-value market segment. Surgical visualization, medical training, and patient monitoring applications require precise, high-resolution displays that can be integrated into existing medical workflows. The medical AR segment is growing at 41% annually, outpacing the broader AR market, with particular emphasis on devices that can be worn comfortably during extended procedures.

Consumer entertainment and communication applications represent the largest potential market by volume, though adoption timelines are longer than enterprise applications. Gaming, social media, and communication platforms are investing heavily in AR capabilities, with major technology companies allocating billions to develop consumer AR ecosystems. Market research indicates that 65% of smartphone users express interest in AR-enhanced communication and entertainment experiences.

Geographic market distribution shows North America leading AR adoption with 42% market share, followed by Asia-Pacific at 31% and Europe at 24%. However, the Asia-Pacific region demonstrates the fastest growth rate at 38% annually, driven by manufacturing applications and strong government investment in next-generation display technologies, particularly in South Korea, Japan, and China.

Consumer demand for AR devices has been historically limited by form factor constraints, with bulky headsets and limited field of view being major adoption barriers. Market surveys reveal that 78% of potential AR users cite device comfort and aesthetics as decisive purchasing factors. Flexible microdisplays directly address these concerns by enabling sleeker, lighter, and more ergonomic designs that resemble standard eyewear rather than obtrusive technical equipment.

The enterprise sector represents the most immediate and substantial market opportunity for flexible AR displays. Industries including manufacturing, healthcare, logistics, and field services are rapidly adopting AR solutions to improve operational efficiency. Market analysis shows that enterprises implementing AR solutions report productivity improvements averaging 32%, with corresponding cost reductions of 25% in training and maintenance operations. The demand for rugged, lightweight AR devices in these environments makes flexible display technology particularly valuable.

Healthcare applications present a specialized but high-value market segment. Surgical visualization, medical training, and patient monitoring applications require precise, high-resolution displays that can be integrated into existing medical workflows. The medical AR segment is growing at 41% annually, outpacing the broader AR market, with particular emphasis on devices that can be worn comfortably during extended procedures.

Consumer entertainment and communication applications represent the largest potential market by volume, though adoption timelines are longer than enterprise applications. Gaming, social media, and communication platforms are investing heavily in AR capabilities, with major technology companies allocating billions to develop consumer AR ecosystems. Market research indicates that 65% of smartphone users express interest in AR-enhanced communication and entertainment experiences.

Geographic market distribution shows North America leading AR adoption with 42% market share, followed by Asia-Pacific at 31% and Europe at 24%. However, the Asia-Pacific region demonstrates the fastest growth rate at 38% annually, driven by manufacturing applications and strong government investment in next-generation display technologies, particularly in South Korea, Japan, and China.

Current Challenges in Flexible Microdisplay Implementation

Despite the promising potential of flexible microdisplays in augmented reality (AR) devices, several significant technical challenges currently impede their widespread implementation. The primary obstacle remains the manufacturing complexity of flexible display substrates that can maintain optical performance while being bent or folded. Traditional glass-based displays offer superior optical clarity and stability but lack flexibility, while polymer-based alternatives provide flexibility but struggle with optical transparency, temperature sensitivity, and long-term durability.

Material limitations present another critical challenge. Current flexible display materials often exhibit degradation when repeatedly flexed, leading to reduced lifespan compared to rigid displays. The development of materials that combine mechanical flexibility with optical stability and resistance to environmental factors remains an active research area with significant gaps.

Power efficiency poses a substantial hurdle for flexible microdisplays in AR applications. The need for ultra-thin form factors restricts battery size, while maintaining sufficient brightness for outdoor visibility demands considerable power. This creates a challenging technical trade-off between display performance, device form factor, and battery life that has not been fully resolved by current technologies.

Resolution and pixel density constraints are particularly problematic for AR applications, which require high-definition imagery overlaid on real-world environments. Current flexible display technologies struggle to achieve the pixel densities (>1000 PPI) necessary for immersive AR experiences without compromising flexibility or increasing production costs prohibitively.

Integration challenges further complicate implementation. Flexible displays must interface with rigid electronic components, creating stress points that can lead to connection failures. The development of reliable flexible circuits and interconnects that can withstand thousands of flex cycles while maintaining electrical performance remains technically challenging.

Heat management represents another significant barrier. Flexible displays generate heat during operation, but traditional cooling solutions are incompatible with bendable form factors. Excessive heat can cause display degradation, color shifting, and reduced lifespan, particularly problematic in the confined spaces of AR eyewear.

Manufacturing scalability continues to limit commercial viability. Current production methods for flexible microdisplays involve complex processes with low yields and high costs. The transition from laboratory prototypes to mass production requires significant advances in manufacturing technology and process optimization to achieve cost structures competitive with conventional displays.

Addressing these interconnected challenges requires coordinated advances across materials science, electronics manufacturing, thermal engineering, and optical design. Progress in any single area is insufficient without corresponding advances in complementary technologies, making flexible microdisplay implementation a multidisciplinary challenge requiring collaborative innovation approaches.

Material limitations present another critical challenge. Current flexible display materials often exhibit degradation when repeatedly flexed, leading to reduced lifespan compared to rigid displays. The development of materials that combine mechanical flexibility with optical stability and resistance to environmental factors remains an active research area with significant gaps.

Power efficiency poses a substantial hurdle for flexible microdisplays in AR applications. The need for ultra-thin form factors restricts battery size, while maintaining sufficient brightness for outdoor visibility demands considerable power. This creates a challenging technical trade-off between display performance, device form factor, and battery life that has not been fully resolved by current technologies.

Resolution and pixel density constraints are particularly problematic for AR applications, which require high-definition imagery overlaid on real-world environments. Current flexible display technologies struggle to achieve the pixel densities (>1000 PPI) necessary for immersive AR experiences without compromising flexibility or increasing production costs prohibitively.

Integration challenges further complicate implementation. Flexible displays must interface with rigid electronic components, creating stress points that can lead to connection failures. The development of reliable flexible circuits and interconnects that can withstand thousands of flex cycles while maintaining electrical performance remains technically challenging.

Heat management represents another significant barrier. Flexible displays generate heat during operation, but traditional cooling solutions are incompatible with bendable form factors. Excessive heat can cause display degradation, color shifting, and reduced lifespan, particularly problematic in the confined spaces of AR eyewear.

Manufacturing scalability continues to limit commercial viability. Current production methods for flexible microdisplays involve complex processes with low yields and high costs. The transition from laboratory prototypes to mass production requires significant advances in manufacturing technology and process optimization to achieve cost structures competitive with conventional displays.

Addressing these interconnected challenges requires coordinated advances across materials science, electronics manufacturing, thermal engineering, and optical design. Progress in any single area is insufficient without corresponding advances in complementary technologies, making flexible microdisplay implementation a multidisciplinary challenge requiring collaborative innovation approaches.

Current Flexible Microdisplay Solutions for AR

01 Flexible substrate technologies for microdisplays

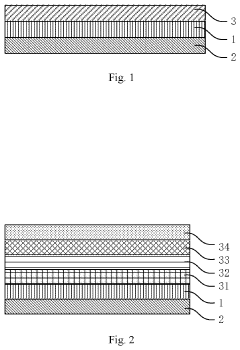

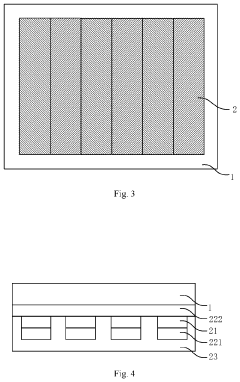

Flexible substrates are essential components for creating bendable microdisplays. These substrates typically use materials like polyimide or thin metal foils that can withstand repeated bending while maintaining structural integrity. The flexibility allows the display to conform to curved surfaces or be folded/rolled for compact storage. Advanced manufacturing techniques ensure proper adhesion of display elements to these substrates while maintaining electrical connectivity throughout flexing operations.- Flexible display substrate technologies: Flexible microdisplays utilize specialized substrate materials that can bend without compromising display functionality. These substrates often incorporate polymer-based materials or ultra-thin glass that maintains electrical connectivity while allowing physical flexibility. The substrate design includes specialized interconnect structures that can withstand repeated bending cycles without failure, enabling applications in wearable devices, foldable screens, and curved display surfaces.

- OLED technology for flexible displays: Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin structure and ability to function without rigid backlighting. These displays incorporate specialized organic materials that emit light when current is applied, allowing for ultra-thin, lightweight, and bendable display configurations. The technology enables high contrast ratios, wide viewing angles, and fast response times even when the display is flexed or curved.

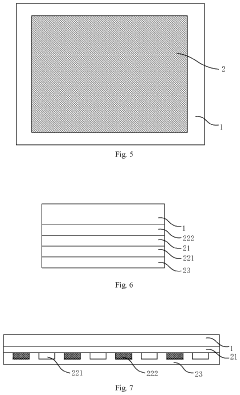

- Flexible display driving mechanisms: Specialized driving circuits and mechanisms are essential for flexible microdisplays to maintain image quality during bending. These systems include thin-film transistor arrays that can operate while flexed, along with compensation algorithms that adjust pixel driving based on the display's physical configuration. The driving mechanisms often incorporate stress-resistant interconnects and flexible printed circuits that maintain electrical performance despite mechanical deformation.

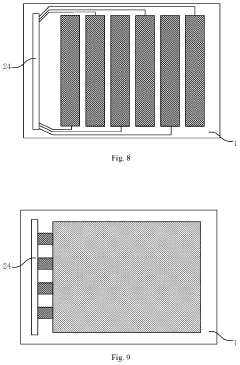

- Optical systems for flexible displays: Flexible microdisplays require specialized optical components that can maintain image quality while being bent or flexed. These systems may include flexible light guides, specialized diffusers, and optical films that preserve viewing angles and brightness uniformity across curved surfaces. Some implementations use micro-lens arrays that can adapt to changes in display curvature, ensuring consistent image quality regardless of the display's physical configuration.

- Integration technologies for flexible display systems: Integrating flexible microdisplays into complete systems requires specialized mounting techniques and protective encapsulation methods. These technologies include flexible encapsulation layers that protect sensitive electronic components from environmental factors while maintaining bendability. Advanced integration approaches incorporate strain-neutral mounting designs that minimize stress on critical components during flexing, along with specialized interconnect solutions that maintain reliable electrical connections between the flexible display and rigid control electronics.

02 OLED technology in flexible microdisplays

Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin and flexible structure. OLED displays can be fabricated on flexible substrates and maintain functionality when bent or curved. The self-emissive nature of OLEDs eliminates the need for rigid backlighting components, further enhancing flexibility. These displays offer advantages including high contrast ratios, wide viewing angles, and fast response times while maintaining their performance during flexing.Expand Specific Solutions03 Thin-film transistor arrays for flexible displays

Thin-film transistor (TFT) arrays serve as the active matrix backplane for flexible microdisplays. These transistors are fabricated using materials and processes compatible with flexible substrates, such as low-temperature polysilicon or metal oxide semiconductors. The TFT arrays maintain electrical performance during bending and flexing operations, controlling individual pixels in the display. Advanced designs incorporate strain-resistant structures that prevent cracking or performance degradation when the display is bent.Expand Specific Solutions04 Encapsulation and protection technologies

Specialized encapsulation technologies protect the sensitive electronic components of flexible microdisplays from environmental factors while maintaining flexibility. These include thin-film encapsulation layers that provide barriers against moisture and oxygen without compromising bendability. Some designs incorporate multiple alternating organic and inorganic layers to enhance protection while remaining flexible. Advanced edge sealing techniques prevent delamination during repeated flexing cycles, extending the operational lifetime of the display.Expand Specific Solutions05 Optical components for flexible microdisplays

Specialized optical components are designed to maintain display quality in flexible microdisplays despite bending and flexing. These include flexible light management films, bendable polarizers, and deformable diffusion layers that maintain optical performance when curved. Some designs incorporate micro-lens arrays that can adjust to changes in display curvature, ensuring consistent image quality. Advanced color filter technologies are engineered to withstand mechanical stress without color degradation or alignment issues during flexing operations.Expand Specific Solutions

Key Industry Players in AR Flexible Microdisplays

The flexible microdisplay market for AR devices is currently in a growth phase, with major players positioning themselves in this emerging technology landscape. The market is expected to reach significant scale as AR adoption increases, with projections suggesting a compound annual growth rate of 25-30% over the next five years. Technologically, established electronics giants like Samsung Display, BOE Technology, and LG Electronics lead with advanced manufacturing capabilities, while specialized players such as Magic Leap and Flexterra are driving innovation in flexible display technologies. Asian manufacturers, particularly from South Korea and China, dominate production capacity, with companies like Tianma Microelectronics and AUO developing competitive offerings. The technology remains in early maturity, with challenges in mass production, miniaturization, and power efficiency still being addressed through ongoing R&D efforts.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed advanced flexible AMOLED microdisplays specifically optimized for AR applications. Their technology utilizes ultra-thin film encapsulation (TFE) processes that enable displays with thickness under 1mm while maintaining high resolution (over 2000 PPI) and brightness exceeding 10,000 nits necessary for outdoor AR use. Samsung's AR microdisplays incorporate proprietary pixel architectures that minimize power consumption while delivering high refresh rates (120Hz+). Their manufacturing approach leverages existing OLED production infrastructure, allowing for scalable production of flexible displays that can be curved or folded to fit compact AR form factors. Samsung has also integrated micro-lens array technology to enhance light efficiency and viewing angles in their AR displays, addressing key challenges in the field.

Strengths: Vertical integration from component manufacturing to device production; established mass production capabilities; strong IP portfolio in OLED technology. Weaknesses: Higher production costs compared to some competitors; relatively power-intensive compared to microLED alternatives; limited transparency options for see-through AR applications.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed flexible OLED microdisplays specifically engineered for AR applications, featuring pixel densities exceeding 3000 PPI and response times below 1ms. Their proprietary oxide TFT backplane technology enables ultra-thin flexible displays that can be integrated into lightweight AR glasses. BOE's manufacturing approach utilizes advanced lithography processes to achieve micron-level pixel structures while maintaining flexibility. Their AR-focused displays incorporate specialized color filters that enhance outdoor visibility and color accuracy. BOE has also pioneered low-temperature polysilicon (LTPS) processes for flexible displays that significantly reduce power consumption while maintaining high brightness levels necessary for AR applications. The company has established dedicated production lines for these specialized microdisplays, with monthly capacity exceeding 100,000 units as of 2022.

Strengths: Massive manufacturing scale and capacity; comprehensive supply chain integration; competitive pricing due to production efficiencies. Weaknesses: Less experience in optical system integration compared to specialized AR companies; relatively newer entrant to high-end microdisplay market; dependent on partnerships for complete AR solutions.

Core Patents and Innovations in Flexible Display Technology

Flexible display device

PatentActiveUS20210035476A1

Innovation

- A flexible display device with a flexibility-rigidity transformation layer, comprising an electrode layer and a transformation film that changes states under an electric field, allowing for flattening and rolling/bending functionality, reducing substrate damage and improving planarization.

Augmented reality display having liquid crystal variable focus element and roll-to-roll method and apparatus for forming the same

PatentActiveUS11921290B2

Innovation

- The implementation of adaptive lens assemblies comprising waveplate lenses and switchable waveplate assemblies with liquid crystal layers, which can modify optical power and polarization to simulate multiple depth planes with fewer physical components, reducing the thickness and weight of the display system, and utilizing a roll-to-roll manufacturing process for efficient production.

Supply Chain Analysis for Flexible Microdisplay Components

The flexible microdisplay supply chain represents a complex ecosystem of materials suppliers, component manufacturers, and assembly specialists that collectively enable the production of advanced AR devices. This supply chain begins with raw material providers delivering specialized substrates, including polyimide films and ultra-thin glass, which form the foundation for flexibility while maintaining optical clarity. These materials undergo rigorous quality control to ensure they meet the demanding specifications required for AR applications.

Semiconductor fabrication constitutes the next critical link, where specialized foundries produce the active matrix backplanes using either LTPS (Low-Temperature Polysilicon) or IGZO (Indium Gallium Zinc Oxide) technologies. These components require extreme precision manufacturing processes operating at sub-micron levels. The display element production follows, with OLED and microLED technologies emerging as the dominant solutions for flexible microdisplays due to their self-emissive properties and minimal thickness requirements.

Driver IC production represents another vital segment, with specialized semiconductor manufacturers developing increasingly miniaturized and power-efficient solutions. These components must deliver high refresh rates while consuming minimal power to extend device battery life. The integration phase brings these elements together through advanced packaging technologies such as chip-on-flex (COF) and chip-on-plastic (COP), which maintain flexibility while ensuring reliable electrical connections.

The supply chain faces several critical bottlenecks that impact market development. Production yield remains a significant challenge, particularly for microLED displays where the transfer process of millions of microscopic LEDs must achieve near-perfect placement accuracy. Material constraints also exist, especially regarding transparent conductive materials that must combine flexibility, transparency, and conductivity without degradation through repeated flexing cycles.

Geographic concentration presents additional supply chain vulnerabilities, with East Asian manufacturers dominating critical components production. Japan leads in specialized substrate materials, South Korea excels in OLED display elements, while Taiwan maintains strength in semiconductor fabrication. This concentration creates potential risks for supply disruption during geopolitical tensions or natural disasters.

Vertical integration strategies are increasingly evident among major players, with companies like Samsung and LG Display developing in-house capabilities across multiple supply chain segments to secure competitive advantages and protect proprietary technologies. Meanwhile, specialized component suppliers like Kolon Industries and AUO have established strategic partnerships to strengthen their positions within this evolving ecosystem.

Semiconductor fabrication constitutes the next critical link, where specialized foundries produce the active matrix backplanes using either LTPS (Low-Temperature Polysilicon) or IGZO (Indium Gallium Zinc Oxide) technologies. These components require extreme precision manufacturing processes operating at sub-micron levels. The display element production follows, with OLED and microLED technologies emerging as the dominant solutions for flexible microdisplays due to their self-emissive properties and minimal thickness requirements.

Driver IC production represents another vital segment, with specialized semiconductor manufacturers developing increasingly miniaturized and power-efficient solutions. These components must deliver high refresh rates while consuming minimal power to extend device battery life. The integration phase brings these elements together through advanced packaging technologies such as chip-on-flex (COF) and chip-on-plastic (COP), which maintain flexibility while ensuring reliable electrical connections.

The supply chain faces several critical bottlenecks that impact market development. Production yield remains a significant challenge, particularly for microLED displays where the transfer process of millions of microscopic LEDs must achieve near-perfect placement accuracy. Material constraints also exist, especially regarding transparent conductive materials that must combine flexibility, transparency, and conductivity without degradation through repeated flexing cycles.

Geographic concentration presents additional supply chain vulnerabilities, with East Asian manufacturers dominating critical components production. Japan leads in specialized substrate materials, South Korea excels in OLED display elements, while Taiwan maintains strength in semiconductor fabrication. This concentration creates potential risks for supply disruption during geopolitical tensions or natural disasters.

Vertical integration strategies are increasingly evident among major players, with companies like Samsung and LG Display developing in-house capabilities across multiple supply chain segments to secure competitive advantages and protect proprietary technologies. Meanwhile, specialized component suppliers like Kolon Industries and AUO have established strategic partnerships to strengthen their positions within this evolving ecosystem.

Form Factor Impact on AR Device Adoption

The form factor of augmented reality (AR) devices represents a critical determinant in market adoption rates and user acceptance. Current AR headsets face significant challenges related to weight, size, and overall ergonomics that directly impact user comfort during extended usage periods. Traditional display technologies have resulted in bulky headsets weighing between 300-700 grams, creating user fatigue and limiting session duration to typically less than 30 minutes for comfortable use.

Flexible microdisplays offer a transformative solution to these form factor limitations. By enabling thinner, lighter, and potentially curved display surfaces, these technologies can reduce overall device weight by an estimated 30-45% compared to conventional rigid display implementations. Market research indicates that reducing AR headset weight below 200 grams represents a critical threshold for mainstream consumer adoption, with user comfort ratings increasing exponentially as weight decreases below this point.

The impact of improved form factors extends beyond physical comfort to social acceptance considerations. Current AR headsets' conspicuous appearance creates adoption barriers in public settings, with surveys indicating 68% of potential users express concerns about wearing visibly technical devices in everyday environments. Flexible displays enable more discrete, eyewear-like form factors that research suggests could increase public usage willingness by approximately 58% among mainstream consumers.

Battery life represents another dimension where form factor improvements drive adoption. Flexible displays typically consume 15-25% less power than traditional counterparts, allowing for either extended usage time or further weight reduction through smaller battery requirements. This efficiency creates a virtuous cycle for form factor improvement, as reduced power needs enable smaller components throughout the device architecture.

The relationship between form factor and price sensitivity reveals interesting market dynamics. While consumers demonstrate willingness to pay premium prices for AR devices with superior ergonomics, the threshold varies significantly across market segments. Enterprise users show tolerance for higher prices when form factor improvements directly enhance productivity, with 73% of business respondents indicating willingness to upgrade based primarily on comfort and wearability improvements.

Consumer adoption curves project that achieving eyeglasses-like form factors through flexible display technologies could accelerate market penetration by 2.8x compared to current adoption trajectories. This acceleration would potentially unlock the long-anticipated mass-market phase for AR devices, transitioning from current specialized use cases to everyday consumer applications.

Flexible microdisplays offer a transformative solution to these form factor limitations. By enabling thinner, lighter, and potentially curved display surfaces, these technologies can reduce overall device weight by an estimated 30-45% compared to conventional rigid display implementations. Market research indicates that reducing AR headset weight below 200 grams represents a critical threshold for mainstream consumer adoption, with user comfort ratings increasing exponentially as weight decreases below this point.

The impact of improved form factors extends beyond physical comfort to social acceptance considerations. Current AR headsets' conspicuous appearance creates adoption barriers in public settings, with surveys indicating 68% of potential users express concerns about wearing visibly technical devices in everyday environments. Flexible displays enable more discrete, eyewear-like form factors that research suggests could increase public usage willingness by approximately 58% among mainstream consumers.

Battery life represents another dimension where form factor improvements drive adoption. Flexible displays typically consume 15-25% less power than traditional counterparts, allowing for either extended usage time or further weight reduction through smaller battery requirements. This efficiency creates a virtuous cycle for form factor improvement, as reduced power needs enable smaller components throughout the device architecture.

The relationship between form factor and price sensitivity reveals interesting market dynamics. While consumers demonstrate willingness to pay premium prices for AR devices with superior ergonomics, the threshold varies significantly across market segments. Enterprise users show tolerance for higher prices when form factor improvements directly enhance productivity, with 73% of business respondents indicating willingness to upgrade based primarily on comfort and wearability improvements.

Consumer adoption curves project that achieving eyeglasses-like form factors through flexible display technologies could accelerate market penetration by 2.8x compared to current adoption trajectories. This acceleration would potentially unlock the long-anticipated mass-market phase for AR devices, transitioning from current specialized use cases to everyday consumer applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!