Flexible Microdisplay Adoption in Global Electronics Market

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Evolution and Objectives

Flexible microdisplays represent a revolutionary advancement in display technology, evolving from traditional rigid displays to malleable, bendable visual interfaces. The journey began in the early 2000s with rudimentary flexible electronic paper displays, progressing through significant technological breakthroughs in materials science and manufacturing processes. By 2010, early prototypes demonstrated basic flexibility but suffered from limited resolution and durability issues.

The evolution accelerated dramatically between 2015-2020, with the introduction of organic light-emitting diode (OLED) technology specifically engineered for flexibility. This period marked crucial developments in substrate materials, transitioning from glass to polyimide films and ultrathin plastic polymers capable of withstanding repeated bending cycles without performance degradation.

Recent advancements have focused on overcoming persistent challenges in pixel density, color accuracy, and power efficiency while maintaining mechanical flexibility. The integration of low-temperature polysilicon (LTPS) and indium gallium zinc oxide (IGZO) backplanes has enabled higher refresh rates and improved resolution in flexible formats, approaching parity with rigid display counterparts.

Current technological objectives center on achieving commercial viability across multiple consumer and industrial applications. Primary goals include reducing manufacturing costs through scalable production methods, enhancing durability to withstand daily usage scenarios, and improving optical performance under various bending conditions. Particular emphasis is placed on developing displays that maintain consistent brightness and color accuracy regardless of form factor manipulation.

Long-term objectives extend to creating truly rollable and foldable microdisplays with zero visible creasing and minimal thickness profiles under 0.5mm. Research priorities include developing self-healing materials to extend product lifespan and implementing advanced touch sensitivity that functions reliably across curved surfaces. Additionally, efforts are underway to reduce power consumption through more efficient pixel architectures and improved battery integration within flexible form factors.

The industry is simultaneously pursuing standardization of flexible display specifications to facilitate broader adoption across product categories. This includes establishing uniform testing protocols for flexibility metrics, environmental durability standards, and performance benchmarks specific to non-rigid display applications. These standards aim to accelerate market acceptance by providing manufacturers with clear development targets and consumers with reliable performance expectations.

As the technology matures, the trajectory points toward increasingly sophisticated implementations including transparent flexible displays, embedded sensor integration, and eventually, displays capable of dynamic shape-shifting based on content requirements or user preferences. These ambitious objectives represent the frontier of display technology evolution, with significant implications for next-generation electronics design paradigms.

The evolution accelerated dramatically between 2015-2020, with the introduction of organic light-emitting diode (OLED) technology specifically engineered for flexibility. This period marked crucial developments in substrate materials, transitioning from glass to polyimide films and ultrathin plastic polymers capable of withstanding repeated bending cycles without performance degradation.

Recent advancements have focused on overcoming persistent challenges in pixel density, color accuracy, and power efficiency while maintaining mechanical flexibility. The integration of low-temperature polysilicon (LTPS) and indium gallium zinc oxide (IGZO) backplanes has enabled higher refresh rates and improved resolution in flexible formats, approaching parity with rigid display counterparts.

Current technological objectives center on achieving commercial viability across multiple consumer and industrial applications. Primary goals include reducing manufacturing costs through scalable production methods, enhancing durability to withstand daily usage scenarios, and improving optical performance under various bending conditions. Particular emphasis is placed on developing displays that maintain consistent brightness and color accuracy regardless of form factor manipulation.

Long-term objectives extend to creating truly rollable and foldable microdisplays with zero visible creasing and minimal thickness profiles under 0.5mm. Research priorities include developing self-healing materials to extend product lifespan and implementing advanced touch sensitivity that functions reliably across curved surfaces. Additionally, efforts are underway to reduce power consumption through more efficient pixel architectures and improved battery integration within flexible form factors.

The industry is simultaneously pursuing standardization of flexible display specifications to facilitate broader adoption across product categories. This includes establishing uniform testing protocols for flexibility metrics, environmental durability standards, and performance benchmarks specific to non-rigid display applications. These standards aim to accelerate market acceptance by providing manufacturers with clear development targets and consumers with reliable performance expectations.

As the technology matures, the trajectory points toward increasingly sophisticated implementations including transparent flexible displays, embedded sensor integration, and eventually, displays capable of dynamic shape-shifting based on content requirements or user preferences. These ambitious objectives represent the frontier of display technology evolution, with significant implications for next-generation electronics design paradigms.

Market Demand Analysis for Flexible Display Technologies

The flexible microdisplay market has witnessed substantial growth in recent years, driven primarily by increasing consumer demand for wearable technology, augmented reality (AR), virtual reality (VR), and foldable smartphones. Market research indicates that the global flexible display market reached approximately $23 billion in 2022 and is projected to grow at a compound annual growth rate of 28% through 2030, with flexible microdisplays representing a significant segment within this broader market.

Consumer electronics remains the dominant application sector, accounting for over 60% of flexible microdisplay demand. Within this sector, smartwatches and fitness trackers have emerged as key growth drivers, with shipments of wearable devices featuring flexible displays increasing by 32% year-over-year in 2022. The automotive industry has also begun integrating flexible microdisplays into dashboard systems and heads-up displays, with luxury vehicle manufacturers leading adoption.

Regional analysis reveals that Asia-Pacific currently dominates the market, with approximately 45% market share, followed by North America (30%) and Europe (20%). China and South Korea have established themselves as manufacturing hubs, while North America leads in technology innovation and high-end applications. The market in emerging economies is expected to grow at above-average rates as smartphone penetration increases and manufacturing capabilities expand.

Consumer preference surveys indicate strong interest in devices with flexible displays, with 78% of respondents expressing willingness to pay a premium for foldable smartphones and 65% showing interest in wearable devices with curved or flexible screens. This consumer sentiment is reinforced by the success of recent product launches featuring flexible display technology, which have consistently outperformed sales forecasts despite premium pricing.

Industry challenges include production costs that remain 30-40% higher than traditional rigid displays, limiting mass-market adoption. Supply chain constraints, particularly regarding specialized materials like flexible substrates and encapsulation technologies, have created bottlenecks that manufacturers are actively working to resolve through vertical integration and strategic partnerships.

The healthcare sector represents an emerging high-potential market, with applications in medical wearables and portable diagnostic equipment projected to grow at 35% annually through 2028. Military and defense applications are also expanding, with requirements for rugged, lightweight displays driving specialized development in this sector.

Consumer electronics remains the dominant application sector, accounting for over 60% of flexible microdisplay demand. Within this sector, smartwatches and fitness trackers have emerged as key growth drivers, with shipments of wearable devices featuring flexible displays increasing by 32% year-over-year in 2022. The automotive industry has also begun integrating flexible microdisplays into dashboard systems and heads-up displays, with luxury vehicle manufacturers leading adoption.

Regional analysis reveals that Asia-Pacific currently dominates the market, with approximately 45% market share, followed by North America (30%) and Europe (20%). China and South Korea have established themselves as manufacturing hubs, while North America leads in technology innovation and high-end applications. The market in emerging economies is expected to grow at above-average rates as smartphone penetration increases and manufacturing capabilities expand.

Consumer preference surveys indicate strong interest in devices with flexible displays, with 78% of respondents expressing willingness to pay a premium for foldable smartphones and 65% showing interest in wearable devices with curved or flexible screens. This consumer sentiment is reinforced by the success of recent product launches featuring flexible display technology, which have consistently outperformed sales forecasts despite premium pricing.

Industry challenges include production costs that remain 30-40% higher than traditional rigid displays, limiting mass-market adoption. Supply chain constraints, particularly regarding specialized materials like flexible substrates and encapsulation technologies, have created bottlenecks that manufacturers are actively working to resolve through vertical integration and strategic partnerships.

The healthcare sector represents an emerging high-potential market, with applications in medical wearables and portable diagnostic equipment projected to grow at 35% annually through 2028. Military and defense applications are also expanding, with requirements for rugged, lightweight displays driving specialized development in this sector.

Technical Barriers and Global Development Status

The global flexible microdisplay market faces significant technical barriers despite its promising growth trajectory. Manufacturing challenges remain at the forefront, particularly in achieving consistent yield rates during the production of flexible substrates. Current manufacturing processes struggle with maintaining uniform performance across large production batches, resulting in higher costs and limited scalability. The delicate balance between flexibility and durability continues to challenge engineers, as increasing bend radius often compromises display longevity and reliability.

Material science limitations present another substantial hurdle. While organic light-emitting diode (OLED) technology has enabled thinner and more flexible displays, the organic materials remain susceptible to degradation from oxygen and moisture exposure. Encapsulation technologies have improved but still fail to provide the multi-year lifespan consumers expect from traditional displays. Additionally, transparent conductive materials that maintain conductivity while bending repeatedly remain in development phases with limited commercial viability.

Regionally, development status varies significantly. East Asia dominates the flexible display ecosystem, with South Korea leading in flexible OLED production capabilities. Samsung Display and LG Display have established advanced manufacturing facilities capable of mass-producing flexible panels, though primarily for premium market segments. Japan maintains strength in specialized materials development, while Taiwan focuses on integration technologies.

China has rapidly expanded its flexible display manufacturing capacity, with BOE Technology and Tianma Microelectronics making substantial investments. However, Chinese manufacturers still lag in cutting-edge encapsulation techniques and ultra-thin glass substrate technologies. North American companies excel in intellectual property and design innovation but rely heavily on Asian manufacturing partners for production.

European development centers around specialized applications and materials research, with companies like FlexEnable (UK) pioneering organic thin-film transistor technologies. The region lacks large-scale manufacturing infrastructure but contributes significantly to advanced material science research.

Resolution limitations persist across all regions, as pixel density in flexible displays remains lower than rigid counterparts. Power efficiency presents another universal challenge, with flexible displays typically consuming more energy than traditional options. This creates particular difficulties for wearable applications where battery capacity is severely constrained.

The technology readiness level varies by application, with smartphone implementations reaching commercial maturity while automotive and medical applications remain in prototype stages. Standardization efforts are fragmented globally, creating interoperability challenges that slow adoption in emerging markets and applications.

Material science limitations present another substantial hurdle. While organic light-emitting diode (OLED) technology has enabled thinner and more flexible displays, the organic materials remain susceptible to degradation from oxygen and moisture exposure. Encapsulation technologies have improved but still fail to provide the multi-year lifespan consumers expect from traditional displays. Additionally, transparent conductive materials that maintain conductivity while bending repeatedly remain in development phases with limited commercial viability.

Regionally, development status varies significantly. East Asia dominates the flexible display ecosystem, with South Korea leading in flexible OLED production capabilities. Samsung Display and LG Display have established advanced manufacturing facilities capable of mass-producing flexible panels, though primarily for premium market segments. Japan maintains strength in specialized materials development, while Taiwan focuses on integration technologies.

China has rapidly expanded its flexible display manufacturing capacity, with BOE Technology and Tianma Microelectronics making substantial investments. However, Chinese manufacturers still lag in cutting-edge encapsulation techniques and ultra-thin glass substrate technologies. North American companies excel in intellectual property and design innovation but rely heavily on Asian manufacturing partners for production.

European development centers around specialized applications and materials research, with companies like FlexEnable (UK) pioneering organic thin-film transistor technologies. The region lacks large-scale manufacturing infrastructure but contributes significantly to advanced material science research.

Resolution limitations persist across all regions, as pixel density in flexible displays remains lower than rigid counterparts. Power efficiency presents another universal challenge, with flexible displays typically consuming more energy than traditional options. This creates particular difficulties for wearable applications where battery capacity is severely constrained.

The technology readiness level varies by application, with smartphone implementations reaching commercial maturity while automotive and medical applications remain in prototype stages. Standardization efforts are fragmented globally, creating interoperability challenges that slow adoption in emerging markets and applications.

Current Implementation Solutions and Architectures

01 Flexible display technologies and materials

Flexible microdisplays utilize specialized materials and construction techniques to achieve bendability while maintaining display functionality. These displays typically incorporate flexible substrates such as plastic or thin glass, combined with pliable electronic components. The flexibility allows for curved, rollable, or foldable display applications while preserving image quality and durability. These technologies enable new form factors for wearable devices, mobile screens, and other applications where rigid displays would be impractical.- Flexible display substrate technologies: Flexible microdisplays utilize specialized substrate materials that can bend without compromising display functionality. These substrates often incorporate polymer-based materials or ultra-thin glass that maintains electrical connectivity while allowing for physical flexibility. The substrate design includes specialized interconnect structures that can withstand repeated bending cycles without failure, enabling applications in wearable devices, foldable screens, and curved display surfaces.

- OLED technology for flexible displays: Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin structure and ability to function without rigid backlighting. These displays incorporate specialized organic materials that emit light when current is applied, allowing for ultra-thin, lightweight, and bendable display configurations. The technology enables high contrast ratios, wide viewing angles, and fast response times even when the display is flexed or curved.

- Flexible display driving circuits: Specialized driving circuits are essential for flexible microdisplays to maintain image quality during bending. These circuits incorporate thin-film transistors (TFTs) on flexible substrates that can withstand mechanical stress while maintaining electrical performance. Advanced addressing schemes compensate for potential distortions caused by bending, ensuring consistent brightness and color accuracy across the curved display surface. The driving architecture may include stress-resistant interconnects and buffer layers to protect sensitive electronic components.

- Optical components for flexible displays: Flexible microdisplays incorporate specialized optical components that maintain visual performance when bent or curved. These include flexible light guide plates, specialized diffusers, and bendable polarizing films that preserve optical properties under mechanical stress. Advanced optical designs compensate for viewing angle changes that occur when displays are curved, ensuring consistent color reproduction and brightness across the entire viewing surface regardless of the display's physical configuration.

- Integration technologies for flexible display systems: System integration techniques for flexible microdisplays address the challenges of combining rigid electronic components with bendable display elements. These approaches include specialized packaging methods, flexible printed circuit boards, and stretchable interconnects that maintain functionality during bending. The integration technologies also encompass touch functionality that works on curved surfaces, environmental protection layers that preserve flexibility, and power management systems optimized for variable display geometries.

02 OLED-based flexible microdisplay systems

Organic Light Emitting Diode (OLED) technology is particularly suitable for flexible microdisplays due to its inherently thin and potentially flexible structure. These systems incorporate organic compounds that emit light when electricity is applied, eliminating the need for backlighting. OLED-based flexible displays offer advantages including higher contrast ratios, better color reproduction, faster response times, and the ability to be manufactured on various flexible substrates. This technology enables ultra-thin, lightweight, and conformable display solutions.Expand Specific Solutions03 Flexible display driving and control mechanisms

Specialized driving and control mechanisms are essential for flexible microdisplays to maintain image quality during bending or flexing. These systems include flexible thin-film transistors (TFTs), specialized addressing schemes, and compensation algorithms that adjust for physical deformation. The control systems must account for changing pixel geometries and electrical characteristics when the display is bent or flexed. Advanced driver ICs and backplane technologies enable stable operation across various curvatures and environmental conditions.Expand Specific Solutions04 Optical systems for flexible microdisplays

Flexible microdisplays incorporate specialized optical systems to maintain image quality despite physical deformation. These include flexible light guides, specialized diffusers, and optical compensation films that preserve viewing angles and brightness uniformity when the display is bent. Some designs incorporate micro-lens arrays or other optical elements that can adapt to changes in display curvature. These optical systems work in conjunction with the display elements to ensure consistent visual performance across different configurations.Expand Specific Solutions05 Integration of flexible displays in electronic devices

Integrating flexible microdisplays into electronic devices presents unique challenges and opportunities. Special mounting systems, connectors, and housing designs are required to accommodate the flexible nature of these displays while protecting sensitive components. The integration must account for repeated bending cycles, environmental factors, and user interaction patterns. Applications include wearable devices, foldable smartphones, curved automotive displays, and medical devices that conform to body contours. These integration techniques enable novel form factors and user experiences not possible with conventional rigid displays.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The flexible microdisplay market is currently in a growth phase, with increasing adoption across consumer electronics, wearables, and automotive applications. The global market size is expanding rapidly, driven by demand for lightweight, energy-efficient display solutions. Leading players include Samsung Electronics and BOE Technology Group, who are investing heavily in R&D to advance flexible OLED and microLED technologies. LG Display, Innolux, and TCL China Star Optoelectronics are also making significant technological strides, while Apple's interest signals mainstream potential. The technology is approaching maturity for certain applications, though challenges in manufacturing scalability and durability remain. Collaboration between display manufacturers and electronics companies is accelerating commercialization efforts.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed comprehensive flexible microdisplay solutions based on their advanced flexible OLED technology. Their approach utilizes ultra-thin flexible glass substrates with thickness below 30 micrometers combined with specialized polymer support layers. BOE's flexible displays incorporate a proprietary pixel compensation algorithm that maintains uniform brightness and color accuracy even when the display is bent at various angles. Their technology achieves bend radii as small as 1mm without performance degradation through a specialized neutral plane design that minimizes stress on active display components. BOE has implemented advanced TFT backplane technology using LTPO materials in flexible displays, enabling variable refresh rates from 1Hz to 144Hz while maintaining flexibility. Their flexible microdisplays feature specialized touch sensor integration that maintains sensitivity even at fold points, with response times under 8ms across the entire display surface. BOE has also pioneered flexible display encapsulation using atomic layer deposition techniques that provide superior moisture barriers while maintaining flexibility, extending display lifetime to over 20,000 hours even under repeated flexing conditions.

Strengths: Rapidly expanding production capacity; competitive pricing compared to Korean manufacturers; strong government backing for R&D. Weaknesses: Still catching up to Samsung and LG in some technical specifications; less established track record in consumer products; some challenges with yield rates for most advanced flexible displays.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered flexible microdisplay technology through its OLED innovations. Their flexible AMOLED displays utilize a polyimide substrate instead of traditional glass, allowing for bendable and foldable form factors. Samsung's Y-OCTA technology integrates the touch sensor directly into the display panel, reducing thickness and enhancing flexibility. Their latest flexible microdisplays achieve pixel densities exceeding 600 PPI with brightness levels up to 1,500 nits while maintaining flexibility. Samsung has implemented Ultra-Thin Glass (UTG) technology in their foldable displays, providing better durability while maintaining flexibility compared to earlier polymer-only solutions. Their displays can withstand over 200,000 fold cycles without significant degradation in performance. Samsung has also developed advanced TFT backplanes using LTPO technology that enables variable refresh rates (1-120Hz) in flexible displays, significantly reducing power consumption by up to 40% compared to conventional displays.

Strengths: Industry-leading production capacity with established supply chains; advanced folding technology with proven durability; strong vertical integration from components to finished products. Weaknesses: Higher production costs compared to rigid displays; limited extreme temperature performance; still facing challenges with crease visibility in folded displays.

Critical Patents and Technical Innovations

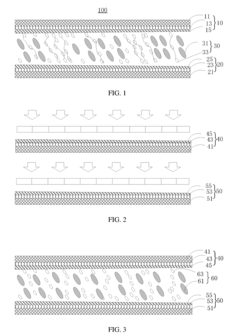

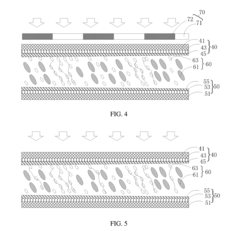

Liquid crystal medium mixture and liquid crystal display panel

PatentInactiveUS20180171235A1

Innovation

- A liquid crystal medium mixture containing a polymerizable monomer that undergoes polymerization under ultraviolet light irradiation to form partitions and polymer networks, restricting the flow and alignment of the liquid crystal material, with the monomer comprising acrylate, acrylate derivatives, and epoxy resins, and a photoinitiator to facilitate the process.

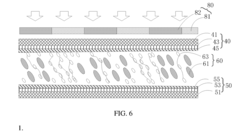

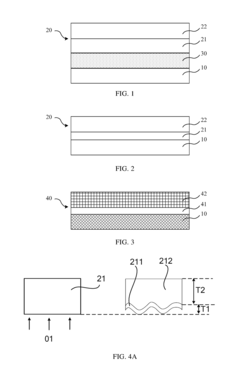

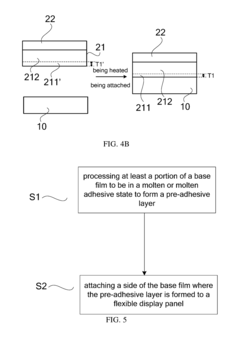

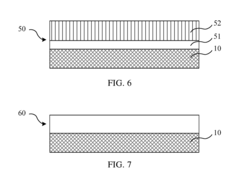

Flexible Display Device and Manufacturing Method Thereof

PatentActiveUS20180366661A1

Innovation

- A flexible display device is designed using a hot melt adhesive film as both a base film and adhesive layer, with a stable layer and a hot melt layer, where the hot melt layer is processed into a molten state to attach the function module directly to the flexible display panel, reducing overall thickness and improving bending properties.

Supply Chain Resilience and Manufacturing Challenges

The global flexible microdisplay supply chain faces unprecedented challenges amid geopolitical tensions, pandemic disruptions, and resource constraints. Manufacturing facilities concentrated in East Asia—particularly Taiwan, South Korea, and Japan—create significant vulnerabilities when regional disruptions occur. The 2021 semiconductor shortage demonstrated how quickly display production bottlenecks can cascade through consumer electronics, automotive, and medical device sectors, with flexible microdisplay components particularly affected due to their specialized production requirements.

Material sourcing represents another critical vulnerability, as flexible displays require rare earth elements and specialized chemicals often sourced from politically sensitive regions. The concentration of indium tin oxide (ITO) production in China (controlling approximately 85% of global supply) creates substantial supply risks for manufacturers dependent on these transparent conductive materials essential for flexible display functionality.

Manufacturing yield rates present ongoing challenges unique to flexible microdisplay production. While rigid display manufacturing has achieved yield rates exceeding 90% in mature processes, flexible variants typically achieve only 60-75% yields due to the complexity of creating uniform performance characteristics on bendable substrates. This inefficiency drives up costs and extends production timelines, making supply chain disruptions particularly damaging.

Equipment dependencies further complicate the manufacturing landscape. Specialized lithography and deposition tools required for high-resolution flexible microdisplays are produced by a limited number of equipment manufacturers, primarily in the Netherlands, Japan, and the United States. When equipment delivery schedules extend—as occurred during 2020-2022 when lead times increased from 6-9 months to 18-24 months—production capacity expansion becomes severely constrained.

Industry leaders have begun implementing multi-faceted resilience strategies. Samsung Display and LG Display have established secondary manufacturing facilities in Vietnam and India, while BOE Technology has expanded capacity across multiple Chinese provinces. Apple and Google have pursued vertical integration by investing in display technology startups and securing long-term material supply agreements.

Standardization efforts across the industry aim to reduce customization requirements that fragment the supply chain. The Flexible Display Manufacturing Consortium, formed in 2022, has proposed manufacturing protocols that could enable more interchangeable production capabilities across facilities, potentially allowing faster recovery from regional disruptions through production reallocation.

Material sourcing represents another critical vulnerability, as flexible displays require rare earth elements and specialized chemicals often sourced from politically sensitive regions. The concentration of indium tin oxide (ITO) production in China (controlling approximately 85% of global supply) creates substantial supply risks for manufacturers dependent on these transparent conductive materials essential for flexible display functionality.

Manufacturing yield rates present ongoing challenges unique to flexible microdisplay production. While rigid display manufacturing has achieved yield rates exceeding 90% in mature processes, flexible variants typically achieve only 60-75% yields due to the complexity of creating uniform performance characteristics on bendable substrates. This inefficiency drives up costs and extends production timelines, making supply chain disruptions particularly damaging.

Equipment dependencies further complicate the manufacturing landscape. Specialized lithography and deposition tools required for high-resolution flexible microdisplays are produced by a limited number of equipment manufacturers, primarily in the Netherlands, Japan, and the United States. When equipment delivery schedules extend—as occurred during 2020-2022 when lead times increased from 6-9 months to 18-24 months—production capacity expansion becomes severely constrained.

Industry leaders have begun implementing multi-faceted resilience strategies. Samsung Display and LG Display have established secondary manufacturing facilities in Vietnam and India, while BOE Technology has expanded capacity across multiple Chinese provinces. Apple and Google have pursued vertical integration by investing in display technology startups and securing long-term material supply agreements.

Standardization efforts across the industry aim to reduce customization requirements that fragment the supply chain. The Flexible Display Manufacturing Consortium, formed in 2022, has proposed manufacturing protocols that could enable more interchangeable production capabilities across facilities, potentially allowing faster recovery from regional disruptions through production reallocation.

Environmental Impact and Sustainability Considerations

The adoption of flexible microdisplays in the electronics market presents significant environmental considerations that must be addressed throughout the product lifecycle. Manufacturing processes for these advanced displays typically involve rare earth elements, specialized polymers, and various chemicals that can have substantial ecological footprints. The extraction of these materials often leads to habitat disruption, water pollution, and energy-intensive processing, particularly concerning for materials like indium tin oxide (ITO) commonly used in transparent conductive layers.

Production facilities for flexible displays consume considerable energy, with estimates suggesting that manufacturing a single square meter of flexible OLED material requires between 500-700 kWh of electricity. This energy demand contributes to carbon emissions, particularly in regions where manufacturing is concentrated and renewable energy adoption remains limited. Water usage is another critical concern, with production processes requiring ultra-pure water for cleaning and processing steps.

The reduced weight and size of flexible microdisplays compared to traditional rigid displays offer sustainability advantages during the usage phase. Products incorporating these displays typically consume 15-30% less power than their rigid counterparts, extending battery life and reducing overall energy consumption. This efficiency gain multiplied across millions of devices represents a meaningful reduction in global energy demand.

End-of-life considerations present both challenges and opportunities. The complex material composition of flexible displays makes recycling difficult using conventional methods. Current recovery rates for critical materials from these displays remain below 20%, with most units ending up in landfills or being incinerated. However, emerging specialized recycling technologies show promise, with pilot programs demonstrating recovery rates of up to 65% for precious metals and rare earth elements.

Several manufacturers have begun implementing sustainability initiatives specifically targeting flexible display production. These include closed-loop water systems reducing freshwater consumption by up to 70%, energy efficiency improvements, and design modifications enabling easier disassembly and material recovery. Industry leaders have established goals to achieve carbon-neutral production by 2030 and increase recycled content in new displays to at least 30% by 2025.

Regulatory frameworks are evolving to address the environmental impacts of advanced display technologies. The European Union's updated WEEE Directive specifically addresses flexible electronics, while several Asian countries have implemented extended producer responsibility programs requiring manufacturers to fund collection and recycling infrastructure. These regulatory pressures are driving innovation in both materials selection and manufacturing processes.

Production facilities for flexible displays consume considerable energy, with estimates suggesting that manufacturing a single square meter of flexible OLED material requires between 500-700 kWh of electricity. This energy demand contributes to carbon emissions, particularly in regions where manufacturing is concentrated and renewable energy adoption remains limited. Water usage is another critical concern, with production processes requiring ultra-pure water for cleaning and processing steps.

The reduced weight and size of flexible microdisplays compared to traditional rigid displays offer sustainability advantages during the usage phase. Products incorporating these displays typically consume 15-30% less power than their rigid counterparts, extending battery life and reducing overall energy consumption. This efficiency gain multiplied across millions of devices represents a meaningful reduction in global energy demand.

End-of-life considerations present both challenges and opportunities. The complex material composition of flexible displays makes recycling difficult using conventional methods. Current recovery rates for critical materials from these displays remain below 20%, with most units ending up in landfills or being incinerated. However, emerging specialized recycling technologies show promise, with pilot programs demonstrating recovery rates of up to 65% for precious metals and rare earth elements.

Several manufacturers have begun implementing sustainability initiatives specifically targeting flexible display production. These include closed-loop water systems reducing freshwater consumption by up to 70%, energy efficiency improvements, and design modifications enabling easier disassembly and material recovery. Industry leaders have established goals to achieve carbon-neutral production by 2030 and increase recycled content in new displays to at least 30% by 2025.

Regulatory frameworks are evolving to address the environmental impacts of advanced display technologies. The European Union's updated WEEE Directive specifically addresses flexible electronics, while several Asian countries have implemented extended producer responsibility programs requiring manufacturers to fund collection and recycling infrastructure. These regulatory pressures are driving innovation in both materials selection and manufacturing processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!