Flexible Microdisplay as a Key Enabler of Invisible Electronics

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Microdisplay Evolution and Objectives

Flexible microdisplay technology has undergone significant evolution over the past two decades, transitioning from rigid glass-based displays to increasingly flexible and conformable solutions. The journey began with early experiments in organic light-emitting diode (OLED) technology in the early 2000s, which demonstrated the potential for creating displays on non-rigid substrates. This initial research laid the groundwork for what would eventually become a transformative technology across multiple industries.

By the mid-2010s, several research institutions and technology companies had made substantial progress in developing thin-film transistor (TFT) backplanes on plastic substrates, enabling truly flexible display prototypes. These early demonstrations, while limited in resolution and durability, showcased the potential for displays that could bend, fold, and conform to non-planar surfaces without compromising visual performance.

The technological progression has been driven by innovations in materials science, particularly the development of advanced organic and inorganic semiconductors that maintain electrical performance under mechanical stress. Concurrent advancements in manufacturing processes, including roll-to-roll fabrication techniques and low-temperature deposition methods, have further accelerated the field's development by enabling cost-effective production at increasingly larger scales.

Current state-of-the-art flexible microdisplays utilize ultra-thin glass or high-performance polymers as substrates, with active-matrix OLED (AMOLED) or microLED technologies providing the visual output. These displays can achieve resolutions exceeding 1000 pixels per inch while maintaining flexibility that allows for bending radii of less than 1mm in some cases, representing a remarkable engineering achievement.

The primary objective of flexible microdisplay technology is to enable a new paradigm of "invisible electronics" – devices that seamlessly integrate into our environment and onto our bodies without the rigid, obtrusive nature of conventional electronics. This vision encompasses applications ranging from augmented reality contact lenses and conformable medical diagnostic tools to smart textiles and paper-like computing interfaces that can be rolled or folded when not in use.

Secondary objectives include developing displays with dramatically reduced power consumption to enable truly wireless operation, improving durability to withstand thousands of flexing cycles without degradation, and achieving manufacturing scalability to bring costs down to consumer-viable levels. Additionally, there is significant focus on environmental sustainability, with research aimed at biodegradable or recyclable display components that reduce electronic waste.

The trajectory of flexible microdisplay evolution points toward increasingly transparent, stretchable, and self-healing displays that could fundamentally transform human-computer interaction and enable entirely new product categories that are currently impossible with rigid display technologies.

By the mid-2010s, several research institutions and technology companies had made substantial progress in developing thin-film transistor (TFT) backplanes on plastic substrates, enabling truly flexible display prototypes. These early demonstrations, while limited in resolution and durability, showcased the potential for displays that could bend, fold, and conform to non-planar surfaces without compromising visual performance.

The technological progression has been driven by innovations in materials science, particularly the development of advanced organic and inorganic semiconductors that maintain electrical performance under mechanical stress. Concurrent advancements in manufacturing processes, including roll-to-roll fabrication techniques and low-temperature deposition methods, have further accelerated the field's development by enabling cost-effective production at increasingly larger scales.

Current state-of-the-art flexible microdisplays utilize ultra-thin glass or high-performance polymers as substrates, with active-matrix OLED (AMOLED) or microLED technologies providing the visual output. These displays can achieve resolutions exceeding 1000 pixels per inch while maintaining flexibility that allows for bending radii of less than 1mm in some cases, representing a remarkable engineering achievement.

The primary objective of flexible microdisplay technology is to enable a new paradigm of "invisible electronics" – devices that seamlessly integrate into our environment and onto our bodies without the rigid, obtrusive nature of conventional electronics. This vision encompasses applications ranging from augmented reality contact lenses and conformable medical diagnostic tools to smart textiles and paper-like computing interfaces that can be rolled or folded when not in use.

Secondary objectives include developing displays with dramatically reduced power consumption to enable truly wireless operation, improving durability to withstand thousands of flexing cycles without degradation, and achieving manufacturing scalability to bring costs down to consumer-viable levels. Additionally, there is significant focus on environmental sustainability, with research aimed at biodegradable or recyclable display components that reduce electronic waste.

The trajectory of flexible microdisplay evolution points toward increasingly transparent, stretchable, and self-healing displays that could fundamentally transform human-computer interaction and enable entirely new product categories that are currently impossible with rigid display technologies.

Market Demand for Invisible Electronics

The invisible electronics market is experiencing unprecedented growth, driven by increasing consumer demand for seamless technology integration into daily life. Current market research indicates that the global market for transparent and flexible electronics is projected to reach $20 billion by 2027, with flexible microdisplays representing a significant portion of this expansion. This growth trajectory is supported by a compound annual growth rate (CAGR) of approximately 24% between 2022 and 2027, demonstrating robust market confidence in these technologies.

Consumer electronics represents the largest market segment for invisible electronics, with wearable devices leading adoption. The wearable technology market alone is expected to surpass $70 billion by 2025, with smart glasses, augmented reality (AR) devices, and health monitoring systems incorporating flexible microdisplays as central components. Market surveys reveal that 67% of consumers express interest in electronics that blend invisibly with their environment or personal items, indicating strong potential for mainstream adoption.

Healthcare applications present another significant market opportunity, with flexible microdisplays enabling advanced medical devices such as smart contact lenses for continuous health monitoring and augmented vision correction. The medical wearables market is growing at 15% annually, with particular demand for non-intrusive patient monitoring systems that can be integrated into clothing or directly attached to skin.

Automotive and aerospace industries are rapidly incorporating transparent display technologies into windshields and cockpit systems. Market analysis shows that 78% of premium vehicle manufacturers are investing in heads-up display technologies that utilize flexible microdisplay components, with the automotive display market expected to reach $30 billion by 2026.

Military and defense sectors represent a premium market segment with specific requirements for rugged, flexible display technologies that can be integrated into combat gear and field equipment. This sector values reliability and performance over cost considerations, creating opportunities for high-margin applications of flexible microdisplay technology.

Retail and smart home environments are emerging as growth markets, with transparent display technologies enabling interactive shopping experiences and ambient information systems. Consumer research indicates that 53% of households express interest in invisible or minimally visible smart home interfaces that preserve aesthetic integrity while providing functionality.

The market demand is further accelerated by consumer preferences shifting toward sustainable, less obtrusive technology. Environmental considerations are influencing purchasing decisions, with 61% of consumers indicating preference for electronics that reduce visual pollution and material waste. Flexible microdisplays address these concerns by enabling devices with reduced material footprint and longer lifecycles through their inherent durability and adaptability.

Consumer electronics represents the largest market segment for invisible electronics, with wearable devices leading adoption. The wearable technology market alone is expected to surpass $70 billion by 2025, with smart glasses, augmented reality (AR) devices, and health monitoring systems incorporating flexible microdisplays as central components. Market surveys reveal that 67% of consumers express interest in electronics that blend invisibly with their environment or personal items, indicating strong potential for mainstream adoption.

Healthcare applications present another significant market opportunity, with flexible microdisplays enabling advanced medical devices such as smart contact lenses for continuous health monitoring and augmented vision correction. The medical wearables market is growing at 15% annually, with particular demand for non-intrusive patient monitoring systems that can be integrated into clothing or directly attached to skin.

Automotive and aerospace industries are rapidly incorporating transparent display technologies into windshields and cockpit systems. Market analysis shows that 78% of premium vehicle manufacturers are investing in heads-up display technologies that utilize flexible microdisplay components, with the automotive display market expected to reach $30 billion by 2026.

Military and defense sectors represent a premium market segment with specific requirements for rugged, flexible display technologies that can be integrated into combat gear and field equipment. This sector values reliability and performance over cost considerations, creating opportunities for high-margin applications of flexible microdisplay technology.

Retail and smart home environments are emerging as growth markets, with transparent display technologies enabling interactive shopping experiences and ambient information systems. Consumer research indicates that 53% of households express interest in invisible or minimally visible smart home interfaces that preserve aesthetic integrity while providing functionality.

The market demand is further accelerated by consumer preferences shifting toward sustainable, less obtrusive technology. Environmental considerations are influencing purchasing decisions, with 61% of consumers indicating preference for electronics that reduce visual pollution and material waste. Flexible microdisplays address these concerns by enabling devices with reduced material footprint and longer lifecycles through their inherent durability and adaptability.

Technical Barriers and Global Development Status

Despite significant advancements in flexible microdisplay technology, several technical barriers continue to impede the full realization of invisible electronics. Material limitations represent a primary challenge, as current flexible substrate materials struggle to simultaneously achieve optimal transparency, durability, and electrical performance. Traditional glass-based displays offer superior optical clarity but lack flexibility, while polymer-based alternatives provide flexibility but often compromise on resolution, color accuracy, and longevity.

Manufacturing scalability presents another significant hurdle. Current production methods for flexible microdisplays involve complex processes that are difficult to scale economically. The precise deposition of thin-film transistors (TFTs) on flexible substrates requires specialized equipment and stringent environmental controls, resulting in low yields and high production costs compared to conventional display manufacturing.

Power efficiency remains problematic for flexible display technologies. The additional layers and components required to enable flexibility often increase power consumption, creating a significant barrier for wearable and portable applications where battery life is critical. This challenge is particularly acute for transparent display systems that must maintain visibility across varying lighting conditions.

Globally, development status varies significantly by region. East Asia, particularly Japan, South Korea, and Taiwan, leads in flexible display research and commercialization. Companies like Samsung, LG Display, and Japan Display have established robust patent portfolios and manufacturing capabilities. These organizations have successfully commercialized flexible OLED displays for consumer electronics, though fully transparent and invisible implementations remain primarily in research phases.

European research institutions and companies focus heavily on materials science innovations, with particular strength in developing novel transparent conductive materials and flexible substrates. The European Commission has funded several large-scale research initiatives through Horizon programs, fostering collaboration between academic and industrial partners.

North American development is characterized by strong academic research coupled with targeted commercial applications. Universities like Stanford, MIT, and UC Berkeley maintain advanced research programs in flexible electronics, while companies like Apple and Google focus on integrating these technologies into next-generation products.

Emerging economies, particularly China, have rapidly expanded their presence in flexible display technology. Chinese manufacturers have made substantial investments in production facilities, though they currently lag in fundamental research and intellectual property ownership compared to more established players.

The global development landscape reveals a technology that has progressed beyond proof-of-concept but remains several years away from widespread commercial implementation in truly invisible electronic applications. Current technical limitations suggest that initial commercial applications will likely focus on semi-transparent displays in specific use cases before advancing to fully invisible implementations.

Manufacturing scalability presents another significant hurdle. Current production methods for flexible microdisplays involve complex processes that are difficult to scale economically. The precise deposition of thin-film transistors (TFTs) on flexible substrates requires specialized equipment and stringent environmental controls, resulting in low yields and high production costs compared to conventional display manufacturing.

Power efficiency remains problematic for flexible display technologies. The additional layers and components required to enable flexibility often increase power consumption, creating a significant barrier for wearable and portable applications where battery life is critical. This challenge is particularly acute for transparent display systems that must maintain visibility across varying lighting conditions.

Globally, development status varies significantly by region. East Asia, particularly Japan, South Korea, and Taiwan, leads in flexible display research and commercialization. Companies like Samsung, LG Display, and Japan Display have established robust patent portfolios and manufacturing capabilities. These organizations have successfully commercialized flexible OLED displays for consumer electronics, though fully transparent and invisible implementations remain primarily in research phases.

European research institutions and companies focus heavily on materials science innovations, with particular strength in developing novel transparent conductive materials and flexible substrates. The European Commission has funded several large-scale research initiatives through Horizon programs, fostering collaboration between academic and industrial partners.

North American development is characterized by strong academic research coupled with targeted commercial applications. Universities like Stanford, MIT, and UC Berkeley maintain advanced research programs in flexible electronics, while companies like Apple and Google focus on integrating these technologies into next-generation products.

Emerging economies, particularly China, have rapidly expanded their presence in flexible display technology. Chinese manufacturers have made substantial investments in production facilities, though they currently lag in fundamental research and intellectual property ownership compared to more established players.

The global development landscape reveals a technology that has progressed beyond proof-of-concept but remains several years away from widespread commercial implementation in truly invisible electronic applications. Current technical limitations suggest that initial commercial applications will likely focus on semi-transparent displays in specific use cases before advancing to fully invisible implementations.

Current Flexible Microdisplay Implementation Approaches

01 Flexible display technologies for invisibility applications

Flexible microdisplays can be used in invisibility applications by conforming to various surfaces and displaying captured background imagery. These displays utilize bendable substrates and flexible electronic components that can maintain functionality while being deformed. The flexibility allows the displays to be integrated into curved surfaces or wearable devices, making objects appear invisible by showing what would normally be behind them.- Flexible display technologies for invisibility applications: Flexible microdisplays can be used in invisibility applications by conforming to various surfaces and displaying captured background imagery. These displays utilize bendable substrates and flexible electronic components that can maintain functionality while being curved or folded. The flexibility allows the displays to be integrated into clothing, vehicles, or other objects where rigid displays would be impractical, enabling camouflage or invisibility effects by blending with surroundings.

- Active camouflage systems using microdisplays: Active camouflage systems incorporate microdisplays that can project real-time images of the background environment onto the surface of an object, effectively rendering it visually undetectable. These systems typically include cameras that capture the background scene from various angles, processing units that adjust the images for perspective, and microdisplays that project the processed images. This technology enables objects to blend seamlessly with their surroundings by displaying what would normally be visible behind them.

- Optical metamaterials for invisibility cloaking: Optical metamaterials integrated with microdisplays can manipulate light waves to create invisibility effects. These engineered materials possess electromagnetic properties not found in nature, allowing them to bend light around objects rather than reflecting or absorbing it. When combined with flexible microdisplays, these metamaterials can create advanced cloaking devices that work across multiple wavelengths of light, making objects appear invisible to both human eyes and various sensors.

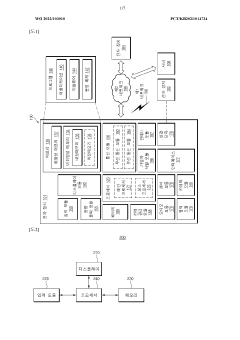

- Control systems for adaptive invisibility displays: Sophisticated control systems are essential for managing adaptive invisibility displays. These systems process environmental data from multiple sensors, adjust display output in real-time, and synchronize multiple display panels to create a seamless invisibility effect. The control architecture typically includes image processing algorithms, power management systems, and feedback mechanisms that continuously optimize the camouflage effect based on changing lighting conditions and observer positions.

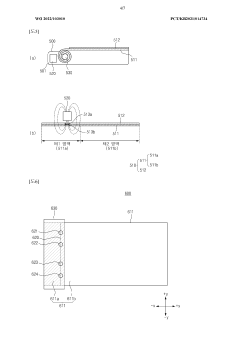

- Pixel architecture for high-resolution invisibility displays: Advanced pixel architectures enable high-resolution invisibility displays that can accurately reproduce background scenes. These specialized pixel designs feature ultra-small dimensions, high refresh rates, and wide color gamuts necessary for convincing invisibility effects. Some implementations use transparent or semi-transparent pixel structures that can both display images and allow light to pass through, creating more effective camouflage by combining active display with partial transparency.

02 Active camouflage systems using microdisplay arrays

Active camouflage systems employ arrays of microdisplays to create invisibility effects. These systems capture images of the background environment and project them onto the opposite side of an object, creating the illusion of transparency. The microdisplay arrays work in conjunction with image sensors and processing units to provide real-time adaptation to changing surroundings, effectively rendering objects visually undetectable.Expand Specific Solutions03 Optical techniques for invisibility with microdisplays

Various optical techniques enhance the invisibility effect of microdisplay systems. These include light field manipulation, metamaterial integration, and specialized coatings that reduce reflection and glare. Advanced optical systems can bend light around objects or use lenticular arrays to create directional viewing effects. These techniques, when combined with flexible microdisplays, significantly improve the convincingness of invisibility implementations.Expand Specific Solutions04 Control systems for adaptive invisibility displays

Sophisticated control systems are essential for effective invisibility applications using flexible microdisplays. These systems include sensors for environmental monitoring, real-time image processing algorithms, and feedback mechanisms to adjust display output based on viewing angles and lighting conditions. The control architecture enables seamless blending with surroundings and can compensate for physical movement of the flexible display surface.Expand Specific Solutions05 Fabrication methods for flexible invisible display systems

Specialized fabrication techniques are required to produce flexible microdisplays for invisibility applications. These include thin-film transistor technologies on polymer substrates, stretchable electronic interconnects, and novel encapsulation methods to protect sensitive components while maintaining flexibility. Advanced manufacturing processes such as roll-to-roll printing and laser patterning enable the creation of large-area, seamless display surfaces that can conform to complex geometries.Expand Specific Solutions

Leading Companies in Flexible Microdisplay Ecosystem

The flexible microdisplay market is currently in a transitional growth phase, evolving from early development to commercial application, with an estimated market value approaching $2 billion by 2025. Major display manufacturers including LG Display, Samsung Electronics, BOE Technology, and E Ink are driving technological advancement, with varying degrees of maturity across different applications. While companies like Apple and Google focus on integration into wearable devices, specialized players such as Semiconductor Energy Laboratory and FineMEMS are developing critical enabling technologies. Research institutions including KAIST and Nanyang Technological University are contributing fundamental innovations, particularly in materials science. The competitive landscape features established electronics giants competing with agile startups, with Asian manufacturers currently dominating production capabilities for these next-generation display technologies that promise to revolutionize invisible electronics.

LG Display Co., Ltd.

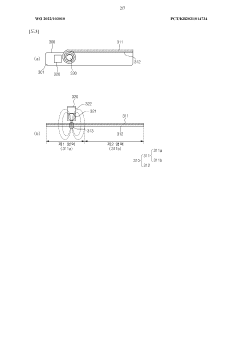

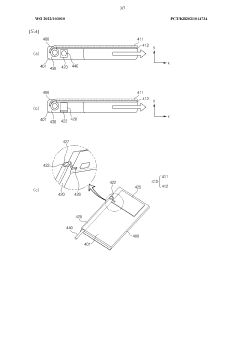

Technical Solution: LG Display has pioneered flexible microdisplay technology through their P-OLED (Plastic OLED) platform, which enables ultra-thin, lightweight displays that can be bent, folded, or rolled. Their proprietary technology incorporates a polyimide substrate instead of traditional glass, allowing for significantly enhanced flexibility while maintaining display performance. LG's flexible microdisplays utilize LTPS (Low-Temperature Polycrystalline Silicon) backplane technology for higher resolution and lower power consumption. The company has developed advanced TFE (Thin Film Encapsulation) techniques that provide superior protection against oxygen and moisture without compromising flexibility. Their latest innovations include transparent flexible displays with up to 40% transparency and rollable displays that can disappear into compact housings when not in use. LG has successfully commercialized these technologies in products like the LG Rollable TV and flexible smartphone displays, demonstrating real-world applications of invisible electronics.

Strengths: Industry-leading TFE technology providing superior barrier properties while maintaining flexibility; established mass production capabilities for flexible displays; strong IP portfolio in flexible display technologies. Weaknesses: Higher production costs compared to conventional displays; limited durability under extreme folding conditions; challenges in achieving uniform brightness across bent surfaces.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed advanced flexible AMOLED microdisplay technology that serves as a cornerstone for invisible electronics. Their approach utilizes ultra-thin flexible substrates (as thin as 30 micrometers) combined with organic light-emitting materials to create displays that can be seamlessly integrated into various form factors. Samsung's proprietary Y-OCTA (Youm On-Cell Touch AMOLED) technology directly builds touch sensors onto the display panel, eliminating additional layers and enhancing flexibility. Their flexible displays incorporate specialized encapsulation technology using alternating inorganic/organic layers that prevent moisture penetration while maintaining bendability. Samsung has pioneered foldable display technology with their Infinity Flex Display, which can withstand over 200,000 fold cycles while maintaining display integrity. The company has also developed transparent flexible displays with up to 38% transparency for augmented reality applications, and stretchable displays that can be extended by up to 30% while maintaining functionality, representing significant advances toward truly invisible electronics.

Strengths: Vertical integration from materials to finished displays provides complete ecosystem control; industry-leading pixel density in flexible formats; proven commercialization track record with multiple generations of foldable devices. Weaknesses: Higher manufacturing costs than conventional displays; challenges with crease formation at fold points after extended use; limited scalability for very large flexible display formats.

Key Patents and Innovations in Flexible Display Materials

Electronic device and operating method of electronic device

PatentWO2022103010A1

Innovation

- Incorporating an input module with inductive or conductive elements that periodically generate signals to determine non-visible areas of the display, allowing the processor to turn off or set these areas to a designated color, thereby reducing power usage.

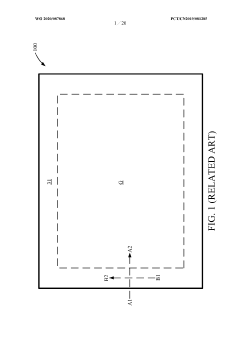

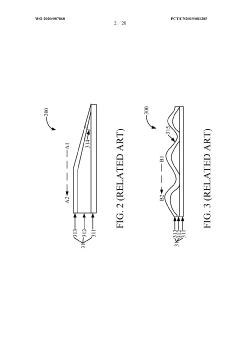

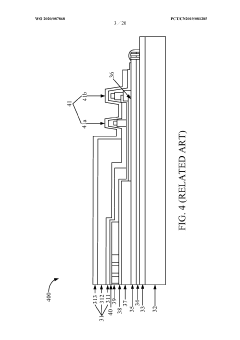

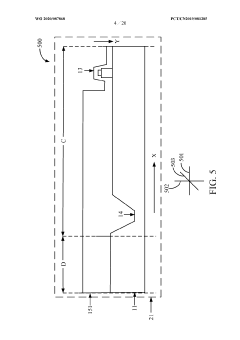

Display panel, display device, and manufacturing methods thereof

PatentWO2020087868A1

Innovation

- Introduction of grooves in the non-display area between the display area and the dam structure to improve flatness of the organic encapsulation layer.

- Strategic placement of dam structure around the display area to reduce peeling between the organic encapsulation layer and the flexible substrate.

- Design of an organic encapsulation layer that covers the display area, non-display area, and the grooves to improve overall display panel quality.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of flexible microdisplays represents a critical factor in determining their commercial viability for invisible electronics applications. Current production methods primarily utilize two approaches: traditional semiconductor fabrication techniques adapted for flexible substrates and emerging roll-to-roll (R2R) processing. The semiconductor approach offers high precision but faces challenges in handling temperature-sensitive flexible materials, while R2R processing promises higher throughput but struggles with achieving comparable resolution and yield rates.

Cost analysis reveals that substrate materials constitute approximately 30-40% of total production expenses, with polyimide and ultrathin glass being the predominant options. Polyimide offers excellent flexibility and thermal stability but at higher costs, while ultrathin glass provides superior barrier properties against moisture and oxygen at the expense of limited bend radius. The thin-film transistor (TFT) backplane fabrication represents another 25-35% of costs, with low-temperature polysilicon (LTPS) and metal oxide semiconductors competing as leading technologies.

Equipment investment presents a significant barrier to market entry, with specialized tools for flexible substrate handling requiring capital expenditures of $50-100 million for a medium-scale production line. This high initial investment necessitates substantial production volumes to achieve economic viability, creating a challenging chicken-and-egg problem for market development.

Yield rates remain substantially lower for flexible displays compared to rigid counterparts, typically 60-70% versus 85-90% for established rigid display technologies. These lower yields directly impact unit costs and represent a key area for technological improvement. Industry analysts project that manufacturing costs could decrease by 40-50% over the next five years as production volumes increase and process optimizations are implemented.

Economies of scale present both opportunities and challenges. While increased production volumes would reduce per-unit costs, the specialized nature of flexible microdisplay manufacturing limits the benefits of scale compared to conventional electronics. Current production capacity across all manufacturers is estimated at less than 5 million units annually, significantly below the threshold needed for dramatic cost reductions.

Supply chain considerations further complicate scalability, with specialized materials often sourced from limited suppliers, creating potential bottlenecks and price volatility. Vertical integration strategies are being pursued by several major manufacturers to mitigate these risks, though this approach requires even greater capital investment.

Cost analysis reveals that substrate materials constitute approximately 30-40% of total production expenses, with polyimide and ultrathin glass being the predominant options. Polyimide offers excellent flexibility and thermal stability but at higher costs, while ultrathin glass provides superior barrier properties against moisture and oxygen at the expense of limited bend radius. The thin-film transistor (TFT) backplane fabrication represents another 25-35% of costs, with low-temperature polysilicon (LTPS) and metal oxide semiconductors competing as leading technologies.

Equipment investment presents a significant barrier to market entry, with specialized tools for flexible substrate handling requiring capital expenditures of $50-100 million for a medium-scale production line. This high initial investment necessitates substantial production volumes to achieve economic viability, creating a challenging chicken-and-egg problem for market development.

Yield rates remain substantially lower for flexible displays compared to rigid counterparts, typically 60-70% versus 85-90% for established rigid display technologies. These lower yields directly impact unit costs and represent a key area for technological improvement. Industry analysts project that manufacturing costs could decrease by 40-50% over the next five years as production volumes increase and process optimizations are implemented.

Economies of scale present both opportunities and challenges. While increased production volumes would reduce per-unit costs, the specialized nature of flexible microdisplay manufacturing limits the benefits of scale compared to conventional electronics. Current production capacity across all manufacturers is estimated at less than 5 million units annually, significantly below the threshold needed for dramatic cost reductions.

Supply chain considerations further complicate scalability, with specialized materials often sourced from limited suppliers, creating potential bottlenecks and price volatility. Vertical integration strategies are being pursued by several major manufacturers to mitigate these risks, though this approach requires even greater capital investment.

Environmental Impact and Sustainability Considerations

The development of flexible microdisplays for invisible electronics necessitates careful consideration of environmental impacts throughout their lifecycle. Current manufacturing processes for these displays often involve hazardous materials including heavy metals, solvents, and specialized chemicals that pose significant environmental risks if improperly managed. The production of flexible substrates and thin-film transistors particularly requires careful monitoring to minimize ecological footprints.

Energy consumption represents another critical environmental concern. While flexible displays potentially offer energy efficiency advantages over rigid alternatives during operation, their production remains energy-intensive. Manufacturing processes such as vacuum deposition, photolithography, and high-temperature annealing contribute substantially to the carbon footprint of these technologies.

Waste management challenges are particularly pronounced for flexible electronics. The composite nature of these devices—combining organic materials, metals, and specialized polymers—complicates recycling efforts. Current end-of-life scenarios often result in these products entering landfills rather than being properly recycled, creating long-term environmental liabilities.

Encouragingly, several sustainability initiatives are emerging within the industry. Bio-based substrates derived from renewable resources are being explored as alternatives to petroleum-based polymers. These materials offer biodegradability advantages while maintaining necessary performance characteristics for flexible display applications.

Water conservation strategies are also gaining traction, with manufacturers implementing closed-loop systems that significantly reduce freshwater consumption. Advanced filtration technologies enable the reclamation and reuse of process water, minimizing both consumption and contamination risks.

The transition toward green chemistry principles represents another promising direction. Researchers are developing water-based processing methods and non-toxic alternatives to traditional solvents, reducing both environmental impacts and workplace hazards. These approaches align with broader circular economy objectives for electronics manufacturing.

Life cycle assessment (LCA) methodologies are increasingly being applied to flexible display technologies, enabling quantitative evaluation of environmental impacts from raw material extraction through disposal. These assessments help identify hotspots for environmental improvement and guide sustainable design decisions. As regulatory frameworks evolve globally, manufacturers are proactively adopting extended producer responsibility approaches, taking ownership of their products' environmental impacts throughout their complete lifecycle.

Energy consumption represents another critical environmental concern. While flexible displays potentially offer energy efficiency advantages over rigid alternatives during operation, their production remains energy-intensive. Manufacturing processes such as vacuum deposition, photolithography, and high-temperature annealing contribute substantially to the carbon footprint of these technologies.

Waste management challenges are particularly pronounced for flexible electronics. The composite nature of these devices—combining organic materials, metals, and specialized polymers—complicates recycling efforts. Current end-of-life scenarios often result in these products entering landfills rather than being properly recycled, creating long-term environmental liabilities.

Encouragingly, several sustainability initiatives are emerging within the industry. Bio-based substrates derived from renewable resources are being explored as alternatives to petroleum-based polymers. These materials offer biodegradability advantages while maintaining necessary performance characteristics for flexible display applications.

Water conservation strategies are also gaining traction, with manufacturers implementing closed-loop systems that significantly reduce freshwater consumption. Advanced filtration technologies enable the reclamation and reuse of process water, minimizing both consumption and contamination risks.

The transition toward green chemistry principles represents another promising direction. Researchers are developing water-based processing methods and non-toxic alternatives to traditional solvents, reducing both environmental impacts and workplace hazards. These approaches align with broader circular economy objectives for electronics manufacturing.

Life cycle assessment (LCA) methodologies are increasingly being applied to flexible display technologies, enabling quantitative evaluation of environmental impacts from raw material extraction through disposal. These assessments help identify hotspots for environmental improvement and guide sustainable design decisions. As regulatory frameworks evolve globally, manufacturers are proactively adopting extended producer responsibility approaches, taking ownership of their products' environmental impacts throughout their complete lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!