Forecasting the Market Dynamics of Ammonia Fuel and Its Derivatives

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Technology Background and Objectives

Ammonia has emerged as a promising carbon-free energy carrier in the global transition towards sustainable energy systems. The history of ammonia as an industrial chemical dates back to the early 20th century with the development of the Haber-Bosch process, which revolutionized fertilizer production. However, its potential as a fuel has only gained significant attention in the past decade as nations worldwide seek alternatives to fossil fuels in pursuit of decarbonization goals.

The evolution of ammonia fuel technology has accelerated notably since 2015, driven by increasing recognition of its advantages: high energy density (5.2 kWh/kg), established global production and distribution infrastructure, and zero carbon emissions during combustion. Unlike hydrogen, ammonia can be liquefied at relatively low pressure (10 bar) or moderate refrigeration (-33°C), making it more practical for storage and transportation.

Current technological development focuses on three primary pathways: direct ammonia combustion in modified internal combustion engines and gas turbines; ammonia fuel cells; and "cracking" ammonia to release hydrogen for use in hydrogen fuel cells. Each pathway presents distinct technical challenges but offers significant potential for decarbonizing sectors that are difficult to electrify directly.

The global ammonia market, currently dominated by fertilizer production (approximately 80% of consumption), is poised for transformation as energy applications gain traction. Annual production exceeds 180 million tonnes, with established infrastructure that could be leveraged for fuel applications, providing a foundation for rapid scaling.

The primary technical objectives in ammonia fuel development include improving combustion efficiency, reducing NOx emissions during combustion, enhancing catalytic cracking efficiency for hydrogen extraction, and developing more efficient direct ammonia fuel cells. Secondary objectives focus on reducing the carbon intensity of ammonia production through green and blue ammonia pathways.

Looking forward, the ammonia fuel sector aims to achieve commercial viability in marine shipping by 2025-2030, power generation by 2030-2035, and potentially in heavy-duty transportation by 2035-2040. These timelines align with global decarbonization targets, positioning ammonia as a strategic component of the future energy mix.

The ultimate goal of ammonia fuel technology development is to establish a complete carbon-neutral energy ecosystem where ammonia serves as both an energy carrier and storage medium, enabling the practical implementation of renewable energy across traditionally challenging sectors while leveraging existing infrastructure to accelerate adoption.

The evolution of ammonia fuel technology has accelerated notably since 2015, driven by increasing recognition of its advantages: high energy density (5.2 kWh/kg), established global production and distribution infrastructure, and zero carbon emissions during combustion. Unlike hydrogen, ammonia can be liquefied at relatively low pressure (10 bar) or moderate refrigeration (-33°C), making it more practical for storage and transportation.

Current technological development focuses on three primary pathways: direct ammonia combustion in modified internal combustion engines and gas turbines; ammonia fuel cells; and "cracking" ammonia to release hydrogen for use in hydrogen fuel cells. Each pathway presents distinct technical challenges but offers significant potential for decarbonizing sectors that are difficult to electrify directly.

The global ammonia market, currently dominated by fertilizer production (approximately 80% of consumption), is poised for transformation as energy applications gain traction. Annual production exceeds 180 million tonnes, with established infrastructure that could be leveraged for fuel applications, providing a foundation for rapid scaling.

The primary technical objectives in ammonia fuel development include improving combustion efficiency, reducing NOx emissions during combustion, enhancing catalytic cracking efficiency for hydrogen extraction, and developing more efficient direct ammonia fuel cells. Secondary objectives focus on reducing the carbon intensity of ammonia production through green and blue ammonia pathways.

Looking forward, the ammonia fuel sector aims to achieve commercial viability in marine shipping by 2025-2030, power generation by 2030-2035, and potentially in heavy-duty transportation by 2035-2040. These timelines align with global decarbonization targets, positioning ammonia as a strategic component of the future energy mix.

The ultimate goal of ammonia fuel technology development is to establish a complete carbon-neutral energy ecosystem where ammonia serves as both an energy carrier and storage medium, enabling the practical implementation of renewable energy across traditionally challenging sectors while leveraging existing infrastructure to accelerate adoption.

Market Demand Analysis for Ammonia as Alternative Fuel

The global market for ammonia as an alternative fuel is experiencing significant growth driven by the urgent need for decarbonization across various sectors. Current projections indicate that the ammonia fuel market could reach $5 billion by 2030, with a compound annual growth rate of approximately 7-9% over the next decade. This growth trajectory is primarily fueled by increasing environmental regulations, particularly in maritime shipping where the International Maritime Organization has set ambitious targets to reduce greenhouse gas emissions by at least 50% by 2050 compared to 2008 levels.

Maritime transportation represents the most promising immediate market for ammonia fuel, with several major shipping companies already announcing pilot projects and investments in ammonia-powered vessels. The sector accounts for approximately 2.5% of global greenhouse gas emissions, creating substantial demand potential as fleet operators seek compliance with tightening regulations. Industry analysts estimate that ammonia could capture 25-30% of the marine fuel market by 2050.

Power generation presents another significant market opportunity, particularly in regions with established hydrogen infrastructure or renewable energy surpluses. Japan and South Korea have emerged as early adopters, incorporating ammonia co-firing in existing coal power plants. Japan's METI has established a roadmap targeting 3 million tons of ammonia fuel use annually by 2030, scaling to 30 million tons by 2050. This represents a substantial market opportunity valued at approximately $1.5-2 billion by 2030 for power generation applications alone.

The industrial sector also shows promising demand potential, particularly in hard-to-abate industries such as steel manufacturing, cement production, and chemical processing. These industries collectively contribute about 20% of global carbon emissions and face significant challenges in decarbonization through electrification alone. Ammonia's dual role as both a hydrogen carrier and direct fuel makes it particularly attractive for these applications.

Regional market analysis reveals varying adoption rates and drivers. Asia-Pacific leads in terms of investment and policy support, with Japan, South Korea, and Australia forming strategic partnerships for ammonia fuel supply chains. Europe follows closely with strong policy frameworks supporting alternative fuels, while North America shows growing interest primarily driven by private sector initiatives rather than comprehensive government policies.

Consumer acceptance and infrastructure development remain critical factors influencing market penetration rates. The existing global ammonia production and distribution infrastructure provides a foundation for scaling, though significant investments estimated at $30-40 billion will be required for purpose-built fuel-grade ammonia facilities by 2035. Safety concerns and public perception issues must be addressed through comprehensive standards and education initiatives to facilitate broader market acceptance.

Maritime transportation represents the most promising immediate market for ammonia fuel, with several major shipping companies already announcing pilot projects and investments in ammonia-powered vessels. The sector accounts for approximately 2.5% of global greenhouse gas emissions, creating substantial demand potential as fleet operators seek compliance with tightening regulations. Industry analysts estimate that ammonia could capture 25-30% of the marine fuel market by 2050.

Power generation presents another significant market opportunity, particularly in regions with established hydrogen infrastructure or renewable energy surpluses. Japan and South Korea have emerged as early adopters, incorporating ammonia co-firing in existing coal power plants. Japan's METI has established a roadmap targeting 3 million tons of ammonia fuel use annually by 2030, scaling to 30 million tons by 2050. This represents a substantial market opportunity valued at approximately $1.5-2 billion by 2030 for power generation applications alone.

The industrial sector also shows promising demand potential, particularly in hard-to-abate industries such as steel manufacturing, cement production, and chemical processing. These industries collectively contribute about 20% of global carbon emissions and face significant challenges in decarbonization through electrification alone. Ammonia's dual role as both a hydrogen carrier and direct fuel makes it particularly attractive for these applications.

Regional market analysis reveals varying adoption rates and drivers. Asia-Pacific leads in terms of investment and policy support, with Japan, South Korea, and Australia forming strategic partnerships for ammonia fuel supply chains. Europe follows closely with strong policy frameworks supporting alternative fuels, while North America shows growing interest primarily driven by private sector initiatives rather than comprehensive government policies.

Consumer acceptance and infrastructure development remain critical factors influencing market penetration rates. The existing global ammonia production and distribution infrastructure provides a foundation for scaling, though significant investments estimated at $30-40 billion will be required for purpose-built fuel-grade ammonia facilities by 2035. Safety concerns and public perception issues must be addressed through comprehensive standards and education initiatives to facilitate broader market acceptance.

Current State and Challenges in Ammonia Fuel Technology

Ammonia fuel technology has witnessed significant advancements globally, with research institutions and energy companies increasingly recognizing its potential as a carbon-free energy carrier. Currently, the production of green ammonia relies predominantly on the Haber-Bosch process coupled with renewable electricity sources. While this represents a technological breakthrough, the energy efficiency of this process remains suboptimal, with approximately 60-65% energy loss during conversion, presenting a substantial challenge for widespread commercial adoption.

The storage and transportation infrastructure for ammonia fuel is relatively mature due to its established use in the fertilizer industry. However, adapting this infrastructure for energy applications requires additional safety measures and technical modifications. The existing global ammonia production capacity stands at approximately 180 million tonnes annually, primarily serving agricultural needs, with only a small fraction currently directed toward energy applications.

A significant technical challenge lies in ammonia's combustion properties. Its high ignition temperature (651°C compared to 232°C for gasoline) and narrow flammability range make direct combustion difficult in conventional engines. Current solutions include ammonia-hydrogen dual-fuel systems and catalytic decomposition technologies, but these approaches still face efficiency and practicality hurdles in real-world applications.

From a geographical perspective, ammonia fuel technology development shows distinct regional characteristics. Japan leads in ammonia co-firing for power generation, with successful demonstrations of up to 20% ammonia in coal-fired plants. Australia has positioned itself as a potential major exporter of green ammonia, leveraging its abundant renewable resources. The European Union focuses on ammonia as part of its hydrogen strategy, while the United States has concentrated efforts on ammonia cracking technologies for hydrogen delivery.

Regulatory frameworks present another challenge, as safety standards and emissions regulations for ammonia fuel remain inconsistent globally. The toxicity of ammonia necessitates robust safety protocols, which vary significantly across jurisdictions, creating barriers to international deployment and standardization.

Cost competitiveness remains perhaps the most pressing challenge. Current production costs for green ammonia range between $600-1,200 per tonne, significantly higher than conventional gray ammonia ($200-400 per tonne). Achieving price parity requires substantial technological improvements in electrolysis efficiency, renewable electricity costs, and economies of scale in production facilities.

The NOx emissions from ammonia combustion present an environmental challenge that requires sophisticated abatement technologies. Current selective catalytic reduction (SCR) systems can reduce these emissions but add complexity and cost to implementation, particularly in mobile applications like shipping and transportation.

The storage and transportation infrastructure for ammonia fuel is relatively mature due to its established use in the fertilizer industry. However, adapting this infrastructure for energy applications requires additional safety measures and technical modifications. The existing global ammonia production capacity stands at approximately 180 million tonnes annually, primarily serving agricultural needs, with only a small fraction currently directed toward energy applications.

A significant technical challenge lies in ammonia's combustion properties. Its high ignition temperature (651°C compared to 232°C for gasoline) and narrow flammability range make direct combustion difficult in conventional engines. Current solutions include ammonia-hydrogen dual-fuel systems and catalytic decomposition technologies, but these approaches still face efficiency and practicality hurdles in real-world applications.

From a geographical perspective, ammonia fuel technology development shows distinct regional characteristics. Japan leads in ammonia co-firing for power generation, with successful demonstrations of up to 20% ammonia in coal-fired plants. Australia has positioned itself as a potential major exporter of green ammonia, leveraging its abundant renewable resources. The European Union focuses on ammonia as part of its hydrogen strategy, while the United States has concentrated efforts on ammonia cracking technologies for hydrogen delivery.

Regulatory frameworks present another challenge, as safety standards and emissions regulations for ammonia fuel remain inconsistent globally. The toxicity of ammonia necessitates robust safety protocols, which vary significantly across jurisdictions, creating barriers to international deployment and standardization.

Cost competitiveness remains perhaps the most pressing challenge. Current production costs for green ammonia range between $600-1,200 per tonne, significantly higher than conventional gray ammonia ($200-400 per tonne). Achieving price parity requires substantial technological improvements in electrolysis efficiency, renewable electricity costs, and economies of scale in production facilities.

The NOx emissions from ammonia combustion present an environmental challenge that requires sophisticated abatement technologies. Current selective catalytic reduction (SCR) systems can reduce these emissions but add complexity and cost to implementation, particularly in mobile applications like shipping and transportation.

Current Technical Solutions for Ammonia Fuel Implementation

01 Ammonia fuel production technologies

Various technologies have been developed for the production of ammonia as a fuel source. These include innovative synthesis methods, catalytic processes, and renewable energy integration systems that improve efficiency and reduce carbon emissions. The technologies focus on sustainable ammonia production pathways that can be scaled for commercial applications, including green ammonia production using renewable electricity sources.- Ammonia fuel production technologies: Various technologies have been developed for the production of ammonia as a fuel source. These include innovative synthesis methods, catalytic processes, and renewable energy integration systems that improve efficiency and reduce carbon emissions. These technologies focus on making ammonia production more sustainable and economically viable for use as an alternative fuel in various applications.

- Ammonia fuel storage and transportation systems: Specialized systems for the storage and transportation of ammonia fuel have been developed to address its unique properties. These include advanced containment vessels, safety mechanisms, and distribution infrastructure designed to handle ammonia's toxicity and corrosive nature. These innovations enable the practical use of ammonia in fuel applications by ensuring safe and efficient handling throughout the supply chain.

- Ammonia fuel cells and power generation: Ammonia-based fuel cell technologies convert chemical energy directly into electrical energy with high efficiency. These systems include direct ammonia fuel cells, ammonia-hydrogen hybrid systems, and specialized catalysts for ammonia decomposition. These technologies enable clean power generation for stationary applications and potentially for transportation, offering reduced emissions compared to conventional fossil fuel systems.

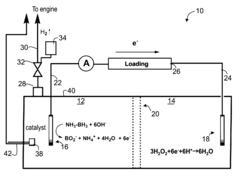

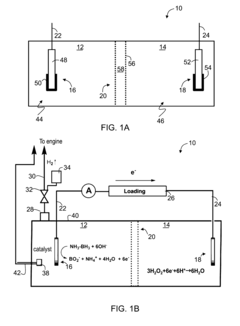

- Ammonia derivatives as energy carriers: Various ammonia derivatives serve as effective energy carriers with improved handling characteristics. These include metal ammine complexes, ammonia borane compounds, and other nitrogen-hydrogen systems that can store and release hydrogen energy on demand. These derivatives address some of the challenges associated with pure ammonia while maintaining its benefits as a carbon-free energy source.

- Market analysis and economic factors for ammonia fuel: Economic analyses and market dynamics studies examine the viability of ammonia as a fuel source. These include assessments of production costs, infrastructure requirements, regulatory frameworks, and competitive positioning against other alternative fuels. The research indicates growing market potential for ammonia fuel, particularly in sectors seeking to decarbonize, though challenges remain in achieving cost parity with conventional fuels.

02 Ammonia fuel storage and transportation systems

Specialized systems for the safe storage and transportation of ammonia fuel have been developed to address its unique properties. These include advanced containment vessels, pressure management systems, and safety mechanisms that enable efficient handling throughout the supply chain. The innovations focus on minimizing risks associated with ammonia's toxicity while maximizing energy density benefits for practical distribution networks.Expand Specific Solutions03 Ammonia fuel cells and power generation

Ammonia-based fuel cell technologies represent a significant advancement in utilizing ammonia as an energy carrier. These systems directly convert ammonia to electricity through electrochemical processes, offering high efficiency and low emissions. Developments include specialized catalysts, membrane technologies, and system integration approaches that enable ammonia to serve as a hydrogen carrier for power generation applications across various scales.Expand Specific Solutions04 Ammonia derivatives and chemical conversion

Ammonia can be converted into various derivative products that serve as alternative fuels or chemical feedstocks. These conversion processes include cracking ammonia to produce hydrogen, synthesizing ammonia-based liquid fuels, and developing ammonia-organic compounds with improved handling characteristics. The technologies enable ammonia to serve as a versatile platform molecule in the renewable energy and chemical industries.Expand Specific Solutions05 Market analysis and commercialization strategies

Economic analyses and market strategies for ammonia fuel adoption have been developed to address commercialization challenges. These include supply chain optimization models, cost-benefit analyses of ammonia versus competing fuels, and regulatory framework assessments. The approaches consider factors such as infrastructure requirements, pricing mechanisms, and policy incentives needed to establish ammonia as a viable alternative fuel in various market segments.Expand Specific Solutions

Key Industry Players in Ammonia Fuel Ecosystem

The ammonia fuel market is in an early growth phase, characterized by increasing R&D investments but limited commercial deployment. The global market is projected to expand significantly as decarbonization efforts intensify, with potential to reach multi-billion dollar valuation by 2030. Technologically, the sector shows varying maturity levels across production, storage, and utilization pathways. Leading academic institutions (Harbin Engineering University, Tianjin University, Jilin University) are advancing fundamental research, while industrial players demonstrate different specialization areas: Samsung Heavy Industries and Hudong-Zhonghua focus on maritime applications; NuScale Power and FuelCell Energy develop power generation solutions; and TotalEnergies and Linde pursue production technologies. This competitive landscape reflects a fragmented but rapidly evolving ecosystem with significant cross-sector collaboration opportunities.

Samsung Heavy Industries Co., Ltd.

Technical Solution: Samsung Heavy Industries has developed advanced ammonia-powered marine propulsion systems as part of their "Ammonia-Ready" vessel design platform. Their dual-fuel engines can operate on both conventional marine fuels and ammonia, with the ability to gradually increase ammonia utilization as infrastructure develops. The company's proprietary combustion control systems address ammonia's lower flame speed and narrower flammability limits, achieving thermal efficiencies within 5% of conventional marine diesel engines. Samsung's market analysis projects that ammonia-powered vessels could represent 30% of new shipbuilding orders by 2035, driven by IMO carbon reduction targets. Their integrated design approach includes specialized storage tanks that can maintain liquid ammonia at -33°C with boil-off gas recovery systems that capture and utilize any evaporated ammonia, achieving near-zero emissions during storage and transport. The company has also developed comprehensive safety systems specifically designed for ammonia's toxicity profile.

Strengths: Integrated vessel design expertise that addresses the full range of ammonia implementation challenges; established position as a leading global shipbuilder; ability to deliver commercial-scale solutions. Weaknesses: Technology primarily focused on maritime applications rather than broader ammonia ecosystem; requires coordination with fuel suppliers and port infrastructure; competing with alternative maritime fuels like LNG and methanol.

Ammonia Casale SpA

Technical Solution: Ammonia Casale has developed proprietary ammonia synthesis technology that significantly improves energy efficiency in ammonia production. Their axial-radial catalyst beds reduce pressure drops by up to 40% compared to conventional systems, enabling lower energy consumption and higher conversion rates. The company's advanced process design incorporates heat recovery systems that capture and reuse thermal energy throughout the ammonia synthesis process, reducing overall energy requirements by approximately 30%. Ammonia Casale has also pioneered modular ammonia production units that can be deployed at various scales, making green ammonia production more accessible for distributed energy applications. Their technology roadmap includes integration with renewable energy sources to produce carbon-neutral ammonia fuel through electrolysis-based hydrogen production coupled with their efficient nitrogen fixation processes.

Strengths: Industry-leading expertise in ammonia synthesis with over 100 years of experience; proprietary catalyst technology that improves conversion efficiency; scalable solutions from small to world-scale plants. Weaknesses: Higher initial capital costs compared to conventional systems; technology primarily focused on production rather than end-use applications; requires integration with other technologies for complete green ammonia value chain.

Core Patents and Innovations in Ammonia Fuel Technology

Direct liquid fuel cell having ammonia borane or derivatives thereof as fuel

PatentInactiveUS9553315B2

Innovation

- A direct liquid fuel cell system utilizing ammonia borane as fuel and hydrogen peroxide as oxidant, with a copper-containing anode and a non-metallic catalyst layer in the cathode, allowing for efficient operation without platinum group metals and reducing overpotentials.

Environmental Impact Assessment of Ammonia Fuel Adoption

The environmental implications of ammonia fuel adoption represent a critical dimension in assessing its viability as an alternative energy carrier. Ammonia's potential as a carbon-free fuel offers significant advantages in reducing greenhouse gas emissions compared to conventional fossil fuels. When combusted or used in fuel cells, ammonia produces primarily nitrogen and water, eliminating direct carbon dioxide emissions that contribute to global warming.

However, the environmental assessment must consider the entire lifecycle of ammonia production and utilization. Currently, most industrial ammonia is produced via the Haber-Bosch process, which is energy-intensive and typically relies on natural gas as both feedstock and energy source. This conventional production pathway generates substantial CO2 emissions—approximately 1.6-1.8 tons of CO2 per ton of ammonia produced—undermining the carbon neutrality claims of ammonia fuel.

The emergence of green ammonia production methods utilizing renewable electricity for hydrogen production through water electrolysis presents a promising pathway toward truly sustainable ammonia fuel. Life cycle assessments indicate that green ammonia could reduce carbon emissions by 80-90% compared to conventional ammonia, though this depends heavily on the carbon intensity of the electricity source.

Beyond carbon emissions, ammonia presents other environmental considerations. As a nitrogen compound, ammonia releases nitrogen oxides (NOx) during combustion, which contribute to air pollution and acid rain. Advanced combustion technologies and selective catalytic reduction systems are being developed to mitigate these emissions, but their effectiveness at scale remains to be fully validated.

Water usage represents another environmental concern, particularly for green ammonia production relying on electrolysis. Preliminary studies suggest that producing one ton of green ammonia may require 1.5-2 cubic meters of freshwater, raising sustainability questions in water-stressed regions where renewable energy resources might be abundant.

Ammonia's toxicity to aquatic ecosystems presents additional environmental risks. Accidental releases during transportation, storage, or handling could have severe localized environmental impacts. The development of robust safety protocols and infrastructure will be essential to minimize these risks as ammonia fuel adoption scales.

Land use impacts vary significantly depending on production methods. Green ammonia facilities coupled with renewable energy generation may require substantial land area, particularly for solar installations, potentially competing with agricultural land or natural habitats. Conversely, offshore wind-powered ammonia production could minimize land use conflicts while leveraging abundant marine renewable resources.

Comprehensive environmental impact assessments must balance these various factors against the environmental costs of continued fossil fuel dependence, considering regional variations in resource availability, existing infrastructure, and environmental sensitivities.

However, the environmental assessment must consider the entire lifecycle of ammonia production and utilization. Currently, most industrial ammonia is produced via the Haber-Bosch process, which is energy-intensive and typically relies on natural gas as both feedstock and energy source. This conventional production pathway generates substantial CO2 emissions—approximately 1.6-1.8 tons of CO2 per ton of ammonia produced—undermining the carbon neutrality claims of ammonia fuel.

The emergence of green ammonia production methods utilizing renewable electricity for hydrogen production through water electrolysis presents a promising pathway toward truly sustainable ammonia fuel. Life cycle assessments indicate that green ammonia could reduce carbon emissions by 80-90% compared to conventional ammonia, though this depends heavily on the carbon intensity of the electricity source.

Beyond carbon emissions, ammonia presents other environmental considerations. As a nitrogen compound, ammonia releases nitrogen oxides (NOx) during combustion, which contribute to air pollution and acid rain. Advanced combustion technologies and selective catalytic reduction systems are being developed to mitigate these emissions, but their effectiveness at scale remains to be fully validated.

Water usage represents another environmental concern, particularly for green ammonia production relying on electrolysis. Preliminary studies suggest that producing one ton of green ammonia may require 1.5-2 cubic meters of freshwater, raising sustainability questions in water-stressed regions where renewable energy resources might be abundant.

Ammonia's toxicity to aquatic ecosystems presents additional environmental risks. Accidental releases during transportation, storage, or handling could have severe localized environmental impacts. The development of robust safety protocols and infrastructure will be essential to minimize these risks as ammonia fuel adoption scales.

Land use impacts vary significantly depending on production methods. Green ammonia facilities coupled with renewable energy generation may require substantial land area, particularly for solar installations, potentially competing with agricultural land or natural habitats. Conversely, offshore wind-powered ammonia production could minimize land use conflicts while leveraging abundant marine renewable resources.

Comprehensive environmental impact assessments must balance these various factors against the environmental costs of continued fossil fuel dependence, considering regional variations in resource availability, existing infrastructure, and environmental sensitivities.

Policy Framework and Incentives for Green Ammonia Development

The global policy landscape for green ammonia development is rapidly evolving, with various countries implementing frameworks to accelerate the transition toward sustainable energy carriers. The European Union leads with its comprehensive Green Deal, which includes specific provisions for hydrogen and ammonia as key components of its decarbonization strategy. The EU's Renewable Energy Directive II (RED II) provides financial incentives for green ammonia production by recognizing it as a renewable fuel of non-biological origin (RFNBO).

In Asia, Japan's Strategic Energy Plan explicitly identifies ammonia as a critical element in achieving carbon neutrality by 2050, offering tax benefits and subsidies for ammonia co-firing in thermal power plants. Similarly, South Korea's Hydrogen Economy Roadmap includes provisions for ammonia as a hydrogen carrier, with financial support mechanisms for infrastructure development.

The United States has introduced the Inflation Reduction Act, which provides significant tax credits for clean hydrogen production—indirectly benefiting green ammonia projects. Section 45V of the Act offers up to $3 per kilogram for hydrogen produced with minimal carbon emissions, creating a substantial economic incentive for green ammonia manufacturers.

Regulatory frameworks are also emerging to standardize safety protocols and emissions accounting for ammonia fuel. The International Maritime Organization (IMO) is developing specific guidelines for ammonia as a marine fuel, while the International Energy Agency (IEA) has established methodologies for calculating lifecycle emissions of ammonia production pathways.

Carbon pricing mechanisms represent another critical policy tool driving green ammonia adoption. The EU Emissions Trading System (ETS) and similar schemes in other regions create economic advantages for low-carbon alternatives to conventional ammonia. As carbon prices continue to rise—projected to reach €100-150 per tonne by 2030 in the EU—the competitiveness of green ammonia will significantly improve.

Public procurement policies are increasingly incorporating green ammonia requirements, particularly in the maritime and agricultural sectors. Several countries have announced mandates for low-carbon fertilizers in government-supported agricultural programs, creating guaranteed markets for green ammonia producers.

International cooperation frameworks, such as the Clean Energy Ministerial's Hydrogen Initiative and the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), are working to harmonize standards and regulations across borders, facilitating global trade in green ammonia and its derivatives.

In Asia, Japan's Strategic Energy Plan explicitly identifies ammonia as a critical element in achieving carbon neutrality by 2050, offering tax benefits and subsidies for ammonia co-firing in thermal power plants. Similarly, South Korea's Hydrogen Economy Roadmap includes provisions for ammonia as a hydrogen carrier, with financial support mechanisms for infrastructure development.

The United States has introduced the Inflation Reduction Act, which provides significant tax credits for clean hydrogen production—indirectly benefiting green ammonia projects. Section 45V of the Act offers up to $3 per kilogram for hydrogen produced with minimal carbon emissions, creating a substantial economic incentive for green ammonia manufacturers.

Regulatory frameworks are also emerging to standardize safety protocols and emissions accounting for ammonia fuel. The International Maritime Organization (IMO) is developing specific guidelines for ammonia as a marine fuel, while the International Energy Agency (IEA) has established methodologies for calculating lifecycle emissions of ammonia production pathways.

Carbon pricing mechanisms represent another critical policy tool driving green ammonia adoption. The EU Emissions Trading System (ETS) and similar schemes in other regions create economic advantages for low-carbon alternatives to conventional ammonia. As carbon prices continue to rise—projected to reach €100-150 per tonne by 2030 in the EU—the competitiveness of green ammonia will significantly improve.

Public procurement policies are increasingly incorporating green ammonia requirements, particularly in the maritime and agricultural sectors. Several countries have announced mandates for low-carbon fertilizers in government-supported agricultural programs, creating guaranteed markets for green ammonia producers.

International cooperation frameworks, such as the Clean Energy Ministerial's Hydrogen Initiative and the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), are working to harmonize standards and regulations across borders, facilitating global trade in green ammonia and its derivatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!