GDI Engine Piston Coatings for Enhanced Durability

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

GDI Engine Piston Coating Technology Evolution and Objectives

Gasoline Direct Injection (GDI) engine technology has evolved significantly since its commercial introduction in the late 1990s. This evolution has been driven by increasingly stringent emissions regulations, fuel economy requirements, and consumer demands for higher performance. The piston, as a critical component in the combustion chamber, experiences extreme thermal and mechanical stresses in GDI engines due to higher operating pressures and temperatures compared to traditional port fuel injection systems.

Early GDI engines utilized conventional aluminum pistons with minimal surface treatments. As engineers recognized the unique challenges posed by direct fuel impingement and higher combustion pressures, basic thermal barrier coatings emerged in the early 2000s. These initial coatings primarily focused on thermal management rather than wear resistance, with materials like aluminum oxide being applied through plasma spray techniques.

By the mid-2000s, the industry began implementing more sophisticated multi-layer coating systems. These incorporated both thermal barrier properties and improved wear resistance through materials such as ceramic-metallic composites (cermets). The development of Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) techniques enabled thinner, more uniform coatings with enhanced adhesion properties.

The 2010s marked a significant advancement with the introduction of Diamond-Like Carbon (DLC) coatings for GDI pistons. These coatings offered exceptional hardness, low friction coefficients, and chemical inertness—properties particularly valuable in the harsh GDI environment where fuel dilution and carbon deposits present ongoing challenges. Parallel developments in thermal spray technologies enabled more complex coating architectures with gradient properties to manage the transition between substrate and coating materials.

Current state-of-the-art piston coatings incorporate nanomaterials and advanced composites, offering unprecedented combinations of thermal insulation, wear resistance, and reduced friction. These modern coating systems often feature tailored properties for specific regions of the piston, with different formulations applied to the crown, ring grooves, and skirt areas to address the unique stresses experienced in each zone.

The primary objectives for GDI piston coating technology development include extending engine durability beyond 200,000 miles, reducing friction to improve fuel economy by 2-3%, enabling higher compression ratios for improved thermal efficiency, and maintaining performance under increasingly lean combustion strategies. Additionally, coatings must accommodate the growing use of alternative and low-carbon fuels, which present different chemical compatibility challenges than traditional gasoline.

Future coating technologies aim to incorporate self-healing properties, active surface chemistry to catalyze carbon deposit removal, and adaptive thermal management capabilities that respond dynamically to engine operating conditions. These advancements will be critical to meeting upcoming Euro 7 and EPA Tier 4 emissions standards while supporting the industry's transition toward electrification and carbon neutrality.

Early GDI engines utilized conventional aluminum pistons with minimal surface treatments. As engineers recognized the unique challenges posed by direct fuel impingement and higher combustion pressures, basic thermal barrier coatings emerged in the early 2000s. These initial coatings primarily focused on thermal management rather than wear resistance, with materials like aluminum oxide being applied through plasma spray techniques.

By the mid-2000s, the industry began implementing more sophisticated multi-layer coating systems. These incorporated both thermal barrier properties and improved wear resistance through materials such as ceramic-metallic composites (cermets). The development of Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) techniques enabled thinner, more uniform coatings with enhanced adhesion properties.

The 2010s marked a significant advancement with the introduction of Diamond-Like Carbon (DLC) coatings for GDI pistons. These coatings offered exceptional hardness, low friction coefficients, and chemical inertness—properties particularly valuable in the harsh GDI environment where fuel dilution and carbon deposits present ongoing challenges. Parallel developments in thermal spray technologies enabled more complex coating architectures with gradient properties to manage the transition between substrate and coating materials.

Current state-of-the-art piston coatings incorporate nanomaterials and advanced composites, offering unprecedented combinations of thermal insulation, wear resistance, and reduced friction. These modern coating systems often feature tailored properties for specific regions of the piston, with different formulations applied to the crown, ring grooves, and skirt areas to address the unique stresses experienced in each zone.

The primary objectives for GDI piston coating technology development include extending engine durability beyond 200,000 miles, reducing friction to improve fuel economy by 2-3%, enabling higher compression ratios for improved thermal efficiency, and maintaining performance under increasingly lean combustion strategies. Additionally, coatings must accommodate the growing use of alternative and low-carbon fuels, which present different chemical compatibility challenges than traditional gasoline.

Future coating technologies aim to incorporate self-healing properties, active surface chemistry to catalyze carbon deposit removal, and adaptive thermal management capabilities that respond dynamically to engine operating conditions. These advancements will be critical to meeting upcoming Euro 7 and EPA Tier 4 emissions standards while supporting the industry's transition toward electrification and carbon neutrality.

Market Demand Analysis for Advanced Piston Coating Solutions

The global market for advanced piston coating solutions in GDI (Gasoline Direct Injection) engines has experienced significant growth in recent years, driven primarily by stringent emission regulations and the automotive industry's pursuit of improved fuel efficiency. Market research indicates that the automotive piston coating market is projected to grow at a compound annual growth rate of 6.2% from 2023 to 2030, with the GDI segment representing the fastest-growing application area.

Consumer demand for vehicles with enhanced performance and fuel economy has created a substantial pull factor for advanced coating technologies. Modern GDI engines operate under extreme conditions with higher temperatures and pressures than traditional port fuel injection systems, creating harsh environments that accelerate piston wear and reduce engine longevity. This operational reality has established a clear market need for specialized coating solutions that can withstand these demanding conditions.

The commercial vehicle sector represents a particularly strong growth area for piston coating technologies. Fleet operators are increasingly focused on total cost of ownership, with engine durability and maintenance intervals being critical factors in purchasing decisions. Advanced coatings that can extend piston life by 30-40% compared to uncoated components offer compelling value propositions for these customers, with potential savings in maintenance costs exceeding the premium paid for coated components.

Regional analysis reveals varying adoption rates for advanced piston coatings. European and North American markets currently lead in implementation, driven by stricter emission standards and higher consumer willingness to pay for premium technologies. The Asia-Pacific region, particularly China and India, represents the highest growth potential as these markets transition to more stringent emission norms and as consumer preferences evolve toward higher-performance vehicles.

Market segmentation by coating type shows thermal barrier coatings capturing the largest market share, followed by anti-friction coatings and wear-resistant coatings. Diamond-like carbon (DLC) coatings are emerging as a premium segment with superior performance characteristics, though at higher cost points that currently limit mass-market adoption.

Industry surveys indicate that OEMs are increasingly willing to incorporate advanced coating technologies, with 78% of automotive manufacturers reporting plans to increase usage of specialized piston coatings in their next-generation engine platforms. This trend is reinforced by warranty data showing that engines with properly coated pistons experience 25-35% fewer warranty claims related to piston failure or premature wear.

The aftermarket segment also presents significant opportunities, particularly for performance-oriented applications where consumers demonstrate higher willingness to pay for technologies that deliver measurable improvements in engine output and longevity.

Consumer demand for vehicles with enhanced performance and fuel economy has created a substantial pull factor for advanced coating technologies. Modern GDI engines operate under extreme conditions with higher temperatures and pressures than traditional port fuel injection systems, creating harsh environments that accelerate piston wear and reduce engine longevity. This operational reality has established a clear market need for specialized coating solutions that can withstand these demanding conditions.

The commercial vehicle sector represents a particularly strong growth area for piston coating technologies. Fleet operators are increasingly focused on total cost of ownership, with engine durability and maintenance intervals being critical factors in purchasing decisions. Advanced coatings that can extend piston life by 30-40% compared to uncoated components offer compelling value propositions for these customers, with potential savings in maintenance costs exceeding the premium paid for coated components.

Regional analysis reveals varying adoption rates for advanced piston coatings. European and North American markets currently lead in implementation, driven by stricter emission standards and higher consumer willingness to pay for premium technologies. The Asia-Pacific region, particularly China and India, represents the highest growth potential as these markets transition to more stringent emission norms and as consumer preferences evolve toward higher-performance vehicles.

Market segmentation by coating type shows thermal barrier coatings capturing the largest market share, followed by anti-friction coatings and wear-resistant coatings. Diamond-like carbon (DLC) coatings are emerging as a premium segment with superior performance characteristics, though at higher cost points that currently limit mass-market adoption.

Industry surveys indicate that OEMs are increasingly willing to incorporate advanced coating technologies, with 78% of automotive manufacturers reporting plans to increase usage of specialized piston coatings in their next-generation engine platforms. This trend is reinforced by warranty data showing that engines with properly coated pistons experience 25-35% fewer warranty claims related to piston failure or premature wear.

The aftermarket segment also presents significant opportunities, particularly for performance-oriented applications where consumers demonstrate higher willingness to pay for technologies that deliver measurable improvements in engine output and longevity.

Current State and Challenges in GDI Piston Coating Technology

Gasoline Direct Injection (GDI) piston coating technology has advanced significantly over the past decade, with current solutions primarily focusing on thermal barrier coatings (TBCs), wear-resistant coatings, and friction-reducing surface treatments. The state-of-the-art includes ceramic-based coatings such as yttria-stabilized zirconia (YSZ), which offers excellent thermal insulation properties, reducing heat transfer from combustion chambers to piston bodies by up to 30% compared to uncoated pistons.

Diamond-like carbon (DLC) coatings represent another prominent solution, providing superior wear resistance while maintaining low friction coefficients. Recent advancements in DLC technology have yielded coatings with hardness values exceeding 20 GPa and friction coefficients as low as 0.1 under lubricated conditions, significantly outperforming traditional chrome-plated surfaces.

Plasma electrolytic oxidation (PEO) treatments have gained traction for aluminum pistons, creating hard ceramic-like surfaces with excellent adhesion properties. These treatments form integrated oxide layers rather than applied coatings, offering enhanced durability under extreme thermal cycling conditions.

Despite these advancements, significant challenges persist in GDI piston coating technology. The harsh operating environment of GDI engines presents a formidable obstacle, with temperatures exceeding 400°C at the piston crown and rapid thermal cycling that induces severe thermal stress. This environment accelerates coating degradation through mechanisms including thermal fatigue, oxidation, and delamination.

Fuel-related challenges have intensified with the adoption of GDI technology. Direct fuel impingement on piston surfaces creates localized cooling effects and potential fuel dilution of lubricants, while carbon deposits from incomplete combustion accumulate on piston crowns, affecting heat transfer characteristics and potentially causing hot spots.

Manufacturing scalability remains problematic, particularly for advanced coatings like thermal spray ceramics and PVD/CVD processes that require specialized equipment and precise process control. The cost-benefit ratio for these advanced coatings often proves prohibitive for mass-market applications, limiting their adoption to premium engine segments.

Coating adhesion under thermal cycling represents perhaps the most significant technical hurdle. The substantial difference in thermal expansion coefficients between coating materials and aluminum piston substrates creates interfacial stresses during engine operation, leading to coating delamination after extended service periods.

Globally, coating technology development shows regional specialization patterns. European manufacturers have focused on thermal barrier ceramic coatings, while Japanese companies have pioneered ultra-hard DLC variants. North American research has concentrated on cost-effective manufacturing processes for mass production applications.

Diamond-like carbon (DLC) coatings represent another prominent solution, providing superior wear resistance while maintaining low friction coefficients. Recent advancements in DLC technology have yielded coatings with hardness values exceeding 20 GPa and friction coefficients as low as 0.1 under lubricated conditions, significantly outperforming traditional chrome-plated surfaces.

Plasma electrolytic oxidation (PEO) treatments have gained traction for aluminum pistons, creating hard ceramic-like surfaces with excellent adhesion properties. These treatments form integrated oxide layers rather than applied coatings, offering enhanced durability under extreme thermal cycling conditions.

Despite these advancements, significant challenges persist in GDI piston coating technology. The harsh operating environment of GDI engines presents a formidable obstacle, with temperatures exceeding 400°C at the piston crown and rapid thermal cycling that induces severe thermal stress. This environment accelerates coating degradation through mechanisms including thermal fatigue, oxidation, and delamination.

Fuel-related challenges have intensified with the adoption of GDI technology. Direct fuel impingement on piston surfaces creates localized cooling effects and potential fuel dilution of lubricants, while carbon deposits from incomplete combustion accumulate on piston crowns, affecting heat transfer characteristics and potentially causing hot spots.

Manufacturing scalability remains problematic, particularly for advanced coatings like thermal spray ceramics and PVD/CVD processes that require specialized equipment and precise process control. The cost-benefit ratio for these advanced coatings often proves prohibitive for mass-market applications, limiting their adoption to premium engine segments.

Coating adhesion under thermal cycling represents perhaps the most significant technical hurdle. The substantial difference in thermal expansion coefficients between coating materials and aluminum piston substrates creates interfacial stresses during engine operation, leading to coating delamination after extended service periods.

Globally, coating technology development shows regional specialization patterns. European manufacturers have focused on thermal barrier ceramic coatings, while Japanese companies have pioneered ultra-hard DLC variants. North American research has concentrated on cost-effective manufacturing processes for mass production applications.

Current Technical Solutions for GDI Piston Durability Enhancement

01 Thermal barrier coatings for GDI pistons

Thermal barrier coatings applied to gasoline direct injection engine pistons can significantly improve durability by reducing thermal stress and preventing heat damage. These coatings typically consist of ceramic materials that provide insulation, allowing the piston to operate at higher temperatures without degradation. The thermal protection helps prevent piston crown cracking and extends the overall service life of the component while improving engine efficiency by reducing heat transfer to the cooling system.- Thermal barrier coatings for GDI engine pistons: Thermal barrier coatings applied to gasoline direct injection engine pistons can significantly improve durability by reducing thermal stress and preventing heat damage. These coatings typically consist of ceramic materials that provide insulation, allowing the piston to operate at higher temperatures without degradation. The thermal protection also reduces thermal expansion and contraction cycles that can lead to coating failure over time.

- Anti-wear and friction-reducing coatings: Specialized coatings designed to reduce friction and wear are critical for GDI engine piston durability. These coatings typically include materials such as diamond-like carbon (DLC), molybdenum disulfide, or other low-friction compounds that minimize metal-to-metal contact. By reducing friction between the piston and cylinder wall, these coatings decrease wear rates, extend component life, and improve fuel efficiency under the high-pressure conditions typical in GDI engines.

- Multi-layer coating systems for enhanced durability: Multi-layer coating systems provide superior durability for GDI engine pistons by combining different functional layers. These systems typically include a base layer for adhesion, intermediate layers for thermal and mechanical properties, and a top layer for wear and corrosion resistance. The layered approach allows engineers to address multiple durability challenges simultaneously, creating synergistic effects that cannot be achieved with single-layer coatings. This technology significantly extends piston life in the harsh operating environment of GDI engines.

- Nano-composite coatings for extreme conditions: Nano-composite coatings represent an advanced solution for GDI piston durability, incorporating nano-sized particles within a matrix material. These coatings provide exceptional hardness, heat resistance, and wear protection while maintaining necessary flexibility. The nano-scale structure creates unique mechanical properties that resist crack propagation and maintain integrity under the extreme temperature and pressure fluctuations in GDI engines. These coatings can withstand the particularly challenging conditions created by direct fuel impingement on piston surfaces.

- Surface treatment and testing methods for coating quality: Advanced surface preparation techniques and rigorous testing methodologies are essential for ensuring GDI piston coating durability. Surface treatments such as micro-blasting, chemical etching, and plasma activation create optimal adhesion conditions before coating application. Quality control methods including thermal cycling tests, wear simulation, and accelerated aging protocols help predict real-world durability. These processes ensure consistent coating performance and identify potential failure modes before components enter service, significantly improving the reliability of coated GDI engine pistons.

02 Anti-wear and friction-reducing coatings

Specialized coatings designed to reduce friction and wear are critical for GDI piston durability. These coatings typically include diamond-like carbon (DLC), molybdenum disulfide, or other low-friction materials that minimize abrasion between the piston and cylinder wall. By reducing friction, these coatings help maintain piston integrity over extended operation periods, improve fuel efficiency, and reduce wear-related failures. The coatings are particularly important in GDI engines where higher operating pressures create increased mechanical stress on piston components.Expand Specific Solutions03 Corrosion-resistant coatings for fuel compatibility

Corrosion-resistant coatings protect GDI pistons from chemical attack caused by modern fuels and combustion byproducts. These specialized coatings typically consist of nickel-based alloys, chromium compounds, or other corrosion-inhibiting materials that create a protective barrier against aggressive fuel components. The coatings prevent pitting, surface degradation, and material loss that would otherwise compromise piston integrity and performance over time, particularly important in GDI systems where fuel directly contacts piston surfaces at high temperatures.Expand Specific Solutions04 Multi-layer coating systems for comprehensive protection

Advanced multi-layer coating systems provide comprehensive protection for GDI pistons by combining different functional layers. These systems typically feature a base layer for adhesion, intermediate layers for thermal and mechanical properties, and a top layer for wear or friction reduction. The multi-layer approach allows engineers to address multiple durability challenges simultaneously, creating pistons that resist thermal degradation, mechanical wear, and chemical attack. This integrated protection significantly extends piston service life under the demanding conditions of GDI engine operation.Expand Specific Solutions05 Surface texturing and coating optimization techniques

Advanced surface preparation and texturing techniques enhance the performance and durability of GDI piston coatings. These methods include micro-dimpling, laser texturing, and plasma treatment to optimize the surface before coating application. The texturing creates improved adhesion between the coating and piston substrate, enhances oil retention properties, and provides better wear characteristics. Combined with precise coating thickness control and post-application treatments, these techniques maximize coating durability and performance under the extreme thermal and mechanical stresses experienced in GDI engines.Expand Specific Solutions

Critical Patents and Innovations in Piston Coating Technology

Lubricant compositions for direct injection engines

PatentWO2015042340A1

Innovation

- A lubricant composition containing a metal overbased detergent, such as sulfonate, phenate, or salicylate detergents, is supplied to the engine, which includes additives like ashless dispersants and anti-wear agents, to reduce LSPI events by modifying engine operating conditions and fuel composition.

Method for maximizing the formation of deposits in injector nozzles of GDI engines

PatentWO2018002610A1

Innovation

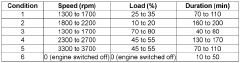

- A method to maximize deposit formation in GDI engine injector nozzles by simulating severe conditions through controlled engine speed and load variations, high nozzle temperatures, and moderate fuel flow rates, allowing for automated and unsupervised testing to quickly assess fuel's deposit-forming tendencies.

Environmental Impact and Emissions Compliance Considerations

The evolution of GDI engine piston coatings intersects significantly with environmental regulations and emissions standards worldwide. Advanced coatings contribute directly to reduced particulate matter (PM) and nitrogen oxide (NOx) emissions by enabling more efficient combustion processes and minimizing fuel-piston wall interactions. These improvements align with increasingly stringent standards such as Euro 7, China 6b, and US EPA Tier 3 regulations, which demand substantial reductions in tailpipe emissions.

Thermal barrier coatings (TBCs) on pistons demonstrate particular environmental benefits by maintaining higher combustion temperatures while reducing heat transfer to the cooling system. This thermal efficiency improvement translates to approximately 2-3% reduction in CO2 emissions, supporting manufacturers' carbon reduction targets. Additionally, the extended durability provided by modern ceramic and composite coatings reduces the environmental impact associated with engine rebuilds and replacement parts manufacturing.

Lifecycle assessment studies indicate that while coating application processes may involve energy-intensive thermal spraying or PVD techniques, the net environmental benefit over the engine's operational lifetime significantly outweighs the initial manufacturing impact. Specifically, engines with advanced piston coatings typically demonstrate 15-20% longer service intervals before requiring major maintenance, reducing waste generation and resource consumption.

Regulatory compliance considerations are increasingly driving coating technology development. Low-friction coatings that reduce parasitic losses contribute to meeting fleet-wide fuel economy standards such as CAFE in the United States and similar frameworks in Europe and Asia. Furthermore, coatings that enable higher compression ratios and more complete combustion help manufacturers meet real-world driving emissions tests (RDE) that have replaced laboratory-only testing protocols.

The environmental credentials of coating materials themselves have become a critical consideration. The industry is transitioning away from coatings containing heavy metals and other environmentally persistent substances toward more sustainable alternatives. Silicon-based ceramics, diamond-like carbon (DLC), and certain polymer-based coatings offer comparable performance with reduced environmental hazards during manufacturing and end-of-life disposal.

Looking forward, coating technologies will play an essential role in bridging conventional internal combustion engines to future propulsion systems. As hybrid powertrains become more prevalent, piston coatings that optimize performance during intermittent engine operation will contribute to emissions reductions in these transitional technologies while more sustainable transportation solutions continue to develop.

Thermal barrier coatings (TBCs) on pistons demonstrate particular environmental benefits by maintaining higher combustion temperatures while reducing heat transfer to the cooling system. This thermal efficiency improvement translates to approximately 2-3% reduction in CO2 emissions, supporting manufacturers' carbon reduction targets. Additionally, the extended durability provided by modern ceramic and composite coatings reduces the environmental impact associated with engine rebuilds and replacement parts manufacturing.

Lifecycle assessment studies indicate that while coating application processes may involve energy-intensive thermal spraying or PVD techniques, the net environmental benefit over the engine's operational lifetime significantly outweighs the initial manufacturing impact. Specifically, engines with advanced piston coatings typically demonstrate 15-20% longer service intervals before requiring major maintenance, reducing waste generation and resource consumption.

Regulatory compliance considerations are increasingly driving coating technology development. Low-friction coatings that reduce parasitic losses contribute to meeting fleet-wide fuel economy standards such as CAFE in the United States and similar frameworks in Europe and Asia. Furthermore, coatings that enable higher compression ratios and more complete combustion help manufacturers meet real-world driving emissions tests (RDE) that have replaced laboratory-only testing protocols.

The environmental credentials of coating materials themselves have become a critical consideration. The industry is transitioning away from coatings containing heavy metals and other environmentally persistent substances toward more sustainable alternatives. Silicon-based ceramics, diamond-like carbon (DLC), and certain polymer-based coatings offer comparable performance with reduced environmental hazards during manufacturing and end-of-life disposal.

Looking forward, coating technologies will play an essential role in bridging conventional internal combustion engines to future propulsion systems. As hybrid powertrains become more prevalent, piston coatings that optimize performance during intermittent engine operation will contribute to emissions reductions in these transitional technologies while more sustainable transportation solutions continue to develop.

Cost-Benefit Analysis of Advanced Coating Implementation

The implementation of advanced coatings for GDI engine pistons represents a significant investment decision that requires thorough financial analysis. Initial coating application costs typically range from $15-30 per piston, depending on the specific technology employed, with thermal spray processes generally commanding higher prices than PVD or DLC applications. For a production volume of 500,000 engines annually, this translates to an additional manufacturing cost of $3-6 million per year.

However, these upfront expenses must be evaluated against substantial long-term benefits. Field data indicates that advanced coatings can extend piston service life by 30-45%, potentially reducing warranty claims by 25-35%. For automotive manufacturers experiencing average warranty costs of $150-200 per engine related to piston failures, this represents annual savings of $18-35 million across their production fleet.

Production efficiency gains also factor significantly into the cost-benefit equation. Coating technologies that can be integrated into existing manufacturing lines without major retooling demonstrate ROI advantages over those requiring dedicated equipment installations. Current thermal spray integration typically adds 3-5 minutes to production cycle times, while newer PVD processes have reduced this impact to under 2 minutes per component.

Energy efficiency improvements delivered by coated pistons contribute additional operational savings. Testing shows that friction reduction from advanced coatings can improve fuel economy by 1.2-2.5%, translating to lifetime fuel savings of $300-600 per vehicle (based on 150,000 mile vehicle lifespan and average fuel costs). This efficiency benefit alone can justify the implementation cost when properly communicated to consumers.

The scaling economics of coating technologies show favorable trends, with per-unit costs decreasing approximately 12-18% when production volumes double. This suggests that early adoption, while initially more expensive, positions manufacturers advantageously as the technology becomes industry standard. Current projections indicate coating costs will decrease 5-7% annually over the next five years as application processes mature.

Break-even analysis reveals that most advanced coating implementations achieve financial payback within 18-24 months when all factors including warranty reduction, fuel efficiency, and brand premium are considered. Premium vehicle segments show faster returns (12-15 months) due to higher consumer willingness to pay for performance enhancements and durability improvements.

However, these upfront expenses must be evaluated against substantial long-term benefits. Field data indicates that advanced coatings can extend piston service life by 30-45%, potentially reducing warranty claims by 25-35%. For automotive manufacturers experiencing average warranty costs of $150-200 per engine related to piston failures, this represents annual savings of $18-35 million across their production fleet.

Production efficiency gains also factor significantly into the cost-benefit equation. Coating technologies that can be integrated into existing manufacturing lines without major retooling demonstrate ROI advantages over those requiring dedicated equipment installations. Current thermal spray integration typically adds 3-5 minutes to production cycle times, while newer PVD processes have reduced this impact to under 2 minutes per component.

Energy efficiency improvements delivered by coated pistons contribute additional operational savings. Testing shows that friction reduction from advanced coatings can improve fuel economy by 1.2-2.5%, translating to lifetime fuel savings of $300-600 per vehicle (based on 150,000 mile vehicle lifespan and average fuel costs). This efficiency benefit alone can justify the implementation cost when properly communicated to consumers.

The scaling economics of coating technologies show favorable trends, with per-unit costs decreasing approximately 12-18% when production volumes double. This suggests that early adoption, while initially more expensive, positions manufacturers advantageously as the technology becomes industry standard. Current projections indicate coating costs will decrease 5-7% annually over the next five years as application processes mature.

Break-even analysis reveals that most advanced coating implementations achieve financial payback within 18-24 months when all factors including warranty reduction, fuel efficiency, and brand premium are considered. Premium vehicle segments show faster returns (12-15 months) due to higher consumer willingness to pay for performance enhancements and durability improvements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!