GDI Engine vs PFI Engine: Fuel Efficiency Comparison

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

GDI and PFI Engine Evolution and Objectives

The evolution of fuel injection systems in internal combustion engines represents one of the most significant technological advancements in automotive engineering over the past century. Port Fuel Injection (PFI) emerged in the 1980s as a replacement for carburetors, offering improved fuel atomization and more precise control over the air-fuel mixture. This technology injects fuel into the intake port just before the intake valve, allowing for better mixing with air before entering the combustion chamber.

Gasoline Direct Injection (GDI) technology, while conceptualized earlier, gained widespread commercial adoption in the early 2000s. Unlike PFI, GDI systems inject fuel directly into the combustion chamber at significantly higher pressures, typically between 100-200 bar compared to PFI's 3-5 bar. This fundamental difference in design creates distinct thermodynamic advantages that have driven the industry's gradual shift toward GDI systems.

The primary objective behind both technologies remains consistent: to optimize the combustion process for maximum energy extraction from fuel while minimizing emissions. However, the evolutionary path has been shaped by increasingly stringent emissions regulations worldwide and consumer demand for improved fuel economy without sacrificing performance.

GDI systems have demonstrated potential fuel efficiency improvements of 15-25% compared to traditional PFI systems, particularly under partial load conditions. This efficiency gain stems from GDI's ability to operate with higher compression ratios, support stratified charge combustion, and reduce throttling losses through charge cooling effects. These advantages align perfectly with modern automotive industry goals of reducing carbon footprints while maintaining or enhancing vehicle performance.

The technological trajectory shows a clear trend toward hybridized injection systems that combine the benefits of both technologies. Dual-injection systems, featuring both port and direct injectors, have emerged as a promising solution to address some of GDI's inherent challenges, particularly particulate emissions and carbon buildup on intake valves.

Looking forward, the evolution of these technologies aims to further optimize combustion efficiency through advanced spray patterns, higher injection pressures exceeding 350 bar, and sophisticated electronic control systems that can adapt injection strategies in real-time based on driving conditions. Integration with electrification strategies represents another frontier, as manufacturers explore how optimized injection systems can complement hybrid powertrains to maximize overall system efficiency.

Gasoline Direct Injection (GDI) technology, while conceptualized earlier, gained widespread commercial adoption in the early 2000s. Unlike PFI, GDI systems inject fuel directly into the combustion chamber at significantly higher pressures, typically between 100-200 bar compared to PFI's 3-5 bar. This fundamental difference in design creates distinct thermodynamic advantages that have driven the industry's gradual shift toward GDI systems.

The primary objective behind both technologies remains consistent: to optimize the combustion process for maximum energy extraction from fuel while minimizing emissions. However, the evolutionary path has been shaped by increasingly stringent emissions regulations worldwide and consumer demand for improved fuel economy without sacrificing performance.

GDI systems have demonstrated potential fuel efficiency improvements of 15-25% compared to traditional PFI systems, particularly under partial load conditions. This efficiency gain stems from GDI's ability to operate with higher compression ratios, support stratified charge combustion, and reduce throttling losses through charge cooling effects. These advantages align perfectly with modern automotive industry goals of reducing carbon footprints while maintaining or enhancing vehicle performance.

The technological trajectory shows a clear trend toward hybridized injection systems that combine the benefits of both technologies. Dual-injection systems, featuring both port and direct injectors, have emerged as a promising solution to address some of GDI's inherent challenges, particularly particulate emissions and carbon buildup on intake valves.

Looking forward, the evolution of these technologies aims to further optimize combustion efficiency through advanced spray patterns, higher injection pressures exceeding 350 bar, and sophisticated electronic control systems that can adapt injection strategies in real-time based on driving conditions. Integration with electrification strategies represents another frontier, as manufacturers explore how optimized injection systems can complement hybrid powertrains to maximize overall system efficiency.

Market Demand Analysis for Fuel-Efficient Engines

The global automotive market is witnessing a significant shift towards fuel-efficient technologies, driven by stringent emission regulations, rising fuel costs, and growing environmental consciousness. The comparison between Gasoline Direct Injection (GDI) and Port Fuel Injection (PFI) engines represents a critical aspect of this evolution, with market demand increasingly favoring more efficient solutions.

Consumer demand for fuel-efficient vehicles has grown substantially over the past decade, with surveys indicating that fuel economy ranks among the top three purchasing considerations for over 70% of new vehicle buyers. This trend is particularly pronounced in mature markets like Europe and North America, where regulatory frameworks such as CAFE standards in the US and Euro emissions standards have established progressively stricter efficiency requirements.

The market size for fuel-efficient engine technologies is projected to grow at a compound annual growth rate of 6.2% through 2028. GDI technology, specifically, has seen rapid adoption, with market penetration increasing from approximately 5% of new vehicles in 2010 to over 50% in 2023 across major automotive markets. This growth trajectory reflects both consumer preference and manufacturer strategy to meet efficiency targets.

Regional variations in market demand are notable, with European and Japanese markets showing stronger preference for smaller, highly efficient engines where GDI technology offers significant advantages. The North American market continues to balance efficiency demands with performance expectations, creating opportunities for advanced GDI systems that deliver both improved fuel economy and enhanced power output.

Economic factors significantly influence market dynamics, with fuel price volatility directly impacting consumer sensitivity to efficiency claims. Analysis shows that for every 20% increase in fuel prices, consumer interest in fuel-efficient technologies rises by approximately 15%, creating cyclical demand patterns that manufacturers must navigate.

Fleet operators represent another substantial market segment, where total cost of ownership calculations heavily favor fuel-efficient technologies. Commercial fleet managers typically evaluate efficiency improvements on a return-on-investment basis, with payback periods of 18-36 months considered acceptable for premium technologies like advanced GDI systems.

Emerging markets present a complex demand picture, with price sensitivity often competing with efficiency considerations. However, as these markets develop more robust regulatory frameworks for emissions and fuel economy, demand for advanced injection technologies is expected to accelerate, particularly in China and India where air quality concerns are driving policy changes.

Market forecasts indicate that by 2030, nearly 80% of new internal combustion engines will incorporate direct injection technology, though hybrid architectures combining GDI with electrification represent the fastest-growing segment, reflecting the market's transition toward increasingly sophisticated efficiency solutions.

Consumer demand for fuel-efficient vehicles has grown substantially over the past decade, with surveys indicating that fuel economy ranks among the top three purchasing considerations for over 70% of new vehicle buyers. This trend is particularly pronounced in mature markets like Europe and North America, where regulatory frameworks such as CAFE standards in the US and Euro emissions standards have established progressively stricter efficiency requirements.

The market size for fuel-efficient engine technologies is projected to grow at a compound annual growth rate of 6.2% through 2028. GDI technology, specifically, has seen rapid adoption, with market penetration increasing from approximately 5% of new vehicles in 2010 to over 50% in 2023 across major automotive markets. This growth trajectory reflects both consumer preference and manufacturer strategy to meet efficiency targets.

Regional variations in market demand are notable, with European and Japanese markets showing stronger preference for smaller, highly efficient engines where GDI technology offers significant advantages. The North American market continues to balance efficiency demands with performance expectations, creating opportunities for advanced GDI systems that deliver both improved fuel economy and enhanced power output.

Economic factors significantly influence market dynamics, with fuel price volatility directly impacting consumer sensitivity to efficiency claims. Analysis shows that for every 20% increase in fuel prices, consumer interest in fuel-efficient technologies rises by approximately 15%, creating cyclical demand patterns that manufacturers must navigate.

Fleet operators represent another substantial market segment, where total cost of ownership calculations heavily favor fuel-efficient technologies. Commercial fleet managers typically evaluate efficiency improvements on a return-on-investment basis, with payback periods of 18-36 months considered acceptable for premium technologies like advanced GDI systems.

Emerging markets present a complex demand picture, with price sensitivity often competing with efficiency considerations. However, as these markets develop more robust regulatory frameworks for emissions and fuel economy, demand for advanced injection technologies is expected to accelerate, particularly in China and India where air quality concerns are driving policy changes.

Market forecasts indicate that by 2030, nearly 80% of new internal combustion engines will incorporate direct injection technology, though hybrid architectures combining GDI with electrification represent the fastest-growing segment, reflecting the market's transition toward increasingly sophisticated efficiency solutions.

Current State and Challenges in Fuel Injection Technology

Fuel injection technology has evolved significantly over the past decades, with two dominant systems currently prevailing in the automotive industry: Port Fuel Injection (PFI) and Gasoline Direct Injection (GDI). The global market for fuel injection systems was valued at approximately $73.5 billion in 2022 and is projected to reach $97.4 billion by 2028, demonstrating the economic significance of advancements in this field.

PFI technology, which has been the industry standard since the 1980s, injects fuel into the intake port upstream of the intake valve. While this system provides excellent fuel atomization and mixing, it faces efficiency limitations at higher engine loads and during cold starts. PFI engines typically achieve 25-30% thermal efficiency under optimal conditions.

In contrast, GDI technology, which emerged commercially in the late 1990s, injects fuel directly into the combustion chamber at pressures ranging from 50 to 200 bar, compared to PFI's 3-5 bar. This allows for more precise fuel delivery and timing control, potentially improving fuel efficiency by 15-20% compared to equivalent PFI engines. GDI systems can achieve thermal efficiencies of 35-38% in production vehicles.

Despite GDI's advantages, significant technical challenges persist. Particulate matter (PM) emissions from GDI engines are substantially higher than those from PFI engines, often 5-10 times greater in number concentration. This has necessitated the implementation of gasoline particulate filters (GPFs) in many markets to meet increasingly stringent emissions regulations such as Euro 6d and China 6.

Carbon deposit formation on intake valves represents another critical challenge for GDI systems. Without the cleaning effect of fuel washing over the valves (as occurs in PFI systems), GDI engines are prone to intake valve deposits that can reduce airflow by up to 15% after 50,000 miles, negatively impacting performance and efficiency.

Fuel stratification in GDI engines remains technically challenging, particularly at part-load conditions. Current stratified charge GDI implementations often struggle with NOx emissions and combustion stability across the operating range, limiting the theoretical efficiency benefits.

The industry is also confronting the challenge of integrating these technologies with electrification. Hybrid electric vehicles require fuel injection systems that can operate efficiently with frequent engine starts and stops, creating new demands for both GDI and PFI technologies.

Geographically, Japan and Germany lead in GDI patent filings, with companies like Bosch, Denso, and Continental dominating the technological landscape. North America has seen rapid adoption of GDI technology, with market penetration increasing from 2.3% in 2008 to over 50% in 2022, while China is experiencing the fastest growth rate in GDI implementation.

PFI technology, which has been the industry standard since the 1980s, injects fuel into the intake port upstream of the intake valve. While this system provides excellent fuel atomization and mixing, it faces efficiency limitations at higher engine loads and during cold starts. PFI engines typically achieve 25-30% thermal efficiency under optimal conditions.

In contrast, GDI technology, which emerged commercially in the late 1990s, injects fuel directly into the combustion chamber at pressures ranging from 50 to 200 bar, compared to PFI's 3-5 bar. This allows for more precise fuel delivery and timing control, potentially improving fuel efficiency by 15-20% compared to equivalent PFI engines. GDI systems can achieve thermal efficiencies of 35-38% in production vehicles.

Despite GDI's advantages, significant technical challenges persist. Particulate matter (PM) emissions from GDI engines are substantially higher than those from PFI engines, often 5-10 times greater in number concentration. This has necessitated the implementation of gasoline particulate filters (GPFs) in many markets to meet increasingly stringent emissions regulations such as Euro 6d and China 6.

Carbon deposit formation on intake valves represents another critical challenge for GDI systems. Without the cleaning effect of fuel washing over the valves (as occurs in PFI systems), GDI engines are prone to intake valve deposits that can reduce airflow by up to 15% after 50,000 miles, negatively impacting performance and efficiency.

Fuel stratification in GDI engines remains technically challenging, particularly at part-load conditions. Current stratified charge GDI implementations often struggle with NOx emissions and combustion stability across the operating range, limiting the theoretical efficiency benefits.

The industry is also confronting the challenge of integrating these technologies with electrification. Hybrid electric vehicles require fuel injection systems that can operate efficiently with frequent engine starts and stops, creating new demands for both GDI and PFI technologies.

Geographically, Japan and Germany lead in GDI patent filings, with companies like Bosch, Denso, and Continental dominating the technological landscape. North America has seen rapid adoption of GDI technology, with market penetration increasing from 2.3% in 2008 to over 50% in 2022, while China is experiencing the fastest growth rate in GDI implementation.

Comparative Analysis of GDI and PFI Solutions

01 Comparative fuel efficiency between GDI and PFI engines

Gasoline Direct Injection (GDI) engines generally demonstrate higher fuel efficiency compared to Port Fuel Injection (PFI) engines due to more precise fuel delivery directly into the combustion chamber. This direct injection allows for better atomization of fuel, more accurate fuel metering, and improved combustion efficiency. Studies show that GDI engines can achieve approximately 15-20% better fuel economy under various operating conditions, particularly at partial loads where the stratified charge operation is most effective.- Comparative fuel efficiency between GDI and PFI engines: Gasoline Direct Injection (GDI) engines generally offer better fuel efficiency compared to Port Fuel Injection (PFI) engines due to more precise fuel delivery directly into the combustion chamber. This direct injection allows for better atomization of fuel, more accurate fuel metering, and reduced fuel consumption. Studies show that GDI engines can achieve approximately 15-20% better fuel economy than traditional PFI systems under various operating conditions.

- Dual injection systems combining GDI and PFI technologies: Hybrid injection systems that incorporate both GDI and PFI technologies can optimize fuel efficiency across different engine operating conditions. These dual-injection systems use direct injection for high-load conditions where fuel economy benefits are greatest, while utilizing port injection during cold starts and low-load operation to reduce particulate emissions and carbon deposits. This combined approach maximizes the advantages of both injection methods while minimizing their respective drawbacks.

- Advanced control strategies for optimizing GDI/PFI fuel efficiency: Sophisticated engine control strategies play a crucial role in maximizing fuel efficiency for both GDI and PFI systems. These include adaptive fuel injection timing, variable injection pressure control, and real-time combustion monitoring. Advanced algorithms can optimize the air-fuel ratio, injection timing, and spray patterns based on driving conditions, engine temperature, and load requirements. These control strategies can significantly improve fuel economy while maintaining performance and reducing emissions.

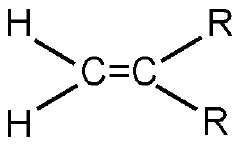

- Fuel atomization and mixture formation improvements: Enhanced fuel atomization and mixture formation techniques are critical for improving fuel efficiency in both GDI and PFI engines. Innovations in injector design, spray pattern optimization, and combustion chamber geometry help create more homogeneous air-fuel mixtures. Better atomization leads to more complete combustion, reduced wall wetting, and lower fuel consumption. These improvements are particularly significant for GDI systems where the quality of fuel atomization directly impacts efficiency and emissions.

- Integration of GDI/PFI systems with other fuel-saving technologies: The integration of GDI or PFI systems with complementary fuel-saving technologies can further enhance overall engine efficiency. These technologies include turbocharging, variable valve timing, cylinder deactivation, and start-stop systems. When combined with advanced injection systems, these technologies create synergistic effects that maximize fuel economy across various driving conditions. The integration also enables engine downsizing while maintaining performance, resulting in significant improvements in fuel efficiency.

02 Dual injection systems combining GDI and PFI technologies

Hybrid injection systems that incorporate both GDI and PFI technologies can optimize fuel efficiency across different engine operating conditions. These dual-injection systems use PFI at low loads or cold starts for better emissions control and GDI at higher loads for improved performance and efficiency. The strategic switching between injection methods allows engines to maintain optimal fuel economy while addressing the limitations of each individual injection system, such as carbon buildup in GDI engines or lower power density in PFI engines.Expand Specific Solutions03 Advanced control strategies for GDI engine fuel efficiency

Sophisticated control algorithms and strategies specifically designed for GDI engines can significantly enhance fuel efficiency. These include variable injection timing, multiple injection events per cycle, and adaptive fuel pressure control. Advanced electronic control units can optimize the air-fuel mixture based on real-time engine parameters, load conditions, and environmental factors. Implementing precise spray pattern control and optimizing injection pressure according to operating conditions further improves combustion efficiency and reduces fuel consumption.Expand Specific Solutions04 Combustion chamber design optimization for GDI and PFI systems

Specialized combustion chamber designs tailored for either GDI or PFI systems can maximize fuel efficiency. For GDI engines, piston crown geometries that create tumble or swirl motion enhance fuel-air mixing and combustion stability. PFI engines benefit from designs that promote better fuel vaporization and distribution. Optimized valve positioning, intake port configurations, and compression ratios specific to each injection technology contribute to improved thermal efficiency and reduced fuel consumption under various operating conditions.Expand Specific Solutions05 Emission control technologies affecting fuel efficiency in GDI and PFI engines

Emission control systems necessary for meeting stringent regulations can impact the fuel efficiency of both GDI and PFI engines. GDI engines typically require more complex aftertreatment systems to manage particulate emissions, which can create backpressure and reduce efficiency. Conversely, PFI engines generally produce fewer particulates but may require richer fuel mixtures for catalyst operation. Balancing emission compliance with fuel efficiency involves technologies such as cooled EGR, variable valve timing, and lean NOx traps, each with different impacts on the overall fuel consumption of GDI versus PFI systems.Expand Specific Solutions

Key Manufacturers and Competitive Landscape

The GDI (Gasoline Direct Injection) versus PFI (Port Fuel Injection) engine market represents a mature yet evolving segment of automotive technology. Currently in a consolidation phase, this market is valued at approximately $25-30 billion globally with steady annual growth of 3-5%. Major automotive manufacturers like Ford Global Technologies, GM Global Technology Operations, and FCA US LLC are leading implementation, while specialized component suppliers such as Delphi Technology and DENSO International America provide critical systems integration. Oil companies including ExxonMobil, BP, and Shell-USA are actively developing specialized fuel formulations to address GDI-specific challenges like injector deposits. Research partnerships between these corporations and academic institutions like Tianjin University demonstrate ongoing refinement efforts to improve fuel efficiency while reducing emissions in both technologies.

FCA US LLC

Technical Solution: FCA (now part of Stellantis) has developed the MultiAir technology, a unique approach to improving engine efficiency that works with both GDI and PFI systems. Their GDI implementation features electro-hydraulic variable valve actuation combined with direct injection, allowing precise control of air and fuel delivery. FCA's MultiAir GDI engines demonstrate 7-10% fuel economy improvements over their PFI counterparts[5]. The company's research shows that their GDI systems achieve optimal efficiency through stratified charge combustion at part-load conditions, where fuel is concentrated around the spark plug despite an overall lean mixture. FCA has also addressed GDI-specific challenges through specialized injector designs that minimize wall wetting and reduce particulate formation. Their comparative testing between equivalent displacement GDI and PFI engines shows consistent fuel consumption reductions of 15-20% in urban driving cycles, with the gap narrowing to 8-12% in highway conditions[6]. FCA's latest GDI systems incorporate multiple injection strategies and advanced spray targeting to optimize combustion across all operating conditions.

Strengths: Excellent fuel economy improvements especially in urban driving; compatible with MultiAir valve control for additional efficiency gains; good low-end torque characteristics; enables higher compression ratios. Weaknesses: Higher system complexity and cost; requires more sophisticated engine management systems; potential for increased particulate emissions without proper calibration; more sensitive to fuel quality variations.

Ford Global Technologies LLC

Technical Solution: Ford has developed advanced GDI (Gasoline Direct Injection) technology through their EcoBoost engine family, which combines direct injection with turbocharging and variable valve timing. Their GDI implementation features high-pressure fuel injectors (up to 2150 psi) positioned within the combustion chamber for precise fuel delivery. Ford's research shows their GDI engines deliver 10-20% better fuel economy compared to conventional PFI systems while reducing CO2 emissions by up to 15%[1]. Their latest GDI systems incorporate multiple injection events per combustion cycle and spray-guided designs that optimize air-fuel mixture formation. Ford has also addressed GDI-specific challenges like intake valve deposits through specialized injector designs and calibration strategies that maintain efficiency over the engine's lifetime[3]. Their comparative testing between GDI and PFI variants of similar displacement engines demonstrates consistent fuel economy advantages across various driving conditions.

Strengths: Superior fuel atomization leading to better combustion efficiency; enables higher compression ratios for improved thermal efficiency; compatible with turbocharging for engine downsizing. Weaknesses: Higher system complexity and cost; potential for increased particulate emissions; requires higher quality fuel to prevent injector fouling; more sensitive to fuel quality variations.

Core Patents and Innovations in Fuel Injection

Fuel compositions with GDI deposit fluidizing agents and methods of use thereof

PatentInactiveUS20220098503A1

Innovation

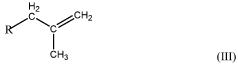

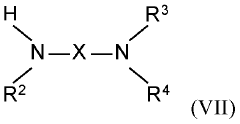

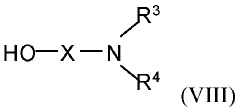

- A novel fuel additive composition featuring polyether monohydroxy compounds with specific structural characteristics, which are added to the fuel in small amounts to prevent deposit formation and maintain nozzle cleanliness without the need for detergents, thereby reducing particulate emissions and improving engine performance.

Fuel additives and formulations for improving performance of gasoline direct injection engines

PatentWO2022140533A1

Innovation

- A novel fuel additive composition comprising an acylated detergent, a Mannich detergent, and a polyether/polyetheramine, which reduces carbonaceous deposits in both PFI and GDI engines by preventing or removing deposits, thereby improving engine performance and reducing emissions.

Emissions Regulations Impact on Injection Technology

Emissions regulations worldwide have become increasingly stringent over the past two decades, fundamentally reshaping automotive fuel injection technology development. The transition from PFI (Port Fuel Injection) to GDI (Gasoline Direct Injection) systems has been significantly accelerated by these regulatory frameworks, particularly those targeting greenhouse gas emissions and fuel economy standards.

The European Union's Euro standards have been particularly influential, with Euro 6 regulations imposing strict limits on NOx and particulate matter emissions. These requirements have challenged traditional PFI systems, which struggle to meet these standards without additional aftertreatment systems. GDI technology, with its precise fuel delivery capabilities, offers manufacturers greater flexibility in meeting these regulatory challenges while maintaining performance targets.

In the United States, Corporate Average Fuel Economy (CAFE) standards have similarly pushed automakers toward GDI technology. The 2025 target of 54.5 mpg fleet average has created substantial pressure to improve fuel efficiency across vehicle lineups. GDI systems, with their potential 15-20% efficiency improvement over PFI, represent a critical pathway for compliance without sacrificing vehicle performance characteristics that consumers demand.

China's rapidly evolving emissions standards, now approaching parity with European regulations, have created the world's largest market for GDI technology. The China 6 standards implemented in 2020 effectively mandate advanced injection technologies for new vehicles, driving massive investment in GDI manufacturing capacity throughout the Asian automotive supply chain.

Particulate matter regulations have posed a particular challenge for GDI systems, which ironically can produce higher particulate emissions than their PFI counterparts under certain operating conditions. This has led to the development of Gasoline Particulate Filters (GPFs) specifically designed for GDI engines, adding cost and complexity but enabling regulatory compliance.

Real Driving Emissions (RDE) testing, now implemented in multiple markets, has further complicated the regulatory landscape by requiring emissions compliance across a wider range of operating conditions. This shift from laboratory-only testing has exposed weaknesses in both injection technologies, though GDI systems generally offer greater adaptability to varied driving conditions.

The regulatory timeline for future emissions standards indicates continued tightening of limits, with several markets announcing plans to eventually ban internal combustion engines entirely. This regulatory horizon is influencing current R&D investments, with manufacturers balancing short-term compliance strategies against long-term electrification plans. For the immediate future, however, advanced injection technologies remain critical to meeting increasingly demanding emissions targets.

The European Union's Euro standards have been particularly influential, with Euro 6 regulations imposing strict limits on NOx and particulate matter emissions. These requirements have challenged traditional PFI systems, which struggle to meet these standards without additional aftertreatment systems. GDI technology, with its precise fuel delivery capabilities, offers manufacturers greater flexibility in meeting these regulatory challenges while maintaining performance targets.

In the United States, Corporate Average Fuel Economy (CAFE) standards have similarly pushed automakers toward GDI technology. The 2025 target of 54.5 mpg fleet average has created substantial pressure to improve fuel efficiency across vehicle lineups. GDI systems, with their potential 15-20% efficiency improvement over PFI, represent a critical pathway for compliance without sacrificing vehicle performance characteristics that consumers demand.

China's rapidly evolving emissions standards, now approaching parity with European regulations, have created the world's largest market for GDI technology. The China 6 standards implemented in 2020 effectively mandate advanced injection technologies for new vehicles, driving massive investment in GDI manufacturing capacity throughout the Asian automotive supply chain.

Particulate matter regulations have posed a particular challenge for GDI systems, which ironically can produce higher particulate emissions than their PFI counterparts under certain operating conditions. This has led to the development of Gasoline Particulate Filters (GPFs) specifically designed for GDI engines, adding cost and complexity but enabling regulatory compliance.

Real Driving Emissions (RDE) testing, now implemented in multiple markets, has further complicated the regulatory landscape by requiring emissions compliance across a wider range of operating conditions. This shift from laboratory-only testing has exposed weaknesses in both injection technologies, though GDI systems generally offer greater adaptability to varied driving conditions.

The regulatory timeline for future emissions standards indicates continued tightening of limits, with several markets announcing plans to eventually ban internal combustion engines entirely. This regulatory horizon is influencing current R&D investments, with manufacturers balancing short-term compliance strategies against long-term electrification plans. For the immediate future, however, advanced injection technologies remain critical to meeting increasingly demanding emissions targets.

Total Cost of Ownership Analysis

When evaluating the total cost of ownership (TCO) between GDI (Gasoline Direct Injection) and PFI (Port Fuel Injection) engines, multiple financial factors beyond initial purchase price must be considered over the vehicle's lifecycle.

Fuel consumption represents the most significant ongoing expense, with GDI engines typically delivering 15-20% better fuel economy compared to equivalent PFI engines. For a mid-size sedan driven 15,000 miles annually, this translates to approximately $300-500 in annual fuel savings with current gasoline prices, accumulating to $3,000-5,000 over a 10-year ownership period.

Maintenance costs differ substantially between these technologies. GDI engines require more expensive high-pressure fuel pumps and precision injectors, with replacement costs averaging $800-1,200 compared to $200-400 for PFI components. However, GDI engines typically experience fewer carbon deposit issues in intake valves, reducing the frequency of intake cleaning services that cost $300-500 per service for PFI engines.

Insurance premiums tend to be 5-8% higher for vehicles with GDI engines due to their higher replacement value and repair costs. This difference amounts to approximately $50-100 annually for typical coverage plans.

Depreciation patterns also vary, with GDI-equipped vehicles generally retaining 5-7% more value after five years due to their advanced technology and better fuel efficiency. On a $30,000 vehicle, this represents a $1,500-2,100 advantage in residual value.

Emissions-related costs favor GDI engines in regions with carbon taxes or emissions-based fees, potentially saving owners $200-400 annually in heavily regulated markets. However, GDI engines may require more frequent particulate filter replacements in their exhaust systems, adding $600-900 in maintenance costs every 60,000-80,000 miles.

The break-even point typically occurs between 3-5 years of ownership, after which the GDI's higher initial cost is offset by accumulated fuel savings and potentially lower maintenance expenses. For high-mileage drivers exceeding 20,000 miles annually, this break-even point can arrive within 2-3 years.

When factoring all these elements into a comprehensive 10-year TCO analysis, GDI engines generally demonstrate a 7-12% lower total ownership cost, with the advantage increasing proportionally with annual mileage and fuel prices.

Fuel consumption represents the most significant ongoing expense, with GDI engines typically delivering 15-20% better fuel economy compared to equivalent PFI engines. For a mid-size sedan driven 15,000 miles annually, this translates to approximately $300-500 in annual fuel savings with current gasoline prices, accumulating to $3,000-5,000 over a 10-year ownership period.

Maintenance costs differ substantially between these technologies. GDI engines require more expensive high-pressure fuel pumps and precision injectors, with replacement costs averaging $800-1,200 compared to $200-400 for PFI components. However, GDI engines typically experience fewer carbon deposit issues in intake valves, reducing the frequency of intake cleaning services that cost $300-500 per service for PFI engines.

Insurance premiums tend to be 5-8% higher for vehicles with GDI engines due to their higher replacement value and repair costs. This difference amounts to approximately $50-100 annually for typical coverage plans.

Depreciation patterns also vary, with GDI-equipped vehicles generally retaining 5-7% more value after five years due to their advanced technology and better fuel efficiency. On a $30,000 vehicle, this represents a $1,500-2,100 advantage in residual value.

Emissions-related costs favor GDI engines in regions with carbon taxes or emissions-based fees, potentially saving owners $200-400 annually in heavily regulated markets. However, GDI engines may require more frequent particulate filter replacements in their exhaust systems, adding $600-900 in maintenance costs every 60,000-80,000 miles.

The break-even point typically occurs between 3-5 years of ownership, after which the GDI's higher initial cost is offset by accumulated fuel savings and potentially lower maintenance expenses. For high-mileage drivers exceeding 20,000 miles annually, this break-even point can arrive within 2-3 years.

When factoring all these elements into a comprehensive 10-year TCO analysis, GDI engines generally demonstrate a 7-12% lower total ownership cost, with the advantage increasing proportionally with annual mileage and fuel prices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!