Gene Therapy Patents: Navigating the Intellectual Property Landscape

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Gene Therapy Evolution and Objectives

Gene therapy has evolved significantly since its conceptual inception in the 1960s, transforming from theoretical possibility to clinical reality. The field's development can be traced through several distinct phases, beginning with early conceptual work by scientists like Edward Tatum and Joshua Lederberg, who first proposed the possibility of treating genetic diseases by introducing functional genes into patients. The 1990s marked the first approved clinical trials, though early setbacks including the tragic death of Jesse Gelsinger in 1999 temporarily slowed progress.

The intellectual property landscape surrounding gene therapy has evolved in parallel with the technology itself. Early patents focused primarily on basic delivery mechanisms and broad methodological approaches. As the field matured, patent applications became increasingly specific, targeting particular disease indications, vector designs, and genetic modification techniques. This evolution reflects the technology's progression from fundamental research to targeted therapeutic applications.

Recent breakthroughs in gene editing technologies, particularly CRISPR-Cas9, have dramatically accelerated development while creating new intellectual property challenges. The patent landscape has become increasingly complex with overlapping claims and cross-licensing agreements becoming commonplace. Major patent disputes, such as the CRISPR patent battle between the Broad Institute and UC Berkeley, highlight the significant commercial stakes involved.

The current objectives in gene therapy patent strategy focus on several key areas. First is establishing robust protection for novel delivery systems, particularly those addressing historical challenges like immunogenicity and tissue specificity. Second is securing intellectual property around disease-specific applications, as regulatory approvals increasingly validate gene therapy approaches for particular conditions. Third is developing patent portfolios that address manufacturing processes, as scalability and cost-effectiveness remain critical barriers to widespread adoption.

Looking forward, gene therapy patent objectives are increasingly focused on combination approaches that integrate multiple technologies. This includes patents covering the integration of gene therapy with other treatment modalities, such as immunotherapy or small molecule drugs. Additionally, there is growing emphasis on securing intellectual property for in vivo gene editing applications, which represent the next frontier in the field.

The global distribution of gene therapy patents reveals interesting geographic trends, with North America and Europe historically dominating the landscape, though China has emerged as a rapidly growing force in recent years. This shifting geographic distribution reflects broader changes in the global biotech innovation ecosystem and has important implications for international intellectual property strategy in this field.

The intellectual property landscape surrounding gene therapy has evolved in parallel with the technology itself. Early patents focused primarily on basic delivery mechanisms and broad methodological approaches. As the field matured, patent applications became increasingly specific, targeting particular disease indications, vector designs, and genetic modification techniques. This evolution reflects the technology's progression from fundamental research to targeted therapeutic applications.

Recent breakthroughs in gene editing technologies, particularly CRISPR-Cas9, have dramatically accelerated development while creating new intellectual property challenges. The patent landscape has become increasingly complex with overlapping claims and cross-licensing agreements becoming commonplace. Major patent disputes, such as the CRISPR patent battle between the Broad Institute and UC Berkeley, highlight the significant commercial stakes involved.

The current objectives in gene therapy patent strategy focus on several key areas. First is establishing robust protection for novel delivery systems, particularly those addressing historical challenges like immunogenicity and tissue specificity. Second is securing intellectual property around disease-specific applications, as regulatory approvals increasingly validate gene therapy approaches for particular conditions. Third is developing patent portfolios that address manufacturing processes, as scalability and cost-effectiveness remain critical barriers to widespread adoption.

Looking forward, gene therapy patent objectives are increasingly focused on combination approaches that integrate multiple technologies. This includes patents covering the integration of gene therapy with other treatment modalities, such as immunotherapy or small molecule drugs. Additionally, there is growing emphasis on securing intellectual property for in vivo gene editing applications, which represent the next frontier in the field.

The global distribution of gene therapy patents reveals interesting geographic trends, with North America and Europe historically dominating the landscape, though China has emerged as a rapidly growing force in recent years. This shifting geographic distribution reflects broader changes in the global biotech innovation ecosystem and has important implications for international intellectual property strategy in this field.

Market Analysis for Gene Therapy Applications

The gene therapy market has experienced exponential growth over the past decade, with a market valuation reaching $7.6 billion in 2022 and projected to exceed $35 billion by 2030. This remarkable expansion is driven by increasing prevalence of genetic disorders, advancements in delivery technologies, and growing investment in research and development activities. North America currently dominates the market with approximately 48% share, followed by Europe at 28% and Asia-Pacific at 18%, with the latter showing the fastest growth rate.

Oncology represents the largest application segment, accounting for roughly 32% of the gene therapy market, followed by rare genetic disorders (27%), cardiovascular diseases (15%), and neurological disorders (12%). The remaining market share is distributed among ophthalmology, infectious diseases, and other therapeutic areas. This distribution reflects both the current technological capabilities and the economic incentives associated with different disease categories.

Viral vector-based gene therapies, particularly those utilizing adeno-associated viruses (AAVs) and lentiviruses, currently dominate the market with over 70% share. However, non-viral delivery methods are gaining traction due to their improved safety profiles and reduced manufacturing complexities. The ex vivo approach remains predominant in commercialized therapies, though in vivo applications are expanding rapidly as delivery technologies advance.

Reimbursement challenges represent a significant market constraint, with single administration therapies commanding prices between $375,000 and $2.1 million per treatment. This has prompted innovative payment models, including outcomes-based agreements and installment plans. Regulatory frameworks continue to evolve, with the FDA and EMA establishing accelerated approval pathways specifically for gene therapies, significantly impacting market entry timelines.

The competitive landscape features both established pharmaceutical companies and specialized biotech firms. Key market players include Novartis, Spark Therapeutics (Roche), bluebird bio, BioMarin, and Sarepta Therapeutics, collectively holding approximately 65% of the current market. Strategic partnerships between technology developers and pharmaceutical companies with established distribution networks have become increasingly common, reshaping traditional market structures.

Patient accessibility remains geographically concentrated, with over 80% of gene therapy recipients located in high-income countries. This disparity highlights significant market expansion opportunities in emerging economies, particularly in regions with high prevalence of genetic disorders. The intellectual property landscape significantly influences market dynamics, with patent thickets around key delivery technologies creating both barriers to entry and opportunities for licensing agreements.

Oncology represents the largest application segment, accounting for roughly 32% of the gene therapy market, followed by rare genetic disorders (27%), cardiovascular diseases (15%), and neurological disorders (12%). The remaining market share is distributed among ophthalmology, infectious diseases, and other therapeutic areas. This distribution reflects both the current technological capabilities and the economic incentives associated with different disease categories.

Viral vector-based gene therapies, particularly those utilizing adeno-associated viruses (AAVs) and lentiviruses, currently dominate the market with over 70% share. However, non-viral delivery methods are gaining traction due to their improved safety profiles and reduced manufacturing complexities. The ex vivo approach remains predominant in commercialized therapies, though in vivo applications are expanding rapidly as delivery technologies advance.

Reimbursement challenges represent a significant market constraint, with single administration therapies commanding prices between $375,000 and $2.1 million per treatment. This has prompted innovative payment models, including outcomes-based agreements and installment plans. Regulatory frameworks continue to evolve, with the FDA and EMA establishing accelerated approval pathways specifically for gene therapies, significantly impacting market entry timelines.

The competitive landscape features both established pharmaceutical companies and specialized biotech firms. Key market players include Novartis, Spark Therapeutics (Roche), bluebird bio, BioMarin, and Sarepta Therapeutics, collectively holding approximately 65% of the current market. Strategic partnerships between technology developers and pharmaceutical companies with established distribution networks have become increasingly common, reshaping traditional market structures.

Patient accessibility remains geographically concentrated, with over 80% of gene therapy recipients located in high-income countries. This disparity highlights significant market expansion opportunities in emerging economies, particularly in regions with high prevalence of genetic disorders. The intellectual property landscape significantly influences market dynamics, with patent thickets around key delivery technologies creating both barriers to entry and opportunities for licensing agreements.

Current IP Landscape and Challenges

The gene therapy patent landscape has evolved dramatically over the past decade, with significant acceleration in patent filings reflecting the field's rapid technological advancement. Currently, over 14,000 patent families related to gene therapy exist globally, with annual filings increasing at approximately 25% year-over-year since 2015. This growth trajectory indicates both the scientific progress and commercial potential driving intellectual property development in this sector.

The United States, China, and Europe dominate the patent landscape, collectively accounting for approximately 75% of all gene therapy patents. The USPTO maintains the largest portfolio, followed closely by China's CNIPA, whose filings have shown the most aggressive growth rate in recent years. Japanese and Korean patent offices have also seen notable increases, particularly in vector technology patents.

Key challenges in the current IP landscape include patent thickets surrounding fundamental delivery technologies, particularly viral vectors. AAV (adeno-associated virus) vectors alone have over 3,000 active patent families, creating significant freedom-to-operate concerns for new market entrants. CRISPR-Cas9 gene editing technologies present another complex IP battleground, with ongoing litigation between the Broad Institute and University of California continuing to create uncertainty for commercial applications.

Patent term limitations pose additional challenges unique to gene therapies. The lengthy development timeline for these treatments—often exceeding 10 years from concept to market—means that significant patent life may be consumed before commercialization. While patent term extensions provide some relief, they rarely compensate fully for the extended development periods required for these complex biologics.

Diagnostic method patents face particular scrutiny following Supreme Court decisions in Mayo and Myriad, creating uncertainty for companion diagnostics essential to personalized gene therapy approaches. This has led to strategic shifts toward claiming specific technical implementations rather than broader diagnostic concepts.

Emerging markets present varying IP protection levels for gene therapies. While China has strengthened its patent system, enforcement remains inconsistent. India's more restrictive patentability criteria for biological materials creates additional complexity for global IP strategies.

Licensing landscapes have become increasingly intricate, with most commercial gene therapy developers requiring multiple licenses from different patent holders. Cross-licensing agreements and patent pools are emerging as potential solutions, though standardization remains limited. Major academic institutions like Stanford, MIT, and the University of Pennsylvania control foundational patents that frequently require licensing for commercial development.

The United States, China, and Europe dominate the patent landscape, collectively accounting for approximately 75% of all gene therapy patents. The USPTO maintains the largest portfolio, followed closely by China's CNIPA, whose filings have shown the most aggressive growth rate in recent years. Japanese and Korean patent offices have also seen notable increases, particularly in vector technology patents.

Key challenges in the current IP landscape include patent thickets surrounding fundamental delivery technologies, particularly viral vectors. AAV (adeno-associated virus) vectors alone have over 3,000 active patent families, creating significant freedom-to-operate concerns for new market entrants. CRISPR-Cas9 gene editing technologies present another complex IP battleground, with ongoing litigation between the Broad Institute and University of California continuing to create uncertainty for commercial applications.

Patent term limitations pose additional challenges unique to gene therapies. The lengthy development timeline for these treatments—often exceeding 10 years from concept to market—means that significant patent life may be consumed before commercialization. While patent term extensions provide some relief, they rarely compensate fully for the extended development periods required for these complex biologics.

Diagnostic method patents face particular scrutiny following Supreme Court decisions in Mayo and Myriad, creating uncertainty for companion diagnostics essential to personalized gene therapy approaches. This has led to strategic shifts toward claiming specific technical implementations rather than broader diagnostic concepts.

Emerging markets present varying IP protection levels for gene therapies. While China has strengthened its patent system, enforcement remains inconsistent. India's more restrictive patentability criteria for biological materials creates additional complexity for global IP strategies.

Licensing landscapes have become increasingly intricate, with most commercial gene therapy developers requiring multiple licenses from different patent holders. Cross-licensing agreements and patent pools are emerging as potential solutions, though standardization remains limited. Major academic institutions like Stanford, MIT, and the University of Pennsylvania control foundational patents that frequently require licensing for commercial development.

Dominant Patent Strategies

01 Patent protection strategies for gene therapy innovations

Various strategies exist for protecting intellectual property in gene therapy, including filing patents that cover the therapeutic genes, delivery vectors, and treatment methods. Companies must develop comprehensive IP strategies that consider the unique challenges of gene therapy, such as demonstrating novelty and non-obviousness for naturally occurring genetic sequences. Effective protection often involves multiple patent applications covering different aspects of the technology to create a robust patent portfolio.- Patent valuation and monetization strategies for gene therapy innovations: Gene therapy patents represent valuable intellectual property assets that can be monetized through various strategies. These include licensing agreements, patent sales, and establishing royalty structures. Effective valuation methods consider market potential, development stage, and therapeutic applications. Companies can leverage these assets to secure funding, form strategic partnerships, and create revenue streams while advancing medical innovation.

- Patent portfolio management for gene therapy technologies: Managing gene therapy patent portfolios requires specialized approaches to maximize protection and commercial value. This includes strategic filing across multiple jurisdictions, maintaining comprehensive documentation of innovations, and implementing robust monitoring systems. Effective portfolio management involves regular audits, gap analysis, and alignment with business objectives to ensure comprehensive coverage of core technologies and potential applications in the rapidly evolving gene therapy field.

- Intellectual property protection strategies for gene therapy methods and vectors: Protecting gene therapy innovations requires multi-layered IP strategies addressing delivery vectors, therapeutic genes, and treatment methods. Comprehensive protection includes patents on viral and non-viral vectors, gene editing technologies, specific genetic constructs, and therapeutic applications. Strategic approaches may involve method-of-treatment claims, composition-of-matter patents, and protection for manufacturing processes to create robust barriers against competitors while ensuring freedom to operate in this complex technological space.

- Patent licensing and collaboration frameworks for gene therapy development: Gene therapy development often requires complex licensing and collaboration agreements to access necessary technologies and expertise. These frameworks typically include provisions for milestone payments, royalty structures, field-of-use limitations, and technology transfer protocols. Successful collaborations balance risk allocation, define development responsibilities, and establish clear commercialization rights while addressing regulatory compliance and liability concerns specific to gene therapy applications.

- Patent analytics and competitive intelligence in gene therapy innovation: Patent analytics provide critical insights into the gene therapy competitive landscape, helping companies identify technology trends, potential partners, and freedom-to-operate issues. Advanced analytics tools can map patent clusters, identify white space opportunities, and track competitor activities. These intelligence systems support strategic decision-making by revealing emerging technologies, potential infringement risks, and opportunities for cross-licensing or acquisition in the rapidly evolving gene therapy sector.

02 Licensing and commercialization of gene therapy patents

Gene therapy patents can be monetized through various licensing models and commercialization strategies. This includes exclusive and non-exclusive licensing agreements, cross-licensing arrangements, and strategic partnerships between research institutions and pharmaceutical companies. The high development costs and specialized expertise required for gene therapies make effective licensing crucial for bringing these innovations to market, with carefully structured royalty arrangements and milestone payments.Expand Specific Solutions03 Patent valuation methods for gene therapy technologies

Specialized valuation methodologies are needed for gene therapy patents due to their unique characteristics and market potential. These methods consider factors such as therapeutic efficacy, addressable patient population, regulatory pathway complexity, and manufacturing challenges. Valuation approaches include income-based methods that project future revenue streams, market-based comparisons with similar technologies, and cost-based approaches that consider R&D investments. The high-risk, high-reward nature of gene therapies requires sophisticated valuation models.Expand Specific Solutions04 Patent landscape analysis and competitive intelligence in gene therapy

Patent landscape analysis provides critical competitive intelligence in the rapidly evolving gene therapy field. This involves systematic review and mapping of patent activities to identify technology trends, white space opportunities, and potential freedom-to-operate issues. Companies use sophisticated patent analytics tools to monitor competitor activities, identify potential collaboration partners, and guide R&D investments. These analyses help organizations navigate the complex intellectual property environment surrounding gene therapy technologies.Expand Specific Solutions05 Regulatory and ethical considerations in gene therapy patenting

Gene therapy patents face unique regulatory and ethical challenges that impact intellectual property strategies. These include considerations around patenting human genetic material, ensuring equitable access to life-saving therapies, and navigating different international patent standards for biotechnology. Patent applicants must address ethical concerns while securing adequate protection for their innovations. The evolving regulatory landscape for gene therapies requires continuous monitoring to ensure patent strategies remain compliant and effective across different jurisdictions.Expand Specific Solutions

Key Patent Holders and Competitors

The gene therapy patent landscape is currently in a growth phase, with a market size expanding rapidly due to increasing clinical applications and investment. The technology is maturing but still evolving, with key players demonstrating varying levels of IP sophistication. Academic institutions like University of California, Duke University, and Johns Hopkins University hold foundational patents, while pharmaceutical companies such as Novartis, Merck, and Sangamo Therapeutics are developing commercial applications. Specialized biotech firms including Encoded Therapeutics, Ionis Pharmaceuticals, and Cellectis are advancing novel delivery technologies and CRISPR applications. The competitive landscape is characterized by strategic partnerships between academia and industry, with increasing patent activity around delivery systems, manufacturing processes, and specific therapeutic applications.

The Regents of the University of California

Technical Solution: The University of California has established itself as a pioneering institution in gene therapy intellectual property, particularly through its groundbreaking CRISPR-Cas9 gene editing technology. UC Berkeley, specifically the Doudna lab, holds fundamental patents covering CRISPR-Cas9 systems for gene editing in various cell types[1]. Their patent portfolio includes claims on the basic components of CRISPR systems, including guide RNAs and Cas9 proteins engineered for improved specificity and reduced off-target effects. The university has been involved in high-profile patent disputes with the Broad Institute regarding CRISPR applications in eukaryotic cells, with outcomes varying across different global jurisdictions[2]. Beyond CRISPR, UC researchers have developed and patented novel viral vector systems for gene delivery, including engineered AAV variants with tissue-specific tropism and reduced immunogenicity. The university has established a sophisticated technology transfer approach, creating a network of licensing agreements with biotechnology companies while retaining rights for academic research[3]. Their patent strategy includes both broad platform patents and specific therapeutic applications across multiple disease areas, including rare genetic disorders, cancer, and infectious diseases. UC has also developed patent portfolios around complementary technologies such as non-viral delivery systems and methods for assessing gene therapy efficacy and safety.

Strengths: UC holds foundational intellectual property in CRISPR gene editing that forms the basis for numerous commercial applications, providing significant licensing revenue potential. Their academic research environment continues to generate innovations that expand and strengthen their patent portfolio. Weaknesses: The ongoing patent disputes with other institutions create uncertainty for licensees and may limit the university's ability to fully capitalize on their innovations. As a public institution, UC may face challenges in aggressively defending their patent position compared to commercial entities with greater financial resources.

Sangamo Therapeutics, Inc.

Technical Solution: Sangamo Therapeutics has developed a proprietary zinc finger nuclease (ZFN) technology platform for gene therapy applications. Their approach focuses on precise genome editing using engineered zinc finger DNA-binding proteins fused to nuclease domains that can target specific DNA sequences[1]. This technology enables targeted gene modification, gene disruption, or gene addition at predetermined locations in the genome. Sangamo has built a substantial patent portfolio around their ZFN technology, with patents covering the design, optimization, and delivery methods of zinc finger proteins for therapeutic applications[2]. The company has strategically expanded their intellectual property through both internal development and licensing agreements with academic institutions. Their patent strategy includes composition of matter patents for their engineered zinc finger proteins as well as method patents covering therapeutic applications in various disease areas including hemophilia, lysosomal storage disorders, and immunological conditions[3].

Strengths: Sangamo's ZFN technology offers highly specific genome editing with reduced off-target effects compared to some other gene editing platforms. Their extensive patent portfolio provides strong market protection and potential licensing revenue. Weaknesses: The complexity of their zinc finger design may increase manufacturing costs and development timelines compared to newer gene editing technologies like CRISPR, potentially limiting scalability for certain applications.

Critical Patent Analysis

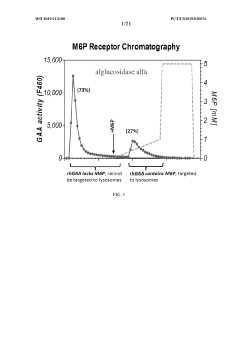

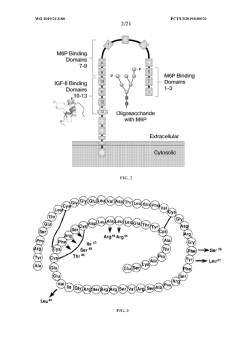

Gene therapy constructs and methods of use

PatentWO2019213180A1

Innovation

- Development of gene therapy vectors comprising nucleic acid constructs with specific sequences, including translation initiation sequences like the Kozak sequence, signal peptides like BiP or Gaussia signal peptides, and internal ribosomal entry sequences, to enhance protein expression, secretion, and cellular uptake, specifically targeting therapeutic proteins to lysosomes for genetic disorders.

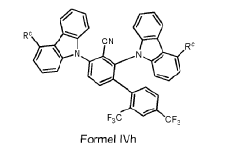

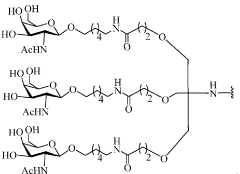

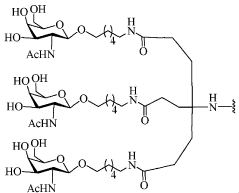

Gene therapy and targeted delivery of conjugated compounds

PatentWO2018057837A1

Innovation

- The use of gene therapy vectors to ectopically express cell surface receptors in non-native cells, combined with conjugated oligonucleotides that bind specifically to these receptors, enables targeted delivery and modulation of gene expression.

Regulatory Framework for Gene Therapy Patents

The regulatory landscape for gene therapy patents represents a complex intersection of intellectual property law, healthcare regulations, and ethical considerations. In the United States, the FDA has established a comprehensive framework through the Center for Biologics Evaluation and Research (CBER), which oversees the approval process for gene therapy products. This regulatory pathway typically involves multiple phases of clinical trials, with stringent requirements for safety and efficacy documentation before market authorization.

The European Medicines Agency (EMA) has developed parallel but distinct regulatory mechanisms, including the Advanced Therapy Medicinal Products (ATMP) classification specifically designed for gene therapies. This framework provides accelerated assessment procedures for innovative treatments while maintaining rigorous safety standards. Both the FDA and EMA have implemented expedited review programs for gene therapies targeting rare diseases or conditions with limited treatment options.

Patent offices worldwide have adapted their examination procedures to address the unique challenges posed by gene therapy innovations. The USPTO has issued specific examination guidelines for biotechnology patents, clarifying the patentability criteria for genetic modifications and therapeutic applications. Similarly, the European Patent Office has refined its approach to assessing inventive step and industrial applicability for gene therapy inventions.

International harmonization efforts, including the TRIPS Agreement and various bilateral treaties, have attempted to standardize patent protection for gene therapies across jurisdictions. However, significant variations persist in how different countries interpret patentability requirements for genetic materials and therapeutic methods. These disparities create strategic challenges for companies seeking global protection for their gene therapy innovations.

Regulatory agencies have also established specialized pathways for orphan drug designation, providing extended market exclusivity and financial incentives for gene therapies targeting rare diseases. These provisions complement patent protection by offering additional forms of market exclusivity, particularly valuable for therapies with smaller patient populations.

Recent regulatory developments have focused on addressing emerging challenges in gene therapy, including the regulation of CRISPR-based therapies and other advanced gene editing technologies. Regulatory frameworks continue to evolve in response to scientific advancements, with increasing attention to long-term safety monitoring and post-market surveillance requirements for gene therapy products.

The intersection of patent law and regulatory approval creates unique strategic considerations for gene therapy developers, who must navigate both systems simultaneously to maximize commercial protection while meeting safety and efficacy standards. This dual-track approach requires careful coordination of patent filing strategies with clinical development timelines and regulatory submission plans.

The European Medicines Agency (EMA) has developed parallel but distinct regulatory mechanisms, including the Advanced Therapy Medicinal Products (ATMP) classification specifically designed for gene therapies. This framework provides accelerated assessment procedures for innovative treatments while maintaining rigorous safety standards. Both the FDA and EMA have implemented expedited review programs for gene therapies targeting rare diseases or conditions with limited treatment options.

Patent offices worldwide have adapted their examination procedures to address the unique challenges posed by gene therapy innovations. The USPTO has issued specific examination guidelines for biotechnology patents, clarifying the patentability criteria for genetic modifications and therapeutic applications. Similarly, the European Patent Office has refined its approach to assessing inventive step and industrial applicability for gene therapy inventions.

International harmonization efforts, including the TRIPS Agreement and various bilateral treaties, have attempted to standardize patent protection for gene therapies across jurisdictions. However, significant variations persist in how different countries interpret patentability requirements for genetic materials and therapeutic methods. These disparities create strategic challenges for companies seeking global protection for their gene therapy innovations.

Regulatory agencies have also established specialized pathways for orphan drug designation, providing extended market exclusivity and financial incentives for gene therapies targeting rare diseases. These provisions complement patent protection by offering additional forms of market exclusivity, particularly valuable for therapies with smaller patient populations.

Recent regulatory developments have focused on addressing emerging challenges in gene therapy, including the regulation of CRISPR-based therapies and other advanced gene editing technologies. Regulatory frameworks continue to evolve in response to scientific advancements, with increasing attention to long-term safety monitoring and post-market surveillance requirements for gene therapy products.

The intersection of patent law and regulatory approval creates unique strategic considerations for gene therapy developers, who must navigate both systems simultaneously to maximize commercial protection while meeting safety and efficacy standards. This dual-track approach requires careful coordination of patent filing strategies with clinical development timelines and regulatory submission plans.

Freedom to Operate Considerations

Freedom to Operate (FTO) analysis is a critical component for any organization venturing into gene therapy development. This process involves comprehensive examination of existing patents to determine whether a proposed product or process might infringe on valid intellectual property rights held by others. For gene therapies, this landscape is particularly complex due to the layered nature of the technology, involving delivery vectors, genetic constructs, therapeutic targets, and manufacturing processes.

Organizations must conduct thorough patent searches across multiple jurisdictions, as patent protection varies geographically. The analysis should include not only directly competitive technologies but also foundational platform patents that may cover broad aspects of gene therapy approaches. Key considerations include identifying unexpired patents, understanding their claim scope, and evaluating their validity and enforceability.

Patent thickets present a significant challenge in gene therapy, where multiple overlapping patents may cover different aspects of a single therapeutic product. This complexity often necessitates licensing agreements with multiple patent holders. Organizations should develop strategic approaches to navigate these thickets, including cross-licensing arrangements, patent pools, or research exemptions where applicable.

Risk assessment forms an essential part of FTO considerations. Companies must evaluate the likelihood of infringement claims, potential damages, and the possibility of injunctive relief that could halt product development or commercialization. This assessment should inform strategic decisions about whether to proceed with development, modify the approach to avoid infringement, or seek licenses from patent holders.

Proactive strategies can significantly enhance freedom to operate. These include monitoring newly published patent applications in the field, maintaining robust internal documentation of independent development, and considering pre-emptive challenges to questionable patents through mechanisms such as inter partes review or opposition proceedings.

For academic institutions and smaller biotech companies with limited resources, careful consideration of patent landscapes early in the research process can prevent costly redirections later. Collaborative approaches, including public-private partnerships and open innovation initiatives, may provide alternative pathways to navigate complex patent landscapes while advancing gene therapy development.

The dynamic nature of gene therapy patent landscapes requires continuous monitoring and reassessment of FTO positions throughout the product development lifecycle. As patents expire, new ones emerge, and legal precedents evolve, organizations must maintain vigilance to ensure their freedom to operate remains secure in this rapidly advancing field.

Organizations must conduct thorough patent searches across multiple jurisdictions, as patent protection varies geographically. The analysis should include not only directly competitive technologies but also foundational platform patents that may cover broad aspects of gene therapy approaches. Key considerations include identifying unexpired patents, understanding their claim scope, and evaluating their validity and enforceability.

Patent thickets present a significant challenge in gene therapy, where multiple overlapping patents may cover different aspects of a single therapeutic product. This complexity often necessitates licensing agreements with multiple patent holders. Organizations should develop strategic approaches to navigate these thickets, including cross-licensing arrangements, patent pools, or research exemptions where applicable.

Risk assessment forms an essential part of FTO considerations. Companies must evaluate the likelihood of infringement claims, potential damages, and the possibility of injunctive relief that could halt product development or commercialization. This assessment should inform strategic decisions about whether to proceed with development, modify the approach to avoid infringement, or seek licenses from patent holders.

Proactive strategies can significantly enhance freedom to operate. These include monitoring newly published patent applications in the field, maintaining robust internal documentation of independent development, and considering pre-emptive challenges to questionable patents through mechanisms such as inter partes review or opposition proceedings.

For academic institutions and smaller biotech companies with limited resources, careful consideration of patent landscapes early in the research process can prevent costly redirections later. Collaborative approaches, including public-private partnerships and open innovation initiatives, may provide alternative pathways to navigate complex patent landscapes while advancing gene therapy development.

The dynamic nature of gene therapy patent landscapes requires continuous monitoring and reassessment of FTO positions throughout the product development lifecycle. As patents expire, new ones emerge, and legal precedents evolve, organizations must maintain vigilance to ensure their freedom to operate remains secure in this rapidly advancing field.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!