HBM4 Interposer Materials: Reliability Of Silicon, Glass And Organic

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HBM4 Interposer Materials Background and Objectives

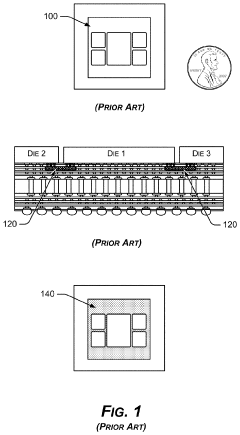

High Bandwidth Memory (HBM) technology has evolved significantly since its introduction, with each generation pushing the boundaries of memory bandwidth, capacity, and power efficiency. The upcoming HBM4 represents the next frontier in this evolution, promising substantial improvements over its predecessors. Interposers, which serve as the critical interconnect substrate between HBM memory stacks and processing units, have become a focal point for technological advancement in this domain.

The development of interposer materials has progressed through several key phases. Initially, silicon interposers dominated the landscape due to their compatibility with existing semiconductor manufacturing processes. As demands for higher performance and lower costs increased, alternative materials such as glass and organic substrates emerged as potential candidates, each offering distinct advantages and challenges in terms of electrical performance, thermal management, and manufacturing scalability.

Current market trends indicate a growing demand for more efficient memory solutions in data-intensive applications such as artificial intelligence, high-performance computing, and graphics processing. This demand is driving the need for interposer materials that can support higher bandwidth, improved signal integrity, and enhanced reliability while maintaining cost-effectiveness and manufacturing feasibility.

The reliability of interposer materials represents a critical factor in the overall performance and longevity of HBM4 implementations. Silicon interposers have established a track record for reliability but face challenges related to cost and manufacturing complexity. Glass interposers offer promising electrical characteristics but present unique reliability concerns regarding mechanical strength and thermal cycling resistance. Organic interposers potentially provide cost advantages but must overcome significant hurdles in terms of dimensional stability and fine-line routing capabilities.

The primary objective of this technical research is to comprehensively evaluate the reliability aspects of silicon, glass, and organic materials as interposer solutions for HBM4 technology. This evaluation encompasses thermal cycling resilience, mechanical stability under various stress conditions, signal integrity at higher frequencies, and long-term performance degradation factors.

Additionally, this research aims to identify potential technological breakthroughs that could address current limitations in each material platform, as well as to forecast the likely evolution paths for interposer technology in the context of future memory requirements. By understanding the strengths and weaknesses of each material option, we can better position our development strategies to align with industry trends and customer needs in the rapidly evolving high-performance computing landscape.

The development of interposer materials has progressed through several key phases. Initially, silicon interposers dominated the landscape due to their compatibility with existing semiconductor manufacturing processes. As demands for higher performance and lower costs increased, alternative materials such as glass and organic substrates emerged as potential candidates, each offering distinct advantages and challenges in terms of electrical performance, thermal management, and manufacturing scalability.

Current market trends indicate a growing demand for more efficient memory solutions in data-intensive applications such as artificial intelligence, high-performance computing, and graphics processing. This demand is driving the need for interposer materials that can support higher bandwidth, improved signal integrity, and enhanced reliability while maintaining cost-effectiveness and manufacturing feasibility.

The reliability of interposer materials represents a critical factor in the overall performance and longevity of HBM4 implementations. Silicon interposers have established a track record for reliability but face challenges related to cost and manufacturing complexity. Glass interposers offer promising electrical characteristics but present unique reliability concerns regarding mechanical strength and thermal cycling resistance. Organic interposers potentially provide cost advantages but must overcome significant hurdles in terms of dimensional stability and fine-line routing capabilities.

The primary objective of this technical research is to comprehensively evaluate the reliability aspects of silicon, glass, and organic materials as interposer solutions for HBM4 technology. This evaluation encompasses thermal cycling resilience, mechanical stability under various stress conditions, signal integrity at higher frequencies, and long-term performance degradation factors.

Additionally, this research aims to identify potential technological breakthroughs that could address current limitations in each material platform, as well as to forecast the likely evolution paths for interposer technology in the context of future memory requirements. By understanding the strengths and weaknesses of each material option, we can better position our development strategies to align with industry trends and customer needs in the rapidly evolving high-performance computing landscape.

Market Demand Analysis for Advanced Packaging Solutions

The advanced packaging market is experiencing unprecedented growth driven by the increasing demand for high-performance computing, artificial intelligence, and data-intensive applications. High Bandwidth Memory (HBM) technology, particularly the upcoming HBM4 standard, represents a critical component in this ecosystem. The global advanced packaging market is projected to reach $42 billion by 2025, with a compound annual growth rate of 8.2% from 2020.

HBM4 interposer materials stand at the intersection of several market demands. Data centers and cloud service providers are seeking solutions that can handle exponentially growing computational requirements while maintaining energy efficiency. This segment alone is expected to consume over 30% of advanced packaging solutions by 2024, with particular emphasis on high-reliability interposers.

The automotive and industrial sectors are emerging as significant consumers of advanced packaging technologies, driven by autonomous driving systems and Industry 4.0 implementations. These applications demand packaging solutions with enhanced thermal management and reliability under harsh operating conditions, creating a premium market segment for high-performance interposers.

Consumer electronics continues to be a major driver, with smartphone manufacturers increasingly adopting advanced packaging to enable greater functionality in limited form factors. The mobile market's demand for thinner, more power-efficient devices is pushing innovation in organic interposer materials that can reduce overall package thickness while maintaining performance.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub for advanced packaging, accounting for approximately 65% of global production capacity. However, recent geopolitical tensions and supply chain vulnerabilities have accelerated investments in North America and Europe, with government initiatives supporting domestic semiconductor packaging capabilities.

The reliability requirements across these market segments vary significantly. Enterprise and data center applications prioritize long-term reliability under continuous operation, making silicon interposers attractive despite higher costs. Consumer electronics emphasize cost-effectiveness and form factor, creating opportunities for organic interposers. Automotive and aerospace applications demand extreme reliability under variable temperature conditions, potentially favoring glass interposers for their thermal stability characteristics.

Market research indicates a growing preference for heterogeneous integration solutions that can accommodate diverse chiplets from multiple vendors. This trend is creating demand for interposer materials that can support standardized interfaces while providing the necessary electrical, thermal, and mechanical performance characteristics for next-generation computing architectures.

HBM4 interposer materials stand at the intersection of several market demands. Data centers and cloud service providers are seeking solutions that can handle exponentially growing computational requirements while maintaining energy efficiency. This segment alone is expected to consume over 30% of advanced packaging solutions by 2024, with particular emphasis on high-reliability interposers.

The automotive and industrial sectors are emerging as significant consumers of advanced packaging technologies, driven by autonomous driving systems and Industry 4.0 implementations. These applications demand packaging solutions with enhanced thermal management and reliability under harsh operating conditions, creating a premium market segment for high-performance interposers.

Consumer electronics continues to be a major driver, with smartphone manufacturers increasingly adopting advanced packaging to enable greater functionality in limited form factors. The mobile market's demand for thinner, more power-efficient devices is pushing innovation in organic interposer materials that can reduce overall package thickness while maintaining performance.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub for advanced packaging, accounting for approximately 65% of global production capacity. However, recent geopolitical tensions and supply chain vulnerabilities have accelerated investments in North America and Europe, with government initiatives supporting domestic semiconductor packaging capabilities.

The reliability requirements across these market segments vary significantly. Enterprise and data center applications prioritize long-term reliability under continuous operation, making silicon interposers attractive despite higher costs. Consumer electronics emphasize cost-effectiveness and form factor, creating opportunities for organic interposers. Automotive and aerospace applications demand extreme reliability under variable temperature conditions, potentially favoring glass interposers for their thermal stability characteristics.

Market research indicates a growing preference for heterogeneous integration solutions that can accommodate diverse chiplets from multiple vendors. This trend is creating demand for interposer materials that can support standardized interfaces while providing the necessary electrical, thermal, and mechanical performance characteristics for next-generation computing architectures.

Current State and Challenges of Interposer Materials

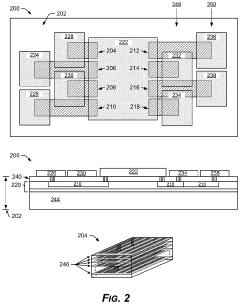

The interposer technology landscape is currently dominated by three primary material platforms: silicon, glass, and organic substrates. Silicon interposers represent the most mature technology with widespread commercial adoption in high-performance computing applications. Companies like TSMC, Samsung, and Intel have established manufacturing capabilities for silicon interposers with through-silicon vias (TSVs), achieving line widths down to 0.5μm and enabling high-density interconnects. However, silicon interposers face significant challenges including high manufacturing costs, wafer size limitations, and thermal expansion coefficient mismatches with organic substrates.

Glass interposers have emerged as a promising alternative, offering superior electrical properties with lower dielectric constants and loss tangents compared to silicon. Recent advancements by companies like Corning and AGC have demonstrated through-glass via (TGV) technologies with diameters as small as 30μm. Glass provides excellent dimensional stability and can be manufactured in panel formats, potentially reducing costs. Nevertheless, glass interposers still face challenges in via formation processes, handling fragility, and establishing robust manufacturing infrastructure.

Organic interposers represent the most cost-effective solution but struggle with achieving the fine line/space requirements necessary for advanced HBM4 applications. Current state-of-the-art organic interposers can achieve approximately 2μm line/space, which falls short of the sub-micron requirements projected for HBM4. Companies like Unimicron and Ibiden continue to push the boundaries of organic interposer technology, but fundamental material limitations remain a significant hurdle.

A critical challenge across all interposer materials is reliability under the increasingly demanding thermal and mechanical stresses of next-generation HBM4 applications. With higher bandwidth requirements driving increased power density, thermal management has become a paramount concern. Silicon interposers exhibit excellent thermal conductivity (150 W/mK) but suffer from brittleness and cracking under thermal cycling. Glass interposers demonstrate superior mechanical stability but have lower thermal conductivity (1-2 W/mK), creating potential hotspots. Organic interposers offer better coefficient of thermal expansion (CTE) matching with substrates but have the poorest thermal performance.

Another significant challenge is the development of cost-effective manufacturing processes that can scale to high-volume production. Silicon interposers remain prohibitively expensive for many applications, while glass and organic alternatives still require substantial process optimization to achieve the necessary performance metrics. The industry is actively exploring hybrid approaches that combine the advantages of different materials, such as silicon bridges embedded in organic substrates or glass cores with organic buildup layers.

Standardization efforts across the industry remain fragmented, with different manufacturers pursuing proprietary solutions. This lack of standardization creates challenges for the broader ecosystem, including testing methodologies, reliability qualification, and supply chain development.

Glass interposers have emerged as a promising alternative, offering superior electrical properties with lower dielectric constants and loss tangents compared to silicon. Recent advancements by companies like Corning and AGC have demonstrated through-glass via (TGV) technologies with diameters as small as 30μm. Glass provides excellent dimensional stability and can be manufactured in panel formats, potentially reducing costs. Nevertheless, glass interposers still face challenges in via formation processes, handling fragility, and establishing robust manufacturing infrastructure.

Organic interposers represent the most cost-effective solution but struggle with achieving the fine line/space requirements necessary for advanced HBM4 applications. Current state-of-the-art organic interposers can achieve approximately 2μm line/space, which falls short of the sub-micron requirements projected for HBM4. Companies like Unimicron and Ibiden continue to push the boundaries of organic interposer technology, but fundamental material limitations remain a significant hurdle.

A critical challenge across all interposer materials is reliability under the increasingly demanding thermal and mechanical stresses of next-generation HBM4 applications. With higher bandwidth requirements driving increased power density, thermal management has become a paramount concern. Silicon interposers exhibit excellent thermal conductivity (150 W/mK) but suffer from brittleness and cracking under thermal cycling. Glass interposers demonstrate superior mechanical stability but have lower thermal conductivity (1-2 W/mK), creating potential hotspots. Organic interposers offer better coefficient of thermal expansion (CTE) matching with substrates but have the poorest thermal performance.

Another significant challenge is the development of cost-effective manufacturing processes that can scale to high-volume production. Silicon interposers remain prohibitively expensive for many applications, while glass and organic alternatives still require substantial process optimization to achieve the necessary performance metrics. The industry is actively exploring hybrid approaches that combine the advantages of different materials, such as silicon bridges embedded in organic substrates or glass cores with organic buildup layers.

Standardization efforts across the industry remain fragmented, with different manufacturers pursuing proprietary solutions. This lack of standardization creates challenges for the broader ecosystem, including testing methodologies, reliability qualification, and supply chain development.

Comparative Analysis of Silicon, Glass and Organic Interposers

01 Silicon interposer reliability for HBM4 applications

Silicon interposers provide excellent thermal expansion matching with silicon dies, making them reliable for high-bandwidth memory applications. Their high thermal conductivity helps dissipate heat efficiently, which is crucial for HBM4 performance. Silicon interposers also offer fine-pitch through-silicon vias (TSVs) that enable high-density interconnections between the memory stack and processor. The rigid structure of silicon provides mechanical stability during thermal cycling, enhancing overall reliability of the HBM4 package.- Silicon interposer reliability for HBM4 applications: Silicon interposers provide excellent thermal expansion matching with silicon dies, making them highly reliable for HBM4 applications. These interposers offer superior electrical performance with fine-pitch interconnects and can withstand thermal cycling stress. The manufacturing process for silicon interposers involves through-silicon vias (TSVs) that enable high-density vertical connections between stacked dies, enhancing overall package reliability while maintaining signal integrity for high-bandwidth memory applications.

- Glass interposer technology for HBM4 integration: Glass interposers offer advantages for HBM4 applications including lower cost than silicon alternatives, excellent electrical insulation properties, and customizable coefficient of thermal expansion. These interposers provide good dimensional stability and can be manufactured with through-glass vias (TGVs) to create high-density interconnects. The reliability of glass interposers is enhanced by their resistance to warpage and ability to maintain structural integrity during thermal cycling, making them suitable for high-performance computing applications requiring HBM4 memory.

- Organic interposer materials and reliability considerations: Organic interposers provide a cost-effective alternative for HBM4 integration with benefits including lower manufacturing costs and established assembly processes. These interposers typically use build-up layers with microvias to create interconnections. However, they face reliability challenges including higher coefficient of thermal expansion mismatch with silicon dies, potential warpage during thermal cycling, and moisture absorption concerns. Advanced organic materials with fillers and specialized designs are being developed to improve thermal performance and reliability for high-bandwidth memory applications.

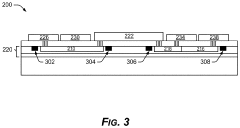

- Thermal management and reliability testing for HBM4 interposers: Thermal management is critical for HBM4 interposer reliability due to the high power density of stacked memory configurations. Various techniques are employed including integrated thermal interface materials, embedded cooling channels, and advanced heat spreaders. Reliability testing methodologies for interposers include thermal cycling tests, power cycling, humidity tests, and mechanical stress evaluations. These tests assess the durability of interposer materials and interconnects under various operating conditions to ensure long-term reliability in high-performance computing applications.

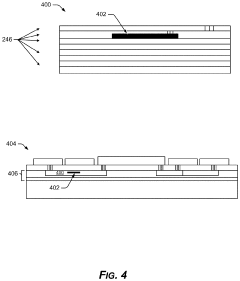

- Advanced interconnect technologies for HBM4 interposer reliability: Advanced interconnect technologies are essential for ensuring HBM4 interposer reliability. These include micro-bump structures with optimized solder compositions, copper pillar interconnects with enhanced mechanical strength, and hybrid bonding techniques for ultra-fine pitch connections. Redistribution layers (RDLs) with specialized dielectric materials help manage stress during thermal cycling. Novel underfill materials with tailored coefficient of thermal expansion and enhanced adhesion properties are being developed to improve the reliability of interposer-based packages, particularly for high-bandwidth memory applications requiring thousands of interconnections.

02 Glass interposer technology for HBM4 integration

Glass interposers offer advantages for HBM4 applications including superior electrical insulation properties and lower signal loss compared to silicon alternatives. The coefficient of thermal expansion of glass can be tailored to match both silicon dies and organic substrates, reducing stress at interfaces during thermal cycling. Glass interposers support through-glass vias (TGVs) that can be fabricated with higher aspect ratios than silicon, enabling thinner package profiles. Additionally, glass provides better RF performance with lower insertion loss, which is beneficial for high-speed data transmission in HBM4 applications.Expand Specific Solutions03 Organic interposer materials and reliability considerations

Organic interposers offer cost advantages and manufacturing flexibility for HBM4 applications. These materials can be processed using conventional PCB manufacturing techniques, reducing production costs compared to silicon or glass alternatives. However, organic interposers face reliability challenges including higher coefficient of thermal expansion mismatch with silicon dies, which can lead to stress-induced failures during thermal cycling. Advanced organic materials with embedded capacitors and resistors can improve electrical performance while maintaining the cost benefits. Reliability enhancement techniques include using specialized build-up layers and reinforcement materials to improve mechanical stability.Expand Specific Solutions04 Thermal management and reliability testing for HBM4 interposers

Thermal management is critical for HBM4 interposer reliability due to the high power density of stacked memory configurations. Various cooling solutions including integrated microfluidic channels, thermal interface materials, and heat spreaders can be incorporated into interposer designs to manage heat effectively. Reliability testing protocols for HBM4 interposers include thermal cycling, power cycling, humidity testing, and electromigration testing to evaluate performance under stress conditions. Advanced thermal simulation techniques help predict hotspots and optimize thermal pathways in the interposer design phase, improving long-term reliability of the memory system.Expand Specific Solutions05 Novel interconnect technologies for HBM4 interposer reliability

Advanced interconnect technologies are being developed to enhance the reliability of HBM4 interposers. These include copper-to-copper direct bonding, hybrid bonding techniques, and advanced through-via structures that minimize stress concentration and improve electrical performance. Self-healing interconnect materials that can repair microcracks during operation are being explored to extend the operational lifetime of interposers. Additionally, novel underfill materials with optimized coefficient of thermal expansion and enhanced adhesion properties help mitigate thermomechanical stress at interfaces between the interposer and attached components, improving overall package reliability.Expand Specific Solutions

Key Industry Players in HBM4 Interposer Development

The HBM4 interposer materials market is currently in a growth phase, with increasing demand driven by advanced computing applications requiring high-bandwidth memory solutions. The market is expected to reach significant scale as data centers, AI applications, and high-performance computing continue to expand. Silicon remains the dominant interposer material due to its established manufacturing ecosystem, with companies like Samsung Electronics, AT&S, and Dow leading development efforts. Glass interposers are gaining traction for their superior electrical properties and thermal performance, with Corning and Central Glass advancing this technology. Organic interposers represent an emerging alternative pursued by companies like Wacker Chemie and Sumitomo Electric, offering potential cost advantages. The competitive landscape shows a mix of established semiconductor manufacturers, materials specialists, and research institutions collaborating to address reliability challenges across these three material platforms.

AT & S Austria Technologie & Systemtechnik AG

Technical Solution: AT&S has developed advanced organic interposer solutions for HBM4 applications, focusing on their ECP (Embedded Component Packaging) technology. Their approach integrates ultra-fine line/space patterns (sub-2μm) with embedded components in organic substrates to create high-performance interposers. AT&S's organic interposers utilize specialized high-temperature resistant polymers with low dielectric constants and optimized coefficient of thermal expansion (CTE) to match silicon dies. Their manufacturing process includes advanced laser drilling for microvias and semi-additive processes for ultra-fine line formation. AT&S has also implemented specialized reliability testing protocols including thermal cycling, high-temperature storage, and humidity tests specifically designed for HBM4 applications to ensure long-term performance in high-bandwidth memory systems.

Strengths: Cost-effective compared to silicon interposers; established manufacturing infrastructure; excellent thermal management capabilities; flexibility in design. Weaknesses: Higher signal loss compared to silicon and glass; potential warpage issues under extreme thermal conditions; relatively lower interconnect density than silicon alternatives.

Corning, Inc.

Technical Solution: Corning has pioneered glass interposer technology for HBM4 applications with their specialized high-performance glass substrates. Their glass interposers feature through-glass vias (TGVs) with diameters as small as 20μm and aspect ratios exceeding 10:1, enabling extremely high interconnect densities. Corning's proprietary glass formulations offer tailored coefficient of thermal expansion (CTE) matching with silicon dies while maintaining excellent dimensional stability. The company has developed specialized metallization processes for glass that achieve superior adhesion and reliability under thermal cycling conditions. Their glass interposers demonstrate exceptional electrical performance with low insertion loss (<0.1dB/mm at 10GHz) and minimal crosstalk, critical for HBM4's increased bandwidth requirements. Corning has established reliability testing protocols specifically for glass interposers, demonstrating survival rates exceeding 1000 cycles in temperature cycling tests from -55°C to 125°C.

Strengths: Superior electrical properties with lower insertion loss than organic; excellent dimensional stability; CTE closely matching silicon; higher interconnect density than organic options. Weaknesses: Higher manufacturing costs than organic interposers; more brittle than organic alternatives; less established manufacturing infrastructure compared to silicon; challenges in handling during assembly.

Critical Reliability Studies and Patents for Interposer Materials

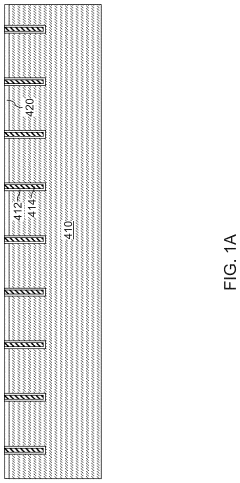

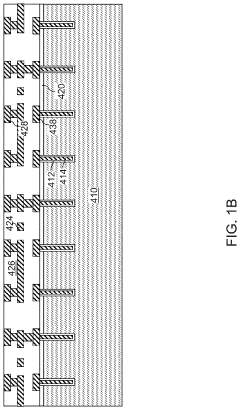

Embedded organic interposer for high bandwidth

PatentPendingUS20210327851A1

Innovation

- Embedded organic interposers with thicker conductors and additional routing layers are embedded within the package core, providing more dielectric space and reducing the resistive-capacitive (RC) load to achieve higher bandwidth transmission, up to 20-60 GHz over longer spans.

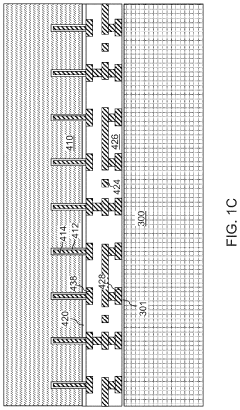

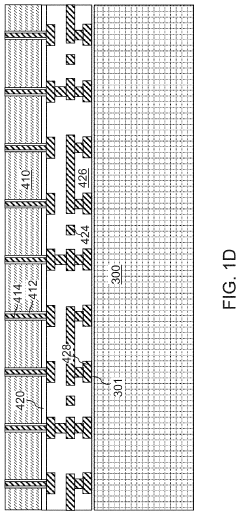

Silicon interposer including through-silicon via structures with enhanced overlay tolerance and methods of forming the same

PatentActiveUS11296032B2

Innovation

- A chip package structure with a silicon interposer featuring through-substrate via structures and package-side metal pads that provide enhanced overlay tolerance, including an epoxy molding compound interposer frame and die-side redistribution structures, to minimize the impact of placement errors and ensure reliable connections.

Thermal Management Strategies for Different Interposer Types

Thermal management represents a critical challenge in HBM4 interposer design, with each interposer material presenting unique heat dissipation characteristics that significantly impact overall system reliability. Silicon interposers offer superior thermal conductivity (approximately 150 W/m·K), enabling efficient heat transfer from HBM memory stacks to the package substrate. This inherent property makes silicon particularly advantageous for high-performance computing applications where thermal loads frequently exceed 100W/cm².

Glass interposers, while exhibiting lower thermal conductivity (approximately 1-2 W/m·K), can be enhanced through strategic integration of thermal vias and specialized through-glass via (TGV) structures. Recent advancements in glass interposer technology have demonstrated that incorporating copper-filled thermal pathways can improve heat dissipation by up to 40% compared to standard glass implementations. Additionally, glass offers better coefficient of thermal expansion (CTE) matching with certain package materials, potentially reducing thermal stress during operational cycles.

Organic interposers present the most significant thermal management challenges due to their inherently low thermal conductivity (typically 0.3-0.5 W/m·K). To address this limitation, advanced thermal management strategies include embedding copper planes, utilizing thermal interface materials (TIMs) with conductivities exceeding 5 W/m·K, and implementing active cooling solutions. Hybrid approaches combining organic substrates with localized silicon or metallic heat spreaders have shown promising results in laboratory testing.

Computational fluid dynamics (CFD) modeling has become essential for optimizing thermal management across all interposer types. These simulations reveal that silicon interposers typically maintain temperature gradients below 10°C across the die area, while glass and organic variants may experience gradients of 15-25°C and 20-35°C respectively under identical operating conditions. Such temperature differentials directly impact signal integrity and long-term reliability of the HBM4 memory system.

Emerging cooling technologies specifically tailored for different interposer materials include microfluidic cooling channels for silicon, thermally conductive adhesives for glass, and embedded vapor chambers for organic substrates. Industry data suggests that implementing these advanced cooling strategies can reduce junction temperatures by 15-30°C depending on the interposer material and system architecture.

The selection of appropriate thermal management strategy must consider not only the interposer material but also the specific application requirements, power density, form factor constraints, and reliability targets. As HBM4 pushes memory bandwidth boundaries, thermal management will increasingly become a differentiating factor in interposer material selection and overall system design.

Glass interposers, while exhibiting lower thermal conductivity (approximately 1-2 W/m·K), can be enhanced through strategic integration of thermal vias and specialized through-glass via (TGV) structures. Recent advancements in glass interposer technology have demonstrated that incorporating copper-filled thermal pathways can improve heat dissipation by up to 40% compared to standard glass implementations. Additionally, glass offers better coefficient of thermal expansion (CTE) matching with certain package materials, potentially reducing thermal stress during operational cycles.

Organic interposers present the most significant thermal management challenges due to their inherently low thermal conductivity (typically 0.3-0.5 W/m·K). To address this limitation, advanced thermal management strategies include embedding copper planes, utilizing thermal interface materials (TIMs) with conductivities exceeding 5 W/m·K, and implementing active cooling solutions. Hybrid approaches combining organic substrates with localized silicon or metallic heat spreaders have shown promising results in laboratory testing.

Computational fluid dynamics (CFD) modeling has become essential for optimizing thermal management across all interposer types. These simulations reveal that silicon interposers typically maintain temperature gradients below 10°C across the die area, while glass and organic variants may experience gradients of 15-25°C and 20-35°C respectively under identical operating conditions. Such temperature differentials directly impact signal integrity and long-term reliability of the HBM4 memory system.

Emerging cooling technologies specifically tailored for different interposer materials include microfluidic cooling channels for silicon, thermally conductive adhesives for glass, and embedded vapor chambers for organic substrates. Industry data suggests that implementing these advanced cooling strategies can reduce junction temperatures by 15-30°C depending on the interposer material and system architecture.

The selection of appropriate thermal management strategy must consider not only the interposer material but also the specific application requirements, power density, form factor constraints, and reliability targets. As HBM4 pushes memory bandwidth boundaries, thermal management will increasingly become a differentiating factor in interposer material selection and overall system design.

Supply Chain Considerations for Interposer Material Selection

The supply chain for interposer materials represents a critical factor in the adoption and scalability of different HBM4 interposer technologies. Silicon interposers benefit from a mature semiconductor manufacturing ecosystem, with established suppliers like TSMC, Samsung, and GlobalFoundries offering advanced silicon interposer fabrication. However, this supply chain faces challenges including capacity constraints at advanced nodes, geographic concentration in East Asia, and competition with logic chip production for manufacturing resources.

Glass interposers present a different supply chain profile, leveraging existing infrastructure from the display and specialty glass industries. Companies like Corning, AGC, and Schott have established capabilities in precision glass manufacturing that can be adapted for interposer production. The supply chain for glass interposers is more geographically diverse, with significant manufacturing presence across North America, Europe, and Asia, potentially offering greater resilience against regional disruptions.

Organic interposers utilize supply chains similar to those for advanced PCBs and substrates, with players like Unimicron, Ibiden, and Shinko Electric having relevant manufacturing expertise. This supply chain is relatively mature and cost-effective but faces challenges in scaling to the ultra-fine pitches required for HBM4 applications.

Material sourcing represents another critical consideration. Silicon interposers rely on high-purity silicon wafers, which may face supply constraints during semiconductor industry upcycles. Glass interposers require specialty glass formulations with precise thermal and mechanical properties, while organic interposers depend on advanced resin systems and copper foils that must meet stringent electrical and thermal requirements.

Equipment availability also varies significantly across interposer technologies. Silicon interposers require advanced lithography and etching equipment, which is limited to a small number of suppliers like ASML and Applied Materials. Glass interposer manufacturing can leverage modified equipment from the display industry but requires specialized tools for through-glass via formation. Organic interposer production utilizes modified advanced PCB manufacturing equipment, which is more widely available but may require upgrades to meet HBM4 specifications.

Lead times and production scalability differ substantially among these options. Silicon interposers typically have the longest lead times (12-20 weeks) due to complex processing requirements, while organic interposers can often be produced in 6-10 weeks. Glass interposers currently fall between these extremes but show potential for faster cycle times as manufacturing processes mature and become more standardized.

Glass interposers present a different supply chain profile, leveraging existing infrastructure from the display and specialty glass industries. Companies like Corning, AGC, and Schott have established capabilities in precision glass manufacturing that can be adapted for interposer production. The supply chain for glass interposers is more geographically diverse, with significant manufacturing presence across North America, Europe, and Asia, potentially offering greater resilience against regional disruptions.

Organic interposers utilize supply chains similar to those for advanced PCBs and substrates, with players like Unimicron, Ibiden, and Shinko Electric having relevant manufacturing expertise. This supply chain is relatively mature and cost-effective but faces challenges in scaling to the ultra-fine pitches required for HBM4 applications.

Material sourcing represents another critical consideration. Silicon interposers rely on high-purity silicon wafers, which may face supply constraints during semiconductor industry upcycles. Glass interposers require specialty glass formulations with precise thermal and mechanical properties, while organic interposers depend on advanced resin systems and copper foils that must meet stringent electrical and thermal requirements.

Equipment availability also varies significantly across interposer technologies. Silicon interposers require advanced lithography and etching equipment, which is limited to a small number of suppliers like ASML and Applied Materials. Glass interposer manufacturing can leverage modified equipment from the display industry but requires specialized tools for through-glass via formation. Organic interposer production utilizes modified advanced PCB manufacturing equipment, which is more widely available but may require upgrades to meet HBM4 specifications.

Lead times and production scalability differ substantially among these options. Silicon interposers typically have the longest lead times (12-20 weeks) due to complex processing requirements, while organic interposers can often be produced in 6-10 weeks. Glass interposers currently fall between these extremes but show potential for faster cycle times as manufacturing processes mature and become more standardized.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!