Hermetic Vs. Non-Hermetic VCSEL Package Tradeoffs

AUG 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

VCSEL Packaging Evolution and Objectives

Vertical-Cavity Surface-Emitting Lasers (VCSELs) have undergone significant evolution in packaging technologies since their commercial introduction in the 1990s. Initially developed for short-range data communication applications, VCSEL packaging has transformed dramatically to meet increasingly diverse application requirements across multiple industries.

The earliest VCSEL packages were primarily TO-can hermetic designs, borrowed from edge-emitting laser technology. These packages provided excellent protection against environmental factors but were relatively bulky and expensive to manufacture at scale. As market demands shifted toward higher-volume applications, packaging evolution became driven by cost reduction, miniaturization, and performance optimization.

By the early 2000s, non-hermetic plastic packages began emerging as viable alternatives for less demanding applications. This represented a significant paradigm shift in the industry, challenging the conventional wisdom that all semiconductor lasers required hermetic sealing for reliable operation. The development of improved passivation techniques and more robust VCSEL chip designs enabled this transition.

The proliferation of smartphones and 3D sensing applications around 2017 catalyzed another revolutionary change in VCSEL packaging approaches. Apple's adoption of VCSEL arrays for Face ID created unprecedented demand for compact, cost-effective packaging solutions capable of supporting arrays containing hundreds or thousands of individual emitters.

Current packaging objectives focus on several key parameters: thermal management, optical efficiency, electrical performance, reliability, and cost-effectiveness. Thermal considerations are particularly critical as VCSEL applications trend toward higher power densities. Efficient heat dissipation directly impacts device lifetime, wavelength stability, and overall performance.

Optical considerations include managing beam divergence, minimizing losses, and in some cases integrating diffractive optical elements directly into the package. Electrical performance requirements center on minimizing parasitic inductance and resistance while maintaining signal integrity at increasingly higher modulation speeds.

Reliability objectives vary significantly by application, with automotive and industrial applications typically demanding more robust packaging solutions than consumer electronics. This has led to a spectrum of packaging approaches rather than a one-size-fits-all solution.

The fundamental tradeoff between hermetic and non-hermetic packaging represents a central challenge in VCSEL development. The industry continues to seek optimal balance points that satisfy application-specific requirements while maintaining competitive cost structures. Future packaging evolution will likely focus on further integration, with advanced substrates, embedded optics, and hybrid assembly techniques enabling new capabilities and applications.

The earliest VCSEL packages were primarily TO-can hermetic designs, borrowed from edge-emitting laser technology. These packages provided excellent protection against environmental factors but were relatively bulky and expensive to manufacture at scale. As market demands shifted toward higher-volume applications, packaging evolution became driven by cost reduction, miniaturization, and performance optimization.

By the early 2000s, non-hermetic plastic packages began emerging as viable alternatives for less demanding applications. This represented a significant paradigm shift in the industry, challenging the conventional wisdom that all semiconductor lasers required hermetic sealing for reliable operation. The development of improved passivation techniques and more robust VCSEL chip designs enabled this transition.

The proliferation of smartphones and 3D sensing applications around 2017 catalyzed another revolutionary change in VCSEL packaging approaches. Apple's adoption of VCSEL arrays for Face ID created unprecedented demand for compact, cost-effective packaging solutions capable of supporting arrays containing hundreds or thousands of individual emitters.

Current packaging objectives focus on several key parameters: thermal management, optical efficiency, electrical performance, reliability, and cost-effectiveness. Thermal considerations are particularly critical as VCSEL applications trend toward higher power densities. Efficient heat dissipation directly impacts device lifetime, wavelength stability, and overall performance.

Optical considerations include managing beam divergence, minimizing losses, and in some cases integrating diffractive optical elements directly into the package. Electrical performance requirements center on minimizing parasitic inductance and resistance while maintaining signal integrity at increasingly higher modulation speeds.

Reliability objectives vary significantly by application, with automotive and industrial applications typically demanding more robust packaging solutions than consumer electronics. This has led to a spectrum of packaging approaches rather than a one-size-fits-all solution.

The fundamental tradeoff between hermetic and non-hermetic packaging represents a central challenge in VCSEL development. The industry continues to seek optimal balance points that satisfy application-specific requirements while maintaining competitive cost structures. Future packaging evolution will likely focus on further integration, with advanced substrates, embedded optics, and hybrid assembly techniques enabling new capabilities and applications.

Market Demand Analysis for VCSEL Package Types

The global VCSEL (Vertical-Cavity Surface-Emitting Laser) market is experiencing robust growth, with package type selection becoming increasingly critical for manufacturers and end-users. Current market analysis indicates that the VCSEL market is projected to reach $3.89 billion by 2026, growing at a CAGR of approximately 17.3% from 2021. Within this expanding market, the choice between hermetic and non-hermetic packaging represents a significant decision point driven by evolving application requirements.

Consumer electronics remains the dominant sector driving VCSEL demand, particularly for 3D sensing applications in smartphones and tablets. This segment predominantly favors non-hermetic packages due to their cost-effectiveness and suitability for mass production. Market data shows that approximately 65% of VCSELs in consumer electronics utilize non-hermetic packaging, with this percentage expected to increase as manufacturers continue to prioritize cost reduction.

Conversely, the automotive LiDAR segment demonstrates stronger demand for hermetic packages, valuing their superior reliability and longevity in harsh operating environments. With the autonomous vehicle market projected to grow at 38.6% CAGR through 2027, demand for hermetically sealed VCSELs is expected to increase proportionally in this sector.

Telecommunications and data center applications present a mixed market picture. While historically favoring hermetic packages for their reliability, the industry is gradually shifting toward non-hermetic solutions as improvements in polymer sealing technologies narrow the performance gap. This transition is particularly evident in short-reach optical interconnects where cost considerations often outweigh marginal reliability benefits.

Regional analysis reveals distinct market preferences, with North American and European markets showing greater willingness to adopt hermetic packages for industrial and automotive applications. In contrast, Asian markets, particularly in consumer electronics manufacturing hubs, demonstrate stronger preference for non-hermetic solutions that support high-volume, cost-sensitive production.

Market surveys indicate that purchasing decisions increasingly factor in total cost of ownership rather than initial component costs alone. This trend potentially benefits hermetic packages in applications where replacement costs and system downtime carry significant financial implications. However, the price premium for hermetic packages remains a substantial barrier, with hermetic solutions typically commanding 30-45% higher prices than their non-hermetic counterparts.

Future market growth for both package types will be influenced by technological advancements in materials science, with innovations in polymer sealants potentially narrowing the performance gap between hermetic and non-hermetic solutions. Additionally, emerging applications in medical devices and industrial sensing are creating new market segments with unique packaging requirements that may reshape demand patterns for both package types.

Consumer electronics remains the dominant sector driving VCSEL demand, particularly for 3D sensing applications in smartphones and tablets. This segment predominantly favors non-hermetic packages due to their cost-effectiveness and suitability for mass production. Market data shows that approximately 65% of VCSELs in consumer electronics utilize non-hermetic packaging, with this percentage expected to increase as manufacturers continue to prioritize cost reduction.

Conversely, the automotive LiDAR segment demonstrates stronger demand for hermetic packages, valuing their superior reliability and longevity in harsh operating environments. With the autonomous vehicle market projected to grow at 38.6% CAGR through 2027, demand for hermetically sealed VCSELs is expected to increase proportionally in this sector.

Telecommunications and data center applications present a mixed market picture. While historically favoring hermetic packages for their reliability, the industry is gradually shifting toward non-hermetic solutions as improvements in polymer sealing technologies narrow the performance gap. This transition is particularly evident in short-reach optical interconnects where cost considerations often outweigh marginal reliability benefits.

Regional analysis reveals distinct market preferences, with North American and European markets showing greater willingness to adopt hermetic packages for industrial and automotive applications. In contrast, Asian markets, particularly in consumer electronics manufacturing hubs, demonstrate stronger preference for non-hermetic solutions that support high-volume, cost-sensitive production.

Market surveys indicate that purchasing decisions increasingly factor in total cost of ownership rather than initial component costs alone. This trend potentially benefits hermetic packages in applications where replacement costs and system downtime carry significant financial implications. However, the price premium for hermetic packages remains a substantial barrier, with hermetic solutions typically commanding 30-45% higher prices than their non-hermetic counterparts.

Future market growth for both package types will be influenced by technological advancements in materials science, with innovations in polymer sealants potentially narrowing the performance gap between hermetic and non-hermetic solutions. Additionally, emerging applications in medical devices and industrial sensing are creating new market segments with unique packaging requirements that may reshape demand patterns for both package types.

Current Hermetic and Non-Hermetic VCSEL Packaging Technologies

VCSEL (Vertical-Cavity Surface-Emitting Laser) packaging technologies can be broadly categorized into hermetic and non-hermetic solutions, each with distinct characteristics and applications. Hermetic packages provide complete isolation from the external environment through airtight sealing, typically using metal, ceramic, or glass materials. These packages maintain an internal controlled atmosphere, often with inert gases like nitrogen or argon, to prevent moisture ingress and contamination that could degrade the laser performance.

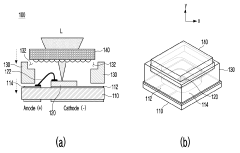

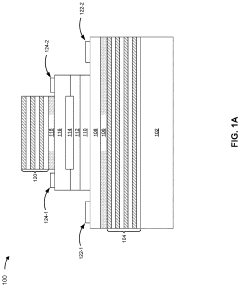

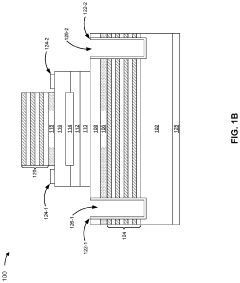

Traditional hermetic VCSEL packages include TO-cans (Transistor Outline), which feature a metal housing with glass feedthroughs for electrical connections and an optical window. These packages offer excellent reliability and environmental protection but come with higher manufacturing costs and larger form factors. Ceramic packages with metal sealing represent another hermetic solution, providing good thermal management while maintaining hermeticity.

Non-hermetic packages, in contrast, utilize polymer-based materials and do not provide complete isolation from the external environment. These packages include plastic molded packages, chip-on-board (COB) configurations, and various surface-mount technology (SMT) formats. The most common non-hermetic approach involves encapsulating the VCSEL die with optical-grade epoxy or silicone materials that offer some degree of protection while allowing light transmission.

Recent advancements in non-hermetic packaging include laminate-based packages with integrated heat spreaders and optical windows, which provide improved thermal performance while maintaining a compact form factor. Flip-chip configurations on organic substrates have also gained popularity, offering enhanced electrical performance and simplified optical coupling.

The industry has witnessed a gradual shift toward non-hermetic solutions, particularly in consumer electronics and automotive applications where cost and size considerations are paramount. This transition has been enabled by improvements in polymer materials, die passivation techniques, and enhanced reliability testing methodologies that have increased confidence in long-term performance.

Manufacturing processes for hermetic packages typically involve precision metal forming, glass-to-metal sealing, and vacuum or controlled-atmosphere sealing steps. These processes require specialized equipment and clean room environments. Non-hermetic packaging processes are generally more aligned with standard semiconductor assembly techniques, including die attach, wire bonding, and molding or encapsulation steps.

Quality control measures differ significantly between the two approaches. Hermetic packages undergo rigorous hermeticity testing using methods such as helium leak detection and residual gas analysis, while non-hermetic packages focus on visual inspection, bond strength testing, and accelerated environmental stress testing to validate reliability.

Traditional hermetic VCSEL packages include TO-cans (Transistor Outline), which feature a metal housing with glass feedthroughs for electrical connections and an optical window. These packages offer excellent reliability and environmental protection but come with higher manufacturing costs and larger form factors. Ceramic packages with metal sealing represent another hermetic solution, providing good thermal management while maintaining hermeticity.

Non-hermetic packages, in contrast, utilize polymer-based materials and do not provide complete isolation from the external environment. These packages include plastic molded packages, chip-on-board (COB) configurations, and various surface-mount technology (SMT) formats. The most common non-hermetic approach involves encapsulating the VCSEL die with optical-grade epoxy or silicone materials that offer some degree of protection while allowing light transmission.

Recent advancements in non-hermetic packaging include laminate-based packages with integrated heat spreaders and optical windows, which provide improved thermal performance while maintaining a compact form factor. Flip-chip configurations on organic substrates have also gained popularity, offering enhanced electrical performance and simplified optical coupling.

The industry has witnessed a gradual shift toward non-hermetic solutions, particularly in consumer electronics and automotive applications where cost and size considerations are paramount. This transition has been enabled by improvements in polymer materials, die passivation techniques, and enhanced reliability testing methodologies that have increased confidence in long-term performance.

Manufacturing processes for hermetic packages typically involve precision metal forming, glass-to-metal sealing, and vacuum or controlled-atmosphere sealing steps. These processes require specialized equipment and clean room environments. Non-hermetic packaging processes are generally more aligned with standard semiconductor assembly techniques, including die attach, wire bonding, and molding or encapsulation steps.

Quality control measures differ significantly between the two approaches. Hermetic packages undergo rigorous hermeticity testing using methods such as helium leak detection and residual gas analysis, while non-hermetic packages focus on visual inspection, bond strength testing, and accelerated environmental stress testing to validate reliability.

Comparative Analysis of Hermetic vs Non-Hermetic Solutions

01 Hermetic sealing techniques for VCSEL packages

Various hermetic sealing techniques are employed in VCSEL packages to protect the sensitive optical components from environmental factors such as moisture and contaminants. These techniques include glass-to-metal seals, welded metal enclosures, and specialized bonding processes that create an airtight enclosure around the VCSEL device. Proper hermetic sealing is crucial for maintaining long-term reliability and performance stability of VCSELs in various applications.- Hermetic sealing techniques for VCSEL packages: Various hermetic sealing techniques are employed to ensure the reliability and longevity of VCSEL packages. These techniques include glass-to-metal seals, welding processes, and specialized bonding methods that create an airtight enclosure. Hermetic sealing protects the sensitive VCSEL components from moisture, contaminants, and environmental factors that could degrade performance or cause failure. These sealing methods are critical for maintaining the optical alignment and electrical characteristics of the device over its operational lifetime.

- Testing and verification of VCSEL package hermeticity: Methods for testing and verifying the hermeticity of VCSEL packages are essential for quality assurance. These include fine and gross leak testing, helium leak detection, residual gas analysis, and other specialized techniques to evaluate the integrity of package seals. Testing procedures may involve pressurizing the package with tracer gases and monitoring for leakage, or using optical methods to detect changes in internal package conditions. These verification methods ensure that the hermetic seal meets the required specifications for long-term reliability in various operating environments.

- Advanced materials for hermetic VCSEL packaging: Specialized materials are used in hermetic VCSEL packaging to achieve optimal performance and reliability. These include high-temperature ceramics, specialized metals and alloys, glass materials with matched thermal expansion coefficients, and advanced polymer compounds. Material selection considers factors such as thermal conductivity, coefficient of thermal expansion, hermeticity properties, and compatibility with the VCSEL device. The proper combination of these materials helps maintain package integrity under thermal cycling and other environmental stresses while ensuring long-term hermeticity.

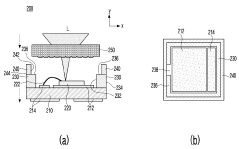

- Hermetic packaging designs for specific VCSEL applications: Various hermetic packaging designs are tailored for specific VCSEL applications, including telecommunications, sensing, and consumer electronics. These designs incorporate features such as optical windows, fiber coupling mechanisms, integrated cooling solutions, and specialized electrical feedthroughs while maintaining hermeticity. Package configurations may include TO-cans, butterfly packages, ceramic submounts with hermetic lids, or custom designs optimized for specific operational requirements. The package design balances optical performance, thermal management, electrical connectivity, and hermetic integrity for the intended application environment.

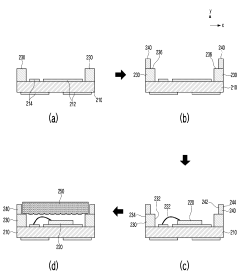

- Innovations in VCSEL package hermeticity for emerging applications: Recent innovations in VCSEL package hermeticity address the demands of emerging applications such as 3D sensing, LiDAR, and augmented reality. These innovations include wafer-level hermetic sealing techniques, advanced bonding processes, novel getter materials for moisture absorption, and miniaturized hermetic packaging solutions. New approaches combine traditional hermeticity with enhanced thermal management and optical performance. These advancements enable more compact, reliable VCSEL packages that maintain hermeticity while meeting the stringent requirements of next-generation applications in harsh or variable environments.

02 Advanced packaging materials for hermetic VCSEL enclosures

The selection of appropriate packaging materials significantly impacts the hermeticity of VCSEL packages. Materials such as specialized ceramics, metal alloys, and glass compositions are used to create robust hermetic seals. These materials must have compatible thermal expansion coefficients to prevent stress-induced failures during temperature cycling. Advanced composite materials are also being developed to enhance hermeticity while maintaining optical transparency where needed for VCSEL operation.Expand Specific Solutions03 Hermeticity testing methods for VCSEL packages

Various testing methodologies are employed to verify the hermeticity of VCSEL packages. These include helium leak detection, residual gas analysis, and moisture ingress testing. Fine leak testing can detect extremely small breaches in the hermetic seal, while gross leak testing identifies larger defects. Advanced optical inspection techniques and specialized sensors are also used to monitor hermeticity throughout the VCSEL package lifecycle, ensuring long-term reliability in demanding applications.Expand Specific Solutions04 Innovative VCSEL package designs for enhanced hermeticity

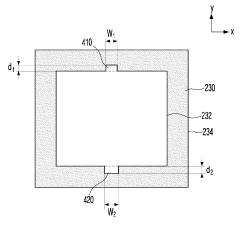

Novel VCSEL package designs incorporate structural features specifically engineered to improve hermeticity. These designs include multi-layer sealing architectures, specialized cavity structures, and integrated moisture barriers. Some packages utilize redundant sealing mechanisms to provide fail-safe protection. Advanced designs also address the challenges of maintaining hermeticity while accommodating electrical feedthroughs and optical windows, which are potential weak points in the hermetic enclosure.Expand Specific Solutions05 Hermeticity considerations for miniaturized VCSEL arrays

As VCSEL technology advances toward higher-density arrays and miniaturized packages, maintaining hermeticity presents unique challenges. Specialized approaches include wafer-level hermetic bonding, thin-film encapsulation, and micro-scale sealing techniques. These methods must preserve optical alignment and performance while providing effective environmental protection. The integration of hermeticity solutions with thermal management systems is particularly important for high-power VCSEL arrays where heat dissipation requirements must be balanced with hermetic integrity.Expand Specific Solutions

Key VCSEL Packaging Industry Players

The VCSEL package market is currently in a growth phase, with increasing adoption across telecommunications, data centers, and sensing applications. The market is projected to expand significantly due to rising demand for 3D sensing in consumer electronics and automotive LiDAR systems. Regarding technology maturity, hermetic packages offer superior reliability and longevity in harsh environments, with companies like II-VI Delaware (Coherent), Vixar, and Fujian Huixin Laser leading development in this space. Non-hermetic packages, championed by Huawei, Cisco, and Mellanox, provide cost advantages and are suitable for consumer applications. The competitive landscape shows a balance between established telecommunications players (Ciena, Ericsson) and specialized optical component manufacturers, with increasing innovation in package designs to optimize performance-cost tradeoffs for specific application requirements.

II-VI Delaware, Inc.

Technical Solution: II-VI采用先进的VCSEL封装技术,同时提供气密(Hermetic)和非气密(Non-Hermetic)解决方案。其气密封装采用金属TO封装和陶瓷封装,提供卓越的可靠性和热稳定性,特别适用于军事、航空航天和电信等高可靠性应用场景。非气密封装则采用塑料封装技术,集成了硅透镜阵列,实现了更高的光学效率和更紧凑的封装尺寸。II-VI的专利技术允许在非气密封装中使用特殊的钝化涂层和保护胶,显著提高了VCSEL阵列在消费电子环境中的可靠性,同时保持了成本效益。公司还开发了混合封装技术,结合两种方法的优势,为中等可靠性要求的应用提供平衡的解决方案[1][2]。

优势:拥有全面的封装技术组合,能够根据不同应用场景灵活选择最适合的封装方案;在非气密封装领域拥有专利保护层技术,显著提高了可靠性。劣势:气密封装解决方案成本较高,在价格敏感的消费市场竞争力受限;非气密封装在极端环境下的长期可靠性仍有待验证。

Huawei Technologies Co., Ltd.

Technical Solution: 华为在VCSEL封装技术领域采用双轨策略,同时开发气密和非气密解决方案。其气密封装技术主要应用于高端光通信设备,采用金属-陶瓷封装结构,实现了优异的热管理和电气性能。华为的创新在于开发了低成本的准气密封装技术(Quasi-Hermetic Package),该技术使用特殊的玻璃-金属密封和改进的焊接工艺,降低了传统气密封装的成本,同时保持了较高的可靠性。在非气密封装领域,华为采用塑料封装与硅基光学元件集成的方案,实现了高度集成的3D传感模块。华为还开发了混合封装技术,在单一封装中集成多个VCSEL阵列和光电探测器,为智能手机和AR/VR设备提供紧凑的3D感应解决方案。华为的封装技术在高速数据中心互连和消费电子领域均有广泛应用[5][6]。

优势:拥有从高端通信到消费电子的全系列VCSEL封装解决方案;准气密封装技术在成本和性能之间取得了良好平衡;垂直整合能力强,可以从芯片设计到系统集成提供完整解决方案。劣势:在某些高端专业封装技术上与西方领先企业仍有差距;受国际贸易限制影响,部分高端封装材料和设备获取受限。

Critical Patents in VCSEL Packaging Technology

Package of Vertical Cavity Surface Emitting Laser Having Out-gassing Passage and Method Thereof

PatentActiveKR1020200116300A

Innovation

- A VCSEL package design featuring a diffuser-supporting housing formed as a panel with integrated outgas passages, eliminating the need for injection molding and allowing gas discharge, using a DPC substrate with AlN and a micro lens array, and a second housing with curvature to prevent gas passage blockage.

Vertical cavity surface emitting laser device with at least one bonding layer

PatentActiveUS20220416506A1

Innovation

- A VCSEL device with a bonding layer that uses non-InP-based mirrors with high index contrast, such as GaAs/AlGaAs-based DBRs, and a multistage process for forming epitaxial substructures at low temperatures, using SU-8 or BCB polymers to bond the mirrors to the InP-based active region without impacting optical performance.

Reliability Testing Standards for VCSEL Packages

Reliability testing standards for VCSEL packages represent a critical framework for evaluating the performance and durability of both hermetic and non-hermetic packaging solutions. These standards typically encompass a comprehensive suite of environmental, mechanical, and operational tests designed to simulate real-world conditions and accelerated aging scenarios.

The industry has established several key testing protocols that have become standard for VCSEL package qualification. Telcordia GR-468-CORE serves as the foundational standard for optoelectronic device reliability, providing specific guidelines for VCSEL testing. Additionally, MIL-STD-883 offers military-grade testing procedures that are often adapted for commercial applications requiring high reliability.

For hermetic VCSEL packages, hermeticity testing according to MIL-STD-883 Method 1014 is mandatory, with fine and gross leak testing being particularly crucial. These packages must typically demonstrate leak rates below 5×10^-8 atm-cc/sec to ensure proper sealing integrity. In contrast, non-hermetic packages undergo different evaluation criteria focused on moisture sensitivity levels (MSL) according to JEDEC J-STD-020, with most commercial VCSELs requiring MSL 3 or better classification.

Temperature cycling tests represent another critical reliability measure, with hermetic packages typically tested between -65°C and +150°C for 1,000 cycles, while non-hermetic packages often undergo less extreme conditions from -40°C to +125°C. High-temperature operating life (HTOL) testing at 85°C and elevated current for 5,000 hours serves as a standard accelerated aging test for both package types, though hermetic packages generally demonstrate superior performance in these extended reliability tests.

Mechanical reliability standards include shock testing (MIL-STD-883 Method 2002) and vibration testing (MIL-STD-883 Method 2007), with hermetic packages typically required to withstand higher g-forces due to their deployment in more demanding applications. For automotive applications, the AEC-Q102 standard imposes additional requirements, including temperature cycling from -40°C to +125°C for 1,000 cycles and HTOL testing for 1,000 hours.

The emergence of consumer applications for VCSELs has led to the development of specialized reliability standards addressing unique use cases. For instance, mobile device applications require additional drop testing and bend testing protocols that evaluate package integrity under conditions typical of consumer electronics usage patterns.

As VCSEL technology continues to evolve, reliability testing standards are being continuously refined to address emerging challenges, particularly for non-hermetic packages that must balance cost considerations with increasingly stringent performance requirements in diverse application environments.

The industry has established several key testing protocols that have become standard for VCSEL package qualification. Telcordia GR-468-CORE serves as the foundational standard for optoelectronic device reliability, providing specific guidelines for VCSEL testing. Additionally, MIL-STD-883 offers military-grade testing procedures that are often adapted for commercial applications requiring high reliability.

For hermetic VCSEL packages, hermeticity testing according to MIL-STD-883 Method 1014 is mandatory, with fine and gross leak testing being particularly crucial. These packages must typically demonstrate leak rates below 5×10^-8 atm-cc/sec to ensure proper sealing integrity. In contrast, non-hermetic packages undergo different evaluation criteria focused on moisture sensitivity levels (MSL) according to JEDEC J-STD-020, with most commercial VCSELs requiring MSL 3 or better classification.

Temperature cycling tests represent another critical reliability measure, with hermetic packages typically tested between -65°C and +150°C for 1,000 cycles, while non-hermetic packages often undergo less extreme conditions from -40°C to +125°C. High-temperature operating life (HTOL) testing at 85°C and elevated current for 5,000 hours serves as a standard accelerated aging test for both package types, though hermetic packages generally demonstrate superior performance in these extended reliability tests.

Mechanical reliability standards include shock testing (MIL-STD-883 Method 2002) and vibration testing (MIL-STD-883 Method 2007), with hermetic packages typically required to withstand higher g-forces due to their deployment in more demanding applications. For automotive applications, the AEC-Q102 standard imposes additional requirements, including temperature cycling from -40°C to +125°C for 1,000 cycles and HTOL testing for 1,000 hours.

The emergence of consumer applications for VCSELs has led to the development of specialized reliability standards addressing unique use cases. For instance, mobile device applications require additional drop testing and bend testing protocols that evaluate package integrity under conditions typical of consumer electronics usage patterns.

As VCSEL technology continues to evolve, reliability testing standards are being continuously refined to address emerging challenges, particularly for non-hermetic packages that must balance cost considerations with increasingly stringent performance requirements in diverse application environments.

Cost-Performance Optimization Strategies

Optimizing the cost-performance ratio in VCSEL packaging requires a strategic approach that balances manufacturing expenses with device reliability and performance metrics. When evaluating hermetic versus non-hermetic packaging options, several optimization strategies emerge as particularly effective for different market segments and application requirements.

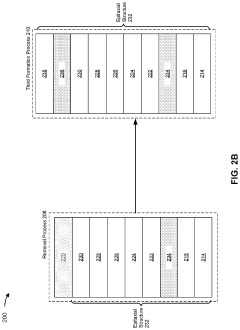

Material selection represents a primary cost optimization lever. For hermetic packages, transitioning from gold-plated Kovar to less expensive alloys with comparable thermal expansion coefficients can reduce material costs by 15-30% while maintaining hermeticity. Similarly, in non-hermetic designs, replacing ceramic substrates with high-performance polymers or composite materials can achieve significant cost reductions without substantially compromising thermal management capabilities.

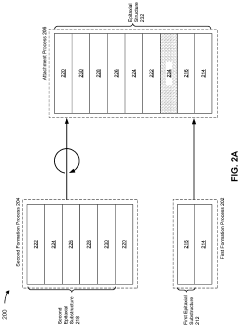

Manufacturing process simplification offers another avenue for cost optimization. Non-hermetic packages inherently benefit from fewer processing steps, eliminating the need for vacuum sealing and helium leak testing. Implementing automated assembly lines specifically designed for non-hermetic packaging can reduce labor costs by up to 40% compared to hermetic assembly processes, which often require more specialized handling and testing procedures.

Tiered product strategies enable companies to address diverse market needs while optimizing overall profitability. High-reliability applications demanding extended lifetimes can justify premium-priced hermetic packages, while cost-sensitive consumer applications can utilize non-hermetic solutions. This market segmentation approach allows manufacturers to maximize margins across their product portfolio while meeting varying customer requirements.

Testing protocol optimization presents significant cost-saving opportunities. Implementing statistical process control and accelerated life testing models can reduce the scope of required testing for non-hermetic packages while maintaining confidence in reliability predictions. For hermetic packages, focused testing on critical parameters rather than comprehensive hermeticity verification for every unit can reduce testing costs by 20-25%.

Supply chain integration strategies, particularly vertical integration of key packaging components, can yield substantial cost benefits. Companies that develop in-house capabilities for substrate manufacturing or die attachment processes gain greater control over both costs and quality parameters. Alternatively, strategic partnerships with specialized packaging suppliers can provide access to advanced technologies without requiring significant capital investment.

Volume scaling represents perhaps the most powerful cost optimization strategy, particularly for non-hermetic packages where automated assembly processes demonstrate excellent economies of scale. Production volumes exceeding 1 million units typically enable cost reductions of 30-50% compared to low-volume manufacturing scenarios, making non-hermetic options increasingly attractive for high-volume applications despite potential reliability trade-offs.

Material selection represents a primary cost optimization lever. For hermetic packages, transitioning from gold-plated Kovar to less expensive alloys with comparable thermal expansion coefficients can reduce material costs by 15-30% while maintaining hermeticity. Similarly, in non-hermetic designs, replacing ceramic substrates with high-performance polymers or composite materials can achieve significant cost reductions without substantially compromising thermal management capabilities.

Manufacturing process simplification offers another avenue for cost optimization. Non-hermetic packages inherently benefit from fewer processing steps, eliminating the need for vacuum sealing and helium leak testing. Implementing automated assembly lines specifically designed for non-hermetic packaging can reduce labor costs by up to 40% compared to hermetic assembly processes, which often require more specialized handling and testing procedures.

Tiered product strategies enable companies to address diverse market needs while optimizing overall profitability. High-reliability applications demanding extended lifetimes can justify premium-priced hermetic packages, while cost-sensitive consumer applications can utilize non-hermetic solutions. This market segmentation approach allows manufacturers to maximize margins across their product portfolio while meeting varying customer requirements.

Testing protocol optimization presents significant cost-saving opportunities. Implementing statistical process control and accelerated life testing models can reduce the scope of required testing for non-hermetic packages while maintaining confidence in reliability predictions. For hermetic packages, focused testing on critical parameters rather than comprehensive hermeticity verification for every unit can reduce testing costs by 20-25%.

Supply chain integration strategies, particularly vertical integration of key packaging components, can yield substantial cost benefits. Companies that develop in-house capabilities for substrate manufacturing or die attachment processes gain greater control over both costs and quality parameters. Alternatively, strategic partnerships with specialized packaging suppliers can provide access to advanced technologies without requiring significant capital investment.

Volume scaling represents perhaps the most powerful cost optimization strategy, particularly for non-hermetic packages where automated assembly processes demonstrate excellent economies of scale. Production volumes exceeding 1 million units typically enable cost reductions of 30-50% compared to low-volume manufacturing scenarios, making non-hermetic options increasingly attractive for high-volume applications despite potential reliability trade-offs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!