How Structural Ceramics Improve Fuel Efficiency in Engines

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Structural Ceramics Evolution and Efficiency Goals

Structural ceramics have undergone significant evolution since their initial introduction in engine applications during the 1980s. Early development focused primarily on silicon nitride (Si3N4) and silicon carbide (SiC) materials, which demonstrated exceptional thermal resistance but suffered from manufacturing complexity and brittleness issues. The technological trajectory has since expanded to include zirconia-toughened alumina (ZTA), aluminum titanate, and various ceramic matrix composites (CMCs) that combine the thermal properties of ceramics with improved mechanical resilience.

The evolution of structural ceramics in engine applications has been driven by increasingly stringent emissions regulations and the automotive industry's pursuit of greater fuel efficiency. Initial applications were limited to simple components like turbocharger rotors and glow plugs, but advancements in manufacturing techniques—particularly injection molding, hot isostatic pressing, and more recently, additive manufacturing—have enabled more complex ceramic engine components.

A critical milestone in this evolution was the development of ceramic coatings for engine components in the 1990s, which provided a transitional technology between conventional metal parts and fully ceramic components. These thermal barrier coatings (TBCs) demonstrated the potential for ceramics to significantly reduce heat loss in combustion chambers, thereby improving thermal efficiency by 2-3% without requiring complete redesign of engine architecture.

The primary efficiency goals for structural ceramics in modern engines center around three key mechanisms: higher operating temperatures, reduced weight, and decreased friction. By enabling combustion temperatures exceeding 1600°C (compared to approximately 1050°C for metal alloys), ceramic components can increase theoretical thermal efficiency by up to 8% according to Carnot cycle principles. Weight reduction of up to 40-60% compared to metal equivalents translates to both direct and indirect fuel efficiency improvements, with each 10% reduction in engine weight typically yielding a 1-2% improvement in overall vehicle efficiency.

Current research is targeting ambitious efficiency goals, with programs like the U.S. Department of Energy's Advanced Engine Materials initiative aiming for ceramic technologies that can contribute to a 20% overall improvement in fuel efficiency by 2025. The industry roadmap envisions progressive integration of ceramic components, beginning with valve train elements and progressing toward "ceramic-intensive" engine designs that could achieve thermal efficiencies approaching 50% for internal combustion engines—significantly higher than the 35-40% typical of today's advanced engines.

The convergence of structural ceramics with other emerging technologies, such as variable compression ratio systems and advanced combustion modes, presents particularly promising pathways for achieving these ambitious efficiency targets while meeting increasingly stringent emissions standards.

The evolution of structural ceramics in engine applications has been driven by increasingly stringent emissions regulations and the automotive industry's pursuit of greater fuel efficiency. Initial applications were limited to simple components like turbocharger rotors and glow plugs, but advancements in manufacturing techniques—particularly injection molding, hot isostatic pressing, and more recently, additive manufacturing—have enabled more complex ceramic engine components.

A critical milestone in this evolution was the development of ceramic coatings for engine components in the 1990s, which provided a transitional technology between conventional metal parts and fully ceramic components. These thermal barrier coatings (TBCs) demonstrated the potential for ceramics to significantly reduce heat loss in combustion chambers, thereby improving thermal efficiency by 2-3% without requiring complete redesign of engine architecture.

The primary efficiency goals for structural ceramics in modern engines center around three key mechanisms: higher operating temperatures, reduced weight, and decreased friction. By enabling combustion temperatures exceeding 1600°C (compared to approximately 1050°C for metal alloys), ceramic components can increase theoretical thermal efficiency by up to 8% according to Carnot cycle principles. Weight reduction of up to 40-60% compared to metal equivalents translates to both direct and indirect fuel efficiency improvements, with each 10% reduction in engine weight typically yielding a 1-2% improvement in overall vehicle efficiency.

Current research is targeting ambitious efficiency goals, with programs like the U.S. Department of Energy's Advanced Engine Materials initiative aiming for ceramic technologies that can contribute to a 20% overall improvement in fuel efficiency by 2025. The industry roadmap envisions progressive integration of ceramic components, beginning with valve train elements and progressing toward "ceramic-intensive" engine designs that could achieve thermal efficiencies approaching 50% for internal combustion engines—significantly higher than the 35-40% typical of today's advanced engines.

The convergence of structural ceramics with other emerging technologies, such as variable compression ratio systems and advanced combustion modes, presents particularly promising pathways for achieving these ambitious efficiency targets while meeting increasingly stringent emissions standards.

Market Demand for Fuel-Efficient Engine Technologies

The global market for fuel-efficient engine technologies has experienced significant growth over the past decade, driven primarily by stringent environmental regulations, rising fuel costs, and increasing consumer awareness about carbon footprints. According to recent market analyses, the automotive fuel efficiency market is projected to reach $740 billion by 2026, with advanced materials like structural ceramics representing one of the fastest-growing segments.

Environmental regulations have become increasingly stringent worldwide, with the European Union's Euro 7 standards, the United States' Corporate Average Fuel Economy (CAFE) standards, and China's China VI emissions standards all pushing manufacturers toward more fuel-efficient solutions. These regulatory pressures have created a substantial market pull for technologies that can improve engine efficiency without compromising performance.

Consumer demand patterns have also shifted noticeably toward fuel-efficient vehicles. A recent survey across major automotive markets revealed that 67% of potential car buyers now consider fuel efficiency among their top three purchasing criteria, up from 48% just five years ago. This shift represents a significant market opportunity for advanced engine technologies incorporating structural ceramics.

The commercial transportation sector presents perhaps the most compelling market case for ceramic engine components. With fuel representing approximately 30-40% of operating costs for fleet operators, even marginal improvements in fuel efficiency translate to substantial cost savings. The heavy-duty truck market has shown particular interest in ceramic technologies, with major manufacturers investing heavily in research and development.

Aerospace and military applications constitute another significant market segment. These sectors prioritize the high-temperature capabilities and weight reduction benefits of structural ceramics, with fuel efficiency improvements serving as a critical secondary benefit. Market analysis indicates this segment will grow at a compound annual growth rate of 8.7% through 2028.

Regional market differences are notable, with Asian markets—particularly Japan and China—showing the highest adoption rates for ceramic engine components. This regional leadership stems from strong government support for fuel-efficient technologies and established ceramic manufacturing expertise. North American and European markets are catching up rapidly as regulatory pressures intensify.

The competitive landscape reveals increasing collaboration between traditional automotive manufacturers and advanced materials specialists. These partnerships aim to overcome the historical barriers to ceramic adoption in engines: high production costs and manufacturing complexity. As these collaborations mature and production scales, market analysts expect a significant reduction in the cost premium associated with ceramic engine components, further accelerating market adoption.

Environmental regulations have become increasingly stringent worldwide, with the European Union's Euro 7 standards, the United States' Corporate Average Fuel Economy (CAFE) standards, and China's China VI emissions standards all pushing manufacturers toward more fuel-efficient solutions. These regulatory pressures have created a substantial market pull for technologies that can improve engine efficiency without compromising performance.

Consumer demand patterns have also shifted noticeably toward fuel-efficient vehicles. A recent survey across major automotive markets revealed that 67% of potential car buyers now consider fuel efficiency among their top three purchasing criteria, up from 48% just five years ago. This shift represents a significant market opportunity for advanced engine technologies incorporating structural ceramics.

The commercial transportation sector presents perhaps the most compelling market case for ceramic engine components. With fuel representing approximately 30-40% of operating costs for fleet operators, even marginal improvements in fuel efficiency translate to substantial cost savings. The heavy-duty truck market has shown particular interest in ceramic technologies, with major manufacturers investing heavily in research and development.

Aerospace and military applications constitute another significant market segment. These sectors prioritize the high-temperature capabilities and weight reduction benefits of structural ceramics, with fuel efficiency improvements serving as a critical secondary benefit. Market analysis indicates this segment will grow at a compound annual growth rate of 8.7% through 2028.

Regional market differences are notable, with Asian markets—particularly Japan and China—showing the highest adoption rates for ceramic engine components. This regional leadership stems from strong government support for fuel-efficient technologies and established ceramic manufacturing expertise. North American and European markets are catching up rapidly as regulatory pressures intensify.

The competitive landscape reveals increasing collaboration between traditional automotive manufacturers and advanced materials specialists. These partnerships aim to overcome the historical barriers to ceramic adoption in engines: high production costs and manufacturing complexity. As these collaborations mature and production scales, market analysts expect a significant reduction in the cost premium associated with ceramic engine components, further accelerating market adoption.

Current Status and Challenges in Ceramic Engine Components

The global market for ceramic engine components has witnessed significant growth in recent years, with the automotive sector being the primary driver. Currently, structural ceramics such as silicon nitride, silicon carbide, alumina, and zirconia are being increasingly integrated into engine designs by major manufacturers. These materials have demonstrated exceptional performance in high-temperature environments, with thermal stability up to 1600°C compared to metals that typically begin to lose structural integrity above 800°C.

Despite promising advancements, ceramic engine components face several critical challenges. Manufacturing complexity remains a significant barrier, as ceramics require specialized processing techniques including hot isostatic pressing, sintering, and precision machining. These processes contribute to higher production costs, making ceramic components 3-5 times more expensive than their metal counterparts, which limits widespread adoption in mass-market vehicles.

Material brittleness continues to be a fundamental challenge. While ceramics offer excellent compression strength, their tensile strength is considerably lower, making them susceptible to catastrophic failure under certain stress conditions. This characteristic necessitates sophisticated design approaches and safety margins that further complicate implementation.

Integration challenges persist when combining ceramic components with traditional metal engine parts. Differences in thermal expansion coefficients create stress at material interfaces, requiring innovative joining techniques and careful system design. Current solutions include specialized ceramic-to-metal brazing methods and gradient materials, though these add complexity to manufacturing processes.

Geographically, Japan leads in ceramic engine technology development, with companies like NGK and Kyocera at the forefront. European manufacturers, particularly in Germany, focus on high-performance applications, while North American research institutions contribute significantly to fundamental material science advancements. China has rapidly expanded its ceramic manufacturing capabilities but still lags in high-precision engine component production.

Recent technological breakthroughs include nano-ceramic composites that demonstrate improved fracture toughness while maintaining thermal properties. Additionally, advanced coating technologies have enabled hybrid approaches where conventional metal components receive ceramic thermal barrier coatings, offering a compromise between performance and manufacturing complexity.

Standardization remains underdeveloped, with limited industry-wide specifications for ceramic engine components. This creates challenges for suppliers and manufacturers in ensuring compatibility and reliability across different applications and systems, further constraining market expansion beyond specialized high-performance segments.

Despite promising advancements, ceramic engine components face several critical challenges. Manufacturing complexity remains a significant barrier, as ceramics require specialized processing techniques including hot isostatic pressing, sintering, and precision machining. These processes contribute to higher production costs, making ceramic components 3-5 times more expensive than their metal counterparts, which limits widespread adoption in mass-market vehicles.

Material brittleness continues to be a fundamental challenge. While ceramics offer excellent compression strength, their tensile strength is considerably lower, making them susceptible to catastrophic failure under certain stress conditions. This characteristic necessitates sophisticated design approaches and safety margins that further complicate implementation.

Integration challenges persist when combining ceramic components with traditional metal engine parts. Differences in thermal expansion coefficients create stress at material interfaces, requiring innovative joining techniques and careful system design. Current solutions include specialized ceramic-to-metal brazing methods and gradient materials, though these add complexity to manufacturing processes.

Geographically, Japan leads in ceramic engine technology development, with companies like NGK and Kyocera at the forefront. European manufacturers, particularly in Germany, focus on high-performance applications, while North American research institutions contribute significantly to fundamental material science advancements. China has rapidly expanded its ceramic manufacturing capabilities but still lags in high-precision engine component production.

Recent technological breakthroughs include nano-ceramic composites that demonstrate improved fracture toughness while maintaining thermal properties. Additionally, advanced coating technologies have enabled hybrid approaches where conventional metal components receive ceramic thermal barrier coatings, offering a compromise between performance and manufacturing complexity.

Standardization remains underdeveloped, with limited industry-wide specifications for ceramic engine components. This creates challenges for suppliers and manufacturers in ensuring compatibility and reliability across different applications and systems, further constraining market expansion beyond specialized high-performance segments.

Current Ceramic Integration Solutions for Engines

01 Ceramic materials for engine components

Structural ceramics can be used to manufacture engine components such as pistons, cylinders, and combustion chambers due to their high temperature resistance and low thermal conductivity. These properties allow engines to operate at higher temperatures, which increases thermal efficiency and reduces fuel consumption. Additionally, ceramic components are lighter than their metal counterparts, further contributing to fuel efficiency improvements through weight reduction.- Ceramic materials for engine components: Structural ceramics can be used to manufacture engine components such as pistons, cylinders, and combustion chambers due to their high temperature resistance and low thermal expansion. These ceramic components reduce heat loss, improve combustion efficiency, and decrease friction, leading to enhanced fuel efficiency in internal combustion engines. The lightweight nature of advanced ceramics also contributes to overall weight reduction of the engine, further improving fuel economy.

- Ceramic thermal barrier coatings: Ceramic thermal barrier coatings applied to engine components can significantly improve fuel efficiency by providing insulation that maintains optimal operating temperatures. These coatings reduce heat transfer from combustion gases to engine cooling systems, allowing more thermal energy to be converted to mechanical work. The thermal barrier properties also enable engines to operate at higher temperatures, increasing thermodynamic efficiency while protecting the underlying metal components from thermal degradation.

- Ceramic materials for vehicle lightweighting: Structural ceramics contribute to vehicle lightweighting strategies by replacing heavier metal components while maintaining or improving mechanical strength. The reduced vehicle weight directly translates to improved fuel efficiency as less energy is required for acceleration and maintaining speed. Advanced ceramic composites provide excellent strength-to-weight ratios and can be engineered for specific applications in automotive structures, suspension systems, and drivetrain components.

- Ceramic catalyst supports for emission control: Ceramic materials serve as effective catalyst supports in emission control systems, improving fuel efficiency while reducing harmful emissions. The high surface area and thermal stability of ceramic substrates enhance catalytic converter performance, allowing engines to operate at more efficient air-fuel ratios. These ceramic structures maintain their integrity under extreme exhaust temperatures and provide uniform flow distribution, optimizing the catalytic reactions that clean exhaust gases while minimizing back pressure that would otherwise reduce engine efficiency.

- Advanced ceramic manufacturing processes for fuel-efficient applications: Innovative manufacturing processes for structural ceramics enable the production of complex geometries and precise components that enhance fuel efficiency. These processes include advanced sintering techniques, additive manufacturing, and precision machining that create ceramics with optimized properties for specific applications. The resulting components feature controlled porosity, enhanced surface finishes, and integrated functionality that contribute to reduced friction, improved thermal management, and overall system efficiency in various transportation and energy applications.

02 Ceramic thermal barrier coatings

Ceramic coatings can be applied to engine components to create thermal barriers that improve fuel efficiency. These coatings reduce heat transfer from combustion gases to engine components, allowing more thermal energy to be converted to mechanical work rather than being lost as waste heat. The insulating properties of ceramic coatings also enable higher operating temperatures and more complete combustion, leading to improved fuel efficiency and reduced emissions.Expand Specific Solutions03 Lightweight ceramic composites for vehicle structures

Advanced ceramic composites can be used to replace heavier materials in vehicle structures, reducing overall vehicle weight and improving fuel efficiency. These ceramic-based materials offer high strength-to-weight ratios while maintaining structural integrity. The weight reduction achieved through the use of ceramic composites directly translates to lower fuel consumption, as less energy is required to accelerate and maintain the speed of lighter vehicles.Expand Specific Solutions04 Ceramic components for fuel systems

Structural ceramics can be incorporated into fuel system components such as fuel injectors, pumps, and sensors. The precision and durability of ceramic components allow for more accurate fuel delivery and atomization, leading to more efficient combustion. Ceramic materials also resist corrosion and wear, maintaining optimal performance over longer periods and preventing efficiency degradation that occurs with worn components.Expand Specific Solutions05 Ceramic heat exchangers and energy recovery systems

Ceramic heat exchangers and energy recovery systems can capture and utilize waste heat from engines and exhaust systems. The high thermal stability and conductivity of certain ceramic materials make them ideal for recovering thermal energy that would otherwise be lost. These systems can redirect captured heat to pre-heat intake air or fuel, power auxiliary systems, or generate additional power through thermoelectric conversion, all of which contribute to improved overall fuel efficiency.Expand Specific Solutions

Leading Manufacturers and Research Institutions Analysis

The structural ceramics market for engine fuel efficiency is in a growth phase, with increasing adoption driven by stringent emissions regulations and fuel economy demands. The market is projected to expand significantly as automotive and aerospace industries seek higher performance materials. Technologically, the field shows varying maturity levels across applications, with companies like NGK Insulators, Kyocera, and Corning leading commercial deployment of advanced ceramic components. Siemens Energy, Rolls-Royce, and Cummins are integrating these materials into next-generation engine designs, while research institutions like Kunming University of Science & Technology are advancing fundamental ceramic properties. Continental Automotive and Robert Bosch are developing ceramic-based sensor and control systems to further optimize engine performance.

NGK Insulators, Ltd.

Technical Solution: NGK Insulators has pioneered silicon nitride-based structural ceramics specifically designed for engine applications requiring extreme durability and thermal resistance. Their proprietary manufacturing process creates ceramic components with uniform microstructures that minimize internal defects, resulting in exceptional mechanical reliability. NGK's ceramic glow plugs utilize their advanced silicon nitride technology to achieve rapid heating (reaching 1000°C within seconds) and maintain stable temperatures, enabling more complete combustion in diesel engines and reducing fuel consumption by up to 25% during cold starts. Their ceramic turbocharger rotors feature specialized compositions that maintain strength at temperatures exceeding 1200°C, allowing for higher boost pressures without the cooling requirements of metal alternatives. NGK has also developed ceramic-lined exhaust gas recirculation (EGR) components that resist corrosion from acidic combustion byproducts, maintaining optimal flow characteristics throughout the engine's lifespan.

Strengths: Exceptional thermal shock resistance allowing rapid temperature changes without failure; superior corrosion resistance in combustion environments; ability to maintain tight tolerances even after thousands of thermal cycles; lower density reducing rotating mass in turbochargers. Weaknesses: Complex manufacturing processes increasing production costs; limited repairability when damaged; challenges in quality control requiring sophisticated non-destructive testing methods.

Robert Bosch GmbH

Technical Solution: Bosch has developed a comprehensive suite of structural ceramic solutions specifically targeting internal combustion engine efficiency. Their silicon nitride-based fuel injector components feature precision-ground surfaces with roughness values below 0.1μm, enabling more precise fuel atomization and reducing unburned hydrocarbon emissions by up to 20%. Bosch's ceramic valve seats maintain dimensional stability even after millions of cycles at elevated temperatures, preserving optimal valve sealing and preventing compression losses that would otherwise reduce efficiency. Their zirconia-based oxygen sensors utilize the material's unique ionic conductivity properties to provide precise air-fuel ratio measurements, enabling engines to operate consistently at their most efficient combustion point. Bosch has also pioneered ceramic glow plugs that reach operating temperatures in less than 2 seconds—approximately 70% faster than conventional metal designs—significantly reducing cold-start fuel consumption in diesel engines. These technologies are integrated into Bosch's engine management systems to optimize combustion parameters in real-time, adapting to changing operating conditions for maximum efficiency.

Strengths: Comprehensive integration with electronic control systems maximizing real-world efficiency gains; extensive manufacturing expertise ensuring consistent quality; proven durability in mass-production applications; compatibility with existing engine architectures facilitating adoption. Weaknesses: Incremental rather than revolutionary efficiency improvements; continued dependence on precision manufacturing processes; challenges in cost reduction for economy vehicle segments.

Key Patents and Innovations in Engine Ceramic Materials

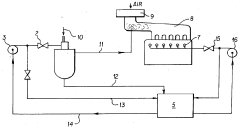

Method for improving fuel efficiency and reduced emissions in internal combustion engines

PatentInactiveUS4524730A

Innovation

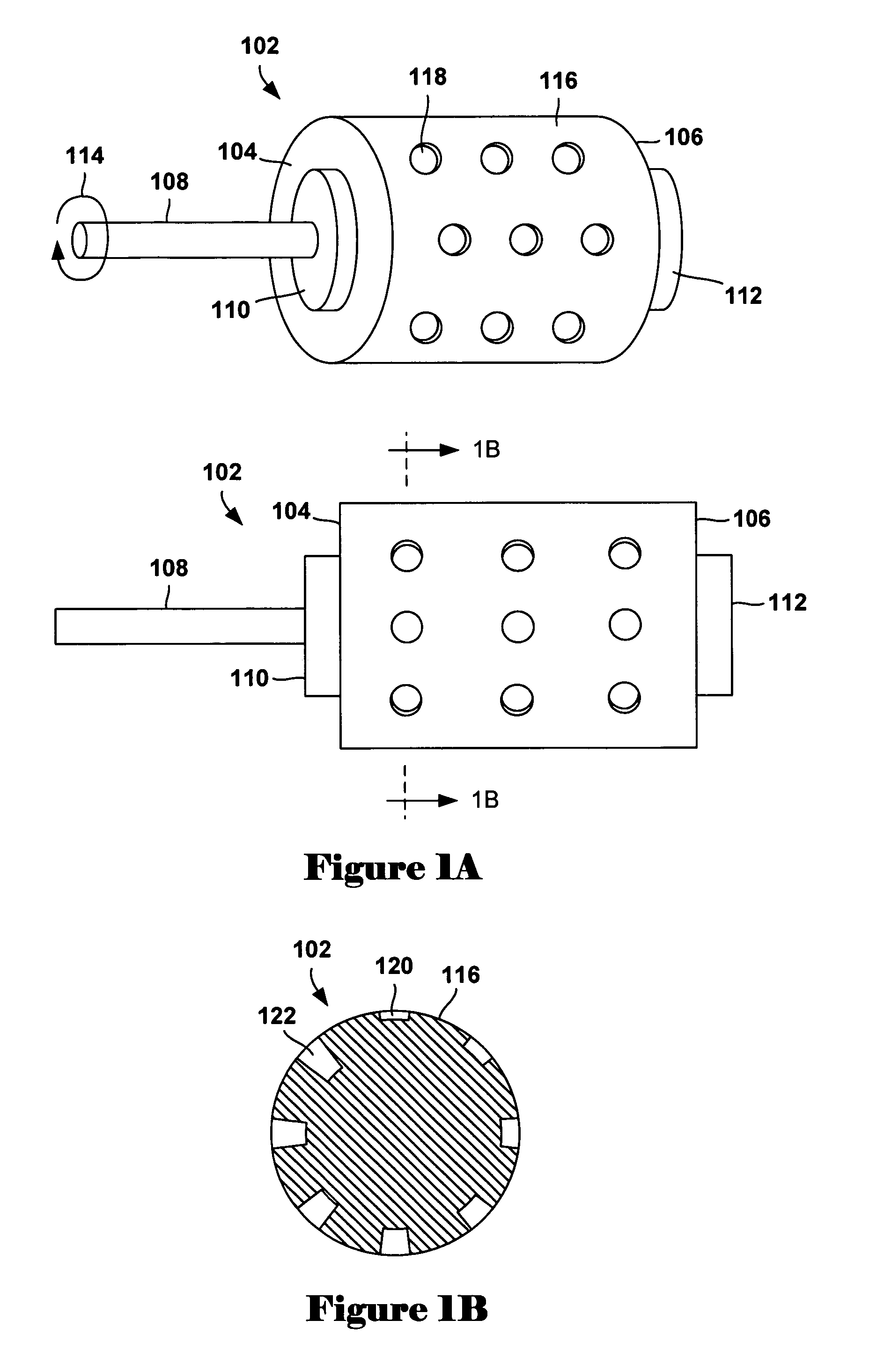

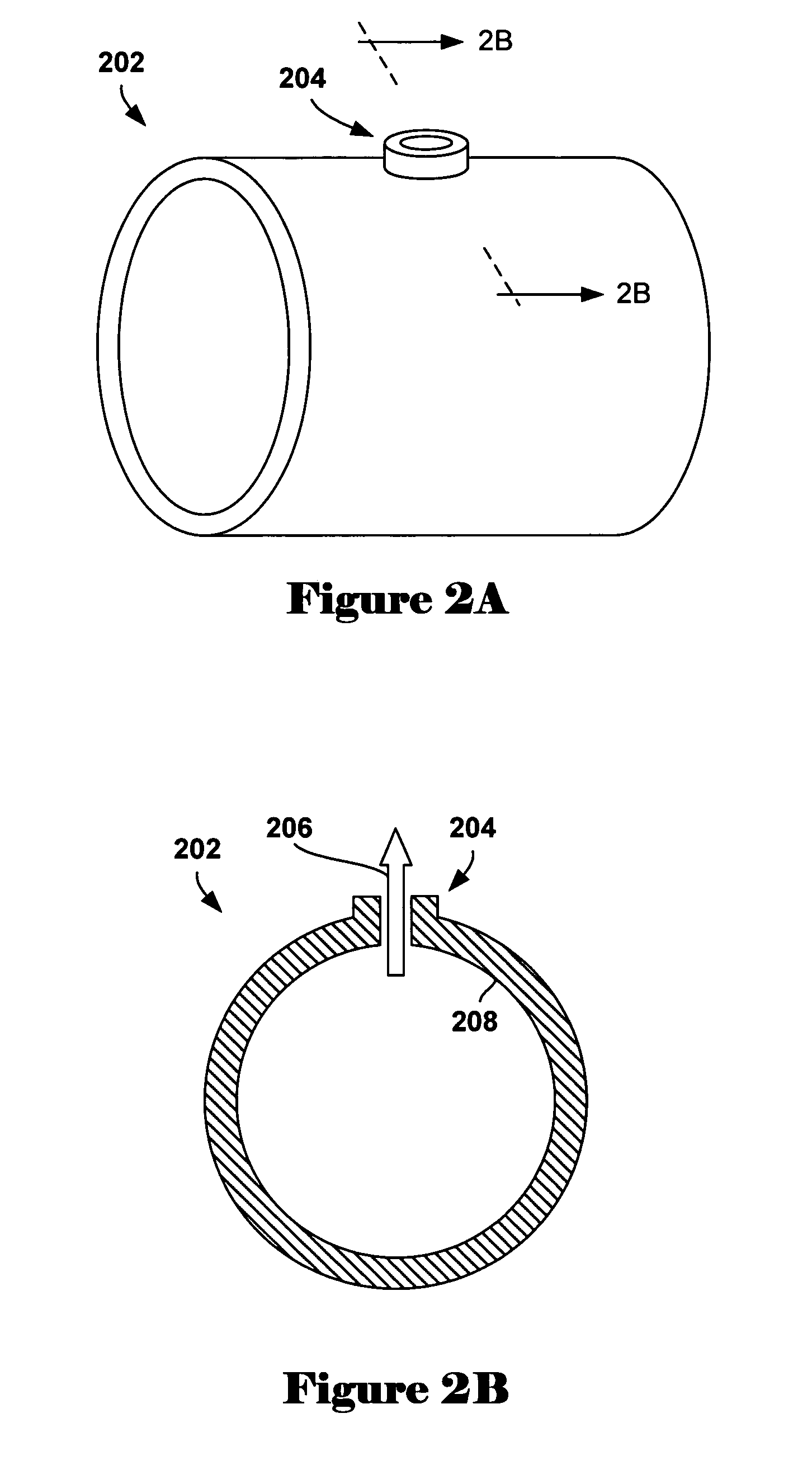

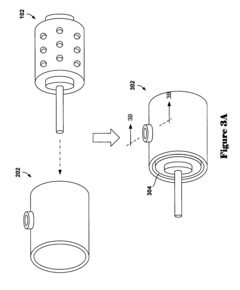

- A vaporization chamber system that introduces a small percentage of vaporized fuel into the air intake stream of internal combustion engines, operating alongside the standard fuel delivery system, suitable for various engine types without substantial redesign, using a vaporization chamber with fuel and air inputs connected to the intake manifold.

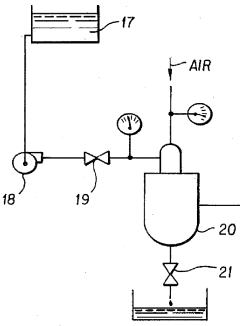

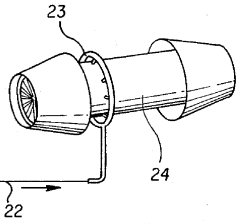

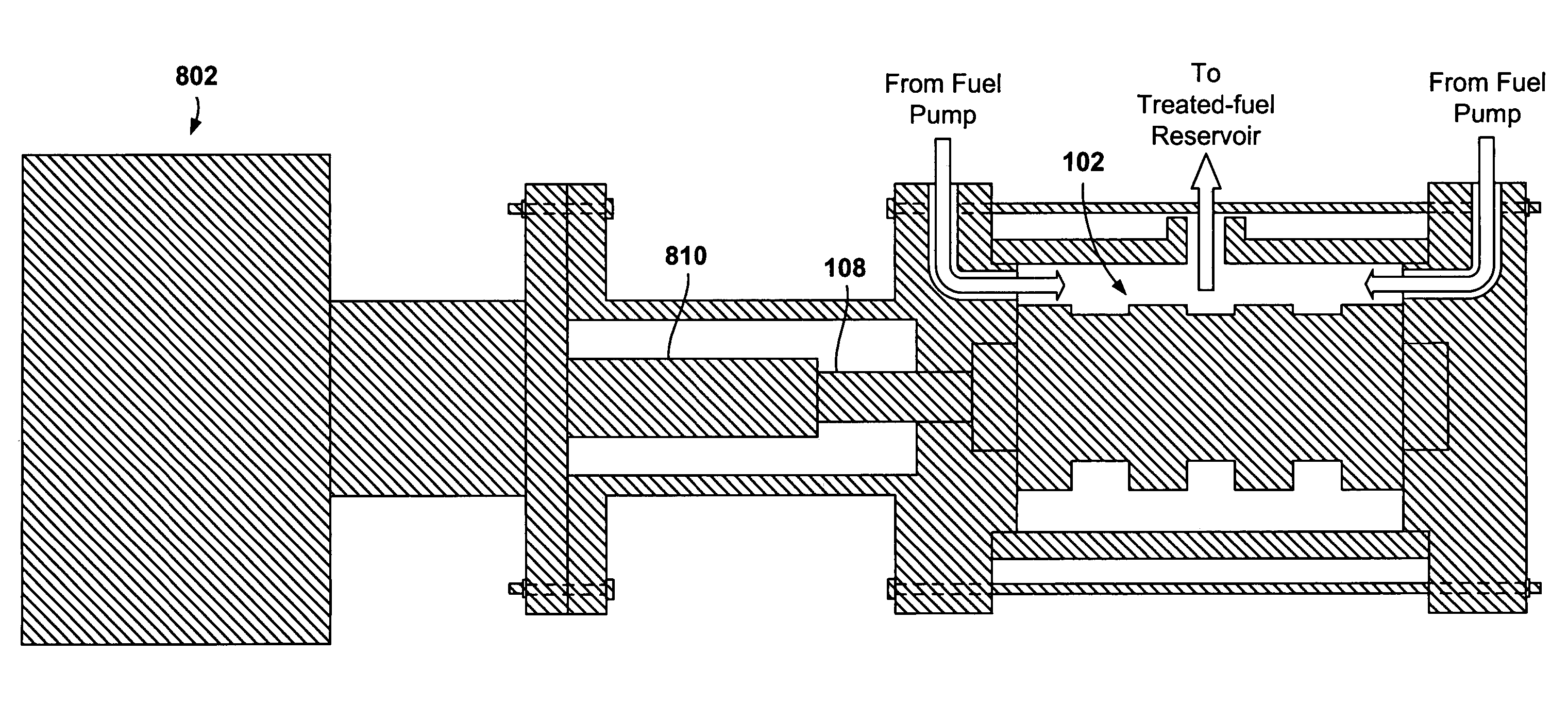

System and method for treating fuel to increase fuel efficiency in internal combustion engines

PatentInactiveUS7334781B2

Innovation

- A system and method involving a fuel-acceleration chamber where hydrocarbon-based fuel is radially accelerated by a rotating rotor within a stationary rotor housing, generating turbulence and cavitation, before being output to a treated-fuel reservoir and combustion site, to increase fuel efficiency.

Environmental Impact and Emissions Reduction Potential

The implementation of structural ceramics in engine design represents a significant advancement in reducing environmental impact through improved fuel efficiency. When engines operate with ceramic components, they can withstand higher temperatures, allowing for more complete combustion processes. This optimization directly translates to reduced carbon dioxide (CO2) emissions per unit of power generated, with studies indicating potential reductions of 5-15% compared to conventional metal-based engine designs.

Beyond CO2 reduction, structural ceramics contribute substantially to decreasing nitrogen oxide (NOx) emissions. The precise temperature control enabled by ceramic components helps maintain optimal combustion conditions, minimizing the formation of these harmful pollutants. Research demonstrates that ceramic-enhanced engines can achieve up to 20% reduction in NOx emissions without compromising performance parameters.

Particulate matter emissions also see notable improvement with ceramic implementation. The enhanced thermal efficiency and more complete combustion process result in fewer unburned hydrocarbons and soot particles. This benefit is particularly significant for diesel engines, where particulate emissions have traditionally been a major environmental concern.

From a lifecycle perspective, ceramic components offer additional environmental advantages. Their exceptional durability extends engine service life, reducing the environmental footprint associated with manufacturing replacement parts. Although ceramic production initially requires substantial energy input, the extended operational lifespan and efficiency gains typically offset this environmental cost within the first 30-40% of the engine's service life.

The emissions reduction potential of structural ceramics extends beyond direct engine operation. By enabling more efficient engines, these materials support broader transportation electrification efforts through more efficient hybrid systems. Ceramic components in hybrid powertrains can optimize the thermal management between combustion and electric systems, further enhancing overall environmental performance.

Regulatory frameworks worldwide increasingly recognize these environmental benefits. Several countries have implemented incentive programs for manufacturers employing advanced ceramic technologies in engine design, acknowledging their contribution to meeting increasingly stringent emissions standards. This regulatory support accelerates adoption and continues to drive innovation in ceramic applications for transportation systems.

Beyond CO2 reduction, structural ceramics contribute substantially to decreasing nitrogen oxide (NOx) emissions. The precise temperature control enabled by ceramic components helps maintain optimal combustion conditions, minimizing the formation of these harmful pollutants. Research demonstrates that ceramic-enhanced engines can achieve up to 20% reduction in NOx emissions without compromising performance parameters.

Particulate matter emissions also see notable improvement with ceramic implementation. The enhanced thermal efficiency and more complete combustion process result in fewer unburned hydrocarbons and soot particles. This benefit is particularly significant for diesel engines, where particulate emissions have traditionally been a major environmental concern.

From a lifecycle perspective, ceramic components offer additional environmental advantages. Their exceptional durability extends engine service life, reducing the environmental footprint associated with manufacturing replacement parts. Although ceramic production initially requires substantial energy input, the extended operational lifespan and efficiency gains typically offset this environmental cost within the first 30-40% of the engine's service life.

The emissions reduction potential of structural ceramics extends beyond direct engine operation. By enabling more efficient engines, these materials support broader transportation electrification efforts through more efficient hybrid systems. Ceramic components in hybrid powertrains can optimize the thermal management between combustion and electric systems, further enhancing overall environmental performance.

Regulatory frameworks worldwide increasingly recognize these environmental benefits. Several countries have implemented incentive programs for manufacturers employing advanced ceramic technologies in engine design, acknowledging their contribution to meeting increasingly stringent emissions standards. This regulatory support accelerates adoption and continues to drive innovation in ceramic applications for transportation systems.

Manufacturing Scalability and Cost Optimization Strategies

The scalability of structural ceramic manufacturing represents a critical challenge in the widespread adoption of these materials for engine applications. Current production methods for advanced ceramics such as silicon nitride, silicon carbide, and zirconia often involve complex processes including powder preparation, forming, sintering, and precision machining. These processes traditionally require significant capital investment and specialized equipment, limiting mass production capabilities and increasing unit costs.

To address these challenges, several promising manufacturing optimization strategies have emerged. Injection molding techniques adapted specifically for ceramic materials have demonstrated potential for high-volume production of complex engine components with consistent quality. This approach reduces labor costs while maintaining tight dimensional tolerances necessary for engine applications. Similarly, advanced pressing technologies combined with near-net-shape forming processes minimize expensive post-sintering machining operations.

Cost reduction initiatives must focus on raw material sourcing and processing improvements. The development of standardized ceramic powder specifications and increased supplier competition can drive down material costs, which currently represent 30-40% of total production expenses. Additionally, implementing lean manufacturing principles throughout the production chain has shown potential to reduce waste by up to 25% in pilot programs.

Energy consumption during sintering remains a significant cost factor. New microwave and field-assisted sintering technologies demonstrate potential energy savings of 40-60% compared to conventional methods while simultaneously reducing processing time from days to hours. These technologies not only lower production costs but also improve environmental sustainability metrics important to automotive manufacturers.

Quality control automation represents another critical optimization pathway. Advanced non-destructive testing methods using acoustic emission and computed tomography enable 100% inspection of critical components without increasing labor costs proportionally to production volume. This ensures reliability while maintaining competitive pricing structures necessary for market penetration.

Strategic partnerships between ceramic manufacturers and automotive OEMs offer additional cost optimization opportunities through vertical integration and knowledge sharing. Joint development programs have successfully reduced development cycles by up to 40% while ensuring designs are optimized for both performance and manufacturability from inception. These collaborative approaches help distribute initial investment costs and accelerate time-to-market for new ceramic engine components.

To address these challenges, several promising manufacturing optimization strategies have emerged. Injection molding techniques adapted specifically for ceramic materials have demonstrated potential for high-volume production of complex engine components with consistent quality. This approach reduces labor costs while maintaining tight dimensional tolerances necessary for engine applications. Similarly, advanced pressing technologies combined with near-net-shape forming processes minimize expensive post-sintering machining operations.

Cost reduction initiatives must focus on raw material sourcing and processing improvements. The development of standardized ceramic powder specifications and increased supplier competition can drive down material costs, which currently represent 30-40% of total production expenses. Additionally, implementing lean manufacturing principles throughout the production chain has shown potential to reduce waste by up to 25% in pilot programs.

Energy consumption during sintering remains a significant cost factor. New microwave and field-assisted sintering technologies demonstrate potential energy savings of 40-60% compared to conventional methods while simultaneously reducing processing time from days to hours. These technologies not only lower production costs but also improve environmental sustainability metrics important to automotive manufacturers.

Quality control automation represents another critical optimization pathway. Advanced non-destructive testing methods using acoustic emission and computed tomography enable 100% inspection of critical components without increasing labor costs proportionally to production volume. This ensures reliability while maintaining competitive pricing structures necessary for market penetration.

Strategic partnerships between ceramic manufacturers and automotive OEMs offer additional cost optimization opportunities through vertical integration and knowledge sharing. Joint development programs have successfully reduced development cycles by up to 40% while ensuring designs are optimized for both performance and manufacturability from inception. These collaborative approaches help distribute initial investment costs and accelerate time-to-market for new ceramic engine components.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!