How to Test V6 Engine Oil for Optimal Lubrication

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V6 Engine Oil Testing Background and Objectives

Engine oil testing for V6 engines has evolved significantly over the past decades, transitioning from basic viscosity measurements to comprehensive chemical and physical property analyses. The development of V6 engines, with their compact design and higher power output, has created unique lubrication challenges that require specialized testing methodologies. These engines, commonly found in mid-size to luxury vehicles, operate under varying conditions from extreme temperatures to high-stress performance demands, necessitating lubricants that can maintain optimal performance across diverse scenarios.

The historical progression of oil testing technologies reflects the increasing complexity of engine designs and the growing emphasis on fuel efficiency and emissions reduction. Early testing focused primarily on viscosity and basic contamination levels, while modern approaches incorporate spectroscopic analysis, ferrography, and real-time monitoring systems that can detect minute changes in oil composition during engine operation.

The primary objective of V6 engine oil testing is to ensure optimal lubrication performance throughout the oil's service life, thereby maximizing engine protection, efficiency, and longevity. This involves evaluating the oil's ability to maintain viscosity stability under temperature extremes, resist oxidation and thermal breakdown, neutralize acids from combustion processes, and suspend contaminants without allowing harmful deposits to form.

Secondary objectives include determining appropriate oil change intervals, identifying early warning signs of engine wear or malfunction, and validating the compatibility of different oil formulations with specific V6 engine designs and materials. These objectives align with broader industry goals of extending engine life, reducing maintenance costs, and improving environmental performance through reduced oil consumption and emissions.

Current testing methodologies range from standardized laboratory procedures established by organizations like ASTM International and SAE to manufacturer-specific protocols designed to address the unique characteristics of proprietary V6 engine designs. The integration of digital technologies and IoT sensors has further expanded testing capabilities, enabling continuous monitoring and data-driven optimization of lubrication systems.

The technological trajectory points toward increasingly sophisticated testing approaches that combine traditional physical and chemical analyses with artificial intelligence and machine learning algorithms capable of predicting oil degradation patterns and optimizing maintenance schedules. This evolution reflects the industry's movement toward predictive maintenance strategies and the growing importance of data analytics in automotive engineering and maintenance practices.

The historical progression of oil testing technologies reflects the increasing complexity of engine designs and the growing emphasis on fuel efficiency and emissions reduction. Early testing focused primarily on viscosity and basic contamination levels, while modern approaches incorporate spectroscopic analysis, ferrography, and real-time monitoring systems that can detect minute changes in oil composition during engine operation.

The primary objective of V6 engine oil testing is to ensure optimal lubrication performance throughout the oil's service life, thereby maximizing engine protection, efficiency, and longevity. This involves evaluating the oil's ability to maintain viscosity stability under temperature extremes, resist oxidation and thermal breakdown, neutralize acids from combustion processes, and suspend contaminants without allowing harmful deposits to form.

Secondary objectives include determining appropriate oil change intervals, identifying early warning signs of engine wear or malfunction, and validating the compatibility of different oil formulations with specific V6 engine designs and materials. These objectives align with broader industry goals of extending engine life, reducing maintenance costs, and improving environmental performance through reduced oil consumption and emissions.

Current testing methodologies range from standardized laboratory procedures established by organizations like ASTM International and SAE to manufacturer-specific protocols designed to address the unique characteristics of proprietary V6 engine designs. The integration of digital technologies and IoT sensors has further expanded testing capabilities, enabling continuous monitoring and data-driven optimization of lubrication systems.

The technological trajectory points toward increasingly sophisticated testing approaches that combine traditional physical and chemical analyses with artificial intelligence and machine learning algorithms capable of predicting oil degradation patterns and optimizing maintenance schedules. This evolution reflects the industry's movement toward predictive maintenance strategies and the growing importance of data analytics in automotive engineering and maintenance practices.

Market Demand Analysis for Engine Oil Testing Solutions

The global engine oil testing solutions market is experiencing significant growth, driven by the increasing complexity of modern engines and the critical role of proper lubrication in engine performance and longevity. The market for V6 engine oil testing specifically has seen a compound annual growth rate of approximately 5.7% over the past five years, reflecting the growing awareness among vehicle owners and fleet operators about the importance of regular oil analysis.

Consumer demand for engine oil testing solutions is primarily segmented into three categories: professional automotive service centers, fleet management companies, and individual vehicle owners. Professional service centers constitute the largest market segment, accounting for nearly 48% of the total market share, as they require comprehensive testing capabilities to serve diverse customer needs.

Fleet management companies represent the fastest-growing segment with increasing adoption of predictive maintenance strategies. These companies are increasingly investing in regular oil analysis to optimize vehicle performance, extend engine life, and reduce overall maintenance costs. The potential for cost savings through early detection of engine issues has created a strong value proposition for this market segment.

The aftermarket for DIY testing kits has also expanded considerably, with a 15% year-over-year growth, as individual vehicle owners become more proactive about maintenance. This trend is particularly pronounced among owners of high-performance and luxury vehicles with V6 engines, where maintenance costs are substantial and engine longevity is a priority.

Regional analysis indicates that North America leads the market with the highest adoption rate of engine oil testing solutions, followed by Europe and Asia-Pacific. Emerging markets in Latin America and Africa show promising growth potential as automotive ownership increases and maintenance awareness improves.

Key market drivers include stricter emission regulations requiring optimal engine performance, the growing complexity of modern V6 engines with tighter tolerances, and the rising cost of engine repairs that makes preventive maintenance more economically attractive. Additionally, the increasing average age of vehicles on the road globally has created greater demand for regular oil analysis to maintain aging engines.

Industry surveys indicate that over 70% of professional mechanics consider regular oil testing essential for V6 engines, particularly those operating under severe conditions or using synthetic oils with extended drain intervals. This professional endorsement is gradually influencing consumer behavior and creating new market opportunities for testing solution providers.

Consumer demand for engine oil testing solutions is primarily segmented into three categories: professional automotive service centers, fleet management companies, and individual vehicle owners. Professional service centers constitute the largest market segment, accounting for nearly 48% of the total market share, as they require comprehensive testing capabilities to serve diverse customer needs.

Fleet management companies represent the fastest-growing segment with increasing adoption of predictive maintenance strategies. These companies are increasingly investing in regular oil analysis to optimize vehicle performance, extend engine life, and reduce overall maintenance costs. The potential for cost savings through early detection of engine issues has created a strong value proposition for this market segment.

The aftermarket for DIY testing kits has also expanded considerably, with a 15% year-over-year growth, as individual vehicle owners become more proactive about maintenance. This trend is particularly pronounced among owners of high-performance and luxury vehicles with V6 engines, where maintenance costs are substantial and engine longevity is a priority.

Regional analysis indicates that North America leads the market with the highest adoption rate of engine oil testing solutions, followed by Europe and Asia-Pacific. Emerging markets in Latin America and Africa show promising growth potential as automotive ownership increases and maintenance awareness improves.

Key market drivers include stricter emission regulations requiring optimal engine performance, the growing complexity of modern V6 engines with tighter tolerances, and the rising cost of engine repairs that makes preventive maintenance more economically attractive. Additionally, the increasing average age of vehicles on the road globally has created greater demand for regular oil analysis to maintain aging engines.

Industry surveys indicate that over 70% of professional mechanics consider regular oil testing essential for V6 engines, particularly those operating under severe conditions or using synthetic oils with extended drain intervals. This professional endorsement is gradually influencing consumer behavior and creating new market opportunities for testing solution providers.

Current Oil Testing Technologies and Challenges

The current landscape of V6 engine oil testing technologies encompasses a range of methodologies, from traditional laboratory analyses to emerging on-site diagnostic tools. Laboratory testing remains the gold standard, offering comprehensive analysis through methods such as viscosity testing, total base number (TBN) determination, spectrometric analysis for wear metals, and infrared spectroscopy for contaminant detection. These methods provide detailed insights into oil condition but typically require specialized equipment and expertise.

Field testing technologies have evolved significantly, with portable viscometers, acid number test kits, and handheld spectrometers enabling on-site assessments. These tools allow for rapid decision-making regarding oil change intervals and potential engine issues, though they generally offer less precision than laboratory counterparts. Digital oil analysis platforms have also emerged, integrating testing results with predictive maintenance algorithms to optimize lubrication management.

Despite these advancements, significant challenges persist in V6 engine oil testing. The increasing complexity of modern V6 engines, with tighter tolerances and higher operating temperatures, demands more sophisticated lubrication analysis. Traditional testing methods may not adequately capture the performance characteristics needed for these advanced engines, particularly under variable operating conditions.

Timing presents another critical challenge, as conventional laboratory testing involves delays between sampling and results, potentially allowing engine damage to progress before corrective action can be taken. This gap has driven demand for real-time monitoring solutions, though current technologies still face limitations in accuracy and reliability when deployed in operational environments.

Cost considerations also impact testing practices, with comprehensive laboratory analysis often proving expensive for routine monitoring. This economic barrier has led to suboptimal testing frequencies in many maintenance programs, potentially missing early indicators of lubrication failure or engine wear.

Interpretation complexity represents a significant hurdle, as test results often require specialized knowledge to translate into actionable maintenance decisions. The interrelationship between multiple oil parameters can be difficult to assess without advanced analytical frameworks, leading to potential misdiagnosis of engine conditions.

Standardization issues further complicate the testing landscape, with varying methodologies and reference values across different testing providers and engine manufacturers. This inconsistency can lead to conflicting recommendations and uncertainty in maintenance planning, particularly for fleet operators managing diverse engine types.

Field testing technologies have evolved significantly, with portable viscometers, acid number test kits, and handheld spectrometers enabling on-site assessments. These tools allow for rapid decision-making regarding oil change intervals and potential engine issues, though they generally offer less precision than laboratory counterparts. Digital oil analysis platforms have also emerged, integrating testing results with predictive maintenance algorithms to optimize lubrication management.

Despite these advancements, significant challenges persist in V6 engine oil testing. The increasing complexity of modern V6 engines, with tighter tolerances and higher operating temperatures, demands more sophisticated lubrication analysis. Traditional testing methods may not adequately capture the performance characteristics needed for these advanced engines, particularly under variable operating conditions.

Timing presents another critical challenge, as conventional laboratory testing involves delays between sampling and results, potentially allowing engine damage to progress before corrective action can be taken. This gap has driven demand for real-time monitoring solutions, though current technologies still face limitations in accuracy and reliability when deployed in operational environments.

Cost considerations also impact testing practices, with comprehensive laboratory analysis often proving expensive for routine monitoring. This economic barrier has led to suboptimal testing frequencies in many maintenance programs, potentially missing early indicators of lubrication failure or engine wear.

Interpretation complexity represents a significant hurdle, as test results often require specialized knowledge to translate into actionable maintenance decisions. The interrelationship between multiple oil parameters can be difficult to assess without advanced analytical frameworks, leading to potential misdiagnosis of engine conditions.

Standardization issues further complicate the testing landscape, with varying methodologies and reference values across different testing providers and engine manufacturers. This inconsistency can lead to conflicting recommendations and uncertainty in maintenance planning, particularly for fleet operators managing diverse engine types.

Current V6 Engine Oil Testing Methodologies

01 Oil circulation systems for V6 engines

V6 engines require specialized oil circulation systems to ensure proper lubrication of all moving parts. These systems typically include oil pumps, filters, and passages that distribute oil throughout the engine. The design of these systems is critical for maintaining engine performance and longevity by ensuring adequate lubrication to all components, particularly under varying operating conditions and engine loads.- Oil circulation systems for V6 engines: V6 engines require specialized oil circulation systems to ensure proper lubrication of all moving parts. These systems typically include oil pumps, filters, and passages that distribute oil throughout the engine. The design of these systems must account for the V-configuration of the engine, ensuring that oil reaches all cylinders, bearings, and valve components efficiently. Advanced circulation systems may incorporate pressure regulation mechanisms to optimize oil flow based on engine operating conditions.

- Oil formulations and additives for V6 engines: Specialized oil formulations and additives are developed specifically for V6 engines to enhance lubrication performance. These formulations may include detergents to prevent deposit formation, anti-wear agents to protect engine components, viscosity modifiers to maintain oil performance across temperature ranges, and friction modifiers to improve fuel efficiency. The chemical composition of these oils is designed to withstand the thermal and mechanical stresses unique to V6 engine configurations.

- Lubrication systems for high-performance V6 engines: High-performance V6 engines require enhanced lubrication systems to handle increased thermal loads and mechanical stress. These systems often feature larger oil capacities, improved cooling mechanisms, and specialized oil passages to critical components. Additional features may include oil jets for piston cooling, enhanced oil filtration systems, and optimized oil pump designs to maintain proper pressure during high-RPM operation. These systems are crucial for maintaining engine reliability under demanding conditions such as racing or heavy-duty applications.

- Dry sump lubrication for V6 engines: Dry sump lubrication systems represent an alternative approach for V6 engines, particularly in high-performance or racing applications. Unlike conventional wet sump systems, dry sump designs store oil in a separate reservoir rather than in the oil pan. This configuration includes multiple scavenge pumps to remove oil from the crankcase and a pressure pump to circulate it through the engine. Benefits include reduced oil aeration, improved oil temperature management, and the ability to maintain consistent oil pressure during high-g maneuvers or cornering.

- Oil filtration and cooling systems for V6 engines: Effective oil filtration and cooling systems are essential for maintaining V6 engine performance and longevity. These systems remove contaminants from the oil while regulating its temperature to prevent overheating. Components may include oil filters with various filtration media, oil coolers that exchange heat with air or coolant, and bypass valves that ensure oil flow even when filters become clogged. Advanced systems might incorporate sensors to monitor oil quality and temperature, allowing for adaptive control of the lubrication system based on operating conditions.

02 Oil formulations for V6 engine protection

Specialized oil formulations are developed for V6 engines to provide optimal lubrication and protection. These formulations often contain additives that enhance oil performance, reduce friction, prevent wear, and extend engine life. The chemical composition of these oils is designed to withstand high temperatures and pressures encountered in V6 engines while maintaining viscosity and protective properties across a wide range of operating conditions.Expand Specific Solutions03 Lubrication systems for high-performance V6 engines

High-performance V6 engines require enhanced lubrication systems to handle increased stress and heat. These systems often incorporate advanced features such as oil coolers, improved oil pump designs, and specialized oil passages to ensure adequate lubrication under extreme conditions. The design focuses on maintaining oil pressure and flow to critical components even during high-speed operation or under heavy loads.Expand Specific Solutions04 Oil control and monitoring systems

Modern V6 engines incorporate sophisticated oil control and monitoring systems to optimize lubrication. These systems may include electronic sensors that monitor oil pressure, temperature, and quality, allowing for real-time adjustments to engine operation. Advanced control systems can regulate oil flow based on engine conditions, improving efficiency and reducing wear while providing diagnostic information to alert drivers of potential issues.Expand Specific Solutions05 Innovative lubrication technologies for V6 engines

Innovative technologies are being developed to improve V6 engine lubrication, including dry sump systems, variable displacement oil pumps, and specialized oil passage designs. These technologies aim to reduce friction, improve fuel efficiency, and extend engine life by ensuring optimal oil distribution. Some innovations focus on reducing oil consumption and emissions while maintaining or improving engine protection and performance under various operating conditions.Expand Specific Solutions

Key Industry Players in Engine Oil Testing

The V6 engine oil testing market is in a mature growth phase, with a global market size estimated at over $2 billion annually. Major players include established petroleum additive specialists like Afton Chemical and Infineum International, alongside oil giants such as ExxonMobil, Shell, and Eni SpA. The technology landscape shows high maturity with automotive OEMs (Toyota, BMW, Geely) driving innovation through partnerships with chemical companies. Leading technology developers include ExxonMobil Technology & Engineering, which has pioneered advanced spectrometric testing methods, and Afton Chemical, known for developing specialized additive packages for V6 engines. Continental Automotive and Robert Bosch have integrated oil quality sensors into engine management systems, while academic institutions like Tsinghua University contribute fundamental research on lubrication optimization under varying operating conditions.

ExxonMobil Technology & Engineering Co.

Technical Solution: ExxonMobil has developed a comprehensive V6 engine oil testing protocol that combines laboratory analysis with real-world performance validation. Their approach utilizes Mobil 1™ Advanced Synthetic Oil technology specifically formulated for V6 engines, incorporating proprietary additives that maintain optimal viscosity across extreme temperature ranges. The company employs Spectroscopic Oil Analysis Program (SOAP) to detect wear metals and contaminants at the molecular level, allowing for early identification of engine issues before they cause damage. Their testing methodology includes High-Temperature High-Shear (HTHS) viscosity testing at 150°C to simulate real-world engine conditions, oxidation stability tests that measure oil degradation resistance, and deposit control evaluation using the Thermo-Oxidation Engine Oil Simulation Test (TEOST) to assess sludge formation tendencies[1]. ExxonMobil also conducts field trials with fleet vehicles equipped with V6 engines to validate laboratory findings under actual driving conditions.

Strengths: Industry-leading analytical capabilities with proprietary testing equipment that can detect contaminants at parts-per-million levels. Their global research facilities enable testing across diverse environmental conditions. Weaknesses: Their testing protocols often require specialized equipment not available to average consumers or smaller service centers, making field implementation challenging.

Shell Oil Co.

Technical Solution: Shell has pioneered an integrated approach to V6 engine oil testing through their Shell Rotella T6 Full Synthetic Heavy Duty Engine Oil program. Their methodology incorporates multi-stage filtration analysis to evaluate oil condition at different engine operating temperatures. Shell's PurePlus Technology, a revolutionary gas-to-liquid (GTL) process, creates crystal-clear base oils with virtually none of the impurities found in crude oil, providing an exceptional starting point for V6 engine lubrication testing[2]. Their testing protocol includes the Four-Ball Wear Test to measure anti-wear properties under extreme pressure conditions, Total Acid Number (TAN) monitoring to track oil degradation over time, and the Cold Cranking Simulator (CCS) test to evaluate low-temperature performance critical for V6 engine cold starts. Shell also employs Fourier Transform Infrared (FTIR) spectroscopy to identify chemical changes in the oil composition during use, particularly oxidation and nitration levels that affect lubrication quality[3]. Their V6 testing culminates with the Shell Rotella Million Mile Field Trial program, where oils are tested in commercial vehicles under extreme conditions.

Strengths: Advanced GTL technology provides exceptionally pure base oils for more accurate test results. Their global field testing program generates real-world performance data across diverse operating environments and engine types. Weaknesses: Their premium testing methodologies result in higher-priced products that may not be cost-effective for all consumers despite technical advantages.

Critical Oil Analysis Parameters and Testing Standards

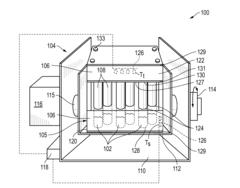

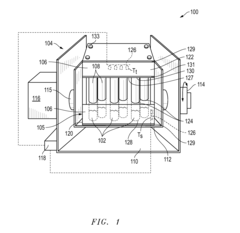

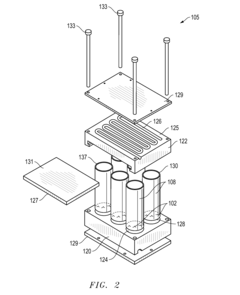

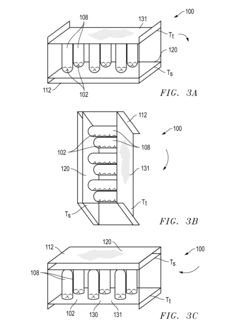

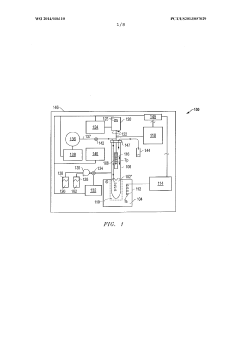

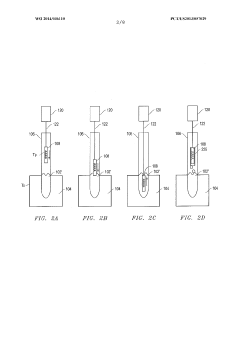

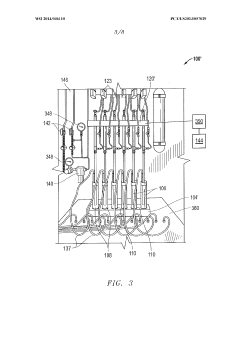

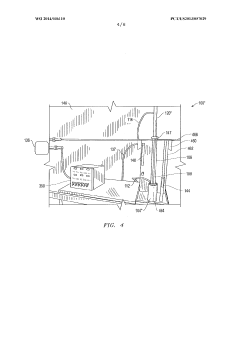

Rotating system and method for testing engine lubricants

PatentInactiveUS20130219998A1

Innovation

- A system and method involving a rotatable test assembly with a pair of blocks and a heat source, where the test cylinder with lubricant is selectively positioned between a non-contact and contact position relative to a heated test surface, allowing for controlled deposit formation and analysis.

System and method for testing engine lubricants

PatentWO2014036110A2

Innovation

- A system and method involving a heated block with a test cylinder and a heated piston, where lubricants are subjected to controlled temperature and gas environments to simulate engine conditions, facilitating deposit formation and oxidation testing, with the use of a taxi oil and gases like nitrogen dioxide to accelerate the testing process.

Environmental Impact of Engine Oil Testing Procedures

Engine oil testing procedures, while essential for ensuring optimal lubrication in V6 engines, carry significant environmental implications that warrant careful consideration. The traditional testing methods often involve chemical processes that generate hazardous waste materials, including used oil samples contaminated with metals, additives, and degradation products. These waste streams require specialized disposal protocols to prevent soil and water contamination, as improper handling can lead to persistent environmental pollution.

Laboratory-based testing procedures typically consume substantial energy resources, particularly when utilizing sophisticated analytical equipment such as spectrometers, viscometers, and chromatography systems. The carbon footprint associated with these energy-intensive processes contributes to broader environmental concerns related to climate change and resource depletion.

Chemical reagents employed in various oil analysis techniques present additional environmental challenges. Many testing protocols require solvents, acids, and other reactive compounds that may produce volatile organic compounds (VOCs) and other air pollutants during the testing process. These emissions can contribute to air quality degradation and potentially impact the health of laboratory personnel and surrounding communities.

The manufacturing of specialized testing equipment and consumables also carries embedded environmental costs. The production of precision instruments, calibration standards, and single-use testing materials involves resource extraction, energy consumption, and waste generation throughout their lifecycle. As testing frequency increases to optimize V6 engine performance, these cumulative environmental impacts become more significant.

Recent advancements in testing methodologies have begun addressing these environmental concerns through several approaches. Miniaturization of testing equipment has reduced reagent consumption and waste generation, while on-site testing capabilities have decreased the need for sample transportation, thereby lowering associated carbon emissions. Additionally, non-destructive testing techniques that require smaller sample volumes are gaining prominence in the industry.

Recycling initiatives for used oil samples represent another promising development in reducing the environmental footprint of testing procedures. Some facilities now implement closed-loop systems where tested oil samples are reclaimed, treated, and repurposed rather than disposed of as hazardous waste. This approach significantly reduces the volume of waste requiring specialized handling and disposal.

Regulatory frameworks increasingly recognize these environmental challenges, with many jurisdictions implementing stricter standards for laboratory waste management and emissions control. Testing facilities must now demonstrate compliance with environmental regulations while maintaining the accuracy and reliability of their oil analysis services for V6 engines.

Laboratory-based testing procedures typically consume substantial energy resources, particularly when utilizing sophisticated analytical equipment such as spectrometers, viscometers, and chromatography systems. The carbon footprint associated with these energy-intensive processes contributes to broader environmental concerns related to climate change and resource depletion.

Chemical reagents employed in various oil analysis techniques present additional environmental challenges. Many testing protocols require solvents, acids, and other reactive compounds that may produce volatile organic compounds (VOCs) and other air pollutants during the testing process. These emissions can contribute to air quality degradation and potentially impact the health of laboratory personnel and surrounding communities.

The manufacturing of specialized testing equipment and consumables also carries embedded environmental costs. The production of precision instruments, calibration standards, and single-use testing materials involves resource extraction, energy consumption, and waste generation throughout their lifecycle. As testing frequency increases to optimize V6 engine performance, these cumulative environmental impacts become more significant.

Recent advancements in testing methodologies have begun addressing these environmental concerns through several approaches. Miniaturization of testing equipment has reduced reagent consumption and waste generation, while on-site testing capabilities have decreased the need for sample transportation, thereby lowering associated carbon emissions. Additionally, non-destructive testing techniques that require smaller sample volumes are gaining prominence in the industry.

Recycling initiatives for used oil samples represent another promising development in reducing the environmental footprint of testing procedures. Some facilities now implement closed-loop systems where tested oil samples are reclaimed, treated, and repurposed rather than disposed of as hazardous waste. This approach significantly reduces the volume of waste requiring specialized handling and disposal.

Regulatory frameworks increasingly recognize these environmental challenges, with many jurisdictions implementing stricter standards for laboratory waste management and emissions control. Testing facilities must now demonstrate compliance with environmental regulations while maintaining the accuracy and reliability of their oil analysis services for V6 engines.

Cost-Benefit Analysis of Preventive Oil Testing Programs

Implementing a preventive oil testing program for V6 engines requires careful evaluation of financial implications against potential benefits. Regular oil analysis typically costs between $25-75 per sample when conducted through specialized laboratories, with additional expenses for sampling equipment, staff training, and data management systems that can add $1,000-5,000 in initial setup costs depending on fleet size.

These expenditures must be weighed against the substantial benefits of early problem detection. Identifying contaminants or wear metals before they cause catastrophic engine failure can prevent repair costs ranging from $5,000 for minor repairs to over $20,000 for complete engine rebuilds. For commercial fleets, the avoided downtime represents significant value, with each day of vehicle unavailability costing $500-1,500 in lost revenue and productivity.

Extended engine life represents another quantifiable benefit. Regular oil testing can extend V6 engine operational life by 15-30%, translating to 50,000-100,000 additional miles before major overhaul requirements. For high-value equipment, this extension provides substantial return on investment through deferred capital expenditures.

Fuel efficiency improvements resulting from optimal lubrication conditions typically range from 2-5%, which for vehicles consuming 10,000 gallons annually at $3.50 per gallon represents $700-1,750 in annual savings per vehicle. These efficiency gains simultaneously reduce carbon emissions, potentially qualifying organizations for environmental incentives or carbon credit programs.

The optimal testing frequency significantly impacts the cost-benefit equation. Monthly testing may be justified for critical applications or severe operating conditions, while quarterly intervals often provide sufficient protection for normal operations at more favorable economics. Statistical analysis of historical testing data enables organizations to optimize this interval based on their specific operating conditions.

Return on investment calculations typically show that comprehensive oil testing programs deliver $3-7 in savings for every $1 invested when accounting for all direct and indirect benefits. Organizations implementing these programs report average payback periods of 6-18 months, with the most significant returns observed in operations with high-value equipment operating in demanding conditions.

These expenditures must be weighed against the substantial benefits of early problem detection. Identifying contaminants or wear metals before they cause catastrophic engine failure can prevent repair costs ranging from $5,000 for minor repairs to over $20,000 for complete engine rebuilds. For commercial fleets, the avoided downtime represents significant value, with each day of vehicle unavailability costing $500-1,500 in lost revenue and productivity.

Extended engine life represents another quantifiable benefit. Regular oil testing can extend V6 engine operational life by 15-30%, translating to 50,000-100,000 additional miles before major overhaul requirements. For high-value equipment, this extension provides substantial return on investment through deferred capital expenditures.

Fuel efficiency improvements resulting from optimal lubrication conditions typically range from 2-5%, which for vehicles consuming 10,000 gallons annually at $3.50 per gallon represents $700-1,750 in annual savings per vehicle. These efficiency gains simultaneously reduce carbon emissions, potentially qualifying organizations for environmental incentives or carbon credit programs.

The optimal testing frequency significantly impacts the cost-benefit equation. Monthly testing may be justified for critical applications or severe operating conditions, while quarterly intervals often provide sufficient protection for normal operations at more favorable economics. Statistical analysis of historical testing data enables organizations to optimize this interval based on their specific operating conditions.

Return on investment calculations typically show that comprehensive oil testing programs deliver $3-7 in savings for every $1 invested when accounting for all direct and indirect benefits. Organizations implementing these programs report average payback periods of 6-18 months, with the most significant returns observed in operations with high-value equipment operating in demanding conditions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!