Improving GDI Engine Mileage for Economic Use

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

GDI Engine Evolution and Efficiency Targets

Gasoline Direct Injection (GDI) technology has evolved significantly since its commercial introduction in the late 1990s. The journey began with first-generation systems focused primarily on fuel delivery precision, progressing through multiple iterations that have continuously refined combustion efficiency, emissions control, and overall engine performance. This evolution has been driven by increasingly stringent global emissions regulations, consumer demand for improved fuel economy, and competitive market pressures requiring manufacturers to deliver enhanced performance without sacrificing efficiency.

The technological progression of GDI systems has followed a clear trajectory from basic high-pressure fuel delivery to sophisticated integration with complementary technologies. Early systems operated at pressures of 50-100 bar, while current advanced systems function at 200-350 bar, with research systems pushing beyond 500 bar. This pressure increase has enabled finer atomization of fuel, more precise injection timing, and multiple injection events per combustion cycle, all contributing to improved combustion efficiency.

Current efficiency targets for GDI engines focus on achieving a 15-20% improvement in fuel economy compared to port fuel injection systems, while simultaneously reducing particulate emissions by 25-30% to meet Euro 7 and equivalent global standards. These targets necessitate holistic optimization across multiple engine parameters, including compression ratios typically ranging from 11:1 to 14:1, advanced valve timing strategies, and integration with electrification technologies.

The industry has established benchmark targets for GDI systems, including thermal efficiency exceeding 40% (compared to approximately 35% for conventional systems), specific power output of 100+ kW/liter, and BSFC (Brake Specific Fuel Consumption) values below 220 g/kWh. Leading manufacturers are pursuing even more ambitious goals, with research programs targeting 45% thermal efficiency for next-generation systems through innovations in combustion chamber design, spray pattern optimization, and advanced control algorithms.

Critical to achieving these efficiency targets is the optimization of the air-fuel mixture formation process. This involves precise control of injection timing, duration, and pressure to create stratified charge under partial load conditions and homogeneous charge under full load. Advanced systems employ multiple injection events (up to 5-7 per cycle) to optimize combustion phasing and reduce emissions formation.

The roadmap for future GDI development includes integration with 48V mild hybrid systems, enabling engine downsizing while maintaining performance, implementation of variable compression ratio technologies to optimize efficiency across operating conditions, and development of advanced materials capable of withstanding higher combustion pressures and temperatures. These evolutionary paths collectively aim to position GDI technology as a viable bridge technology during the transition toward full electrification of vehicle powertrains.

The technological progression of GDI systems has followed a clear trajectory from basic high-pressure fuel delivery to sophisticated integration with complementary technologies. Early systems operated at pressures of 50-100 bar, while current advanced systems function at 200-350 bar, with research systems pushing beyond 500 bar. This pressure increase has enabled finer atomization of fuel, more precise injection timing, and multiple injection events per combustion cycle, all contributing to improved combustion efficiency.

Current efficiency targets for GDI engines focus on achieving a 15-20% improvement in fuel economy compared to port fuel injection systems, while simultaneously reducing particulate emissions by 25-30% to meet Euro 7 and equivalent global standards. These targets necessitate holistic optimization across multiple engine parameters, including compression ratios typically ranging from 11:1 to 14:1, advanced valve timing strategies, and integration with electrification technologies.

The industry has established benchmark targets for GDI systems, including thermal efficiency exceeding 40% (compared to approximately 35% for conventional systems), specific power output of 100+ kW/liter, and BSFC (Brake Specific Fuel Consumption) values below 220 g/kWh. Leading manufacturers are pursuing even more ambitious goals, with research programs targeting 45% thermal efficiency for next-generation systems through innovations in combustion chamber design, spray pattern optimization, and advanced control algorithms.

Critical to achieving these efficiency targets is the optimization of the air-fuel mixture formation process. This involves precise control of injection timing, duration, and pressure to create stratified charge under partial load conditions and homogeneous charge under full load. Advanced systems employ multiple injection events (up to 5-7 per cycle) to optimize combustion phasing and reduce emissions formation.

The roadmap for future GDI development includes integration with 48V mild hybrid systems, enabling engine downsizing while maintaining performance, implementation of variable compression ratio technologies to optimize efficiency across operating conditions, and development of advanced materials capable of withstanding higher combustion pressures and temperatures. These evolutionary paths collectively aim to position GDI technology as a viable bridge technology during the transition toward full electrification of vehicle powertrains.

Market Demand for Fuel-Efficient Vehicles

The global automotive market has witnessed a significant shift towards fuel-efficient vehicles over the past decade, driven primarily by increasing environmental concerns, stringent government regulations, and rising fuel costs. According to recent market research, the global fuel-efficient vehicle market was valued at approximately $513 billion in 2022 and is projected to reach $768 billion by 2028, growing at a CAGR of 6.9% during the forecast period.

Consumer demand for vehicles with improved fuel economy has been steadily increasing, with surveys indicating that fuel efficiency now ranks among the top three considerations for new vehicle purchases across major markets including North America, Europe, and Asia. In the United States alone, 78% of prospective car buyers cited fuel economy as a critical factor in their purchasing decision, representing a 15% increase from five years ago.

The market demand is further bolstered by increasingly stringent emissions regulations worldwide. The European Union's target of reducing CO2 emissions to 95g/km by 2021 and further reductions planned for 2025 and 2030 have compelled manufacturers to invest heavily in fuel-efficient technologies. Similarly, China's dual-credit policy and the United States' Corporate Average Fuel Economy (CAFE) standards continue to push automakers towards developing more economical vehicles.

Gasoline Direct Injection (GDI) engines have emerged as a key technology in meeting these market demands. The global GDI system market size was valued at $46.3 billion in 2021 and is expected to expand at a compound annual growth rate of 8.2% from 2022 to 2030. This growth is directly correlated with the increasing consumer preference for vehicles that offer improved fuel economy without compromising performance.

Economic factors also play a crucial role in driving market demand. With global average gasoline prices experiencing volatility and general upward trends, consumers are increasingly sensitive to the long-term operational costs of vehicle ownership. Market analysis reveals that a 10% improvement in fuel efficiency can translate to savings of approximately $1,500 to $2,000 over a five-year ownership period for an average driver, creating a compelling economic incentive for consumers.

Fleet operators and commercial vehicle users represent another significant segment driving demand for fuel-efficient technologies. For commercial fleets, even marginal improvements in fuel economy can result in substantial cost savings at scale. This has led to increased adoption of advanced engine technologies, including improved GDI systems, across commercial vehicle segments.

The market also shows regional variations in demand patterns. While developed markets like North America and Europe show stronger preference for hybrid and electric solutions alongside efficient internal combustion engines, emerging markets in Asia and Latin America continue to prioritize affordable fuel-efficient conventional powertrains, creating diverse market opportunities for improved GDI technology implementation.

Consumer demand for vehicles with improved fuel economy has been steadily increasing, with surveys indicating that fuel efficiency now ranks among the top three considerations for new vehicle purchases across major markets including North America, Europe, and Asia. In the United States alone, 78% of prospective car buyers cited fuel economy as a critical factor in their purchasing decision, representing a 15% increase from five years ago.

The market demand is further bolstered by increasingly stringent emissions regulations worldwide. The European Union's target of reducing CO2 emissions to 95g/km by 2021 and further reductions planned for 2025 and 2030 have compelled manufacturers to invest heavily in fuel-efficient technologies. Similarly, China's dual-credit policy and the United States' Corporate Average Fuel Economy (CAFE) standards continue to push automakers towards developing more economical vehicles.

Gasoline Direct Injection (GDI) engines have emerged as a key technology in meeting these market demands. The global GDI system market size was valued at $46.3 billion in 2021 and is expected to expand at a compound annual growth rate of 8.2% from 2022 to 2030. This growth is directly correlated with the increasing consumer preference for vehicles that offer improved fuel economy without compromising performance.

Economic factors also play a crucial role in driving market demand. With global average gasoline prices experiencing volatility and general upward trends, consumers are increasingly sensitive to the long-term operational costs of vehicle ownership. Market analysis reveals that a 10% improvement in fuel efficiency can translate to savings of approximately $1,500 to $2,000 over a five-year ownership period for an average driver, creating a compelling economic incentive for consumers.

Fleet operators and commercial vehicle users represent another significant segment driving demand for fuel-efficient technologies. For commercial fleets, even marginal improvements in fuel economy can result in substantial cost savings at scale. This has led to increased adoption of advanced engine technologies, including improved GDI systems, across commercial vehicle segments.

The market also shows regional variations in demand patterns. While developed markets like North America and Europe show stronger preference for hybrid and electric solutions alongside efficient internal combustion engines, emerging markets in Asia and Latin America continue to prioritize affordable fuel-efficient conventional powertrains, creating diverse market opportunities for improved GDI technology implementation.

Current GDI Technology Limitations and Challenges

Despite the significant advancements in Gasoline Direct Injection (GDI) technology over the past decade, several critical limitations and challenges persist that hinder optimal fuel economy performance. The primary challenge remains the particulate matter (PM) emissions, which are substantially higher in GDI engines compared to traditional port fuel injection systems. These emissions necessitate additional filtration systems that add weight and complexity, ultimately reducing overall fuel efficiency.

Combustion instability presents another significant challenge, particularly during cold starts and low-load operations. The direct injection process creates localized rich fuel zones that can lead to incomplete combustion, resulting in increased fuel consumption and reduced mileage. Current GDI systems struggle to maintain optimal air-fuel mixture homogeneity across all operating conditions, which directly impacts fuel economy.

Injector deposit formation continues to be a persistent issue affecting long-term performance. Carbon deposits on injector tips alter spray patterns and reduce flow rates, leading to progressive deterioration in fuel atomization quality. Studies indicate that after 50,000 miles, many GDI engines show a 3-7% reduction in fuel economy due to injector fouling alone, representing a significant economic disadvantage for consumers.

The high-pressure fuel systems required for GDI operation (typically 200-300 bar) demand more energy from the engine to drive the fuel pump, creating a parasitic loss that partially offsets the efficiency gains. This high-pressure requirement also increases system complexity and manufacturing costs, making economic optimization challenging.

Wall wetting phenomena, where fuel impinges on cylinder walls rather than fully atomizing, remains problematic especially during transient operations. This leads to increased hydrocarbon emissions and reduced combustion efficiency, directly impacting mileage performance. Current injector designs and control strategies have not fully resolved this issue across the entire operating range.

Integration challenges with other fuel-saving technologies also exist. While GDI theoretically complements turbocharging and engine downsizing, the practical implementation often reveals compatibility issues that prevent achieving the full theoretical efficiency benefits. The complex interaction between boost pressure, injection timing, and combustion stability creates a challenging optimization problem.

From a manufacturing perspective, the tight tolerances required for GDI components increase production costs and potential reliability issues. The precision-machined injectors with multiple orifices as small as 50 microns are susceptible to manufacturing variations that can impact spray quality and consequently fuel economy. These manufacturing challenges translate directly to higher vehicle costs, affecting the economic value proposition of GDI technology.

Combustion instability presents another significant challenge, particularly during cold starts and low-load operations. The direct injection process creates localized rich fuel zones that can lead to incomplete combustion, resulting in increased fuel consumption and reduced mileage. Current GDI systems struggle to maintain optimal air-fuel mixture homogeneity across all operating conditions, which directly impacts fuel economy.

Injector deposit formation continues to be a persistent issue affecting long-term performance. Carbon deposits on injector tips alter spray patterns and reduce flow rates, leading to progressive deterioration in fuel atomization quality. Studies indicate that after 50,000 miles, many GDI engines show a 3-7% reduction in fuel economy due to injector fouling alone, representing a significant economic disadvantage for consumers.

The high-pressure fuel systems required for GDI operation (typically 200-300 bar) demand more energy from the engine to drive the fuel pump, creating a parasitic loss that partially offsets the efficiency gains. This high-pressure requirement also increases system complexity and manufacturing costs, making economic optimization challenging.

Wall wetting phenomena, where fuel impinges on cylinder walls rather than fully atomizing, remains problematic especially during transient operations. This leads to increased hydrocarbon emissions and reduced combustion efficiency, directly impacting mileage performance. Current injector designs and control strategies have not fully resolved this issue across the entire operating range.

Integration challenges with other fuel-saving technologies also exist. While GDI theoretically complements turbocharging and engine downsizing, the practical implementation often reveals compatibility issues that prevent achieving the full theoretical efficiency benefits. The complex interaction between boost pressure, injection timing, and combustion stability creates a challenging optimization problem.

From a manufacturing perspective, the tight tolerances required for GDI components increase production costs and potential reliability issues. The precision-machined injectors with multiple orifices as small as 50 microns are susceptible to manufacturing variations that can impact spray quality and consequently fuel economy. These manufacturing challenges translate directly to higher vehicle costs, affecting the economic value proposition of GDI technology.

Current Approaches to GDI Mileage Optimization

01 Fuel injection optimization for GDI engines

Gasoline Direct Injection (GDI) engines can achieve improved mileage through optimized fuel injection strategies. These include precise control of injection timing, pressure, and spray pattern to ensure complete combustion. Advanced injection systems can adjust parameters based on driving conditions, load requirements, and engine temperature to maximize fuel efficiency while maintaining performance.- Fuel injection optimization for GDI engines: Optimizing fuel injection parameters in Gasoline Direct Injection (GDI) engines can significantly improve mileage. This includes precise control of injection timing, pressure, and spray pattern to ensure optimal air-fuel mixture formation. Advanced injection strategies such as multiple injections per cycle and variable injection pressure can enhance combustion efficiency, reducing fuel consumption while maintaining or improving engine performance.

- Combustion chamber design improvements: Innovative combustion chamber designs for GDI engines can enhance fuel economy by promoting better air-fuel mixing and more complete combustion. These designs include optimized piston crown shapes, strategic placement of spark plugs, and improved intake port configurations. Such modifications create controlled turbulence and direct the fuel spray for more efficient combustion, resulting in reduced fuel consumption and improved mileage.

- Engine control systems for fuel efficiency: Advanced engine control systems utilize sophisticated algorithms and sensors to optimize GDI engine operation for maximum fuel efficiency. These systems continuously adjust parameters such as air-fuel ratio, ignition timing, and valve timing based on driving conditions. Machine learning and adaptive control strategies can further enhance mileage by learning from driving patterns and optimizing engine operation accordingly.

- Thermal management solutions: Effective thermal management systems can improve GDI engine mileage by maintaining optimal operating temperatures. These solutions include advanced cooling systems, heat recovery mechanisms, and thermal barrier coatings. By reducing friction losses, preventing knock, and enabling leaner combustion, proper thermal management contributes significantly to fuel efficiency improvements in GDI engines.

- Integration with hybrid and electrification technologies: Combining GDI engines with electrification technologies can substantially improve overall vehicle mileage. These hybrid approaches include mild hybrid systems with start-stop functionality, regenerative braking, and electric assist during acceleration. The integration allows the GDI engine to operate in its most efficient range more frequently, while electric components handle less efficient operating conditions, resulting in significant mileage improvements.

02 Combustion chamber design improvements

Modifications to the combustion chamber geometry in GDI engines can significantly impact fuel economy. Optimized piston crown designs, valve positioning, and cylinder head configurations promote better air-fuel mixing and more efficient combustion. These design improvements help achieve more complete fuel burning, reduced heat losses, and ultimately better mileage performance.Expand Specific Solutions03 Engine control systems for efficiency

Advanced electronic control systems play a crucial role in maximizing GDI engine mileage. These systems utilize sensors and algorithms to continuously monitor and adjust engine parameters such as air-fuel ratio, ignition timing, and valve timing. Adaptive control strategies can optimize operation based on driving conditions, enabling the engine to operate in its most efficient range while maintaining performance requirements.Expand Specific Solutions04 Thermal management solutions

Effective thermal management systems can improve GDI engine mileage by maintaining optimal operating temperatures. These solutions include advanced cooling systems, heat recovery mechanisms, and thermal barrier coatings that reduce heat losses. By controlling engine temperature more precisely, these systems help reduce friction, improve combustion efficiency, and optimize overall engine performance for better fuel economy.Expand Specific Solutions05 Reduction of friction and mechanical losses

Minimizing friction and mechanical losses in GDI engines contributes to improved mileage. This can be achieved through advanced surface treatments, low-friction coatings, optimized bearing designs, and improved lubrication systems. Additionally, lightweight components and materials can reduce reciprocating and rotational masses, decreasing the energy required to operate the engine and thereby improving fuel efficiency.Expand Specific Solutions

Leading Manufacturers and Competitive Landscape

The GDI Engine Mileage improvement market is in a growth phase, with increasing demand driven by global fuel economy regulations and consumer cost concerns. Major automotive manufacturers including Ford, GM, Hyundai, and Geely are actively competing in this space, with significant R&D investments. Technology maturity varies across players, with established companies like Ford Global Technologies and GM Global Technology Operations leading with advanced direct injection solutions, while Lubrizol and Chevron Oronite focus on complementary fuel additive technologies. Chinese manufacturers including Chery, Changan, and Dongfeng are rapidly closing the technology gap through strategic partnerships and domestic research initiatives, particularly in optimizing GDI systems for regional fuel qualities and driving conditions.

Ford Global Technologies LLC

Technical Solution: Ford has developed advanced GDI engine technologies focusing on optimizing fuel atomization and combustion efficiency. Their EcoBoost engine family incorporates high-pressure direct injection systems (up to 2150 bar) with precisely controlled multiple injection events per cycle. Ford's technology includes adaptive injection timing based on real-time combustion feedback and variable swirl control to enhance air-fuel mixing. They've implemented innovative spray-guided combustion chambers with optimized piston crown designs that reduce wall wetting and minimize particulate emissions. Ford has also integrated their GDI systems with cylinder deactivation technology and advanced thermal management systems that rapidly bring engines to optimal operating temperatures, reducing cold-start fuel consumption by approximately 15%. Their latest iterations incorporate predictive algorithms that adjust injection parameters based on driving conditions and driver behavior patterns.

Strengths: Superior integration with turbocharging technology, allowing for significant engine downsizing while maintaining performance. Advanced control algorithms provide exceptional adaptability to varying driving conditions. Weaknesses: Higher system complexity increases manufacturing costs and potential maintenance issues compared to port fuel injection systems. Some earlier implementations faced carbon deposit challenges on intake valves.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has pioneered the Continuously Variable Valve Duration (CVVD) technology specifically for their GDI engines, representing a significant advancement in improving fuel efficiency. This system allows for precise control of valve opening duration according to driving conditions, optimizing both power output and fuel economy. Their GDI implementation features a high-pressure fuel system operating at 200-350 bar with multi-hole injectors strategically positioned for optimal spray patterns. Hyundai's Smart Stream G engines combine GDI with an innovative thermal management system that incorporates split cooling channels and an integrated thermal management module. This system reduces mechanical losses by maintaining optimal temperature distribution throughout the engine. Additionally, Hyundai has developed a low-pressure exhaust gas recirculation system specifically calibrated for GDI engines that reduces pumping losses and improves fuel efficiency by approximately 5%. Their combustion chamber design features an optimized intake port that creates controlled tumble flow, enhancing air-fuel mixture formation.

Strengths: Industry-leading valve control technology (CVVD) provides exceptional flexibility in optimizing engine operation across various load conditions. Comprehensive thermal management approach minimizes energy losses. Weaknesses: Higher manufacturing complexity compared to conventional systems. Requires more sophisticated control systems and sensors, potentially increasing cost and maintenance requirements.

Key Innovations in Fuel Injection Technology

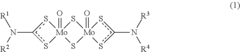

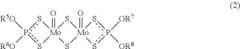

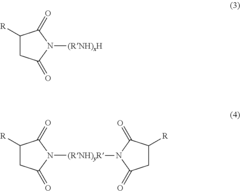

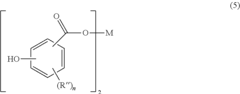

Low viscosity lubricating oil composition

PatentInactiveUS20180258365A1

Innovation

- A lubricating oil composition with a High Temperature High Shear (HTHS) viscosity of 1.3 to 2.3 cP, comprising a major amount of lubricating viscosity oil, an organomolybdenum compound providing 200-1500 ppm molybdenum, a calcium-containing detergent, a magnesium-containing detergent, and a viscosity modifier with a Permanent Shear Stability Index (PSSI) of 30 or less, is developed to address these challenges.

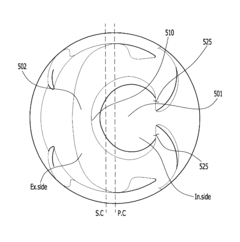

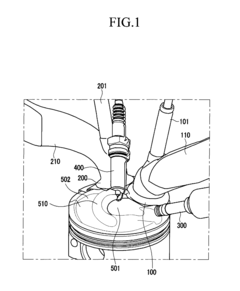

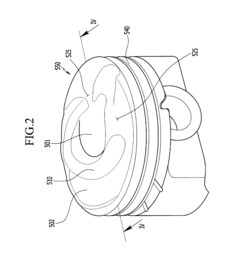

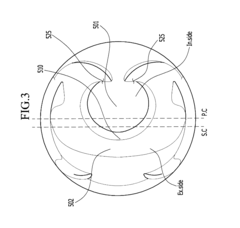

Gasoline direct injection engine

PatentInactiveUS8251040B2

Innovation

- The engine design includes a piston head with a first cavity for fuel return to the spark plug and a protrusion offset towards the exhaust valve, featuring a second cavity of a smaller height, allowing for differential control of intake and exhaust valve volumes to optimize the combustion chamber's volume ratio.

Emissions Regulations Impact on GDI Development

Emissions regulations have become a primary driver for Gasoline Direct Injection (GDI) engine development globally, creating both challenges and opportunities for improving fuel economy. The implementation of stringent emission standards such as Euro 7 in Europe, China 6b, and Tier 3 in the United States has fundamentally reshaped GDI technology trajectories. These regulations specifically target reductions in nitrogen oxides (NOx), particulate matter (PM), and carbon dioxide (CO2) emissions, forcing manufacturers to balance performance with environmental compliance.

The regulatory landscape has accelerated the adoption of advanced GDI technologies, particularly those focused on optimizing combustion efficiency. Manufacturers have responded by implementing higher-pressure fuel injection systems, moving from 200 bar systems to advanced 350+ bar configurations that enable more precise fuel atomization and reduced particulate formation. This regulatory pressure has also catalyzed the development of integrated exhaust aftertreatment systems specifically designed for GDI engines, including gasoline particulate filters (GPFs) that have become mandatory in many markets.

Emission compliance requirements have significantly influenced the cost structure of GDI engine development. The additional components required for emissions control, such as GPFs and advanced catalytic converters, add approximately $200-400 per vehicle in manufacturing costs. This economic impact necessitates offsetting improvements in fuel economy to maintain market competitiveness, driving innovations in spray pattern optimization, variable compression ratio technologies, and advanced thermal management systems.

Regional regulatory differences create complex challenges for global GDI platform development. European standards emphasize CO2 reduction through fleet-wide targets, while U.S. regulations focus on NOx and hydrocarbon emissions with different testing protocols. Chinese regulations have rapidly evolved to match international standards but with unique implementation timelines. These variations force manufacturers to develop modular GDI architectures that can be adapted to different regional requirements while maintaining core efficiency benefits.

Real Driving Emissions (RDE) testing protocols introduced in recent regulatory frameworks have particularly challenged GDI optimization strategies. Traditional laboratory-based calibrations often fail to deliver expected efficiency under real-world driving conditions, necessitating more robust control algorithms and wider operating envelopes for fuel injection systems. This regulatory shift has accelerated the integration of model-based control systems and machine learning approaches to optimize GDI performance across diverse operating conditions.

The regulatory timeline for emissions standards continues to tighten, with most major markets announcing plans for increasingly stringent targets through 2030. This regulatory certainty provides a clear development pathway for GDI technology but requires substantial ongoing investment in research and development to meet future standards while continuing to improve fuel economy metrics that remain critical for consumer acceptance.

The regulatory landscape has accelerated the adoption of advanced GDI technologies, particularly those focused on optimizing combustion efficiency. Manufacturers have responded by implementing higher-pressure fuel injection systems, moving from 200 bar systems to advanced 350+ bar configurations that enable more precise fuel atomization and reduced particulate formation. This regulatory pressure has also catalyzed the development of integrated exhaust aftertreatment systems specifically designed for GDI engines, including gasoline particulate filters (GPFs) that have become mandatory in many markets.

Emission compliance requirements have significantly influenced the cost structure of GDI engine development. The additional components required for emissions control, such as GPFs and advanced catalytic converters, add approximately $200-400 per vehicle in manufacturing costs. This economic impact necessitates offsetting improvements in fuel economy to maintain market competitiveness, driving innovations in spray pattern optimization, variable compression ratio technologies, and advanced thermal management systems.

Regional regulatory differences create complex challenges for global GDI platform development. European standards emphasize CO2 reduction through fleet-wide targets, while U.S. regulations focus on NOx and hydrocarbon emissions with different testing protocols. Chinese regulations have rapidly evolved to match international standards but with unique implementation timelines. These variations force manufacturers to develop modular GDI architectures that can be adapted to different regional requirements while maintaining core efficiency benefits.

Real Driving Emissions (RDE) testing protocols introduced in recent regulatory frameworks have particularly challenged GDI optimization strategies. Traditional laboratory-based calibrations often fail to deliver expected efficiency under real-world driving conditions, necessitating more robust control algorithms and wider operating envelopes for fuel injection systems. This regulatory shift has accelerated the integration of model-based control systems and machine learning approaches to optimize GDI performance across diverse operating conditions.

The regulatory timeline for emissions standards continues to tighten, with most major markets announcing plans for increasingly stringent targets through 2030. This regulatory certainty provides a clear development pathway for GDI technology but requires substantial ongoing investment in research and development to meet future standards while continuing to improve fuel economy metrics that remain critical for consumer acceptance.

Cost-Benefit Analysis of Advanced GDI Solutions

The implementation of advanced Gasoline Direct Injection (GDI) technologies requires careful economic evaluation to determine their viability in the competitive automotive market. When analyzing the cost-benefit ratio of these solutions, manufacturers must consider both immediate implementation expenses and long-term operational savings.

Initial investment costs for advanced GDI systems typically range from $800-1,500 per unit above conventional port fuel injection systems, representing a significant premium. This includes expenses for high-precision injectors, reinforced fuel pumps capable of higher pressures (up to 350 bar in modern systems), and more sophisticated engine control units with enhanced computational capabilities.

Manufacturing complexity adds another dimension to the cost structure. The production of GDI components requires tighter tolerances and more specialized manufacturing processes, increasing production line investment by approximately 15-20% compared to traditional injection systems. However, economies of scale have begun to reduce these premiums as adoption rates increase across global markets.

From the consumer perspective, the fuel economy improvements of 12-15% translate to substantial lifetime savings. Based on average driving patterns of 15,000 miles annually and current fuel prices, consumers can expect to recover the additional vehicle cost within 3-5 years of ownership. This recovery period shortens in regions with higher fuel taxation or for drivers with above-average annual mileage.

Maintenance considerations present a mixed economic picture. While GDI systems generally demonstrate excellent durability, they can be susceptible to carbon buildup on intake valves, potentially requiring additional maintenance procedures costing $300-500 every 60,000-80,000 miles. This partially offsets lifetime operational savings.

Regulatory compliance represents another significant economic factor. As emissions standards tighten globally, the cost of non-compliance through penalties or market exclusion far exceeds the implementation costs of GDI technology. Manufacturers can avoid an estimated $80-120 per vehicle in potential regulatory penalties through GDI adoption.

Fleet operators experience the most favorable cost-benefit ratio due to their higher utilization rates and fuel consumption volumes. Analysis indicates that commercial fleets can achieve return on investment in as little as 18-24 months, making advanced GDI solutions particularly attractive for this segment.

The total cost of ownership calculations demonstrate that despite higher initial acquisition costs, vehicles equipped with advanced GDI technology typically deliver 7-10% lower lifetime ownership costs when accounting for fuel savings, maintenance requirements, and residual value retention.

Initial investment costs for advanced GDI systems typically range from $800-1,500 per unit above conventional port fuel injection systems, representing a significant premium. This includes expenses for high-precision injectors, reinforced fuel pumps capable of higher pressures (up to 350 bar in modern systems), and more sophisticated engine control units with enhanced computational capabilities.

Manufacturing complexity adds another dimension to the cost structure. The production of GDI components requires tighter tolerances and more specialized manufacturing processes, increasing production line investment by approximately 15-20% compared to traditional injection systems. However, economies of scale have begun to reduce these premiums as adoption rates increase across global markets.

From the consumer perspective, the fuel economy improvements of 12-15% translate to substantial lifetime savings. Based on average driving patterns of 15,000 miles annually and current fuel prices, consumers can expect to recover the additional vehicle cost within 3-5 years of ownership. This recovery period shortens in regions with higher fuel taxation or for drivers with above-average annual mileage.

Maintenance considerations present a mixed economic picture. While GDI systems generally demonstrate excellent durability, they can be susceptible to carbon buildup on intake valves, potentially requiring additional maintenance procedures costing $300-500 every 60,000-80,000 miles. This partially offsets lifetime operational savings.

Regulatory compliance represents another significant economic factor. As emissions standards tighten globally, the cost of non-compliance through penalties or market exclusion far exceeds the implementation costs of GDI technology. Manufacturers can avoid an estimated $80-120 per vehicle in potential regulatory penalties through GDI adoption.

Fleet operators experience the most favorable cost-benefit ratio due to their higher utilization rates and fuel consumption volumes. Analysis indicates that commercial fleets can achieve return on investment in as little as 18-24 months, making advanced GDI solutions particularly attractive for this segment.

The total cost of ownership calculations demonstrate that despite higher initial acquisition costs, vehicles equipped with advanced GDI technology typically deliver 7-10% lower lifetime ownership costs when accounting for fuel savings, maintenance requirements, and residual value retention.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!