Life Extension Strategies For CMC Components In Commercial Fleets

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CMC Components Lifecycle Background and Objectives

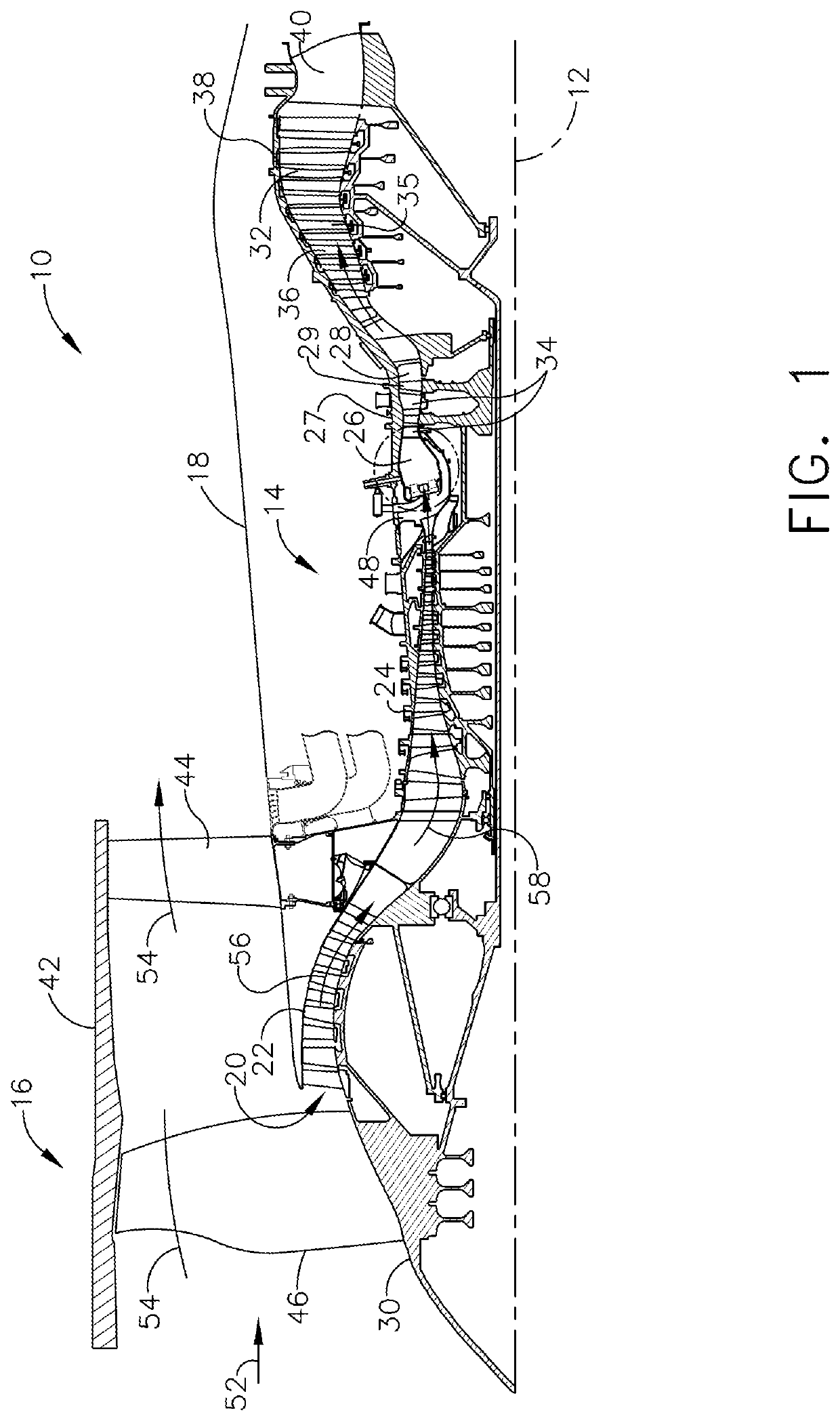

Ceramic Matrix Composites (CMCs) represent a revolutionary class of materials that have transformed the aerospace industry over the past three decades. These advanced materials combine ceramic fibers within a ceramic matrix, offering exceptional high-temperature capabilities, oxidation resistance, and significantly reduced weight compared to traditional superalloys. The evolution of CMCs began in the 1980s with research primarily focused on military applications, but has since expanded dramatically into commercial aviation, particularly for hot-section components in gas turbine engines.

The primary objective of CMC lifecycle management is to maximize component service life while maintaining safety and performance standards across commercial fleets. As these components operate in extreme environments—experiencing temperatures exceeding 1200°C, high mechanical stresses, and oxidative conditions—understanding their degradation mechanisms becomes critical for developing effective life extension strategies.

Current commercial aircraft fleets incorporating CMC components face significant challenges related to lifecycle management. With acquisition costs for CMC parts substantially higher than traditional metallic counterparts, airlines and manufacturers share a vested interest in extending their operational lifespan. The economic implications of premature replacement versus optimized maintenance schedules represent millions of dollars in fleet operating costs.

Historical data indicates that first-generation CMC components in commercial engines have demonstrated variable service life, with some components requiring replacement earlier than projected design specifications. This variability stems from multiple factors including manufacturing inconsistencies, operational conditions, and limited in-service performance data. The technology trajectory shows steady improvement in durability with each successive generation of materials and manufacturing processes.

The technical goals for CMC component life extension include developing predictive models for remaining useful life, establishing non-destructive evaluation techniques for in-situ condition monitoring, and creating repair methodologies that can restore degraded components to serviceable condition. Additionally, there is significant interest in developing coating systems that can further protect CMC substrates from environmental attack during service.

Industry stakeholders—including OEMs, airlines, maintenance providers, and regulatory bodies—have aligned on the need for standardized approaches to CMC lifecycle management. This collaborative effort aims to establish industry-wide best practices for inspection, maintenance, and repair that can be implemented across diverse fleet operations while meeting stringent airworthiness requirements.

The evolution of CMC technology continues to accelerate, with research focusing on more damage-tolerant architectures, advanced manufacturing techniques like additive manufacturing of ceramic components, and hybrid systems that combine the benefits of different material classes. These developments promise to address current limitations while expanding the application envelope for CMCs in next-generation commercial aircraft.

The primary objective of CMC lifecycle management is to maximize component service life while maintaining safety and performance standards across commercial fleets. As these components operate in extreme environments—experiencing temperatures exceeding 1200°C, high mechanical stresses, and oxidative conditions—understanding their degradation mechanisms becomes critical for developing effective life extension strategies.

Current commercial aircraft fleets incorporating CMC components face significant challenges related to lifecycle management. With acquisition costs for CMC parts substantially higher than traditional metallic counterparts, airlines and manufacturers share a vested interest in extending their operational lifespan. The economic implications of premature replacement versus optimized maintenance schedules represent millions of dollars in fleet operating costs.

Historical data indicates that first-generation CMC components in commercial engines have demonstrated variable service life, with some components requiring replacement earlier than projected design specifications. This variability stems from multiple factors including manufacturing inconsistencies, operational conditions, and limited in-service performance data. The technology trajectory shows steady improvement in durability with each successive generation of materials and manufacturing processes.

The technical goals for CMC component life extension include developing predictive models for remaining useful life, establishing non-destructive evaluation techniques for in-situ condition monitoring, and creating repair methodologies that can restore degraded components to serviceable condition. Additionally, there is significant interest in developing coating systems that can further protect CMC substrates from environmental attack during service.

Industry stakeholders—including OEMs, airlines, maintenance providers, and regulatory bodies—have aligned on the need for standardized approaches to CMC lifecycle management. This collaborative effort aims to establish industry-wide best practices for inspection, maintenance, and repair that can be implemented across diverse fleet operations while meeting stringent airworthiness requirements.

The evolution of CMC technology continues to accelerate, with research focusing on more damage-tolerant architectures, advanced manufacturing techniques like additive manufacturing of ceramic components, and hybrid systems that combine the benefits of different material classes. These developments promise to address current limitations while expanding the application envelope for CMCs in next-generation commercial aircraft.

Market Analysis for CMC Components in Commercial Aviation

The commercial aviation market for Ceramic Matrix Composite (CMC) components is experiencing significant growth, driven by the increasing demand for fuel-efficient aircraft and the push for reduced emissions. The global market for CMC components in aviation was valued at approximately $2.1 billion in 2022 and is projected to reach $5.8 billion by 2030, representing a compound annual growth rate of 13.5%. This growth trajectory is primarily fueled by the expanding commercial aircraft fleet, which is expected to double in the next two decades according to industry forecasts.

North America currently dominates the market with a 42% share, followed by Europe at 31% and Asia-Pacific at 21%. The remaining 6% is distributed across other regions. This regional distribution reflects the concentration of major aircraft manufacturers and their supply chains. However, the Asia-Pacific region is anticipated to witness the fastest growth due to increasing air travel demand and the emergence of regional aircraft manufacturers.

The market segmentation for CMC components reveals that engine applications account for approximately 65% of the total market value. This dominance is attributed to the critical role CMCs play in improving engine efficiency and durability. Structural components represent about 25% of the market, while other applications such as interior components and auxiliary systems constitute the remaining 10%.

Key market drivers include stringent environmental regulations that mandate reduced emissions and improved fuel efficiency. The International Civil Aviation Organization's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) has set ambitious targets for carbon-neutral growth from 2020 onwards, pushing airlines to adopt more efficient technologies. Additionally, the rising cost of aviation fuel, despite fluctuations, continues to incentivize airlines to invest in fuel-saving technologies like CMC components.

Customer demand patterns indicate a strong preference for components that offer extended service life and reduced maintenance requirements. Airlines are increasingly focusing on total lifecycle costs rather than initial acquisition expenses. This shift benefits CMC components, which typically offer longer service intervals and reduced replacement frequency compared to traditional materials.

Market challenges include the high initial cost of CMC components, which can be 3-5 times more expensive than conventional alternatives. Supply chain constraints and limited manufacturing capacity also pose significant barriers to wider adoption. Furthermore, the certification process for new materials in aviation is rigorous and time-consuming, often taking 5-7 years from development to commercial implementation.

North America currently dominates the market with a 42% share, followed by Europe at 31% and Asia-Pacific at 21%. The remaining 6% is distributed across other regions. This regional distribution reflects the concentration of major aircraft manufacturers and their supply chains. However, the Asia-Pacific region is anticipated to witness the fastest growth due to increasing air travel demand and the emergence of regional aircraft manufacturers.

The market segmentation for CMC components reveals that engine applications account for approximately 65% of the total market value. This dominance is attributed to the critical role CMCs play in improving engine efficiency and durability. Structural components represent about 25% of the market, while other applications such as interior components and auxiliary systems constitute the remaining 10%.

Key market drivers include stringent environmental regulations that mandate reduced emissions and improved fuel efficiency. The International Civil Aviation Organization's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) has set ambitious targets for carbon-neutral growth from 2020 onwards, pushing airlines to adopt more efficient technologies. Additionally, the rising cost of aviation fuel, despite fluctuations, continues to incentivize airlines to invest in fuel-saving technologies like CMC components.

Customer demand patterns indicate a strong preference for components that offer extended service life and reduced maintenance requirements. Airlines are increasingly focusing on total lifecycle costs rather than initial acquisition expenses. This shift benefits CMC components, which typically offer longer service intervals and reduced replacement frequency compared to traditional materials.

Market challenges include the high initial cost of CMC components, which can be 3-5 times more expensive than conventional alternatives. Supply chain constraints and limited manufacturing capacity also pose significant barriers to wider adoption. Furthermore, the certification process for new materials in aviation is rigorous and time-consuming, often taking 5-7 years from development to commercial implementation.

Current Challenges in CMC Durability for Fleet Applications

Despite significant advancements in Ceramic Matrix Composite (CMC) technology, several critical challenges persist in ensuring long-term durability for commercial fleet applications. The primary concern remains environmental degradation mechanisms, particularly oxidation and volatilization of the matrix and fiber constituents when exposed to high-temperature combustion environments. These mechanisms progressively compromise the structural integrity of CMC components, leading to performance deterioration over time.

Water vapor attack represents a particularly severe challenge for SiC-based CMCs, as it accelerates the degradation of protective silica scales through the formation of volatile silicon hydroxide species. This phenomenon is especially problematic in aviation applications where humidity levels fluctuate considerably during different flight phases and geographical routes.

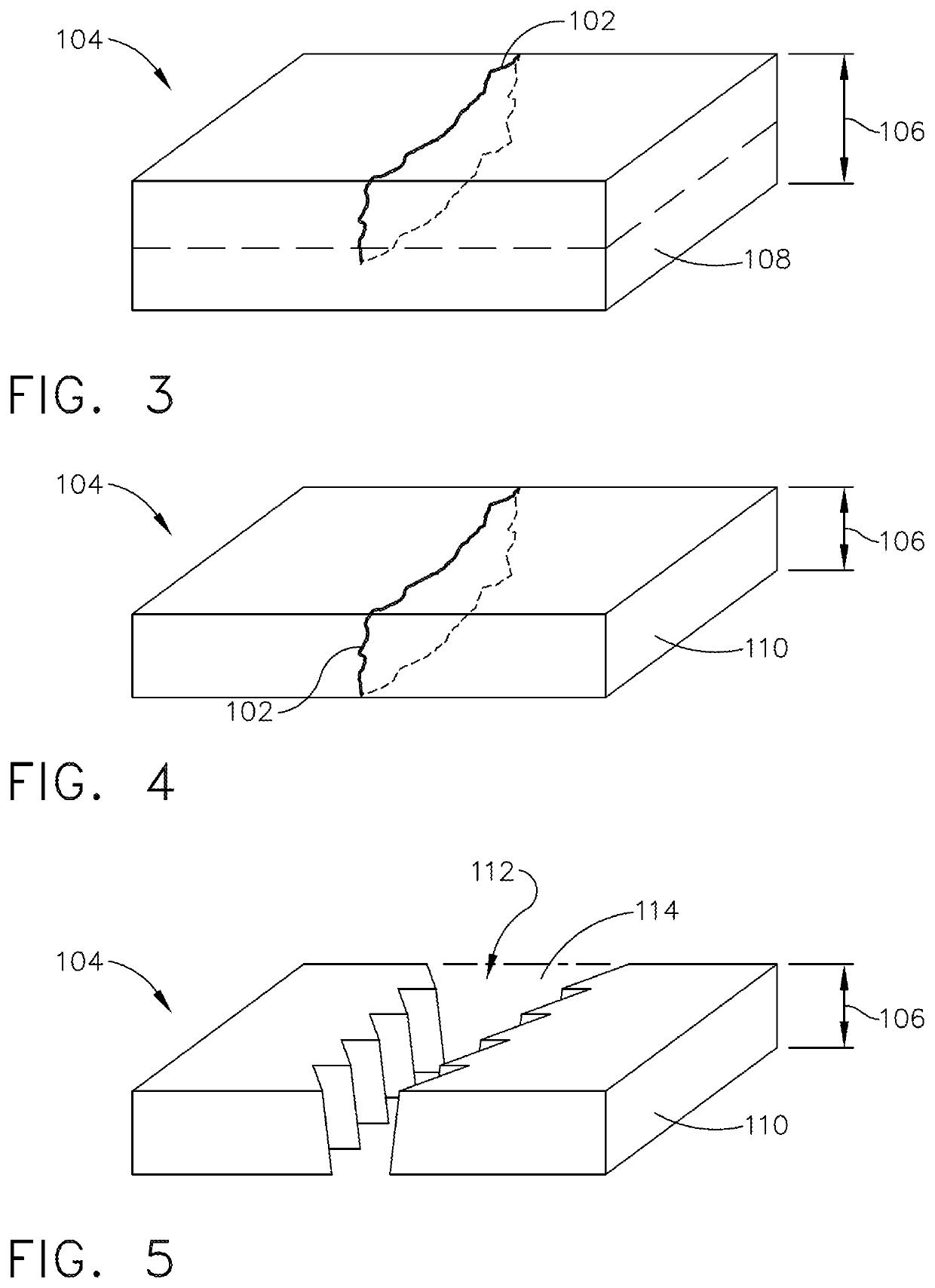

Foreign object damage (FOD) resistance presents another significant hurdle. While CMCs offer superior thermal properties compared to traditional superalloys, they exhibit relatively lower impact resistance. In commercial fleet operations, where debris ingestion is common, this vulnerability can lead to premature component failure through crack initiation and propagation.

Thermal cycling fatigue poses a substantial challenge for CMC durability. Commercial aircraft engines typically undergo thousands of start-stop cycles during their service life, creating thermal gradients that induce mechanical stresses at material interfaces. These repeated thermal cycles can lead to progressive microcracking and interfacial debonding within the composite structure.

Manufacturing variability continues to impact CMC reliability in fleet applications. Current production processes still struggle with consistency issues, resulting in statistical variations in component performance and lifespans. This variability complicates maintenance scheduling and reliability predictions across large commercial fleets.

Inspection and monitoring limitations further compound durability challenges. Unlike metallic components, CMCs present unique difficulties for non-destructive evaluation techniques. Conventional methods often fail to detect subsurface damage or early-stage degradation in these complex microstructures, making it difficult to implement condition-based maintenance strategies.

Cost-effective repair methodologies remain underdeveloped for CMC components. When damage occurs, current repair options are limited and often economically prohibitive, forcing complete component replacement rather than targeted restoration. This significantly impacts the total lifecycle cost of CMC implementation in commercial fleets.

Accelerated testing correlation with actual service conditions represents a final major challenge. Laboratory tests frequently fail to accurately replicate the complex, multimodal degradation mechanisms experienced in real-world operations, making it difficult to confidently predict component lifespans and establish appropriate maintenance intervals.

Water vapor attack represents a particularly severe challenge for SiC-based CMCs, as it accelerates the degradation of protective silica scales through the formation of volatile silicon hydroxide species. This phenomenon is especially problematic in aviation applications where humidity levels fluctuate considerably during different flight phases and geographical routes.

Foreign object damage (FOD) resistance presents another significant hurdle. While CMCs offer superior thermal properties compared to traditional superalloys, they exhibit relatively lower impact resistance. In commercial fleet operations, where debris ingestion is common, this vulnerability can lead to premature component failure through crack initiation and propagation.

Thermal cycling fatigue poses a substantial challenge for CMC durability. Commercial aircraft engines typically undergo thousands of start-stop cycles during their service life, creating thermal gradients that induce mechanical stresses at material interfaces. These repeated thermal cycles can lead to progressive microcracking and interfacial debonding within the composite structure.

Manufacturing variability continues to impact CMC reliability in fleet applications. Current production processes still struggle with consistency issues, resulting in statistical variations in component performance and lifespans. This variability complicates maintenance scheduling and reliability predictions across large commercial fleets.

Inspection and monitoring limitations further compound durability challenges. Unlike metallic components, CMCs present unique difficulties for non-destructive evaluation techniques. Conventional methods often fail to detect subsurface damage or early-stage degradation in these complex microstructures, making it difficult to implement condition-based maintenance strategies.

Cost-effective repair methodologies remain underdeveloped for CMC components. When damage occurs, current repair options are limited and often economically prohibitive, forcing complete component replacement rather than targeted restoration. This significantly impacts the total lifecycle cost of CMC implementation in commercial fleets.

Accelerated testing correlation with actual service conditions represents a final major challenge. Laboratory tests frequently fail to accurately replicate the complex, multimodal degradation mechanisms experienced in real-world operations, making it difficult to confidently predict component lifespans and establish appropriate maintenance intervals.

Existing Life Extension Solutions for CMC Components

01 Coating technologies for CMC component protection

Various coating technologies are employed to protect Ceramic Matrix Composite (CMC) components from environmental degradation, thereby extending their operational life. These coatings create barriers against oxidation, corrosion, and thermal stress. Advanced coating formulations include environmental barrier coatings (EBCs) that shield the underlying CMC material from high-temperature steam and combustion environments. These protective layers significantly enhance component durability in extreme operating conditions.- Coating technologies for CMC component protection: Various coating technologies are employed to protect Ceramic Matrix Composite (CMC) components from environmental degradation, thereby extending their operational life. These coatings create barriers against oxidation, corrosion, and thermal stress. Advanced coating formulations may include environmental barrier coatings (EBCs), thermal barrier coatings (TBCs), and multi-layer protective systems that shield the underlying CMC structure from harsh operating conditions in high-temperature applications such as gas turbines and aerospace components.

- Cooling system optimization for CMC components: Optimized cooling systems are critical for extending the life of CMC components operating in high-temperature environments. These systems include innovative cooling channel designs, film cooling techniques, and impingement cooling methods that effectively manage thermal loads. By maintaining CMC components within their operational temperature limits, these cooling systems prevent thermal fatigue and degradation, significantly extending component lifespan while maintaining structural integrity and performance in demanding applications.

- Predictive maintenance and condition monitoring for CMC components: Advanced predictive maintenance strategies and condition monitoring systems are implemented to extend the service life of CMC components. These approaches utilize sensors, data analytics, and machine learning algorithms to detect early signs of degradation or failure. By continuously monitoring operational parameters and material conditions, maintenance can be performed proactively before catastrophic failure occurs, optimizing component lifespan and reducing unplanned downtime in critical applications.

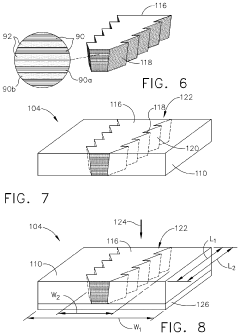

- Material composition and manufacturing improvements: Innovations in material composition and manufacturing processes significantly enhance the durability and longevity of CMC components. These advancements include refined fiber architectures, improved matrix materials, and optimized fiber-matrix interfaces that increase resistance to thermal cycling, mechanical fatigue, and environmental attack. Novel manufacturing techniques such as advanced infiltration methods and precise fiber placement contribute to more uniform, defect-free components with extended operational lifespans in extreme environments.

- Repair and regeneration techniques for CMC components: Specialized repair and regeneration techniques have been developed to restore damaged CMC components, extending their useful life beyond initial design parameters. These methods include localized repair processes, crack healing technologies, and surface regeneration treatments that can be applied in-situ or during scheduled maintenance. By restoring damaged areas without compromising the overall component integrity, these techniques provide cost-effective alternatives to complete replacement while maintaining performance standards in high-value applications.

02 Cooling system enhancements for CMC components

Innovative cooling system designs help extend the life of CMC components by managing thermal loads more effectively. These systems incorporate advanced cooling channels, film cooling techniques, and impingement cooling to reduce operating temperatures. By maintaining CMC components within their optimal temperature range, these cooling enhancements minimize thermal fatigue and prevent premature material degradation, significantly extending component service life in high-temperature applications.Expand Specific Solutions03 Structural design optimization for CMC durability

Optimized structural designs for CMC components focus on stress distribution, geometry modifications, and reinforcement techniques to enhance durability. These designs incorporate features that minimize stress concentrations, accommodate thermal expansion, and improve resistance to mechanical fatigue. Advanced computational modeling helps identify optimal component geometries that balance performance requirements with longevity considerations, resulting in CMC components with significantly extended operational lifespans.Expand Specific Solutions04 Condition monitoring and predictive maintenance systems

Sophisticated monitoring systems and predictive maintenance approaches are implemented to extend CMC component life. These systems utilize sensors, data analytics, and machine learning algorithms to track component health in real-time, detect early signs of degradation, and optimize maintenance schedules. By enabling condition-based maintenance rather than time-based replacement, these technologies prevent catastrophic failures while maximizing the useful life of CMC components in service.Expand Specific Solutions05 Material composition improvements for enhanced CMC longevity

Advanced material formulations and processing techniques enhance the inherent durability of CMC components. These improvements include optimized fiber-matrix interfaces, self-healing matrix compositions, and novel reinforcement architectures that increase resistance to crack propagation. Specialized additives and dopants are incorporated to improve oxidation resistance and high-temperature stability. These material advancements significantly extend component life by addressing fundamental degradation mechanisms at the microstructural level.Expand Specific Solutions

Leading Manufacturers and Suppliers in CMC Industry

The CMC components life extension market in commercial fleets is currently in a growth phase, with increasing adoption across aerospace and power generation sectors. The market is projected to expand significantly as CMC technology matures, driven by demands for improved fuel efficiency and reduced emissions. Leading aerospace players like GE, RTX Corp., Rolls-Royce, and Safran are at the forefront of CMC technology development, with significant investments in research and commercialization. These companies are advancing from first-generation CMC applications to more sophisticated implementations with extended service life. Research institutions including Naval Research Laboratory and universities like Nanjing University of Aeronautics & Astronautics are contributing fundamental research, while specialized manufacturers such as COI Ceramics are developing innovative material solutions to address durability challenges in high-temperature environments.

General Electric Company

Technical Solution: GE has developed advanced Environmental Barrier Coatings (EBCs) specifically designed for CMC components in commercial aircraft engines. Their multi-layer coating system includes a bond coat, intermediate layer, and top coat that work together to protect against moisture, oxidation, and thermal cycling. GE's proprietary self-healing glass ceramic compositions can flow and reseal cracks during operation, extending component life by up to 2x compared to first-generation CMCs[1]. Additionally, GE has implemented non-destructive evaluation techniques including digital X-ray, thermography, and ultrasonic inspection to monitor CMC degradation in service, allowing for condition-based maintenance rather than time-based replacement[2]. Their LEAP engine program incorporates CMC shrouds with specialized edge sealing technology to prevent hot gas ingress at component interfaces, a common failure point in commercial applications.

Strengths: Industry-leading experience with CMCs in commercial engines with proven field performance data; comprehensive life-cycle management system integrating materials science, monitoring technology, and maintenance protocols. Weaknesses: Higher initial manufacturing costs compared to traditional materials; requires specialized repair facilities and techniques that may not be widely available across all service networks.

RTX Corp.

Technical Solution: RTX (formerly Raytheon Technologies) has pioneered a comprehensive CMC life extension strategy focused on their "Preemptive Maintenance System" for commercial fleet applications. This approach combines advanced materials engineering with real-time monitoring capabilities. RTX's silicon carbide (SiC) fiber-reinforced CMCs feature engineered interphases with boron nitride coatings that control crack propagation and enhance oxidation resistance in humid environments typical of commercial operations[3]. Their proprietary matrix compositions incorporate self-healing additives that react with oxygen at high temperatures to form protective silica, extending component life by approximately 30% in cyclic operating conditions. RTX has also developed a digital twin modeling system that predicts CMC degradation based on actual flight data, allowing operators to optimize maintenance schedules according to actual usage patterns rather than conservative estimates[4]. This is complemented by embedded fiber optic sensors that monitor temperature distributions and strain in critical components during operation.

Strengths: Integrated approach combining materials science with digital monitoring solutions; strong focus on practical implementation in commercial fleet environments with variable operating conditions. Weaknesses: System complexity requires significant operator training and data infrastructure; higher initial implementation costs that may be challenging to justify for smaller fleet operators.

Critical Technologies for CMC Longevity Enhancement

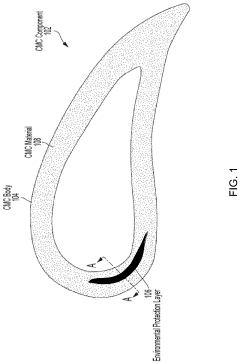

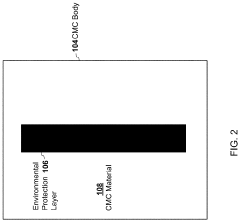

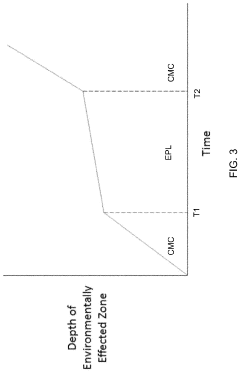

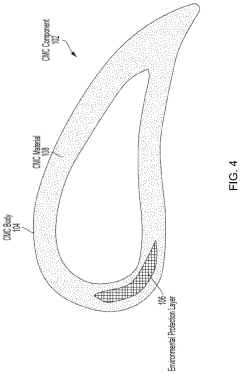

Recession resistant intermediate layer for CMC vane

PatentActiveUS20210246081A1

Innovation

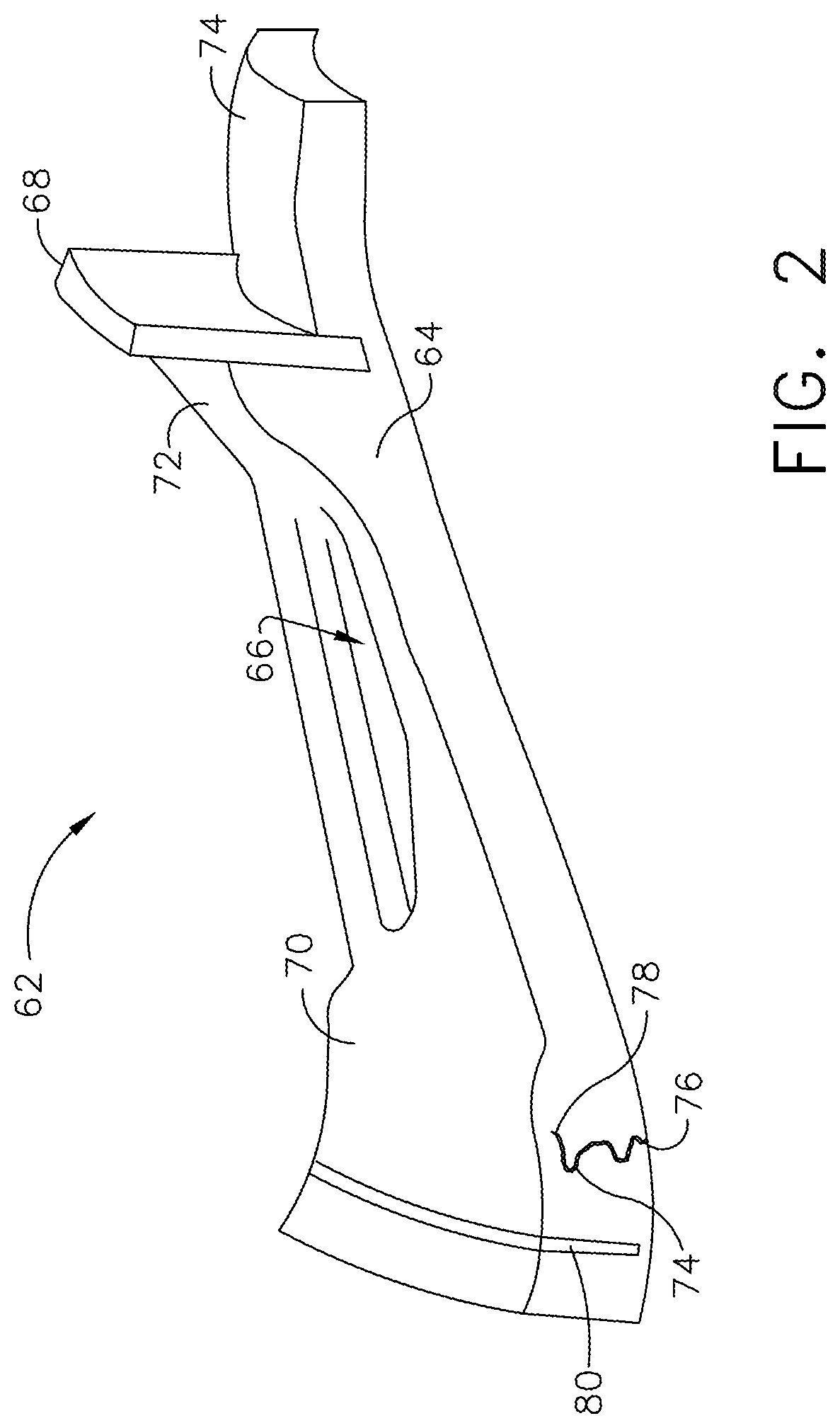

- A ceramic matrix composite component is developed with an embedded environmental protection layer made of higher-resistant ceramics, such as silicon carbide or rare earth silicates, which surrounds the CMC material, enhancing both impact and environmental resistance by slowing damage progression and preventing thermally-induced cracking.

CMC component including directionally controllable CMC insert and method of fabrication

PatentActiveUS11459908B2

Innovation

- A directionally controllable CMC insert with optimized architecture is integrated into the CMC components to redirect cracks towards low crack growth regions, utilizing a shaped void and mechanical interlocking joints to minimize stress and prevent crack propagation.

Cost-Benefit Analysis of CMC Life Extension Methods

The economic viability of CMC life extension strategies requires thorough cost-benefit analysis to justify implementation across commercial fleets. Initial investment in CMC components represents a significant capital expenditure, with costs ranging from $5,000 to $50,000 per component depending on size, complexity, and application environment. This substantial upfront investment creates strong financial incentives for extending service life rather than replacement.

When evaluating life extension methods, direct costs include inspection technologies (ranging from $50,000-$200,000 for advanced systems), repair materials (specialized coatings at $500-$2,000 per application), and skilled labor ($150-$300 per hour). These must be weighed against the alternative replacement costs and associated downtime expenses, which can reach $10,000-$30,000 per hour in commercial aviation applications.

Preventative maintenance approaches demonstrate particularly favorable cost-benefit ratios. Data from fleet operations indicates that implementing scheduled inspection and coating renewal programs typically extends CMC component life by 30-50% with a return on investment of 300-500% over the component lifecycle. These programs cost approximately 15-25% of replacement expenses while significantly reducing unplanned maintenance events.

Reactive repair methods show more variable economic outcomes. Surface treatments for minor degradation offer excellent value, costing 10-20% of replacement while recovering 70-90% of original performance. However, more extensive matrix infiltration techniques for moderate damage, while technically feasible, may approach 40-60% of replacement costs, making economic justification more challenging except for high-value components.

Operational adjustments present minimal direct costs but may impact overall system efficiency. Analysis of flight data from commercial fleets shows that modified operating parameters can extend CMC component life by 15-25% with negligible implementation costs, though potential efficiency penalties of 1-3% must be factored into long-term operational expenses.

The most compelling economic case emerges from integrated approaches combining preventative inspections, targeted repairs, and operational adjustments. Fleet data demonstrates that comprehensive life extension programs reduce total lifecycle costs by 30-45% compared to standard replacement schedules, with maintenance costs amortized over significantly longer service intervals. These integrated approaches typically achieve breakeven within 12-18 months of implementation across commercial fleets.

When evaluating life extension methods, direct costs include inspection technologies (ranging from $50,000-$200,000 for advanced systems), repair materials (specialized coatings at $500-$2,000 per application), and skilled labor ($150-$300 per hour). These must be weighed against the alternative replacement costs and associated downtime expenses, which can reach $10,000-$30,000 per hour in commercial aviation applications.

Preventative maintenance approaches demonstrate particularly favorable cost-benefit ratios. Data from fleet operations indicates that implementing scheduled inspection and coating renewal programs typically extends CMC component life by 30-50% with a return on investment of 300-500% over the component lifecycle. These programs cost approximately 15-25% of replacement expenses while significantly reducing unplanned maintenance events.

Reactive repair methods show more variable economic outcomes. Surface treatments for minor degradation offer excellent value, costing 10-20% of replacement while recovering 70-90% of original performance. However, more extensive matrix infiltration techniques for moderate damage, while technically feasible, may approach 40-60% of replacement costs, making economic justification more challenging except for high-value components.

Operational adjustments present minimal direct costs but may impact overall system efficiency. Analysis of flight data from commercial fleets shows that modified operating parameters can extend CMC component life by 15-25% with negligible implementation costs, though potential efficiency penalties of 1-3% must be factored into long-term operational expenses.

The most compelling economic case emerges from integrated approaches combining preventative inspections, targeted repairs, and operational adjustments. Fleet data demonstrates that comprehensive life extension programs reduce total lifecycle costs by 30-45% compared to standard replacement schedules, with maintenance costs amortized over significantly longer service intervals. These integrated approaches typically achieve breakeven within 12-18 months of implementation across commercial fleets.

Environmental Impact of Extended CMC Component Usage

The environmental implications of extending the service life of Ceramic Matrix Composite (CMC) components in commercial fleets are substantial and multifaceted. By prolonging the operational lifespan of these advanced materials, significant reductions in raw material extraction can be achieved. CMCs typically require rare earth elements and energy-intensive manufacturing processes; therefore, each extension of component life directly translates to decreased mining activities and associated habitat disruption, water pollution, and carbon emissions from extraction operations.

Manufacturing of CMC components demands considerable energy input, with production temperatures often exceeding 1000°C. Life extension strategies effectively amortize this initial environmental investment over a longer operational period. Quantitative analyses indicate that extending CMC component life by 30% can reduce the manufacturing-related carbon footprint by approximately 23-27% when calculated on a per-flight-hour basis.

Waste reduction represents another critical environmental benefit. The aerospace industry generates substantial composite waste, much of which presents recycling challenges due to the heterogeneous nature of these materials. Extended component usage directly diminishes the volume of end-of-life CMC materials entering waste streams. Current estimates suggest that comprehensive life extension programs could reduce CMC waste generation by 15-20% across commercial fleet operations.

The operational efficiency gains from maintained CMC performance characteristics yield additional environmental dividends. As these components maintain their lightweight properties and thermal resistance longer, aircraft fuel efficiency remains optimized for extended periods. Each 1% improvement in fuel efficiency through maintained component performance prevents approximately 250,000 tons of CO2 emissions annually across a typical commercial airline fleet.

However, certain environmental trade-offs must be acknowledged. Some life extension treatments involve chemical processes that may introduce additional environmental hazards if not properly managed. Specialized coatings and surface treatments sometimes contain volatile organic compounds or heavy metals that require careful handling and disposal protocols to prevent environmental contamination.

Lifecycle assessment studies comparing new component manufacturing versus life extension treatments demonstrate a clear environmental advantage for extension strategies. The carbon footprint of comprehensive refurbishment typically represents only 30-40% of that required for new component production, with proportional reductions in water usage, particulate emissions, and energy consumption.

Manufacturing of CMC components demands considerable energy input, with production temperatures often exceeding 1000°C. Life extension strategies effectively amortize this initial environmental investment over a longer operational period. Quantitative analyses indicate that extending CMC component life by 30% can reduce the manufacturing-related carbon footprint by approximately 23-27% when calculated on a per-flight-hour basis.

Waste reduction represents another critical environmental benefit. The aerospace industry generates substantial composite waste, much of which presents recycling challenges due to the heterogeneous nature of these materials. Extended component usage directly diminishes the volume of end-of-life CMC materials entering waste streams. Current estimates suggest that comprehensive life extension programs could reduce CMC waste generation by 15-20% across commercial fleet operations.

The operational efficiency gains from maintained CMC performance characteristics yield additional environmental dividends. As these components maintain their lightweight properties and thermal resistance longer, aircraft fuel efficiency remains optimized for extended periods. Each 1% improvement in fuel efficiency through maintained component performance prevents approximately 250,000 tons of CO2 emissions annually across a typical commercial airline fleet.

However, certain environmental trade-offs must be acknowledged. Some life extension treatments involve chemical processes that may introduce additional environmental hazards if not properly managed. Specialized coatings and surface treatments sometimes contain volatile organic compounds or heavy metals that require careful handling and disposal protocols to prevent environmental contamination.

Lifecycle assessment studies comparing new component manufacturing versus life extension treatments demonstrate a clear environmental advantage for extension strategies. The carbon footprint of comprehensive refurbishment typically represents only 30-40% of that required for new component production, with proportional reductions in water usage, particulate emissions, and energy consumption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!