Process Scale-Up Challenges For CMC Component Manufacturers

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CMC Process Scale-Up Background and Objectives

Ceramic Matrix Composites (CMCs) represent a revolutionary class of materials that combine the high-temperature capabilities of ceramics with the damage tolerance of composites. The development of CMCs dates back to the 1970s, with significant advancements occurring in the 1990s and 2000s. These materials have evolved from laboratory curiosities to critical components in high-performance applications, particularly in aerospace, defense, and energy sectors where extreme operating conditions demand exceptional material properties.

The technological evolution of CMCs has been driven by the increasing demand for materials that can withstand higher temperatures, more aggressive environments, and greater mechanical loads than traditional materials. This evolution has followed a trajectory from simple oxide-based systems to more complex non-oxide compositions, with corresponding advancements in manufacturing processes, fiber architectures, and matrix formulations.

Current market trends indicate a growing adoption of CMCs in gas turbine engines, rocket propulsion systems, and nuclear applications, where their superior temperature resistance and reduced weight offer significant performance advantages. The global CMC market is projected to expand at a compound annual growth rate exceeding 10% over the next decade, highlighting the strategic importance of mastering scale-up challenges.

The primary objective of addressing process scale-up challenges for CMC component manufacturers is to bridge the gap between laboratory-scale production and full industrial implementation. This involves developing robust, repeatable manufacturing processes that maintain material quality and performance while achieving economically viable production rates and costs.

Specific technical goals include optimizing fiber preform fabrication techniques for complex geometries, developing consistent matrix infiltration methods for larger components, establishing reliable quality control protocols for scaled production, and reducing cycle times without compromising material integrity. Additionally, there is a critical need to standardize testing methodologies and certification processes for CMC components to facilitate broader industry adoption.

Environmental considerations also factor into scale-up objectives, with increasing emphasis on reducing energy consumption, minimizing waste generation, and limiting the use of hazardous materials in CMC manufacturing processes. These sustainability goals align with broader industry trends toward greener manufacturing practices.

The successful achievement of these objectives would enable CMC manufacturers to meet growing market demand, reduce production costs, and ultimately expand the application range of these advanced materials into new sectors where their unique properties could provide transformative benefits.

The technological evolution of CMCs has been driven by the increasing demand for materials that can withstand higher temperatures, more aggressive environments, and greater mechanical loads than traditional materials. This evolution has followed a trajectory from simple oxide-based systems to more complex non-oxide compositions, with corresponding advancements in manufacturing processes, fiber architectures, and matrix formulations.

Current market trends indicate a growing adoption of CMCs in gas turbine engines, rocket propulsion systems, and nuclear applications, where their superior temperature resistance and reduced weight offer significant performance advantages. The global CMC market is projected to expand at a compound annual growth rate exceeding 10% over the next decade, highlighting the strategic importance of mastering scale-up challenges.

The primary objective of addressing process scale-up challenges for CMC component manufacturers is to bridge the gap between laboratory-scale production and full industrial implementation. This involves developing robust, repeatable manufacturing processes that maintain material quality and performance while achieving economically viable production rates and costs.

Specific technical goals include optimizing fiber preform fabrication techniques for complex geometries, developing consistent matrix infiltration methods for larger components, establishing reliable quality control protocols for scaled production, and reducing cycle times without compromising material integrity. Additionally, there is a critical need to standardize testing methodologies and certification processes for CMC components to facilitate broader industry adoption.

Environmental considerations also factor into scale-up objectives, with increasing emphasis on reducing energy consumption, minimizing waste generation, and limiting the use of hazardous materials in CMC manufacturing processes. These sustainability goals align with broader industry trends toward greener manufacturing practices.

The successful achievement of these objectives would enable CMC manufacturers to meet growing market demand, reduce production costs, and ultimately expand the application range of these advanced materials into new sectors where their unique properties could provide transformative benefits.

Market Demand Analysis for CMC Components

The global market for Ceramic Matrix Composite (CMC) components has been experiencing robust growth, driven primarily by increasing demand from aerospace, defense, and energy sectors. Current market valuations indicate that the global CMC market reached approximately 4.8 billion USD in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.1% through 2030, potentially reaching 12 billion USD by the end of the forecast period.

The aerospace industry remains the dominant consumer of CMC components, accounting for nearly 40% of total market demand. This is largely attributed to the superior performance characteristics of CMCs in high-temperature applications, where they offer significant weight reduction compared to traditional superalloys while maintaining mechanical integrity under extreme conditions. Major commercial aircraft manufacturers have increasingly incorporated CMC components in engine hot sections, resulting in fuel efficiency improvements of 15-20%.

Defense applications represent the second-largest market segment, with particular emphasis on missile systems, hypersonic vehicles, and next-generation propulsion systems. The thermal protection capabilities of CMCs make them ideal for these demanding applications, where temperatures can exceed 1600°C.

Energy sector demand is growing at the fastest rate among all industries, with a particular focus on gas turbine components, nuclear applications, and renewable energy systems. The ability of CMCs to operate efficiently at higher temperatures enables improved thermodynamic efficiency in power generation systems, potentially reducing carbon emissions by 20-30% compared to conventional materials.

Regional market analysis reveals that North America currently holds the largest market share at 38%, followed by Europe (27%) and Asia-Pacific (25%). However, the Asia-Pacific region is expected to witness the highest growth rate over the next decade, driven by expanding aerospace and defense industries in China, Japan, and India.

Customer requirements are increasingly focused on cost reduction and manufacturing scalability. While CMC components offer superior performance, their current production costs remain 3-5 times higher than traditional alternatives. Industry surveys indicate that a 40% reduction in manufacturing costs would significantly accelerate adoption across multiple sectors.

Supply chain considerations are becoming increasingly critical as demand grows. Limited raw material availability, particularly for high-purity ceramic fibers and specialized matrix precursors, represents a potential constraint on market expansion. Additionally, the complex and time-intensive manufacturing processes currently employed present challenges for meeting growing volume requirements, creating opportunities for innovative process scale-up solutions.

The aerospace industry remains the dominant consumer of CMC components, accounting for nearly 40% of total market demand. This is largely attributed to the superior performance characteristics of CMCs in high-temperature applications, where they offer significant weight reduction compared to traditional superalloys while maintaining mechanical integrity under extreme conditions. Major commercial aircraft manufacturers have increasingly incorporated CMC components in engine hot sections, resulting in fuel efficiency improvements of 15-20%.

Defense applications represent the second-largest market segment, with particular emphasis on missile systems, hypersonic vehicles, and next-generation propulsion systems. The thermal protection capabilities of CMCs make them ideal for these demanding applications, where temperatures can exceed 1600°C.

Energy sector demand is growing at the fastest rate among all industries, with a particular focus on gas turbine components, nuclear applications, and renewable energy systems. The ability of CMCs to operate efficiently at higher temperatures enables improved thermodynamic efficiency in power generation systems, potentially reducing carbon emissions by 20-30% compared to conventional materials.

Regional market analysis reveals that North America currently holds the largest market share at 38%, followed by Europe (27%) and Asia-Pacific (25%). However, the Asia-Pacific region is expected to witness the highest growth rate over the next decade, driven by expanding aerospace and defense industries in China, Japan, and India.

Customer requirements are increasingly focused on cost reduction and manufacturing scalability. While CMC components offer superior performance, their current production costs remain 3-5 times higher than traditional alternatives. Industry surveys indicate that a 40% reduction in manufacturing costs would significantly accelerate adoption across multiple sectors.

Supply chain considerations are becoming increasingly critical as demand grows. Limited raw material availability, particularly for high-purity ceramic fibers and specialized matrix precursors, represents a potential constraint on market expansion. Additionally, the complex and time-intensive manufacturing processes currently employed present challenges for meeting growing volume requirements, creating opportunities for innovative process scale-up solutions.

Technical Challenges in CMC Manufacturing Scale-Up

The scale-up of Ceramic Matrix Composite (CMC) manufacturing processes presents significant technical challenges that manufacturers must overcome to achieve commercial viability. These challenges stem from the inherent complexity of CMC materials, which combine ceramic fibers, matrices, and interface coatings to create components with superior high-temperature performance and durability compared to traditional materials.

One of the primary technical hurdles is maintaining consistent material properties during scale-up. Laboratory-scale processes often achieve excellent results under tightly controlled conditions, but translating these to industrial scale introduces variability in fiber distribution, matrix infiltration, and interface coating uniformity. This variability can lead to unpredictable mechanical properties and performance degradation in the final components.

Process control automation represents another major challenge. Many CMC manufacturing steps remain highly manual or semi-automated, requiring significant expertise and craftsmanship. Developing robust automated systems for fiber placement, matrix infiltration, and complex geometry formation requires substantial engineering investment and often custom solutions that don't exist in off-the-shelf manufacturing equipment.

Thermal management during processing presents particular difficulties at scale. CMC manufacturing typically involves high-temperature processes such as chemical vapor infiltration (CVI), polymer infiltration and pyrolysis (PIP), or melt infiltration (MI). Scaling up these thermal processes while maintaining uniform temperature distribution throughout larger components requires sophisticated furnace design and thermal modeling capabilities that many manufacturers lack.

Quality control and non-destructive evaluation (NDE) methods also face limitations during scale-up. Techniques that work well for small components may be insufficient for detecting defects in larger, more complex geometries. Developing appropriate NDE protocols for production-scale components remains an ongoing challenge, particularly for internal defects that could lead to catastrophic failure.

Cost-effective raw material sourcing becomes increasingly critical at production scale. High-performance ceramic fibers, specialized matrix precursors, and coating materials often have limited suppliers and high costs. Securing consistent supply chains while reducing material costs through volume purchasing or alternative material development is essential for commercial viability.

Equipment scaling itself introduces unique engineering challenges. Custom-designed furnaces, fiber placement systems, and infiltration equipment must be developed to handle larger components while maintaining process parameters within tight tolerances. This often requires significant capital investment with uncertain returns until production is stabilized.

One of the primary technical hurdles is maintaining consistent material properties during scale-up. Laboratory-scale processes often achieve excellent results under tightly controlled conditions, but translating these to industrial scale introduces variability in fiber distribution, matrix infiltration, and interface coating uniformity. This variability can lead to unpredictable mechanical properties and performance degradation in the final components.

Process control automation represents another major challenge. Many CMC manufacturing steps remain highly manual or semi-automated, requiring significant expertise and craftsmanship. Developing robust automated systems for fiber placement, matrix infiltration, and complex geometry formation requires substantial engineering investment and often custom solutions that don't exist in off-the-shelf manufacturing equipment.

Thermal management during processing presents particular difficulties at scale. CMC manufacturing typically involves high-temperature processes such as chemical vapor infiltration (CVI), polymer infiltration and pyrolysis (PIP), or melt infiltration (MI). Scaling up these thermal processes while maintaining uniform temperature distribution throughout larger components requires sophisticated furnace design and thermal modeling capabilities that many manufacturers lack.

Quality control and non-destructive evaluation (NDE) methods also face limitations during scale-up. Techniques that work well for small components may be insufficient for detecting defects in larger, more complex geometries. Developing appropriate NDE protocols for production-scale components remains an ongoing challenge, particularly for internal defects that could lead to catastrophic failure.

Cost-effective raw material sourcing becomes increasingly critical at production scale. High-performance ceramic fibers, specialized matrix precursors, and coating materials often have limited suppliers and high costs. Securing consistent supply chains while reducing material costs through volume purchasing or alternative material development is essential for commercial viability.

Equipment scaling itself introduces unique engineering challenges. Custom-designed furnaces, fiber placement systems, and infiltration equipment must be developed to handle larger components while maintaining process parameters within tight tolerances. This often requires significant capital investment with uncertain returns until production is stabilized.

Current Scale-Up Methodologies and Solutions

01 Biopharmaceutical process scale-up challenges

Scale-up of biopharmaceutical processes presents unique challenges related to maintaining consistent product quality and yield when transitioning from laboratory to industrial production. These challenges include ensuring proper cell culture conditions, optimizing fermentation parameters, and developing robust purification methods that work effectively at larger scales. Strategies to address these challenges involve careful parameter monitoring, process analytical technology implementation, and systematic approach to scale-up design.- Biopharmaceutical Process Scale-Up Challenges: Scale-up of biopharmaceutical processes presents unique challenges due to the complexity of biological systems. These challenges include maintaining consistent product quality, optimizing cell culture conditions, and ensuring process robustness when transitioning from laboratory to industrial scale. Key considerations involve controlling critical process parameters, adapting fermentation techniques, and implementing effective purification strategies to maintain yield and purity at larger scales.

- Equipment and Technology Transfer Challenges: Transferring processes from laboratory to commercial scale requires addressing equipment-related challenges. This includes selecting appropriate equipment designs, managing heat and mass transfer differences, and adapting mixing technologies. Successful scale-up depends on understanding how equipment characteristics change with size and implementing appropriate modifications to maintain process performance across different scales of operation.

- Quality Control and Regulatory Compliance: Maintaining consistent quality during process scale-up requires robust quality control systems and regulatory compliance strategies. This involves developing appropriate analytical methods, establishing acceptance criteria, and implementing validation protocols that ensure product quality attributes remain consistent despite the change in production scale. Regulatory considerations must be addressed early in the scale-up process to avoid delays in approval.

- Data Management and Process Modeling: Effective process scale-up relies on comprehensive data management systems and accurate process modeling. This includes collecting and analyzing process data, developing predictive models, and using computational tools to simulate scale-up effects. Advanced modeling techniques help identify potential issues before full-scale implementation, reducing risk and optimizing process parameters for successful technology transfer.

- Risk Management and Troubleshooting Strategies: Managing risks during process scale-up requires systematic approaches to identify potential failure points and develop mitigation strategies. This includes conducting risk assessments, implementing design of experiments methodology, and establishing troubleshooting protocols. Effective risk management strategies address critical process parameters, material variability, and equipment performance to ensure successful scale-up and consistent manufacturing outcomes.

02 Equipment and technology transfer challenges

Transferring processes from small-scale laboratory equipment to industrial-scale manufacturing equipment introduces significant challenges. These include differences in mixing efficiency, heat transfer capabilities, and mass transfer rates. Successfully addressing these challenges requires understanding equipment-specific parameters, conducting appropriate engineering studies, and implementing design modifications to ensure comparable process performance across different scales of operation.Expand Specific Solutions03 Quality control and regulatory compliance in scale-up

Maintaining consistent quality control and regulatory compliance during process scale-up is critical for pharmaceutical and biotechnology industries. This involves establishing robust analytical methods, implementing appropriate validation protocols, and ensuring that scaled-up processes meet all regulatory requirements. Challenges include developing representative sampling strategies, establishing meaningful acceptance criteria, and demonstrating process equivalence between different scales of operation.Expand Specific Solutions04 Data management and computational modeling for scale-up

Effective data management and computational modeling are essential for successful process scale-up. This includes utilizing process simulation tools, statistical analysis of experimental data, and predictive modeling to anticipate scale-up effects. Advanced computational approaches help identify critical process parameters, optimize operating conditions, and reduce the number of experimental runs required during scale-up, ultimately saving time and resources while improving outcomes.Expand Specific Solutions05 Economic and operational efficiency in scale-up

Achieving economic and operational efficiency during process scale-up involves balancing technical requirements with cost considerations. Challenges include optimizing resource utilization, minimizing waste generation, and ensuring process robustness while maintaining economic viability. Strategies to address these challenges include implementing lean manufacturing principles, developing continuous processing approaches, and utilizing process intensification techniques to improve overall efficiency and reduce production costs.Expand Specific Solutions

Key Players in CMC Component Manufacturing Industry

Process Scale-Up Challenges for CMC Component Manufacturers are currently at a critical industry development stage, with the global market expected to reach $120 billion by 2025. The semiconductor manufacturing sector shows varying degrees of technical maturity, with established players like Taiwan Semiconductor Manufacturing Co., Ltd. and Tokyo Electron Ltd. leading with advanced process technologies. Companies such as GLOBALFOUNDRIES, United Microelectronics Corp., and SMIC are rapidly advancing their capabilities, while newer entrants like Sinmat Commercial LLC are focusing on specialized solutions for chemical mechanical planarization. The competitive landscape is characterized by regional clusters in East Asia, North America, and Europe, with increasing collaboration between established manufacturers and research institutions to overcome scaling challenges in complex manufacturing environments.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has developed a comprehensive CMC (Chemical Mechanical Planarization) scale-up strategy that integrates advanced process control systems with real-time monitoring capabilities. Their approach includes a modular manufacturing platform that allows for seamless transition from R&D to mass production while maintaining consistent quality metrics. TSMC employs a multi-stage verification protocol where each CMC component undergoes rigorous testing at incrementally larger production volumes before full-scale implementation. Their proprietary Advanced Process Control (APC) system continuously monitors over 300 parameters during scale-up to ensure uniformity across wafers. TSMC has also implemented an AI-driven predictive maintenance system that has reduced unplanned downtime by approximately 25% during scale-up transitions. The company utilizes digital twin technology to simulate scale-up challenges before physical implementation, reducing the number of pilot runs required by up to 40%.

Strengths: Industry-leading process control capabilities with exceptional yield management during scale-up transitions. Their integrated approach combining AI and digital twin technology provides superior predictability for scale-up challenges. Weaknesses: High capital investment requirements for their comprehensive approach may be prohibitive for smaller manufacturers. Their solutions are highly customized to semiconductor applications and may not transfer easily to other CMC component types.

Semiconductor Manufacturing International (Shanghai) Corp.

Technical Solution: SMIC has developed a systematic approach to CMC component scale-up challenges through their "Progressive Capacity Expansion" methodology. This framework addresses the critical transition points between lab-scale, pilot, and mass production phases with specialized protocols for each stage. SMIC's approach incorporates a comprehensive material qualification system that tests raw materials at increasing batch sizes to identify potential inconsistencies before they impact production. Their scale-up process includes specialized equipment modification protocols that account for the different kinetics and dynamics present in larger reaction vessels and processing equipment. SMIC has implemented a statistical process control system specifically designed for scale-up transitions, which monitors over 200 process parameters and has demonstrated a 30% reduction in scale-up related defects. The company also employs a cross-functional scale-up team structure that integrates R&D, manufacturing, and quality assurance personnel to address challenges holistically.

Strengths: Strong focus on material qualification across different production scales, which is critical for CMC components. Their cross-functional team approach enables rapid problem-solving during scale-up transitions. Weaknesses: Their technology is somewhat less mature than industry leaders like TSMC, particularly in advanced process nodes. The company's scale-up methodology is still evolving and may require more iterations than more established competitors.

Critical Patents and Technical Literature Review

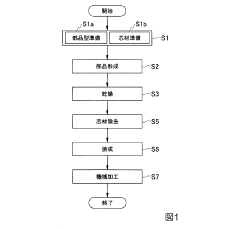

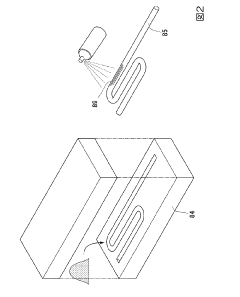

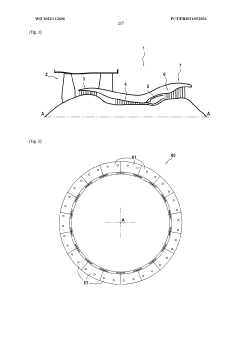

Production method of ceramic composite material component

PatentActiveJP2019085310A

Innovation

- A method involving the use of water-soluble core materials to create spaces in CMC components, allowing for easy removal through contact with water and reducing the need for additional heating steps, combined with the formation of a ceramic matrix phase and optional machining to form additional spaces.

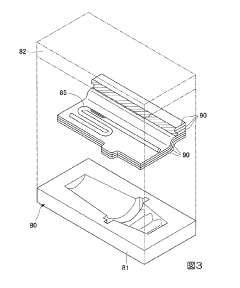

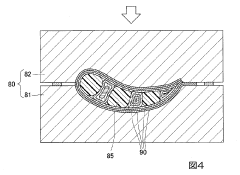

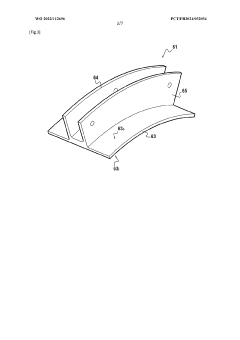

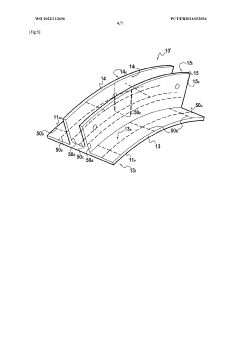

Part made from CMC and method for manufacturing such a part

PatentWO2022112696A1

Innovation

- Incorporating inserts made of a different material within the CMC composite material to promote the migration of liquid silicon, allowing controlled nodule formation in non-sensitive areas, thereby reducing manufacturing costs and cycle time without altering the densification process or material composition.

Regulatory Compliance for CMC Manufacturing Processes

Regulatory compliance represents a critical dimension for Chemistry, Manufacturing, and Controls (CMC) component manufacturers facing process scale-up challenges. The transition from laboratory-scale to commercial production necessitates adherence to increasingly stringent regulatory frameworks established by authorities such as the FDA, EMA, and NMPA. These regulations ensure product quality, safety, and efficacy throughout the manufacturing lifecycle.

The regulatory landscape for CMC manufacturing processes encompasses multiple compliance domains. Good Manufacturing Practices (GMP) serve as the cornerstone, requiring manufacturers to implement robust quality management systems, maintain appropriate documentation, and ensure process validation during scale-up activities. Notably, 21 CFR Part 210/211 in the US and Annex 15 of EU GMP guidelines specifically address process validation requirements critical during scale-up operations.

Process Analytical Technology (PAT) initiatives have gained regulatory significance, with authorities encouraging manufacturers to implement real-time monitoring and control strategies during scale-up. This approach facilitates continuous verification of critical quality attributes and enhances regulatory compliance through improved process understanding and control.

Documentation requirements intensify substantially during scale-up phases. Manufacturers must maintain comprehensive records of process development, risk assessments, validation protocols, and change management procedures. The regulatory expectation for data integrity has also increased, with requirements for electronic systems to comply with 21 CFR Part 11 or equivalent standards in other jurisdictions.

Scale-up activities frequently trigger regulatory submissions and amendments. Changes to manufacturing processes, equipment, or facilities often necessitate prior approval supplements or comparability protocols. The ICH Q8, Q9, Q10, and Q11 guidelines provide the framework for implementing Quality by Design (QbD) principles, which facilitate regulatory flexibility during scale-up by establishing design spaces and control strategies based on thorough process understanding.

Environmental regulations present additional compliance challenges during scale-up, particularly regarding waste management, emissions control, and resource utilization. Manufacturers must navigate complex environmental protection requirements that vary significantly across different regions and jurisdictions.

Cross-border regulatory harmonization efforts, while progressing through initiatives like the International Council for Harmonisation (ICH), still leave manufacturers navigating disparate regulatory requirements when scaling up processes for global markets. This regulatory complexity necessitates strategic planning and robust regulatory intelligence capabilities to ensure compliant scale-up across multiple markets.

The regulatory landscape for CMC manufacturing processes encompasses multiple compliance domains. Good Manufacturing Practices (GMP) serve as the cornerstone, requiring manufacturers to implement robust quality management systems, maintain appropriate documentation, and ensure process validation during scale-up activities. Notably, 21 CFR Part 210/211 in the US and Annex 15 of EU GMP guidelines specifically address process validation requirements critical during scale-up operations.

Process Analytical Technology (PAT) initiatives have gained regulatory significance, with authorities encouraging manufacturers to implement real-time monitoring and control strategies during scale-up. This approach facilitates continuous verification of critical quality attributes and enhances regulatory compliance through improved process understanding and control.

Documentation requirements intensify substantially during scale-up phases. Manufacturers must maintain comprehensive records of process development, risk assessments, validation protocols, and change management procedures. The regulatory expectation for data integrity has also increased, with requirements for electronic systems to comply with 21 CFR Part 11 or equivalent standards in other jurisdictions.

Scale-up activities frequently trigger regulatory submissions and amendments. Changes to manufacturing processes, equipment, or facilities often necessitate prior approval supplements or comparability protocols. The ICH Q8, Q9, Q10, and Q11 guidelines provide the framework for implementing Quality by Design (QbD) principles, which facilitate regulatory flexibility during scale-up by establishing design spaces and control strategies based on thorough process understanding.

Environmental regulations present additional compliance challenges during scale-up, particularly regarding waste management, emissions control, and resource utilization. Manufacturers must navigate complex environmental protection requirements that vary significantly across different regions and jurisdictions.

Cross-border regulatory harmonization efforts, while progressing through initiatives like the International Council for Harmonisation (ICH), still leave manufacturers navigating disparate regulatory requirements when scaling up processes for global markets. This regulatory complexity necessitates strategic planning and robust regulatory intelligence capabilities to ensure compliant scale-up across multiple markets.

Supply Chain Optimization Strategies for CMC Production

Optimizing the supply chain for CMC (Ceramic Matrix Composite) production represents a critical factor in addressing process scale-up challenges. The complex nature of CMC manufacturing, with its multi-stage processes and specialized material requirements, necessitates sophisticated supply chain strategies to ensure consistent quality, cost efficiency, and timely production.

A primary consideration in supply chain optimization involves strategic sourcing of raw materials. CMC manufacturers must establish relationships with multiple qualified suppliers to mitigate risks associated with material shortages or quality inconsistencies. Implementing vendor qualification programs that rigorously assess supplier capabilities, quality systems, and financial stability can significantly reduce disruptions during scale-up phases.

Inventory management presents another crucial aspect of supply chain optimization. The implementation of just-in-time (JIT) inventory systems, balanced with strategic buffer stocks for critical components, can minimize carrying costs while ensuring production continuity. Advanced forecasting models utilizing machine learning algorithms have demonstrated up to 30% improvement in inventory accuracy for specialized materials used in CMC production.

Vertical integration strategies merit careful evaluation for CMC manufacturers facing scale-up challenges. Bringing critical supply chain elements in-house can provide greater control over quality and lead times, though this approach requires substantial capital investment. Hybrid models, where manufacturers maintain ownership of core processes while strategically outsourcing non-critical components, have proven effective in balancing control with capital efficiency.

Digital transformation of supply chain operations offers significant opportunities for optimization. Implementation of integrated ERP systems with specialized modules for CMC production can provide real-time visibility across the entire supply network. Digital twins of the supply chain enable scenario planning and risk assessment, allowing manufacturers to proactively address potential bottlenecks before they impact production.

Collaborative planning with key suppliers and customers represents an emerging best practice in CMC supply chain management. Establishing shared forecasting systems and collaborative planning processes can reduce lead times by up to 40% while improving overall supply chain responsiveness. These collaborative approaches are particularly valuable during scale-up phases when demand patterns may be less predictable.

Transportation logistics optimization, including modal selection and route planning, can significantly impact both cost and environmental sustainability of CMC production. Advanced logistics planning systems that consider factors such as material sensitivity, lead time requirements, and carbon footprint can identify optimal transportation strategies that balance cost, time, and environmental considerations.

A primary consideration in supply chain optimization involves strategic sourcing of raw materials. CMC manufacturers must establish relationships with multiple qualified suppliers to mitigate risks associated with material shortages or quality inconsistencies. Implementing vendor qualification programs that rigorously assess supplier capabilities, quality systems, and financial stability can significantly reduce disruptions during scale-up phases.

Inventory management presents another crucial aspect of supply chain optimization. The implementation of just-in-time (JIT) inventory systems, balanced with strategic buffer stocks for critical components, can minimize carrying costs while ensuring production continuity. Advanced forecasting models utilizing machine learning algorithms have demonstrated up to 30% improvement in inventory accuracy for specialized materials used in CMC production.

Vertical integration strategies merit careful evaluation for CMC manufacturers facing scale-up challenges. Bringing critical supply chain elements in-house can provide greater control over quality and lead times, though this approach requires substantial capital investment. Hybrid models, where manufacturers maintain ownership of core processes while strategically outsourcing non-critical components, have proven effective in balancing control with capital efficiency.

Digital transformation of supply chain operations offers significant opportunities for optimization. Implementation of integrated ERP systems with specialized modules for CMC production can provide real-time visibility across the entire supply network. Digital twins of the supply chain enable scenario planning and risk assessment, allowing manufacturers to proactively address potential bottlenecks before they impact production.

Collaborative planning with key suppliers and customers represents an emerging best practice in CMC supply chain management. Establishing shared forecasting systems and collaborative planning processes can reduce lead times by up to 40% while improving overall supply chain responsiveness. These collaborative approaches are particularly valuable during scale-up phases when demand patterns may be less predictable.

Transportation logistics optimization, including modal selection and route planning, can significantly impact both cost and environmental sustainability of CMC production. Advanced logistics planning systems that consider factors such as material sensitivity, lead time requirements, and carbon footprint can identify optimal transportation strategies that balance cost, time, and environmental considerations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!