Lifecycle Economic Assessment: CMCs Versus Superalloys

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CMCs vs Superalloys Background and Objectives

Ceramic Matrix Composites (CMCs) and superalloys represent two critical material systems that have revolutionized high-temperature applications across aerospace, energy, and industrial sectors. The evolution of these materials spans several decades, with superalloys emerging in the 1940s as essential components for jet engines, while CMCs gained prominence in the 1970s as potential alternatives offering superior temperature capabilities and weight reduction.

The technological trajectory of these materials has been driven by increasingly demanding operating environments, particularly in gas turbine engines where efficiency correlates directly with operating temperatures. Superalloys, primarily nickel-based, have undergone continuous refinement through alloying strategies, processing innovations, and microstructural engineering to push their temperature limits from approximately 650°C to beyond 1100°C for single-crystal variants.

CMCs, consisting of ceramic fibers embedded in ceramic matrices, emerged as promising alternatives due to their exceptional temperature resistance (potentially exceeding 1400°C), lower density, and superior oxidation resistance. Their development has progressed from early oxide-oxide systems to more advanced silicon carbide (SiC) fiber-reinforced silicon carbide matrix composites, which now represent the state-of-the-art for extreme temperature applications.

The primary objective of this technical assessment is to conduct a comprehensive lifecycle economic analysis comparing CMCs and superalloys across their entire value chain—from raw material extraction and processing to manufacturing, in-service performance, maintenance requirements, and end-of-life considerations. This analysis aims to quantify the total cost of ownership for components made from these competing materials, accounting for both direct costs and indirect economic impacts.

Additionally, this assessment seeks to identify technological inflection points where CMCs become economically viable alternatives to superalloys in specific applications. While CMCs offer superior performance in certain metrics, their widespread adoption has been hindered by higher manufacturing costs, processing challenges, and limited industrial infrastructure. Understanding these economic crossover points is crucial for strategic investment decisions in material development and manufacturing capabilities.

The assessment will also explore how emerging trends—including additive manufacturing, computational materials engineering, and sustainability considerations—may alter the economic equation between these material systems in the coming decade. By establishing a comprehensive economic framework for comparing these materials, this research aims to guide technology roadmapping and investment prioritization for both material systems.

The technological trajectory of these materials has been driven by increasingly demanding operating environments, particularly in gas turbine engines where efficiency correlates directly with operating temperatures. Superalloys, primarily nickel-based, have undergone continuous refinement through alloying strategies, processing innovations, and microstructural engineering to push their temperature limits from approximately 650°C to beyond 1100°C for single-crystal variants.

CMCs, consisting of ceramic fibers embedded in ceramic matrices, emerged as promising alternatives due to their exceptional temperature resistance (potentially exceeding 1400°C), lower density, and superior oxidation resistance. Their development has progressed from early oxide-oxide systems to more advanced silicon carbide (SiC) fiber-reinforced silicon carbide matrix composites, which now represent the state-of-the-art for extreme temperature applications.

The primary objective of this technical assessment is to conduct a comprehensive lifecycle economic analysis comparing CMCs and superalloys across their entire value chain—from raw material extraction and processing to manufacturing, in-service performance, maintenance requirements, and end-of-life considerations. This analysis aims to quantify the total cost of ownership for components made from these competing materials, accounting for both direct costs and indirect economic impacts.

Additionally, this assessment seeks to identify technological inflection points where CMCs become economically viable alternatives to superalloys in specific applications. While CMCs offer superior performance in certain metrics, their widespread adoption has been hindered by higher manufacturing costs, processing challenges, and limited industrial infrastructure. Understanding these economic crossover points is crucial for strategic investment decisions in material development and manufacturing capabilities.

The assessment will also explore how emerging trends—including additive manufacturing, computational materials engineering, and sustainability considerations—may alter the economic equation between these material systems in the coming decade. By establishing a comprehensive economic framework for comparing these materials, this research aims to guide technology roadmapping and investment prioritization for both material systems.

Market Demand Analysis for Advanced Materials

The global market for advanced materials, particularly Ceramic Matrix Composites (CMCs) and superalloys, has experienced significant growth driven by increasing demands in aerospace, defense, energy, and automotive sectors. These high-performance materials address critical needs for components operating in extreme environments where conventional materials fail to deliver adequate performance.

The aerospace industry represents the largest market segment for both CMCs and superalloys, with commercial aviation and military applications driving demand. The transition toward more fuel-efficient aircraft has accelerated interest in lightweight materials that can withstand high temperatures, with CMCs offering weight reduction of 30-40% compared to nickel-based superalloys while maintaining thermal stability.

Energy generation represents another substantial market, particularly in gas turbines where efficiency improvements directly correlate with operating temperatures. The power generation sector's shift toward cleaner energy solutions has increased demand for materials capable of withstanding higher combustion temperatures, reducing emissions while improving overall system efficiency.

Defense applications constitute a premium market segment where performance requirements often supersede cost considerations. Military aircraft, missile systems, and naval applications require materials with exceptional reliability under extreme conditions, creating steady demand for both material categories despite their high costs.

Industrial applications in chemical processing, oil and gas, and manufacturing equipment represent growing markets as companies seek to extend component lifespans and reduce maintenance costs in corrosive or high-temperature environments. The automotive sector, particularly in high-performance and racing applications, has begun adopting these advanced materials for specific components where traditional materials reach their performance limits.

Market analysis indicates the global superalloys market currently dominates with approximately $6 billion in annual revenue, growing at 4-5% annually. Meanwhile, the CMC market, though smaller at around $2 billion, demonstrates more aggressive growth rates of 8-10% annually, suggesting a gradual shift in market preference as manufacturing technologies mature and costs decrease.

Regional demand patterns show North America and Europe leading in adoption, primarily due to their established aerospace and defense industries. However, Asia-Pacific markets, particularly China, Japan, and India, are experiencing the fastest growth rates as these countries expand their aerospace manufacturing capabilities and energy infrastructure.

Customer requirements increasingly emphasize total lifecycle costs rather than initial acquisition expenses, creating market opportunities for materials that offer superior longevity and reduced maintenance requirements. This shift in purchasing criteria has strengthened the value proposition for CMCs despite their higher initial costs compared to traditional superalloys.

The aerospace industry represents the largest market segment for both CMCs and superalloys, with commercial aviation and military applications driving demand. The transition toward more fuel-efficient aircraft has accelerated interest in lightweight materials that can withstand high temperatures, with CMCs offering weight reduction of 30-40% compared to nickel-based superalloys while maintaining thermal stability.

Energy generation represents another substantial market, particularly in gas turbines where efficiency improvements directly correlate with operating temperatures. The power generation sector's shift toward cleaner energy solutions has increased demand for materials capable of withstanding higher combustion temperatures, reducing emissions while improving overall system efficiency.

Defense applications constitute a premium market segment where performance requirements often supersede cost considerations. Military aircraft, missile systems, and naval applications require materials with exceptional reliability under extreme conditions, creating steady demand for both material categories despite their high costs.

Industrial applications in chemical processing, oil and gas, and manufacturing equipment represent growing markets as companies seek to extend component lifespans and reduce maintenance costs in corrosive or high-temperature environments. The automotive sector, particularly in high-performance and racing applications, has begun adopting these advanced materials for specific components where traditional materials reach their performance limits.

Market analysis indicates the global superalloys market currently dominates with approximately $6 billion in annual revenue, growing at 4-5% annually. Meanwhile, the CMC market, though smaller at around $2 billion, demonstrates more aggressive growth rates of 8-10% annually, suggesting a gradual shift in market preference as manufacturing technologies mature and costs decrease.

Regional demand patterns show North America and Europe leading in adoption, primarily due to their established aerospace and defense industries. However, Asia-Pacific markets, particularly China, Japan, and India, are experiencing the fastest growth rates as these countries expand their aerospace manufacturing capabilities and energy infrastructure.

Customer requirements increasingly emphasize total lifecycle costs rather than initial acquisition expenses, creating market opportunities for materials that offer superior longevity and reduced maintenance requirements. This shift in purchasing criteria has strengthened the value proposition for CMCs despite their higher initial costs compared to traditional superalloys.

Current State and Challenges in CMCs and Superalloys

Ceramic Matrix Composites (CMCs) and superalloys represent two competing materials in high-temperature applications, particularly in aerospace and energy sectors. Currently, superalloys dominate the market with established manufacturing processes and extensive performance data spanning decades. Nickel-based superalloys remain the standard for turbine components operating at temperatures up to 1100°C, while cobalt and iron-based variants serve specific niche applications.

CMCs have emerged as promising alternatives, offering weight reduction of 30-50% compared to superalloys and potential operating temperatures exceeding 1200°C without cooling systems. However, their widespread adoption faces significant challenges, including high manufacturing costs that can be 5-10 times greater than traditional superalloys for equivalent components. The complex processing techniques for CMCs, including chemical vapor infiltration and polymer infiltration and pyrolysis, contribute to extended production cycles and increased costs.

Material availability presents another challenge, particularly for CMCs requiring specialized fibers like silicon carbide. Supply chain constraints for these advanced materials create bottlenecks in production scaling, whereas superalloy supply chains are mature and globally distributed. This disparity significantly impacts production economics and implementation timelines.

Performance validation remains a critical hurdle for CMCs. While superalloys benefit from decades of operational data and established design methodologies, CMCs lack comprehensive long-term performance records in actual service environments. This knowledge gap necessitates extensive testing programs, further extending development timelines and increasing costs before widespread implementation.

Geographically, superalloy technology is well-distributed across North America, Europe, and Asia, with established manufacturing centers in the US, UK, Germany, Japan, and increasingly China. CMC development remains concentrated in fewer locations, primarily in the US, Japan, and France, creating regional imbalances in expertise and production capability.

Recyclability presents another significant challenge in lifecycle assessment. Superalloys benefit from established recycling processes with recovery rates exceeding 80% for some alloys, while CMC recycling technology remains underdeveloped, complicating end-of-life management and overall environmental impact calculations.

Regulatory frameworks and certification processes favor superalloys due to their established history, creating additional barriers for CMC implementation. New materials require extensive certification, particularly in safety-critical applications, adding years to development timelines and millions in additional costs before commercial deployment can begin.

CMCs have emerged as promising alternatives, offering weight reduction of 30-50% compared to superalloys and potential operating temperatures exceeding 1200°C without cooling systems. However, their widespread adoption faces significant challenges, including high manufacturing costs that can be 5-10 times greater than traditional superalloys for equivalent components. The complex processing techniques for CMCs, including chemical vapor infiltration and polymer infiltration and pyrolysis, contribute to extended production cycles and increased costs.

Material availability presents another challenge, particularly for CMCs requiring specialized fibers like silicon carbide. Supply chain constraints for these advanced materials create bottlenecks in production scaling, whereas superalloy supply chains are mature and globally distributed. This disparity significantly impacts production economics and implementation timelines.

Performance validation remains a critical hurdle for CMCs. While superalloys benefit from decades of operational data and established design methodologies, CMCs lack comprehensive long-term performance records in actual service environments. This knowledge gap necessitates extensive testing programs, further extending development timelines and increasing costs before widespread implementation.

Geographically, superalloy technology is well-distributed across North America, Europe, and Asia, with established manufacturing centers in the US, UK, Germany, Japan, and increasingly China. CMC development remains concentrated in fewer locations, primarily in the US, Japan, and France, creating regional imbalances in expertise and production capability.

Recyclability presents another significant challenge in lifecycle assessment. Superalloys benefit from established recycling processes with recovery rates exceeding 80% for some alloys, while CMC recycling technology remains underdeveloped, complicating end-of-life management and overall environmental impact calculations.

Regulatory frameworks and certification processes favor superalloys due to their established history, creating additional barriers for CMC implementation. New materials require extensive certification, particularly in safety-critical applications, adding years to development timelines and millions in additional costs before commercial deployment can begin.

Current Lifecycle Economic Assessment Methodologies

01 Manufacturing and processing cost considerations for CMCs and superalloys

The manufacturing and processing costs of Ceramic Matrix Composites (CMCs) and superalloys significantly impact their lifecycle economics. Various manufacturing techniques, such as chemical vapor infiltration, melt infiltration, and powder metallurgy, have different cost implications. Advanced processing methods can reduce production costs while maintaining or improving material properties. The economic viability of these materials depends on optimizing manufacturing processes to balance performance requirements with production expenses.- Manufacturing and repair cost considerations for CMCs and superalloys: The manufacturing and repair costs of Ceramic Matrix Composites (CMCs) and superalloys significantly impact their lifecycle economics. Advanced manufacturing techniques, such as additive manufacturing and specialized joining methods, can reduce production costs while extending component life. Repair methodologies for both CMCs and superalloys are critical for maintaining economic viability throughout their lifecycle, with innovative repair processes helping to restore damaged components rather than requiring complete replacement.

- Lifecycle performance comparison between CMCs and superalloys: CMCs offer superior high-temperature performance and weight reduction compared to traditional superalloys, resulting in improved fuel efficiency and extended service intervals in aerospace and power generation applications. While superalloys have established performance metrics and predictable lifecycle costs, CMCs demonstrate longer operational lifespans under extreme conditions, reducing replacement frequency and associated maintenance costs. This performance differential significantly impacts the total cost of ownership when comparing these materials over their complete lifecycle.

- Environmental impact and sustainability factors in material selection: The environmental footprint of CMCs and superalloys throughout their lifecycle influences economic decisions beyond direct costs. CMCs typically require higher initial energy input during manufacturing but offer reduced environmental impact during operation through improved efficiency and reduced emissions. End-of-life considerations, including recyclability and disposal requirements, factor into the complete economic assessment of these materials, with some superalloys offering better recyclability pathways than certain CMC formulations.

- Testing and qualification economics for aerospace applications: The extensive testing and qualification processes required for CMCs and superalloys in aerospace applications represent significant upfront costs in their lifecycle economics. Non-destructive evaluation techniques and monitoring systems help optimize maintenance schedules and prevent catastrophic failures, improving the economic proposition of these materials. The certification pathway for new CMC components typically requires greater investment than for established superalloy alternatives, creating an economic barrier to adoption despite potential long-term operational savings.

- Material development and production scaling considerations: The economics of scaling production from laboratory to industrial volumes significantly impacts the viability of both CMCs and superalloys. Material innovations that simplify manufacturing processes or reduce raw material costs can dramatically improve lifecycle economics. Supply chain considerations, including raw material availability and processing requirements, influence the long-term economic sustainability of components made from these advanced materials, with some superalloys facing challenges due to rare element dependencies.

02 Durability and lifecycle performance comparison between CMCs and superalloys

CMCs and superalloys offer different durability profiles that affect their lifecycle economics. CMCs typically provide superior high-temperature performance, oxidation resistance, and reduced cooling requirements compared to superalloys. However, superalloys often demonstrate better mechanical properties under certain conditions and may have more predictable failure modes. The selection between these materials involves analyzing their performance characteristics over the entire lifecycle, including maintenance intervals, degradation patterns, and operational limits.Expand Specific Solutions03 Repair, maintenance, and replacement economics

The economics of repair, maintenance, and replacement significantly impact the total lifecycle cost of components made from CMCs and superalloys. CMCs often have different repair methodologies compared to superalloys, which affects maintenance costs and downtime. The inspection intervals, repair techniques, and component replacement strategies must be considered when evaluating the overall economic viability of these materials. Advanced repair technologies can extend component life and improve the cost-effectiveness of both material systems.Expand Specific Solutions04 Performance benefits and fuel efficiency impacts on lifecycle costs

The performance benefits of CMCs and superalloys, particularly in high-temperature applications like gas turbines, translate into significant lifecycle economic advantages. CMCs enable higher operating temperatures, which can improve fuel efficiency and reduce emissions. Superalloys provide reliable performance in critical applications with established operational parameters. The fuel savings and performance improvements achieved through the use of these advanced materials often offset their higher initial costs, resulting in favorable lifecycle economics for applications where efficiency is paramount.Expand Specific Solutions05 Testing, certification, and quality control economics

The economics of testing, certification, and quality control processes for CMCs and superalloys are significant factors in their lifecycle costs. These materials require specialized testing methodologies to verify their properties and performance characteristics. Non-destructive evaluation techniques, accelerated lifecycle testing, and quality control systems add to the overall cost but are essential for ensuring reliability. The development of more efficient testing protocols and standardized certification processes can reduce these costs while maintaining the necessary quality assurance for critical applications.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The lifecycle economic assessment of Ceramic Matrix Composites (CMCs) versus superalloys represents a maturing technological field with significant market growth potential. The industry is transitioning from early adoption to mainstream implementation, particularly in high-temperature applications. Key players including GE, Rolls-Royce, Honeywell, and Safran are driving innovation in CMC technology, while traditional superalloy manufacturers like Haynes International maintain strong market positions. The global market is expanding rapidly, projected to reach $7-9 billion by 2028, with aerospace and energy sectors leading adoption. Technical maturity varies significantly across applications, with CMCs demonstrating superior lifecycle performance in extreme environments despite higher initial costs compared to established superalloy solutions from Siemens, Mitsubishi Heavy Industries, and RTX Corporation.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed a comprehensive lifecycle economic assessment framework for evaluating CMCs against superalloys that integrates both financial and environmental metrics. Their methodology employs a sophisticated cost modeling approach that accounts for raw material costs, manufacturing complexity, operational performance, maintenance requirements, and end-of-life considerations. Honeywell's proprietary CMC technology focuses on oxide-based ceramic composites that offer temperature capabilities up to 1100°C while reducing component weight by approximately 30% compared to nickel-based superalloys. Their economic assessment demonstrates that despite CMCs having 2-2.5x higher initial production costs, the total ownership cost over a typical 20-year service life is approximately 15-20% lower due to reduced fuel consumption, decreased maintenance frequency, and extended component lifespan. Honeywell's analysis incorporates detailed environmental impact assessments, showing that CMC implementation can reduce CO2 emissions by approximately 25% over the component lifecycle compared to superalloy alternatives.

Strengths: Extensive experience in both aerospace and industrial applications; robust supply chain for specialized materials; advanced testing capabilities for validating long-term performance. Weaknesses: Higher upfront manufacturing costs; specialized production facilities required; challenges in achieving consistent quality at scale.

Rolls-Royce Plc

Technical Solution: Rolls-Royce has developed a sophisticated lifecycle economic assessment framework specifically tailored for evaluating CMCs against traditional nickel-based superalloys in high-temperature aerospace applications. Their approach employs a multi-criteria decision analysis that integrates both quantitative cost modeling and qualitative performance metrics across the entire product lifecycle. The company's proprietary CMC technology focuses on oxide-oxide ceramic composites that demonstrate temperature capabilities up to 1200°C, approximately 150-200°C higher than advanced superalloys. Their economic assessment methodology incorporates detailed manufacturing cost analysis, showing that while CMC production costs are initially 2-3x higher than superalloys, the operational benefits include approximately 25% weight reduction, 15-20% improved fuel efficiency, and significantly reduced cooling requirements. Rolls-Royce's lifecycle models account for the extended component lifespans of CMCs, with their testing showing up to 30% longer time-between-overhaul intervals compared to superalloy counterparts.

Strengths: Comprehensive testing infrastructure for validating CMC performance; established supply chain relationships for specialized materials; advanced modeling capabilities for accurate lifecycle cost prediction. Weaknesses: Higher initial investment costs; limited in-service repair options compared to superalloys; challenges in scaling production to meet commercial demand.

Critical Technical Innovations in Materials Science

Ceramic matrix composites and methods for producing ceramic matrix composites

PatentWO2014150394A2

Innovation

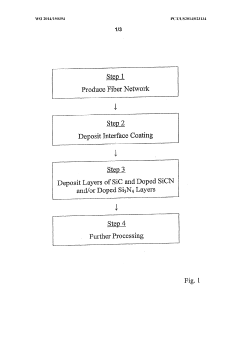

- A method for producing CMCs involves forming a network of fibers and depositing a matrix material with specific component ratios and additional elements to match creep rates, using techniques like chemical vapor infiltration, polymer infiltration and pyrolysis, and melt infiltration, with the option of applying interface layers such as boron nitride or silicon doped boron nitride to optimize properties.

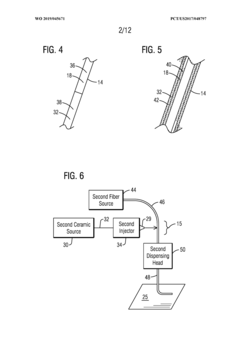

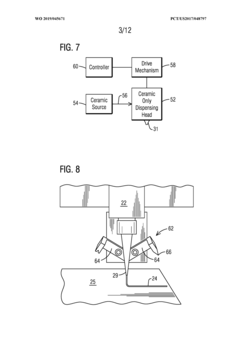

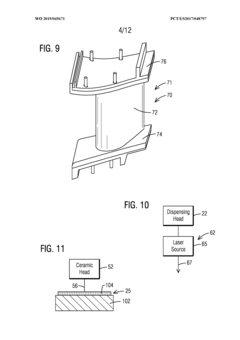

Three-dimensional printing of a ceramic fiber composite for forming cooling designs in a component

PatentWO2019045671A1

Innovation

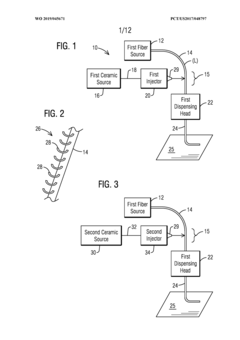

- The process of 3D printing a ceramic fiber composite material to form customized cooling structures, including passages and holes, within CMC components, allowing for complex shapes and reduced interlaminar cracks by eliminating plies and providing enhanced structural integrity at high temperature areas.

Environmental Impact and Carbon Footprint Comparison

The environmental impact assessment of Ceramic Matrix Composites (CMCs) versus superalloys reveals significant differences throughout their respective lifecycles. CMCs demonstrate a notably lower carbon footprint during the operational phase, primarily due to their superior thermal efficiency and reduced weight, which translates to decreased fuel consumption in aerospace and power generation applications. Studies indicate that aircraft components made from CMCs can contribute to a 15-20% reduction in CO2 emissions compared to their superalloy counterparts over the operational lifetime.

Manufacturing processes for CMCs, however, typically require higher energy inputs than traditional superalloy production. The sintering and chemical vapor infiltration processes used in CMC fabrication operate at extremely high temperatures (often exceeding 1200°C) for extended periods, resulting in substantial energy consumption. This initial carbon investment is approximately 30-40% higher than that required for superalloy casting and forging operations.

Raw material extraction presents another environmental consideration. While superalloys rely heavily on nickel and cobalt—metals with environmentally intensive mining processes—CMCs utilize silicon, carbon, and various ceramic materials that generally have lower extraction impacts. Recent lifecycle analyses suggest that the environmental burden of raw material acquisition for CMCs is approximately 25% lower than for nickel-based superalloys when normalized for component lifespan.

End-of-life considerations further differentiate these materials. Superalloys benefit from well-established recycling infrastructure, with recovery rates reaching 80-90% in aerospace applications. Conversely, CMC recycling remains challenging due to the heterogeneous nature of the composite structure. Current recycling technologies for CMCs achieve only 30-40% material recovery, though research into improved reclamation methods is advancing rapidly.

Water usage patterns also differ significantly between these material systems. Superalloy production typically requires substantial water resources for cooling and processing, with estimates suggesting 50-70 gallons per kilogram of finished material. CMC manufacturing processes, while water-intensive during certain stages, generally consume 20-30% less water overall, representing a meaningful conservation advantage in regions facing water scarcity.

When considering the complete lifecycle environmental impact, CMCs increasingly demonstrate a net advantage despite their higher manufacturing footprint. The crossover point—where CMCs become environmentally preferable—typically occurs after 2-3 years of operation in high-temperature applications, with the advantage growing substantially thereafter as operational efficiency benefits accumulate.

Manufacturing processes for CMCs, however, typically require higher energy inputs than traditional superalloy production. The sintering and chemical vapor infiltration processes used in CMC fabrication operate at extremely high temperatures (often exceeding 1200°C) for extended periods, resulting in substantial energy consumption. This initial carbon investment is approximately 30-40% higher than that required for superalloy casting and forging operations.

Raw material extraction presents another environmental consideration. While superalloys rely heavily on nickel and cobalt—metals with environmentally intensive mining processes—CMCs utilize silicon, carbon, and various ceramic materials that generally have lower extraction impacts. Recent lifecycle analyses suggest that the environmental burden of raw material acquisition for CMCs is approximately 25% lower than for nickel-based superalloys when normalized for component lifespan.

End-of-life considerations further differentiate these materials. Superalloys benefit from well-established recycling infrastructure, with recovery rates reaching 80-90% in aerospace applications. Conversely, CMC recycling remains challenging due to the heterogeneous nature of the composite structure. Current recycling technologies for CMCs achieve only 30-40% material recovery, though research into improved reclamation methods is advancing rapidly.

Water usage patterns also differ significantly between these material systems. Superalloy production typically requires substantial water resources for cooling and processing, with estimates suggesting 50-70 gallons per kilogram of finished material. CMC manufacturing processes, while water-intensive during certain stages, generally consume 20-30% less water overall, representing a meaningful conservation advantage in regions facing water scarcity.

When considering the complete lifecycle environmental impact, CMCs increasingly demonstrate a net advantage despite their higher manufacturing footprint. The crossover point—where CMCs become environmentally preferable—typically occurs after 2-3 years of operation in high-temperature applications, with the advantage growing substantially thereafter as operational efficiency benefits accumulate.

Supply Chain Resilience and Raw Material Considerations

The global supply chain for both Ceramic Matrix Composites (CMCs) and superalloys presents significant vulnerabilities that impact their economic viability throughout their lifecycle. CMCs rely heavily on specialized raw materials including silicon carbide fibers, boron nitride coatings, and various ceramic matrices, many of which are sourced from geopolitically sensitive regions. The concentration of silicon carbide fiber production in Japan and the United States creates potential bottlenecks, while China's dominance in rare earth elements needed for certain CMC variants introduces additional supply risks.

Superalloys face similar challenges with their dependence on critical elements such as nickel, cobalt, rhenium, and hafnium. The Democratic Republic of Congo supplies approximately 70% of global cobalt, creating significant geopolitical exposure. Similarly, rhenium production is concentrated in Chile and Kazakhstan, introducing vulnerability to political instability or trade restrictions. These supply constraints have historically led to price volatility that directly impacts manufacturing economics.

Material recycling capabilities represent another crucial differentiator between these material systems. Superalloys benefit from well-established recycling infrastructure, with approximately 60-70% of nickel-based superalloys being recovered and reprocessed at end-of-life. This circular economy approach significantly reduces lifecycle costs and environmental impact. In contrast, CMC recycling remains technically challenging and economically unfeasible at industrial scale, primarily due to the difficulty in separating fiber reinforcements from ceramic matrices.

Raw material price trends further complicate the economic assessment. Nickel and cobalt have experienced significant price fluctuations over the past decade, with cobalt prices quadrupling between 2016 and 2018 before declining. Meanwhile, silicon carbide fiber costs have steadily decreased as production capacity has expanded, dropping approximately 30% over the past five years, though they remain substantially higher than metallic alternatives.

Diversification strategies are emerging to mitigate these supply chain risks. Leading aerospace manufacturers are investing in alternative material formulations that reduce dependence on the most vulnerable elements. For superalloys, this includes developing lower-rhenium compositions, while CMC research focuses on alternative fiber coatings that don't require boron nitride. Vertical integration is also becoming more common, with major OEMs acquiring raw material suppliers to ensure continuity of supply and price stability.

Superalloys face similar challenges with their dependence on critical elements such as nickel, cobalt, rhenium, and hafnium. The Democratic Republic of Congo supplies approximately 70% of global cobalt, creating significant geopolitical exposure. Similarly, rhenium production is concentrated in Chile and Kazakhstan, introducing vulnerability to political instability or trade restrictions. These supply constraints have historically led to price volatility that directly impacts manufacturing economics.

Material recycling capabilities represent another crucial differentiator between these material systems. Superalloys benefit from well-established recycling infrastructure, with approximately 60-70% of nickel-based superalloys being recovered and reprocessed at end-of-life. This circular economy approach significantly reduces lifecycle costs and environmental impact. In contrast, CMC recycling remains technically challenging and economically unfeasible at industrial scale, primarily due to the difficulty in separating fiber reinforcements from ceramic matrices.

Raw material price trends further complicate the economic assessment. Nickel and cobalt have experienced significant price fluctuations over the past decade, with cobalt prices quadrupling between 2016 and 2018 before declining. Meanwhile, silicon carbide fiber costs have steadily decreased as production capacity has expanded, dropping approximately 30% over the past five years, though they remain substantially higher than metallic alternatives.

Diversification strategies are emerging to mitigate these supply chain risks. Leading aerospace manufacturers are investing in alternative material formulations that reduce dependence on the most vulnerable elements. For superalloys, this includes developing lower-rhenium compositions, while CMC research focuses on alternative fiber coatings that don't require boron nitride. Vertical integration is also becoming more common, with major OEMs acquiring raw material suppliers to ensure continuity of supply and price stability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!