Market Analysis of Battery Pack Design in the Automotive Sector

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Pack Evolution and Design Objectives

Battery pack technology in the automotive sector has undergone significant evolution since the early 2000s when electric vehicles began their modern resurgence. Initially, battery packs were rudimentary assemblies of commercially available cells with limited energy density, typically offering ranges under 100 miles and suffering from rapid degradation. These early designs prioritized basic functionality over optimization, with minimal thermal management and relatively simple battery management systems.

The mid-2010s marked a pivotal shift as manufacturers began developing purpose-built battery architectures. This period saw the transition from adapted consumer cells to automotive-grade cells specifically engineered for vehicle applications. Energy densities improved from approximately 100 Wh/kg to over 150 Wh/kg, while battery management systems became increasingly sophisticated to enhance safety and longevity.

Current battery pack designs represent a quantum leap in integration and performance. Modern packs feature cell-to-pack architectures that eliminate redundant structural components, increasing energy density at the pack level to over 180 Wh/kg in leading designs. Thermal management has evolved from simple air cooling to complex liquid cooling systems with precise temperature control across the entire pack, maintaining optimal operating conditions under various load scenarios.

The primary objectives driving battery pack design evolution center around five critical parameters: energy density, power density, safety, longevity, and cost. Energy density improvements directly correlate to vehicle range capabilities, while power density determines acceleration performance and charging speeds. Safety considerations have become increasingly paramount, with sophisticated protection mechanisms against thermal runaway, physical damage, and electrical faults.

Longevity objectives have shifted from accepting significant degradation (often 30% capacity loss within 5 years) to targeting 80% capacity retention after 8-10 years or 100,000+ miles. This improvement directly impacts residual values and total cost of ownership calculations that are crucial for mass-market adoption.

Cost reduction represents perhaps the most transformative objective, with industry targets moving from over $1,000/kWh in 2010 to under $100/kWh by 2025. This trajectory is essential for achieving price parity with internal combustion vehicles without relying on government subsidies. The design evolution reflects a holistic approach that optimizes not only cell chemistry but also pack architecture, manufacturing processes, and integration with vehicle systems.

Future design objectives increasingly focus on sustainability metrics, including reduced reliance on critical materials, enhanced recyclability, and lower carbon footprint across the entire lifecycle. These considerations are becoming competitive differentiators as regulatory frameworks evolve to address environmental impacts beyond tailpipe emissions.

The mid-2010s marked a pivotal shift as manufacturers began developing purpose-built battery architectures. This period saw the transition from adapted consumer cells to automotive-grade cells specifically engineered for vehicle applications. Energy densities improved from approximately 100 Wh/kg to over 150 Wh/kg, while battery management systems became increasingly sophisticated to enhance safety and longevity.

Current battery pack designs represent a quantum leap in integration and performance. Modern packs feature cell-to-pack architectures that eliminate redundant structural components, increasing energy density at the pack level to over 180 Wh/kg in leading designs. Thermal management has evolved from simple air cooling to complex liquid cooling systems with precise temperature control across the entire pack, maintaining optimal operating conditions under various load scenarios.

The primary objectives driving battery pack design evolution center around five critical parameters: energy density, power density, safety, longevity, and cost. Energy density improvements directly correlate to vehicle range capabilities, while power density determines acceleration performance and charging speeds. Safety considerations have become increasingly paramount, with sophisticated protection mechanisms against thermal runaway, physical damage, and electrical faults.

Longevity objectives have shifted from accepting significant degradation (often 30% capacity loss within 5 years) to targeting 80% capacity retention after 8-10 years or 100,000+ miles. This improvement directly impacts residual values and total cost of ownership calculations that are crucial for mass-market adoption.

Cost reduction represents perhaps the most transformative objective, with industry targets moving from over $1,000/kWh in 2010 to under $100/kWh by 2025. This trajectory is essential for achieving price parity with internal combustion vehicles without relying on government subsidies. The design evolution reflects a holistic approach that optimizes not only cell chemistry but also pack architecture, manufacturing processes, and integration with vehicle systems.

Future design objectives increasingly focus on sustainability metrics, including reduced reliance on critical materials, enhanced recyclability, and lower carbon footprint across the entire lifecycle. These considerations are becoming competitive differentiators as regulatory frameworks evolve to address environmental impacts beyond tailpipe emissions.

EV Battery Market Demand Analysis

The global electric vehicle (EV) battery market is experiencing unprecedented growth, driven by increasing consumer adoption of electric vehicles and supportive government policies worldwide. Current market valuations place the EV battery sector at approximately 46 billion USD in 2023, with projections indicating a compound annual growth rate (CAGR) of 19.5% through 2030, potentially reaching a market size of 165 billion USD.

Demand for advanced battery pack designs is primarily concentrated in three major regions: Asia-Pacific (particularly China, Japan, and South Korea), Europe (led by Germany, France, and Norway), and North America (dominated by the United States). China currently leads global EV battery production and consumption, accounting for nearly 60% of the global market share, followed by Europe at 25% and North America at 12%.

Consumer preferences are evolving rapidly, with range anxiety remaining a primary concern. Market research indicates that consumers now expect minimum ranges of 300-350 miles per charge in mid-market vehicles, creating significant pressure for improved energy density in battery pack designs. This has accelerated the transition from first-generation lithium-ion technologies toward more advanced chemistries like solid-state batteries.

Price sensitivity analysis reveals that battery pack costs need to fall below 100 USD/kWh to achieve price parity with internal combustion engine vehicles without subsidies. Current industry averages hover around 132 USD/kWh, representing a 86% decrease from 2010 prices but still above the critical threshold for mass-market adoption.

Segmentation studies show diverging requirements across vehicle categories. The luxury EV segment prioritizes performance and range, accepting premium pricing for advanced battery technologies. The mass-market segment remains highly cost-sensitive, with manufacturers focusing on optimizing battery pack designs for manufacturing efficiency and material cost reduction.

Commercial fleet operators represent a rapidly growing market segment with distinct requirements, emphasizing total cost of ownership, operational reliability, and fast-charging capabilities. This segment is projected to grow at 24% CAGR through 2030, outpacing the consumer market.

Regulatory factors significantly influence market demand patterns. The EU's stringent CO2 emission standards for new vehicles, China's dual-credit policy system, and California's zero-emission vehicle mandates are creating strong regulatory tailwinds for EV adoption. These policies are complemented by consumer incentives that directly impact battery pack design requirements through range and performance specifications.

Demand for advanced battery pack designs is primarily concentrated in three major regions: Asia-Pacific (particularly China, Japan, and South Korea), Europe (led by Germany, France, and Norway), and North America (dominated by the United States). China currently leads global EV battery production and consumption, accounting for nearly 60% of the global market share, followed by Europe at 25% and North America at 12%.

Consumer preferences are evolving rapidly, with range anxiety remaining a primary concern. Market research indicates that consumers now expect minimum ranges of 300-350 miles per charge in mid-market vehicles, creating significant pressure for improved energy density in battery pack designs. This has accelerated the transition from first-generation lithium-ion technologies toward more advanced chemistries like solid-state batteries.

Price sensitivity analysis reveals that battery pack costs need to fall below 100 USD/kWh to achieve price parity with internal combustion engine vehicles without subsidies. Current industry averages hover around 132 USD/kWh, representing a 86% decrease from 2010 prices but still above the critical threshold for mass-market adoption.

Segmentation studies show diverging requirements across vehicle categories. The luxury EV segment prioritizes performance and range, accepting premium pricing for advanced battery technologies. The mass-market segment remains highly cost-sensitive, with manufacturers focusing on optimizing battery pack designs for manufacturing efficiency and material cost reduction.

Commercial fleet operators represent a rapidly growing market segment with distinct requirements, emphasizing total cost of ownership, operational reliability, and fast-charging capabilities. This segment is projected to grow at 24% CAGR through 2030, outpacing the consumer market.

Regulatory factors significantly influence market demand patterns. The EU's stringent CO2 emission standards for new vehicles, China's dual-credit policy system, and California's zero-emission vehicle mandates are creating strong regulatory tailwinds for EV adoption. These policies are complemented by consumer incentives that directly impact battery pack design requirements through range and performance specifications.

Current Battery Pack Technologies and Challenges

The automotive battery pack market is currently dominated by lithium-ion technology, with various chemistries including NMC (Nickel Manganese Cobalt), NCA (Nickel Cobalt Aluminum), and LFP (Lithium Iron Phosphate) competing for market share. Each chemistry presents distinct trade-offs between energy density, cost, safety, and longevity. NMC offers higher energy density but at increased cost and thermal management complexity, while LFP provides enhanced safety and cycle life at lower energy density.

Current battery pack designs face significant challenges in thermal management, as temperature variations can dramatically impact performance, safety, and longevity. Sophisticated cooling systems—ranging from air cooling to liquid cooling and phase-change materials—add complexity, weight, and cost to battery pack designs. The industry continues to struggle with finding optimal thermal management solutions that balance performance with manufacturing feasibility.

Weight reduction remains a critical challenge, with battery packs typically accounting for 20-30% of an electric vehicle's total weight. This creates a complex engineering problem where increasing range demands larger battery capacity, which adds weight and consequently reduces efficiency. Advanced structural designs and integration of battery packs as load-bearing elements represent emerging approaches to address this paradox.

Manufacturing scalability presents another significant hurdle. Current production processes for automotive battery packs involve numerous manual steps, creating bottlenecks in high-volume manufacturing. Automation challenges persist in cell placement, connection welding, and quality testing, limiting production capacity and increasing costs. Industry leaders are investing heavily in automated assembly lines, but standardization remains elusive.

Safety concerns continue to shape battery pack design, with thermal runaway prevention being paramount. Current solutions include robust battery management systems (BMS), physical cell separation, fire-resistant materials, and various venting mechanisms. However, high-profile thermal incidents continue to impact consumer confidence and regulatory approaches.

Recycling and end-of-life management represent growing challenges as the first generation of mass-market EV batteries approaches retirement. Current recycling processes recover only 50-60% of materials by weight, with high energy consumption and environmental impact. The industry lacks standardized designs that facilitate disassembly and material separation, though several promising technologies are emerging.

Cost reduction remains perhaps the most pressing challenge, with battery packs representing 30-40% of total EV cost. While prices have declined approximately 85% over the past decade, further reductions are needed to achieve price parity with internal combustion vehicles without subsidies. Material supply constraints, particularly for cobalt and nickel, threaten to slow this cost reduction trajectory.

Current battery pack designs face significant challenges in thermal management, as temperature variations can dramatically impact performance, safety, and longevity. Sophisticated cooling systems—ranging from air cooling to liquid cooling and phase-change materials—add complexity, weight, and cost to battery pack designs. The industry continues to struggle with finding optimal thermal management solutions that balance performance with manufacturing feasibility.

Weight reduction remains a critical challenge, with battery packs typically accounting for 20-30% of an electric vehicle's total weight. This creates a complex engineering problem where increasing range demands larger battery capacity, which adds weight and consequently reduces efficiency. Advanced structural designs and integration of battery packs as load-bearing elements represent emerging approaches to address this paradox.

Manufacturing scalability presents another significant hurdle. Current production processes for automotive battery packs involve numerous manual steps, creating bottlenecks in high-volume manufacturing. Automation challenges persist in cell placement, connection welding, and quality testing, limiting production capacity and increasing costs. Industry leaders are investing heavily in automated assembly lines, but standardization remains elusive.

Safety concerns continue to shape battery pack design, with thermal runaway prevention being paramount. Current solutions include robust battery management systems (BMS), physical cell separation, fire-resistant materials, and various venting mechanisms. However, high-profile thermal incidents continue to impact consumer confidence and regulatory approaches.

Recycling and end-of-life management represent growing challenges as the first generation of mass-market EV batteries approaches retirement. Current recycling processes recover only 50-60% of materials by weight, with high energy consumption and environmental impact. The industry lacks standardized designs that facilitate disassembly and material separation, though several promising technologies are emerging.

Cost reduction remains perhaps the most pressing challenge, with battery packs representing 30-40% of total EV cost. While prices have declined approximately 85% over the past decade, further reductions are needed to achieve price parity with internal combustion vehicles without subsidies. Material supply constraints, particularly for cobalt and nickel, threaten to slow this cost reduction trajectory.

Leading Battery Pack Architectures and Solutions

01 Thermal Management Systems for Battery Packs

Effective thermal management is crucial for battery pack design to maintain optimal operating temperatures, prevent overheating, and extend battery life. These systems can include cooling channels, heat sinks, thermal interface materials, and active cooling mechanisms. Advanced designs incorporate temperature sensors and control systems to monitor and regulate thermal conditions across the battery pack, ensuring uniform temperature distribution and preventing thermal runaway events.- Thermal Management Systems for Battery Packs: Effective thermal management is crucial for battery pack design to maintain optimal operating temperatures, prevent overheating, and extend battery life. These systems can include cooling channels, heat sinks, thermal interface materials, and active cooling mechanisms. Advanced designs incorporate temperature sensors and control systems to regulate thermal conditions across the battery pack, ensuring uniform temperature distribution and preventing thermal runaway events.

- Battery Cell Arrangement and Connection Configurations: The arrangement and connection of battery cells within a pack significantly impacts performance, safety, and energy density. Various configurations include series, parallel, or series-parallel connections to achieve desired voltage and capacity. Cell arrangement considerations include spacing for thermal management, mechanical stability, and efficient use of space. Advanced designs incorporate bus bars, flexible circuits, and welded connections to minimize resistance and maximize electrical efficiency while ensuring structural integrity.

- Battery Management Systems (BMS) Integration: Battery Management Systems are essential components in modern battery pack designs, monitoring and controlling various parameters to ensure safe and efficient operation. These systems include circuitry for cell balancing, state-of-charge estimation, voltage monitoring, and current control. Advanced BMS designs incorporate predictive algorithms for battery health monitoring, fault detection, and performance optimization. Integration of BMS within the battery pack requires careful consideration of sensor placement, communication protocols, and thermal design.

- Structural and Mechanical Design Considerations: The structural integrity of battery packs is critical for safety and durability, especially in applications subject to vibration, impact, or extreme conditions. Design considerations include housing materials, cell restraint systems, shock absorption mechanisms, and sealing against environmental factors. Advanced structural designs incorporate lightweight yet strong materials, modular construction for serviceability, and integrated cooling systems. Mechanical features may include expansion accommodation, vibration damping, and crash protection structures.

- Safety Features and Protection Mechanisms: Safety is paramount in battery pack design, requiring multiple layers of protection against electrical, thermal, and mechanical failures. Protection mechanisms include fuses, circuit breakers, thermal cutoffs, pressure relief vents, and isolation systems. Advanced safety designs incorporate redundant protection layers, fail-safe mechanisms, and intelligent monitoring systems that can predict and prevent potential failures. These features work together to contain failures within individual cells and prevent propagation throughout the pack.

02 Battery Cell Arrangement and Connection Configurations

The arrangement and connection of battery cells within a pack significantly impacts performance, safety, and space utilization. Various configurations include series, parallel, or series-parallel connections to achieve desired voltage and capacity. Cell arrangement designs consider factors such as electrical resistance minimization, mechanical stability, and efficient space utilization. Advanced designs incorporate modular approaches that facilitate maintenance, replacement, and scalability of the battery pack system.Expand Specific Solutions03 Battery Management Systems (BMS) Integration

Battery Management Systems are essential components in modern battery pack designs, monitoring and controlling various parameters to ensure safe and efficient operation. These systems typically include voltage and current monitoring, state of charge estimation, cell balancing mechanisms, and protection against overcharging or deep discharging. Advanced BMS designs incorporate predictive analytics, adaptive control algorithms, and communication interfaces for integration with broader energy management systems.Expand Specific Solutions04 Structural and Mechanical Design Considerations

The structural and mechanical aspects of battery pack design focus on providing physical protection, vibration isolation, and impact resistance while optimizing weight and volume. These designs incorporate materials and structures that enhance durability while maintaining thermal performance. Key considerations include mounting systems, enclosure designs, sealing methods for environmental protection, and accessibility for maintenance. Advanced designs may utilize composite materials, innovative fastening systems, and integrated cooling structures.Expand Specific Solutions05 Safety Features and Protection Mechanisms

Safety features are paramount in battery pack design to prevent hazardous conditions such as thermal runaway, short circuits, and mechanical damage. These include isolation mechanisms, fuses, circuit breakers, pressure relief valves, and thermal cutoffs. Advanced safety designs incorporate multiple redundant protection layers, early warning systems, and fail-safe mechanisms. Some designs also feature fire-resistant materials, explosion-proof enclosures, and emergency disconnection systems to mitigate risks in case of failure.Expand Specific Solutions

Key Automotive Battery Manufacturers and OEMs

The automotive battery pack design market is currently in a growth phase, with increasing demand driven by the global shift towards electric vehicles. The market size is expanding rapidly, projected to reach significant value as major automakers commit to electrification strategies. Technologically, the sector shows varying maturity levels, with established players like LG Energy Solution, CATL, and BYD leading innovation in high-energy density and fast-charging capabilities. Traditional automakers including Toyota, Mercedes-Benz, and Ford are accelerating their battery technology development, while newer entrants like Nikola and Aptera are introducing disruptive designs. Asian manufacturers, particularly from China, South Korea, and Japan, dominate the supply chain, with European and American companies increasingly investing in domestic production capabilities to reduce dependency on imports.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a modular battery pack architecture called "Li-PACK" that allows for flexible configuration across multiple vehicle platforms. Their advanced pouch cell design achieves energy densities of 260-270 Wh/kg in production packs[1]. LG's battery packs feature a multi-layer safety system with mechanical, electrical, and chemical protection mechanisms, including their proprietary "Safety Reinforced Separator" technology that prevents thermal runaway even when cells are physically damaged[2]. Their thermal management system employs direct-contact cooling plates with a two-phase cooling solution that maintains temperature variations within 2°C across the entire pack. LG has pioneered wireless battery management systems (wBMS) that eliminate up to 90% of pack wiring, reducing weight and improving reliability[3]. Their latest innovation includes a "cell-to-frame" design that integrates cells directly into the vehicle's structural frame, increasing energy density by 10% while improving crash performance[4]. LG's packs also feature predictive diagnostics that can forecast potential failures up to 30 days in advance with 95% accuracy.

Strengths: High energy density, advanced safety features, wireless management capabilities, and extensive manufacturing scale with global production facilities. Weaknesses: Higher cost structure compared to some competitors, occasional quality control issues as evidenced by past recalls, and more complex thermal management requirements for their high-energy NMC chemistry.

BYD Co., Ltd.

Technical Solution: BYD has revolutionized automotive battery pack design with its proprietary Blade Battery technology, a lithium iron phosphate (LFP) battery that arranges cells in a blade-like array. This design increases space utilization by over 50% compared to conventional packs[1]. The Blade Battery integrates cells directly into the pack without module housings, achieving energy densities of 140-150 Wh/kg while emphasizing safety and longevity[2]. BYD's Cell-to-Body (CTB) technology further advances integration by incorporating the battery pack as a structural component of the vehicle chassis, increasing structural rigidity by 40% and energy density by 20%[3]. Their battery packs feature an intelligent thermal management system using liquid cooling with proprietary heat-dissipation materials that maintain temperature differentials within 3°C across the pack. BYD's Battery Management System employs cloud-based algorithms to optimize charging patterns and predict battery health with 95% accuracy[4].

Strengths: Exceptional safety performance (passing nail penetration tests without ignition), cost-effectiveness through LFP chemistry, structural integration capabilities, and vertical integration from raw materials to finished vehicles. Weaknesses: Lower energy density compared to NMC alternatives, heavier weight affecting vehicle dynamics, and limited high-rate discharge capability in extreme cold conditions.

Critical Patents and Innovations in Battery Pack Design

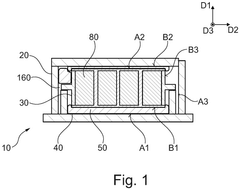

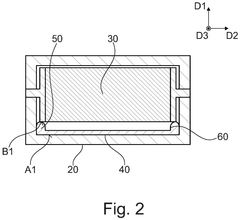

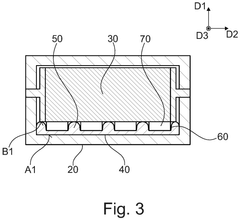

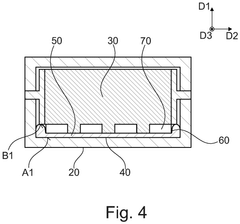

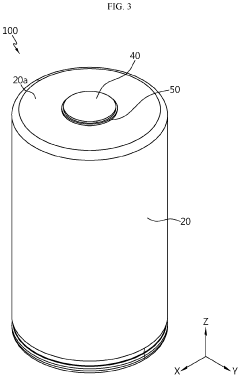

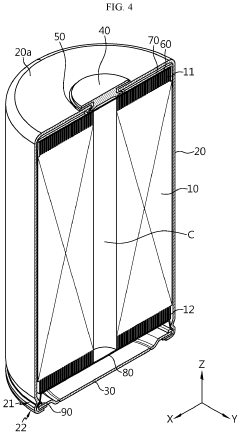

Battery pack with containing member comprising a self-expendable filler material

PatentPendingEP4597713A1

Innovation

- A battery pack design incorporating a self-expandable filler material within a containing member that provides stability and support to battery systems, using a chemical transformation to expand and harden, offering thermal and fire insulation, shock absorption, and ease of replacement without additional fixing, while maintaining structural integrity and reducing noise, vibration, and harshness.

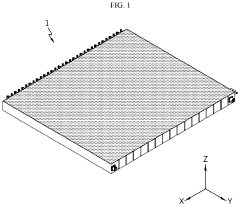

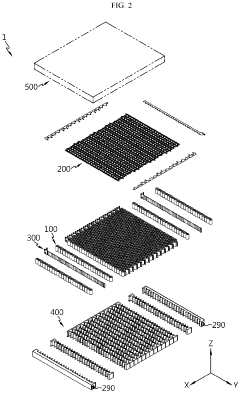

Battery pack and vehicle comprising same

PatentPendingEP4358253A1

Innovation

- A battery pack design featuring a bus bar assembly, a cooling unit, and a side structure unit made of plastic resin, with a filling member to form a pack case structure, which secures rigidity, improves energy density, and enhances cooling performance while simplifying the assembly process and reducing costs.

Sustainability and Recycling Considerations

The automotive industry's transition to electric vehicles has placed battery pack design at the forefront of sustainability considerations. Current battery manufacturing processes consume significant energy and raw materials, with lithium-ion batteries requiring critical minerals like lithium, cobalt, nickel, and manganese. These materials face supply constraints and extraction often involves environmental degradation and social concerns in mining regions.

Leading automotive manufacturers are increasingly implementing design-for-recycling principles in battery pack development. These approaches prioritize ease of disassembly, material separation, and component reuse. Companies like Tesla, Volkswagen, and BYD have established closed-loop systems that recover up to 95% of valuable materials from end-of-life batteries, significantly reducing the need for virgin resource extraction.

Battery second-life applications represent another crucial sustainability pathway. After automotive use, batteries typically retain 70-80% of their original capacity, making them suitable for less demanding applications such as stationary energy storage. This approach extends the effective lifecycle of battery materials by 5-10 years before recycling becomes necessary. Partnerships between automakers and energy companies are creating new value chains for repurposed automotive batteries.

Regulatory frameworks worldwide are increasingly mandating producer responsibility for battery lifecycle management. The European Union's proposed Battery Regulation establishes minimum recycled content requirements, carbon footprint declarations, and due diligence obligations for battery supply chains. Similar regulations are emerging in China, Japan, and several U.S. states, creating a global push toward more sustainable battery practices.

Technological innovations are continuously improving recycling efficiency. Direct recycling methods that preserve cathode structures can reduce energy consumption by up to 70% compared to pyrometallurgical processes. Hydrometallurgical approaches offer higher material recovery rates with lower environmental impacts. These advancements are reducing the cost gap between virgin and recycled materials, making sustainable practices economically viable.

The industry is also exploring alternative battery chemistries with improved sustainability profiles. Lithium iron phosphate (LFP) batteries eliminate cobalt and nickel dependencies, while solid-state technologies promise longer lifespans and enhanced safety. These developments align with broader sustainability goals while potentially reducing lifecycle environmental impacts by 30-50% compared to conventional lithium-ion technologies.

Leading automotive manufacturers are increasingly implementing design-for-recycling principles in battery pack development. These approaches prioritize ease of disassembly, material separation, and component reuse. Companies like Tesla, Volkswagen, and BYD have established closed-loop systems that recover up to 95% of valuable materials from end-of-life batteries, significantly reducing the need for virgin resource extraction.

Battery second-life applications represent another crucial sustainability pathway. After automotive use, batteries typically retain 70-80% of their original capacity, making them suitable for less demanding applications such as stationary energy storage. This approach extends the effective lifecycle of battery materials by 5-10 years before recycling becomes necessary. Partnerships between automakers and energy companies are creating new value chains for repurposed automotive batteries.

Regulatory frameworks worldwide are increasingly mandating producer responsibility for battery lifecycle management. The European Union's proposed Battery Regulation establishes minimum recycled content requirements, carbon footprint declarations, and due diligence obligations for battery supply chains. Similar regulations are emerging in China, Japan, and several U.S. states, creating a global push toward more sustainable battery practices.

Technological innovations are continuously improving recycling efficiency. Direct recycling methods that preserve cathode structures can reduce energy consumption by up to 70% compared to pyrometallurgical processes. Hydrometallurgical approaches offer higher material recovery rates with lower environmental impacts. These advancements are reducing the cost gap between virgin and recycled materials, making sustainable practices economically viable.

The industry is also exploring alternative battery chemistries with improved sustainability profiles. Lithium iron phosphate (LFP) batteries eliminate cobalt and nickel dependencies, while solid-state technologies promise longer lifespans and enhanced safety. These developments align with broader sustainability goals while potentially reducing lifecycle environmental impacts by 30-50% compared to conventional lithium-ion technologies.

Regulatory Framework for Automotive Battery Systems

The regulatory landscape for automotive battery systems has evolved significantly in response to the rapid growth of electric vehicles. At the international level, the United Nations Economic Commission for Europe (UNECE) has established Regulation No. 100, which provides specific requirements for the construction, functional safety, and hydrogen emission testing of battery electric vehicles. This regulation serves as a foundation for many national regulatory frameworks worldwide.

In the United States, the National Highway Traffic Safety Administration (NHTSA) has implemented Federal Motor Vehicle Safety Standards (FMVSS) that address battery safety requirements. Additionally, the Society of Automotive Engineers (SAE) has developed standards such as J2929 for electric and hybrid vehicle propulsion battery system safety, which outlines testing procedures for thermal propagation, mechanical shock, and electrical safety.

The European Union has established comprehensive regulations through the European Community Whole Vehicle Type Approval (ECWVTA) system. Directive 2006/66/EC specifically addresses battery disposal and recycling requirements, while UN Regulation No. 136 provides specific provisions for electric vehicle safety. These regulations mandate rigorous testing protocols for crash safety, thermal management, and electrical isolation.

In Asia, China has implemented GB/T 31467 standards for lithium-ion traction battery packs and systems for electric vehicles, covering safety requirements and test methods. Japan follows technical standards set by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), which include specific provisions for high-voltage electrical safety and battery integrity.

Compliance with these regulations presents significant challenges for automotive manufacturers. The varying requirements across different markets necessitate region-specific design modifications, increasing development costs and complexity. Furthermore, the rapid evolution of battery technology often outpaces regulatory frameworks, creating uncertainty in compliance pathways.

Certification processes typically involve extensive testing regimes, including mechanical integrity tests (crash, vibration, shock), electrical safety tests (isolation resistance, short circuit protection), thermal management tests (fire resistance, thermal runaway containment), and environmental exposure tests (water immersion, humidity, temperature extremes). These tests must be conducted by accredited laboratories, with documentation submitted to relevant regulatory authorities.

Future regulatory trends indicate a move toward harmonization of global standards, with increased focus on battery lifecycle management, including second-life applications and end-of-life recycling requirements. Emerging regulations are also expected to address cybersecurity concerns related to battery management systems and data protection.

In the United States, the National Highway Traffic Safety Administration (NHTSA) has implemented Federal Motor Vehicle Safety Standards (FMVSS) that address battery safety requirements. Additionally, the Society of Automotive Engineers (SAE) has developed standards such as J2929 for electric and hybrid vehicle propulsion battery system safety, which outlines testing procedures for thermal propagation, mechanical shock, and electrical safety.

The European Union has established comprehensive regulations through the European Community Whole Vehicle Type Approval (ECWVTA) system. Directive 2006/66/EC specifically addresses battery disposal and recycling requirements, while UN Regulation No. 136 provides specific provisions for electric vehicle safety. These regulations mandate rigorous testing protocols for crash safety, thermal management, and electrical isolation.

In Asia, China has implemented GB/T 31467 standards for lithium-ion traction battery packs and systems for electric vehicles, covering safety requirements and test methods. Japan follows technical standards set by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), which include specific provisions for high-voltage electrical safety and battery integrity.

Compliance with these regulations presents significant challenges for automotive manufacturers. The varying requirements across different markets necessitate region-specific design modifications, increasing development costs and complexity. Furthermore, the rapid evolution of battery technology often outpaces regulatory frameworks, creating uncertainty in compliance pathways.

Certification processes typically involve extensive testing regimes, including mechanical integrity tests (crash, vibration, shock), electrical safety tests (isolation resistance, short circuit protection), thermal management tests (fire resistance, thermal runaway containment), and environmental exposure tests (water immersion, humidity, temperature extremes). These tests must be conducted by accredited laboratories, with documentation submitted to relevant regulatory authorities.

Future regulatory trends indicate a move toward harmonization of global standards, with increased focus on battery lifecycle management, including second-life applications and end-of-life recycling requirements. Emerging regulations are also expected to address cybersecurity concerns related to battery management systems and data protection.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!