The Influence of Regulatory Policies on Battery Pack Innovation

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Regulation Evolution and Innovation Targets

Battery regulations have evolved significantly over the past three decades, transitioning from minimal oversight to comprehensive frameworks addressing safety, performance, and environmental impact. The 1990s marked the beginning of formal battery regulations with basic safety standards and disposal guidelines. By the early 2000s, regulations expanded to include specific chemical restrictions, notably through the EU's Battery Directive (2006/66/EC), which limited mercury and cadmium content while establishing collection and recycling targets.

The 2010s witnessed a paradigm shift as electric vehicles gained prominence, prompting regulators to develop specialized frameworks for high-capacity lithium-ion battery packs. These regulations incorporated thermal runaway prevention, crash safety requirements, and enhanced testing protocols. The UN Transport of Dangerous Goods regulations and IEC 62133 standards became globally influential benchmarks for battery safety and transportation.

Most recently, regulatory focus has expanded beyond safety to encompass sustainability and circular economy principles. The EU's proposed Battery Regulation (2020) represents this evolution, introducing carbon footprint declarations, recycled content requirements, and battery passports to track materials throughout the lifecycle. Similarly, China's battery recycling policies and the US Department of Energy's Battery Critical Materials initiatives reflect growing concerns about resource security and environmental impact.

The technological innovation targets driven by these regulations have evolved correspondingly. Initially, compliance focused on eliminating toxic materials like mercury and lead. Subsequently, innovation shifted toward enhancing energy density while maintaining safety, particularly for EV applications where regulatory weight limits and range requirements created competing pressures on battery design.

Current innovation targets center on four key areas: extended battery lifespan to meet warranty regulations; improved recyclability to achieve mandated recovery rates; reduced carbon footprint across manufacturing processes; and enhanced traceability systems for regulatory reporting. The EU's target of 70% lithium recovery by 2030, for instance, is driving significant innovation in battery design for disassembly and material separation.

Looking forward, regulatory trends indicate future innovation will likely focus on standardization of battery modules for second-life applications, development of non-destructive state-of-health assessment technologies, and design approaches that eliminate critical materials facing supply restrictions. The anticipated global battery passport system will require sophisticated tracking technologies and data management solutions, creating new innovation imperatives for battery manufacturers worldwide.

The 2010s witnessed a paradigm shift as electric vehicles gained prominence, prompting regulators to develop specialized frameworks for high-capacity lithium-ion battery packs. These regulations incorporated thermal runaway prevention, crash safety requirements, and enhanced testing protocols. The UN Transport of Dangerous Goods regulations and IEC 62133 standards became globally influential benchmarks for battery safety and transportation.

Most recently, regulatory focus has expanded beyond safety to encompass sustainability and circular economy principles. The EU's proposed Battery Regulation (2020) represents this evolution, introducing carbon footprint declarations, recycled content requirements, and battery passports to track materials throughout the lifecycle. Similarly, China's battery recycling policies and the US Department of Energy's Battery Critical Materials initiatives reflect growing concerns about resource security and environmental impact.

The technological innovation targets driven by these regulations have evolved correspondingly. Initially, compliance focused on eliminating toxic materials like mercury and lead. Subsequently, innovation shifted toward enhancing energy density while maintaining safety, particularly for EV applications where regulatory weight limits and range requirements created competing pressures on battery design.

Current innovation targets center on four key areas: extended battery lifespan to meet warranty regulations; improved recyclability to achieve mandated recovery rates; reduced carbon footprint across manufacturing processes; and enhanced traceability systems for regulatory reporting. The EU's target of 70% lithium recovery by 2030, for instance, is driving significant innovation in battery design for disassembly and material separation.

Looking forward, regulatory trends indicate future innovation will likely focus on standardization of battery modules for second-life applications, development of non-destructive state-of-health assessment technologies, and design approaches that eliminate critical materials facing supply restrictions. The anticipated global battery passport system will require sophisticated tracking technologies and data management solutions, creating new innovation imperatives for battery manufacturers worldwide.

Market Demand Analysis for Compliant Battery Solutions

The global battery market is experiencing unprecedented growth driven by regulatory policies aimed at reducing carbon emissions and promoting sustainable energy solutions. Current market analysis indicates that the demand for compliant battery solutions is projected to reach $240 billion by 2027, with a compound annual growth rate of 18.7% from 2022. This surge is primarily fueled by stringent environmental regulations in key markets including the European Union, China, and increasingly the United States.

The electric vehicle (EV) sector represents the largest demand segment for compliant battery solutions, accounting for approximately 60% of the total market. Regulatory frameworks such as the EU's Battery Directive, China's New Energy Vehicle (NEV) policies, and California's Zero-Emission Vehicle (ZEV) mandate are creating substantial market pull for batteries that meet specific safety, performance, and sustainability criteria.

Energy storage systems (ESS) constitute the second-largest market segment, growing at 22% annually as grid modernization and renewable energy integration accelerate globally. Regulations mandating energy storage capacity for utilities and incentivizing residential storage systems are driving demand for compliant battery solutions that meet grid-connection standards and safety certifications.

Consumer electronics manufacturers are increasingly seeking battery solutions that comply with expanded producer responsibility regulations, particularly regarding recyclability and hazardous material restrictions. This segment values batteries with lower environmental footprints and documented compliance with regulations like the EU's Restriction of Hazardous Substances (RoHS) directive.

Market research indicates that customers are willing to pay a premium of 15-20% for battery solutions that demonstrably exceed minimum regulatory requirements, particularly regarding safety and environmental performance. This premium is highest in the EV sector, where battery safety incidents have significant brand implications.

Regional analysis shows varying demand patterns based on regulatory maturity. The EU market prioritizes batteries with comprehensive life-cycle documentation and recycled content. The North American market emphasizes safety compliance and domestic production capabilities in response to supply chain security regulations. The Asia-Pacific region shows the highest growth rate for compliant solutions as countries implement increasingly stringent environmental standards.

Industry surveys reveal that 78% of battery procurement decisions now include regulatory compliance as a primary selection criterion, compared to just 45% five years ago. This shift indicates that regulatory alignment has evolved from a technical requirement to a core market differentiator and competitive advantage.

The electric vehicle (EV) sector represents the largest demand segment for compliant battery solutions, accounting for approximately 60% of the total market. Regulatory frameworks such as the EU's Battery Directive, China's New Energy Vehicle (NEV) policies, and California's Zero-Emission Vehicle (ZEV) mandate are creating substantial market pull for batteries that meet specific safety, performance, and sustainability criteria.

Energy storage systems (ESS) constitute the second-largest market segment, growing at 22% annually as grid modernization and renewable energy integration accelerate globally. Regulations mandating energy storage capacity for utilities and incentivizing residential storage systems are driving demand for compliant battery solutions that meet grid-connection standards and safety certifications.

Consumer electronics manufacturers are increasingly seeking battery solutions that comply with expanded producer responsibility regulations, particularly regarding recyclability and hazardous material restrictions. This segment values batteries with lower environmental footprints and documented compliance with regulations like the EU's Restriction of Hazardous Substances (RoHS) directive.

Market research indicates that customers are willing to pay a premium of 15-20% for battery solutions that demonstrably exceed minimum regulatory requirements, particularly regarding safety and environmental performance. This premium is highest in the EV sector, where battery safety incidents have significant brand implications.

Regional analysis shows varying demand patterns based on regulatory maturity. The EU market prioritizes batteries with comprehensive life-cycle documentation and recycled content. The North American market emphasizes safety compliance and domestic production capabilities in response to supply chain security regulations. The Asia-Pacific region shows the highest growth rate for compliant solutions as countries implement increasingly stringent environmental standards.

Industry surveys reveal that 78% of battery procurement decisions now include regulatory compliance as a primary selection criterion, compared to just 45% five years ago. This shift indicates that regulatory alignment has evolved from a technical requirement to a core market differentiator and competitive advantage.

Global Battery Regulatory Landscape and Technical Barriers

The global battery regulatory landscape is characterized by a complex web of policies that vary significantly across regions, creating a challenging environment for innovation and standardization. In North America, the United States has established comprehensive safety standards through organizations like UL (Underwriters Laboratories) and the Department of Transportation (DOT), focusing primarily on transportation safety and performance requirements. The Environmental Protection Agency (EPA) and state-level regulations, particularly California's stringent environmental policies, further shape battery development trajectories.

The European Union presents one of the most rigorous regulatory frameworks globally through its Battery Directive (2006/66/EC) and the more recent Batteries Regulation proposal. These regulations emphasize sustainability throughout the battery lifecycle, mandating collection targets, recycling efficiencies, and carbon footprint declarations. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation adds another layer of complexity by restricting hazardous substances in battery manufacturing.

In Asia, China has emerged as a dominant force in battery regulation through policies like "Made in China 2025" and GB standards that govern safety, performance, and increasingly, recycling requirements. Japan and South Korea have established their own regulatory frameworks that balance innovation support with safety considerations, often serving as intermediaries between Western and Chinese approaches.

These divergent regulatory landscapes create significant technical barriers for battery pack innovation. First, compliance costs across multiple jurisdictions can be prohibitive, particularly for smaller companies and startups. The resources required to navigate different certification processes often divert funding from core R&D activities, slowing innovation cycles.

Second, technical fragmentation presents a substantial challenge as manufacturers must design different versions of their products to meet region-specific requirements. This impedes economies of scale and complicates global supply chain management, particularly for electric vehicle manufacturers operating across multiple markets.

Third, regulatory uncertainty and frequent policy changes create hesitation in long-term R&D investments. The battery industry's capital-intensive nature requires stable regulatory horizons, yet policies often evolve faster than product development cycles, creating misalignment between innovation timelines and compliance requirements.

Finally, intellectual property protection varies significantly across jurisdictions, affecting how companies approach innovation and technology transfer. In regions with weaker IP enforcement, companies may be reluctant to introduce cutting-edge technologies, creating innovation "safe havens" and "innovation deserts" based on regulatory maturity rather than technical capability.

The European Union presents one of the most rigorous regulatory frameworks globally through its Battery Directive (2006/66/EC) and the more recent Batteries Regulation proposal. These regulations emphasize sustainability throughout the battery lifecycle, mandating collection targets, recycling efficiencies, and carbon footprint declarations. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation adds another layer of complexity by restricting hazardous substances in battery manufacturing.

In Asia, China has emerged as a dominant force in battery regulation through policies like "Made in China 2025" and GB standards that govern safety, performance, and increasingly, recycling requirements. Japan and South Korea have established their own regulatory frameworks that balance innovation support with safety considerations, often serving as intermediaries between Western and Chinese approaches.

These divergent regulatory landscapes create significant technical barriers for battery pack innovation. First, compliance costs across multiple jurisdictions can be prohibitive, particularly for smaller companies and startups. The resources required to navigate different certification processes often divert funding from core R&D activities, slowing innovation cycles.

Second, technical fragmentation presents a substantial challenge as manufacturers must design different versions of their products to meet region-specific requirements. This impedes economies of scale and complicates global supply chain management, particularly for electric vehicle manufacturers operating across multiple markets.

Third, regulatory uncertainty and frequent policy changes create hesitation in long-term R&D investments. The battery industry's capital-intensive nature requires stable regulatory horizons, yet policies often evolve faster than product development cycles, creating misalignment between innovation timelines and compliance requirements.

Finally, intellectual property protection varies significantly across jurisdictions, affecting how companies approach innovation and technology transfer. In regions with weaker IP enforcement, companies may be reluctant to introduce cutting-edge technologies, creating innovation "safe havens" and "innovation deserts" based on regulatory maturity rather than technical capability.

Current Battery Pack Design Solutions for Regulatory Compliance

01 Battery Management Systems for Enhanced Performance

Advanced battery management systems (BMS) are crucial for optimizing battery pack performance and longevity. These systems monitor and control various parameters such as voltage, current, temperature, and state of charge to ensure safe and efficient operation. Innovations in BMS include improved algorithms for accurate state of health estimation, thermal management, and cell balancing techniques that extend battery life and enhance overall performance.- Battery Management Systems: Advanced battery management systems (BMS) are crucial for optimizing battery pack performance and safety. These systems monitor and control various parameters such as voltage, current, temperature, and state of charge to ensure efficient operation and prevent damage. Modern BMS innovations include predictive analytics for battery health monitoring, adaptive charging algorithms, and thermal management integration to extend battery life and improve overall performance.

- Thermal Management Solutions: Innovative thermal management solutions are essential for maintaining optimal battery pack temperature during operation. These include advanced cooling systems using liquid or air circulation, phase change materials for heat absorption, and intelligent thermal regulation algorithms. Effective thermal management prevents overheating, extends battery lifespan, and maintains consistent performance across various operating conditions while enhancing safety by reducing thermal runaway risks.

- Structural Design Improvements: Structural innovations in battery pack design focus on enhancing mechanical integrity, space efficiency, and weight reduction. These include modular architectures that facilitate easier maintenance and replacement, honeycomb structures for improved strength-to-weight ratios, and integrated cooling channels within the structural components. Advanced materials such as composite frames and specialized polymers are being utilized to create lighter yet more robust battery enclosures that provide better protection against physical damage and environmental factors.

- Cell Connection and Integration Technologies: Innovations in cell connection and integration focus on improving electrical performance and reliability within battery packs. These include advanced busbar designs, novel welding techniques for cell interconnections, and flexible circuit integration. Improved connection technologies reduce internal resistance, minimize heat generation at connection points, and enhance current distribution throughout the pack. These advancements result in higher efficiency, better power delivery, and increased overall battery pack reliability under various load conditions.

- Smart Battery Systems with IoT Integration: Smart battery systems incorporate Internet of Things (IoT) technology to enable remote monitoring, diagnostics, and management capabilities. These systems feature wireless connectivity, cloud-based analytics, and mobile application interfaces for real-time battery status monitoring. Advanced data collection and analysis allow for predictive maintenance, usage optimization, and performance tracking across battery lifecycles. IoT integration also enables fleet management for multiple battery packs, with features such as over-the-air updates and adaptive charging protocols based on usage patterns and environmental conditions.

02 Thermal Management Solutions for Battery Packs

Effective thermal management is essential for battery pack safety and performance. Innovations in this area include advanced cooling systems, heat dissipation materials, and temperature regulation mechanisms. These solutions help maintain optimal operating temperatures, prevent thermal runaway, and ensure consistent performance across various environmental conditions, ultimately extending battery life and improving safety.Expand Specific Solutions03 Structural Design Improvements for Battery Packs

Innovative structural designs for battery packs focus on optimizing space utilization, weight reduction, and mechanical integrity. These designs incorporate modular approaches, novel housing materials, and improved assembly methods that enhance durability while reducing overall weight. Advanced structural configurations also facilitate better thermal management, easier maintenance, and improved safety features for various applications.Expand Specific Solutions04 Cell Connection and Integration Technologies

Innovations in cell connection and integration focus on improving electrical connections between cells, reducing resistance, and enhancing overall pack reliability. These technologies include advanced bus bar designs, novel welding techniques, and integrated circuit solutions that optimize power distribution. Improved connection methods also facilitate better monitoring capabilities, simplified manufacturing, and enhanced safety features within the battery pack.Expand Specific Solutions05 Safety Enhancement Features for Battery Packs

Safety innovations for battery packs include advanced protection mechanisms against overcharging, over-discharging, short circuits, and thermal events. These features incorporate specialized sensors, isolation systems, and fail-safe designs that prevent catastrophic failures. Innovations also include fire-resistant materials, pressure relief mechanisms, and intelligent disconnection systems that activate during abnormal conditions to protect users and surrounding equipment.Expand Specific Solutions

Key Industry Players and Regulatory Compliance Leaders

The regulatory landscape for battery pack innovation is evolving rapidly in a market transitioning from early growth to maturity. With global market size expanding significantly, regulations are increasingly shaping technological development pathways. Leading players like LG Energy Solution, Samsung SDI, and BYD are demonstrating advanced technical maturity through significant R&D investments in regulatory-compliant battery technologies. Meanwhile, Toyota, Panasonic, and Microvast are adapting their innovation strategies to navigate complex regional regulatory frameworks. Emerging companies like Rimac Technology and Sion Power are leveraging regulatory requirements as competitive differentiators, focusing on specialized applications where compliance creates market entry barriers. The interplay between policy and innovation is creating both constraints and opportunities, particularly in safety standards and sustainability requirements.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a comprehensive regulatory compliance framework for battery pack innovation that adapts to varying global standards. Their approach includes a modular battery architecture that can be quickly reconfigured to meet different regional safety requirements without redesigning the entire system. The company has invested in advanced Battery Management Systems (BMS) that incorporate regulatory-compliant safety protocols across different markets, including thermal runaway prevention that exceeds standards in North America, Europe, and Asia. Their design philosophy emphasizes "Design for Compliance" from the earliest stages of R&D, with dedicated regulatory affairs teams embedded within innovation departments to ensure new technologies align with emerging regulations. LG has also pioneered traceability systems that document compliance throughout the battery lifecycle, facilitating certification processes across multiple jurisdictions[1][2].

Strengths: Global regulatory expertise across multiple markets allows for faster product deployment worldwide; advanced compliance prediction models help anticipate regulatory changes. Weaknesses: Higher development costs associated with maintaining multiple regulatory-compliant designs; sometimes sacrifices energy density to meet the strictest safety standards in certain markets.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has implemented a "Regulatory Foresight" framework for battery innovation that emphasizes early identification of policy trends across global markets. Their approach includes advanced simulation and testing protocols that can validate compliance with regulations before physical prototypes are built, accelerating the development cycle. Samsung maintains specialized materials science teams focused on developing battery chemistries that inherently meet or exceed safety regulations, particularly regarding thermal stability and fire resistance. Their battery pack designs incorporate modular safety systems that can be configured to meet different regional requirements without fundamental redesigns. Samsung SDI has developed proprietary manufacturing quality control systems that ensure consistent compliance with varying certification requirements across production facilities. The company also maintains an active policy engagement strategy, participating in standards development organizations to help shape future regulations in ways that balance innovation with safety considerations[9][10].

Strengths: Advanced materials science capabilities allow for innovative compliance solutions at the chemistry level; strong quality control systems ensure consistent regulatory compliance across global manufacturing. Weaknesses: Sometimes faces higher scrutiny following historical safety incidents; regulatory compliance approach can be more conservative in consumer electronics applications compared to automotive applications.

Critical Patents and Technologies for Regulatory-Driven Innovation

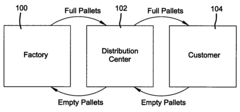

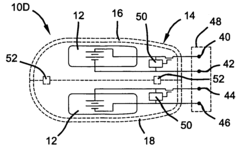

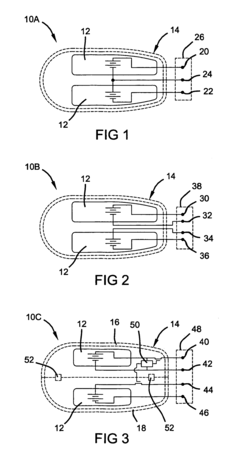

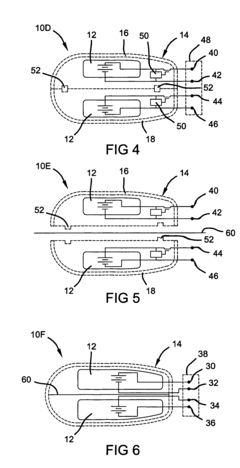

Battery pack shipping method

PatentInactiveUS7486047B2

Innovation

- The use of specialized pallets for shipping battery packs that can separate batteries during transport, either physically or with separating materials, to meet regulatory requirements, while also allowing for reusable packaging and integration of intumescent materials for safety and flame retardation.

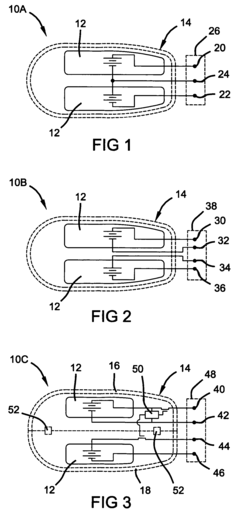

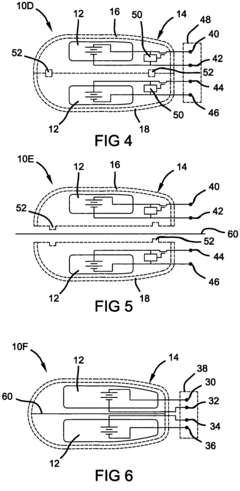

Battery pack housing and packaging

PatentInactiveUS7463007B2

Innovation

- A battery pack design featuring a housing with multiple cells connected in series, a controller for managing charging and safety functions, and a mechanical interface that separates or connects the cells to comply with regulatory limits, including the use of flame-retardant materials and specialized pallets for shipping to ensure safe transportation.

Environmental Impact Assessment of Battery Regulations

Battery regulations across global markets have created a complex environmental impact landscape that both manufacturers and policymakers must navigate. The implementation of stringent environmental standards has significantly altered the lifecycle management of battery technologies, particularly in electric vehicle (EV) applications. These regulations have prompted manufacturers to develop more environmentally sustainable battery chemistries and production processes that reduce toxic material usage and minimize ecological footprints.

The European Union's Battery Directive and the more recent Sustainable Batteries Regulation have established comprehensive frameworks for battery waste management, requiring manufacturers to account for the full environmental impact of their products. These regulations mandate recycling targets and extended producer responsibility, effectively transforming how companies approach battery design and end-of-life considerations.

In North America, varying state-level regulations have created a patchwork of environmental compliance requirements. California's advanced battery recycling mandates have become particularly influential, often serving as a model for other regions. These regulations have accelerated the development of closed-loop recycling systems that recover critical materials like lithium, cobalt, and nickel, significantly reducing the need for environmentally damaging mining operations.

Asian markets, particularly China, have implemented regulations focusing on production emissions and resource efficiency. These policies have driven innovations in manufacturing processes that consume less energy and water while generating fewer pollutants. The environmental impact assessment frameworks in these regions increasingly emphasize carbon footprint reduction throughout the battery lifecycle.

Life Cycle Assessment (LCA) methodologies have become standardized tools for evaluating battery environmental impacts under these regulatory frameworks. These assessments reveal that while EV batteries offer significant environmental benefits during operation, their production and disposal phases present substantial environmental challenges that regulations seek to address.

The regulatory push toward environmental sustainability has catalyzed innovations in battery chemistry that replace environmentally problematic materials. For instance, the shift from cobalt-heavy formulations to lithium iron phosphate (LFP) batteries has been accelerated by regulations targeting the environmental and social impacts of cobalt mining. Similarly, solid-state battery development has gained momentum partly due to its potential for reduced environmental impact.

Water usage and contamination concerns have also become central to battery regulations, with manufacturers now required to implement advanced water treatment systems and reduce process water requirements. This regulatory focus has led to innovations in dry electrode manufacturing processes that significantly reduce water consumption in battery production.

The European Union's Battery Directive and the more recent Sustainable Batteries Regulation have established comprehensive frameworks for battery waste management, requiring manufacturers to account for the full environmental impact of their products. These regulations mandate recycling targets and extended producer responsibility, effectively transforming how companies approach battery design and end-of-life considerations.

In North America, varying state-level regulations have created a patchwork of environmental compliance requirements. California's advanced battery recycling mandates have become particularly influential, often serving as a model for other regions. These regulations have accelerated the development of closed-loop recycling systems that recover critical materials like lithium, cobalt, and nickel, significantly reducing the need for environmentally damaging mining operations.

Asian markets, particularly China, have implemented regulations focusing on production emissions and resource efficiency. These policies have driven innovations in manufacturing processes that consume less energy and water while generating fewer pollutants. The environmental impact assessment frameworks in these regions increasingly emphasize carbon footprint reduction throughout the battery lifecycle.

Life Cycle Assessment (LCA) methodologies have become standardized tools for evaluating battery environmental impacts under these regulatory frameworks. These assessments reveal that while EV batteries offer significant environmental benefits during operation, their production and disposal phases present substantial environmental challenges that regulations seek to address.

The regulatory push toward environmental sustainability has catalyzed innovations in battery chemistry that replace environmentally problematic materials. For instance, the shift from cobalt-heavy formulations to lithium iron phosphate (LFP) batteries has been accelerated by regulations targeting the environmental and social impacts of cobalt mining. Similarly, solid-state battery development has gained momentum partly due to its potential for reduced environmental impact.

Water usage and contamination concerns have also become central to battery regulations, with manufacturers now required to implement advanced water treatment systems and reduce process water requirements. This regulatory focus has led to innovations in dry electrode manufacturing processes that significantly reduce water consumption in battery production.

Cross-Industry Standardization Efforts and Harmonization Challenges

The global battery industry faces significant challenges in standardization across different sectors, with automotive, consumer electronics, and energy storage systems often operating under disparate regulatory frameworks. These cross-industry standardization efforts are critical for accelerating battery pack innovation while ensuring safety and interoperability across applications.

Major automotive manufacturers, electronics companies, and energy storage providers have established several international consortia aimed at harmonizing battery standards. The Battery Standards Consortium (BSC) and Global Battery Alliance (GBA) represent significant collaborative efforts to develop unified testing protocols, safety requirements, and performance metrics that can be applied across industries. These initiatives seek to reduce fragmentation that currently impedes innovation and increases compliance costs.

Harmonization challenges persist primarily due to industry-specific requirements and legacy systems. The automotive sector demands higher safety standards and longer lifecycles, while consumer electronics prioritize energy density and form factor flexibility. Energy storage systems, meanwhile, focus on scalability and grid integration capabilities. These divergent priorities create natural tensions in standardization efforts.

Technical specification alignment represents another significant challenge. Voltage ranges, thermal management requirements, and battery management system (BMS) protocols vary substantially across industries. For instance, electric vehicle battery packs typically operate at 400-800V, while consumer electronics remain in the 3.7-12V range, creating fundamental design differences that complicate standardization.

Regulatory bodies including ISO, IEC, and SAE have developed overlapping but distinct battery standards, further complicating cross-industry harmonization. The IEC 62133 standard for portable batteries and the UN 38.3 for transportation safety represent important but incomplete efforts toward unified global standards. The lack of mutual recognition agreements between major markets creates additional compliance burdens.

Progress toward harmonization has accelerated in recent years, with the development of common testing methodologies for thermal runaway, cycle life assessment, and safety certification. The emergence of universal battery passport initiatives and digital battery identification systems demonstrates growing recognition of the need for cross-industry compatibility and traceability standards.

Future standardization efforts will likely focus on creating modular approaches that allow for industry-specific requirements while maintaining core compatibility in areas such as safety protocols, sustainability metrics, and second-life applications. This balanced approach may provide the flexibility needed to support innovation while ensuring basic interoperability across diverse applications.

Major automotive manufacturers, electronics companies, and energy storage providers have established several international consortia aimed at harmonizing battery standards. The Battery Standards Consortium (BSC) and Global Battery Alliance (GBA) represent significant collaborative efforts to develop unified testing protocols, safety requirements, and performance metrics that can be applied across industries. These initiatives seek to reduce fragmentation that currently impedes innovation and increases compliance costs.

Harmonization challenges persist primarily due to industry-specific requirements and legacy systems. The automotive sector demands higher safety standards and longer lifecycles, while consumer electronics prioritize energy density and form factor flexibility. Energy storage systems, meanwhile, focus on scalability and grid integration capabilities. These divergent priorities create natural tensions in standardization efforts.

Technical specification alignment represents another significant challenge. Voltage ranges, thermal management requirements, and battery management system (BMS) protocols vary substantially across industries. For instance, electric vehicle battery packs typically operate at 400-800V, while consumer electronics remain in the 3.7-12V range, creating fundamental design differences that complicate standardization.

Regulatory bodies including ISO, IEC, and SAE have developed overlapping but distinct battery standards, further complicating cross-industry harmonization. The IEC 62133 standard for portable batteries and the UN 38.3 for transportation safety represent important but incomplete efforts toward unified global standards. The lack of mutual recognition agreements between major markets creates additional compliance burdens.

Progress toward harmonization has accelerated in recent years, with the development of common testing methodologies for thermal runaway, cycle life assessment, and safety certification. The emergence of universal battery passport initiatives and digital battery identification systems demonstrates growing recognition of the need for cross-industry compatibility and traceability standards.

Future standardization efforts will likely focus on creating modular approaches that allow for industry-specific requirements while maintaining core compatibility in areas such as safety protocols, sustainability metrics, and second-life applications. This balanced approach may provide the flexibility needed to support innovation while ensuring basic interoperability across diverse applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!