Research on Cathode-Coating Techniques for Battery Packs

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Cathode-Coating Evolution and Objectives

Cathode coating technology has evolved significantly over the past three decades, transforming from basic protective layers to sophisticated engineered interfaces that dramatically enhance battery performance. In the 1990s, simple oxide coatings were applied primarily to prevent cathode material dissolution. By the early 2000s, researchers began exploring more complex coating compositions, including phosphates and fluorides, which offered improved ionic conductivity while maintaining protective functions.

The evolution accelerated around 2010 with the introduction of multi-functional coatings designed to simultaneously address multiple performance limitations. These advanced coatings not only protected cathode materials but also facilitated faster ion transport, suppressed unwanted side reactions, and enhanced structural stability during cycling. Recent developments have focused on atomic-level precision coatings using techniques such as atomic layer deposition (ALD) and molecular layer deposition (MLD).

Current research trends indicate a shift toward gradient and composite coatings that provide spatially varied properties across the cathode-electrolyte interface. These sophisticated coating architectures are designed to optimize the balance between protection and performance, addressing the complex electrochemical environment within modern high-energy battery systems.

The primary objectives of cathode coating technology development center on several critical performance metrics. First is the enhancement of battery cycle life by preventing cathode degradation mechanisms, particularly at elevated voltages where conventional cathode materials become unstable. Second is improving rate capability by facilitating more efficient lithium-ion transport across the cathode-electrolyte interface, enabling faster charging capabilities.

Safety enhancement represents another crucial objective, with coatings designed to suppress exothermic reactions between cathode materials and electrolytes under abuse conditions. Additionally, researchers aim to develop coating technologies that enable the use of higher-nickel content cathodes, which offer increased energy density but suffer from accelerated degradation without proper surface protection.

Looking forward, the field is moving toward scalable, cost-effective coating processes suitable for mass production. This includes the development of solution-based techniques that can be integrated into existing manufacturing lines without significant capital investment. The ultimate goal is to develop cathode coating technologies that enable next-generation battery systems with energy densities exceeding 350 Wh/kg while maintaining cycle life beyond 1,000 full cycles and ensuring safety under various operating conditions.

The evolution accelerated around 2010 with the introduction of multi-functional coatings designed to simultaneously address multiple performance limitations. These advanced coatings not only protected cathode materials but also facilitated faster ion transport, suppressed unwanted side reactions, and enhanced structural stability during cycling. Recent developments have focused on atomic-level precision coatings using techniques such as atomic layer deposition (ALD) and molecular layer deposition (MLD).

Current research trends indicate a shift toward gradient and composite coatings that provide spatially varied properties across the cathode-electrolyte interface. These sophisticated coating architectures are designed to optimize the balance between protection and performance, addressing the complex electrochemical environment within modern high-energy battery systems.

The primary objectives of cathode coating technology development center on several critical performance metrics. First is the enhancement of battery cycle life by preventing cathode degradation mechanisms, particularly at elevated voltages where conventional cathode materials become unstable. Second is improving rate capability by facilitating more efficient lithium-ion transport across the cathode-electrolyte interface, enabling faster charging capabilities.

Safety enhancement represents another crucial objective, with coatings designed to suppress exothermic reactions between cathode materials and electrolytes under abuse conditions. Additionally, researchers aim to develop coating technologies that enable the use of higher-nickel content cathodes, which offer increased energy density but suffer from accelerated degradation without proper surface protection.

Looking forward, the field is moving toward scalable, cost-effective coating processes suitable for mass production. This includes the development of solution-based techniques that can be integrated into existing manufacturing lines without significant capital investment. The ultimate goal is to develop cathode coating technologies that enable next-generation battery systems with energy densities exceeding 350 Wh/kg while maintaining cycle life beyond 1,000 full cycles and ensuring safety under various operating conditions.

Market Analysis for Advanced Battery Coating Solutions

The global market for advanced battery coating solutions is experiencing robust growth, driven primarily by the expanding electric vehicle (EV) sector and increasing demand for high-performance energy storage systems. Current market valuations indicate that the battery coating technologies segment reached approximately 2.3 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 12.7% through 2030. This growth trajectory is particularly pronounced in regions with strong EV adoption policies, including China, Europe, and North America.

Consumer demand patterns reveal a clear preference for batteries with enhanced safety features, longer cycle life, and faster charging capabilities – all benefits that advanced cathode coating technologies can deliver. Market research indicates that end-users are willing to pay a premium of 15-20% for battery systems that demonstrate superior performance metrics, especially in high-end EV applications and grid-scale storage solutions.

The industrial landscape shows segmentation between coating solutions for different battery chemistries, with lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) cathodes representing the largest market segments. Coating materials market share is currently dominated by aluminum oxide (Al₂O₃) at approximately 38%, followed by lithium phosphate (Li₃PO₄) at 22%, and various fluoride-based coatings at 17%.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub, accounting for 65% of global production capacity for coated cathode materials. This concentration is attributed to the established battery manufacturing ecosystem in countries like South Korea, Japan, and particularly China, which alone represents 43% of global capacity.

Emerging market trends indicate growing interest in environmentally sustainable coating processes that minimize solvent use and reduce energy consumption. Water-based coating technologies have seen a 28% increase in adoption over the past three years, reflecting broader industry shifts toward greener manufacturing practices.

Market barriers include high initial capital requirements for coating equipment, with industrial-scale atomic layer deposition (ALD) systems typically requiring investments of 3-5 million USD. Additionally, intellectual property constraints present challenges, as key coating technologies are protected by approximately 1,200 active patents held predominantly by established materials science companies and battery manufacturers.

Future market opportunities are emerging in specialized coatings for extreme operating conditions, including high-temperature environments and rapid-charging applications. The market for silicon-based anode coating solutions is also expanding rapidly, with projected growth rates exceeding 18% annually as manufacturers seek to overcome the volumetric expansion challenges associated with silicon anodes.

Consumer demand patterns reveal a clear preference for batteries with enhanced safety features, longer cycle life, and faster charging capabilities – all benefits that advanced cathode coating technologies can deliver. Market research indicates that end-users are willing to pay a premium of 15-20% for battery systems that demonstrate superior performance metrics, especially in high-end EV applications and grid-scale storage solutions.

The industrial landscape shows segmentation between coating solutions for different battery chemistries, with lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) cathodes representing the largest market segments. Coating materials market share is currently dominated by aluminum oxide (Al₂O₃) at approximately 38%, followed by lithium phosphate (Li₃PO₄) at 22%, and various fluoride-based coatings at 17%.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub, accounting for 65% of global production capacity for coated cathode materials. This concentration is attributed to the established battery manufacturing ecosystem in countries like South Korea, Japan, and particularly China, which alone represents 43% of global capacity.

Emerging market trends indicate growing interest in environmentally sustainable coating processes that minimize solvent use and reduce energy consumption. Water-based coating technologies have seen a 28% increase in adoption over the past three years, reflecting broader industry shifts toward greener manufacturing practices.

Market barriers include high initial capital requirements for coating equipment, with industrial-scale atomic layer deposition (ALD) systems typically requiring investments of 3-5 million USD. Additionally, intellectual property constraints present challenges, as key coating technologies are protected by approximately 1,200 active patents held predominantly by established materials science companies and battery manufacturers.

Future market opportunities are emerging in specialized coatings for extreme operating conditions, including high-temperature environments and rapid-charging applications. The market for silicon-based anode coating solutions is also expanding rapidly, with projected growth rates exceeding 18% annually as manufacturers seek to overcome the volumetric expansion challenges associated with silicon anodes.

Current Cathode-Coating Technologies and Barriers

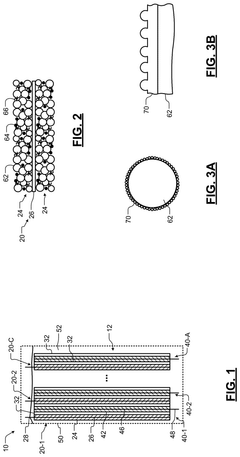

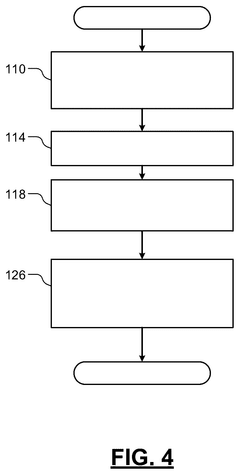

The cathode coating process represents a critical step in battery manufacturing, directly impacting performance, safety, and longevity of battery packs. Current mainstream technologies include wet coating, dry coating, and emerging vapor deposition methods, each with distinct advantages and limitations in industrial applications.

Wet coating technologies dominate the market, with slot-die coating being the most widely implemented method. This process involves applying a slurry of active materials, conductive additives, and binders onto aluminum foil substrates. The technique offers excellent thickness control (±2μm precision) and coating uniformity, making it suitable for mass production. However, it requires significant energy consumption during the drying phase and uses environmentally concerning N-Methyl-2-pyrrolidone (NMP) solvents, presenting both cost and sustainability challenges.

Dry coating methods have emerged as promising alternatives, eliminating solvent usage and associated drying processes. Electrostatic dry coating and powder coating techniques can reduce energy consumption by up to 30% compared to wet methods. Maxwell Technologies and Tesla have pioneered dry electrode technology that reportedly increases energy density by 16% while reducing production costs. Despite these advantages, dry coating faces challenges in achieving uniform particle distribution and adequate adhesion strength, particularly at high production speeds.

Vapor deposition techniques, including Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), represent the cutting edge of cathode coating. These methods enable the creation of ultra-thin, highly uniform coatings with excellent control over composition and crystallinity. However, their high equipment costs and relatively slow deposition rates have limited industrial adoption to specialized applications like solid-state batteries.

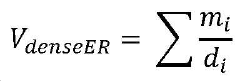

The primary technical barriers across all coating technologies include scalability limitations, material compatibility issues, and quality control challenges. Current coating processes struggle to maintain uniformity when scaled to the high speeds (>30m/min) required for cost-effective mass production. Additionally, newer high-nickel cathode materials (NMC811, NCA) exhibit increased sensitivity to moisture and processing conditions, complicating coating procedures.

Interface engineering remains another significant challenge, as coating quality directly affects the electrode-electrolyte interface stability. Defects such as pinholes, cracks, and delamination can lead to capacity fade and safety issues. Advanced quality control systems utilizing machine vision and AI-based defect detection are being developed but remain in early implementation stages.

Wet coating technologies dominate the market, with slot-die coating being the most widely implemented method. This process involves applying a slurry of active materials, conductive additives, and binders onto aluminum foil substrates. The technique offers excellent thickness control (±2μm precision) and coating uniformity, making it suitable for mass production. However, it requires significant energy consumption during the drying phase and uses environmentally concerning N-Methyl-2-pyrrolidone (NMP) solvents, presenting both cost and sustainability challenges.

Dry coating methods have emerged as promising alternatives, eliminating solvent usage and associated drying processes. Electrostatic dry coating and powder coating techniques can reduce energy consumption by up to 30% compared to wet methods. Maxwell Technologies and Tesla have pioneered dry electrode technology that reportedly increases energy density by 16% while reducing production costs. Despite these advantages, dry coating faces challenges in achieving uniform particle distribution and adequate adhesion strength, particularly at high production speeds.

Vapor deposition techniques, including Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), represent the cutting edge of cathode coating. These methods enable the creation of ultra-thin, highly uniform coatings with excellent control over composition and crystallinity. However, their high equipment costs and relatively slow deposition rates have limited industrial adoption to specialized applications like solid-state batteries.

The primary technical barriers across all coating technologies include scalability limitations, material compatibility issues, and quality control challenges. Current coating processes struggle to maintain uniformity when scaled to the high speeds (>30m/min) required for cost-effective mass production. Additionally, newer high-nickel cathode materials (NMC811, NCA) exhibit increased sensitivity to moisture and processing conditions, complicating coating procedures.

Interface engineering remains another significant challenge, as coating quality directly affects the electrode-electrolyte interface stability. Defects such as pinholes, cracks, and delamination can lead to capacity fade and safety issues. Advanced quality control systems utilizing machine vision and AI-based defect detection are being developed but remain in early implementation stages.

Contemporary Cathode-Coating Methodologies

01 Physical Vapor Deposition Techniques

Physical vapor deposition (PVD) techniques are widely used for cathode coating in battery and electronic applications. These methods include sputtering, thermal evaporation, and electron beam deposition, which create thin, uniform films on cathode surfaces. PVD techniques allow precise control over coating thickness and composition, resulting in improved cathode performance, enhanced conductivity, and extended battery life.- Physical Vapor Deposition Techniques: Physical vapor deposition (PVD) techniques are widely used for cathode coating in battery and electronic applications. These methods include sputtering, thermal evaporation, and electron beam deposition, which create thin, uniform films on cathode surfaces. PVD techniques offer precise control over coating thickness and composition, resulting in improved cathode performance, enhanced conductivity, and extended battery life.

- Chemical Vapor Deposition Methods: Chemical vapor deposition (CVD) methods involve the deposition of gaseous reactants onto cathode surfaces to form solid coatings. These techniques include plasma-enhanced CVD, atomic layer deposition, and metal-organic CVD. CVD methods provide excellent conformality and can coat complex cathode geometries with precise thickness control, resulting in improved electrochemical performance and stability of cathode materials.

- Solution-Based Coating Processes: Solution-based coating processes involve applying cathode materials from liquid precursors using techniques such as dip coating, spray coating, and sol-gel methods. These approaches are cost-effective and scalable for mass production, allowing for the deposition of various functional materials on cathode surfaces. The solution-based methods can incorporate additives to enhance adhesion, conductivity, and electrochemical stability of the cathode coatings.

- Electrochemical Deposition Techniques: Electrochemical deposition techniques, including electroplating, electroless plating, and anodization, are used to form protective and functional coatings on cathode surfaces. These methods utilize electric current or chemical reactions to deposit metals, alloys, or compounds onto cathode substrates. Electrochemical techniques offer advantages such as room-temperature processing, uniform coating thickness, and the ability to coat complex geometries, resulting in improved cathode performance and durability.

- Advanced Surface Modification Methods: Advanced surface modification methods for cathode coating include plasma treatment, ion implantation, and laser surface engineering. These techniques alter the surface properties of cathode materials without significantly changing their bulk characteristics. Surface modification can enhance cathode-electrolyte interface stability, improve ion transport, reduce side reactions, and extend battery cycle life. These methods are particularly valuable for high-performance batteries and specialized electronic applications.

02 Chemical Vapor Deposition Methods

Chemical vapor deposition (CVD) methods involve the deposition of gaseous reactants onto cathode surfaces to form solid coatings. These techniques include plasma-enhanced CVD, atomic layer deposition, and metal-organic CVD. CVD methods provide excellent conformality and can coat complex cathode geometries with high precision. The resulting coatings offer improved electrochemical stability, reduced interfacial resistance, and enhanced cycling performance in battery applications.Expand Specific Solutions03 Solution-Based Coating Processes

Solution-based coating processes involve applying liquid precursors to cathode surfaces through techniques such as dip coating, spray coating, and sol-gel methods. These approaches are cost-effective and scalable for mass production. The liquid precursors typically contain active materials, binders, and conductive additives that form protective or functional layers on cathode surfaces after drying and curing. These coatings can significantly improve cathode stability, reduce side reactions with electrolytes, and enhance overall battery performance.Expand Specific Solutions04 Electrochemical Deposition Techniques

Electrochemical deposition techniques utilize electrical current to deposit materials onto cathode surfaces. Methods include electroplating, electroless plating, and electrophoretic deposition. These techniques offer advantages such as room-temperature processing, uniform coating formation, and the ability to coat complex geometries. Electrochemical deposition can create protective layers that prevent cathode dissolution, enhance structural stability, and improve the interface between the cathode and electrolyte in battery systems.Expand Specific Solutions05 Advanced Surface Modification Techniques

Advanced surface modification techniques for cathodes include atomic layer deposition, plasma treatment, and ion implantation. These methods can create ultrathin protective layers, modify surface chemistry, or introduce dopants to enhance cathode properties. Surface modifications can significantly improve cathode-electrolyte interface stability, reduce unwanted side reactions, enhance rate capability, and extend cycling life of batteries. These techniques are particularly valuable for high-energy density cathode materials that are prone to degradation.Expand Specific Solutions

Leading Battery Coating Industry Manufacturers

The cathode-coating techniques for battery packs market is currently in a growth phase, with increasing demand driven by electric vehicle adoption and energy storage applications. The market size is projected to expand significantly as battery technology becomes critical for sustainable energy solutions. Technologically, the field shows varying maturity levels, with established players like Contemporary Amperex Technology (CATL), LG Energy Solution, and PowerCo SE leading commercial implementations. Innovative approaches are being developed by specialized companies such as Forge Nano with their atomic layer deposition technology and Solid Power focusing on solid-state battery solutions. Research institutions including University of California and Columbia University contribute fundamental advancements, while traditional manufacturers like Apple and GM integrate these technologies into their product ecosystems. The competitive landscape features both battery manufacturing giants and specialized coating technology providers competing to improve battery performance, safety, and longevity.

GM Global Technology Operations LLC

Technical Solution: GM has developed an advanced cathode coating system called "Ultra-Barrier" that employs a dual-layer approach for their Ultium battery platform. The inner layer consists of aluminum fluoride compounds that chemically bond with cathode particles to prevent transition metal dissolution, while the outer layer uses a proprietary polymer-ceramic composite that enhances mechanical stability and ion conductivity. GM's coating process utilizes a modified chemical vapor deposition technique that achieves uniform coverage even on complex cathode particle geometries. Their technology has demonstrated a 25% improvement in high-temperature cycling stability and reduced capacity fade by approximately 40% over 1000 cycles compared to uncoated materials. GM has also integrated their coating technology with advanced battery management systems that adapt charging protocols based on the specific coating properties, further extending battery life. The company has recently patented a self-healing coating variant that incorporates reactive siloxane compounds that can repair microfractures during normal battery operation.

Strengths: Excellent protection against transition metal dissolution; superior high-temperature performance; integration with battery management systems for optimized performance; scalable manufacturing process. Weaknesses: Higher production costs compared to conventional cathodes; requires precise process control parameters; some formulations may have reduced initial capacity due to coating resistance.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed advanced cathode coating techniques using atomic layer deposition (ALD) to create uniform, nanometer-thick protective layers on cathode materials. Their CTP (cell-to-pack) technology integrates coated cathodes with direct cooling systems, improving energy density by 13% compared to conventional designs. CATL's gradient coating approach applies multiple functional layers to cathode particles - an inner layer for structural stability, a middle layer for ion conductivity, and an outer layer for electrolyte compatibility. This multi-layer strategy has demonstrated a 20% improvement in cycle life and significantly reduced capacity fade at high temperatures. Their dry coating process eliminates toxic solvents, reducing environmental impact while maintaining coating quality. CATL has also pioneered the integration of self-healing polymer additives in their cathode coatings that can repair microcracks formed during cycling.

Strengths: Superior coating uniformity at nanoscale thickness; environmentally friendly dry coating processes; multi-functional gradient coatings that address multiple degradation mechanisms simultaneously. Weaknesses: Higher manufacturing costs compared to conventional techniques; complex quality control requirements for multi-layer coatings; potential scalability challenges for certain advanced coating technologies.

Key Patents in Cathode Surface Modification

Method for coating cathode active material with alkali-doped alumina using spray drying

PatentPendingUS20250183286A1

Innovation

- A spray drying, water-based coating method using an alkali-doped alumina coating is applied to cathode active material particles, selected from various materials like lithium- and manganese-rich (LMR) or lithium nickel manganese cobalt oxide (NMC), to enhance their performance.

Cathode coatings for lithium-ion batteries

PatentPendingKR1020240069798A

Innovation

- A cathode coating composed of poly(vinylidene fluorides), lithium salt, and conductive additives is applied directly to the cathode, providing a physical separation between the solid electrolyte and the electrode active material, enhancing ionic conductivity, electrochemical stability, and mechanical strength.

Environmental Impact of Coating Processes

The environmental impact of cathode coating processes in battery pack manufacturing represents a critical consideration as the industry scales to meet growing demand for electric vehicles and energy storage systems. Traditional coating methods often involve the use of N-Methyl-2-pyrrolidone (NMP) as a solvent, which is classified as a reproductive toxin and poses significant environmental hazards. The volatile organic compound emissions from NMP-based processes contribute to air pollution and require extensive abatement systems to meet regulatory standards.

Water-based coating alternatives have emerged as more environmentally friendly options, reducing hazardous air pollutants by up to 95% compared to NMP-based processes. However, these aqueous systems typically require higher energy consumption during the drying phase, creating a trade-off between reduced chemical toxicity and increased carbon footprint from energy usage. Life cycle assessments indicate that the environmental benefits of water-based coatings generally outweigh the energy penalties when renewable energy sources are utilized in manufacturing facilities.

Dry coating technologies represent the most promising frontier for environmentally sustainable cathode coating. These solvent-free approaches eliminate liquid waste streams entirely and reduce energy consumption by up to 40% compared to wet coating methods. The absence of drying steps significantly decreases the process carbon footprint while maintaining or even improving electrode performance characteristics. Companies pioneering these technologies report reductions in greenhouse gas emissions of approximately 30-50% across the coating process lifecycle.

Waste management practices for coating processes have also evolved considerably. Closed-loop solvent recovery systems now achieve recapture rates exceeding 95% for facilities still utilizing NMP-based methods, substantially reducing environmental discharge. Advanced filtration systems for particulate matter have similarly reduced airborne emissions from dry powder handling in newer coating technologies, addressing potential respiratory health concerns for both workers and surrounding communities.

The geographical distribution of environmental impacts varies significantly based on regional energy mixes and regulatory frameworks. Manufacturing facilities in regions with coal-dominant electricity generation face greater challenges in minimizing the carbon footprint of energy-intensive coating processes compared to those operating with hydroelectric or nuclear power sources. This disparity has driven innovation in energy-efficient coating equipment design, with the latest generation of coating lines incorporating heat recovery systems that reduce overall energy requirements by 15-25%.

Water-based coating alternatives have emerged as more environmentally friendly options, reducing hazardous air pollutants by up to 95% compared to NMP-based processes. However, these aqueous systems typically require higher energy consumption during the drying phase, creating a trade-off between reduced chemical toxicity and increased carbon footprint from energy usage. Life cycle assessments indicate that the environmental benefits of water-based coatings generally outweigh the energy penalties when renewable energy sources are utilized in manufacturing facilities.

Dry coating technologies represent the most promising frontier for environmentally sustainable cathode coating. These solvent-free approaches eliminate liquid waste streams entirely and reduce energy consumption by up to 40% compared to wet coating methods. The absence of drying steps significantly decreases the process carbon footprint while maintaining or even improving electrode performance characteristics. Companies pioneering these technologies report reductions in greenhouse gas emissions of approximately 30-50% across the coating process lifecycle.

Waste management practices for coating processes have also evolved considerably. Closed-loop solvent recovery systems now achieve recapture rates exceeding 95% for facilities still utilizing NMP-based methods, substantially reducing environmental discharge. Advanced filtration systems for particulate matter have similarly reduced airborne emissions from dry powder handling in newer coating technologies, addressing potential respiratory health concerns for both workers and surrounding communities.

The geographical distribution of environmental impacts varies significantly based on regional energy mixes and regulatory frameworks. Manufacturing facilities in regions with coal-dominant electricity generation face greater challenges in minimizing the carbon footprint of energy-intensive coating processes compared to those operating with hydroelectric or nuclear power sources. This disparity has driven innovation in energy-efficient coating equipment design, with the latest generation of coating lines incorporating heat recovery systems that reduce overall energy requirements by 15-25%.

Scale-up Challenges for Mass Production

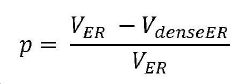

The transition from laboratory-scale cathode coating processes to mass production presents significant challenges that must be addressed to ensure commercial viability. Current pilot production lines typically operate at speeds of 5-20 meters per minute, while industrial-scale manufacturing requires throughput rates of 50-100 meters per minute or higher. This substantial increase in production speed introduces issues related to coating uniformity, thickness control, and defect management that are not as prominent in smaller-scale operations.

Material handling becomes increasingly complex at industrial scales, particularly for slurry-based coating methods. The rheological properties of cathode slurries often exhibit non-Newtonian behavior, making them difficult to manage consistently when scaling up. Viscosity fluctuations due to temperature variations, aging effects, and shear forces in large-scale mixing equipment can lead to coating inconsistencies across production batches.

Equipment design represents another critical challenge. Industrial coating machinery must maintain precise control over coating parameters while accommodating wider substrates and faster line speeds. The drying zones must be extended proportionally to ensure complete solvent evaporation without thermal damage to the substrate or active materials. Additionally, the capital investment for such specialized equipment is substantial, often ranging from $10-50 million for a complete production line.

Quality control systems must evolve to accommodate high-speed production. Traditional inspection methods that work well for small batches become bottlenecks in mass production. Advanced in-line monitoring technologies using optical, laser, or X-ray techniques are necessary but add complexity and cost to the production system. Statistical process control methods must be implemented to detect trends before they result in significant yield losses.

Environmental considerations also scale with production volume. Solvent recovery systems must handle much larger volumes, and waste management becomes more challenging. Water-based coating systems, while environmentally preferable, introduce their own scaling challenges related to drying energy requirements and potential substrate interactions at high speeds.

Energy consumption increases dramatically with scale-up, particularly in the drying and curing processes. A typical industrial cathode coating line may consume 2-5 MW of power, necessitating efficient energy management systems and potentially requiring dedicated power infrastructure. The economic viability of the scaled process depends heavily on optimizing these energy-intensive steps without compromising product quality.

Material handling becomes increasingly complex at industrial scales, particularly for slurry-based coating methods. The rheological properties of cathode slurries often exhibit non-Newtonian behavior, making them difficult to manage consistently when scaling up. Viscosity fluctuations due to temperature variations, aging effects, and shear forces in large-scale mixing equipment can lead to coating inconsistencies across production batches.

Equipment design represents another critical challenge. Industrial coating machinery must maintain precise control over coating parameters while accommodating wider substrates and faster line speeds. The drying zones must be extended proportionally to ensure complete solvent evaporation without thermal damage to the substrate or active materials. Additionally, the capital investment for such specialized equipment is substantial, often ranging from $10-50 million for a complete production line.

Quality control systems must evolve to accommodate high-speed production. Traditional inspection methods that work well for small batches become bottlenecks in mass production. Advanced in-line monitoring technologies using optical, laser, or X-ray techniques are necessary but add complexity and cost to the production system. Statistical process control methods must be implemented to detect trends before they result in significant yield losses.

Environmental considerations also scale with production volume. Solvent recovery systems must handle much larger volumes, and waste management becomes more challenging. Water-based coating systems, while environmentally preferable, introduce their own scaling challenges related to drying energy requirements and potential substrate interactions at high speeds.

Energy consumption increases dramatically with scale-up, particularly in the drying and curing processes. A typical industrial cathode coating line may consume 2-5 MW of power, necessitating efficient energy management systems and potentially requiring dedicated power infrastructure. The economic viability of the scaled process depends heavily on optimizing these energy-intensive steps without compromising product quality.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!