Pioneering New Frontiers with Ethyl Acetate Applications

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Evolution

Ethyl acetate has undergone a remarkable evolution since its discovery in the early 19th century. Initially synthesized as a laboratory curiosity, it quickly found its way into industrial applications due to its unique properties. The journey of ethyl acetate began with its use as a solvent in the production of nitrocellulose, marking the start of its industrial significance.

As chemical manufacturing techniques advanced in the early 20th century, the production of ethyl acetate became more efficient and cost-effective. This led to its widespread adoption in various industries, particularly in the manufacture of paints, coatings, and adhesives. The 1930s and 1940s saw a surge in ethyl acetate's use as a key ingredient in nail polish removers and other cosmetic products, solidifying its position in the consumer goods market.

The post-World War II era brought about a revolution in synthetic materials, and ethyl acetate played a crucial role in this transformation. Its compatibility with a wide range of polymers made it an indispensable component in the production of plastics and synthetic fibers. This period also witnessed the expansion of ethyl acetate's application in the food industry, where it became a popular flavoring agent and extraction solvent.

The late 20th century marked a significant shift in the production methods of ethyl acetate. Traditional processes based on the esterification of ethanol and acetic acid were gradually replaced by more sustainable and economical routes. The development of catalytic processes and the use of renewable feedstocks opened new avenues for ethyl acetate production, aligning with growing environmental concerns.

In recent years, the evolution of ethyl acetate has taken a more sustainable turn. Research efforts have focused on developing bio-based production methods, utilizing agricultural waste and other renewable resources. This shift reflects the broader trend towards green chemistry and circular economy principles in the chemical industry.

The digital age has also influenced the trajectory of ethyl acetate's evolution. Advanced process control systems and predictive modeling have optimized production processes, leading to improved yields and reduced energy consumption. Furthermore, the integration of ethyl acetate into new high-tech applications, such as in the electronics industry for cleaning precision components, has expanded its market reach.

Looking ahead, the evolution of ethyl acetate is poised to continue in exciting new directions. Emerging applications in nanotechnology, advanced materials, and biotechnology are likely to drive further innovations in its production and use. As sustainability remains a key focus, we can expect to see continued efforts in developing even more eco-friendly production methods and novel applications that leverage ethyl acetate's unique properties in addressing global challenges.

As chemical manufacturing techniques advanced in the early 20th century, the production of ethyl acetate became more efficient and cost-effective. This led to its widespread adoption in various industries, particularly in the manufacture of paints, coatings, and adhesives. The 1930s and 1940s saw a surge in ethyl acetate's use as a key ingredient in nail polish removers and other cosmetic products, solidifying its position in the consumer goods market.

The post-World War II era brought about a revolution in synthetic materials, and ethyl acetate played a crucial role in this transformation. Its compatibility with a wide range of polymers made it an indispensable component in the production of plastics and synthetic fibers. This period also witnessed the expansion of ethyl acetate's application in the food industry, where it became a popular flavoring agent and extraction solvent.

The late 20th century marked a significant shift in the production methods of ethyl acetate. Traditional processes based on the esterification of ethanol and acetic acid were gradually replaced by more sustainable and economical routes. The development of catalytic processes and the use of renewable feedstocks opened new avenues for ethyl acetate production, aligning with growing environmental concerns.

In recent years, the evolution of ethyl acetate has taken a more sustainable turn. Research efforts have focused on developing bio-based production methods, utilizing agricultural waste and other renewable resources. This shift reflects the broader trend towards green chemistry and circular economy principles in the chemical industry.

The digital age has also influenced the trajectory of ethyl acetate's evolution. Advanced process control systems and predictive modeling have optimized production processes, leading to improved yields and reduced energy consumption. Furthermore, the integration of ethyl acetate into new high-tech applications, such as in the electronics industry for cleaning precision components, has expanded its market reach.

Looking ahead, the evolution of ethyl acetate is poised to continue in exciting new directions. Emerging applications in nanotechnology, advanced materials, and biotechnology are likely to drive further innovations in its production and use. As sustainability remains a key focus, we can expect to see continued efforts in developing even more eco-friendly production methods and novel applications that leverage ethyl acetate's unique properties in addressing global challenges.

Market Demand Analysis

The global market for ethyl acetate has been experiencing steady growth, driven by its versatile applications across various industries. The compound's unique properties, including its low toxicity, pleasant odor, and excellent solvency, have made it a preferred choice in numerous sectors. In the paints and coatings industry, ethyl acetate has seen increased demand due to its fast-evaporating nature and ability to provide a smooth finish. This sector alone accounts for a significant portion of the overall market share.

The pharmaceutical industry has also been a major contributor to the rising demand for ethyl acetate. Its use as a solvent in the production of various drugs and as an extraction agent in the manufacture of antibiotics has led to a surge in consumption. Additionally, the food and beverage industry has shown growing interest in ethyl acetate, particularly for its role as a flavoring agent and in the decaffeination of coffee and tea.

In the adhesives sector, ethyl acetate has gained traction as a key ingredient in the formulation of various adhesive products. The increasing use of flexible packaging in the food and consumer goods industries has further boosted the demand for ethyl acetate-based adhesives. The electronics industry, too, has been adopting ethyl acetate in cleaning applications, contributing to its market growth.

Emerging applications in the biodiesel industry, where ethyl acetate is used as a reactant in the production process, have opened new avenues for market expansion. This trend aligns with the growing focus on renewable energy sources and sustainable production methods. The personal care and cosmetics industry has also begun to explore ethyl acetate's potential, particularly in nail polish removers and other beauty products.

Geographically, Asia-Pacific has emerged as the largest consumer of ethyl acetate, with China and India leading the demand. The rapid industrialization and growth of end-use industries in these countries have been key drivers. North America and Europe follow, with steady demand from established industries. Developing regions in Latin America and Africa are showing promising growth potential as their industrial sectors expand.

The market demand for ethyl acetate is expected to continue its upward trajectory, with analysts projecting a compound annual growth rate (CAGR) in the mid-single digits over the next five years. This growth is attributed to the compound's expanding application scope and the overall industrial growth in emerging economies. However, the market faces challenges from volatile raw material prices and increasing environmental regulations, which may impact production costs and market dynamics.

The pharmaceutical industry has also been a major contributor to the rising demand for ethyl acetate. Its use as a solvent in the production of various drugs and as an extraction agent in the manufacture of antibiotics has led to a surge in consumption. Additionally, the food and beverage industry has shown growing interest in ethyl acetate, particularly for its role as a flavoring agent and in the decaffeination of coffee and tea.

In the adhesives sector, ethyl acetate has gained traction as a key ingredient in the formulation of various adhesive products. The increasing use of flexible packaging in the food and consumer goods industries has further boosted the demand for ethyl acetate-based adhesives. The electronics industry, too, has been adopting ethyl acetate in cleaning applications, contributing to its market growth.

Emerging applications in the biodiesel industry, where ethyl acetate is used as a reactant in the production process, have opened new avenues for market expansion. This trend aligns with the growing focus on renewable energy sources and sustainable production methods. The personal care and cosmetics industry has also begun to explore ethyl acetate's potential, particularly in nail polish removers and other beauty products.

Geographically, Asia-Pacific has emerged as the largest consumer of ethyl acetate, with China and India leading the demand. The rapid industrialization and growth of end-use industries in these countries have been key drivers. North America and Europe follow, with steady demand from established industries. Developing regions in Latin America and Africa are showing promising growth potential as their industrial sectors expand.

The market demand for ethyl acetate is expected to continue its upward trajectory, with analysts projecting a compound annual growth rate (CAGR) in the mid-single digits over the next five years. This growth is attributed to the compound's expanding application scope and the overall industrial growth in emerging economies. However, the market faces challenges from volatile raw material prices and increasing environmental regulations, which may impact production costs and market dynamics.

Technical Challenges

The development of ethyl acetate applications faces several technical challenges that require innovative solutions. One of the primary obstacles is the optimization of production processes to enhance efficiency and reduce costs. Current manufacturing methods often involve energy-intensive steps and generate significant waste, necessitating the development of more sustainable and economical production techniques.

Another challenge lies in improving the purity and quality of ethyl acetate for specialized applications. While conventional methods can produce ethyl acetate suitable for many uses, certain high-tech industries, such as electronics and pharmaceuticals, demand ultra-pure grades with minimal impurities. Achieving these stringent quality standards consistently and cost-effectively remains a significant hurdle.

The environmental impact of ethyl acetate production and use also presents a notable challenge. Despite being less toxic than many other solvents, ethyl acetate is still a volatile organic compound (VOC) that contributes to air pollution. Developing green synthesis routes and implementing effective recycling and recovery systems are crucial for minimizing its environmental footprint.

Expanding the application scope of ethyl acetate introduces additional technical difficulties. As researchers explore its potential in novel areas such as advanced materials and biotechnology, they encounter challenges related to compatibility, stability, and performance optimization. For instance, incorporating ethyl acetate into new polymer formulations or using it as a reaction medium for sensitive biological processes requires extensive research and fine-tuning.

Safety concerns in handling and storage of ethyl acetate continue to be a focus area for improvement. Its high flammability and potential for forming explosive mixtures with air necessitate the development of advanced safety protocols and storage solutions, particularly for large-scale industrial applications.

The quest for alternatives to petroleum-based ethyl acetate production represents another significant challenge. Developing bio-based routes using renewable resources is an active area of research, but scaling these processes to meet industrial demands while maintaining cost-competitiveness remains difficult.

Lastly, the integration of ethyl acetate applications with emerging technologies such as artificial intelligence and advanced manufacturing processes poses unique challenges. Leveraging these technologies to optimize production, predict quality, and discover new applications requires interdisciplinary expertise and substantial investment in research and development infrastructure.

Another challenge lies in improving the purity and quality of ethyl acetate for specialized applications. While conventional methods can produce ethyl acetate suitable for many uses, certain high-tech industries, such as electronics and pharmaceuticals, demand ultra-pure grades with minimal impurities. Achieving these stringent quality standards consistently and cost-effectively remains a significant hurdle.

The environmental impact of ethyl acetate production and use also presents a notable challenge. Despite being less toxic than many other solvents, ethyl acetate is still a volatile organic compound (VOC) that contributes to air pollution. Developing green synthesis routes and implementing effective recycling and recovery systems are crucial for minimizing its environmental footprint.

Expanding the application scope of ethyl acetate introduces additional technical difficulties. As researchers explore its potential in novel areas such as advanced materials and biotechnology, they encounter challenges related to compatibility, stability, and performance optimization. For instance, incorporating ethyl acetate into new polymer formulations or using it as a reaction medium for sensitive biological processes requires extensive research and fine-tuning.

Safety concerns in handling and storage of ethyl acetate continue to be a focus area for improvement. Its high flammability and potential for forming explosive mixtures with air necessitate the development of advanced safety protocols and storage solutions, particularly for large-scale industrial applications.

The quest for alternatives to petroleum-based ethyl acetate production represents another significant challenge. Developing bio-based routes using renewable resources is an active area of research, but scaling these processes to meet industrial demands while maintaining cost-competitiveness remains difficult.

Lastly, the integration of ethyl acetate applications with emerging technologies such as artificial intelligence and advanced manufacturing processes poses unique challenges. Leveraging these technologies to optimize production, predict quality, and discover new applications requires interdisciplinary expertise and substantial investment in research and development infrastructure.

Current Solutions

01 Production and purification of ethyl acetate

Various methods for producing and purifying ethyl acetate are described. These include esterification processes, distillation techniques, and the use of specific catalysts to improve yield and purity. The processes aim to optimize the production of ethyl acetate for industrial applications.- Production and purification of ethyl acetate: Various methods are employed for the production and purification of ethyl acetate, including esterification reactions, distillation processes, and separation techniques. These methods aim to improve yield, purity, and efficiency in the manufacturing of ethyl acetate for industrial applications.

- Applications of ethyl acetate in chemical processes: Ethyl acetate is widely used as a solvent and reagent in various chemical processes. It finds applications in extraction, synthesis, and as a reaction medium in different industries, including pharmaceuticals, polymers, and fine chemicals.

- Ethyl acetate in coating and adhesive formulations: Ethyl acetate is a key component in many coating and adhesive formulations. It is used as a solvent in paints, varnishes, and adhesives due to its favorable properties such as low boiling point, fast evaporation rate, and good solvency for various resins and polymers.

- Recovery and recycling of ethyl acetate: Processes for recovering and recycling ethyl acetate from industrial waste streams and spent solvents have been developed. These methods aim to reduce environmental impact and improve cost-effectiveness in industries that use large quantities of ethyl acetate.

- Ethyl acetate as a green solvent alternative: Ethyl acetate is being explored as a more environmentally friendly solvent alternative in various applications. Its relatively low toxicity, biodegradability, and renewable sourcing potential make it an attractive option for replacing more hazardous solvents in certain processes.

02 Applications of ethyl acetate in chemical processes

Ethyl acetate is utilized in various chemical processes and industries. It serves as a solvent, reactant, or intermediate in the production of other chemicals, pharmaceuticals, and materials. Its versatility makes it valuable in diverse manufacturing applications.Expand Specific Solutions03 Ethyl acetate in extraction and separation processes

Ethyl acetate is employed in extraction and separation processes for various compounds. Its properties make it suitable for liquid-liquid extraction, chromatography, and other separation techniques in analytical and industrial settings.Expand Specific Solutions04 Ethyl acetate as a green solvent

The use of ethyl acetate as an environmentally friendly solvent is explored. Its relatively low toxicity and biodegradability make it a preferred choice in green chemistry applications, replacing more harmful solvents in various processes.Expand Specific Solutions05 Recovery and recycling of ethyl acetate

Methods for recovering and recycling ethyl acetate from industrial processes are developed. These techniques aim to improve the efficiency of ethyl acetate usage, reduce waste, and minimize environmental impact in various applications.Expand Specific Solutions

Key Industry Players

The ethyl acetate applications market is in a growth phase, driven by increasing demand across various industries. The global market size is projected to expand significantly in the coming years, with key players like Celanese, Dow, DuPont, and Shell leading innovation. These companies are investing heavily in R&D to develop advanced applications and improve production processes. The technology is relatively mature, but there's ongoing research to enhance efficiency and sustainability. Emerging players like Nanjing Tech University and Dalian Institute of Chemical Physics are contributing to technological advancements, particularly in green chemistry and novel catalytic processes. The competitive landscape is characterized by a mix of established chemical giants and specialized firms, with increasing focus on eco-friendly solutions and cost-effective production methods.

Celanese International Corp.

Technical Solution: Celanese has developed innovative applications for ethyl acetate in sustainable packaging materials. Their technology focuses on creating bio-based ethyl acetate from renewable resources, reducing reliance on fossil fuels[1]. They have also engineered high-performance coatings using ethyl acetate as a key solvent, which offer improved adhesion and chemical resistance for various industrial applications[2]. Additionally, Celanese has pioneered the use of ethyl acetate in advanced polymer production, enabling the creation of lightweight, durable materials for automotive and aerospace industries[3].

Strengths: Sustainable sourcing, versatile applications across industries, and advanced material properties. Weaknesses: Potential higher production costs for bio-based ethyl acetate and market competition from established petroleum-based alternatives.

Dow Global Technologies LLC

Technical Solution: Dow has developed a novel process for ethyl acetate production using advanced catalysts, significantly improving yield and energy efficiency[4]. Their technology also incorporates a closed-loop recycling system, minimizing waste and environmental impact. Dow's ethyl acetate innovations extend to smart packaging solutions, where they've created active films that release controlled amounts of ethyl acetate to extend food freshness[5]. Furthermore, they've pioneered the use of ethyl acetate in next-generation electronics manufacturing, developing low-residue cleaning solvents for precision components[6].

Strengths: High efficiency production, sustainable practices, and diverse high-tech applications. Weaknesses: High initial investment costs for new production facilities and potential regulatory challenges in some markets.

Innovative Technologies

Catalyst for production of acetic acid or acetic acid and ethyl acetate, process for its production and process for production of acetic acid or acetic acid and ethyl acetate using it

PatentInactiveEP1185495B1

Innovation

- A catalyst comprising metallic palladium combined with elements from specific groups of the Periodic Table, such as Group 14, 15, and 16 elements, or Group 6, 7, 8, 9, 10, 11, and 12 elements, supported on a carrier, which reduces carbon dioxide selectivity and enhances activity and selectivity for acetic acid and ethyl acetate production.

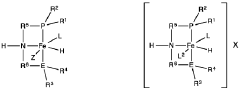

Homogeneous iron catalysts for the conversion of ethanol to ethyl acetate and hydrogen

PatentWO2019027965A1

Innovation

- A process utilizing a homogeneous iron catalyst with a tridentate pincer ligand for dehydrogenative coupling of ethanol at moderate temperatures, producing ethyl acetate efficiently and selectively, with iron loadings as low as 0.001 mol%, allowing for continuous operation and easy separation of ethyl acetate from the catalyst.

Environmental Impact

The environmental impact of ethyl acetate applications is a critical consideration in the pursuit of sustainable industrial practices. As a widely used solvent and chemical intermediate, ethyl acetate's lifecycle from production to disposal has significant implications for ecosystems and human health. The manufacturing process of ethyl acetate, primarily through the esterification of ethanol and acetic acid, requires substantial energy inputs and generates potential pollutants if not properly managed.

In terms of air quality, ethyl acetate is classified as a volatile organic compound (VOC). When released into the atmosphere, it can contribute to the formation of ground-level ozone and photochemical smog, particularly in urban and industrial areas. However, its relatively short atmospheric half-life of about 4 days mitigates long-term accumulation in the environment. Nonetheless, stringent emission controls are essential in industrial settings to minimize air pollution and protect worker health.

Water contamination is another concern associated with ethyl acetate use. Although it is moderately soluble in water, improper disposal or accidental spills can lead to localized water pollution. In aquatic environments, ethyl acetate undergoes hydrolysis, breaking down into ethanol and acetic acid. While this process reduces its persistence, it can temporarily alter water pH and impact aquatic organisms in the immediate vicinity.

Soil contamination from ethyl acetate is generally less problematic due to its high volatility and biodegradability. Microorganisms in soil can effectively break down ethyl acetate under aerobic conditions, limiting its long-term presence in terrestrial ecosystems. However, large-scale spills or continuous exposure may still pose risks to soil-dwelling organisms and potentially contaminate groundwater.

The biodegradability of ethyl acetate is a significant advantage from an environmental perspective. Unlike many persistent organic pollutants, ethyl acetate does not bioaccumulate in food chains or pose long-term ecological risks. This characteristic has led to its increased use as a more environmentally friendly alternative to some traditional solvents in various industries.

As industries explore new frontiers for ethyl acetate applications, there is a growing emphasis on green chemistry principles and circular economy approaches. Innovations in bio-based production methods, using renewable feedstocks instead of petrochemical sources, are reducing the carbon footprint associated with ethyl acetate manufacturing. Additionally, advancements in solvent recovery and recycling technologies are minimizing waste and improving the overall environmental profile of ethyl acetate-based processes.

In terms of air quality, ethyl acetate is classified as a volatile organic compound (VOC). When released into the atmosphere, it can contribute to the formation of ground-level ozone and photochemical smog, particularly in urban and industrial areas. However, its relatively short atmospheric half-life of about 4 days mitigates long-term accumulation in the environment. Nonetheless, stringent emission controls are essential in industrial settings to minimize air pollution and protect worker health.

Water contamination is another concern associated with ethyl acetate use. Although it is moderately soluble in water, improper disposal or accidental spills can lead to localized water pollution. In aquatic environments, ethyl acetate undergoes hydrolysis, breaking down into ethanol and acetic acid. While this process reduces its persistence, it can temporarily alter water pH and impact aquatic organisms in the immediate vicinity.

Soil contamination from ethyl acetate is generally less problematic due to its high volatility and biodegradability. Microorganisms in soil can effectively break down ethyl acetate under aerobic conditions, limiting its long-term presence in terrestrial ecosystems. However, large-scale spills or continuous exposure may still pose risks to soil-dwelling organisms and potentially contaminate groundwater.

The biodegradability of ethyl acetate is a significant advantage from an environmental perspective. Unlike many persistent organic pollutants, ethyl acetate does not bioaccumulate in food chains or pose long-term ecological risks. This characteristic has led to its increased use as a more environmentally friendly alternative to some traditional solvents in various industries.

As industries explore new frontiers for ethyl acetate applications, there is a growing emphasis on green chemistry principles and circular economy approaches. Innovations in bio-based production methods, using renewable feedstocks instead of petrochemical sources, are reducing the carbon footprint associated with ethyl acetate manufacturing. Additionally, advancements in solvent recovery and recycling technologies are minimizing waste and improving the overall environmental profile of ethyl acetate-based processes.

Regulatory Framework

The regulatory framework surrounding ethyl acetate applications is complex and multifaceted, reflecting the diverse uses of this versatile compound across various industries. At the international level, organizations such as the World Health Organization (WHO) and the Food and Agriculture Organization (FAO) have established guidelines for the safe use of ethyl acetate in food and pharmaceutical applications. These guidelines set maximum residue limits and acceptable daily intake levels, ensuring consumer safety while facilitating global trade.

In the United States, the Food and Drug Administration (FDA) regulates ethyl acetate under the Federal Food, Drug, and Cosmetic Act. The FDA has classified ethyl acetate as Generally Recognized as Safe (GRAS) for use as a food additive and flavoring agent. However, its use in pharmaceutical applications is subject to more stringent controls, including Good Manufacturing Practice (GMP) requirements and specific quality standards outlined in the United States Pharmacopeia (USP).

The European Union has implemented comprehensive regulations through the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) framework. Under REACH, manufacturers and importers of ethyl acetate must register the substance and provide detailed safety information. The European Food Safety Authority (EFSA) has also evaluated ethyl acetate for use in food contact materials, setting specific migration limits to ensure consumer safety.

In Asia, countries like China and Japan have their own regulatory frameworks. China's National Medical Products Administration (NMPA) oversees the use of ethyl acetate in pharmaceuticals and medical devices, while the Ministry of Agriculture and Rural Affairs regulates its use in pesticide formulations. Japan's Ministry of Health, Labour and Welfare has established standards for ethyl acetate in food additives and cosmetics.

Environmental regulations also play a crucial role in shaping the use of ethyl acetate. Many countries classify it as a volatile organic compound (VOC) and have implemented emission control measures. For instance, the U.S. Environmental Protection Agency (EPA) regulates ethyl acetate emissions under the Clean Air Act, while the EU's Industrial Emissions Directive sets limits on VOC emissions from industrial processes using solvents like ethyl acetate.

As new applications for ethyl acetate emerge, regulatory bodies are adapting their frameworks to address potential risks and ensure safe use. This includes ongoing assessments of its environmental impact, occupational exposure limits, and potential long-term health effects. The dynamic nature of these regulations underscores the need for continuous monitoring and compliance efforts by industries utilizing ethyl acetate in their processes or products.

In the United States, the Food and Drug Administration (FDA) regulates ethyl acetate under the Federal Food, Drug, and Cosmetic Act. The FDA has classified ethyl acetate as Generally Recognized as Safe (GRAS) for use as a food additive and flavoring agent. However, its use in pharmaceutical applications is subject to more stringent controls, including Good Manufacturing Practice (GMP) requirements and specific quality standards outlined in the United States Pharmacopeia (USP).

The European Union has implemented comprehensive regulations through the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) framework. Under REACH, manufacturers and importers of ethyl acetate must register the substance and provide detailed safety information. The European Food Safety Authority (EFSA) has also evaluated ethyl acetate for use in food contact materials, setting specific migration limits to ensure consumer safety.

In Asia, countries like China and Japan have their own regulatory frameworks. China's National Medical Products Administration (NMPA) oversees the use of ethyl acetate in pharmaceuticals and medical devices, while the Ministry of Agriculture and Rural Affairs regulates its use in pesticide formulations. Japan's Ministry of Health, Labour and Welfare has established standards for ethyl acetate in food additives and cosmetics.

Environmental regulations also play a crucial role in shaping the use of ethyl acetate. Many countries classify it as a volatile organic compound (VOC) and have implemented emission control measures. For instance, the U.S. Environmental Protection Agency (EPA) regulates ethyl acetate emissions under the Clean Air Act, while the EU's Industrial Emissions Directive sets limits on VOC emissions from industrial processes using solvents like ethyl acetate.

As new applications for ethyl acetate emerge, regulatory bodies are adapting their frameworks to address potential risks and ensure safe use. This includes ongoing assessments of its environmental impact, occupational exposure limits, and potential long-term health effects. The dynamic nature of these regulations underscores the need for continuous monitoring and compliance efforts by industries utilizing ethyl acetate in their processes or products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!