Plate Heat Exchanger Use in High-Purity Chemical Production

JUL 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PHE in Chemical Production: Background and Objectives

Plate heat exchangers (PHEs) have emerged as a crucial technology in the production of high-purity chemicals, revolutionizing heat transfer processes in the chemical industry. The evolution of PHEs can be traced back to the early 20th century, with significant advancements occurring in the 1950s and 1960s. These developments have led to the current state-of-the-art designs that offer superior heat transfer efficiency and compact size compared to traditional shell-and-tube heat exchangers.

The primary objective of implementing PHEs in high-purity chemical production is to enhance process efficiency while maintaining product quality. This technology aims to address the challenges associated with heat-sensitive materials and the need for precise temperature control in chemical reactions. By providing rapid and uniform heat transfer, PHEs contribute to improved product consistency and reduced processing times.

In recent years, the chemical industry has witnessed a growing demand for high-purity chemicals across various sectors, including pharmaceuticals, electronics, and specialty materials. This trend has driven the need for more sophisticated heat exchange solutions that can handle increasingly complex processes and stringent purity requirements. As a result, PHE technology has continued to evolve, incorporating advanced materials, innovative plate designs, and enhanced sealing mechanisms.

The development of PHEs for high-purity chemical production has been influenced by several key factors. These include the need for corrosion-resistant materials to handle aggressive chemicals, the requirement for easy cleaning and maintenance to prevent cross-contamination, and the demand for modular designs that allow for scalability and flexibility in production processes. Additionally, regulatory pressures and sustainability concerns have pushed for more energy-efficient and environmentally friendly heat exchange solutions.

Looking ahead, the technological trajectory of PHEs in high-purity chemical production is expected to focus on further improvements in heat transfer efficiency, the development of novel plate geometries, and the integration of smart monitoring and control systems. These advancements aim to address the industry's ongoing challenges, such as reducing fouling, minimizing pressure drop, and optimizing heat recovery in complex chemical processes.

As the chemical industry continues to evolve, PHEs are poised to play an increasingly critical role in enabling the production of high-purity chemicals with greater efficiency and precision. The ongoing research and development in this field are driven by the dual goals of enhancing product quality and reducing operational costs, ultimately contributing to the advancement of various high-tech industries that rely on ultra-pure chemical inputs.

The primary objective of implementing PHEs in high-purity chemical production is to enhance process efficiency while maintaining product quality. This technology aims to address the challenges associated with heat-sensitive materials and the need for precise temperature control in chemical reactions. By providing rapid and uniform heat transfer, PHEs contribute to improved product consistency and reduced processing times.

In recent years, the chemical industry has witnessed a growing demand for high-purity chemicals across various sectors, including pharmaceuticals, electronics, and specialty materials. This trend has driven the need for more sophisticated heat exchange solutions that can handle increasingly complex processes and stringent purity requirements. As a result, PHE technology has continued to evolve, incorporating advanced materials, innovative plate designs, and enhanced sealing mechanisms.

The development of PHEs for high-purity chemical production has been influenced by several key factors. These include the need for corrosion-resistant materials to handle aggressive chemicals, the requirement for easy cleaning and maintenance to prevent cross-contamination, and the demand for modular designs that allow for scalability and flexibility in production processes. Additionally, regulatory pressures and sustainability concerns have pushed for more energy-efficient and environmentally friendly heat exchange solutions.

Looking ahead, the technological trajectory of PHEs in high-purity chemical production is expected to focus on further improvements in heat transfer efficiency, the development of novel plate geometries, and the integration of smart monitoring and control systems. These advancements aim to address the industry's ongoing challenges, such as reducing fouling, minimizing pressure drop, and optimizing heat recovery in complex chemical processes.

As the chemical industry continues to evolve, PHEs are poised to play an increasingly critical role in enabling the production of high-purity chemicals with greater efficiency and precision. The ongoing research and development in this field are driven by the dual goals of enhancing product quality and reducing operational costs, ultimately contributing to the advancement of various high-tech industries that rely on ultra-pure chemical inputs.

Market Demand Analysis for High-Purity Chemical Production

The market demand for high-purity chemicals in production processes has been steadily increasing across various industries, driven by the growing need for advanced materials and stringent quality requirements. Sectors such as semiconductors, pharmaceuticals, and specialty chemicals are particularly fueling this demand, as they require ultra-pure substances to maintain product integrity and performance.

In the semiconductor industry, the push towards smaller and more powerful microchips necessitates chemicals with extremely low levels of contaminants. The global semiconductor market is projected to reach $726 billion by 2027, with a significant portion attributed to the demand for high-purity chemicals used in manufacturing processes. This growth is further accelerated by the expansion of 5G networks, artificial intelligence, and Internet of Things (IoT) devices.

The pharmaceutical sector is another major driver of high-purity chemical demand. With the increasing complexity of drug formulations and the rise of biopharmaceuticals, the need for ultra-pure reagents and solvents has never been greater. The global pharmaceutical market is expected to exceed $1.5 trillion by 2023, with a substantial portion dedicated to ensuring the purity of chemical inputs throughout the production chain.

Specialty chemicals manufacturers are also contributing to the market demand for high-purity production processes. Industries such as aerospace, automotive, and electronics require specialized chemicals with precise compositions and minimal impurities. The global specialty chemicals market is anticipated to grow at a CAGR of 5.2% from 2021 to 2028, reflecting the increasing demand for high-performance materials across various applications.

Environmental regulations and sustainability initiatives are further shaping the market landscape for high-purity chemical production. Stricter emissions controls and waste reduction targets are pushing manufacturers to adopt more efficient and cleaner production methods. This trend is driving innovation in purification technologies and process optimization, including advancements in heat exchanger design and operation.

The Asia-Pacific region, particularly China, Japan, and South Korea, is emerging as a significant market for high-purity chemicals due to their robust electronics and semiconductor industries. North America and Europe continue to be strong markets, driven by their pharmaceutical and specialty chemical sectors. Developing economies are also showing increased demand as they expand their manufacturing capabilities in high-tech industries.

As industries continue to evolve and quality standards become more stringent, the market for high-purity chemical production is expected to maintain its growth trajectory. This trend underscores the importance of efficient and reliable production processes, highlighting the potential for innovative technologies like advanced plate heat exchangers to meet the escalating demand for ultra-pure chemicals across diverse industrial applications.

In the semiconductor industry, the push towards smaller and more powerful microchips necessitates chemicals with extremely low levels of contaminants. The global semiconductor market is projected to reach $726 billion by 2027, with a significant portion attributed to the demand for high-purity chemicals used in manufacturing processes. This growth is further accelerated by the expansion of 5G networks, artificial intelligence, and Internet of Things (IoT) devices.

The pharmaceutical sector is another major driver of high-purity chemical demand. With the increasing complexity of drug formulations and the rise of biopharmaceuticals, the need for ultra-pure reagents and solvents has never been greater. The global pharmaceutical market is expected to exceed $1.5 trillion by 2023, with a substantial portion dedicated to ensuring the purity of chemical inputs throughout the production chain.

Specialty chemicals manufacturers are also contributing to the market demand for high-purity production processes. Industries such as aerospace, automotive, and electronics require specialized chemicals with precise compositions and minimal impurities. The global specialty chemicals market is anticipated to grow at a CAGR of 5.2% from 2021 to 2028, reflecting the increasing demand for high-performance materials across various applications.

Environmental regulations and sustainability initiatives are further shaping the market landscape for high-purity chemical production. Stricter emissions controls and waste reduction targets are pushing manufacturers to adopt more efficient and cleaner production methods. This trend is driving innovation in purification technologies and process optimization, including advancements in heat exchanger design and operation.

The Asia-Pacific region, particularly China, Japan, and South Korea, is emerging as a significant market for high-purity chemicals due to their robust electronics and semiconductor industries. North America and Europe continue to be strong markets, driven by their pharmaceutical and specialty chemical sectors. Developing economies are also showing increased demand as they expand their manufacturing capabilities in high-tech industries.

As industries continue to evolve and quality standards become more stringent, the market for high-purity chemical production is expected to maintain its growth trajectory. This trend underscores the importance of efficient and reliable production processes, highlighting the potential for innovative technologies like advanced plate heat exchangers to meet the escalating demand for ultra-pure chemicals across diverse industrial applications.

Current State and Challenges of PHE in Chemical Industry

Plate heat exchangers (PHEs) have gained significant traction in the chemical industry, particularly in high-purity chemical production. The current state of PHE technology in this sector is characterized by continuous advancements and increasing adoption rates. PHEs offer several advantages over traditional shell-and-tube heat exchangers, including improved heat transfer efficiency, compact design, and easier maintenance.

In high-purity chemical production, PHEs have demonstrated their ability to maintain product quality while enhancing process efficiency. The design of PHEs allows for precise temperature control and minimal product degradation, which is crucial in maintaining the purity of sensitive chemical compounds. Many chemical manufacturers have successfully integrated PHEs into their production lines, reporting improved yields and reduced energy consumption.

Despite these advancements, the chemical industry faces several challenges in fully leveraging PHE technology. One of the primary concerns is the material compatibility of PHEs with corrosive or high-temperature chemical processes. While manufacturers have developed specialized plate materials and gaskets to address this issue, there is still a need for more robust solutions that can withstand extreme chemical environments without compromising performance or lifespan.

Another significant challenge is the potential for fouling in PHEs when handling certain chemical streams. Fouling can lead to reduced heat transfer efficiency and increased maintenance requirements. Research is ongoing to develop innovative plate designs and surface treatments that minimize fouling and extend the operational periods between cleaning cycles.

The scalability of PHEs for large-volume chemical production presents another hurdle. While PHEs excel in small to medium-scale operations, adapting them for high-capacity chemical plants without sacrificing efficiency or increasing complexity remains a focus area for engineers and manufacturers.

Furthermore, the integration of PHEs into existing chemical production facilities poses challenges related to process redesign and capital investment. Many chemical plants have legacy systems built around traditional heat exchanger technologies, and transitioning to PHEs often requires significant modifications to piping, control systems, and operational procedures.

Lastly, there is a growing need for standardization in PHE design and performance metrics specific to the chemical industry. While general standards exist, developing industry-specific guidelines that address the unique requirements of high-purity chemical production could accelerate the adoption and optimization of PHE technology in this sector.

In high-purity chemical production, PHEs have demonstrated their ability to maintain product quality while enhancing process efficiency. The design of PHEs allows for precise temperature control and minimal product degradation, which is crucial in maintaining the purity of sensitive chemical compounds. Many chemical manufacturers have successfully integrated PHEs into their production lines, reporting improved yields and reduced energy consumption.

Despite these advancements, the chemical industry faces several challenges in fully leveraging PHE technology. One of the primary concerns is the material compatibility of PHEs with corrosive or high-temperature chemical processes. While manufacturers have developed specialized plate materials and gaskets to address this issue, there is still a need for more robust solutions that can withstand extreme chemical environments without compromising performance or lifespan.

Another significant challenge is the potential for fouling in PHEs when handling certain chemical streams. Fouling can lead to reduced heat transfer efficiency and increased maintenance requirements. Research is ongoing to develop innovative plate designs and surface treatments that minimize fouling and extend the operational periods between cleaning cycles.

The scalability of PHEs for large-volume chemical production presents another hurdle. While PHEs excel in small to medium-scale operations, adapting them for high-capacity chemical plants without sacrificing efficiency or increasing complexity remains a focus area for engineers and manufacturers.

Furthermore, the integration of PHEs into existing chemical production facilities poses challenges related to process redesign and capital investment. Many chemical plants have legacy systems built around traditional heat exchanger technologies, and transitioning to PHEs often requires significant modifications to piping, control systems, and operational procedures.

Lastly, there is a growing need for standardization in PHE design and performance metrics specific to the chemical industry. While general standards exist, developing industry-specific guidelines that address the unique requirements of high-purity chemical production could accelerate the adoption and optimization of PHE technology in this sector.

Existing PHE Solutions for High-Purity Chemical Production

01 Improved plate design for heat exchangers

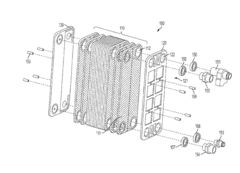

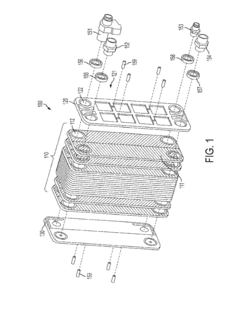

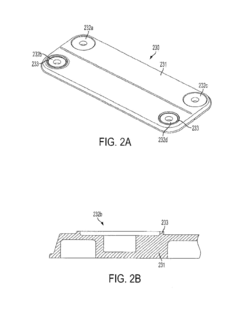

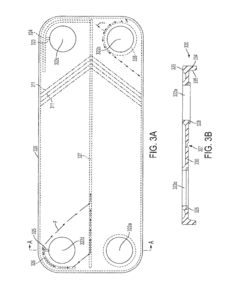

Advanced plate designs are being developed to enhance the efficiency of heat exchangers. These designs focus on optimizing flow distribution, reducing pressure drop, and increasing heat transfer rates. Innovations include specialized corrugation patterns, strategic placement of flow channels, and improved plate geometries to maximize surface area for heat exchange.- Improved plate design for heat exchangers: Advanced plate designs are developed to enhance heat transfer efficiency and reduce pressure drop in plate heat exchangers. These designs may include optimized flow patterns, turbulence promoters, or novel surface geometries that increase heat transfer area and improve fluid distribution.

- Sealing and gasket innovations: New sealing technologies and gasket materials are introduced to improve the reliability and performance of plate heat exchangers. These innovations aim to prevent leakage, enhance chemical resistance, and extend the operational life of the exchanger under various temperature and pressure conditions.

- Modular and customizable designs: Plate heat exchangers are developed with modular and customizable designs, allowing for easy assembly, disassembly, and modification. This approach enables adaptability to different process requirements, facilitates maintenance, and improves overall system flexibility.

- Integration of advanced materials: The use of advanced materials in plate heat exchangers is explored to improve corrosion resistance, thermal conductivity, and overall performance. These materials may include specialized alloys, composites, or surface treatments that enhance heat transfer properties and extend equipment lifespan.

- Smart monitoring and control systems: Intelligent monitoring and control systems are integrated into plate heat exchangers to optimize performance, detect faults, and enable predictive maintenance. These systems may include sensors, data analytics, and automation technologies to enhance efficiency and reliability.

02 Novel sealing mechanisms for plate heat exchangers

New sealing technologies are being implemented to prevent leakage and improve the overall performance of plate heat exchangers. These innovations include advanced gasket materials, improved sealing techniques, and novel plate edge designs. The focus is on enhancing durability, reducing maintenance requirements, and ensuring reliable operation under various operating conditions.Expand Specific Solutions03 Integration of phase change materials in plate heat exchangers

Researchers are exploring the incorporation of phase change materials (PCMs) into plate heat exchanger designs. This approach aims to enhance thermal energy storage capabilities, improve heat transfer efficiency, and provide better temperature control. The integration of PCMs can lead to more compact designs and improved overall system performance in various applications.Expand Specific Solutions04 Modular and customizable plate heat exchanger systems

Manufacturers are developing modular and easily customizable plate heat exchanger systems. These designs allow for greater flexibility in installation, maintenance, and scalability. The modular approach enables easier adaptation to specific application requirements, simplified assembly and disassembly processes, and improved overall system efficiency.Expand Specific Solutions05 Advanced materials for plate heat exchangers

Research is ongoing in the development and application of advanced materials for plate heat exchangers. These materials aim to improve corrosion resistance, thermal conductivity, and overall durability. Innovations include the use of specialized alloys, composite materials, and surface treatments to enhance heat transfer properties and extend the lifespan of heat exchanger components.Expand Specific Solutions

Key Players in PHE and Chemical Production Equipment

The research on plate heat exchangers in high-purity chemical production is in a mature stage, with a growing market driven by increasing demand for efficient heat transfer solutions. The global plate heat exchanger market is expected to reach significant size in the coming years, fueled by advancements in manufacturing processes and materials. Key players like Alfa Laval, Haldor Topsøe, and Vahterus Oy are at the forefront of innovation, developing high-performance exchangers for demanding chemical applications. These companies, along with others such as EVAPCO and Linde GmbH, are continuously improving designs to enhance heat transfer efficiency, reduce fouling, and withstand corrosive environments, solidifying the technology's position in high-purity chemical production.

Alfa Laval Corporate AB

Technical Solution: Alfa Laval has developed advanced plate heat exchangers specifically designed for high-purity chemical production. Their technology incorporates innovative plate designs with optimized flow distribution, ensuring uniform heat transfer and minimizing the risk of contamination. The company's AlfaNova fusion-bonded plate heat exchangers use a patented fusion bonding process, creating a 100% stainless steel exchanger without gaskets or brazing material[1]. This design is particularly suitable for high-purity applications, as it eliminates potential sources of contamination. Alfa Laval's plate heat exchangers also feature enhanced turbulence promoters, which increase heat transfer efficiency while reducing fouling and improving cleanability[2]. The company has implemented advanced computational fluid dynamics (CFD) modeling to optimize flow patterns and heat transfer characteristics, resulting in exchangers that can handle a wide range of viscosities and flow rates typical in high-purity chemical processes[3].

Strengths: Superior contamination prevention, high efficiency, and excellent cleanability. Weaknesses: Potentially higher initial cost compared to traditional shell-and-tube exchangers, and limited applicability in extremely high-temperature or high-pressure applications.

Haldor Topsøe A/S

Technical Solution: Haldor Topsøe has developed specialized plate heat exchangers for high-purity chemical production, focusing on catalytic processes. Their technology integrates catalytic functionality directly into the plate design, creating a compact and efficient solution for combined reaction and heat exchange. The company's plate reactors feature precisely engineered microchannels that enhance mass transfer and provide excellent temperature control, crucial for maintaining product purity in sensitive chemical reactions[4]. Haldor Topsøe's plate heat exchangers incorporate advanced materials resistant to corrosion and fouling, such as specialized alloys and ceramic coatings, ensuring longevity and consistent performance in harsh chemical environments[5]. The company has also implemented modular designs that allow for easy scaling and maintenance, addressing the flexibility needs of high-purity chemical production processes.

Strengths: Integrated catalytic functionality, excellent temperature control, and modular design for scalability. Weaknesses: Potentially limited to specific catalytic processes and may require specialized maintenance.

Core Innovations in PHE for Chemical Applications

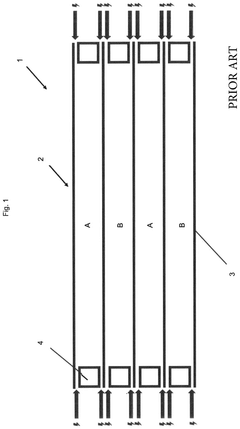

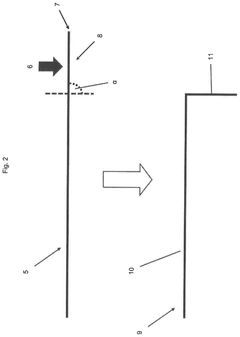

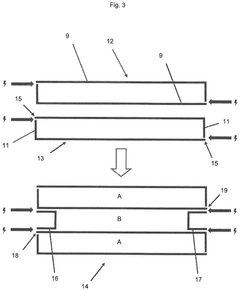

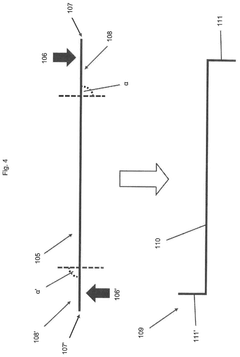

Method for the production of a plate heat exchanger

PatentActiveUS12240030B2

Innovation

- The method involves forming plate pairs by bending metal sheets to create standing seams, which then replace the need for separate spacers, thereby reducing the number of weld seams and energy expenditure. Additionally, elongate spacers with L-shaped, C-shaped, or complex cross-sections are used to further enhance mechanical stability and reduce the need for additional spacers.

Plate heat exchanger

PatentInactiveUS20140352934A1

Innovation

- The design incorporates end plates with ridges and troughs to direct fluid flows, oblique flanges with dissimilar draft angles for improved sealing, and strategically placed slots to ensure hermetic sealing and structural integrity, reducing leakage and cracking while maintaining precision.

Environmental Impact and Sustainability Considerations

The use of plate heat exchangers in high-purity chemical production processes presents both environmental challenges and opportunities for sustainability. These devices offer significant advantages in terms of energy efficiency and resource conservation, which align well with global efforts to reduce industrial carbon footprints. By enabling more effective heat transfer, plate heat exchangers can substantially decrease energy consumption in chemical manufacturing, leading to lower greenhouse gas emissions and reduced reliance on fossil fuels.

However, the environmental impact of plate heat exchangers extends beyond energy considerations. The materials used in their construction, typically stainless steel or specialized alloys, have their own ecological footprint associated with mining, refining, and manufacturing processes. The production of these materials can contribute to habitat disruption, water pollution, and air quality degradation. Nonetheless, the long lifespan and recyclability of these materials partially offset their initial environmental cost.

In the context of high-purity chemical production, plate heat exchangers play a crucial role in minimizing waste and improving product quality. Their efficient design allows for precise temperature control, reducing the likelihood of off-spec batches that would otherwise be discarded. This waste reduction not only conserves raw materials but also decreases the environmental burden associated with waste disposal and treatment.

Water conservation is another key sustainability aspect of plate heat exchangers in chemical production. Their compact design and high heat transfer efficiency often result in reduced cooling water requirements compared to traditional shell-and-tube heat exchangers. This is particularly significant in regions facing water scarcity, where industrial water use can strain local ecosystems and communities.

The maintenance and cleaning of plate heat exchangers in high-purity applications also have environmental implications. While their design allows for easier cleaning and reduces the need for harsh chemicals, the disposal of cleaning agents and potential leakage of process fluids must be carefully managed to prevent environmental contamination. Implementing closed-loop cleaning systems and using biodegradable cleaning agents can mitigate these risks.

Looking towards the future, the integration of plate heat exchangers with renewable energy sources and smart manufacturing technologies offers promising avenues for further enhancing sustainability in chemical production. By coupling these devices with solar thermal systems or waste heat recovery units, industries can move closer to carbon-neutral operations. Additionally, the development of advanced materials for plate construction, such as bio-based or recycled composites, could further reduce the environmental impact of heat exchanger manufacturing and end-of-life disposal.

However, the environmental impact of plate heat exchangers extends beyond energy considerations. The materials used in their construction, typically stainless steel or specialized alloys, have their own ecological footprint associated with mining, refining, and manufacturing processes. The production of these materials can contribute to habitat disruption, water pollution, and air quality degradation. Nonetheless, the long lifespan and recyclability of these materials partially offset their initial environmental cost.

In the context of high-purity chemical production, plate heat exchangers play a crucial role in minimizing waste and improving product quality. Their efficient design allows for precise temperature control, reducing the likelihood of off-spec batches that would otherwise be discarded. This waste reduction not only conserves raw materials but also decreases the environmental burden associated with waste disposal and treatment.

Water conservation is another key sustainability aspect of plate heat exchangers in chemical production. Their compact design and high heat transfer efficiency often result in reduced cooling water requirements compared to traditional shell-and-tube heat exchangers. This is particularly significant in regions facing water scarcity, where industrial water use can strain local ecosystems and communities.

The maintenance and cleaning of plate heat exchangers in high-purity applications also have environmental implications. While their design allows for easier cleaning and reduces the need for harsh chemicals, the disposal of cleaning agents and potential leakage of process fluids must be carefully managed to prevent environmental contamination. Implementing closed-loop cleaning systems and using biodegradable cleaning agents can mitigate these risks.

Looking towards the future, the integration of plate heat exchangers with renewable energy sources and smart manufacturing technologies offers promising avenues for further enhancing sustainability in chemical production. By coupling these devices with solar thermal systems or waste heat recovery units, industries can move closer to carbon-neutral operations. Additionally, the development of advanced materials for plate construction, such as bio-based or recycled composites, could further reduce the environmental impact of heat exchanger manufacturing and end-of-life disposal.

Safety Regulations and Compliance in Chemical Production

The use of plate heat exchangers in high-purity chemical production necessitates strict adherence to safety regulations and compliance standards. These regulations are designed to ensure the protection of workers, the environment, and the integrity of the final product. In the context of high-purity chemical production, safety measures are particularly crucial due to the potential hazards associated with reactive, corrosive, or toxic substances.

Regulatory bodies such as the Occupational Safety and Health Administration (OSHA) in the United States and the European Chemicals Agency (ECHA) in the European Union have established comprehensive guidelines for chemical production facilities. These guidelines encompass various aspects of safety, including equipment design, operational procedures, and emergency response protocols.

For plate heat exchangers specifically, materials of construction must comply with chemical compatibility requirements to prevent corrosion and contamination. Stainless steel, titanium, and specialized alloys are often mandated for high-purity applications. The design of the heat exchanger must also incorporate features that minimize the risk of leaks or cross-contamination between process fluids.

Pressure vessel codes, such as the ASME Boiler and Pressure Vessel Code, dictate the structural integrity requirements for plate heat exchangers. These codes ensure that the equipment can safely withstand operational pressures and temperatures. Regular inspection and testing protocols are typically required to maintain compliance and detect any potential issues before they lead to failures.

Process safety management (PSM) regulations often apply to facilities using plate heat exchangers in high-purity chemical production. These regulations mandate the implementation of comprehensive safety programs, including hazard analysis, operating procedures, training, and incident investigation. For plate heat exchangers, this may involve specific procedures for startup, shutdown, and maintenance operations.

Environmental regulations also play a significant role in compliance for chemical production facilities. Emissions control, waste management, and spill prevention measures must be in place and may influence the design and operation of plate heat exchangers. For instance, secondary containment systems may be required to prevent the release of chemicals in case of equipment failure.

Quality assurance standards, such as Good Manufacturing Practices (GMP) and ISO 9001, are essential for maintaining product purity and consistency. These standards often require validation of heat exchanger performance, cleaning procedures, and monitoring systems to ensure that the equipment does not introduce contaminants or affect product quality.

Compliance with these regulations requires ongoing effort and documentation. Facilities must maintain detailed records of equipment specifications, maintenance activities, operator training, and safety incidents. Regular audits and inspections by regulatory agencies are common, and facilities must be prepared to demonstrate their compliance at any time.

As technology and understanding of chemical processes evolve, safety regulations are periodically updated. Facilities using plate heat exchangers in high-purity chemical production must stay informed about these changes and be prepared to adapt their equipment and procedures accordingly. This ongoing process of compliance ensures the safe and efficient operation of plate heat exchangers in the demanding environment of high-purity chemical production.

Regulatory bodies such as the Occupational Safety and Health Administration (OSHA) in the United States and the European Chemicals Agency (ECHA) in the European Union have established comprehensive guidelines for chemical production facilities. These guidelines encompass various aspects of safety, including equipment design, operational procedures, and emergency response protocols.

For plate heat exchangers specifically, materials of construction must comply with chemical compatibility requirements to prevent corrosion and contamination. Stainless steel, titanium, and specialized alloys are often mandated for high-purity applications. The design of the heat exchanger must also incorporate features that minimize the risk of leaks or cross-contamination between process fluids.

Pressure vessel codes, such as the ASME Boiler and Pressure Vessel Code, dictate the structural integrity requirements for plate heat exchangers. These codes ensure that the equipment can safely withstand operational pressures and temperatures. Regular inspection and testing protocols are typically required to maintain compliance and detect any potential issues before they lead to failures.

Process safety management (PSM) regulations often apply to facilities using plate heat exchangers in high-purity chemical production. These regulations mandate the implementation of comprehensive safety programs, including hazard analysis, operating procedures, training, and incident investigation. For plate heat exchangers, this may involve specific procedures for startup, shutdown, and maintenance operations.

Environmental regulations also play a significant role in compliance for chemical production facilities. Emissions control, waste management, and spill prevention measures must be in place and may influence the design and operation of plate heat exchangers. For instance, secondary containment systems may be required to prevent the release of chemicals in case of equipment failure.

Quality assurance standards, such as Good Manufacturing Practices (GMP) and ISO 9001, are essential for maintaining product purity and consistency. These standards often require validation of heat exchanger performance, cleaning procedures, and monitoring systems to ensure that the equipment does not introduce contaminants or affect product quality.

Compliance with these regulations requires ongoing effort and documentation. Facilities must maintain detailed records of equipment specifications, maintenance activities, operator training, and safety incidents. Regular audits and inspections by regulatory agencies are common, and facilities must be prepared to demonstrate their compliance at any time.

As technology and understanding of chemical processes evolve, safety regulations are periodically updated. Facilities using plate heat exchangers in high-purity chemical production must stay informed about these changes and be prepared to adapt their equipment and procedures accordingly. This ongoing process of compliance ensures the safe and efficient operation of plate heat exchangers in the demanding environment of high-purity chemical production.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!