Retrofitting challenges for legacy gate valve systems in modern applications

AUG 20, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Legacy Valve Evolution

Gate valve systems have undergone significant evolution since their inception in the late 19th century. Initially designed for simple on-off flow control in industrial applications, these valves have adapted to meet increasingly complex demands in modern industries. The evolution of legacy gate valve systems can be traced through several key phases, each marked by technological advancements and changing industry requirements.

In the early 20th century, gate valves were primarily constructed from cast iron or brass, with simple wedge-shaped gates and manual operation. These valves were robust but lacked precision control and were prone to leakage. As industrial processes became more sophisticated, the need for improved sealing and control led to the development of flexible wedge gates and the introduction of materials like stainless steel and high-performance alloys in the 1950s and 1960s.

The advent of automation in the 1970s and 1980s brought about a significant shift in gate valve design. Pneumatic and hydraulic actuators were integrated, allowing for remote operation and improved process control. This period also saw the introduction of double-disc gate valves, offering enhanced sealing capabilities for critical applications in the oil and gas industry.

The digital revolution of the 1990s and early 2000s further transformed gate valve systems. Smart valves equipped with sensors and digital controllers emerged, enabling real-time monitoring, diagnostics, and predictive maintenance. These advancements improved operational efficiency and reduced downtime in industrial processes.

In recent years, the focus has shifted towards sustainability and energy efficiency. Modern gate valve designs incorporate features like low-friction coatings and optimized flow paths to minimize pressure drops and energy consumption. Additionally, the integration of Industrial Internet of Things (IIoT) technologies has enabled advanced data analytics and remote management capabilities.

Despite these advancements, many industries still rely on legacy gate valve systems installed decades ago. These older systems, while functional, often lack the precision, efficiency, and connectivity of modern valves. The challenge of retrofitting these legacy systems to meet contemporary standards has become a significant concern for many industries, particularly in sectors with aging infrastructure such as oil and gas, water treatment, and power generation.

In the early 20th century, gate valves were primarily constructed from cast iron or brass, with simple wedge-shaped gates and manual operation. These valves were robust but lacked precision control and were prone to leakage. As industrial processes became more sophisticated, the need for improved sealing and control led to the development of flexible wedge gates and the introduction of materials like stainless steel and high-performance alloys in the 1950s and 1960s.

The advent of automation in the 1970s and 1980s brought about a significant shift in gate valve design. Pneumatic and hydraulic actuators were integrated, allowing for remote operation and improved process control. This period also saw the introduction of double-disc gate valves, offering enhanced sealing capabilities for critical applications in the oil and gas industry.

The digital revolution of the 1990s and early 2000s further transformed gate valve systems. Smart valves equipped with sensors and digital controllers emerged, enabling real-time monitoring, diagnostics, and predictive maintenance. These advancements improved operational efficiency and reduced downtime in industrial processes.

In recent years, the focus has shifted towards sustainability and energy efficiency. Modern gate valve designs incorporate features like low-friction coatings and optimized flow paths to minimize pressure drops and energy consumption. Additionally, the integration of Industrial Internet of Things (IIoT) technologies has enabled advanced data analytics and remote management capabilities.

Despite these advancements, many industries still rely on legacy gate valve systems installed decades ago. These older systems, while functional, often lack the precision, efficiency, and connectivity of modern valves. The challenge of retrofitting these legacy systems to meet contemporary standards has become a significant concern for many industries, particularly in sectors with aging infrastructure such as oil and gas, water treatment, and power generation.

Retrofitting Market Analysis

The retrofitting market for legacy gate valve systems in modern applications has experienced significant growth in recent years, driven by the increasing need to upgrade aging infrastructure across various industries. This market segment is characterized by a strong demand for cost-effective solutions that can enhance the performance, reliability, and efficiency of existing valve systems without the need for complete replacement.

The global valve market, which includes retrofitting services, was valued at approximately $68 billion in 2020 and is projected to reach $85 billion by 2025, with a compound annual growth rate (CAGR) of 4.5%. Within this broader market, the retrofitting segment for gate valves is estimated to account for 15-20% of the total market value, indicating a substantial opportunity for companies specializing in valve upgrades and modernization.

Key industries driving the demand for gate valve retrofitting include oil and gas, water and wastewater treatment, power generation, and chemical processing. The oil and gas sector, in particular, represents a significant portion of the market, with many aging facilities requiring valve upgrades to meet current safety and environmental standards. The water and wastewater treatment industry is also experiencing increased demand for retrofitting solutions, as municipalities and utilities seek to improve the efficiency and reliability of their distribution systems.

Geographically, North America and Europe currently dominate the retrofitting market for gate valves, owing to their extensive industrial infrastructure and stringent regulatory requirements. However, emerging economies in Asia-Pacific and Latin America are expected to witness rapid growth in this market segment as they modernize their industrial facilities and invest in infrastructure development.

The market is characterized by a mix of large multinational corporations and specialized service providers. Major players in the valve industry, such as Emerson, Flowserve, and Cameron (Schlumberger), have expanded their offerings to include retrofitting services. Additionally, numerous smaller companies have emerged, focusing exclusively on valve retrofitting and maintenance services.

Key market trends include the integration of smart technologies and IoT capabilities into retrofitted valve systems, enabling remote monitoring and predictive maintenance. This trend is particularly evident in critical applications where downtime can result in significant financial losses. Furthermore, there is a growing emphasis on environmentally friendly retrofitting solutions that can help reduce emissions and improve overall system efficiency.

Despite the positive market outlook, challenges such as budget constraints, technical complexities, and the need for specialized expertise may impact the adoption rate of retrofitting solutions. However, the long-term cost savings and operational benefits associated with valve retrofitting are expected to drive continued market growth in the coming years.

The global valve market, which includes retrofitting services, was valued at approximately $68 billion in 2020 and is projected to reach $85 billion by 2025, with a compound annual growth rate (CAGR) of 4.5%. Within this broader market, the retrofitting segment for gate valves is estimated to account for 15-20% of the total market value, indicating a substantial opportunity for companies specializing in valve upgrades and modernization.

Key industries driving the demand for gate valve retrofitting include oil and gas, water and wastewater treatment, power generation, and chemical processing. The oil and gas sector, in particular, represents a significant portion of the market, with many aging facilities requiring valve upgrades to meet current safety and environmental standards. The water and wastewater treatment industry is also experiencing increased demand for retrofitting solutions, as municipalities and utilities seek to improve the efficiency and reliability of their distribution systems.

Geographically, North America and Europe currently dominate the retrofitting market for gate valves, owing to their extensive industrial infrastructure and stringent regulatory requirements. However, emerging economies in Asia-Pacific and Latin America are expected to witness rapid growth in this market segment as they modernize their industrial facilities and invest in infrastructure development.

The market is characterized by a mix of large multinational corporations and specialized service providers. Major players in the valve industry, such as Emerson, Flowserve, and Cameron (Schlumberger), have expanded their offerings to include retrofitting services. Additionally, numerous smaller companies have emerged, focusing exclusively on valve retrofitting and maintenance services.

Key market trends include the integration of smart technologies and IoT capabilities into retrofitted valve systems, enabling remote monitoring and predictive maintenance. This trend is particularly evident in critical applications where downtime can result in significant financial losses. Furthermore, there is a growing emphasis on environmentally friendly retrofitting solutions that can help reduce emissions and improve overall system efficiency.

Despite the positive market outlook, challenges such as budget constraints, technical complexities, and the need for specialized expertise may impact the adoption rate of retrofitting solutions. However, the long-term cost savings and operational benefits associated with valve retrofitting are expected to drive continued market growth in the coming years.

Technical Hurdles

Retrofitting legacy gate valve systems for modern applications presents several significant technical hurdles. One of the primary challenges is the compatibility of older valve designs with current industry standards and regulations. Many legacy systems were built to specifications that are no longer considered adequate for safety, efficiency, or environmental protection. This necessitates extensive modifications to bring these systems up to code, often requiring complex engineering solutions.

Another major hurdle is the integration of modern control and monitoring systems with legacy valve infrastructure. Older gate valves typically lack the necessary interfaces for digital control systems, making it difficult to incorporate them into automated processes or remote monitoring setups. This gap in technological capabilities can lead to reduced operational efficiency and increased risk of human error in valve operation.

The materials used in legacy gate valves pose additional challenges. Many older valves were constructed using materials that may not meet current standards for corrosion resistance, temperature tolerance, or pressure ratings. Retrofitting these valves often requires careful material selection and engineering to ensure that the upgraded components can withstand modern operational demands without compromising the integrity of the existing system.

Maintenance and repair of retrofitted legacy systems present ongoing technical challenges. As original parts become obsolete, finding suitable replacements or developing custom solutions becomes increasingly difficult. This can lead to extended downtime during repairs and potentially compromise the reliability of the valve system.

Space constraints within existing installations often complicate retrofitting efforts. Modern valve systems may require additional components or larger footprints, which can be challenging to accommodate within the confines of legacy infrastructure. Engineers must develop creative solutions to integrate new technologies while working within the physical limitations of existing layouts.

The need for minimal disruption to ongoing operations during the retrofitting process adds another layer of complexity. Many industries cannot afford extended shutdowns, requiring engineers to develop strategies for gradual upgrades or modular replacements that can be implemented with minimal impact on production.

Lastly, ensuring the long-term reliability and performance of retrofitted systems remains a significant technical hurdle. The integration of new components with legacy infrastructure can create unforeseen stress points or operational issues that may only become apparent over time. Extensive testing and monitoring protocols must be developed to validate the effectiveness of retrofitting solutions and to identify potential problems before they lead to system failures.

Another major hurdle is the integration of modern control and monitoring systems with legacy valve infrastructure. Older gate valves typically lack the necessary interfaces for digital control systems, making it difficult to incorporate them into automated processes or remote monitoring setups. This gap in technological capabilities can lead to reduced operational efficiency and increased risk of human error in valve operation.

The materials used in legacy gate valves pose additional challenges. Many older valves were constructed using materials that may not meet current standards for corrosion resistance, temperature tolerance, or pressure ratings. Retrofitting these valves often requires careful material selection and engineering to ensure that the upgraded components can withstand modern operational demands without compromising the integrity of the existing system.

Maintenance and repair of retrofitted legacy systems present ongoing technical challenges. As original parts become obsolete, finding suitable replacements or developing custom solutions becomes increasingly difficult. This can lead to extended downtime during repairs and potentially compromise the reliability of the valve system.

Space constraints within existing installations often complicate retrofitting efforts. Modern valve systems may require additional components or larger footprints, which can be challenging to accommodate within the confines of legacy infrastructure. Engineers must develop creative solutions to integrate new technologies while working within the physical limitations of existing layouts.

The need for minimal disruption to ongoing operations during the retrofitting process adds another layer of complexity. Many industries cannot afford extended shutdowns, requiring engineers to develop strategies for gradual upgrades or modular replacements that can be implemented with minimal impact on production.

Lastly, ensuring the long-term reliability and performance of retrofitted systems remains a significant technical hurdle. The integration of new components with legacy infrastructure can create unforeseen stress points or operational issues that may only become apparent over time. Extensive testing and monitoring protocols must be developed to validate the effectiveness of retrofitting solutions and to identify potential problems before they lead to system failures.

Current Retrofit Solutions

01 Legacy system integration and modernization

This approach focuses on integrating legacy gate valve systems with modern technologies. It involves developing methods to bridge old and new systems, ensuring compatibility and improved functionality. This can include updating software interfaces, implementing middleware solutions, and creating adapters to allow legacy systems to communicate with newer components.- Legacy system integration and modernization: This approach focuses on integrating legacy gate valve systems with modern technologies. It involves developing methods to bridge old and new systems, enabling seamless communication and operation. This modernization process can include updating control mechanisms, implementing digital interfaces, and enhancing overall system efficiency while maintaining compatibility with existing infrastructure.

- Security enhancements for legacy gate valve systems: Security is a critical concern for legacy gate valve systems. This point addresses the implementation of advanced security measures to protect these systems from unauthorized access and potential cyber threats. It may involve encryption techniques, secure authentication protocols, and robust access control mechanisms to ensure the integrity and safety of the valve operations.

- Performance optimization and monitoring: This aspect focuses on improving the performance of legacy gate valve systems through advanced monitoring and optimization techniques. It may include the implementation of sensors, data analytics, and predictive maintenance algorithms to enhance system efficiency, reduce downtime, and extend the operational life of legacy equipment.

- Virtualization and simulation of legacy gate valve systems: Virtualization technologies are applied to legacy gate valve systems to create digital twins or simulated environments. This approach allows for testing, training, and system analysis without risking the actual physical infrastructure. It can aid in troubleshooting, scenario planning, and optimizing system configurations.

- Interoperability and standardization: This point addresses the challenges of interoperability between different legacy gate valve systems and newer technologies. It involves developing standardized interfaces, protocols, and data formats to ensure smooth communication and integration across various system components, regardless of their age or manufacturer.

02 Security enhancements for legacy gate valve systems

Security measures are implemented to protect legacy gate valve systems from potential vulnerabilities. This includes developing encryption protocols, access control mechanisms, and secure communication channels. The focus is on maintaining the integrity and confidentiality of data within these systems while allowing for necessary operations and maintenance.Expand Specific Solutions03 Performance optimization of legacy gate valves

Techniques are developed to enhance the performance of legacy gate valve systems without complete replacement. This may involve software optimizations, hardware upgrades, or the implementation of more efficient algorithms. The goal is to improve response times, increase throughput, and extend the operational life of existing systems.Expand Specific Solutions04 Data management and migration for legacy systems

This approach focuses on managing and migrating data from legacy gate valve systems to newer platforms. It includes developing strategies for data extraction, transformation, and loading (ETL) processes, ensuring data integrity during migration, and creating systems for ongoing data synchronization between legacy and modern components.Expand Specific Solutions05 Remote monitoring and control of legacy gate valves

Implementation of remote monitoring and control capabilities for legacy gate valve systems. This involves developing interfaces and protocols to allow for remote access, real-time monitoring, and control of valve operations. The aim is to improve efficiency, reduce on-site maintenance requirements, and enable better decision-making through enhanced data collection and analysis.Expand Specific Solutions

Industry Leaders

The retrofitting of legacy gate valve systems in modern applications presents a complex competitive landscape. The industry is in a transitional phase, with a growing market driven by the need to upgrade aging infrastructure. While the technology is mature, innovations are emerging to address modern requirements. Key players like NOV, Inc., Halliburton Energy Services, and Valveworks USA are leading the charge, leveraging their extensive experience in oil and gas equipment. Companies such as Tokyo Electron Ltd. and Lam Research Corp. are bringing advanced manufacturing techniques to the field, potentially disrupting traditional approaches. The market is characterized by a mix of established industry giants and specialized valve manufacturers, creating a dynamic environment for technological advancements and market competition.

NOV, Inc.

Technical Solution: NOV has developed advanced retrofitting solutions for legacy gate valve systems, focusing on digital transformation and automation. Their approach includes the integration of smart sensors and actuators to modernize existing valve infrastructure. NOV's retrofitting technology enables real-time monitoring, predictive maintenance, and remote operation capabilities for legacy gate valves[1]. The company has also introduced a modular design that allows for easier upgrades and replacements of individual components, reducing downtime and maintenance costs[2]. Additionally, NOV has implemented advanced sealing technologies to improve the performance and longevity of retrofitted gate valves in challenging environments, such as high-pressure and high-temperature applications[3].

Strengths: Comprehensive digital integration, modular design for easy upgrades, and advanced sealing technologies. Weaknesses: Potential high initial costs for full system upgrades and possible compatibility issues with very old legacy systems.

Halliburton Energy Services, Inc.

Technical Solution: Halliburton has developed a multi-faceted approach to retrofitting legacy gate valve systems, focusing on enhancing safety, efficiency, and environmental performance. Their solution includes the implementation of advanced materials science to upgrade valve components, improving resistance to corrosion and wear in harsh operating conditions[4]. Halliburton's retrofitting technology also incorporates smart monitoring systems that use machine learning algorithms to predict valve failures and optimize maintenance schedules[5]. The company has introduced a novel sealing technology that significantly reduces fugitive emissions from legacy gate valves, addressing environmental concerns in modern applications[6]. Furthermore, Halliburton offers a comprehensive assessment service to evaluate the condition of existing gate valve systems and provide tailored retrofitting solutions.

Strengths: Advanced materials science application, predictive maintenance capabilities, and improved environmental performance. Weaknesses: Potentially complex implementation process and high costs for comprehensive system overhauls.

Key Retrofit Innovations

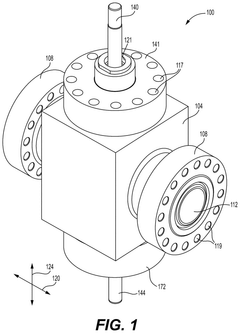

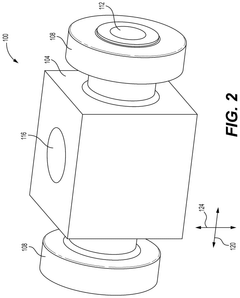

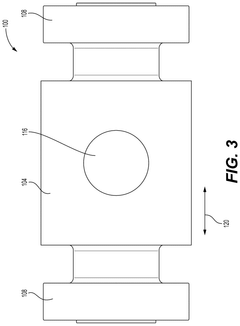

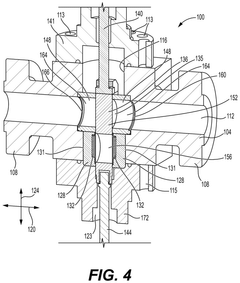

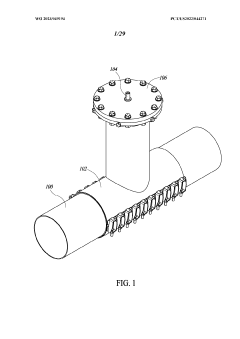

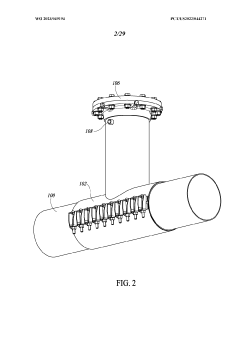

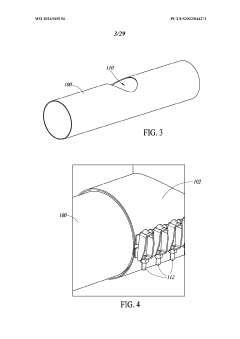

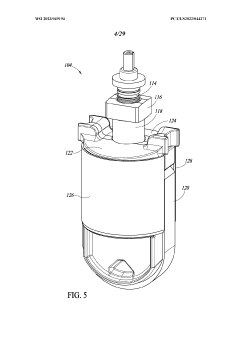

Slab Gate Valves and Methods of Retrofitting

PatentActiveUS20250129854A1

Innovation

- The retrofitting of round gate valves with rectangular slabs and dynamic skirt assemblies, which convert the round gate cavity into a semi-rectangular shape to accommodate a slab gate, enhancing fluid control and sealing capabilities.

Valve gates

PatentWO2023049194A1

Innovation

- A valve gate design featuring a seal with an outer shell and inner strap, a movable body, and a lever mechanism that allows the valve to be inserted and retracted through a tapping sleeve without disrupting pipeline operation, utilizing a tapping sleeve to create an opening in the pipeline for valve installation.

Regulatory Compliance

Regulatory compliance plays a crucial role in the retrofitting of legacy gate valve systems for modern applications. As industries evolve and environmental concerns grow, governments and regulatory bodies have implemented stricter standards and regulations to ensure safety, efficiency, and environmental protection. These regulations often necessitate the upgrading or replacement of older gate valve systems to meet new requirements.

One of the primary challenges in regulatory compliance for retrofitting legacy gate valve systems is the need to adhere to updated safety standards. Many older valve systems may not meet current safety regulations, particularly in industries such as oil and gas, chemical processing, and power generation. Retrofitting these systems often requires the integration of advanced safety features, such as improved sealing mechanisms, leak detection systems, and fail-safe operations.

Environmental regulations also pose significant challenges for legacy gate valve systems. Stricter emissions control and fugitive emissions reduction requirements have led to the need for upgrading valve sealing technologies and implementing more robust monitoring systems. This often involves the incorporation of low-emission packing materials, advanced stem seals, and real-time monitoring capabilities to ensure compliance with environmental standards.

The energy efficiency requirements set forth by regulatory bodies present another hurdle in retrofitting legacy gate valve systems. Many older valves may not meet current energy efficiency standards, necessitating upgrades to reduce energy consumption and improve overall system performance. This may involve the implementation of advanced actuators, optimized flow control mechanisms, and improved valve designs that minimize pressure drops and energy losses.

Compliance with industry-specific regulations adds another layer of complexity to the retrofitting process. For instance, in the pharmaceutical and food processing industries, legacy gate valve systems may need to be upgraded to meet stringent hygiene and contamination prevention standards. This often requires the use of specialized materials, surface finishes, and cleaning mechanisms that were not originally incorporated into the legacy systems.

The documentation and certification requirements associated with regulatory compliance pose additional challenges. Retrofitting projects must be meticulously documented, with detailed records of modifications, testing procedures, and performance data. Obtaining necessary certifications and approvals from regulatory bodies can be a time-consuming and complex process, requiring extensive testing and validation of the retrofitted systems.

Lastly, the need for ongoing compliance monitoring and reporting adds to the challenges of retrofitting legacy gate valve systems. Modern regulations often mandate regular inspections, performance assessments, and reporting of operational data. Integrating these capabilities into older systems may require significant modifications to control systems, data acquisition infrastructure, and maintenance protocols.

One of the primary challenges in regulatory compliance for retrofitting legacy gate valve systems is the need to adhere to updated safety standards. Many older valve systems may not meet current safety regulations, particularly in industries such as oil and gas, chemical processing, and power generation. Retrofitting these systems often requires the integration of advanced safety features, such as improved sealing mechanisms, leak detection systems, and fail-safe operations.

Environmental regulations also pose significant challenges for legacy gate valve systems. Stricter emissions control and fugitive emissions reduction requirements have led to the need for upgrading valve sealing technologies and implementing more robust monitoring systems. This often involves the incorporation of low-emission packing materials, advanced stem seals, and real-time monitoring capabilities to ensure compliance with environmental standards.

The energy efficiency requirements set forth by regulatory bodies present another hurdle in retrofitting legacy gate valve systems. Many older valves may not meet current energy efficiency standards, necessitating upgrades to reduce energy consumption and improve overall system performance. This may involve the implementation of advanced actuators, optimized flow control mechanisms, and improved valve designs that minimize pressure drops and energy losses.

Compliance with industry-specific regulations adds another layer of complexity to the retrofitting process. For instance, in the pharmaceutical and food processing industries, legacy gate valve systems may need to be upgraded to meet stringent hygiene and contamination prevention standards. This often requires the use of specialized materials, surface finishes, and cleaning mechanisms that were not originally incorporated into the legacy systems.

The documentation and certification requirements associated with regulatory compliance pose additional challenges. Retrofitting projects must be meticulously documented, with detailed records of modifications, testing procedures, and performance data. Obtaining necessary certifications and approvals from regulatory bodies can be a time-consuming and complex process, requiring extensive testing and validation of the retrofitted systems.

Lastly, the need for ongoing compliance monitoring and reporting adds to the challenges of retrofitting legacy gate valve systems. Modern regulations often mandate regular inspections, performance assessments, and reporting of operational data. Integrating these capabilities into older systems may require significant modifications to control systems, data acquisition infrastructure, and maintenance protocols.

Cost-Benefit Analysis

Conducting a cost-benefit analysis for retrofitting legacy gate valve systems in modern applications is crucial for organizations considering upgrades to their existing infrastructure. This analysis involves evaluating the financial implications of implementing new technologies against maintaining the status quo.

The primary costs associated with retrofitting legacy gate valve systems include the initial investment in new equipment, installation expenses, and potential downtime during the upgrade process. These costs can be substantial, especially for large-scale industrial operations. Additionally, there may be indirect costs related to staff training and adapting existing processes to accommodate the new systems.

On the benefit side, retrofitted gate valve systems often offer improved efficiency, reduced maintenance requirements, and enhanced safety features. These improvements can lead to significant long-term cost savings through reduced energy consumption, fewer repairs, and decreased risk of system failures. Modern valve systems also typically provide better control and monitoring capabilities, which can optimize overall system performance.

Another important consideration is the potential for increased regulatory compliance. As environmental and safety standards become more stringent, legacy systems may fall short of new requirements. Retrofitting can help organizations avoid costly fines and penalties associated with non-compliance.

The longevity of the retrofitted system is a key factor in the cost-benefit equation. While the initial investment may be substantial, a well-designed retrofit can extend the lifespan of the valve system by several years or even decades. This extended service life can significantly offset the upfront costs when compared to the ongoing maintenance and potential replacement costs of aging legacy systems.

It's also essential to consider the opportunity costs of not retrofitting. Continued reliance on outdated technology may result in lost productivity, increased downtime, and potential safety hazards. These factors can have a substantial negative impact on an organization's bottom line and reputation.

When conducting the cost-benefit analysis, it's important to use a comprehensive approach that considers both short-term and long-term impacts. This may include utilizing net present value (NPV) calculations to account for the time value of money and internal rate of return (IRR) assessments to gauge the profitability of the investment.

Organizations should also factor in potential incentives or rebates offered by government agencies or utility companies for upgrading to more energy-efficient systems. These incentives can significantly reduce the overall cost of retrofitting and improve the return on investment.

The primary costs associated with retrofitting legacy gate valve systems include the initial investment in new equipment, installation expenses, and potential downtime during the upgrade process. These costs can be substantial, especially for large-scale industrial operations. Additionally, there may be indirect costs related to staff training and adapting existing processes to accommodate the new systems.

On the benefit side, retrofitted gate valve systems often offer improved efficiency, reduced maintenance requirements, and enhanced safety features. These improvements can lead to significant long-term cost savings through reduced energy consumption, fewer repairs, and decreased risk of system failures. Modern valve systems also typically provide better control and monitoring capabilities, which can optimize overall system performance.

Another important consideration is the potential for increased regulatory compliance. As environmental and safety standards become more stringent, legacy systems may fall short of new requirements. Retrofitting can help organizations avoid costly fines and penalties associated with non-compliance.

The longevity of the retrofitted system is a key factor in the cost-benefit equation. While the initial investment may be substantial, a well-designed retrofit can extend the lifespan of the valve system by several years or even decades. This extended service life can significantly offset the upfront costs when compared to the ongoing maintenance and potential replacement costs of aging legacy systems.

It's also essential to consider the opportunity costs of not retrofitting. Continued reliance on outdated technology may result in lost productivity, increased downtime, and potential safety hazards. These factors can have a substantial negative impact on an organization's bottom line and reputation.

When conducting the cost-benefit analysis, it's important to use a comprehensive approach that considers both short-term and long-term impacts. This may include utilizing net present value (NPV) calculations to account for the time value of money and internal rate of return (IRR) assessments to gauge the profitability of the investment.

Organizations should also factor in potential incentives or rebates offered by government agencies or utility companies for upgrading to more energy-efficient systems. These incentives can significantly reduce the overall cost of retrofitting and improve the return on investment.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!