The Significance of Overcurrent Protection in Battery Thermal Runaway

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Overcurrent Protection Background and Objectives

Battery overcurrent protection has evolved significantly since the early development of rechargeable battery technologies in the 1970s. Initially, simple fuses were the primary protection mechanism, but as battery energy densities increased—particularly with the commercialization of lithium-ion batteries in the 1990s—more sophisticated protection systems became necessary. The evolution of these protection mechanisms has been driven by high-profile battery failure incidents, including laptop fires in the early 2000s and electric vehicle thermal events in the 2010s.

The fundamental challenge addressed by overcurrent protection is preventing thermal runaway—a catastrophic failure mode where exothermic chemical reactions within the battery create a dangerous positive feedback loop. This phenomenon occurs when excessive current flow generates heat that exceeds the battery's thermal dissipation capacity, potentially leading to temperatures above 500°C, cell rupture, and in severe cases, fires or explosions.

Current technological trends show a shift toward multi-layered protection approaches that combine hardware and software solutions. These include advanced battery management systems (BMS) with predictive algorithms, solid-state circuit breakers, and intelligent current limiting devices that can respond within milliseconds to dangerous conditions. The integration of these technologies with IoT capabilities allows for remote monitoring and preemptive intervention before critical thresholds are reached.

The primary objective of modern overcurrent protection research is to develop systems that can reliably prevent thermal runaway while maximizing battery performance and lifespan. This involves creating protection mechanisms that can distinguish between safe high-current operations (such as fast charging or high-power discharge) and dangerous conditions requiring intervention. The ideal solution must balance sensitivity with specificity to avoid false positives that unnecessarily limit battery functionality.

Secondary objectives include miniaturization of protection components to improve energy density, reduction of implementation costs to enable widespread adoption, and development of standardized testing protocols to validate protection effectiveness across different battery chemistries and form factors. These objectives align with broader industry goals of improving battery safety without compromising the performance characteristics that make advanced battery technologies attractive for various applications.

The technical landscape is further complicated by emerging battery chemistries such as solid-state, lithium-sulfur, and sodium-ion, each presenting unique overcurrent protection challenges. Research must therefore anticipate how protection strategies will need to evolve as these next-generation technologies move toward commercialization, ensuring that safety mechanisms remain effective as the underlying battery technology advances.

The fundamental challenge addressed by overcurrent protection is preventing thermal runaway—a catastrophic failure mode where exothermic chemical reactions within the battery create a dangerous positive feedback loop. This phenomenon occurs when excessive current flow generates heat that exceeds the battery's thermal dissipation capacity, potentially leading to temperatures above 500°C, cell rupture, and in severe cases, fires or explosions.

Current technological trends show a shift toward multi-layered protection approaches that combine hardware and software solutions. These include advanced battery management systems (BMS) with predictive algorithms, solid-state circuit breakers, and intelligent current limiting devices that can respond within milliseconds to dangerous conditions. The integration of these technologies with IoT capabilities allows for remote monitoring and preemptive intervention before critical thresholds are reached.

The primary objective of modern overcurrent protection research is to develop systems that can reliably prevent thermal runaway while maximizing battery performance and lifespan. This involves creating protection mechanisms that can distinguish between safe high-current operations (such as fast charging or high-power discharge) and dangerous conditions requiring intervention. The ideal solution must balance sensitivity with specificity to avoid false positives that unnecessarily limit battery functionality.

Secondary objectives include miniaturization of protection components to improve energy density, reduction of implementation costs to enable widespread adoption, and development of standardized testing protocols to validate protection effectiveness across different battery chemistries and form factors. These objectives align with broader industry goals of improving battery safety without compromising the performance characteristics that make advanced battery technologies attractive for various applications.

The technical landscape is further complicated by emerging battery chemistries such as solid-state, lithium-sulfur, and sodium-ion, each presenting unique overcurrent protection challenges. Research must therefore anticipate how protection strategies will need to evolve as these next-generation technologies move toward commercialization, ensuring that safety mechanisms remain effective as the underlying battery technology advances.

Market Demand Analysis for Battery Safety Solutions

The global market for battery safety solutions has experienced unprecedented growth, driven primarily by the rapid expansion of electric vehicles (EVs), portable electronics, and energy storage systems. Current market valuations indicate the battery safety solutions sector reached approximately $8.2 billion in 2022, with projections suggesting a compound annual growth rate of 16.7% through 2030. This remarkable growth trajectory reflects the increasing recognition of thermal runaway as a critical safety concern across multiple industries.

Consumer demand for safer battery technologies has intensified following high-profile incidents involving lithium-ion battery fires in smartphones, laptops, and electric vehicles. These incidents have heightened public awareness and regulatory scrutiny, creating substantial market pull for advanced overcurrent protection solutions. Industry surveys reveal that 78% of EV consumers now rank battery safety features among their top three purchasing considerations, compared to just 45% five years ago.

The automotive sector represents the largest market segment for battery safety solutions, accounting for approximately 42% of total demand. As automotive manufacturers accelerate their transition to electric powertrains, the need for sophisticated overcurrent protection systems has become paramount. Major automakers have increased their investment in battery safety technologies by an average of 24% annually since 2020, with particular emphasis on systems that can prevent thermal runaway cascades.

Energy storage systems (ESS) constitute the fastest-growing application segment, with demand increasing at 22.3% annually. This growth is fueled by the expanding deployment of grid-scale and residential energy storage solutions, where the consequences of thermal events can be particularly severe. Regulatory frameworks in key markets now mandate specific overcurrent protection measures for ESS installations exceeding certain capacity thresholds.

Consumer electronics manufacturers have also significantly increased their focus on battery safety, particularly following implementation of more stringent transportation regulations for lithium-ion batteries. The portable electronics segment now represents approximately 28% of the total market for battery safety solutions, with premium device manufacturers differentiating their products through enhanced safety features.

Geographically, Asia-Pacific dominates the market with a 46% share, driven by the concentration of battery manufacturing capacity and strong government initiatives promoting electric vehicle adoption. North America and Europe follow with 27% and 21% market shares respectively, with both regions showing accelerated growth rates as domestic battery production capacity expands in response to supply chain security concerns and green manufacturing initiatives.

Consumer demand for safer battery technologies has intensified following high-profile incidents involving lithium-ion battery fires in smartphones, laptops, and electric vehicles. These incidents have heightened public awareness and regulatory scrutiny, creating substantial market pull for advanced overcurrent protection solutions. Industry surveys reveal that 78% of EV consumers now rank battery safety features among their top three purchasing considerations, compared to just 45% five years ago.

The automotive sector represents the largest market segment for battery safety solutions, accounting for approximately 42% of total demand. As automotive manufacturers accelerate their transition to electric powertrains, the need for sophisticated overcurrent protection systems has become paramount. Major automakers have increased their investment in battery safety technologies by an average of 24% annually since 2020, with particular emphasis on systems that can prevent thermal runaway cascades.

Energy storage systems (ESS) constitute the fastest-growing application segment, with demand increasing at 22.3% annually. This growth is fueled by the expanding deployment of grid-scale and residential energy storage solutions, where the consequences of thermal events can be particularly severe. Regulatory frameworks in key markets now mandate specific overcurrent protection measures for ESS installations exceeding certain capacity thresholds.

Consumer electronics manufacturers have also significantly increased their focus on battery safety, particularly following implementation of more stringent transportation regulations for lithium-ion batteries. The portable electronics segment now represents approximately 28% of the total market for battery safety solutions, with premium device manufacturers differentiating their products through enhanced safety features.

Geographically, Asia-Pacific dominates the market with a 46% share, driven by the concentration of battery manufacturing capacity and strong government initiatives promoting electric vehicle adoption. North America and Europe follow with 27% and 21% market shares respectively, with both regions showing accelerated growth rates as domestic battery production capacity expands in response to supply chain security concerns and green manufacturing initiatives.

Current State and Challenges in Overcurrent Protection Technology

Overcurrent protection technology in battery systems has evolved significantly over the past decade, with major advancements driven by the rapid growth of electric vehicles, portable electronics, and energy storage systems. Currently, the global market employs several mainstream protection mechanisms, including fuses, circuit breakers, positive temperature coefficient (PTC) devices, and battery management systems (BMS) with integrated overcurrent detection algorithms.

The state-of-the-art in overcurrent protection features multi-layered approaches that combine hardware and software solutions. Modern systems typically incorporate primary protection through physical components like fuses that disconnect circuits during severe overcurrent events, supplemented by secondary protection through intelligent BMS that can detect and respond to abnormal current patterns before they become critical. Advanced systems now feature response times in milliseconds, significantly reducing the risk of thermal runaway initiation.

Despite these advancements, several critical challenges persist in overcurrent protection technology. The balance between sensitivity and false alarms remains problematic, as systems must detect genuine threats while avoiding unnecessary shutdowns that impact user experience. This challenge is particularly acute in high-power applications where normal current fluctuations can mimic fault conditions.

Miniaturization presents another significant hurdle, especially for consumer electronics where space constraints limit the implementation of robust protection mechanisms. As batteries become more energy-dense, the physical space allocated for protection components continues to shrink, forcing engineers to develop increasingly compact solutions without compromising safety.

Temperature dependency of protection mechanisms also poses challenges, as many current protection devices exhibit variable performance across different operating temperatures. This variability can lead to inconsistent protection levels, particularly in extreme environments where batteries are increasingly deployed.

The geographic distribution of overcurrent protection technology development shows concentration in East Asia (particularly Japan, South Korea, and China), North America, and Europe. Chinese manufacturers have rapidly expanded their market share in recent years, while established players in Japan and the United States continue to lead in high-end protection solutions for critical applications.

Regulatory frameworks across different regions present another challenge, as manufacturers must navigate varying safety standards and certification requirements. The lack of globally harmonized standards for overcurrent protection in batteries creates additional complexity for companies operating in international markets, often necessitating region-specific design modifications.

The state-of-the-art in overcurrent protection features multi-layered approaches that combine hardware and software solutions. Modern systems typically incorporate primary protection through physical components like fuses that disconnect circuits during severe overcurrent events, supplemented by secondary protection through intelligent BMS that can detect and respond to abnormal current patterns before they become critical. Advanced systems now feature response times in milliseconds, significantly reducing the risk of thermal runaway initiation.

Despite these advancements, several critical challenges persist in overcurrent protection technology. The balance between sensitivity and false alarms remains problematic, as systems must detect genuine threats while avoiding unnecessary shutdowns that impact user experience. This challenge is particularly acute in high-power applications where normal current fluctuations can mimic fault conditions.

Miniaturization presents another significant hurdle, especially for consumer electronics where space constraints limit the implementation of robust protection mechanisms. As batteries become more energy-dense, the physical space allocated for protection components continues to shrink, forcing engineers to develop increasingly compact solutions without compromising safety.

Temperature dependency of protection mechanisms also poses challenges, as many current protection devices exhibit variable performance across different operating temperatures. This variability can lead to inconsistent protection levels, particularly in extreme environments where batteries are increasingly deployed.

The geographic distribution of overcurrent protection technology development shows concentration in East Asia (particularly Japan, South Korea, and China), North America, and Europe. Chinese manufacturers have rapidly expanded their market share in recent years, while established players in Japan and the United States continue to lead in high-end protection solutions for critical applications.

Regulatory frameworks across different regions present another challenge, as manufacturers must navigate varying safety standards and certification requirements. The lack of globally harmonized standards for overcurrent protection in batteries creates additional complexity for companies operating in international markets, often necessitating region-specific design modifications.

Existing Overcurrent Protection Mechanisms and Implementations

01 Battery management systems for thermal runaway prevention

Battery management systems incorporate overcurrent protection mechanisms to prevent thermal runaway in battery cells. These systems monitor battery parameters such as temperature, voltage, and current to detect abnormal conditions that could lead to thermal runaway. When overcurrent conditions are detected, the systems can implement protective measures such as disconnecting the battery, reducing charging current, or activating cooling systems to prevent thermal runaway events.- Battery management systems with thermal monitoring: Battery management systems that incorporate thermal monitoring capabilities to detect and prevent thermal runaway. These systems use temperature sensors to continuously monitor battery cells and can trigger protective measures when abnormal temperature rises are detected. Advanced systems may include predictive algorithms to anticipate potential thermal events before they occur, allowing for preemptive action to prevent thermal runaway conditions.

- Circuit breakers and fuses for overcurrent protection: Specialized circuit breakers and fuses designed to detect and interrupt excessive current flow before it can cause thermal runaway. These devices monitor current levels and automatically disconnect the circuit when predetermined thresholds are exceeded. Some advanced designs incorporate temperature-sensitive elements that provide faster response times when both current and temperature increases are detected, offering dual-parameter protection against thermal events.

- Cooling systems for thermal management: Active and passive cooling systems designed to dissipate heat and prevent thermal runaway in electronic and power systems. These solutions include liquid cooling circuits, heat sinks, thermal interface materials, and forced air cooling. Advanced cooling systems may incorporate phase-change materials or thermoelectric elements to provide enhanced heat transfer capabilities during potential overcurrent situations, maintaining temperatures below critical thresholds.

- Intelligent power management controllers: Microprocessor-based control systems that continuously monitor electrical parameters and implement protective measures to prevent thermal runaway. These controllers can dynamically adjust operating parameters, implement load shedding, or initiate emergency shutdown procedures when dangerous conditions are detected. Some advanced systems incorporate machine learning algorithms to adapt protection strategies based on historical performance data and usage patterns.

- Thermal isolation and containment structures: Physical design elements and materials that isolate potential thermal runaway events and prevent their propagation to adjacent components or systems. These include fire-resistant barriers, thermal insulation layers, and compartmentalized designs that contain thermal events. Some advanced solutions incorporate intumescent materials that expand when exposed to heat, creating additional thermal barriers during overcurrent events and limiting the spread of thermal runaway conditions.

02 Circuit breakers and fuses for overcurrent protection

Circuit breakers and fuses are fundamental components in overcurrent protection systems that prevent thermal runaway by interrupting the circuit when current exceeds safe thresholds. These devices are designed to respond quickly to overcurrent conditions, breaking the circuit before components can overheat and enter thermal runaway. Advanced circuit breakers may include electronic trip units that provide more precise current monitoring and faster response times compared to traditional thermal-magnetic breakers.Expand Specific Solutions03 Thermal sensors and monitoring systems

Thermal sensors and monitoring systems are integrated into electrical and electronic devices to continuously monitor temperature changes and detect potential thermal runaway conditions. These systems use temperature sensors strategically placed near critical components to provide real-time temperature data. When temperatures approach dangerous levels, the monitoring systems can trigger protective actions such as reducing power, activating cooling systems, or shutting down the device completely to prevent thermal runaway.Expand Specific Solutions04 Cooling systems for thermal management

Cooling systems play a crucial role in preventing thermal runaway by managing heat dissipation in electrical and electronic devices. These systems can include passive cooling methods such as heat sinks and thermal pads, or active cooling methods such as fans, liquid cooling, or thermoelectric coolers. By efficiently removing heat from critical components, cooling systems help maintain safe operating temperatures and prevent the onset of thermal runaway conditions even during high current operations.Expand Specific Solutions05 Integrated protection circuits for electronic devices

Integrated protection circuits combine multiple protective features to prevent thermal runaway in electronic devices. These circuits typically include overcurrent detection, overvoltage protection, temperature monitoring, and short-circuit protection in a single integrated solution. When abnormal conditions are detected, these circuits can implement a graduated response based on the severity of the condition, from limiting current flow to completely disconnecting power, thereby preventing thermal runaway events before they can occur.Expand Specific Solutions

Key Industry Players in Battery Protection Systems

The battery thermal runaway protection market is in a growth phase, with increasing demand driven by electric vehicle proliferation and energy storage applications. Market size is expanding rapidly as safety concerns become paramount in lithium-ion battery deployment. Technology maturity varies significantly across players: industry leaders Tesla, BYD, and CATL have developed sophisticated overcurrent protection systems with integrated thermal management; Samsung SDI, LG Energy Solution, and Hyundai are advancing mid-tier solutions; while specialized innovators like American Lithium Energy and Aspen Aerogels focus on breakthrough technologies. The competitive landscape features automotive OEMs, battery manufacturers, and specialized component suppliers collaborating to address this critical safety challenge, with increasing regulatory pressure accelerating technology adoption and standardization efforts.

Tesla, Inc.

Technical Solution: Tesla has developed a multi-layered approach to battery thermal runaway protection. Their system incorporates advanced overcurrent protection mechanisms that utilize both hardware and software solutions. The hardware includes specialized fuses and circuit breakers that can detect and interrupt excessive current flows within milliseconds. Tesla's Battery Management System (BMS) continuously monitors individual cell voltages, temperatures, and current flows, employing predictive algorithms to identify potential thermal events before they escalate. Their vehicles feature dedicated pyro-fuses that can physically disconnect the battery pack in emergency situations. Tesla has also implemented thermal barrier materials between cells and modules to prevent propagation of thermal events. Their patented technology includes rapid discharge capabilities that can safely reduce battery energy levels when anomalies are detected, significantly reducing thermal runaway risks.

Strengths: Comprehensive integration of hardware and software protection systems; real-time monitoring with predictive capabilities; multi-level redundancy in safety systems. Weaknesses: Complex systems require sophisticated manufacturing processes; higher production costs compared to simpler protection schemes; system updates and maintenance require specialized knowledge.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has pioneered advanced overcurrent protection technologies specifically designed to prevent thermal runaway in lithium-ion batteries. Their solution incorporates multi-layered safety mechanisms including specialized Current Interrupt Devices (CIDs) that physically disconnect cells when pressure builds due to overcurrent conditions. Samsung's proprietary Safety Reinforced Separator (SRS) technology adds an additional layer of protection by incorporating a specialized ceramic coating that increases mechanical and thermal stability under extreme conditions. Their batteries feature integrated Positive Temperature Coefficient (PTC) devices that increase resistance as temperature rises, effectively limiting current flow during potential thermal events. Samsung SDI has also developed advanced Battery Management Systems (BMS) that continuously monitor current, voltage, and temperature parameters, implementing immediate protective measures when abnormal conditions are detected. Their latest generation batteries incorporate flame-retardant additives in the electrolyte to further mitigate thermal propagation risks.

Strengths: Multi-layered protection approach combining mechanical, chemical and electronic safeguards; proprietary separator technology provides additional protection against internal shorts; advanced BMS with predictive capabilities. Weaknesses: Higher manufacturing costs compared to conventional batteries; slightly reduced energy density due to safety components; requires sophisticated quality control processes.

Critical Technologies for Preventing Battery Thermal Runaway

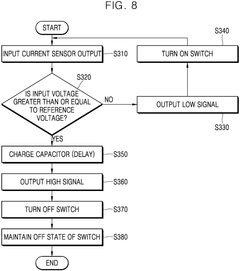

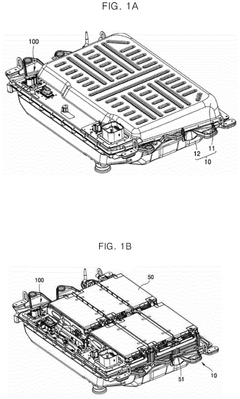

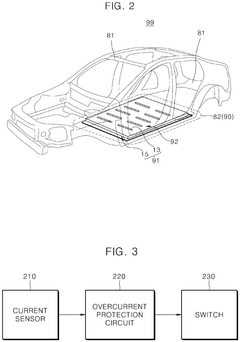

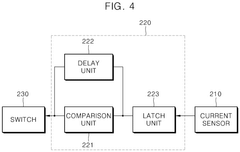

Overcurrent protection apparatus and protection method thereof

PatentPendingEP4550601A1

Innovation

- An overcurrent protection apparatus comprising a current sensor, a switch, and an overcurrent protection circuit that compares input voltage from the current sensor to a reference voltage, maintaining the switch in an on state for temporary overcurrents and turning it off after a predetermined delay for continuous overcurrents.

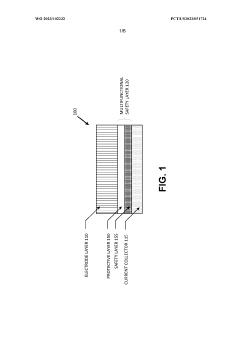

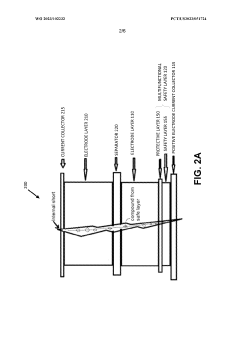

Universally compatible, multifunctional safety layer for battery cell

PatentWO2023102232A2

Innovation

- A universally compatible, multifunctional safety layer is introduced, comprising a safety layer and a protective layer interposed between the electrode and current collector, allowing for flexible material selection for the safety layer while preventing premature activation by other components, and activating only upon specific triggers to interrupt current flow and prevent thermal runaway.

Regulatory Standards and Compliance Requirements

The regulatory landscape for battery safety, particularly concerning overcurrent protection to prevent thermal runaway, has evolved significantly in response to high-profile battery failure incidents. International standards organizations have established comprehensive frameworks that manufacturers must adhere to before bringing battery-powered products to market.

IEC 62133 serves as a cornerstone standard for secondary cells and batteries containing alkaline or non-acid electrolytes, mandating specific overcurrent protection mechanisms. This standard requires that batteries must include protection against excessive current flow and maintain safe operation under abnormal charging conditions. Similarly, UL 1642 for lithium batteries establishes rigorous testing protocols for overcurrent scenarios, including short-circuit tests at various temperatures to verify protection system efficacy.

For electric vehicles, UN Regulation No. 100 and ISO 6469 outline safety specifications with particular emphasis on overcurrent protection systems. These standards require redundant protection mechanisms and specify performance criteria under various fault conditions. The automotive industry faces additional compliance requirements through SAE J2464, which details test procedures for evaluating battery systems under abuse conditions, including overcurrent events.

Consumer electronics are governed by IEC 61960, which addresses safety requirements for portable devices. This standard mandates that protection circuits must prevent current exceeding specified safe limits and requires manufacturers to implement both hardware and software protection layers. In the United States, CPSC guidelines further enforce these requirements with specific reporting obligations for battery-related incidents.

Emerging regulations are increasingly focusing on Battery Management System (BMS) capabilities, with requirements for real-time monitoring and response to overcurrent conditions. The IEC 63056 standard specifically addresses electrical energy storage systems, requiring sophisticated overcurrent detection with response times measured in milliseconds rather than seconds.

Compliance testing protocols have become more stringent, with regulatory bodies now requiring documentation of protection circuit design, component selection justification, and failure mode analysis. Manufacturers must demonstrate through certified testing that their overcurrent protection systems remain effective throughout the battery's operational lifetime and under extreme environmental conditions.

Regional variations in regulatory requirements present significant challenges for global manufacturers. While the European Union's approach emphasizes preventative measures through the Battery Directive 2006/66/EC and subsequent amendments, China's GB/T 31485 standard focuses on verification testing with specific overcurrent thresholds defined for different battery chemistries and applications.

IEC 62133 serves as a cornerstone standard for secondary cells and batteries containing alkaline or non-acid electrolytes, mandating specific overcurrent protection mechanisms. This standard requires that batteries must include protection against excessive current flow and maintain safe operation under abnormal charging conditions. Similarly, UL 1642 for lithium batteries establishes rigorous testing protocols for overcurrent scenarios, including short-circuit tests at various temperatures to verify protection system efficacy.

For electric vehicles, UN Regulation No. 100 and ISO 6469 outline safety specifications with particular emphasis on overcurrent protection systems. These standards require redundant protection mechanisms and specify performance criteria under various fault conditions. The automotive industry faces additional compliance requirements through SAE J2464, which details test procedures for evaluating battery systems under abuse conditions, including overcurrent events.

Consumer electronics are governed by IEC 61960, which addresses safety requirements for portable devices. This standard mandates that protection circuits must prevent current exceeding specified safe limits and requires manufacturers to implement both hardware and software protection layers. In the United States, CPSC guidelines further enforce these requirements with specific reporting obligations for battery-related incidents.

Emerging regulations are increasingly focusing on Battery Management System (BMS) capabilities, with requirements for real-time monitoring and response to overcurrent conditions. The IEC 63056 standard specifically addresses electrical energy storage systems, requiring sophisticated overcurrent detection with response times measured in milliseconds rather than seconds.

Compliance testing protocols have become more stringent, with regulatory bodies now requiring documentation of protection circuit design, component selection justification, and failure mode analysis. Manufacturers must demonstrate through certified testing that their overcurrent protection systems remain effective throughout the battery's operational lifetime and under extreme environmental conditions.

Regional variations in regulatory requirements present significant challenges for global manufacturers. While the European Union's approach emphasizes preventative measures through the Battery Directive 2006/66/EC and subsequent amendments, China's GB/T 31485 standard focuses on verification testing with specific overcurrent thresholds defined for different battery chemistries and applications.

Economic Impact of Battery Safety Failures

Battery safety failures carry substantial economic consequences across multiple sectors. The direct costs of thermal runaway incidents include property damage, which can range from localized equipment destruction to catastrophic facility fires. For example, energy storage system (ESS) fires have resulted in damages exceeding $30 million per incident in several documented cases, while electric vehicle battery fires have caused damages averaging $60,000-$187,000 per occurrence—significantly higher than conventional vehicle fire costs.

Beyond immediate property damage, business interruption expenses represent a major economic burden. Manufacturing facilities experiencing battery-related incidents face production downtime averaging 2-4 weeks, with associated revenue losses of $2-5 million per day for large-scale operations. For commercial users of battery systems, operational disruptions can trigger cascading financial impacts throughout supply chains.

Liability costs constitute another significant economic dimension. Product recalls related to battery safety defects have cost manufacturers billions—Samsung's Galaxy Note 7 recall alone resulted in an estimated $5.3 billion loss. Legal settlements from battery thermal runaway incidents have reached into tens of millions per case, particularly when personal injuries occur.

Insurance markets have responded to these risks with premium increases of 30-50% for businesses with lithium battery exposures. Some facilities with large battery installations report difficulty obtaining coverage at any price, creating additional financial uncertainty and potentially limiting technology adoption.

The reputational damage following safety incidents creates long-term economic consequences that often exceed direct costs. Market studies indicate consumer confidence in brands experiencing high-profile battery failures typically drops 15-25%, with recovery periods extending 18-36 months. This translates to sustained revenue impacts well beyond the immediate incident.

Regulatory responses to battery safety failures introduce compliance costs across industries. Following major incidents, regulatory bodies typically implement more stringent safety requirements, increasing manufacturing costs by 5-15% according to industry analyses. These costs ultimately affect market pricing and technology adoption rates.

The economic ripple effects extend to investment patterns, with venture capital and public market funding for battery technologies increasingly tied to demonstrated safety performance. Companies with strong safety records command valuation premiums of 10-30% compared to competitors with documented safety issues.

Beyond immediate property damage, business interruption expenses represent a major economic burden. Manufacturing facilities experiencing battery-related incidents face production downtime averaging 2-4 weeks, with associated revenue losses of $2-5 million per day for large-scale operations. For commercial users of battery systems, operational disruptions can trigger cascading financial impacts throughout supply chains.

Liability costs constitute another significant economic dimension. Product recalls related to battery safety defects have cost manufacturers billions—Samsung's Galaxy Note 7 recall alone resulted in an estimated $5.3 billion loss. Legal settlements from battery thermal runaway incidents have reached into tens of millions per case, particularly when personal injuries occur.

Insurance markets have responded to these risks with premium increases of 30-50% for businesses with lithium battery exposures. Some facilities with large battery installations report difficulty obtaining coverage at any price, creating additional financial uncertainty and potentially limiting technology adoption.

The reputational damage following safety incidents creates long-term economic consequences that often exceed direct costs. Market studies indicate consumer confidence in brands experiencing high-profile battery failures typically drops 15-25%, with recovery periods extending 18-36 months. This translates to sustained revenue impacts well beyond the immediate incident.

Regulatory responses to battery safety failures introduce compliance costs across industries. Following major incidents, regulatory bodies typically implement more stringent safety requirements, increasing manufacturing costs by 5-15% according to industry analyses. These costs ultimately affect market pricing and technology adoption rates.

The economic ripple effects extend to investment patterns, with venture capital and public market funding for battery technologies increasingly tied to demonstrated safety performance. Companies with strong safety records command valuation premiums of 10-30% compared to competitors with documented safety issues.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!